NolanVincent

No content yet

An OG who received 5,000 $BTC 12 years ago sold another 500 $BTC ($47.77M) today. This OG originally received the 5,000 $BTC 12 years ago ($1.66M at the time), when $BTC was priced at $332. Since December 4, 2024, he has been selling $BTC, dumping 2,500 $BTC ($265M) at an average price of $106,164. He still holds 2,500 $BTC ($237.5M), with total profits exceeding $500M.

BTC-0,16%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- 1

- Repost

- Share

GateUser-67acb45f :

:

Very interesting information, thank you ♥️Don't place large directional bets at ~50¢ odds.

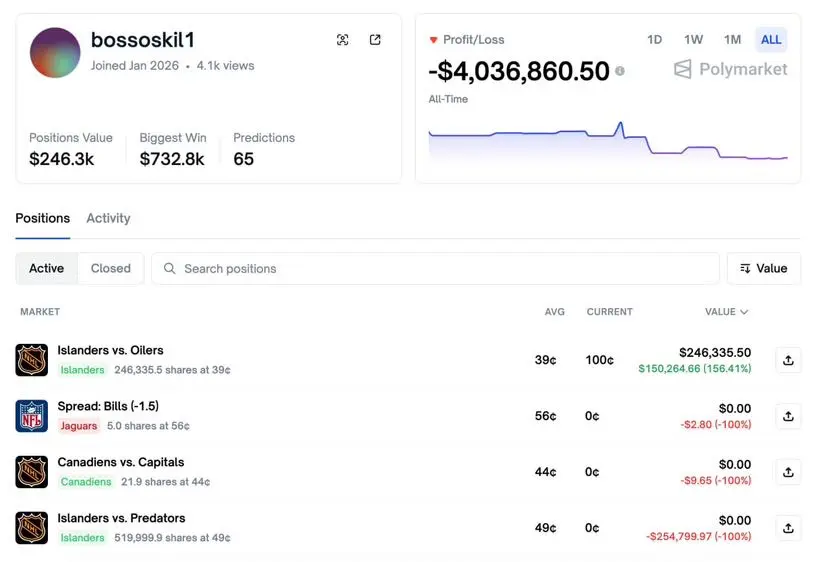

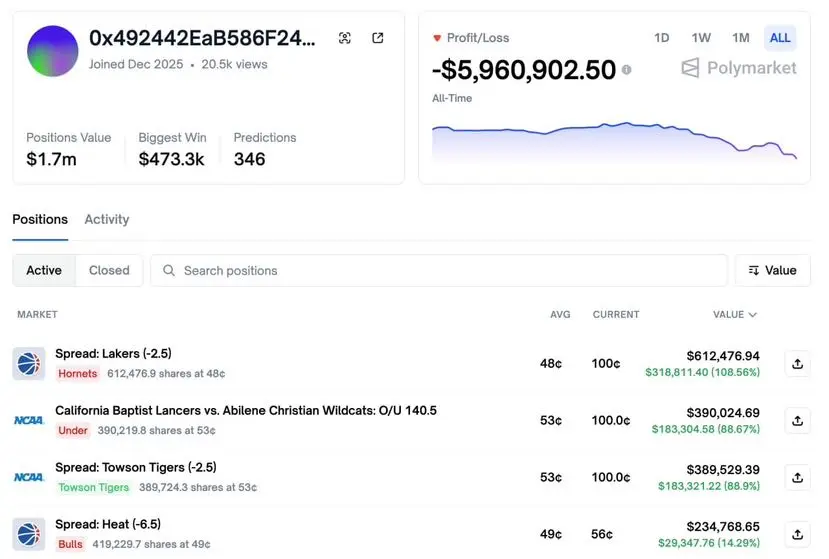

2 #Polymarket traders bet heavily on sports markets at 48¢–57¢, and lost nearly $10M in less than a month.

0x4924: 346 predictions, 46.24% win rate, -$5.96M in 24 days

bossoskil1: 65 predictions, 41.54% win rate, -$4.04M in 11 days

At ~50¢ odds, you're basically flipping a coin. Betting big just means losing faster.

2 #Polymarket traders bet heavily on sports markets at 48¢–57¢, and lost nearly $10M in less than a month.

0x4924: 346 predictions, 46.24% win rate, -$5.96M in 24 days

bossoskil1: 65 predictions, 41.54% win rate, -$4.04M in 11 days

At ~50¢ odds, you're basically flipping a coin. Betting big just means losing faster.

- Reward

- 1

- 1

- Repost

- Share

GateUser-19ac3732 :

:

Thank you for the information provided 👋- Reward

- like

- Comment

- Repost

- Share

This guy deposited 3M $USDC into #Hyperliquid for a high-stakes gamble.

