Yusfirah

No content yet

Yusfirah

#TopCoinsRisingAgainsttheTrend

In early 2026, the broader cryptocurrency market has been under significant pressure, driven by macroeconomic uncertainty, tightening monetary policies, and general risk-off sentiment across global financial markets. Bitcoin and Ethereum, the market leaders, have experienced notable declines, reflecting investor caution and the repricing of risk assets. However, amid this general weakness, certain digital assets have demonstrated resilience and outperformance, rising against the broader trend. This phenomenon highlights the growing complexity and segmentation of

In early 2026, the broader cryptocurrency market has been under significant pressure, driven by macroeconomic uncertainty, tightening monetary policies, and general risk-off sentiment across global financial markets. Bitcoin and Ethereum, the market leaders, have experienced notable declines, reflecting investor caution and the repricing of risk assets. However, amid this general weakness, certain digital assets have demonstrated resilience and outperformance, rising against the broader trend. This phenomenon highlights the growing complexity and segmentation of

- Reward

- 2

- 4

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#WhiteHouseTalksStablecoinYields

Ultra‑Deep Policy, Economic & Market Analysis February 2026

The ongoing White House discussions on stablecoin yields represent one of the most significant regulatory and monetary policy debates of the decade. At their core, these talks reflect an urgent effort by U.S. policymakers to reconcile innovation in digital finance with foundational principles of financial stability, investor protection, and monetary integrity. Stablecoins once an experimental corner of the crypto ecosystem have rapidly evolved into major financial instruments that bridge digital asse

Ultra‑Deep Policy, Economic & Market Analysis February 2026

The ongoing White House discussions on stablecoin yields represent one of the most significant regulatory and monetary policy debates of the decade. At their core, these talks reflect an urgent effort by U.S. policymakers to reconcile innovation in digital finance with foundational principles of financial stability, investor protection, and monetary integrity. Stablecoins once an experimental corner of the crypto ecosystem have rapidly evolved into major financial instruments that bridge digital asse

- Reward

- 2

- 4

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#WalshonFedPolicy

In-Depth Analysis of Kevin Warsh’s Fed Nomination and Potential Market Impact Feb 9, 2026

On January 30, 2026, President Trump nominated Kevin Warsh, former Federal Reserve Governor (2006–2011), to succeed Jerome Powell as Chair of the Federal Reserve. Warsh, historically known as an inflation hawk, has recently shifted his stance toward supporting lower interest rates while simultaneously advocating for aggressive balance sheet reduction. This combination of dovish short-term rate policy with long-term quantitative tightening (QT) represents a nuanced and potentially marke

In-Depth Analysis of Kevin Warsh’s Fed Nomination and Potential Market Impact Feb 9, 2026

On January 30, 2026, President Trump nominated Kevin Warsh, former Federal Reserve Governor (2006–2011), to succeed Jerome Powell as Chair of the Federal Reserve. Warsh, historically known as an inflation hawk, has recently shifted his stance toward supporting lower interest rates while simultaneously advocating for aggressive balance sheet reduction. This combination of dovish short-term rate policy with long-term quantitative tightening (QT) represents a nuanced and potentially marke

BTC-0,96%

- Reward

- 3

- 4

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#ChinaShapesCryptoRules

China’s latest steps to formalize and shape cryptocurrency regulations mark a pivotal moment in the global digital asset ecosystem. By clarifying rules, establishing compliance frameworks, and signaling regulatory boundaries, China is positioning itself to control systemic risk, maintain financial stability, and influence the trajectory of domestic and international crypto markets. These developments reflect a broader strategy to balance technological innovation with macroeconomic control, ensuring that cryptocurrency activities operate under a framework aligned with m

China’s latest steps to formalize and shape cryptocurrency regulations mark a pivotal moment in the global digital asset ecosystem. By clarifying rules, establishing compliance frameworks, and signaling regulatory boundaries, China is positioning itself to control systemic risk, maintain financial stability, and influence the trajectory of domestic and international crypto markets. These developments reflect a broader strategy to balance technological innovation with macroeconomic control, ensuring that cryptocurrency activities operate under a framework aligned with m

DEFI-5,1%

- Reward

- 3

- 5

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Just go for it💪View More

#CFTCOKsBankStablecoins

The recent approval of bank-issued stablecoins by the U.S. Commodity Futures Trading Commission (CFTC) marks a significant milestone in the evolving regulatory and financial landscape. By formally recognizing bank-backed stablecoins, the CFTC is bridging the gap between traditional finance and digital assets, providing a framework that enhances market legitimacy, transparency, and investor confidence. This move not only accelerates the adoption of stablecoins in mainstream financial markets but also signals growing regulatory alignment with the realities of digital pay

