Emilyvuong

No content yet

emilyvuong

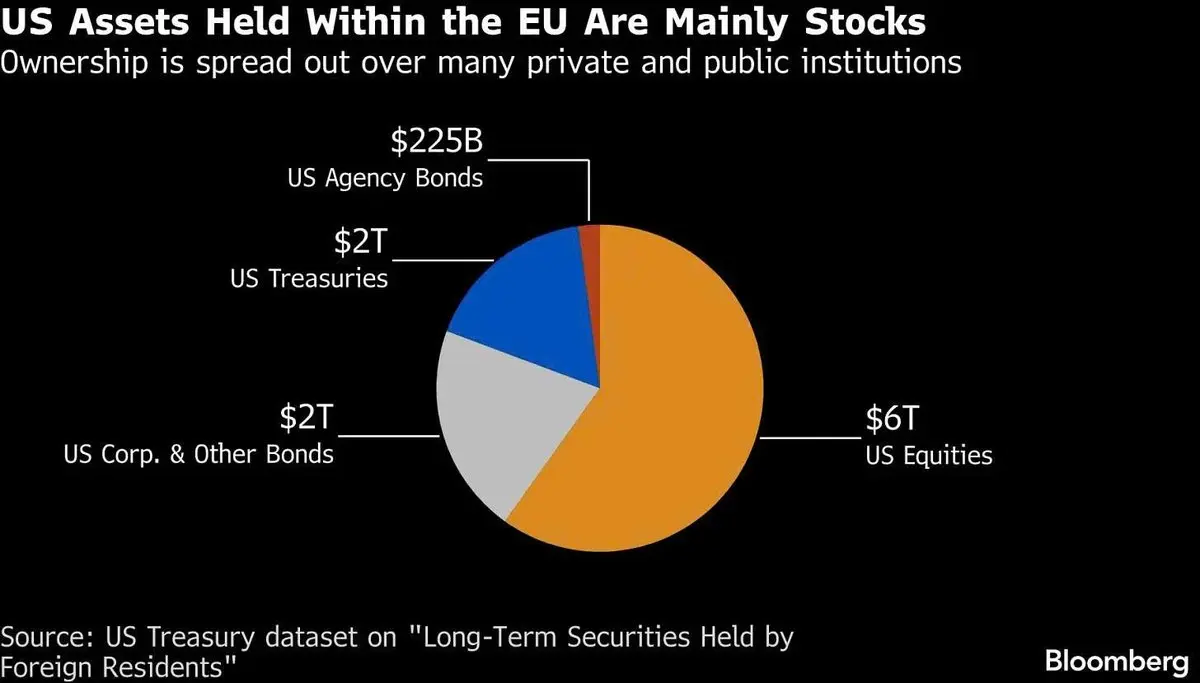

🔶Donald Trump threatens to impose a 10% tariff on European goods if the EU does not support the US in purchasing Greenland.

The list of affected countries includes: Denmark, Norway, Sweden, the UK, France, Germany, the Netherlands, Finland.

If the opposition continues, the tariff could be raised to 25%.

-> The estimated impact of this tariff level is equivalent to 1-1.5% of the EU's GDP. Large enough to exert economic pressure.

EU response:

- The EU is considering activating the Anti-Coercion Instrument (ACI) and a retaliatory tariff package of ~$93B.

- Only France supports a firm stance; Ger

View OriginalThe list of affected countries includes: Denmark, Norway, Sweden, the UK, France, Germany, the Netherlands, Finland.

If the opposition continues, the tariff could be raised to 25%.

-> The estimated impact of this tariff level is equivalent to 1-1.5% of the EU's GDP. Large enough to exert economic pressure.

EU response:

- The EU is considering activating the Anti-Coercion Instrument (ACI) and a retaliatory tariff package of ~$93B.

