# YiLihuaExitsPositions

810

HighAmbition

#YiLihuaExitsPositions

#YiLihuaExitsPositions 🚨

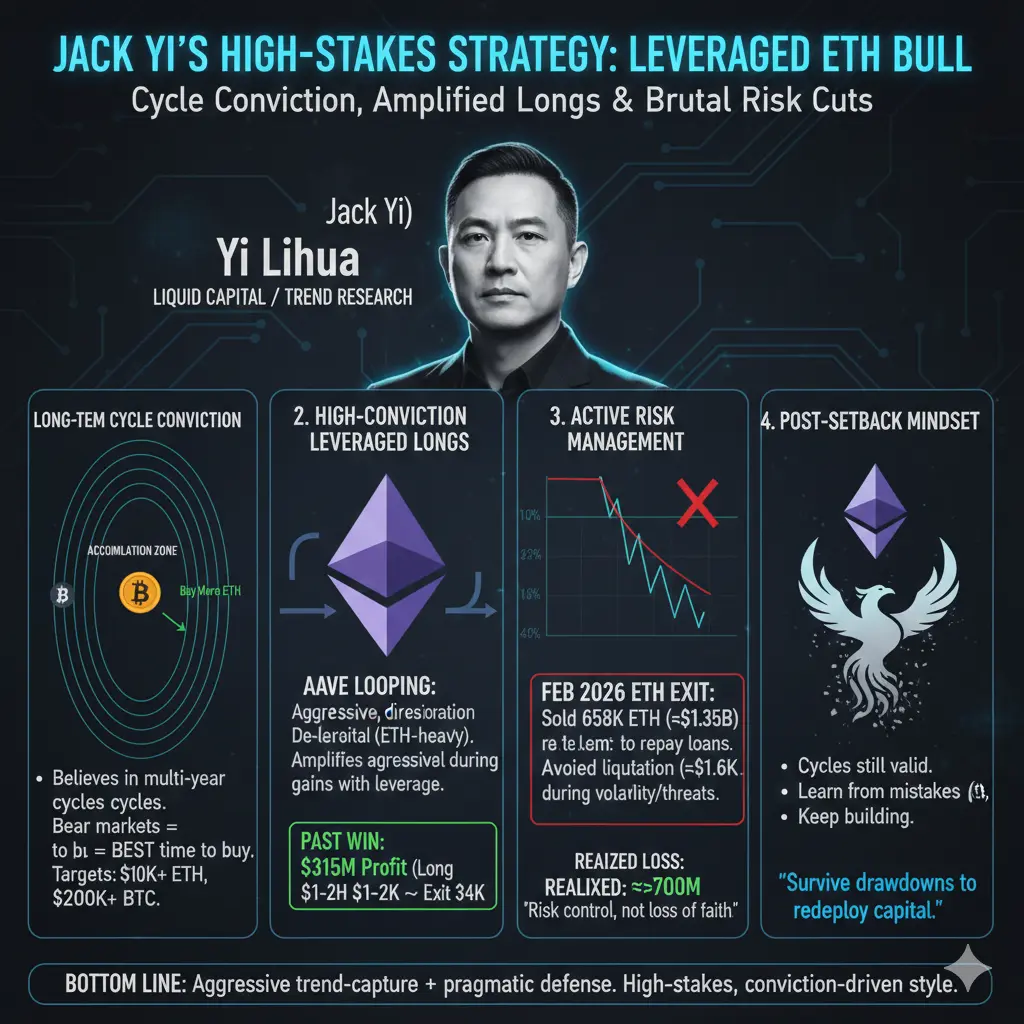

Yi Lihua (Jack Yi), founder of Trend Research and former LD Capital, has fully exited his massive Ethereum (ETH) positions — a move watched closely in crypto circles. Here’s what happened in simple terms:

1️⃣ What “Exiting Positions” Means

Selling or closing your trade to lock in profits or cut losses.

Yi’s team had a leveraged long on ETH (~658K ETH, $2B+ value).

Exit = swapped ETH → USDT, repaid loans, sold almost everything.

2️⃣ Why He Exited

ETH price crashed from ~$3,386 → ~$1,750–$1,820.

Leverage risk: potential forced liquidation.

Tactic

#YiLihuaExitsPositions 🚨

Yi Lihua (Jack Yi), founder of Trend Research and former LD Capital, has fully exited his massive Ethereum (ETH) positions — a move watched closely in crypto circles. Here’s what happened in simple terms:

1️⃣ What “Exiting Positions” Means

Selling or closing your trade to lock in profits or cut losses.