The recent approval of bank-issued stablecoins by the U.S. Commodity Futures Trading Commission (CFTC) marks a significant milestone in the evolving regulatory and financial landscape. By formally recognizing bank-backed stablecoins, the CFTC is bridging the gap between traditional finance and digital assets, providing a framework that enhances market legitimacy, transparency, and investor confidence. This move not only accelerates the adoption of stablecoins in mainstream financial markets but also signals growing regulatory alignment with the realities of digital pay

- Reward

- 5

- 5

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Stay strong and HODL💎View More

#JapanElection

Japan’s upcoming elections represent a critical juncture for domestic governance, economic strategy, and international positioning. As the world’s third-largest economy, political outcomes in Japan influence not only domestic fiscal and monetary policy but also global trade, financial markets, and investor sentiment. Historically, Japanese elections have triggered volatility in the yen, shifts in bond yields, and sector-specific equity movements, particularly in technology, manufacturing, and energy sectors. The stakes this year are especially high, with the electorate focused

Japan’s upcoming elections represent a critical juncture for domestic governance, economic strategy, and international positioning. As the world’s third-largest economy, political outcomes in Japan influence not only domestic fiscal and monetary policy but also global trade, financial markets, and investor sentiment. Historically, Japanese elections have triggered volatility in the yen, shifts in bond yields, and sector-specific equity movements, particularly in technology, manufacturing, and energy sectors. The stakes this year are especially high, with the electorate focused

- Reward

- 2

- 1

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊#BTCMiningDifficultyDrops

Bitcoin’s recent mining difficulty drop has generated significant attention across the market, serving as both a technical network indicator and a signal for broader market and miner behavior. Mining difficulty, which adjusts approximately every two weeks to maintain the average 10-minute block interval, is an essential metric for network stability, miner profitability, and investor sentiment. A decrease in difficulty typically reflects a short-term decline in hash rate, miner capitulation, or strategic operational adjustments, and carries implications for both on-ch

Bitcoin’s recent mining difficulty drop has generated significant attention across the market, serving as both a technical network indicator and a signal for broader market and miner behavior. Mining difficulty, which adjusts approximately every two weeks to maintain the average 10-minute block interval, is an essential metric for network stability, miner profitability, and investor sentiment. A decrease in difficulty typically reflects a short-term decline in hash rate, miner capitulation, or strategic operational adjustments, and carries implications for both on-ch

BTC-0,96%

- Reward

- 4

- 4

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Hold on tight, we're about to take off 🛫View More

The #GateSquareValentineGiveaway is more than a seasonal giveaway; it is a strategically designed engagement initiative that aligns platform incentives with user behavior, maximizing both community growth and user participation. Such campaigns are crafted not only to reward loyal participants but also to attract new users and strengthen the ecosystem by encouraging interaction across multiple platform touchpoints. For participants, understanding the structure, timing, and strategic approach of this giveaway is crucial to maximize potential rewards.

The campaign operates at the intersection of

The campaign operates at the intersection of

- Reward

- 4

- 6

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Hold on tight, we're about to take off 🛫View More

#YiLihuaExitsPositions

The recent exit of Yi Lihua from significant cryptocurrency positions has created ripples throughout the market, emphasizing the influence of major institutional flows on price behavior and market sentiment. Large-scale exits from prominent investors serve as both a direct source of selling pressure and an indirect psychological signal for retail and professional participants alike. In this case, Bitcoin and other major assets reacted with immediate volatility, reflecting a combination of forced liquidations, short-term panic selling, and reactive buying from opportunis

The recent exit of Yi Lihua from significant cryptocurrency positions has created ripples throughout the market, emphasizing the influence of major institutional flows on price behavior and market sentiment. Large-scale exits from prominent investors serve as both a direct source of selling pressure and an indirect psychological signal for retail and professional participants alike. In this case, Bitcoin and other major assets reacted with immediate volatility, reflecting a combination of forced liquidations, short-term panic selling, and reactive buying from opportunis

