MarketMaestro

No content yet

MarketMaestro

The Great Rotation: From Virtual Growth to Real Production and a New Economic Paradigm

Rotation or regime change? 🦇Batman’s View on the Situation

Markets are going through a tectonic shift. The last decade’s growth led, tech dominated rally is giving way to value, the real economy, and global diversification. Trump’s economic vision, the strategy orbiting Scott Bessent and Kevin Warsh, and the desire to weaken the dollar and de-dollarize trade make this look less like a simple sector rotation and more like a paradigm change.

MAG7, inefficient CapEx fears, and the prisoner’s dilemma

The tech g

Rotation or regime change? 🦇Batman’s View on the Situation

Markets are going through a tectonic shift. The last decade’s growth led, tech dominated rally is giving way to value, the real economy, and global diversification. Trump’s economic vision, the strategy orbiting Scott Bessent and Kevin Warsh, and the desire to weaken the dollar and de-dollarize trade make this look less like a simple sector rotation and more like a paradigm change.

MAG7, inefficient CapEx fears, and the prisoner’s dilemma

The tech g

- Reward

- like

- Comment

- Repost

- Share

$WDC

BULL's EYE!🎯

I said it could run all the way to the neckline that’s been in place since 1973. It got there. it can break that neckline and start writing a new story

BULL's EYE!🎯

I said it could run all the way to the neckline that’s been in place since 1973. It got there. it can break that neckline and start writing a new story

- Reward

- like

- Comment

- Repost

- Share

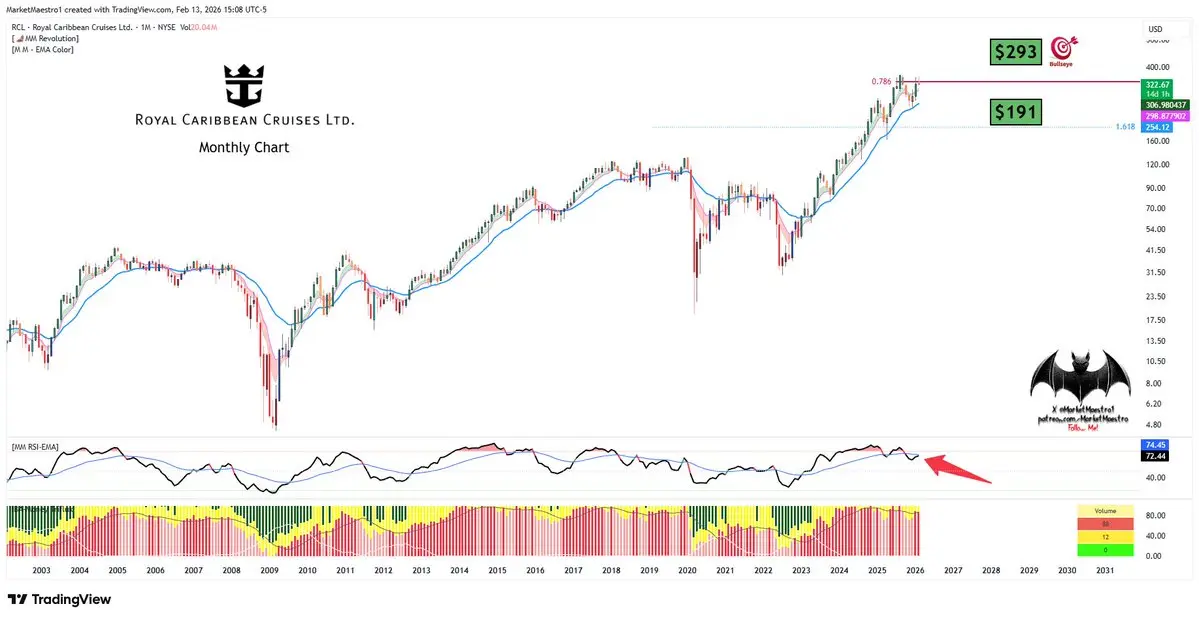

$RCL

This technical setup is risky. It couldn’t clear the fibo78 resistance, and a double top risk is on the table right now

This technical setup is risky. It couldn’t clear the fibo78 resistance, and a double top risk is on the table right now

- Reward

- like

- Comment

- Repost

- Share

$NNE

Honestly, they broke the indexes last week, right when the index had a chance to breakout, because of AI, Warsh, and other reasons. It also broke the green support.