Yi’s team had a leveraged long on ETH (~658K ETH, $2B+ value).

Exit = swapped ETH → USDT, repaid loans, sold almost everything.

2️⃣ Why He Exited

ETH price crashed from ~$3,386 → ~$1,750–$1,820.

Leverage risk: potential forced liquidation.

Tactic

- Reward

- 10

- 14

- Repost

- Share

BlockRider :

:

Buy To Earn 💎View More

#YiLihuaExitsPositions

In markets, sometimes the loudest moments are when the most strategic moves are hidden.

The gradual reduction of billion-dollar leveraged positions—particularly on Ethereum—and the ETH transfers to exchanges by Liquid Capital founder Yi Lihua might be perceived by the market as an "exit." However, a deeper look reveals this is a professional "self-rescue" maneuver and a calculated move for financial sustainability.

Market Cycles and Risk Management

Maintaining liquidation levels in crypto markets is not just a game of mathematics; it is a test of patience. Despite a

In markets, sometimes the loudest moments are when the most strategic moves are hidden.

The gradual reduction of billion-dollar leveraged positions—particularly on Ethereum—and the ETH transfers to exchanges by Liquid Capital founder Yi Lihua might be perceived by the market as an "exit." However, a deeper look reveals this is a professional "self-rescue" maneuver and a calculated move for financial sustainability.

Market Cycles and Risk Management

Maintaining liquidation levels in crypto markets is not just a game of mathematics; it is a test of patience. Despite a

- Reward

- 4

- 6

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

# YiLihuaExitsPositions

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

- Reward

- like

- Comment

- Repost

- Share

# YiLihuaExitsPositions

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

- Reward

- 1

- Comment

- Repost

- Share

#YiLihuaExitsPositions

The recent exit of Yi Lihua from significant cryptocurrency positions has created ripples throughout the market, emphasizing the influence of major institutional flows on price behavior and market sentiment. Large-scale exits from prominent investors serve as both a direct source of selling pressure and an indirect psychological signal for retail and professional participants alike. In this case, Bitcoin and other major assets reacted with immediate volatility, reflecting a combination of forced liquidations, short-term panic selling, and reactive buying from opportunis

The recent exit of Yi Lihua from significant cryptocurrency positions has created ripples throughout the market, emphasizing the influence of major institutional flows on price behavior and market sentiment. Large-scale exits from prominent investors serve as both a direct source of selling pressure and an indirect psychological signal for retail and professional participants alike. In this case, Bitcoin and other major assets reacted with immediate volatility, reflecting a combination of forced liquidations, short-term panic selling, and reactive buying from opportunis

BTC-0,59%

- Reward

- 5

- 6

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

New Year Wealth Explosion 🤑View More

⚠️ #YiLihuaExitsPositions

Breaking: Yi Lihua has reportedly exited some of their positions, sparking market attention. Traders are now watching BTC and other major coins closely for potential volatility.

🔍 Market Insight:

Sudden exits from large holders can cause short-term price fluctuations.

Watch key support and resistance levels to gauge market reaction.

Risk management is essential during periods of high activity from whales.

💡 Tip: Stay alert, avoid panic selling, and focus on strategic entry points.

#YiLihuaExitsPositions #CryptoNews #BTC #Bitcoin #Gateio

Breaking: Yi Lihua has reportedly exited some of their positions, sparking market attention. Traders are now watching BTC and other major coins closely for potential volatility.

🔍 Market Insight:

Sudden exits from large holders can cause short-term price fluctuations.

Watch key support and resistance levels to gauge market reaction.

Risk management is essential during periods of high activity from whales.

💡 Tip: Stay alert, avoid panic selling, and focus on strategic entry points.

#YiLihuaExitsPositions #CryptoNews #BTC #Bitcoin #Gateio

BTC-0,59%

- Reward

- 4

- 9

- Repost

- Share

MrKing :

:

1000x VIbes 🤑View More

#YiLihuaExitsPositions

News of Yi Lihua exiting positions has quickly circulated across crypto circles, triggering a familiar wave of speculation, caution, and narrative-driven reactions. Whenever a well-known market participant adjusts or closes positions, the market rarely stays neutral. Some interpret it as a warning sign, others see it as routine portfolio management. The truth, as always, lies somewhere in between and understanding context matters far more than reacting to headlines.

