# ETHEREUM

610.97K

AylaShinex

#EthereumFoundationUnveilsItsStrawmap 🗺️⚙️

The Ethereum Foundation has introduced its latest “Strawmap” — an early-stage strategic outline designed to guide Ethereum’s next phase of development.

Unlike a rigid roadmap, a strawmap is flexible. It outlines direction, priorities, and long-term thinking without locking the ecosystem into fixed deadlines.

🔍 What Stands Out

⚙️ Scalability Focus

Continued work on rollups, data availability, and Layer-2 efficiency suggests Ethereum is doubling down on modular scaling.

🔐 Security & Resilience

Improvements to validator operations and network robustne

The Ethereum Foundation has introduced its latest “Strawmap” — an early-stage strategic outline designed to guide Ethereum’s next phase of development.

Unlike a rigid roadmap, a strawmap is flexible. It outlines direction, priorities, and long-term thinking without locking the ecosystem into fixed deadlines.

🔍 What Stands Out

⚙️ Scalability Focus

Continued work on rollups, data availability, and Layer-2 efficiency suggests Ethereum is doubling down on modular scaling.

🔐 Security & Resilience

Improvements to validator operations and network robustne

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊#ETHMarketAnalysis #ETHMarketAnalysis ⚔️

Ethereum at the Edge: Holding Structure or Slipping Lower?

Ethereum is hovering around the $1,900 region after bouncing from a sharp dip near $1,850. What began as a relief reaction has now transitioned into a clear defensive phase, with bulls attempting to stabilize price within the $1,880–$1,900 corridor.

This zone is no longer just support — it’s a structural decision point.

📊 Technical Positioning

Short-Term Context:

After a steep intraday drop, price action shows reactive buying rather than aggressive continuation lower. However, recovery momentum

Ethereum at the Edge: Holding Structure or Slipping Lower?

Ethereum is hovering around the $1,900 region after bouncing from a sharp dip near $1,850. What began as a relief reaction has now transitioned into a clear defensive phase, with bulls attempting to stabilize price within the $1,880–$1,900 corridor.

This zone is no longer just support — it’s a structural decision point.

📊 Technical Positioning

Short-Term Context:

After a steep intraday drop, price action shows reactive buying rather than aggressive continuation lower. However, recovery momentum

ETH-0,42%

- Reward

- 1

- Comment

- Repost

- Share

$ETH Bearish Flag Breakdown Below $1,800 = Free Fall to $1,300

#Ethereum Price Still respecting descending channel with multiple BOS confirmations from $4,950 TOP.

🔴 Bearish OB: $3,400-$3,550 ✅

🟢 FVG: $3,200-$3,400 (Short Entry Filled ✅)

🔵 Support: $1,800 (Channel Low)

🟢 Best Accumulation: $1,300 (For Long Term Holders)

No CHoCH on HTF = Bearish bias intact.

Smart Money Likely Targeting Liquidity Below $1,750 Before Any Reversal.

If price breaks down $1,800 bearish flag channel support, high chances ETH revisits $1,300. Which Would be a mind-blowing entry for long-term holders.

Bearish

#Ethereum Price Still respecting descending channel with multiple BOS confirmations from $4,950 TOP.

🔴 Bearish OB: $3,400-$3,550 ✅

🟢 FVG: $3,200-$3,400 (Short Entry Filled ✅)

🔵 Support: $1,800 (Channel Low)

🟢 Best Accumulation: $1,300 (For Long Term Holders)

No CHoCH on HTF = Bearish bias intact.

Smart Money Likely Targeting Liquidity Below $1,750 Before Any Reversal.

If price breaks down $1,800 bearish flag channel support, high chances ETH revisits $1,300. Which Would be a mind-blowing entry for long-term holders.

Bearish

ETH-0,42%

MC:$5.57KHolders:2

0.09%

- Reward

- 3

- Comment

- Repost

- Share

The Ethereum Foundation has unveiled its latest “strawmap,” offering a forward-looking framework for Ethereum’s technical and ecosystem priorities. The outline emphasizes scalability, security, and developer experience as the network continues to evolve.

This early-stage roadmap signals a collaborative approach, inviting community feedback before final directions are set. As Ethereum matures, such transparent planning reinforces confidence among builders, investors, and users watching the network’s next phase of growth.

#Ethereum #ETH #Blockchain #CryptoInnovation #Web3

This early-stage roadmap signals a collaborative approach, inviting community feedback before final directions are set. As Ethereum matures, such transparent planning reinforces confidence among builders, investors, and users watching the network’s next phase of growth.

