USDC News Today

Latest crypto news and price forecasts for USDC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Data: Two whale addresses spent a total of 21.06 million USDC to purchase HYPE tokens in the past 2 days.

According to Mars Finance, Spot On Chain monitoring shows that two Whale Addresses have collectively spent 21.06 million USDC to purchase HYPE Tokens. Whale "0x5AE" spent 11.21 million USDC at an average price of $39.23 to acquire 285,821 HYPE—still holding 2.79 million USDC in reserve. Whale "0x152" invested 9.85 million USDC at an average price of $39.54 to buy 249,073 HYPE—remaining 703,000 USDC. Both Whales are currently experiencing slight losses, but seem to be preparing for significant positioning.

HYPE-7.99%

MarsBitNews·11-07 12:28

The liquidity in the Sui currency market is tight! The utilization rate of mainstream lending protocol USDC is 100%, and users cannot withdraw.

The TVL of the Sui on-chain DeFi protocol has significantly decreased over the past month, mainly due to the loss of funds after the Momentum Airdrop and the outflow of funds from major lending protocols such as NAVI, SuiLend, and Scallop. In addition, the USDC utilization rate of NAVI and SuiLend has reached 100%, preventing users from withdrawing, and the high borrowing annual interest rates highlight the tight liquidity situation.

ChainNewsAbmedia·11-07 11:54

A user lost $1.22 million in cryptocurrency assets due to signing multiple phishing "permit" signatures.

Deep Tide TechFlow news, November 7th, according to Scam Sniffer monitoring, about 30 minutes ago, a user lost $1.22 million in cryptocurrency assets, including USDC and aPlaUSDT0 tokens, due to signing multiple phishing "permit" signatures.

DeepFlowTech·11-07 10:15

Whale Moves 14M USDC to Buy $8.3M in HYPE on Hyperliquid

A major crypto whale has made waves on-chain after moving millions into the trending decentralized exchange Hyperliquid. The trader deposited 14 million USDC and used most of it to buy over $8.3 million worth of HYPE tokens. This is a move that instantly caught the attention of on-chain

HYPE-7.99%

Coinfomania·11-07 07:47

Elixir: deUSD is officially invalidated, and the USDC compensation process will be initiated for all DeUSD and its derivations holders.

According to Mars Finance, Elixir's official Twitter announced that the stablecoin deUSD has officially been retired and no longer holds any value. The platform will initiate a USDC compensation process for all holders of deUSD and its derivations (such as sdeUSD). The affected range includes collateralizers on lending platforms, AMM LPs, Pendle LPs, etc. Elixir also warns users not to purchase or invest in deUSD through AMM or other channels.

PENDLE-3.24%

MarsBitNews·11-07 05:13

A Whale deposited 14,000,000 USD USDC into HyperLiquid and bought HYPE Spot.

According to Mars Finance, a whale deposited 14,000,000 USDC into HyperLiquid and has bought HYPE on the spot market.

HYPE-7.99%

MarsBitNews·11-07 05:09

USDC Treasury has minted an additional 50 million USDC on the Ethereum blockchain.

Deep Tide TechFlow news: On November 6th, according to Whale Alert, the USDC Treasury minted an additional 50 million USDC on the Ethereum blockchain.