BTC-0,96%

- Reward

- 5

- 6

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

New Year Wealth Explosion 🤑View More

#BitcoinBouncesBack

Bitcoin has staged a sharp rebound after revisiting deeply oversold levels, touching $60,000, a 16-month low. This aggressive recovery, roughly 11% intraday, represents a reactive relief rally rather than a structural reversal. The $60,000 zone acted as a critical high-confluence support, combining psychological significance, historical accumulation nodes, and extreme oversold conditions. Short-term indicators reflect this bounce: EMA15 has crossed above EMA30, forming a short-term golden cross, Bollinger Bands are widening upward signaling expanding volatility, and RSI ha

Bitcoin has staged a sharp rebound after revisiting deeply oversold levels, touching $60,000, a 16-month low. This aggressive recovery, roughly 11% intraday, represents a reactive relief rally rather than a structural reversal. The $60,000 zone acted as a critical high-confluence support, combining psychological significance, historical accumulation nodes, and extreme oversold conditions. Short-term indicators reflect this bounce: EMA15 has crossed above EMA30, forming a short-term golden cross, Bollinger Bands are widening upward signaling expanding volatility, and RSI ha

BTC-0,96%

- Reward

- 5

- 7

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

GT is GTView More

#BuyTheDipOrWaitNow?

Bitcoin at a High-Stakes Inflection Zone A Deep Market Dissection

Bitcoin is currently trading in one of the most psychologically and structurally important zones of this cycle. The market is not simply correcting; it is undergoing a redistribution of conviction, leverage, and belief. These phases are uncomfortable, confusing, and volatile but historically, they are where long-term positioning is decided.

Market Snapshot Reading Between the Numbers

Current Price: ~$70,600 – $71,100

Price is stabilizing after aggressive downside volatility, but stabilization should not b

Bitcoin at a High-Stakes Inflection Zone A Deep Market Dissection

Bitcoin is currently trading in one of the most psychologically and structurally important zones of this cycle. The market is not simply correcting; it is undergoing a redistribution of conviction, leverage, and belief. These phases are uncomfortable, confusing, and volatile but historically, they are where long-term positioning is decided.

Market Snapshot Reading Between the Numbers

Current Price: ~$70,600 – $71,100

Price is stabilizing after aggressive downside volatility, but stabilization should not b

BTC-0,96%

- Reward

- 7

- 6

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

Check in to Stream, Sprint for VIP+1 and Monthly Bonus https://www.gate.com/campaigns/4006?ref=VLJNBLTXUG&ref_type=132

- Reward

- 5

- 3

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

Whether you worry about recent market volatility or not, don't worry, Gate has launched the new round of First Futures Position Airdrop event. Both new and existing users can participate to win instant airdrop rewards. Each participant is guaranteed to receive at least $630. Come and secure your exclusive benefits now. https://www.gate.com/campaigns/3985?ch=810&ref=VLJNBLTXUG&ref_type=132

