Post content & earn content mining yield

placeholder

Powdere

Good night, team

Another intense day in the books and tomorrow brings new adventures

Wishing you all deep rest, clear minds, and sweet dreams.

Sleep well

Another intense day in the books and tomorrow brings new adventures

Wishing you all deep rest, clear minds, and sweet dreams.

Sleep well

- Reward

- like

- Comment

- Repost

- Share

🔥 News: 🔥

Revolut has applied for a full banking license in Peru, expanding its push into Latin America.

Revolut has applied for a full banking license in Peru, expanding its push into Latin America.

- Reward

- like

- Comment

- Repost

- Share

马年币富

马年币富

Created By@XiaoliangIsGoingToSu

Listing Progress

0.00%

MC:

$3.45K

Create My Token

- Reward

- 1

- Comment

- Repost

- Share

💯💯💯💯💯💯

🇧🇲 Bermuda is building the world’s first fully onchain national economy, backed by #Coinbase and Circle. 💛

#crypto

🇧🇲 Bermuda is building the world’s first fully onchain national economy, backed by #Coinbase and Circle. 💛

#crypto

- Reward

- like

- Comment

- Repost

- Share

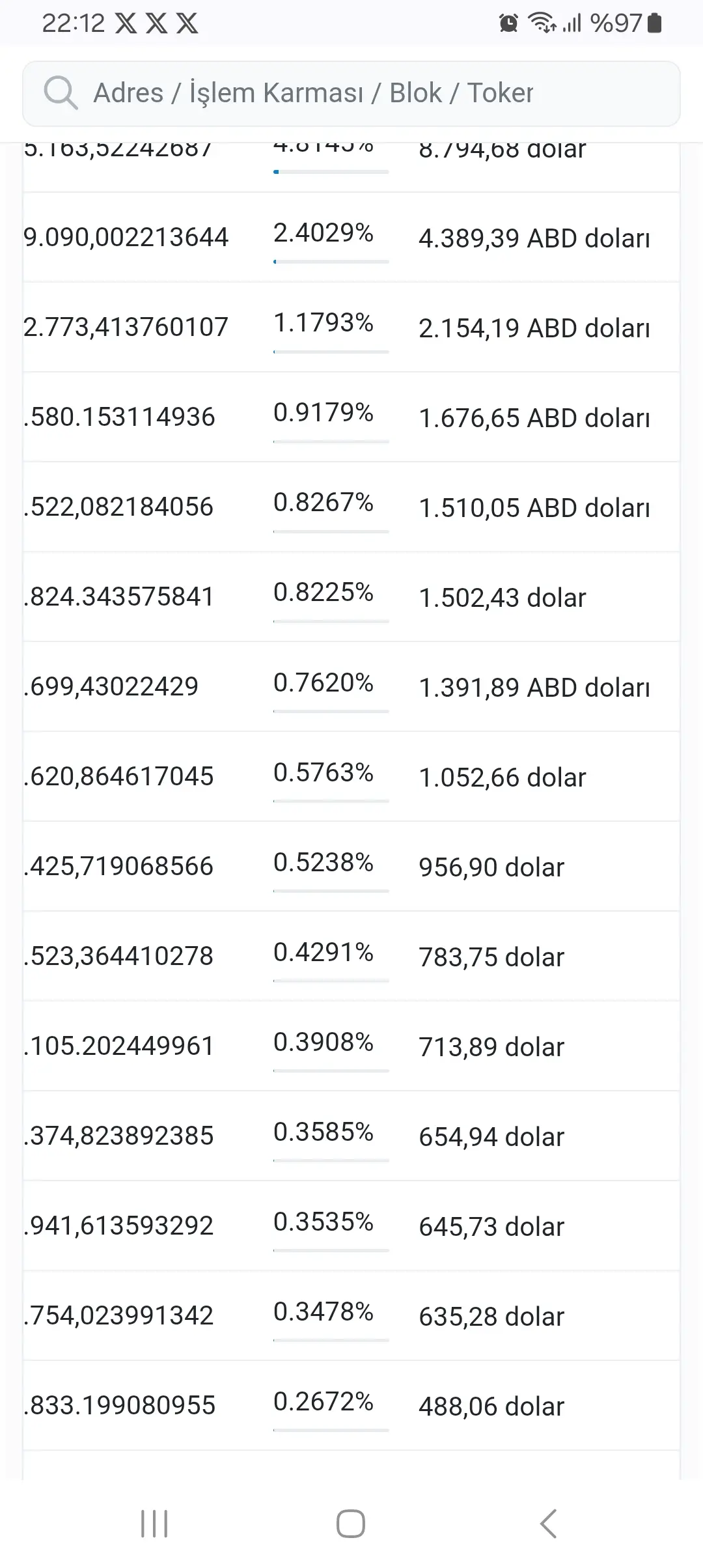

$2.17 BILLION POURED INTO DIGITAL ASSETS THIS WEEK -- BIGGEST INFLOW SINCE OCTOBER!

#Bitcoin just flexed hard, pulling in a massive $1.55 BILLION alone as investors piled back into crypto products despite late-week geopolitical drama, tariff threats, and policy uncertainty.

According to fresh CoinShares data, total net inflows hit $2.17B -- the strongest week since October 2025. $ETH joined the party with $496M, $SOL grabbed $45.5M, and even $XRP saw $69.5M in fresh capital.

The U.S. led the charge with over $2B of the inflows, proving institutions still see $BTC and major alts as core holding

#Bitcoin just flexed hard, pulling in a massive $1.55 BILLION alone as investors piled back into crypto products despite late-week geopolitical drama, tariff threats, and policy uncertainty.

According to fresh CoinShares data, total net inflows hit $2.17B -- the strongest week since October 2025. $ETH joined the party with $496M, $SOL grabbed $45.5M, and even $XRP saw $69.5M in fresh capital.

The U.S. led the charge with over $2B of the inflows, proving institutions still see $BTC and major alts as core holding