DeepFlowTech·11-06 15:18

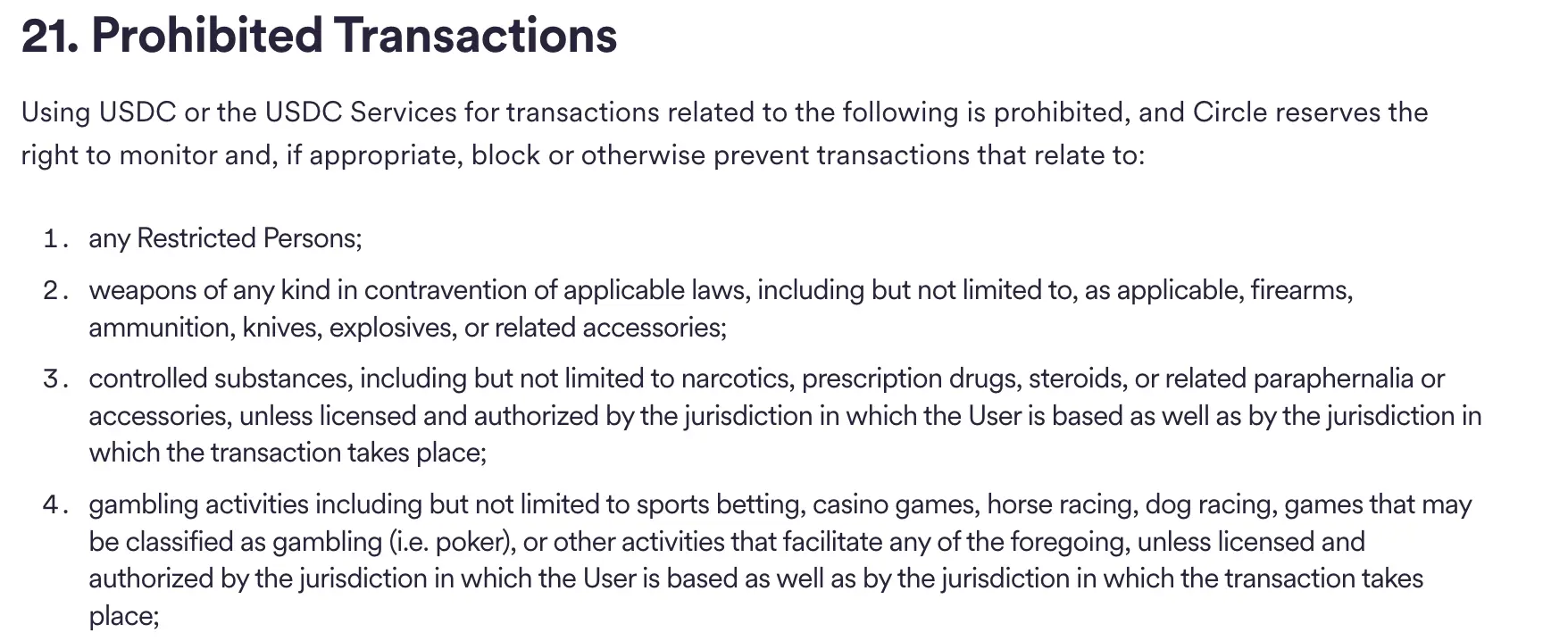

Circle Revises Terms to Permit Lawful Firearm Purchases With USDC

Circle’s policy change allows USDC use for legal firearm sales, reversing its previous blanket weapons ban.

Lawmakers and advocacy groups view the update as a step toward preventing financial discrimination in digital payments.

The policy revision follows recent U.S. stablecoin legislation under t

CryptoNewsLand·11-06 14:43

Circle Lifts USDC Ban on Legal Firearm Purchases, Aligning with GENIUS Act

Circle Internet Group has updated its USDC terms to permit legal firearm transactions, reversing a prior blanket prohibition and aligning with the GENIUS Act's federal framework for dollar-backed stablecoins.

CryptoPulseElite·11-06 09:41

Circle Allows Legal Firearm Purchases With USDC After Regulatory Pressure

Circle updated USDC terms to allow legal firearm purchases, ending its previous ban on weapon transactions.

The policy change aligns with federal regulations and industry advocacy against financial discrimination.

New regulatory clarity from the GENIUS Act encourages adoption and shapes the

BeInCrypto·11-06 08:15

Stable has launched the second phase of its $500 million USDC pre-deposit program and plans to convert it into USDT.

Stable, a leading stablecoin public blockchain, officially launched the second phase of its $500 million USDC pre-deposit program on November 6, 2025. The plan is to convert these USDC into new USDT, aiming to promote the development of the stablecoin market by enhancing on-chain liquidity.

MarketWhisper·11-06 06:51

Circle updates USDC policy to allow legal gun purchases, sparking discussions on stablecoin neutrality.