- Reward

- 7

- 5

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

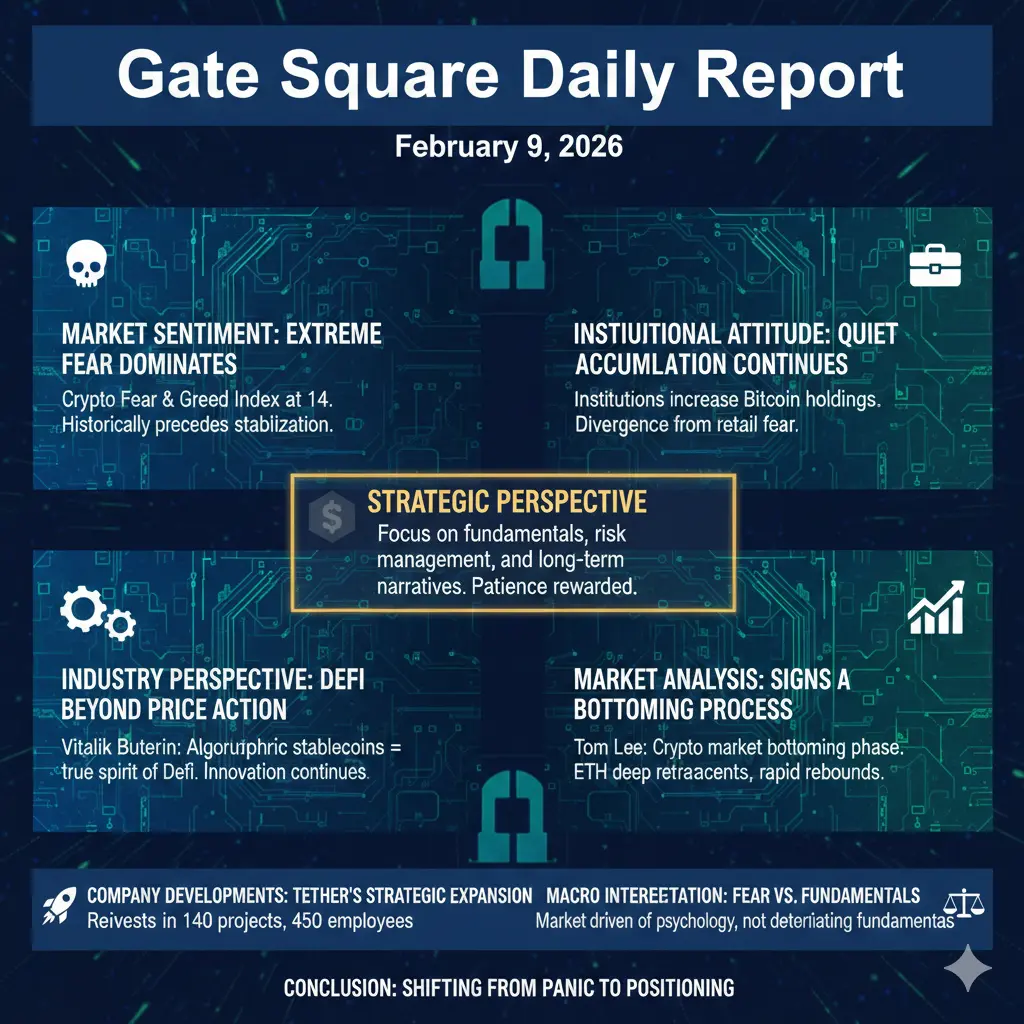

Gate Square Daily Report | February 9, 2026

The crypto market continues to operate under intense psychological pressure, yet beneath the surface, several structural signals suggest a transition phase may be underway. Today’s Gate Square Daily Report highlights a clear disconnect between sentiment and long-term positioning.

Market Sentiment: Extreme Fear Dominates

The Crypto Fear & Greed Index has climbed slightly to 14, but remains firmly within the Extreme Fear zone. Historically, these levels reflect widespread uncertainty, forced liquidations, and emotional decision-making rather than ratio

The crypto market continues to operate under intense psychological pressure, yet beneath the surface, several structural signals suggest a transition phase may be underway. Today’s Gate Square Daily Report highlights a clear disconnect between sentiment and long-term positioning.

Market Sentiment: Extreme Fear Dominates

The Crypto Fear & Greed Index has climbed slightly to 14, but remains firmly within the Extreme Fear zone. Historically, these levels reflect widespread uncertainty, forced liquidations, and emotional decision-making rather than ratio