At this stage of the cycle, exits from prominent figures often reflect risk management rather than outri

News of Yi Lihua exiting positions has quickly circulated across crypto circles, triggering a familiar wave of speculation, caution, and narrative-driven reactions. Whenever a well-known market participant adjusts or closes positions, the market rarely stays neutral. Some interpret it as a warning sign, others see it as routine portfolio management. The truth, as always, lies somewhere in between and understanding context matters far more than reacting to headlines.

At this stage of the cycle, exits from prominent figures often reflect risk management rather than outri

- Reward

- 3

- 4

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

🔥 #YiLihuaExitsPositions 🔥

Market buzz: Yi Lihua, one of the prominent investors, is reportedly exiting some of their positions. This move could signal caution or portfolio rebalancing. 📉💡

💡 Key Points:

Investor Action: Partial or full exit from certain holdings.

Market Sentiment: Traders may react to anticipate further moves.

Next Steps: Keep an eye on price reactions and related market indicators.

⚠️ Bottom Line: Major exits like this can create short-term volatility. Stay alert and watch the charts! 📊

Market buzz: Yi Lihua, one of the prominent investors, is reportedly exiting some of their positions. This move could signal caution or portfolio rebalancing. 📉💡

💡 Key Points:

Investor Action: Partial or full exit from certain holdings.

Market Sentiment: Traders may react to anticipate further moves.

Next Steps: Keep an eye on price reactions and related market indicators.

⚠️ Bottom Line: Major exits like this can create short-term volatility. Stay alert and watch the charts! 📊

- Reward

- like

- Comment

- Repost

- Share

Day 14 · Build Your "Asset Filter": Lock in Three Key Signals Among Thousands of Coins

Good morning, focused hunters.

This is #币圈100天成长计划 Day 14/100.

🌊 The market every day produces countless new codes, narratives, and hot topics. Chasing every "possibility" will quickly dilute your energy and capital.

The real dilemma is often not "having no options," but having too many.

What you need is not just research ability, but a **ruthless filtering system** that can eliminate 99% of the noise before it even reaches your radar.

💎 Today's Build: Three-Layer Funnel Filtering Method

From now on, any

Good morning, focused hunters.

This is #币圈100天成长计划 Day 14/100.

🌊 The market every day produces countless new codes, narratives, and hot topics. Chasing every "possibility" will quickly dilute your energy and capital.

The real dilemma is often not "having no options," but having too many.

What you need is not just research ability, but a **ruthless filtering system** that can eliminate 99% of the noise before it even reaches your radar.

💎 Today's Build: Three-Layer Funnel Filtering Method

From now on, any

BTC-0,59%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 2

- Repost

- Share

CurrencyPaparazzi :

:

90 days basically reset to zero, returning everything to its initial state.View More

12:00 First Analysis: Yesterday, Bitcoin and ETH spot minute charts experienced abnormal fluctuations, possibly caused by a liquidation event of a market-making bot.

BlockBeats reports that on February 9, Wintermute founder Evgeny Gaevoy analyzed the abnormal volatility in Bitcoin and ETH spot 1-minute charts on the early morning of February 8. He stated that it was very likely due to a market-making bot experiencing a liquidation, with losses possibly reaching tens of millions of dollars. The abnormal fluctuations were caused by losses from the bot, not malicious actions by market makers, a

BlockBeats reports that on February 9, Wintermute founder Evgeny Gaevoy analyzed the abnormal volatility in Bitcoin and ETH spot 1-minute charts on the early morning of February 8. He stated that it was very likely due to a market-making bot experiencing a liquidation, with losses possibly reaching tens of millions of dollars. The abnormal fluctuations were caused by losses from the bot, not malicious actions by market makers, a

ETH-2,62%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

180.03K Popularity

39.9K Popularity

57 Popularity

810 Popularity

3.79K Popularity

1.81K Popularity

1.59K Popularity

247 Popularity

13.22K Popularity

1.84K Popularity

1.5K Popularity

974 Popularity

70.58K Popularity

17.2K Popularity

37.24K Popularity

News

View MoreData: Gate's 24-hour net fund inflow exceeds $17.81 million, ranking first worldwide

3 m

Is Ethereum shifting its strategy? The wavering priority of Rollups has led the Ethereum mainnet to reassert itself as the central engine driving the ecosystem forward.

5 m

XRP Price News: Whale Accumulation + Corporate $2 Billion Reserves, Is XRP Poised to Reach a New High Again?

7 m

2026 Crypto Crash "Contrarians": XMR, SUI, AVAX, LINK Decouple and Outperform the Market

8 m

Maple: The web application has security vulnerabilities, which could compromise user deposit safety. Please be cautious and ensure your funds are protected.

9 m

Pin