According to Deep潮 TechFlow news on November 6, Circle, a stablecoin issuer, has updated its terms of service to remove the previous ban on using USDC to purchase firearms. This policy change was made under pressure from the National Shooting Sports Foundation (NSSF) and gun rights advocates, who accused Circle of discriminating against legal business activities.

A Circle spokesperson confirmed: "We have clarified the terms, reflecting that USDC can be used for legal firearm transactions protected under the Second Amendment. We will not refuse USDC transactions involving legal firearms."

Republican Senator Bill Hagerty called it a victory "against the weaponization of the financial system." However, Kadan, the CTO of blockchain technology company Komodo,

DeepFlowTech·11-06 05:26

Circle Updates Terms of Service to Allow ‘Legal’ Firearm Purchases With USDC

In brief

Circle has updated policy on prohibition on firearms purchases following complaints from firearms industry advocates.

Senator Bill Hagerty called the update a victory against "weaponization" of the financial system and chokepoint-style discrimination.

An industry expert warned that the

Decrypt·11-06 05:24

Tangem launches Visa-backed Tangem Pay for onchain USDC spending

Tangem introduces Tangem Pay, enabling users to spend USDC with a virtual Visa card while retaining full control of their assets. Launching in November across the U.S., LATAM, and APAC+, it preserves user privacy and incurs no monthly fees.

POL-2.3%

Cryptonews·11-06 04:48

The encryption bug bounty platform Immunefi (IMU) token sale will start on November 12, 2025.

Immunefi Token sale will start on November 12, 2025, with a unit price of $0.01337, 100% unlocked at TGE, distributing 373,971,578 IMU, accounting for 3.74% of the total supply. The platform is dedicated to Web3 and smart contracts security and has raised $29 million.

MarsBitNews·11-06 02:45

USDC stablecoin now allows gun purchases! Circle has amended its terms to permit legal firearm transactions.

Stablecoin issuer Circle has updated its USDC policy to clarify rules regarding prohibited transactions, explicitly addressing the use of legally obtained guns and weapons. This week's cryptocurrency detective report noted that Circle revised its USDC terms, stating that the platform "reserves the right to monitor and, where appropriate, block or otherwise prevent transactions related to the purchase of guns, ammunition, explosives, and other weapons."

MarketWhisper·11-06 01:28

Circle Changes Policy, Now Letting Users Purchase Select Weapons with USDC

In a move that highlights the evolving landscape of cryptocurrency regulation and compliance, stablecoin issuer Circle has updated its policies concerning transactions involving firearms and weapons. This latest amendment aims to clarify the platform’s stance on prohibited transaction types,

CryptoBreaking·11-05 20:36

IMF Expert Report: Stablecoins Cause Surge in Demand for US Treasury Bonds, Posing Financial Risks

In the rapidly evolving International Monetary System, US stablecoins are quietly playing a key role. According to the research report "The Rise of Stablecoins and Implications for Treasury Markets" published in October 2025 by IMF experts Sonja Davidovic, Tarek Ghani, and Mariano Moszoro, stablecoins are rapidly penetrating the global payment system while significantly purchasing US Treasury bonds, leading to profound impacts on US fiscal stability and global financial markets.

This report by the Brookings Institution

ChainNewsAbmedia·11-05 10:53

Apex Fusion Integrates Stargate to Bring USDC Liquidity to Cardano

Apex Fusion's partnership with Stargate enables native USDC transfers across blockchains, enhancing Cardano's DeFi ecosystem by providing $2.5 million in liquidity. This integration improves cross-chain interoperability and stablecoin availability for developers.

Coinpedia·11-05 08:20

Unsecured Stablecoin Lending Fantasies

Article author: haonan

Article compilation: Block unicorn

Introduction

Users in the global unsecured consumer credit market are like fat sheep of modern finance—slow to act, lacking judgment, and lacking mathematical ability.

When unsecured consumer credit shifts to the stablecoin track, its operating mechanism will change, and new participants will have the opportunity to share the pie.