- Only France supports a firm stance; Ger

- Reward

- like

- Comment

- Repost

- Share

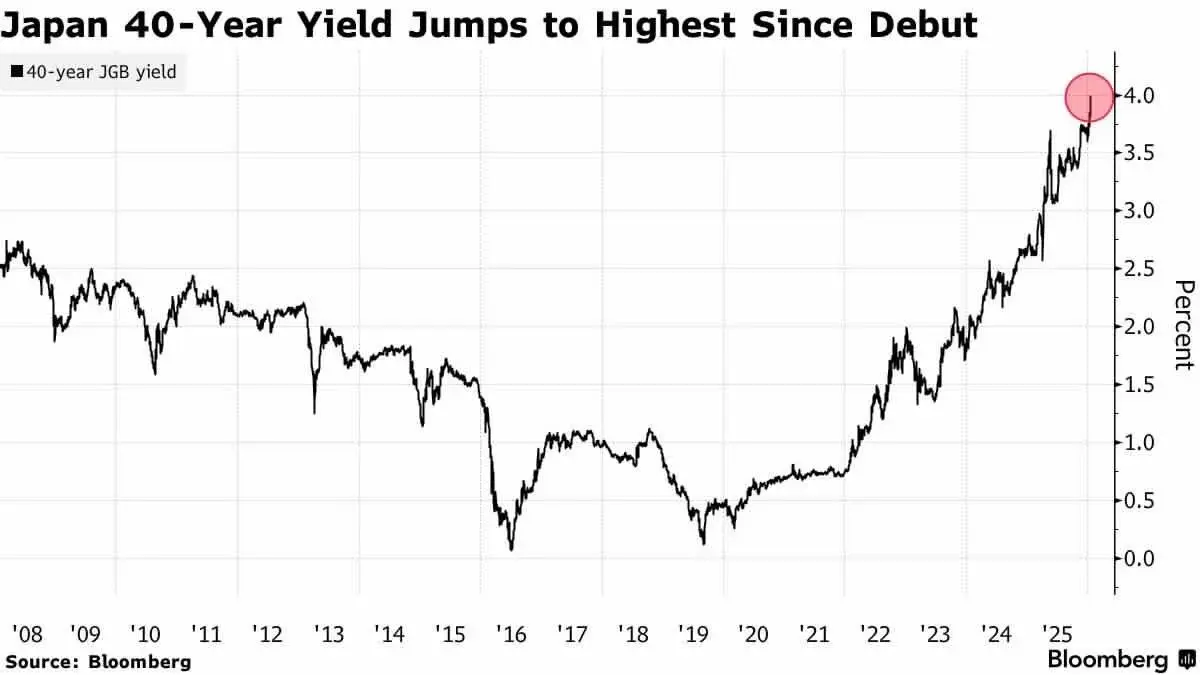

🔶The 40Y JGB yield reaches the highest in history. Something very big is about to happen.

Sanae Takaichi, although not directly calling for dissolving the National Diet, signals a desire to dissolve the House of Representatives and hold early elections to restore the government's legitimacy.

Sanae Takaichi proposes reducing the food tax to 0% for 2 years to ease the cost of living pressure on citizens. This means the Japanese government must shoulder an additional $65B to cover losses.

It is expected that Tokyo wants to offset the deficit by cutting subsidies and increasing non-tax revenue i

View OriginalSanae Takaichi, although not directly calling for dissolving the National Diet, signals a desire to dissolve the House of Representatives and hold early elections to restore the government's legitimacy.

Sanae Takaichi proposes reducing the food tax to 0% for 2 years to ease the cost of living pressure on citizens. This means the Japanese government must shoulder an additional $65B to cover losses.

It is expected that Tokyo wants to offset the deficit by cutting subsidies and increasing non-tax revenue i