He used maximum leverage to short 18,261 $ETH($60.32M) and 1,845 $XMR($1.27M).

$ETH liquidation price: $3,380

He used maximum leverage to short 18,261 $ETH($60.32M) and 1,845 $XMR($1.27M).

$ETH liquidation price: $3,380

ETH0,5%

- Reward

- 1

- 1

- Repost

- Share

GateUser-1391e233 :

:

Thank you very much for the information 👋- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

This guy created a new wallet "mutualdelta", posing as an insider, and spent $40K betting on “US strikes Iran by January 14, 2026.”

He lost the bet — the entire $40K was wiped out.

He lost the bet — the entire $40K was wiped out.

- Reward

- like

- Comment

- Repost

- Share

Donald Trump said that a Venezuelan leaker is already in jail.

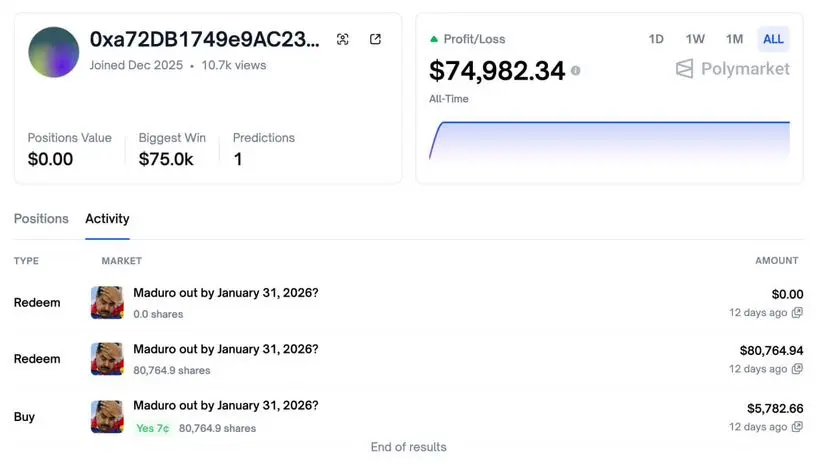

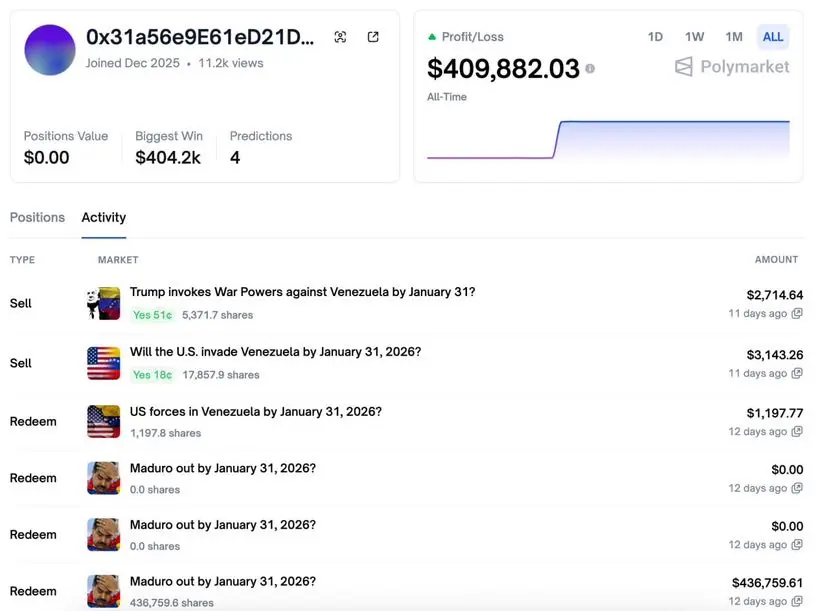

We noticed that two of the three wallets that previously profited from betting on Venezuelan President Maduro being out of office have been inactive for 11 days.

The remaining wallet, "SBet365" placed another bet 2 days ago, predicting that Khamenei out as Supreme Leader of Iran by January 31.

We noticed that two of the three wallets that previously profited from betting on Venezuelan President Maduro being out of office have been inactive for 11 days.

The remaining wallet, "SBet365" placed another bet 2 days ago, predicting that Khamenei out as Supreme Leader of Iran by January 31.

- Reward

- like

- Comment

- Repost

- Share

Smart trader hai15617 uses the same strategy again to predict #Bitcoin价格走势,又赚取了44.5K美元。他在一天内做出了24个预测,其中有8个是成功的,赢率为33.33%,总利润达到了136.8K美元。

BTC-0,16%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share