Shenron1226

No content yet

Shenron1226

BITCOIN ON TRACK FOR ITS LONGEST LOSING STREAK IN 7 YEARS

The selling just isn’t stopping.

February is already down -13%.

If it closes red, Bitcoin will print 5 straight monthly losses — the LONGEST streak since 2018.

Total drawdown already sits near -40% in ~5 months.

One of the STEEPEST sustained selloffs in Bitcoin history.🔥

The selling just isn’t stopping.

February is already down -13%.

If it closes red, Bitcoin will print 5 straight monthly losses — the LONGEST streak since 2018.

Total drawdown already sits near -40% in ~5 months.

One of the STEEPEST sustained selloffs in Bitcoin history.🔥

BTC-0,46%

- Reward

- like

- Comment

- Repost

- Share

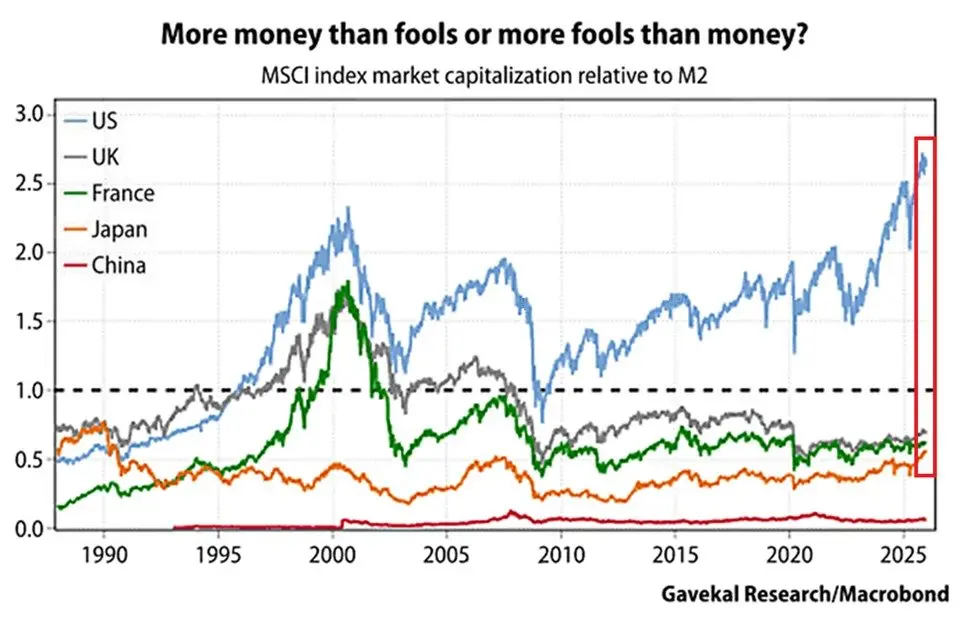

The US stock market is witnessing a historic run:

The MSCI USA Index's market cap relative to the US M2 money supply is up to a record 270%.

This ratio is up +120 percentage points since 2022.

This now surpasses the 2000 Dot-Com Bubble peak by ~40 percentage points, and the pre-2008 Financial Crisis high by ~75 percentage points.

By comparison, the UK and France MSCI indexes relative to their M2 stand at ~60%, still below pre-pandemic highs.

At the same time, Japan’s market cap to M2 is up to ~60%, the highest since the 1990s.

The market has never run this far ahead of liquidity before.

The MSCI USA Index's market cap relative to the US M2 money supply is up to a record 270%.

This ratio is up +120 percentage points since 2022.

This now surpasses the 2000 Dot-Com Bubble peak by ~40 percentage points, and the pre-2008 Financial Crisis high by ~75 percentage points.

By comparison, the UK and France MSCI indexes relative to their M2 stand at ~60%, still below pre-pandemic highs.

At the same time, Japan’s market cap to M2 is up to ~60%, the highest since the 1990s.

The market has never run this far ahead of liquidity before.