- Reward

- like

- Comment

- Repost

- Share

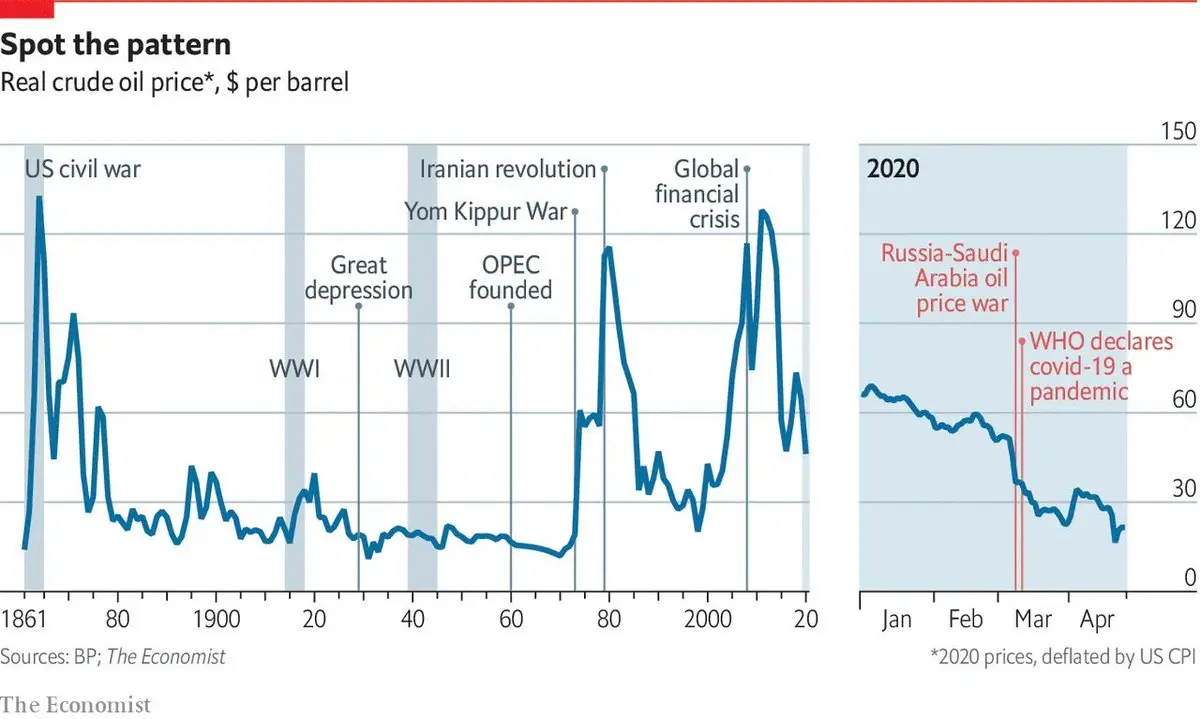

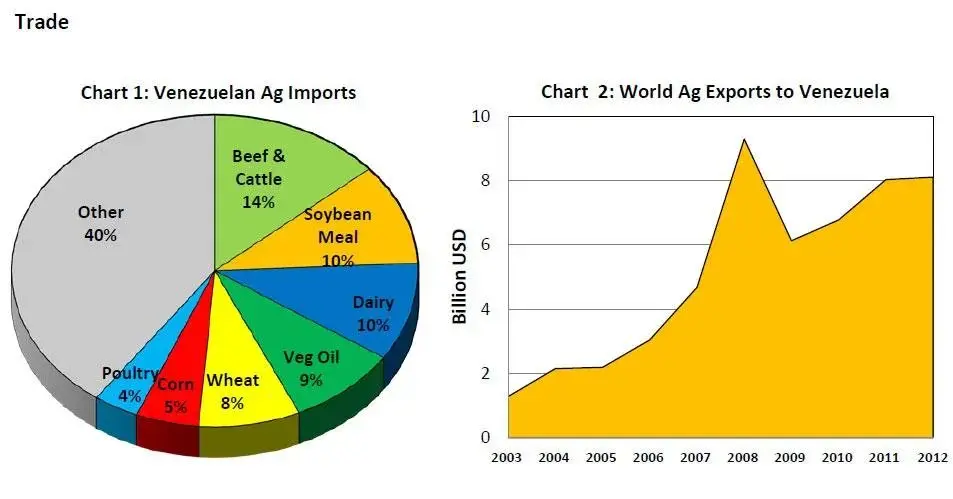

Venezuela - a closed-loop chain of cause and effect

Oil creates an illusion of capacity (1999–2012)

- Venezuela with 17% of the global reserves, surpassing even Saudi Arabia.

- During Hugo Chávez's rule, the global oil price boom also drove Venezuela's GDP to soar, peaking around $350B

The issue is:

- No signs of industrial growth

- No productivity improvements

- No export diversification

-> The economy grew rapidly thanks to an external factor, the oil price, which increased too quickly and obscured the effective use of state capital, while vigorous domestic consumption masked a sharp decline

View OriginalOil creates an illusion of capacity (1999–2012)

- Venezuela with 17% of the global reserves, surpassing even Saudi Arabia.

- During Hugo Chávez's rule, the global oil price boom also drove Venezuela's GDP to soar, peaking around $350B

The issue is:

- No signs of industrial growth

- No productivity improvements

- No export diversification

-> The economy grew rapidly thanks to an external factor, the oil price, which increased too quickly and obscured the effective use of state capital, while vigorous domestic consumption masked a sharp decline

- Reward

- like

- Comment

- Repost

- Share

📍 Canada - China upgrades diplomatic relations

Canada has just announced the establishment of a new strategic partnership with China, according to a statement from Prime Minister Mark Carney. Key points of the agreement:

- Canola Canada exports to China: Tariffs sharply reduced from 85% to 15%, effective before 3/1 - accelerating the rescue of the agricultural sector.

