# Investing

461.1K

neesa04

📉 Why Are Gold, Gold Stocks, and Bitcoin Falling Together?

Recently, investors have observed an unusual phenomenon: traditional safe-haven assets like gold and gold stocks, along with Bitcoin (BTC), are declining simultaneously. Understanding why this is happening requires looking at macroeconomic trends and investor behavior.

💡 Key Factors Behind the Sell-Off:

Rising Interest Rates:

Central banks around the world have been raising interest rates to combat inflation. Higher interest rates make fixed-income assets like bonds more attractive, drawing capital away from gold and cryptocurrencies

Recently, investors have observed an unusual phenomenon: traditional safe-haven assets like gold and gold stocks, along with Bitcoin (BTC), are declining simultaneously. Understanding why this is happening requires looking at macroeconomic trends and investor behavior.

💡 Key Factors Behind the Sell-Off:

Rising Interest Rates:

Central banks around the world have been raising interest rates to combat inflation. Higher interest rates make fixed-income assets like bonds more attractive, drawing capital away from gold and cryptocurrencies

BTC2,11%

- Reward

- like

- Comment

- Repost

- Share

💥 Silver Rollercoaster: Crash & Bounce Update!

Silver is grabbing attention—not just for its price, but for wild, crypto-like moves.

🌪️ What Happened:

After hitting $111 in late January, Silver crashed 15% in one day (Feb 5), now trading $64–$73.

The drop was like a crypto "margin squeeze"—forced selling after breaking key levels.

Buyers are stepping in near $70, hinting at a possible bottom.

🔋 Why Crypto Fans Care:

Supply Shortage: 5 years of less silver than demand.

Industrial Boom: Solar panels & AI data centers use lots of silver.

Gold-Silver Ratio: Silver is catching up to gold despite

Silver is grabbing attention—not just for its price, but for wild, crypto-like moves.

🌪️ What Happened:

After hitting $111 in late January, Silver crashed 15% in one day (Feb 5), now trading $64–$73.

The drop was like a crypto "margin squeeze"—forced selling after breaking key levels.

Buyers are stepping in near $70, hinting at a possible bottom.

🔋 Why Crypto Fans Care:

Supply Shortage: 5 years of less silver than demand.

Industrial Boom: Solar panels & AI data centers use lots of silver.

Gold-Silver Ratio: Silver is catching up to gold despite

- Reward

- like

- Comment

- Repost

- Share

#SEConTokenizedSecurities

The world of finance is rapidly evolving, and one of the most transformative trends today is the rise of tokenized securities. Tokenization essentially means converting traditional financial assets, like stocks, bonds, or real estate, into digital tokens on a blockchain. This innovation is reshaping how investors access and trade assets, making markets more inclusive, transparent, and efficient.

Tokenized securities offer liquidity in previously illiquid markets. Traditionally, assets such as private equity or real estate required significant capital and long holding

The world of finance is rapidly evolving, and one of the most transformative trends today is the rise of tokenized securities. Tokenization essentially means converting traditional financial assets, like stocks, bonds, or real estate, into digital tokens on a blockchain. This innovation is reshaping how investors access and trade assets, making markets more inclusive, transparent, and efficient.

Tokenized securities offer liquidity in previously illiquid markets. Traditionally, assets such as private equity or real estate required significant capital and long holding

- Reward

- 10

- 12

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

#SEConTokenizedSecurities

The world of finance is rapidly evolving, and one of the most transformative trends today is the rise of tokenized securities. Tokenization essentially means converting traditional financial assets, like stocks, bonds, or real estate, into digital tokens on a blockchain. This innovation is reshaping how investors access and trade assets, making markets more inclusive, transparent, and efficient.

Tokenized securities offer liquidity in previously illiquid markets. Traditionally, assets such as private equity or real estate required significant capital and long holding

The world of finance is rapidly evolving, and one of the most transformative trends today is the rise of tokenized securities. Tokenization essentially means converting traditional financial assets, like stocks, bonds, or real estate, into digital tokens on a blockchain. This innovation is reshaping how investors access and trade assets, making markets more inclusive, transparent, and efficient.

Tokenized securities offer liquidity in previously illiquid markets. Traditionally, assets such as private equity or real estate required significant capital and long holding

- Reward

- 2

- Comment

- Repost

- Share

Market Analysis: The Gold Frenzy & The Coming Capital Rotation

Current Sentiment & Data Points:

There is a notable surge in bullish sentiment across traditional safe-haven assets. Prominent figures like Robert Kiyosaki are publishing extreme long-term targets (e.g., $27,000/oz for gold), while on-chain and futures data indicate sustained accumulation by institutional "whales." This trend has now extended to retail traders on centralized exchanges (CEXs), who are increasingly allocating to gold and silver futures.