- Reward

- like

- Comment

- Repost

- Share

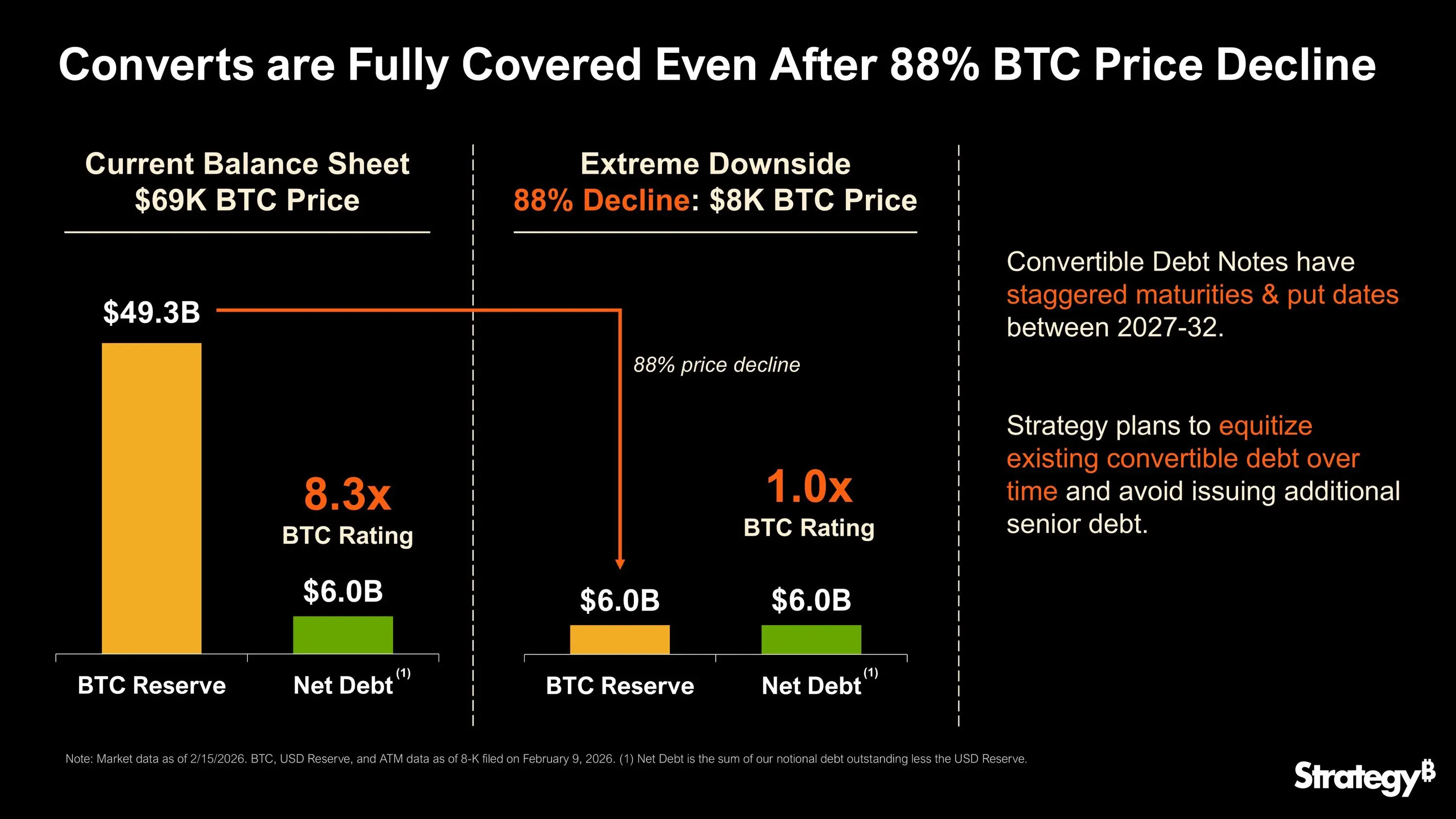

🚨 LATEST: Michael Saylor's Strategy reveals it can withstand an 88% Bitcoin price decline to $8K and “still have sufficient assets to fully cover its debt.”