- Chinese electric vehicles into Canada: Import tariffs reduced from 100% to MFN 6.1%, but limited to 49,000 vehicles per year.

- Seafood & agricultural products: Tariffs reduced for lobster, crab, and Canadian peas.

- Investmen

View OriginalCanada has just announced the establishment of a new strategic partnership with China, according to a statement from Prime Minister Mark Carney. Key points of the agreement:

- Canola Canada exports to China: Tariffs sharply reduced from 85% to 15%, effective before 3/1 - accelerating the rescue of the agricultural sector.

- Chinese electric vehicles into Canada: Import tariffs reduced from 100% to MFN 6.1%, but limited to 49,000 vehicles per year.

- Seafood & agricultural products: Tariffs reduced for lobster, crab, and Canadian peas.

- Investmen

- Reward

- like

- Comment

- Repost

- Share

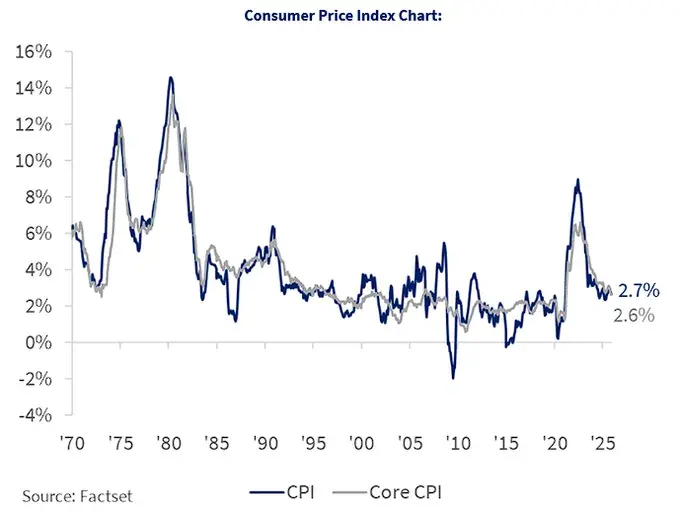

📍Gold has had the best year of gains since 1979 with an increase of over 60%.

It is clearly impossible to explain that gold is being revalued by inflation when US CPI and most G10 groups are expected to slow down in 2025.

The Gold/CPI ratio reached 13.3 – also the highest level in history.

The real gold price ( adjusted for inflation ) has surpassed the historic peak of the 1980s.

Gold is not chasing inflation, but faith in fiat is at an all-time low.

View OriginalIt is clearly impossible to explain that gold is being revalued by inflation when US CPI and most G10 groups are expected to slow down in 2025.

The Gold/CPI ratio reached 13.3 – also the highest level in history.

The real gold price ( adjusted for inflation ) has surpassed the historic peak of the 1980s.

Gold is not chasing inflation, but faith in fiat is at an all-time low.