There’s nothing below the OBZ it’s the last line of defense

Honestly, they broke the indexes last week, right when the index had a chance to breakout, because of AI, Warsh, and other reasons. It also broke the green support.

There’s nothing below the OBZ it’s the last line of defense

- Reward

- like

- Comment

- Repost

- Share

$SMR

The chart looks scary. If it breaks down below the green zone, It can become much riskier. In the prior bottoms I marked with the green box, it also created a similar risky look. Of course, back then the market was much calmer

The chart looks scary. If it breaks down below the green zone, It can become much riskier. In the prior bottoms I marked with the green box, it also created a similar risky look. Of course, back then the market was much calmer

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

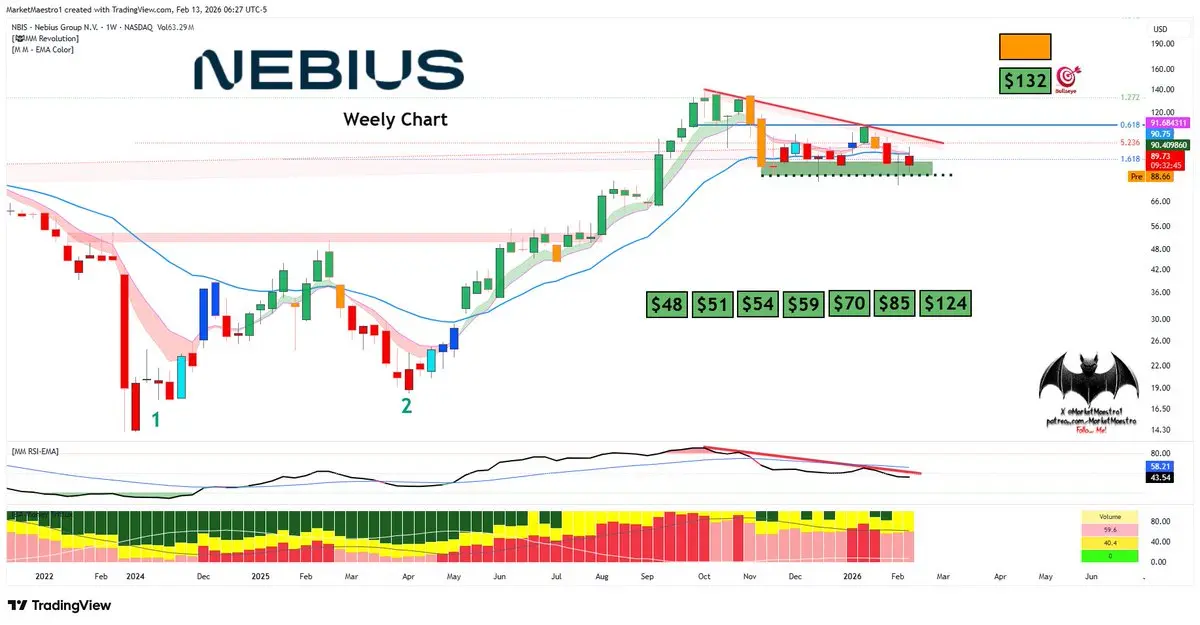

$NBIS

Even showing this kind of strength at this stage is very good. But the danger isn’t over yet. The earliest we can start talking is if it clears red diagonal resistance

Even showing this kind of strength at this stage is very good. But the danger isn’t over yet. The earliest we can start talking is if it clears red diagonal resistance