BTC-0,46%

- Reward

- like

- Comment

- Repost

- Share

⚠️ INSTITUTIONS COULD “FIRE” BITCOIN DEVS OVER QUANTUM RISK

Big holders like BlackRock may lose patience if Bitcoin developers don’t address quantum computing threats, says VC Nic Carter.

He warns that if devs “do nothing,” institutions could take control and replace them.

Big holders like BlackRock may lose patience if Bitcoin developers don’t address quantum computing threats, says VC Nic Carter.

He warns that if devs “do nothing,” institutions could take control and replace them.

BTC-0,46%

- Reward

- 2

- Comment

- Repost

- Share

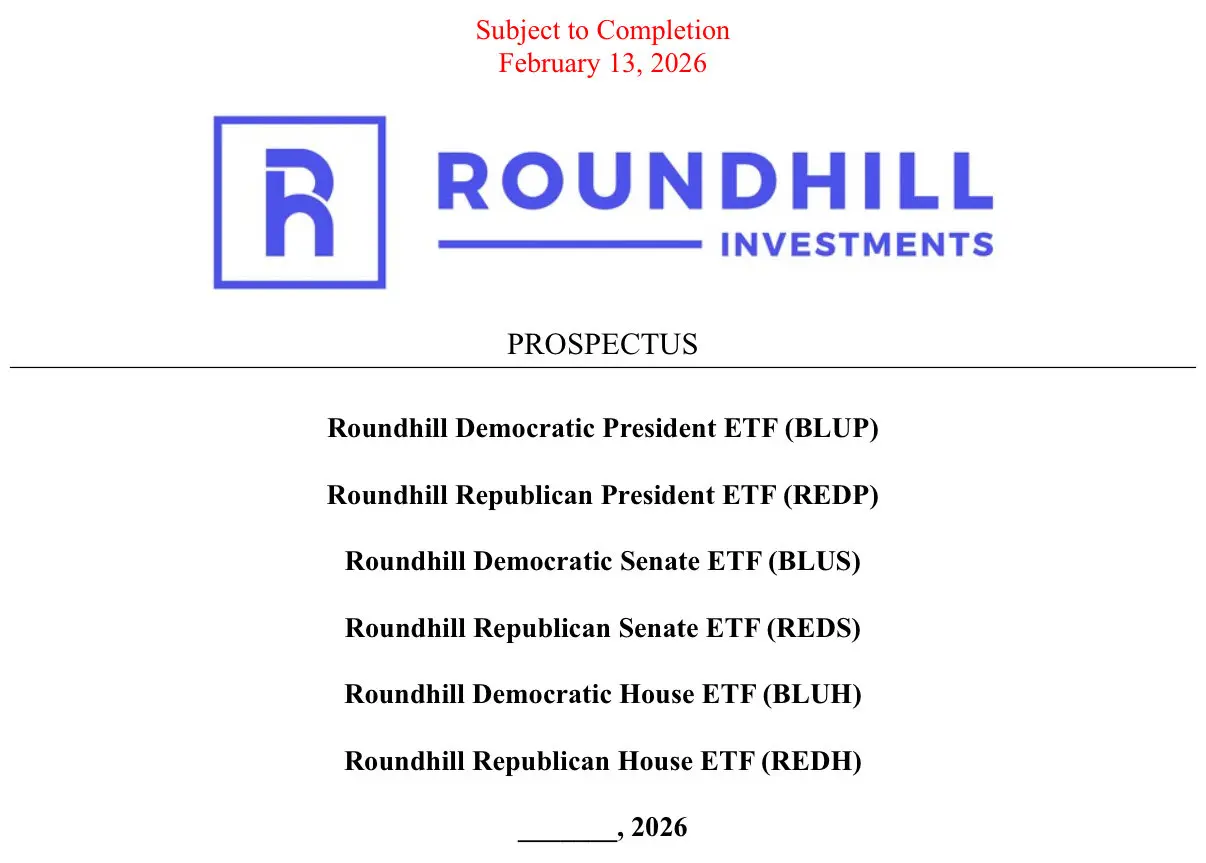

🇺🇸 ETF TO BET ON U.S. ELECTION OUTCOMES FILED

Roundhill Investments filed with the SEC to launch 6 ETFs tied to event contracts that bet on outcomes of the 2028 U.S. elections.

If approved, the funds would track results like which party controls the presidency or Congress.

Roundhill Investments filed with the SEC to launch 6 ETFs tied to event contracts that bet on outcomes of the 2028 U.S. elections.

If approved, the funds would track results like which party controls the presidency or Congress.