- Reward

- like

- Comment

- Repost

- Share

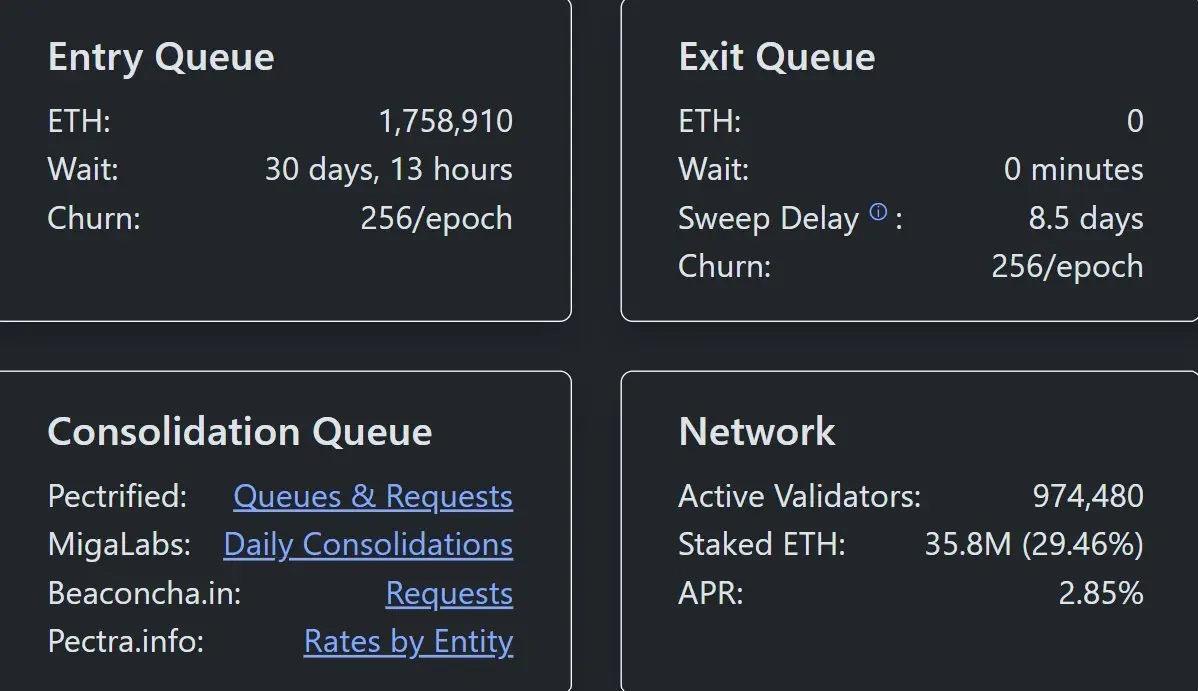

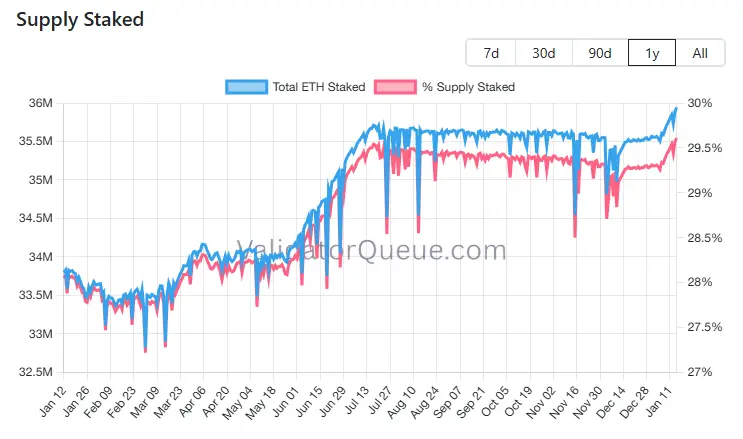

🟠Nearly 36M $ETH (30% of the total supply) - equivalent to $119B being staked.

This number continues to rise sharply in the early days of the year. After several months of stagnation since August last year, the amount of #ETH locked increased from 35.5M to 35.9M in a short period, marking the end of the quiet phase.

This number continues to rise sharply in the early days of the year. After several months of stagnation since August last year, the amount of #ETH locked increased from 35.5M to 35.9M in a short period, marking the end of the quiet phase.