#Ethereum #ETH #Blockchain #CryptoInnovation #Web3

ETH-0,42%

- Reward

- 3

- 2

- Repost

- Share

CryptoEye :

:

LFG 🔥View More

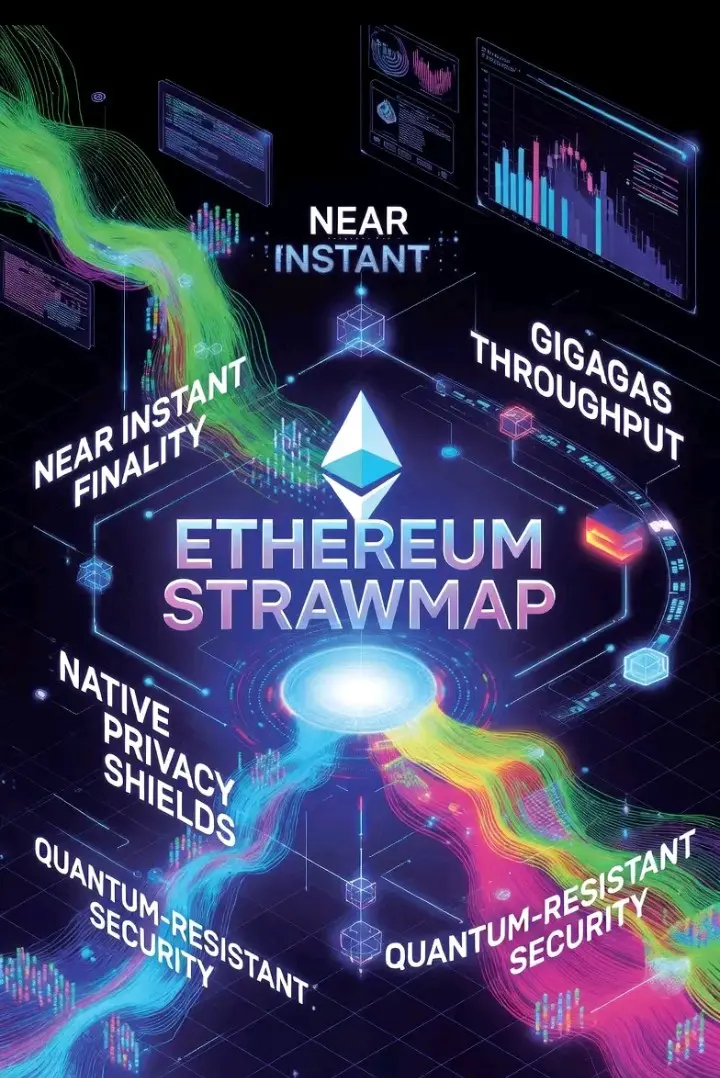

# EthereumFoundationUnveilsItsStrawmap

The future of Ethereum is looking

clearer than ever. 🌕✨

The Ethereum Foundation has updated

its vision, unveiling the latest "Strawmap" for the network's

evolution. We aren't just looking at scaling anymore; we are looking at

sustainability, censorship resistance, and long-term viability.

Key highlights on the horizon: 🛡️ The Scourge: Tackling MEV and centralization risks

to ensure credible neutrality. 🚀

The Surge: Scaling L2s to 100,000 TPS. 🌳

The Verge: Moving toward stateless clients. 🧹 The Purge: Cleaning up historical data to ease node

opera

The future of Ethereum is looking

clearer than ever. 🌕✨

The Ethereum Foundation has updated

its vision, unveiling the latest "Strawmap" for the network's

evolution. We aren't just looking at scaling anymore; we are looking at

sustainability, censorship resistance, and long-term viability.

Key highlights on the horizon: 🛡️ The Scourge: Tackling MEV and centralization risks

to ensure credible neutrality. 🚀

The Surge: Scaling L2s to 100,000 TPS. 🌳

The Verge: Moving toward stateless clients. 🧹 The Purge: Cleaning up historical data to ease node

opera

ETH-0,42%

- Reward

- 2

- Comment

- Repost

- Share

🚨 Market Update | February 19

BTC: ~$66,900

ETH: ~$1,980

Crypto markets continue to consolidate as volatility remains present.

🔹 Bitcoin (BTC)

BTC is trading around the $67K region, maintaining a neutral short-term structure.

Price action shows stabilization, but no confirmed breakout yet.

🔹 Ethereum (ETH)

ETH is hovering below the $2,000 psychological level.