- Reward

- 2

- Comment

- Repost

- Share

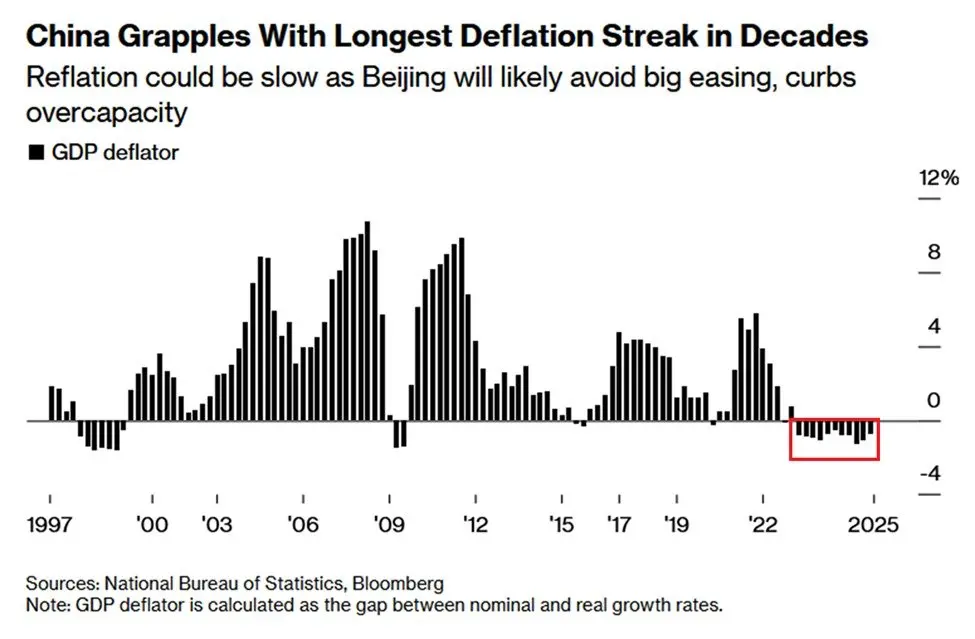

China is stuck in its longest deflationary streak in decades:

China’s GDP deflator fell -0.7% in Q4 2025, marking the 11th consecutive quarterly decline, the longest streak in at least 30 years.

China has been in deflation for 3 consecutive years now, the longest stretch since the country transitioned to a market economy in the late 1970s.

By comparison, the streak lasted just 2 quarters following the 2008 Financial Crisis.

Most recently, producer prices fell -1.4% YoY in January, marking the 40th consecutive month of factory deflation.

This comes as weak consumer demand, driven by a property

China’s GDP deflator fell -0.7% in Q4 2025, marking the 11th consecutive quarterly decline, the longest streak in at least 30 years.

China has been in deflation for 3 consecutive years now, the longest stretch since the country transitioned to a market economy in the late 1970s.

By comparison, the streak lasted just 2 quarters following the 2008 Financial Crisis.