ETH0,68%

- Reward

- like

- Comment

- Repost

- Share

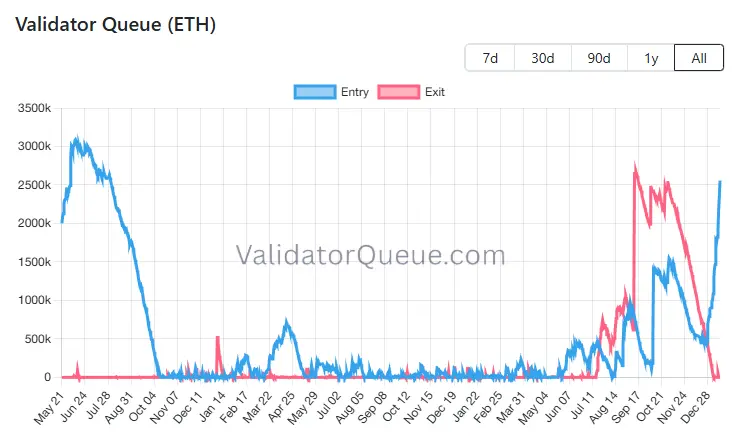

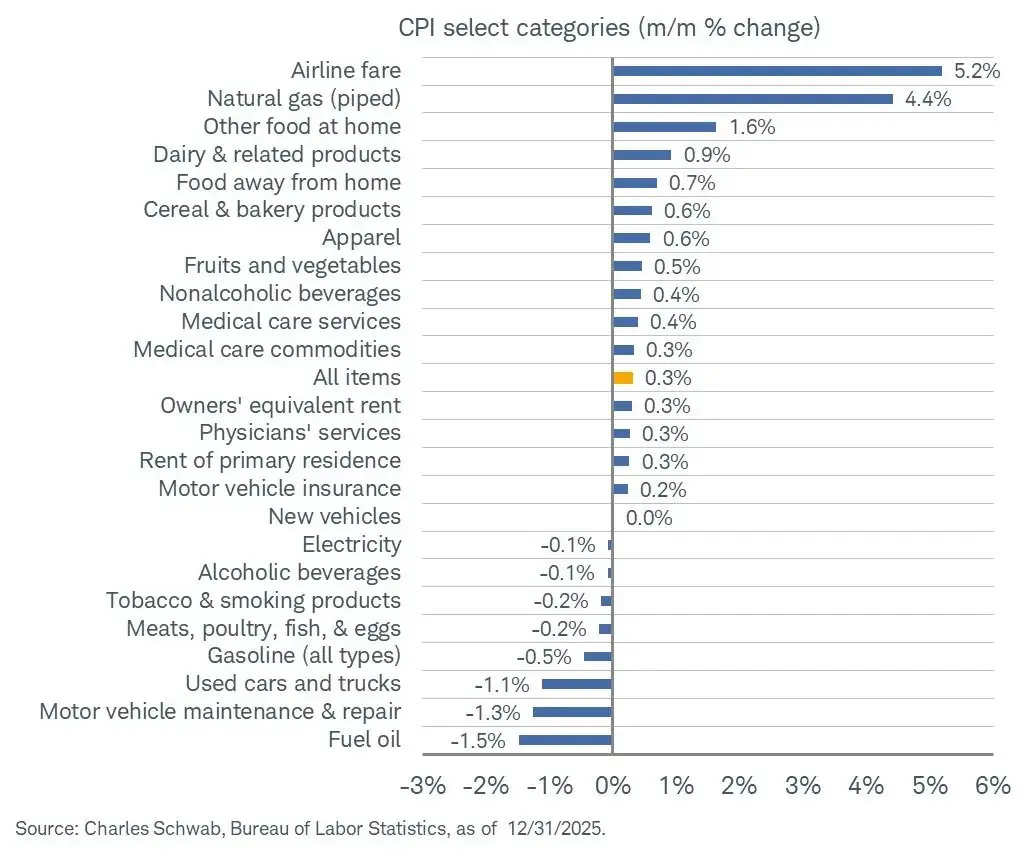

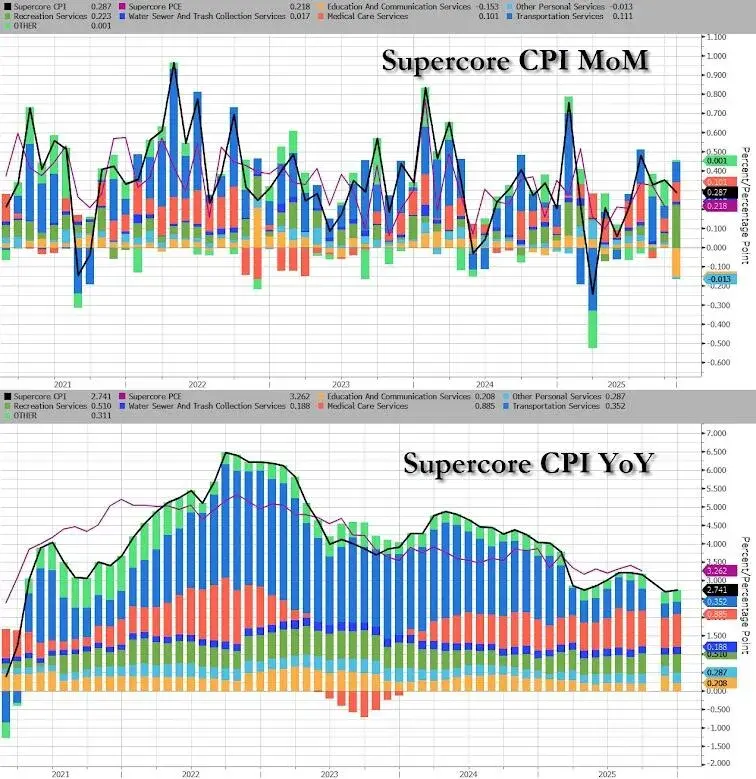

📍 US December CPI: The best CPI reading since Trump took office

📌 Year-over-year (YoY)

- Headline CPI: +2.7% YoY - unchanged from the previous month, in line with forecasts.

