#WhenisBestTimetoEntertheMarket

The age-old question in crypto: When is the best time to enter the market?

Timing the market is one of the most debated topics among investors. Some swear by waiting for the perfect dip, others say it's impossible and you should just get in. In volatile crypto, especially Bitcoin right now (sitting around $67K–$70K after that sharp drop from $126K highs), the answer isn't one-size-fits-all—but there are proven strategies, historical patterns, and smart approaches that can stack the odds in your favor.

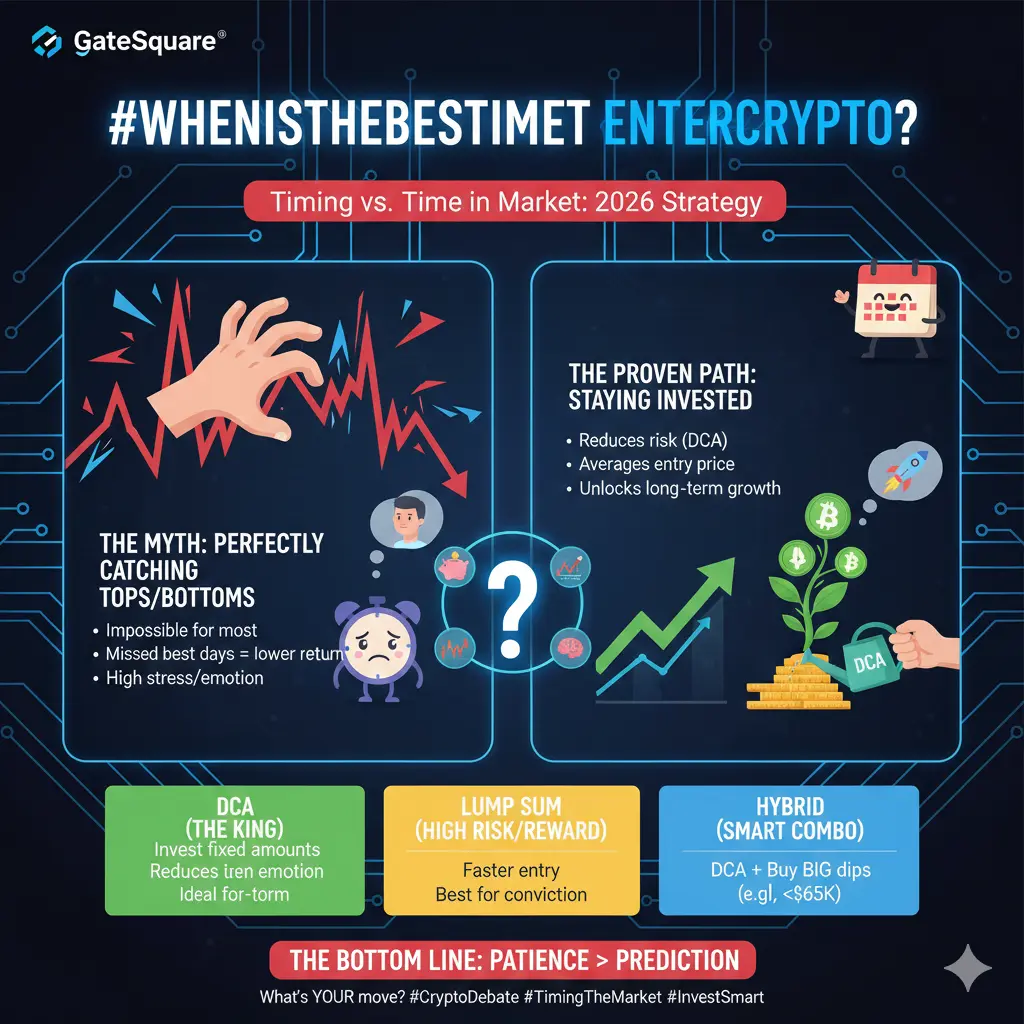

1. The Hard Truth: Nobody Can Perfectly Time the Market (Consistently)

Trying to catch the absolute bottom or top is like gambling. Even pros get it wrong. Studies and backtests show that timing the market (waiting for the "perfect" entry) underperforms simply being in the market over long periods. Why? Markets spend more time going up than down, and missing the best days crushes returns. In crypto, this is amplified—Bitcoin's massive bull runs reward those who stay invested through the noise.

2. Historical Cycles: Where Are We in 2026?

Bitcoin follows roughly 4-year cycles tied to halvings (the last one was April 2024). Post-halving, we usually see:

Accumulation → Bull run peaks ~12–18 months later.

Then sharp corrections/bear phases.

In 2026, we're roughly 20+ months post-halving. Many analysts see this as late-cycle: potential for choppy consolidation, deeper corrections (some predict $50K–$65K tests), or a final push higher if institutional demand holds. Predictions range wildly—$75K–$150K+ by year-end—but volatility is expected to stay high with macro factors (rates, geopolitics, regulation).