Most recently, producer prices fell -1.4% YoY in January, marking the 40th consecutive month of factory deflation.

This comes as weak consumer demand, driven by a property

- Reward

- 2

- Comment

- Repost

- Share

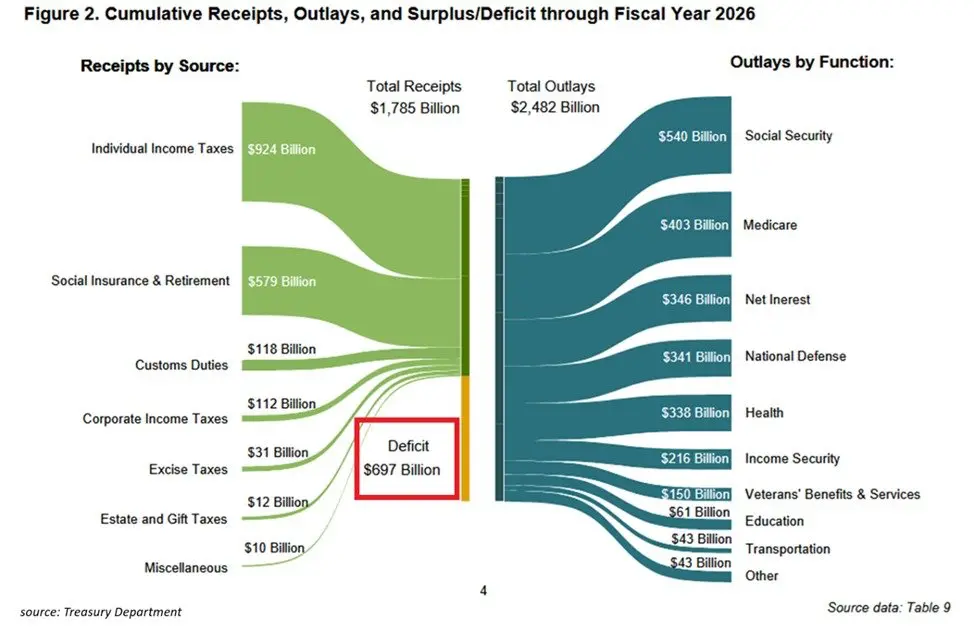

The US Treasury budget deficit fell -26% YoY in January, to $95 billion.

Over the first 4 months of FY2026, the deficit is down -17% YoY, to $697 billion, still posting the 3rd-worst start to a year in history.

Government revenue rose +12% YoY, to $1.8 trillion, lifted by tariff revenues, which surged +304% YoY, to $124 billion for the period.

At the same time, government expenditures increased +2% YoY, to $2.5 trillion.

Tariff revenues are making a dent in the US deficit.

Over the first 4 months of FY2026, the deficit is down -17% YoY, to $697 billion, still posting the 3rd-worst start to a year in history.

Government revenue rose +12% YoY, to $1.8 trillion, lifted by tariff revenues, which surged +304% YoY, to $124 billion for the period.

At the same time, government expenditures increased +2% YoY, to $2.5 trillion.

Tariff revenues are making a dent in the US deficit.

- Reward

- 1

- Comment

- Repost

- Share

ALTS MAY HAVE ALREADY BOTTOMED VS BITCOIN

After more than a year of downside and broken structure, the Others Dominance chart is starting to shift. It has already reclaimed the levels we saw before the October 10 crash, while Bitcoin is still roughly 40% below its highs from that same period. That divergence matters. If altcoins were still in heavy distribution, dominance would continue making new lows. Instead, it has risen sharply over the past two months, suggesting seller exhaustion rather than continued capitulation.

We saw a similar dynamic in 2019 to 2020. $BTC continued to correct for

After more than a year of downside and broken structure, the Others Dominance chart is starting to shift. It has already reclaimed the levels we saw before the October 10 crash, while Bitcoin is still roughly 40% below its highs from that same period. That divergence matters. If altcoins were still in heavy distribution, dominance would continue making new lows. Instead, it has risen sharply over the past two months, suggesting seller exhaustion rather than continued capitulation.