Movement remains aligned with BTC, reflecting cautious market positioning.

🔹 Current Conditions

• Elevated volatility

• Balanced buyer-seller activity

• Liquidity-driven intraday moves

• Neutral momentum overall

──────────

🧠 Market N

BTC: ~$66,900

ETH: ~$1,980

Crypto markets continue to consolidate as volatility remains present.

🔹 Bitcoin (BTC)

BTC is trading around the $67K region, maintaining a neutral short-term structure.

Price action shows stabilization, but no confirmed breakout yet.

🔹 Ethereum (ETH)

ETH is hovering below the $2,000 psychological level.

Movement remains aligned with BTC, reflecting cautious market positioning.

🔹 Current Conditions

• Elevated volatility

• Balanced buyer-seller activity

• Liquidity-driven intraday moves

• Neutral momentum overall

──────────

🧠 Market N

- Reward

- 7

- 7

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#ETHMarketAnalysis 📊🔥

Ethereum is showing signs of consolidation as bulls 🟢 and bears 🔴 battle near key levels. Momentum is moderate, and the market is waiting for a decisive move.

Here’s what we’re watching 👀

📌 RSI holding near the mid-zone → Slight bullish bias but not overbought

📌 Volume steady → No explosive breakout yet

📌 Price near resistance → Break above could trigger upside momentum 🚀

📌 Support holding → Buyers still defending key levels

What needs to happen for a strong bullish continuation?

✅ Clean breakout with strong volume

✅ Higher highs formation

✅ Momentum indicators

Ethereum is showing signs of consolidation as bulls 🟢 and bears 🔴 battle near key levels. Momentum is moderate, and the market is waiting for a decisive move.

Here’s what we’re watching 👀

📌 RSI holding near the mid-zone → Slight bullish bias but not overbought

📌 Volume steady → No explosive breakout yet

📌 Price near resistance → Break above could trigger upside momentum 🚀

📌 Support holding → Buyers still defending key levels

What needs to happen for a strong bullish continuation?

✅ Clean breakout with strong volume

✅ Higher highs formation

✅ Momentum indicators

ETH-0,42%

- Reward

- 3

- 3

- Repost

- Share

EagleEye :

:

watching closely thanks for infromationView More

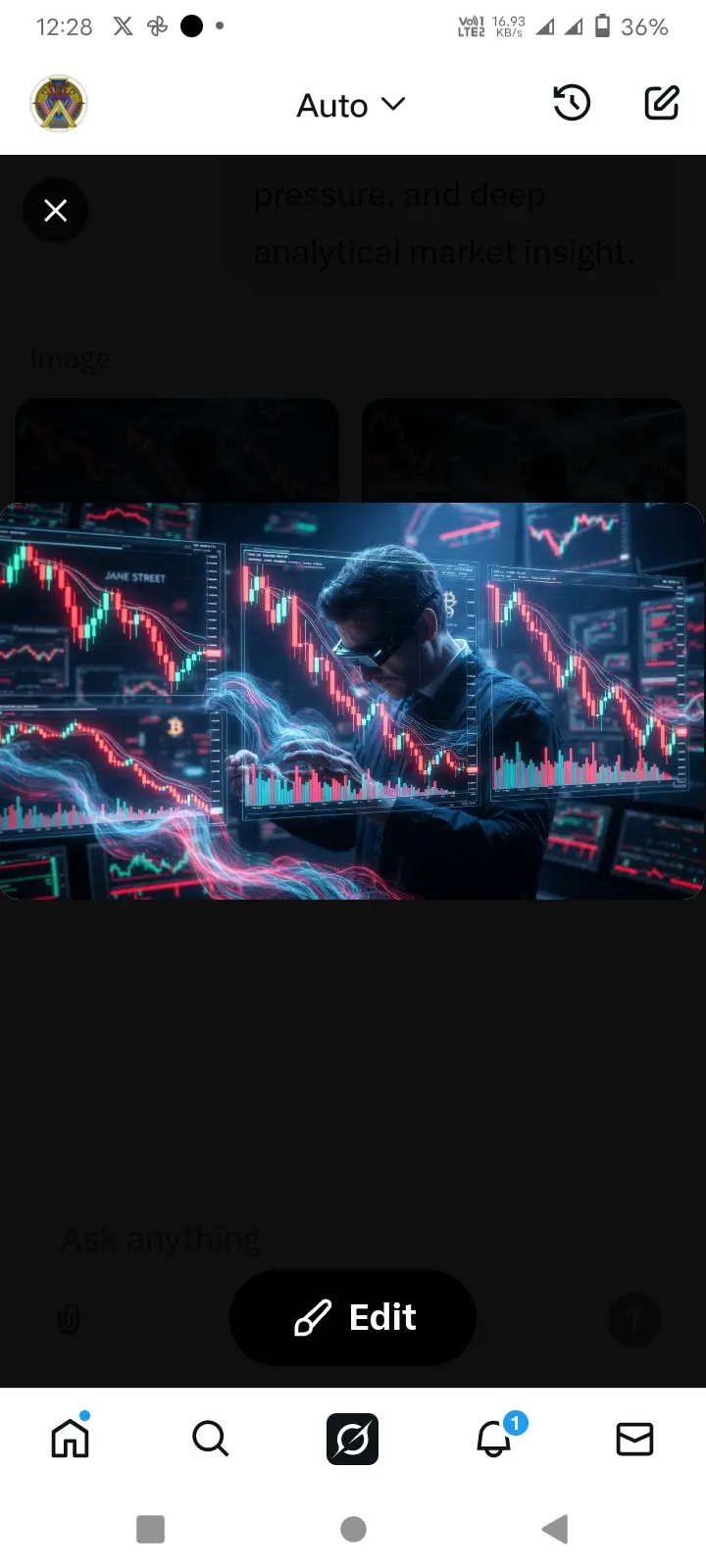

#JaneStreet10AMSellOff

Market Analysis 🚨

This morning’s 10 AM sell-off driven by Jane Street flows wasn’t just a random dip — it reveals underlying market dynamics that traders need to understand.

📊 Market Breakdown:

BTC & ETH: Sharp intraday drop triggered by stop-loss cascades.

Exchange Flows: Significant outflows, indicating long-term holders are absorbing the sell pressure.

Funding Rates: Neutral to slightly negative → short squeeze potential remains intact.

💡 Insights for Traders & Creators:

Liquidity Zones: Major support levels ($65K–$66K for BTC) are key to monitor.

Institutional Ac

Market Analysis 🚨

This morning’s 10 AM sell-off driven by Jane Street flows wasn’t just a random dip — it reveals underlying market dynamics that traders need to understand.

📊 Market Breakdown:

BTC & ETH: Sharp intraday drop triggered by stop-loss cascades.

Exchange Flows: Significant outflows, indicating long-term holders are absorbing the sell pressure.

Funding Rates: Neutral to slightly negative → short squeeze potential remains intact.

💡 Insights for Traders & Creators:

Liquidity Zones: Major support levels ($65K–$66K for BTC) are key to monitor.

Institutional Ac

- Reward

- 2

- Comment

- Repost

- Share

#JaneStreet10AMSellOff

Market Analysis 🚨

This morning’s 10 AM sell-off driven by Jane Street flows wasn’t just a random dip — it reveals underlying market dynamics that traders need to understand.

📊 Market Breakdown:

BTC & ETH: Sharp intraday drop triggered by stop-loss cascades.

Exchange Flows: Significant outflows, indicating long-term holders are absorbing the sell pressure.

Funding Rates: Neutral to slightly negative → short squeeze potential remains intact.

💡 Insights for Traders & Creators:

Liquidity Zones: Major support levels ($65K–$66K for BTC) are key to monitor.

Institutional Ac

Market Analysis 🚨

This morning’s 10 AM sell-off driven by Jane Street flows wasn’t just a random dip — it reveals underlying market dynamics that traders need to understand.

📊 Market Breakdown:

BTC & ETH: Sharp intraday drop triggered by stop-loss cascades.

Exchange Flows: Significant outflows, indicating long-term holders are absorbing the sell pressure.

Funding Rates: Neutral to slightly negative → short squeeze potential remains intact.

💡 Insights for Traders & Creators:

Liquidity Zones: Major support levels ($65K–$66K for BTC) are key to monitor.