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

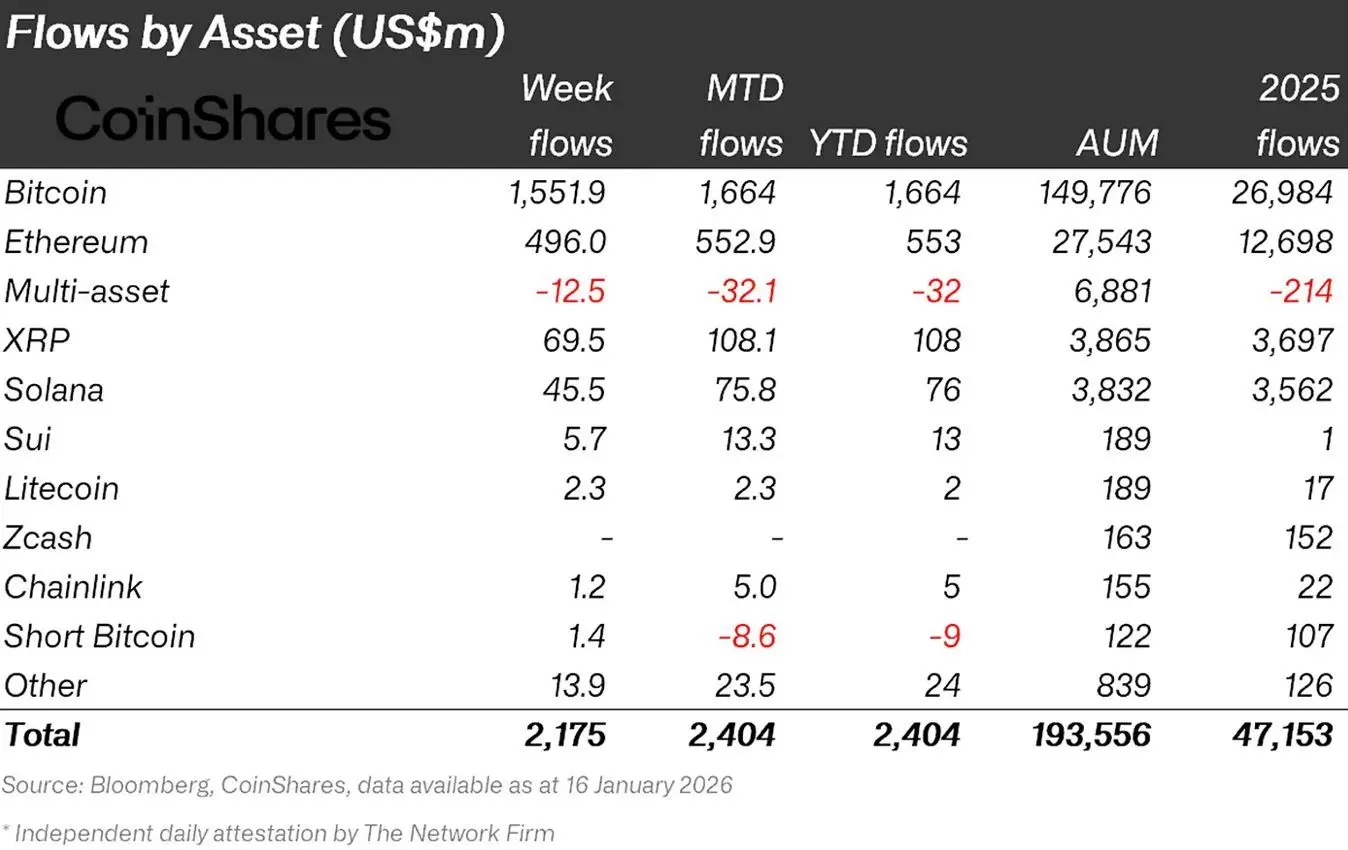

$BTC and crypto dipped on a classic macro shock: geopolitical tariff headlines hit during low weekend liquidity, triggering risk-off, leveraged long liquidations, and a cascade through derivatives.

Key detail: ETF markets were closed, selling came from spot/OTC and futures, not structural ETF outflows. Over $870M in liquidations flushed crowded longs fast.

The positive part? This was positioning-driven, not thesis-breaking. $BTC already reclaimed ~$93K, showing buyers are still present.

Volatility clears excess. Structure stays intact. These resets are how stronger trends continue.

Key detail: ETF markets were closed, selling came from spot/OTC and futures, not structural ETF outflows. Over $870M in liquidations flushed crowded longs fast.

The positive part? This was positioning-driven, not thesis-breaking. $BTC already reclaimed ~$93K, showing buyers are still present.

Volatility clears excess. Structure stays intact. These resets are how stronger trends continue.

BTC-2,3%

- Reward

- like

- Comment

- Repost

- Share

My Gate 2025 Year-End Summary is here! See how I performed this year.

Click the link to view your exclusive #2025GateYearEndSummary and claim a 20 USDT Position Voucher. https://www.gate.com/competition/your-year-in-review-2025?ref=VQIRVFPACQ&ref_type=126