We saw a similar dynamic in 2019 to 2020. $BTC continued to correct for

BTC-0,46%

- Reward

- 1

- Comment

- Repost

- Share

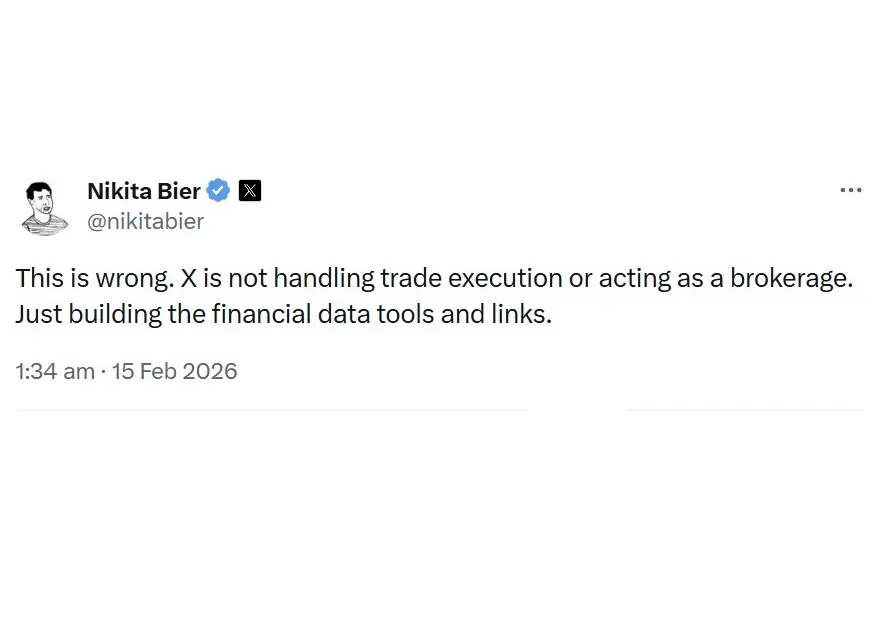

NIKITA BIER CLARIFIES : X WON’T EXECUTE TRADES, IT’S BUILDING THE TOOLS & LINKS

According to X head of product Nikita Bier, Smart Cashtags won’t directly execute trades.

Instead, they’ll power financial data tools, charts, and deep links that connect to external brokerages via APIs ; letting users buy and sell stocks or crypto without leaving the app.

The goal is clear: keep FinTwit trading activity inside the timeline with real-time pricing, charts, and Cashtag-driven functionality ; turning X into a financial command center, not just a social feed.

According to X head of product Nikita Bier, Smart Cashtags won’t directly execute trades.

Instead, they’ll power financial data tools, charts, and deep links that connect to external brokerages via APIs ; letting users buy and sell stocks or crypto without leaving the app.

The goal is clear: keep FinTwit trading activity inside the timeline with real-time pricing, charts, and Cashtag-driven functionality ; turning X into a financial command center, not just a social feed.

- Reward

- 2

- 1

- Repost

- Share

I'mLost,I'mLost. :

:

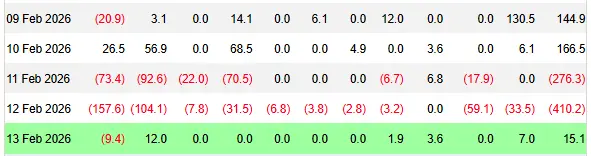

Wishing you great wealth in the Year of the Horse 🐴BITCOIN ETF FLOWS TURN POSITIVE BUT TREND STILL WEAK

Bitcoin ETFs just broke a short selling streak with $15.2M in fresh inflows.

However, funds have lost $360M this week overall, marking four consecutive weeks of withdrawals not seen since late last year.