Institutional Ac

- Reward

- 8

- 6

- Repost

- Share

SheenCrypto :

:

2026 GOGOGO 👊View More

🚨 **Ethereum “Strawmap” Revealed!** ⚡

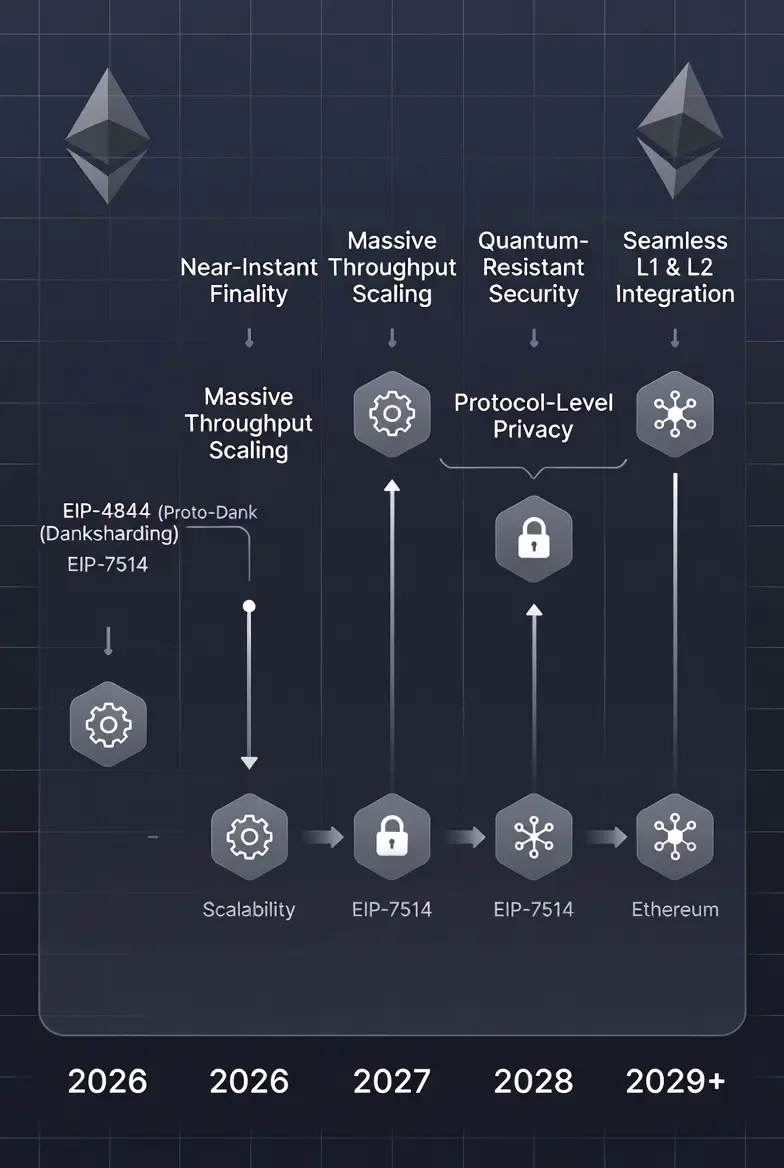

Ethereum just unveiled its long-revealed **Strawmap roadmap** — a plan for major upgrades through **2029**.

💡 Goals:

⚡ Faster transactions (seconds finality)

📈 Huge scalability boost

🔐 Better security & privacy

👉 This could strengthen Ethereum’s position as the **global settlement layer** for Web3.

📊 **Tokens to Watch:**

🔵 $ETH

🟣 $ARB

🟢 $OP

🟠 $MATIC

#Ethereum #ETH #CryptoNews #Web3

Ethereum just unveiled its long-revealed **Strawmap roadmap** — a plan for major upgrades through **2029**.

💡 Goals:

⚡ Faster transactions (seconds finality)

📈 Huge scalability boost

🔐 Better security & privacy

👉 This could strengthen Ethereum’s position as the **global settlement layer** for Web3.

📊 **Tokens to Watch:**

🔵 $ETH

🟣 $ARB

🟢 $OP

🟠 $MATIC

#Ethereum #ETH #CryptoNews #Web3

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.46M Popularity

152.16K Popularity

101.93K Popularity

1.66M Popularity

499.73K Popularity

9.76K Popularity

8.79K Popularity

22.19K Popularity

4.84K Popularity

366.98K Popularity

45.84K Popularity

103.6K Popularity

17.9K Popularity

106.1K Popularity

8.83K Popularity

News

View MoreBULLA increased by 50.55% after launching Alpha, current price is 0.02304 USDT

53 m

Data: In the past 24 hours, the total liquidation across the network was $498 million, with long positions liquidated at $357 million and short positions at $141 million.

1 h

CIA assessment: Even if Hamedani is killed, hardliners in Iran will succeed him

1 h

Vitalik: EIP-8141 is expected to be implemented within a year, fully resolving the account abstraction issue

1 h

The EU states that they received radio signals from Iran stating "No ships are allowed to pass through the Strait of Hormuz"

1 h

Pin