Click the link to view your exclusive #2025GateYearEndSummary and claim a 20 USDT Position Voucher. https://www.gate.com/competition/your-year-in-review-2025?ref=VQIRVFPACQ&ref_type=126

- Reward

- like

- Comment

- Repost

- Share

🔹 ETH breaks below $3,200 — is this a short-term panic flush or a signal of trend reversal?

- Reward

- like

- Comment

- Repost

- Share

芝麻天下

芝麻天下

Created By@XiaoliangIsGoingToSu

Listing Progress

0.00%

MC:

$3.45K

Create My Token

Waking up late at night, I happened to come across a scandal of infidelity on a friend’s Moments: it’s nothing more than those ridiculously cliché things—talking to several people at once, then one of them finds out and posts chat screenshots, hotel booking records, takeout orders...

From high school, college, to the workplace, these absurd dramas seem to replay over and over in front of my eyes. Roommates, classmates, colleagues, leaders... some I saw with my own eyes, others I learned about through others. Behind the glamorous facade, all I see are hypocritical appearances and dark hearts.

A

View OriginalFrom high school, college, to the workplace, these absurd dramas seem to replay over and over in front of my eyes. Roommates, classmates, colleagues, leaders... some I saw with my own eyes, others I learned about through others. Behind the glamorous facade, all I see are hypocritical appearances and dark hearts.