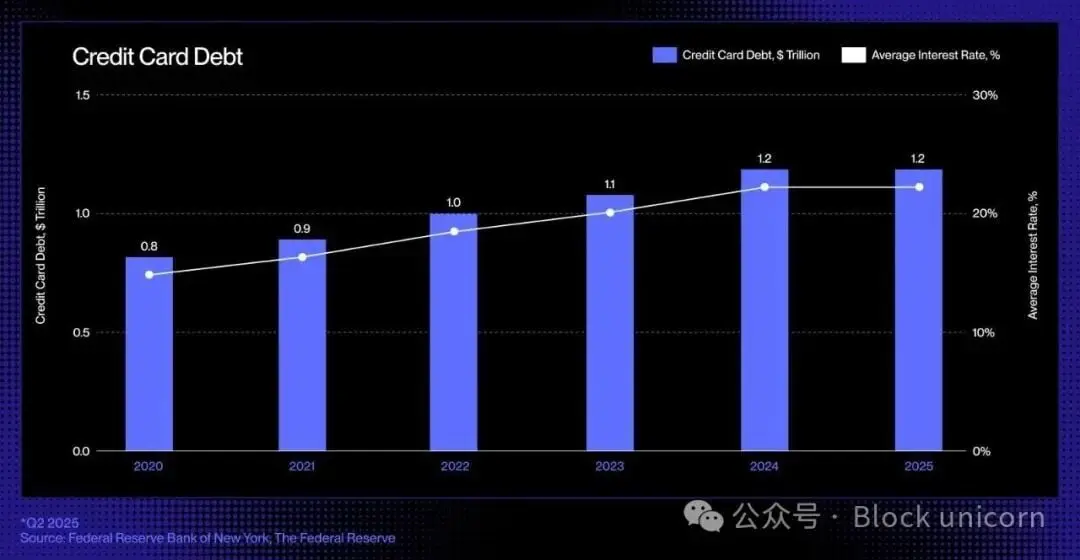

Market Size

In the United States, the primary form of unsecured borrowing is credit cards: this ubiquitous, highly liquid, and instantly available credit tool allows consumers to borrow without providing collateral during shopping. Unpaid credit card debt continues to rise and has now reached approximately $1.21 trillion.

Outdated Technology

The last major change in the credit card lending field occurred in the 1990s when Capital One introduced risk-based pricing, a groundbreaking move that reshaped the industry.

PANews·11-05 04:50

What is Belong (LONG)? The platform only serves genuine customers, disrupting the 580 billion market

Belong is a Web3 ecosystem that combines a content creator platform with decentralized venue marketing. The platform charges a low fee of 3% (compared to higher fees on Patreon), supporting anonymous cryptocurrency payments and NFT membership benefits. The core innovation, CheckIn, completely transforms the venue marketing market valued at $580 billion to $750 billion: venues only pay for verified in-store customers.

MarketWhisper·11-05 03:36

What is THORWallet? Own your Private Key and spend globally with a Mastercard.

THORWallet combines non-custodial cryptocurrency control with traditional banking through Swiss accounts and a global Mastercard. Control your finances through a non-custodial wallet—no hidden fees, directly debited from a secure Swiss bank account, with a global Mastercard in your pocket. With a licensed Swiss bank account and multi-currency Mastercard integration, it offers self-custody control and global spending power.

MarketWhisper·11-04 02:33

Unsecured stablecoin lending

The unsecured consumer credit market is facing a transformation, and the application of stablecoins is expected to reshape the credit mechanism. Through on-chain technology, real-time liquidity, transparent funding sources, and automatic repayments can be achieved, reducing risks. At the same time, it creates opportunities for efficient allocation and dynamic pricing in the credit market, promoting the establishment of an open global credit system.

DeepFlowTech·11-04 01:54

Unsecured stablecoin lending

Preface

Users in the global unsecured consumer credit market are like the fat sheep of modern finance – slow to act, lacking judgment, and lacking mathematical ability.

When unsecured consumer credit shifts to the stablecoin track, its operating mechanism will change, and new participants will have the opportunity to share in the profits.

The market is huge.

