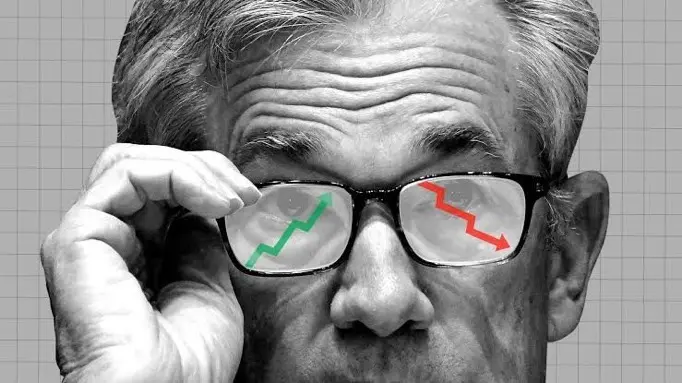

The FOMC meeting minutes are just around the corner, and the market is already bracing for a strong reaction. These minutes reveal what the Federal Reserve has been discussing privately — and traders are eager to see whether the outlook leans toward rate cuts, cautious neutrality, or possibly tighter policy as we move toward year-end.

If the minutes reflect confidence in declining inflation, Bitcoin and other altcoins often gain positive momentum. But if the Fed shows hesitation, expect sharp waves of volatility. That’s why markets usually move slowly before the release and then surge unpredic

If the minutes reflect confidence in declining inflation, Bitcoin and other altcoins often gain positive momentum. But if the Fed shows hesitation, expect sharp waves of volatility. That’s why markets usually move slowly before the release and then surge unpredic

BTC-0,69%