- Reward

- like

- Comment

- Repost

- Share

$RDW

I was expecting this pullback, but I wasn’t expecting it to get this deep. When the market mood shifted from growth stocks to value stocks, the selloff intensified. Why? Because in this kind of environment, if the market doesn’t believe in the story for these cash burning names, it shows no mercy. This is a moonshot stock. It requires time, patience, and conviction

I was expecting this pullback, but I wasn’t expecting it to get this deep. When the market mood shifted from growth stocks to value stocks, the selloff intensified. Why? Because in this kind of environment, if the market doesn’t believe in the story for these cash burning names, it shows no mercy. This is a moonshot stock. It requires time, patience, and conviction

- Reward

- like

- Comment

- Repost

- Share

$MOVE

The anxiety isn’t in the $VIX. It’s in the MOVE. The bond vigilantes seem like they don’t want the Fed to cut rates. But if rates aren’t cut on time, the economy could slip into deflation. While the bond vigilantes are trying to keep the Fed’s hand cold, they’re ignoring the risk of pushing the economy into a deflation pit. And deflation is not a good thing at all. The vigilantes’ hawkish stance right now contradicts the fundamentals of the economy. Ignoring the disinflation process isn’t cooling the engine, it’s breaking it. If any vigilantes are reading this message, I’d love to give t

The anxiety isn’t in the $VIX. It’s in the MOVE. The bond vigilantes seem like they don’t want the Fed to cut rates. But if rates aren’t cut on time, the economy could slip into deflation. While the bond vigilantes are trying to keep the Fed’s hand cold, they’re ignoring the risk of pushing the economy into a deflation pit. And deflation is not a good thing at all. The vigilantes’ hawkish stance right now contradicts the fundamentals of the economy. Ignoring the disinflation process isn’t cooling the engine, it’s breaking it. If any vigilantes are reading this message, I’d love to give t

- Reward

- like

- Comment

- Repost

- Share

$SN

Such a hard to find setup in an environment like this!

Its financial growth is very strong. Based on the financials, this should still be ripping higher

Such a hard to find setup in an environment like this!

Its financial growth is very strong. Based on the financials, this should still be ripping higher

- Reward

- 1

- Comment

- Repost

- Share

There is no inflation in America! I’ve been trying to explain since I started writing here that the U.S. has entered a disinflation process. The market didn’t really take it positively, but…