In the United States, the primary form of unsecured lending is credit cards: this ubiquitous, highly liquid, and instantly available credit tool allows consumers to borrow without providing collateral when making purchases. Outstanding credit card debt continues to grow, currently reaching approximately $1.21 trillion.

Outdated technology

The last major transformation in the credit card loan sector occurred in the 1990s when Capital One launched a risk-based pricing model, a groundbreaking initiative that reshaped the consumer credit landscape. Since then, despite the emergence of new banks and fintech companies, credit cards

金色财经_·11-03 14:42

x402 may become the next trend.

Author: David Hoffman Source: Bankless Translator: Shan Ouba, Golden Finance

This week, I recorded a highly valuable podcast with the founder of Merit Systems. After finishing, I am convinced that x402 may become the next big trend.

x402 is the intersection of artificial intelligence and cryptocurrency, where both combine to create real value. Through x402, intelligent agents can perform transactions as "first-class citizens" of the internet, while providing new opportunities for developers who can create products and services to meet the resource purchasing needs of intelligent agents.

x402 Development History

In the early 1990s, internet pioneers reserved the HTTP 402 status code (meaning "Payment Required") when defining network architecture, aiming to pave the way for a future model of "server charging on request."

When

金色财经_·11-03 08:55

What is Arc Network? Circle launches USDC payment stablecoin dedicated chain.

Arc Network is a new open Layer-1 Blockchain launched by Circle, designed from the ground up specifically for stablecoin-native applications. What is the core innovation of Arc Network? It uses USDC as its native Gas, providing low, predictable, USD-denominated fees without the need to hold volatile Crypto Assets.

MarketWhisper·11-03 06:26

The surge of stablecoins triggers global regulatory shock: Basel banking encryption rules face major overhaul, with the US leading the demand for exemptions for USDC and USDT.

Due to the rapid development of stablecoins, there has been strong opposition from the United States, and global regulators are discussing reforms to the banking crypto assets holdings rules originally set to take effect next year. These standards, conceived by the Basel Committee on Banking Supervision at the end of 2022, impose a heavy capital burden on banks' crypto assets and are seen as a signal hindering institutional adoption. The United States is leading calls to revise the standards, arguing that they are incompatible with industry developments such as stablecoins. However, some jurisdictions, including the European Central Bank (ECB), have not yet committed to timely implementation of the existing rules.

BTC-1.65%

MarketWhisper·11-03 02:05

Tether's dual stablecoin strategy: A new chapter in competition and regulation.

Written by: Thejaswini M A

Compiled by: Block unicorn

Original link:

Statement: This article is a reprint. Readers can obtain more information through the original link. If the author has any objections to the reprint format, please contact us, and we will make modifications as per the author's request. Reprinting is for informational sharing only and does not constitute any investment advice, nor does it represent Wu's views and positions.

Introduction

In August this year, Bo Hines resigned from his position as a member of the White House Cryptocurrency Council and quickly took on the role of CEO of the newly established U.S. division of Tether. His mission is to launch

BTC-1.65%

WuSaidBlockchainW·11-02 15:20

Coinbase Close to $2B Deal to Buy BVNK Stablecoin Platform

Coinbase is negotiating a $2B acquisition of BVNK, enhancing its stablecoin infrastructure and global crypto-to-fiat payment capabilities, potentially solidifying its position in stablecoin payments and strengthening its USDC partnership.

BitcoincomNews·11-01 08:46

$3M Whale Bet Shakes Crypto Market! Massive USDC Move Sparks Zcash Short Shock

A crypto whale deposited $3 million USDC into HyperLiquid and took a leveraged short of 1.41 million ZEC, indicating bearish sentiment towards Zcash. This highlights the influence of whales in the market and reflects confidence in Arbitrum's scalability.

HYPE-7.99%

Coinfomania·11-01 08:14

Vitalik once again sold the meme coin he obtained for free, cashing out 15,170 USDC.

Deep Tide TechFlow news, on November 1, according to Lookonchain monitoring, Ethereum co-founder Vitalik Buterin has once again sold his free meme coins, cashing out 15,170 USDC.