- Reward

- 5

- 6

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

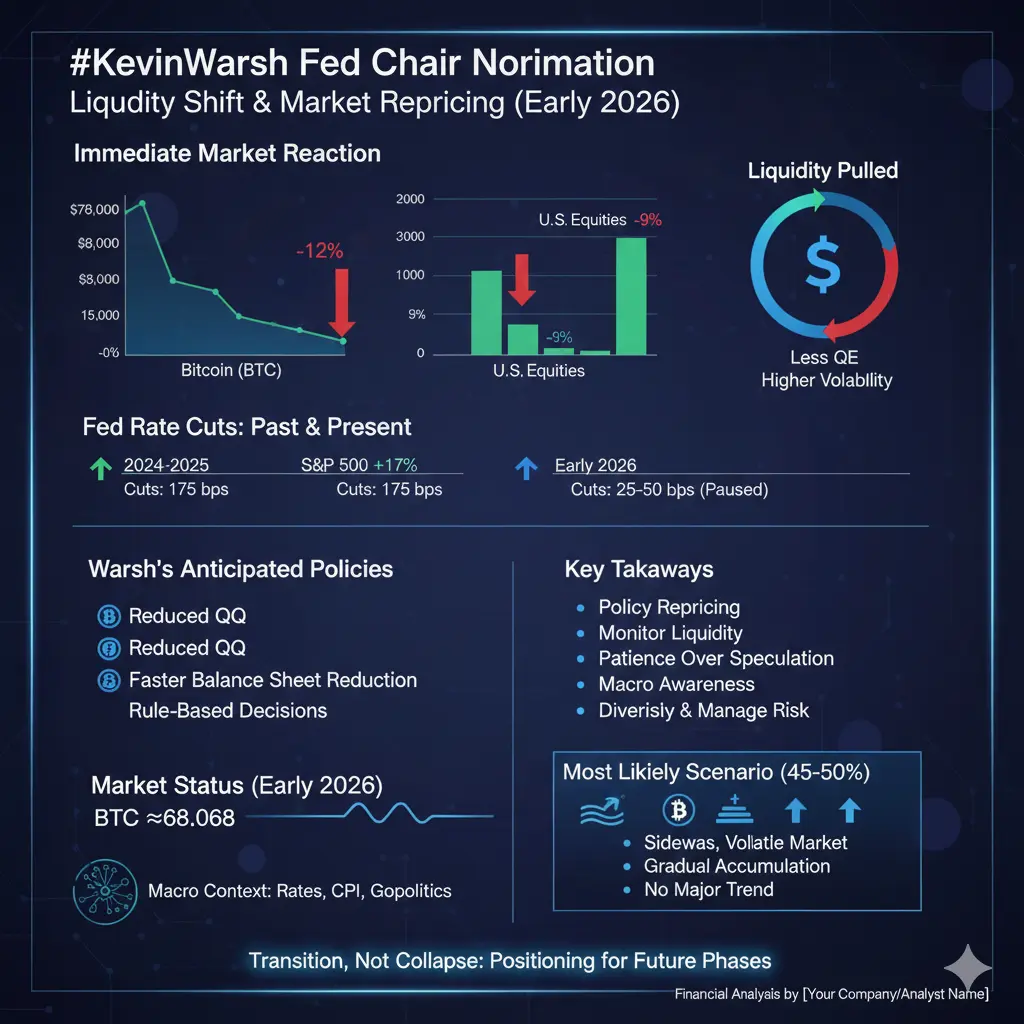

#FedLeadershipImpact

The nomination of Kevin Warsh as the next Federal Reserve Chair marks a significant shift in market expectations. Known as a monetary hawk, Warsh’s policy orientation signals tighter future liquidity conditions, emphasizing balance sheet discipline and fewer emergency interventions. While markets reacted sharply at first, the deeper analysis shows a transition phase, not a collapse, across crypto, equities, and global liquidity flows.

1. Immediate Market Reaction: Short-Term Shock

When Warsh’s nomination became public, investors repriced risk across all major markets:

Cry

The nomination of Kevin Warsh as the next Federal Reserve Chair marks a significant shift in market expectations. Known as a monetary hawk, Warsh’s policy orientation signals tighter future liquidity conditions, emphasizing balance sheet discipline and fewer emergency interventions. While markets reacted sharply at first, the deeper analysis shows a transition phase, not a collapse, across crypto, equities, and global liquidity flows.

1. Immediate Market Reaction: Short-Term Shock

When Warsh’s nomination became public, investors repriced risk across all major markets:

Cry

BTC-0,96%

- Reward

- 9

- 13

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

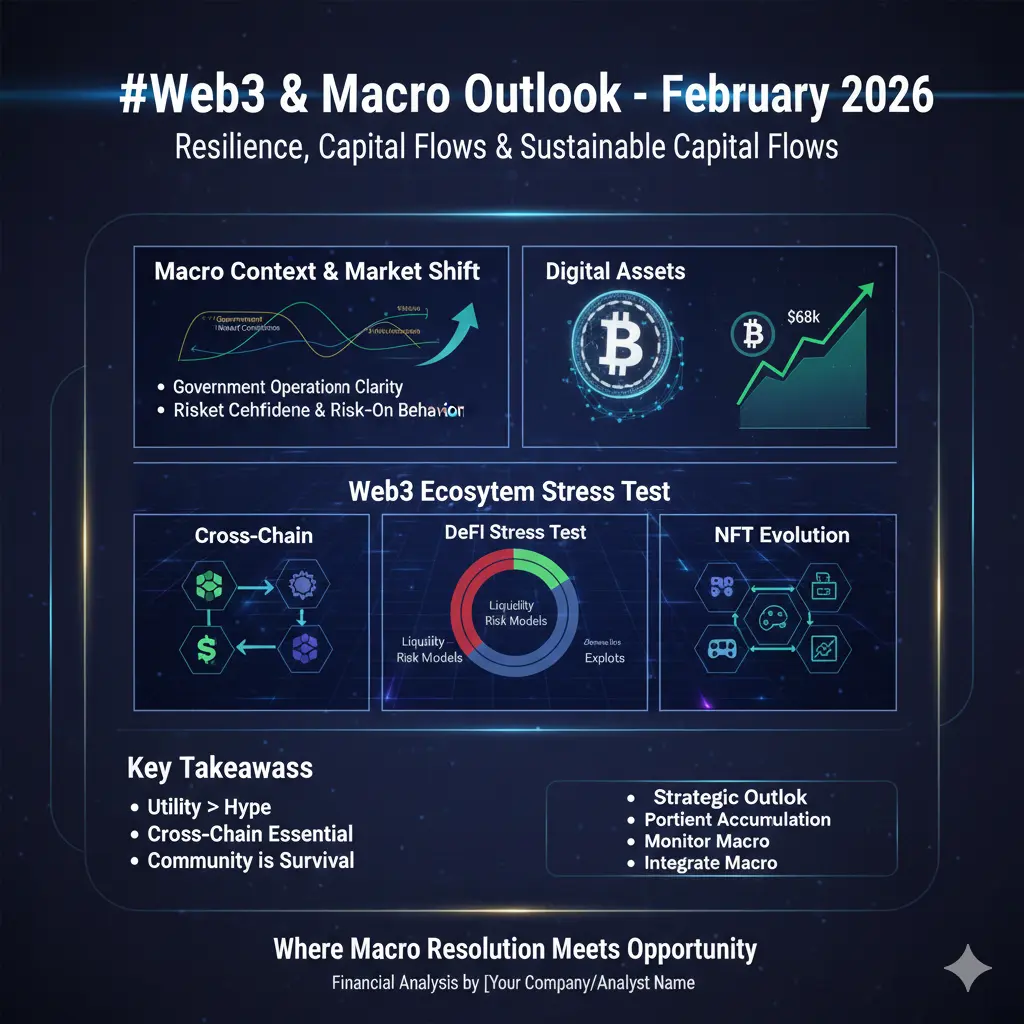

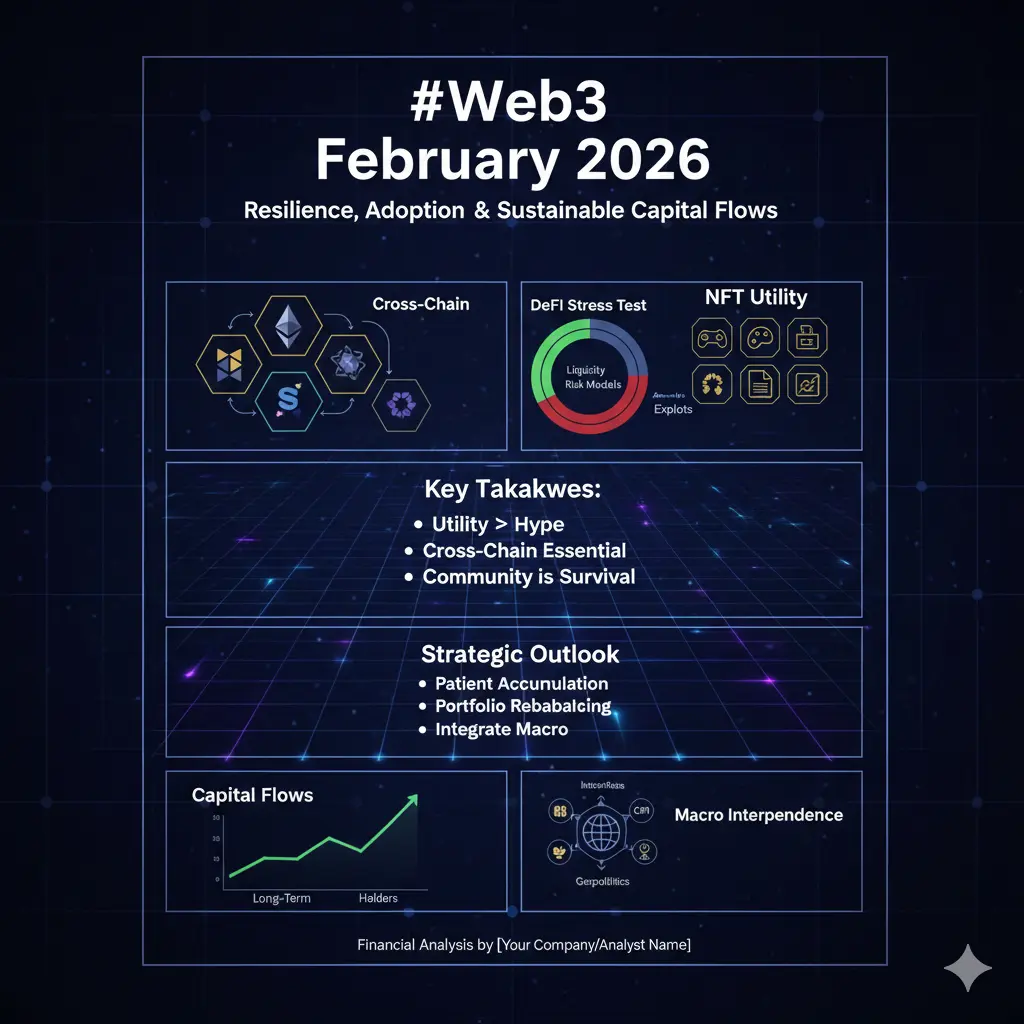

#Web3FebruaryFocus

As Web3 enters February 2026, it is clear that the ecosystem is transitioning from narrative-driven speculation to a phase defined by resilience, real adoption, and sustainable capital flows. This month is shaping up as a critical test for projects across DeFi, NFTs, and cross-chain protocols, as well as for investors who have previously relied on hype and momentum rather than fundamentals.

1. Market Maturity and Capital Dynamics

The Web3 space is experiencing a shift in capital behavior. Short-term speculative flows, often called “paper capital,” continue to cause volatili

As Web3 enters February 2026, it is clear that the ecosystem is transitioning from narrative-driven speculation to a phase defined by resilience, real adoption, and sustainable capital flows. This month is shaping up as a critical test for projects across DeFi, NFTs, and cross-chain protocols, as well as for investors who have previously relied on hype and momentum rather than fundamentals.

1. Market Maturity and Capital Dynamics

The Web3 space is experiencing a shift in capital behavior. Short-term speculative flows, often called “paper capital,” continue to cause volatili

- Reward

- 10

- 11

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#PartialGovernmentShutdownEnds

Market Impact & Strategic Implications (February 2026)

The recent partial U.S. government shutdown has officially concluded, restoring full federal operations and removing a key source of short-term macro uncertainty. While the direct economic damage was limited, the event’s psychological, structural, and market impacts were significant, influencing investor behavior, capital flows, and risk perception across both traditional and crypto markets. Its resolution marks a critical inflection point in market dynamics, providing a cleaner macro backdrop for traders,