- Reward

- like

- Comment

- Repost

- Share

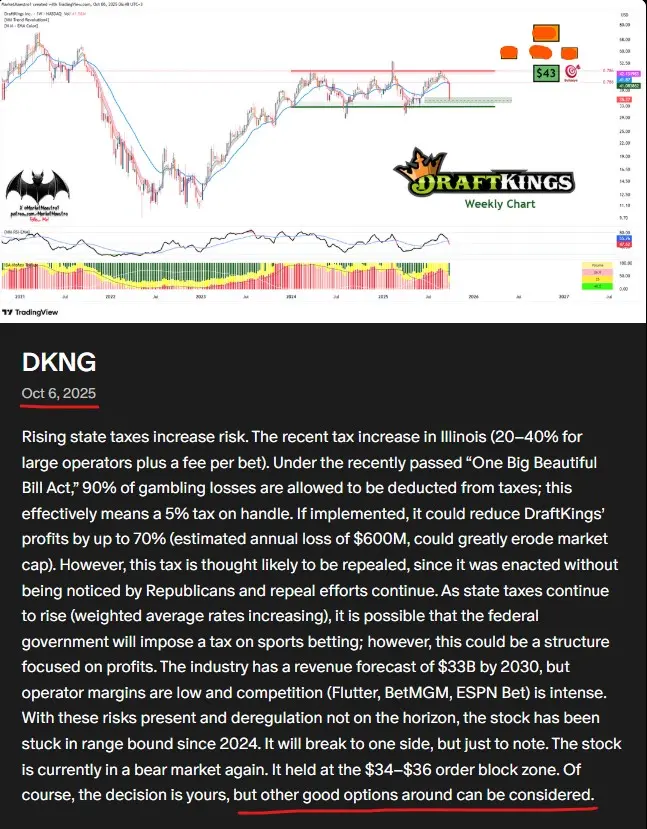

$DKNG 👇❗️

View Original

- Reward

- like

- Comment

- Repost

- Share

$BGC

it did a neckline retest, then it also broke the red diagonal resistance and got stuck at the $9.60 fibo61 resistance. The monthly setup looks good

it did a neckline retest, then it also broke the red diagonal resistance and got stuck at the $9.60 fibo61 resistance. The monthly setup looks good

- Reward

- like

- Comment

- Repost

- Share

$META

It couldn’t clear $742-fibo78. That created a possible distribution setup risk. In 2021 the issue was fear of excessive CapEx spending. This time there isn’t the same fear because ad revenue is increasing; in 2021 it was seen as burying money in the grave.

At first, I think it will form a triangle like consolidation. But after the fibo78 rejection, I also can’t ignore the double top distribution pattern that’s showing up

It couldn’t clear $742-fibo78. That created a possible distribution setup risk. In 2021 the issue was fear of excessive CapEx spending. This time there isn’t the same fear because ad revenue is increasing; in 2021 it was seen as burying money in the grave.

At first, I think it will form a triangle like consolidation. But after the fibo78 rejection, I also can’t ignore the double top distribution pattern that’s showing up

- Reward

- 1

- 1

- Repost

- Share

JuniorSistersCanStillEarn. :

:

Good luck and prosperity 🧧$ANET

ANET Q4 2025 Financial Results and 2026 Outlook

Big picture: strong finish, more aggressive 2026 Arista Networks closed 2025 with a strong beat and shifted its 2026 message to a higher pace. In Q4 2025, the company reported $2.49B in revenue (+29% YoY) and $0.82 in Non-GAAP EPS. Combined with full-year 2025 growth of 28.6% and record revenue of $9B, this wasn’t just a strong quarter, it signals Arista is riding an expanding demand cycle.

2026 outlook: higher growth target, bar set at $11.25B Management translated confidence into numbers by raising its 2026 revenue growth target to 25% an

ANET Q4 2025 Financial Results and 2026 Outlook

Big picture: strong finish, more aggressive 2026 Arista Networks closed 2025 with a strong beat and shifted its 2026 message to a higher pace. In Q4 2025, the company reported $2.49B in revenue (+29% YoY) and $0.82 in Non-GAAP EPS. Combined with full-year 2025 growth of 28.6% and record revenue of $9B, this wasn’t just a strong quarter, it signals Arista is riding an expanding demand cycle.

2026 outlook: higher growth target, bar set at $11.25B Management translated confidence into numbers by raising its 2026 revenue growth target to 25% an

- Reward

- like

- Comment

- Repost

- Share

$ALAB

VWAP, EMA50, and BoS all broke key supports. The index is also below EMA21. Today’s CPI print is very important. Because if it can’t recover, the target becomes green zone. ALAB is like this: sharp corrections and sharp rallies

VWAP, EMA50, and BoS all broke key supports. The index is also below EMA21. Today’s CPI print is very important. Because if it can’t recover, the target becomes green zone. ALAB is like this: sharp corrections and sharp rallies

- Reward

- like

- Comment

- Repost

- Share

$NBIS

Nebius Group generated $227.7M in revenue in the final quarter of 2025, up 547% year over year, but it came in below the market expectation of $242.79M and the shares fell 3%. The company’s net loss widened versus the same quarter last year to $173M; however, Annual Recurring Revenue (ARR) came in at $1.25B, above the company’s own guidance. Management is maintaining its aggressive growth stance by targeting $7–$9B ARR and $3–$3.4B in revenue by the end of 2026. The company emphasized that its current GPU capacity is fully sold out for 2H 2025 and Q1 2026, with no slowdown in demand. It