DeepFlowTech·11-01 00:44

New York court approves Multichain liquidator's request to extend the freeze on the stolen USDC Address.

According to Mars Finance, a New York court has approved the temporary relief request filed by the Singapore liquidator on behalf of the Multichain Foundation, instructing Circle to continue freezing three wallet addresses involved in the hacking attack until further notice. This measure will prevent USDC in the aforementioned wallets from being transferred. According to court documents, Circle implemented the freeze by blacklisting the relevant addresses in the USDC smart contracts. Multichain suffered a $210 million cross-chain bridge attack in July 2023, which included approximately $63 million in USDC being stolen. Earlier this year, Multichain entered liquidation proceedings in Singapore, aiming to recover the stolen assets. The court believes that this temporary relief is an effective mechanism to maintain asset security in cross-border bankruptcy cases and facilitates judicial cooperation between U.S. and foreign courts.

MULTI3.25%

MarsBitNews·10-31 10:11

Stablecoin regulatory storm! Taiwan's Central Bank defines it as "equivalent to currency", VASP special law submitted for review.

On October 30, the Finance Committee of the Legislative Yuan released a special report, confirming that the Financial Supervisory Commission's draft of the "Virtual Asset Service Act (VASP)" has been submitted to the Executive Yuan for review. This bill will officially elevate Taiwan's regulatory level on virtual assets from the previous registration system focused on Money Laundering prevention to a highly regulated system requiring permits, similar to Financial Institutions. Central Bank Vice President Zhu Meili stated for the first time that stablecoins have essentially become currency.

MarketWhisper·10-31 08:24

USDC Treasury has once again burned 65,000,000 USDC on the Ethereum blockchain.

According to Mars Finance news, Whale Alert monitored that USDC Treasury has again burned 65,000,000 USDC on the Ethereum on-chain.

MarsBitNews·10-31 05:04

JPMorgan: Circle has a compliance advantage with MiCA, and USDC's on-chain activity surpasses that of USDT.

JP Morgan ( latest report points out that the US dollar stablecoin USDC launched by Circle has, for the first time, surpassed Tether's USDT in on-chain trading activity. With the European MiCA stablecoin regulations coming into effect, market funds are clearly shifting towards "transparent, Compliance" stablecoin assets, making USDC one of the biggest winners this year.

USDC on-chain activity surpasses USDT, with market value skyrocketing by 72% since the beginning of the year.

The report indicates that Circle's USDC has officially surpassed Tether's USDT in on-chain trading activity. The analysis suggests that this represents a gradual shift of investors and institutional funds towards stablecoin products that comply with emerging regulatory requirements and have high transparency.

The report mentioned that USDC's market value surged by 72% this year, reaching 74 billion USD ) before the deadline.

ChainNewsAbmedia·10-31 03:54

New York Court upholds order to freeze 63 million USDC in Multichain case

The New York court has issued a temporary order under Section 1519, requiring Circle to continue freezing three Ethereum wallets containing approximately 63 million USDC that were stolen — at the request of liquidation entities Multichain in Singapore.

Judge David S. Jones directed Circle to safeguard both the wallet and the corresponding amount of USD reserves, as well

MULTI3.25%

TapChiBitcoin·10-31 03:29

The market capitalization of USDC has risen by 72%, far exceeding USDT, with JPMorgan warning: Tether's European market is under threat.

According to a report by JPMorgan analysts, Circle's USDC stablecoin is significantly outperforming Tether's USDT in terms of on-chain activity and market capitalization growth. Since January of this year, the market capitalization of USDC has skyrocketed from approximately $43 billion to about $74 billion, an increase of 72%, far exceeding USDT's growth of 32% during the same period. Analysts believe this divergence is primarily due to USDC's clearer regulatory framework and increasing institutional adoption, while USDT faces resistance from delisting and authorization issues brought by the European MiCA regulation.

MarketWhisper·10-31 03:24

Coinbase CEO: Payments will become the next important use case for Crypto Assets.