Interpretation & Risk:

This pervasive, multi-angle hype across investor classes i

Current Sentiment & Data Points:

There is a notable surge in bullish sentiment across traditional safe-haven assets. Prominent figures like Robert Kiyosaki are publishing extreme long-term targets (e.g., $27,000/oz for gold), while on-chain and futures data indicate sustained accumulation by institutional "whales." This trend has now extended to retail traders on centralized exchanges (CEXs), who are increasingly allocating to gold and silver futures.

Interpretation & Risk:

This pervasive, multi-angle hype across investor classes i

BTC2,11%

- Reward

- like

- Comment

- Repost

- Share

Headline: 🚀 ETH to Hit $7,500 by 2026?

Could Ethereum reach a massive $7,500 in the next cycle? Experts and major banks like Standard Chartered are predicting a huge surge for the crypto giant by 2026! 📈

Why the bullish outlook?

✅ Increasing ETF Inflows

✅ Layer 2 Scaling Improvements

✅ Deflationary Supply Mechanics

This could be the opportunity of a lifetime. Are you accumulating ETH right now or waiting for a dip? 🤔

Drop your price prediction in the comments below! 👇

Hashtags:

#Ethereum #CryptoNews #ETH #BullMarket #Investing

Could Ethereum reach a massive $7,500 in the next cycle? Experts and major banks like Standard Chartered are predicting a huge surge for the crypto giant by 2026! 📈

Why the bullish outlook?

✅ Increasing ETF Inflows

✅ Layer 2 Scaling Improvements

✅ Deflationary Supply Mechanics

This could be the opportunity of a lifetime. Are you accumulating ETH right now or waiting for a dip? 🤔

Drop your price prediction in the comments below! 👇

Hashtags:

#Ethereum #CryptoNews #ETH #BullMarket #Investing

ETH4,07%

- Reward

- 2

- 3

- Repost

- Share

Annie'sLegend :

:

It depends on where it hits before it rises again. Right now, buying just makes you a rookie. It all depends on where the price drops to before it bounces back. If you buy now, you're just a rookie trader waiting for the next move.View More

🚀 Bitcoin (BTC) Update: Current Market Outlook

Bitcoin is currently sitting at a critical price level. For investors and traders alike, this is an incredibly exciting time to watch the charts!

📊 Market Highlights:

Market Trend: BTC is showing strong resilience, attempting to maintain its Bullish momentum.

Support Levels: If we see a correction, it is crucial to keep a close eye on the immediate support zones.

Resistance: The next major hurdle or target is the current All-Time High (ATH) or the psychological resistance range just above it.

💡 Why It Matters Right Now:

Institutional In

Bitcoin is currently sitting at a critical price level. For investors and traders alike, this is an incredibly exciting time to watch the charts!

📊 Market Highlights:

Market Trend: BTC is showing strong resilience, attempting to maintain its Bullish momentum.

Support Levels: If we see a correction, it is crucial to keep a close eye on the immediate support zones.

Resistance: The next major hurdle or target is the current All-Time High (ATH) or the psychological resistance range just above it.

💡 Why It Matters Right Now:

Institutional In

BTC2,11%

- Reward

- like

- Comment

- Repost

- Share

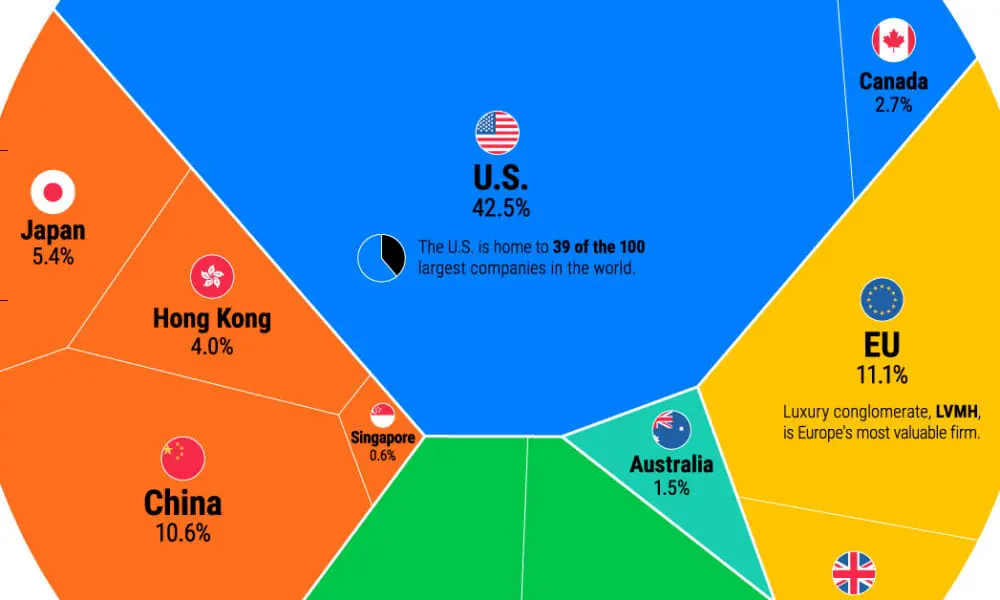

Mind-Blowing Visualization Alert 📊

Ever wondered how massive the U.S. stock market is compared to the rest of the world? The numbers will shock you!

Stock markets offer legendary gains — and unforgettable crashes.

From Warren Buffett's empire to global panic sells, this space is a rollercoaster of adrenaline and opportunity 💰🎢

Right now, the U.S. market is *crushing* the global scene 🌎🇺🇸

Take a look at these unreal charts and see why investors are paying attention.

🔁 Diversify your portfolio with stocks, crypto, and more — only on *Gate.io*

BULLAETH $B

#StockMarket #USStocks

Ever wondered how massive the U.S. stock market is compared to the rest of the world? The numbers will shock you!

Stock markets offer legendary gains — and unforgettable crashes.

From Warren Buffett's empire to global panic sells, this space is a rollercoaster of adrenaline and opportunity 💰🎢

Right now, the U.S. market is *crushing* the global scene 🌎🇺🇸

Take a look at these unreal charts and see why investors are paying attention.

🔁 Diversify your portfolio with stocks, crypto, and more — only on *Gate.io*

BULLAETH $B

#StockMarket #USStocks

- Reward

- like

- Comment

- Repost

- Share

🚀 Before the next wave hits, focus on foundations — not noise.

Here are 10 projects with real utility & strong narratives that could shape the next market cycle 👇

ETH · $SOL ·$ ARB · $LINK · ONDO$

TAO · FET · RNDR · GRT · HNT

📌 Not signals — just the names that keep building while others sleep.

If you want the full breakdown, tell me — I’ll drop the article.

#Crypto #Web3 #BullRun #Investing #DeFi #AI$BTC

Here are 10 projects with real utility & strong narratives that could shape the next market cycle 👇

ETH · $SOL ·$ ARB · $LINK · ONDO$

TAO · FET · RNDR · GRT · HNT

📌 Not signals — just the names that keep building while others sleep.

If you want the full breakdown, tell me — I’ll drop the article.