Key takeaway: If you're long-term bullish on Bitcoin/crypto, now (during corrections) often looks like the "best" entry in hindsight—but only if you hold through the storm.

3. Short-Term Timing: When in the Day/Week to Enter

Crypto never sleeps, but patterns exist due to global overlaps:

Best time of day — Early morning (pre-NYSE open) or late Sunday/early Monday UTC—prices often dip lower with thinner liquidity, then rise as volume kicks in.

Best days — Mondays (after weekend slowdowns) or mid-week (Tue–Thu) when liquidity peaks during Europe/US overlap (around 1–9 PM UTC / evening in many time zones).

Avoid weekends if you're active trading—lower volume means wilder swings and slippage.

These are edges for day traders or quick entries—not magic for long-term investors.

4. Core Strategies: How to Actually Enter Smartly

Dollar-Cost Averaging (DCA) — The king for most people. Invest fixed amounts regularly (weekly/monthly) regardless of price.

Pros: Reduces timing risk, averages your entry, removes emotion.

In volatile 2026, DCA shines during dips—buy more when cheap, less when high. Backtests show it beats trying to time dips most of the time.

Ideal if: You're building over months/years and hate FOMO/regret.

Lump Sum — Invest your full amount at once when you decide to enter.

Pros: Gets you in the market faster—historically beats DCA ~70–80% of the time because time in market > timing.

Cons: Brutal if you buy right before a big crash.

Best for: Strong conviction + long horizon (3–5+ years).

Hybrid/Tiered — DCA most, but add bigger buys on 10–20% dips (e.g., current levels or below $65K support). This combines discipline with opportunity.

Dip Buying — Wait for fear/greed extremes (check indices). Buy when panic sells hit—but only what you can afford to hold forever.

5. Key Indicators to Watch Before Entering

Market sentiment: Extreme fear (like now?) often signals bottoms.

Support levels: $65K hold is huge—if lost, $50K next; hold → recovery potential to $100K+.

On-chain data: Whale accumulation, ETF inflows.

Macro: Lower rates, institutional adoption favor bulls.

Your situation: Only invest what you can lose. Have emergency fund, diversified portfolio first.

6. The Ultimate Answer: The Best Time Is When You're Ready

Financially prepared (no debt pressure).

Mentally ready (accept volatility, long-term view).

Strategically set (DCA plan, risk management).

In crypto's wild ride, time in the market beats timing the market for 90% of people. Waiting for the "perfect" moment often means missing the boat entirely. 2026 could bring massive upside if cycles hold—or more pain if macro worsens. But history favors those who enter during fear and hold through greed.

The age-old question in crypto: When is the best time to enter the market?

Timing the market is one of the most debated topics among investors. Some swear by waiting for the perfect dip, others say it's impossible and you should just get in. In volatile crypto, especially Bitcoin right now (sitting around $67K–$70K after that sharp drop from $126K highs), the answer isn't one-size-fits-all—but there are proven strategies, historical patterns, and smart approaches that can stack the odds in your favor.

1. The Hard Truth: Nobody Can Perfectly Time the Market (Consistently)

Trying to catch the absolute bottom or top is like gambling. Even pros get it wrong. Studies and backtests show that timing the market (waiting for the "perfect" entry) underperforms simply being in the market over long periods. Why? Markets spend more time going up than down, and missing the best days crushes returns. In crypto, this is amplified—Bitcoin's massive bull runs reward those who stay invested through the noise.

2. Historical Cycles: Where Are We in 2026?

Bitcoin follows roughly 4-year cycles tied to halvings (the last one was April 2024). Post-halving, we usually see:

Accumulation → Bull run peaks ~12–18 months later.

Then sharp corrections/bear phases.

In 2026, we're roughly 20+ months post-halving. Many analysts see this as late-cycle: potential for choppy consolidation, deeper corrections (some predict $50K–$65K tests), or a final push higher if institutional demand holds. Predictions range wildly—$75K–$150K+ by year-end—but volatility is expected to stay high with macro factors (rates, geopolitics, regulation).

Key takeaway: If you're long-term bullish on Bitcoin/crypto, now (during corrections) often looks like the "best" entry in hindsight—but only if you hold through the storm.

3. Short-Term Timing: When in the Day/Week to Enter

Crypto never sleeps, but patterns exist due to global overlaps:

Best time of day — Early morning (pre-NYSE open) or late Sunday/early Monday UTC—prices often dip lower with thinner liquidity, then rise as volume kicks in.

Best days — Mondays (after weekend slowdowns) or mid-week (Tue–Thu) when liquidity peaks during Europe/US overlap (around 1–9 PM UTC / evening in many time zones).

Avoid weekends if you're active trading—lower volume means wilder swings and slippage.

These are edges for day traders or quick entries—not magic for long-term investors.