According to Mars Finance, Coinbase CEO Brian Armstrong tweeted that payments are the next important use case for Crypto Assets, and Coinbase occupies a good ecological position in this regard. The company has USDC stablecoin, new partnerships, Coinbase Business enterprise services, Base, in-app payment features, and the newly launched Coinbase One.

MarsBitNews·10-31 01:33

Forbes heavy prediction! Five major changes in digital assets by 2026, the end of the Bitcoin cycle.

Forbes columnist Alexander S. Blume analyzes that the 2026 forecast shows the encryption industry entering a critical phase of "deepening and maturity." Blume presents five major predictions: DATs 2.0 Bitcoin Financial Service companies will gain legitimate status, stablecoins will be ubiquitous, the Bitcoin four-year cycle will come to an end, American investors will gain access to overseas liquidity channels, and crypto financial products will become more complex and specialized.

MarketWhisper·10-31 01:04

JPMorgan: USDC on-chain activity surpasses USDT, regulatory factors drive changes in the stablecoin landscape.

A report by JPMorgan shows that Circle's USDC has surpassed Tether's USDT in on-chain activity, with a market capitalization rise of 72%. This change is due to the implementation of a new regulatory framework and the compliance of USDC, which has enhanced its market competitiveness. While USDT still dominates emerging markets, the regulatory model of USDC may become the standard for global stablecoins.

DeepFlowTech·10-30 11:50

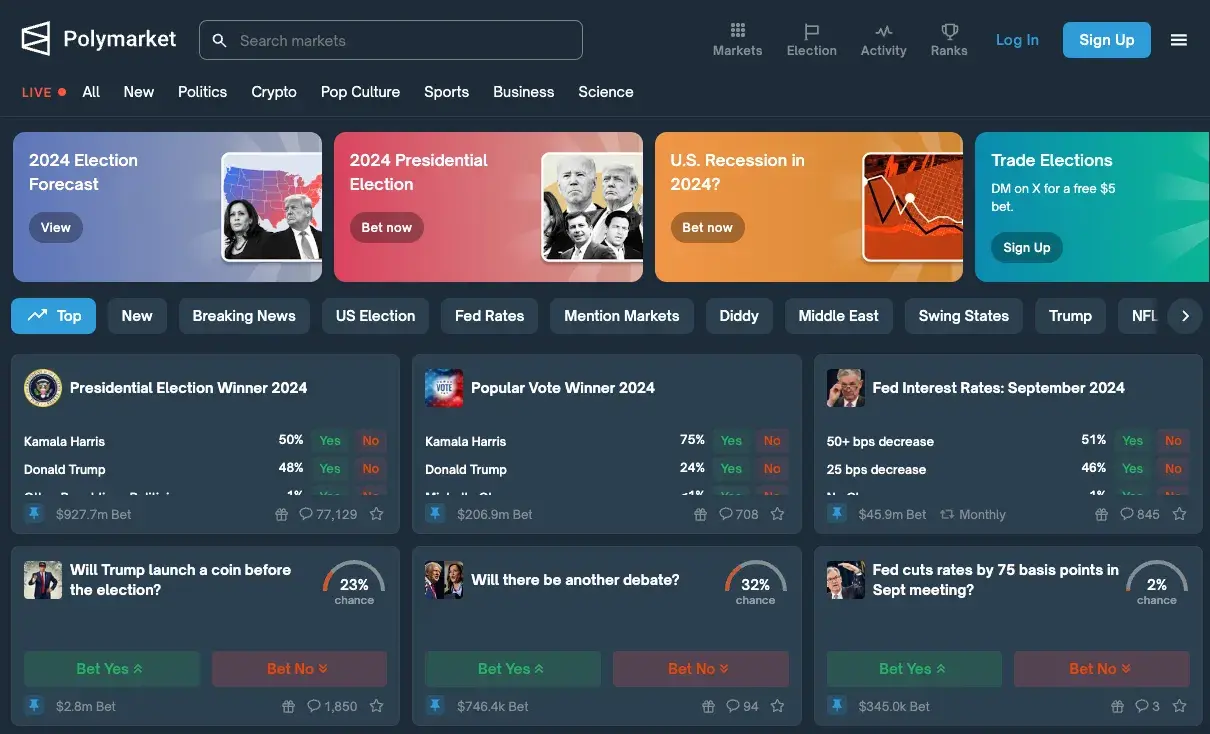

Is the gameplay of Polymarket gambling? Do Chinese players have legal risks?