- Core #CPI: +2.6% YoY - unchanged from the previous month, below the forecast +2.7%.

📌 Month-over-month (MoM)

- Headline CPI: +0.3% MoM - unchanged from the previous month and in line with forecasts.

- Core CPI: +0.2% MoM - unchanged from the previous month, below the forecast +0.3%.

📌 Supercore CPI +0.14% MoM, +2.84% YoY (lowest since 09/2021).

📍 Details of changes by basket

- Food increased sharply by +0.7% MoM

- C

View Original📌 Year-over-year (YoY)

- Headline CPI: +2.7% YoY - unchanged from the previous month, in line with forecasts.

- Core #CPI: +2.6% YoY - unchanged from the previous month, below the forecast +2.7%.

📌 Month-over-month (MoM)

- Headline CPI: +0.3% MoM - unchanged from the previous month and in line with forecasts.

- Core CPI: +0.2% MoM - unchanged from the previous month, below the forecast +0.3%.

📌 Supercore CPI +0.14% MoM, +2.84% YoY (lowest since 09/2021).

📍 Details of changes by basket

- Food increased sharply by +0.7% MoM

- C

- Reward

- like

- Comment

- Repost

- Share

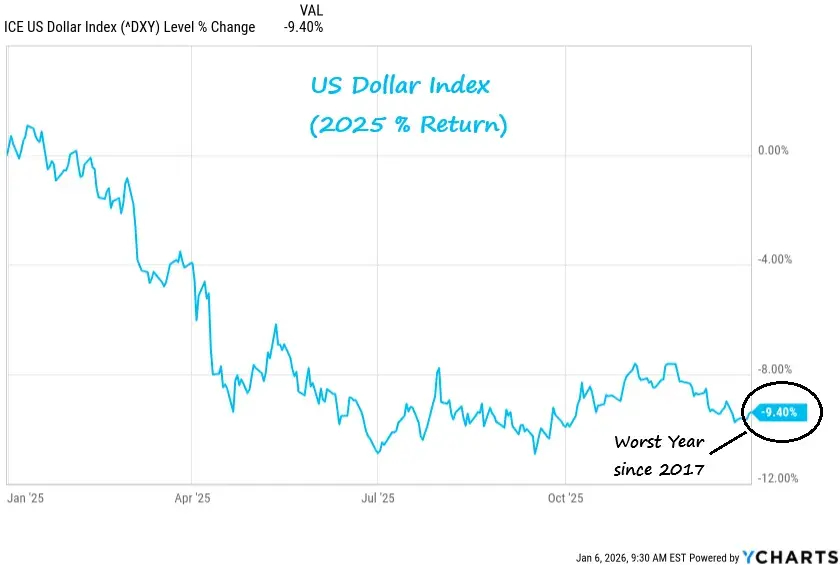

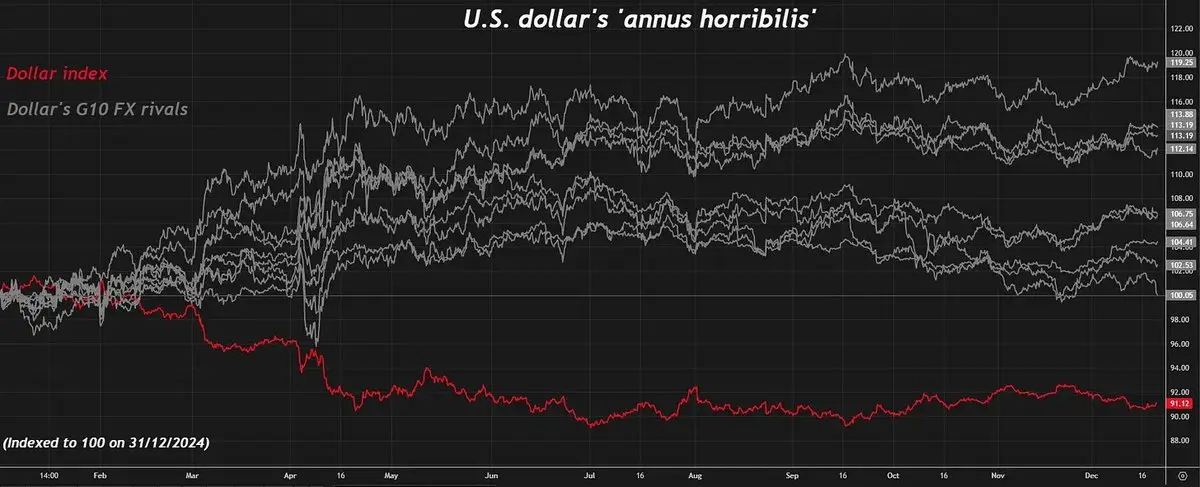