Bitcoin ETFs just broke a short selling streak with $15.2M in fresh inflows.

However, funds have lost $360M this week overall, marking four consecutive weeks of withdrawals not seen since late last year.

BTC-0,46%

- Reward

- 1

- Comment

- Repost

- Share

LATEST: ⚡ Tomasz Stańczak will step down as co-executive director of the Ethereum Foundation at the end of February and be replaced by Bastian Aue, who will join Hsiao-Wei Wang in leading the foundation.

ETH1,08%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 1

- 2

- Repost

- Share

GateUser-4a8b4621 :

:

2026 GOGOGO 👊View More

BITCOIN JUST ENTERED DEEP VALUE

The Power Law Divergence indicator just hit -95.

That means $BTC is trading far below its long-term trend. Historically, readings this low have only happened during major capitulation phases.

The last time we saw this after an ATH was November 2022.

This doesn’t guarantee an immediate bounce. But levels like this have typically marked periods where downside risk was becoming limited relative to upside potential.

Right now, #Bitcoin is statistically stretched to the downside. That’s what the data says.

The Power Law Divergence indicator just hit -95.

That means $BTC is trading far below its long-term trend. Historically, readings this low have only happened during major capitulation phases.

The last time we saw this after an ATH was November 2022.

This doesn’t guarantee an immediate bounce. But levels like this have typically marked periods where downside risk was becoming limited relative to upside potential.

Right now, #Bitcoin is statistically stretched to the downside. That’s what the data says.

BTC-0,46%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

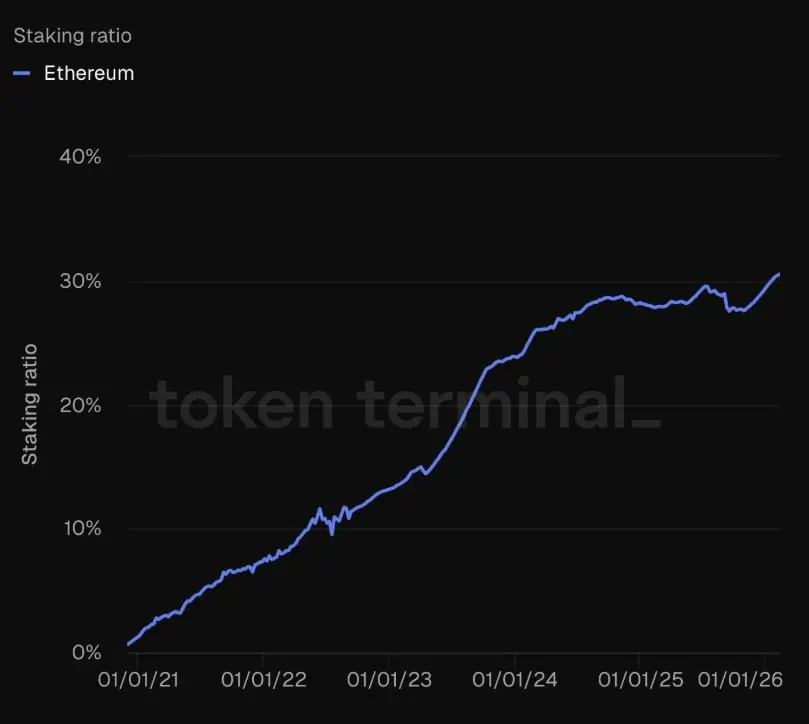

⚡️ INSIGHT: Ethereum’s staking ratio surpasses 30%, setting a new all-time high, per Token Terminal.

ETH1,08%

- Reward

- like

- Comment

- Repost

- Share

Regulatory clarity = Plume victory.

Analysis from Feb 10 confirms the CFTC now allows tokenized cash as margin.

The infrastructure Plume built for institutional RWAs just became the market standard.

Analysis from Feb 10 confirms the CFTC now allows tokenized cash as margin.

The infrastructure Plume built for institutional RWAs just became the market standard.