Original author: Lawyer Liu Zhengyao

Reprint: White55, Mars Finance

Introduction

Recently, prediction markets represented by Polymarket have become very popular, and some players in the country have already entered the game, with reports of some making money. As a lawyer in the Web3 field, a friend asked me whether Polymarket is actually playable and if there are legal risks of gambling involved. We will analyze this in this article.

1. What is a prediction market and Polymarket?

(1) Prediction Market

The so-called "prediction market" can be simply understood as a platform that allows users to predict future events that have not yet occurred, and to place bets and trade on them.

Prediction markets are not a novel concept or gameplay; as early as 2014, there was a political (or policy) prediction platform called Predictit; in 2015, Augur, based on the Ethereum public chain, emerged as one of the most...

MarsBitNews·10-30 10:54

Is playing Polymarket considered gambling? Do Chinese players face legal risks?

Introduction

Recently, prediction marketplaces represented by Polymarket have become very popular. Some domestic players have already entered the space, and it is said that some have even made money. As a Web3 lawyer, a friend asked me whether Polymarket is playable and whether there are legal risks related to gambling. Let's analyze this through this article.

1. What is a prediction marketplace and Polymarket?

(1) Prediction Marketplace

A "prediction marketplace" can be simply understood as a platform that allows users to predict future events that have not yet occurred, and to place bets and trade on them.

Prediction marketplaces are not a new concept or gameplay. As early as 2014, there was a political (or policy) prediction platform called Predictit; in 2015, Augur, built on the Ether blockchain, was among the earliest decentralized prediction marketplaces; also in 2015, it was deployed on the blockchain.

PANews·10-30 10:12

Data: The market capitalization of the US dollar stablecoin has reached 30.35 billion USD, a significant rise of about 50% year-to-date.

According to Mars Finance, data from Coingecko shows that the market capitalization of the USD stablecoin has reached 303.5 billion USD, a significant rise of about 50% compared to the 202.8 billion USD at the beginning of the year. The total market capitalization of USDT is currently reported at 188.4 billion USD, while the total market capitalization of USDC is reported at 76.3 billion USD, ranking first and second respectively.

MarsBitNews·10-30 09:27

Mastercard Acquires Zerohash: \$2B Deal Bolsters Stablecoin Infrastructure

Mastercard is reportedly in late-stage talks to acquire Zerohash, a crypto and stablecoin infrastructure startup, for between \$1.5 billion and \$2 billion, according to Fortune.

PYUSD0.01%

CryptoPulseElite·10-30 08:35

Polygon Labs and DeCard Integration Expands Real-World Stablecoin Payments

Polygon Labs and DeCard have partnered to enable USDT and USDC payments at 150 million merchants globally, marking a significant step in bridging DeFi with everyday commerce.

POL-2.3%

CryptoPulseElite·10-30 06:44

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreBattle of the Builders

Cardano schedules Battle of the Builders for November 11, a live pitch event for projects building or planning to build on Cardano. The top three teams will win prizes, with applications open until October 3.

2025-11-10

AMA on X

Sushi will host an AMA on X with Hemi Network on March 13th at 18:00 UTC to discuss their latest integration.

2025-11-12

Sub0 // SYMBIOSIS in Buenos Aires

Polkadot has announced sub0 // SYMBIOSIS, its new flagship conference, to be held in Buenos Aires from November 14 to 16. The event is described as hyper immersive, aiming to bring builders and the broader ecosystem together under one roof.

2025-11-15

DeFi Day Del Sur in Buenos Aires

Aave reports that the fourth edition of DeFi Day del Sur will be held in Buenos Aires on November 19th.

2025-11-18

DevConnect in Buenos Aires

COTI will participate in DevConnect in Buenos Aires on November 17th-22nd.

2025-11-21