A

- Reward

- like

- Comment

- Repost

- Share

$ONDO ALTSEASON SETUP | 5,000%+ EXPANSION IF MACRO DEMAND HOLDS

#ONDO is trading at a major weekly demand zone after an ~85% correction from ATH, while on-chain data confirms stealth accumulation despite weak price action.

Technical Structure:

✅ Bearish divergence confirmed at $2.14 (Macro Top)

✅ Breakdown + Retest of $0.73–$0.80 Support → Resistance

✅ HTF Demand Present at $0.30–$0.20

✅ Possible Final Retracement into Bullish Order Flow Zone $0.32–$0.20

✅ Bullish while above $0.20 (HTF close)

On-Chain Value Add (Jan 18, 2026 Unlock – 1.94B ONDO):

🔹 Whale spot orders dominating

🔹 $0.35–$0.40

#ONDO is trading at a major weekly demand zone after an ~85% correction from ATH, while on-chain data confirms stealth accumulation despite weak price action.

Technical Structure:

✅ Bearish divergence confirmed at $2.14 (Macro Top)

✅ Breakdown + Retest of $0.73–$0.80 Support → Resistance

✅ HTF Demand Present at $0.30–$0.20

✅ Possible Final Retracement into Bullish Order Flow Zone $0.32–$0.20

✅ Bullish while above $0.20 (HTF close)

On-Chain Value Add (Jan 18, 2026 Unlock – 1.94B ONDO):

🔹 Whale spot orders dominating

🔹 $0.35–$0.40

ONDO-4,65%

- Reward

- like

- Comment

- Repost

- Share

India proposes to link the CBDCs of BRICS countries - #cryptocurrency #bitcoin #altcoins

BTC-2,3%

- Reward

- like

- Comment

- Repost

- Share

Trend Analysis, short_Term Trading

- Reward

- like

- Comment

- Repost

- Share

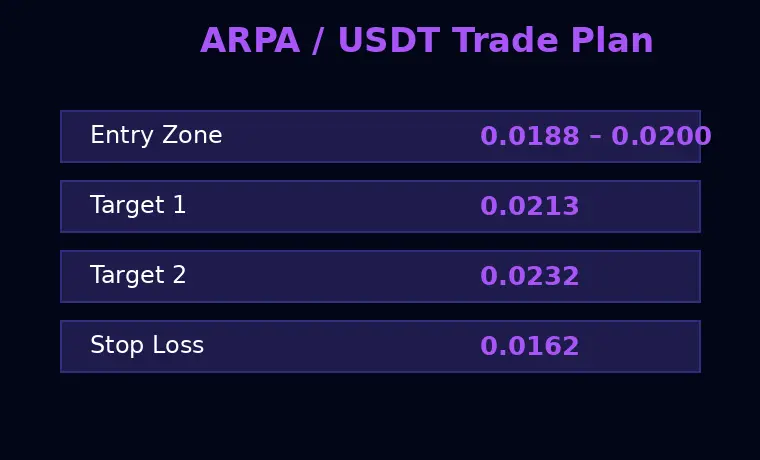

$ARPA ARPA made a sharp upside move in a short time and is now slowing down near a key area.

This looks more like a healthy pause than a breakdown.

As long as price holds above the main support zone, the overall structure remains positive and another push toward resistance is possible. A clean break above resistance could bring fresh momentum, while losing support may weaken the setup.

This is my personal market view, not financial advice. Always manage your own risk.

This looks more like a healthy pause than a breakdown.

As long as price holds above the main support zone, the overall structure remains positive and another push toward resistance is possible. A clean break above resistance could bring fresh momentum, while losing support may weaken the setup.

This is my personal market view, not financial advice. Always manage your own risk.