PLUME-1,18%

- Reward

- 4

- 1

- Repost

- Share

HeyHey :

:

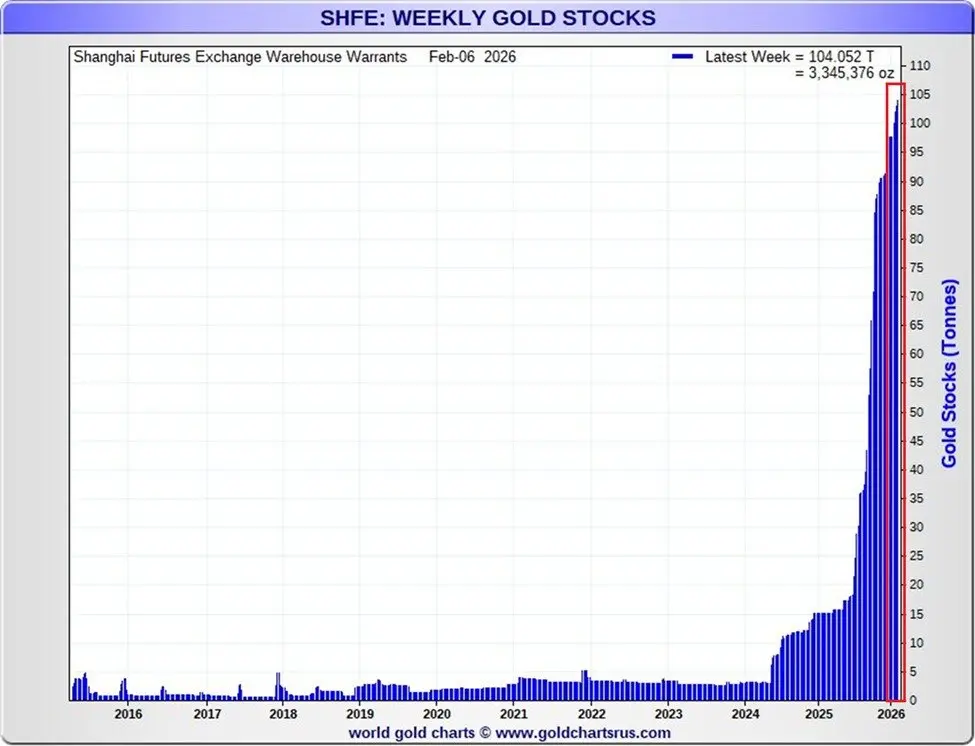

BullshitGold inventories at the Shanghai Futures Exchange vaults are skyrocketing:

Deliverable gold in the Shanghai Futures Exchange, measured by warehouse warrants, is up to a record 104 tonnes.

Warehouse warrants represent physical gold stored in approved exchange vaults that can be held, transferred, or used as collateral.

Warrants have risen more than 500% since mid-2025.

By comparison, until Q2 2024, warehouse gold warrants had not exceeded 5 tonnes for years.

This comes as Chinese demand for physical gold has soared to unprecedented levels.

Physical gold demand in China is exploding.

Deliverable gold in the Shanghai Futures Exchange, measured by warehouse warrants, is up to a record 104 tonnes.

Warehouse warrants represent physical gold stored in approved exchange vaults that can be held, transferred, or used as collateral.

Warrants have risen more than 500% since mid-2025.

By comparison, until Q2 2024, warehouse gold warrants had not exceeded 5 tonnes for years.

This comes as Chinese demand for physical gold has soared to unprecedented levels.

Physical gold demand in China is exploding.

- Reward

- like

- Comment

- Repost

- Share

📊 UPDATE: Entry to the top 15 corporate Bitcoin treasuries now requires 7,500 $BTC, tightening competition for the 21M supply asset.

BTC-0,46%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More152.62K Popularity

29.94K Popularity

26.46K Popularity

71.64K Popularity

12.61K Popularity

Pin