4. Core Strategies: How to Actually Enter Smartly

Dollar-Cost Averaging (DCA) — The king for most people. Invest fixed amounts regularly (weekly/monthly) regardless of price.

Pros: Reduces timing risk, averages your entry, removes emotion.

In volatile 2026, DCA shines during dips—buy more when cheap, less when high. Backtests show it beats trying to time dips most of the time.

Ideal if: You're building over months/years and hate FOMO/regret.

Lump Sum — Invest your full amount at once when you decide to enter.

Pros: Gets you in the market faster—historically beats DCA ~70–80% of the time because time in market > timing.

Cons: Brutal if you buy right before a big crash.

Best for: Strong conviction + long horizon (3–5+ years).

Hybrid/Tiered — DCA most, but add bigger buys on 10–20% dips (e.g., current levels or below $65K support). This combines discipline with opportunity.

Dip Buying — Wait for fear/greed extremes (check indices). Buy when panic sells hit—but only what you can afford to hold forever.

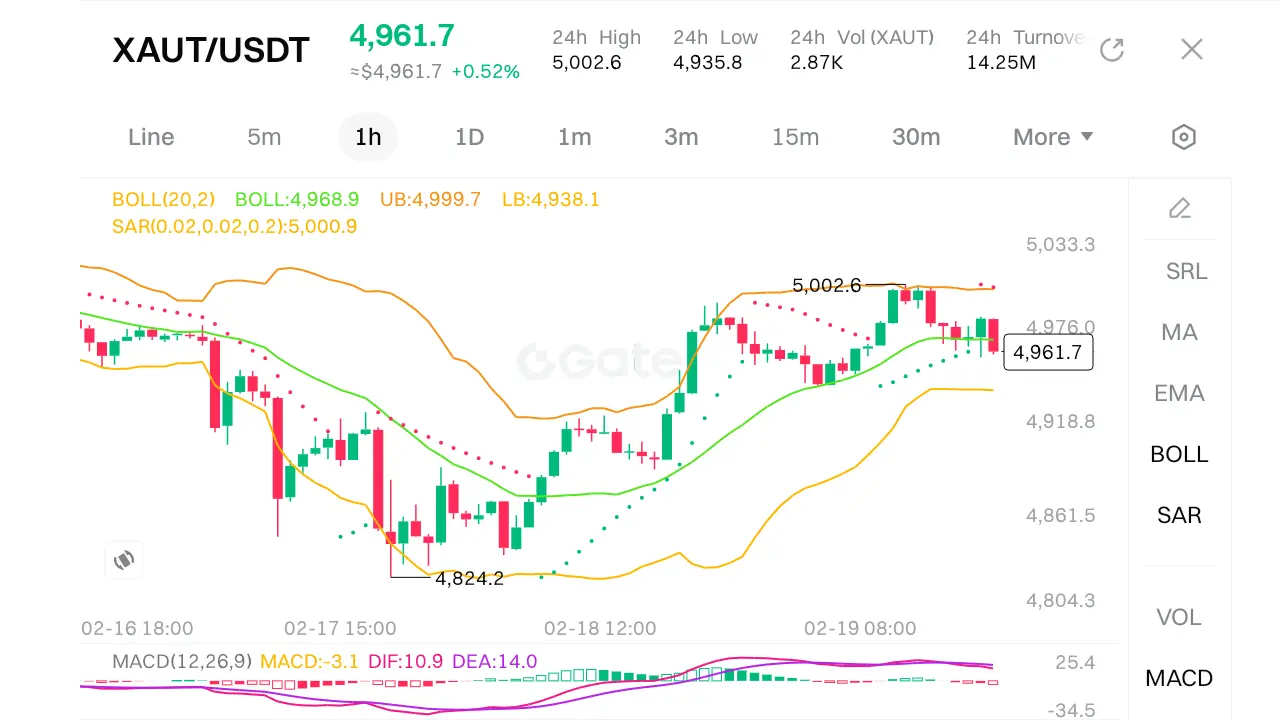

5. Key Indicators to Watch Before Entering

Market sentiment: Extreme fear (like now?) often signals bottoms.

Support levels: $65K hold is huge—if lost, $50K next; hold → recovery potential to $100K+.

On-chain data: Whale accumulation, ETF inflows.

Macro: Lower rates, institutional adoption favor bulls.

Your situation: Only invest what you can lose. Have emergency fund, diversified portfolio first.

6. The Ultimate Answer: The Best Time Is When You're Ready

Financially prepared (no debt pressure).

Mentally ready (accept volatility, long-term view).

Strategically set (DCA plan, risk management).

In crypto's wild ride, time in the market beats timing the market for 90% of people. Waiting for the "perfect" moment often means missing the boat entirely. 2026 could bring massive upside if cycles hold—or more pain if macro worsens. But history favors those who enter during fear and hold through greed.