#Crypto #Web3 #BullRun #Investing #DeFi #AI$BTC

BTC2,11%

- Reward

- 1

- Comment

- Repost

- Share

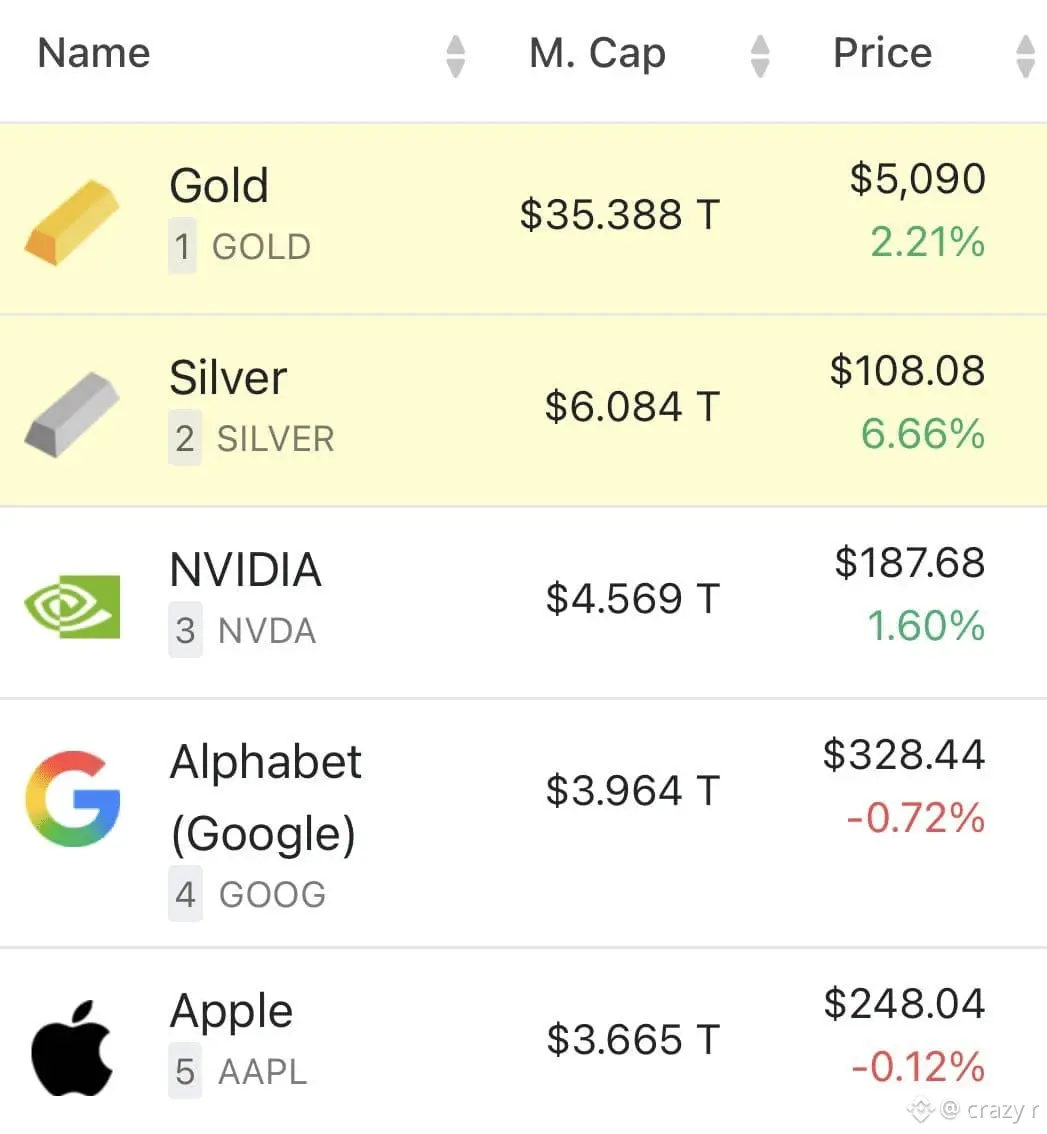

🚨 Market Shock Alert! 🚨

🥈 Silver Surpasses Apple in Global Market Cap Rankings 🍎

According to PANews, fresh data from 8marketcap shows that silver has officially overtaken Apple in total market capitalization 📊

🔥 With this move, silver is now the 3rd largest asset in the world, highlighting the growing strength of precious metals amid global economic shifts.

💡 Key Takeaway:

Investors are increasingly looking at hard assets

Commodities like silver are gaining momentum

A big reminder that traditional markets still matter

📈 Stay sharp. Stay informed.

👉 Follow for more market updates & in

🥈 Silver Surpasses Apple in Global Market Cap Rankings 🍎

According to PANews, fresh data from 8marketcap shows that silver has officially overtaken Apple in total market capitalization 📊

🔥 With this move, silver is now the 3rd largest asset in the world, highlighting the growing strength of precious metals amid global economic shifts.

💡 Key Takeaway:

Investors are increasingly looking at hard assets

Commodities like silver are gaining momentum

A big reminder that traditional markets still matter

📈 Stay sharp. Stay informed.

👉 Follow for more market updates & in

[The user has shared his/her trading data. Go to the App to view more.]

MC:$3.57KHolders:1

0.09%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

156.94K Popularity

15.08K Popularity

394.69K Popularity

4.6K Popularity

16.54K Popularity

13.57K Popularity

14.12K Popularity

13.04K Popularity

9.63K Popularity

3.58K Popularity

22.55K Popularity

13.72K Popularity

26.22K Popularity

34.76K Popularity

29.23K Popularity

News

View MoreData: Tokens such as CONX, AVAX, and APT will experience large unlocks next week, with CONX unlocking worth approximately $15.6 million.

18 m

Analyst: Despite the silver plunge, retail investors continue to double down

29 m

CoinShares: The risk of quantum vulnerability in Bitcoin is manageable, no need to panic at the moment

47 m

Over the past hour, the entire network has experienced liquidations exceeding $30 million, mainly short positions.

1 h

BTC Breaks Through 71,000 USDT

1 h

Pin