ARPA44,51%

- Reward

- like

- Comment

- Repost

- Share

$STI

The chart is young, there are no financials in the company, and there’s no cash cushion either. For companies like this, it need a rallying index and a strong environment

The chart is young, there are no financials in the company, and there’s no cash cushion either. For companies like this, it need a rallying index and a strong environment

- Reward

- like

- Comment

- Repost

- Share

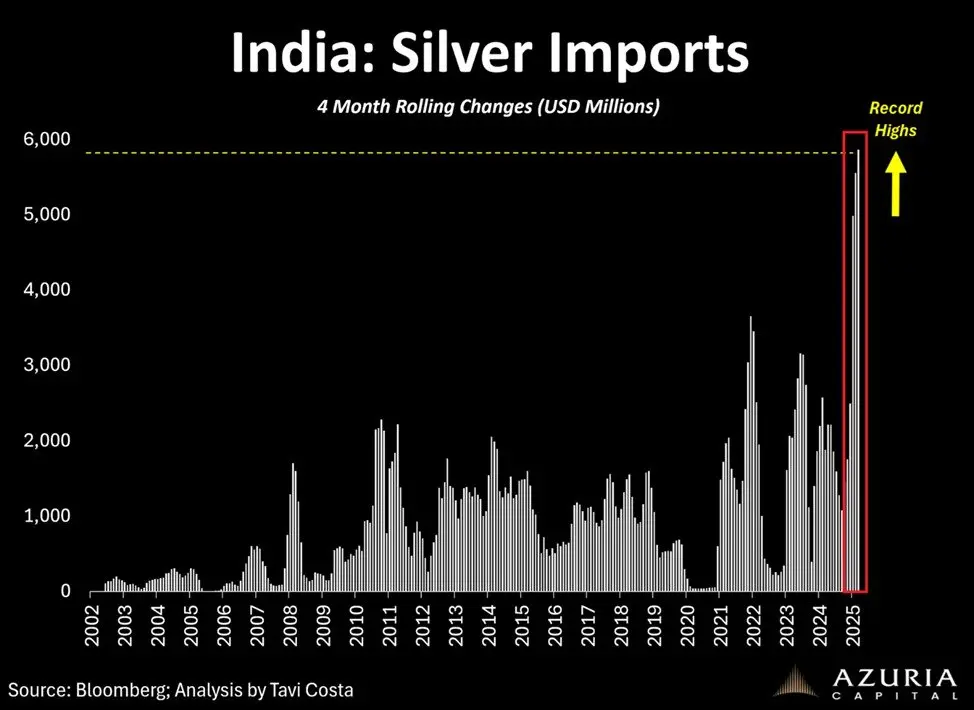

India is stockpiling silver:

India's silver imports spiked to a record ~$5.9 billion over the last 4 months.

This marks a +400% increase since Q4 2024 and is now +64% above the 2022 peak.

By comparison, imports averaged ~$1.5 billion per year from 2013 to 2019.

India is one of the world’s largest silver consumers, with demand driven by jewelry fabrication, investment in physical silver, and rising industrial use in electronics and solar energy applications.

Meanwhile, India's Nifty Metal Index, which tracks major metal and mining companies, is having its best start to a year since 2018.

As a r

India's silver imports spiked to a record ~$5.9 billion over the last 4 months.

This marks a +400% increase since Q4 2024 and is now +64% above the 2022 peak.

By comparison, imports averaged ~$1.5 billion per year from 2013 to 2019.

India is one of the world’s largest silver consumers, with demand driven by jewelry fabrication, investment in physical silver, and rising industrial use in electronics and solar energy applications.

Meanwhile, India's Nifty Metal Index, which tracks major metal and mining companies, is having its best start to a year since 2018.

As a r

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More15.15K Popularity

332.33K Popularity

43.57K Popularity

5.85K Popularity

5.23K Popularity

Hot Gate Fun

View More- MC:$3.68KHolders:21.01%

- MC:$3.45KHolders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.45KHolders:10.00%

News

View More1. After launching Alpha, it increased by 154.96%, current price is 0.014903 USDT

41 m

Data: If BTC breaks through $97,499, the total liquidation strength of mainstream CEX short positions will reach $1.654 billion.

1 h

Data: If ETH breaks through $3,369, the total liquidation strength of short positions on mainstream CEXs will reach $1.402 billion.

1 h

Trump Announces 10% EU Tariffs; Hong Kong Group Seeks CARF Rule Changes

2 h

1. After launching Alpha, it increased by 52.18%, current price is 0.008487 USDT

2 h

Pin