Market Impact & Strategic Implications (February 2026)

The recent partial U.S. government shutdown has officially concluded, restoring full federal operations and removing a key source of short-term macro uncertainty. While the direct economic damage was limited, the event’s psychological, structural, and market impacts were significant, influencing investor behavior, capital flows, and risk perception across both traditional and crypto markets. Its resolution marks a critical inflection point in market dynamics, providing a cleaner macro backdrop for traders,

- Reward

- 8

- 10

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#CryptoMarketStructureUpdate

Crypto Market Structure Update , Capital Flows, and Strategic Implications February 2026

The crypto market in February 2026 is navigating a complex and evolving structure characterized by divergent asset behavior, macro-driven volatility, and selective capital rotation. While Bitcoin has experienced significant downward pressure, falling below $65,000 from prior highs near $70,000, and Ethereum shows signs of stress amid network congestion and rising gas costs, certain altcoins, Layer 2 protocols, and utility-driven tokens are demonstrating resilience. Understand

Crypto Market Structure Update , Capital Flows, and Strategic Implications February 2026

The crypto market in February 2026 is navigating a complex and evolving structure characterized by divergent asset behavior, macro-driven volatility, and selective capital rotation. While Bitcoin has experienced significant downward pressure, falling below $65,000 from prior highs near $70,000, and Ethereum shows signs of stress amid network congestion and rising gas costs, certain altcoins, Layer 2 protocols, and utility-driven tokens are demonstrating resilience. Understand

- Reward

- 9

- 10

- Repost

- Share

Ryakpanda :

:

New Year Wealth Explosion 🤑View More

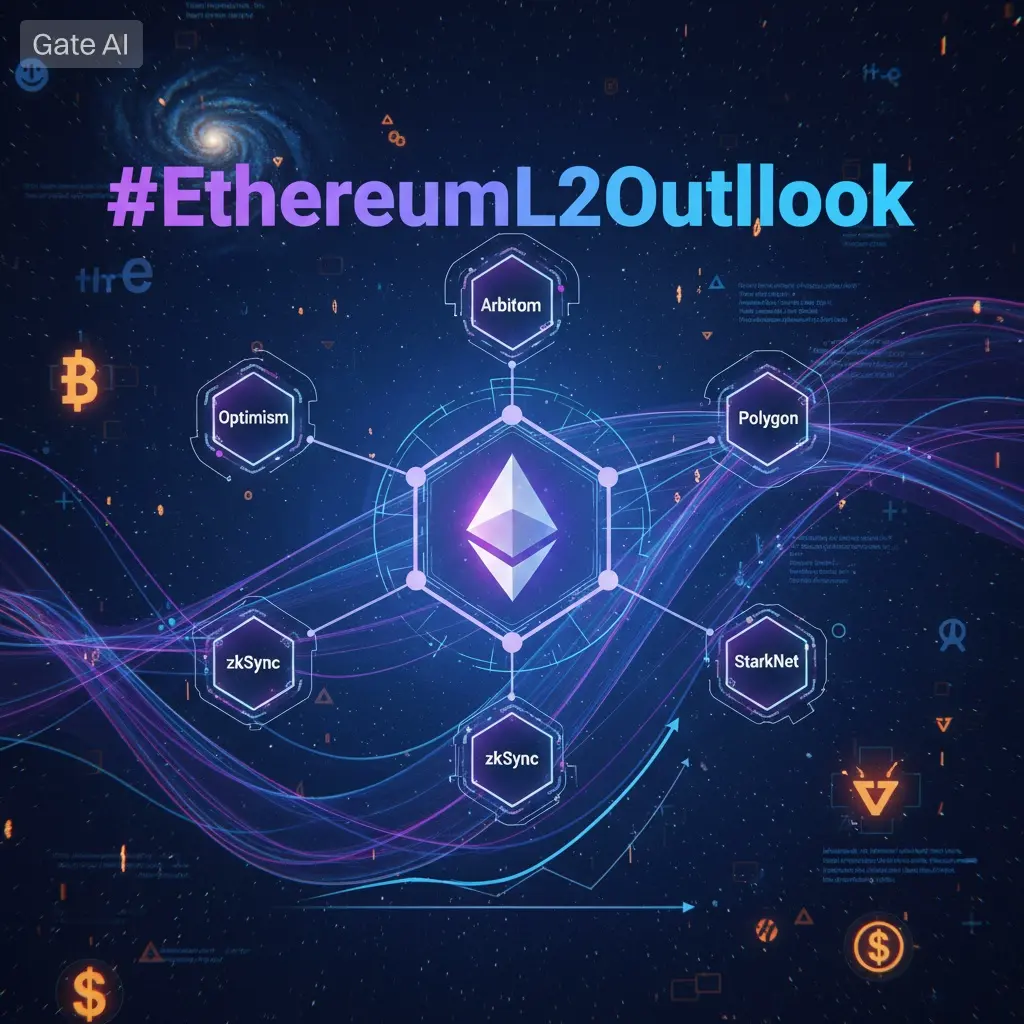

#EthereumL2Outlook

Ethereum Layer 2 Networks: Deep Analysis of Scalability, Adoption, and Future Market Dynamics

The Ethereum ecosystem is entering one of its most critical transformational phases, driven by the rapid evolution of Layer 2 (L2) scaling solutions. Protocols such as Optimism, Arbitrum, zkSync, and Polygon’s zkEVM are no longer optional enhancements they are foundational infrastructure that directly addresses Ethereum’s longstanding bottlenecks: high gas fees, network congestion, and latency in transaction finality. As decentralized applications (dApps) expand across DeFi, NFTs,

Ethereum Layer 2 Networks: Deep Analysis of Scalability, Adoption, and Future Market Dynamics

The Ethereum ecosystem is entering one of its most critical transformational phases, driven by the rapid evolution of Layer 2 (L2) scaling solutions. Protocols such as Optimism, Arbitrum, zkSync, and Polygon’s zkEVM are no longer optional enhancements they are foundational infrastructure that directly addresses Ethereum’s longstanding bottlenecks: high gas fees, network congestion, and latency in transaction finality. As decentralized applications (dApps) expand across DeFi, NFTs,

- Reward

- 10

- 14

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More