Nebius Group generated $227.7M in revenue in the final quarter of 2025, up 547% year over year, but it came in below the market expectation of $242.79M and the shares fell 3%. The company’s net loss widened versus the same quarter last year to $173M; however, Annual Recurring Revenue (ARR) came in at $1.25B, above the company’s own guidance. Management is maintaining its aggressive growth stance by targeting $7–$9B ARR and $3–$3.4B in revenue by the end of 2026. The company emphasized that its current GPU capacity is fully sold out for 2H 2025 and Q1 2026, with no slowdown in demand. It

- Reward

- like

- Comment

- Repost

- Share

$SPY

OI-based Net Gamma Exposure: negative

Volume-based Net Gamma Exposure: clearly negative

Directionalized Volume: negative

This combination means a negative gamma regime. In a negative gamma regime, Market Makers are forced to trade in the direction of the price move. If the market falls, dealers SELL to hedge and accelerate the drop. If the market rises, dealers BUY to hedge, creating a squeeze.

There is a massive pile-up at the 680 strike level. We are currently at 681.06, meaning we are right on top of this big wall. The heavy open interest at this level acts like a magnet that pulls pri

OI-based Net Gamma Exposure: negative

Volume-based Net Gamma Exposure: clearly negative

Directionalized Volume: negative

This combination means a negative gamma regime. In a negative gamma regime, Market Makers are forced to trade in the direction of the price move. If the market falls, dealers SELL to hedge and accelerate the drop. If the market rises, dealers BUY to hedge, creating a squeeze.

There is a massive pile-up at the 680 strike level. We are currently at 681.06, meaning we are right on top of this big wall. The heavy open interest at this level acts like a magnet that pulls pri

- Reward

- like

- Comment

- Repost

- Share

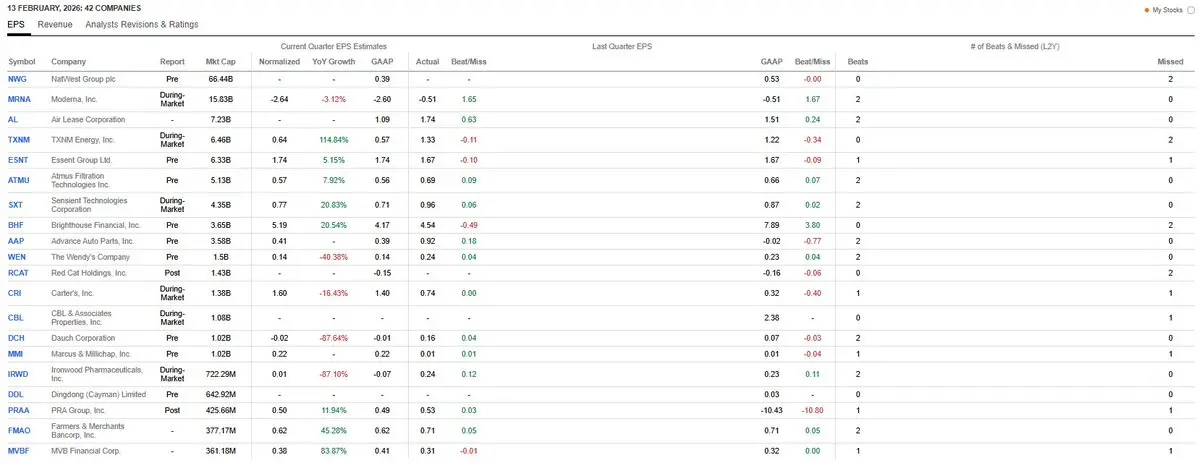

Today's ERs

$RCAT

$RCAT

- Reward

- like

- Comment

- Repost

- Share