#WhiteHouseTalksStablecoinYields

✨The White House discussed stablecoin interest yields.

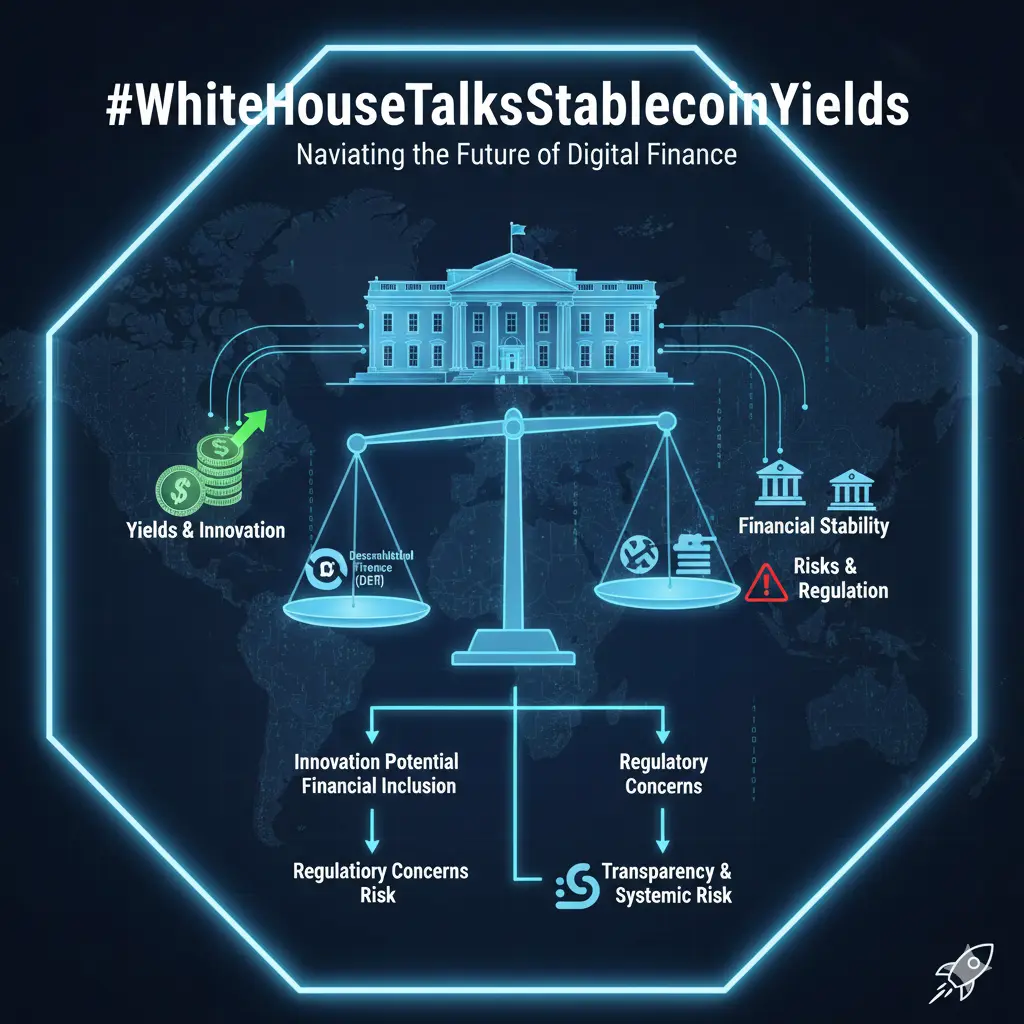

🔹The US administration has begun to give the first serious signals on how the interest income from stablecoin reserves will be shared or regulated.

🔹Some officials are debating whether these yields will remain entirely with the companies or be distributed to the users.

🔥This is poised to be one of the hottest topics of stablecoin regulation in 2026.

🤔Do you think stablecoin yields should be shared with users?

✨The White House discussed stablecoin interest yields.

🔹The US administration has begun to give the first serious signals on how the interest income from stablecoin reserves will be shared or regulated.

🔹Some officials are debating whether these yields will remain entirely with the companies or be distributed to the users.

🔥This is poised to be one of the hottest topics of stablecoin regulation in 2026.

🤔Do you think stablecoin yields should be shared with users?