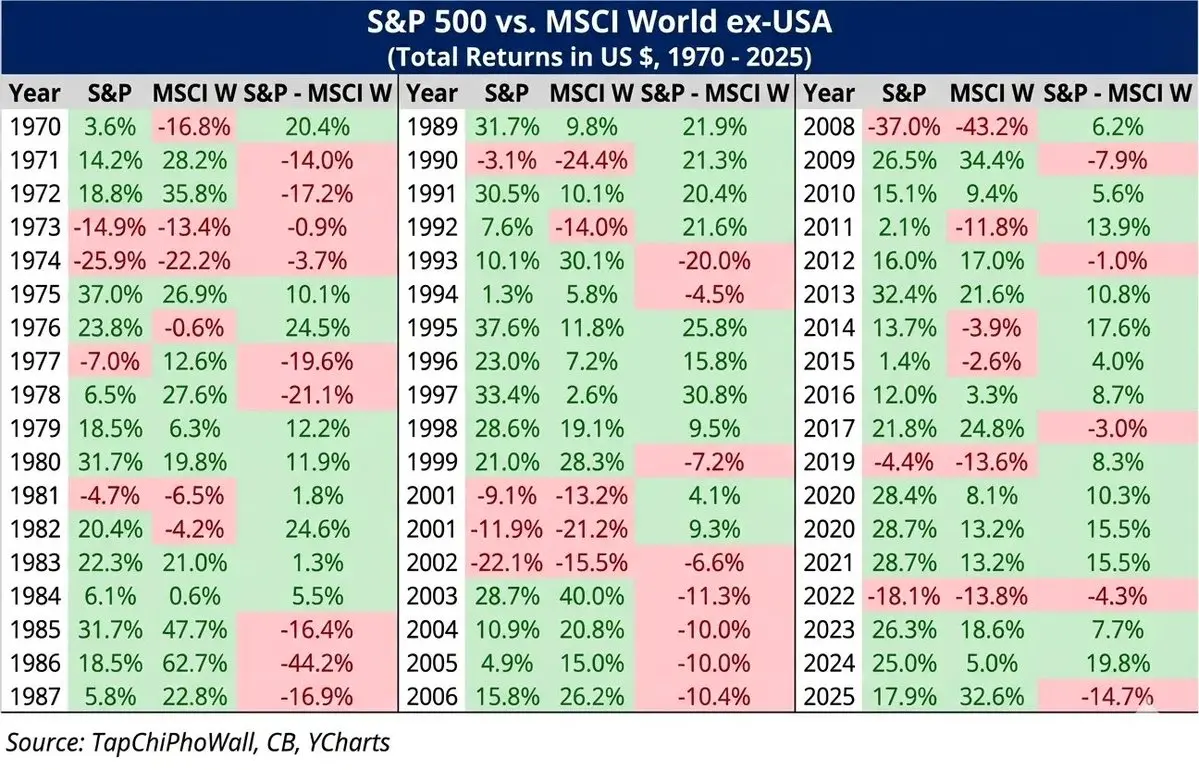

📍USD experienced the worst year in nearly a decade

If we only look at policies, 2025 should have been a favorable year for the US dollar. Tariffs were expected to bring capital flows back to the US, and the story of U.S. exceptionalism became the biggest narrative. However, DXY ended 2025 down -9%. In the first half of 2025: USD fell more than -12%, with a 6-month drop the strongest since the floating exchange rate system was introduced in the 1970s(.

-> On the G10 chart, the USD is the red line below the bottom; all other major currencies outperformed strongly — global capital is broadly lea

View OriginalIf we only look at policies, 2025 should have been a favorable year for the US dollar. Tariffs were expected to bring capital flows back to the US, and the story of U.S. exceptionalism became the biggest narrative. However, DXY ended 2025 down -9%. In the first half of 2025: USD fell more than -12%, with a 6-month drop the strongest since the floating exchange rate system was introduced in the 1970s(.

-> On the G10 chart, the USD is the red line below the bottom; all other major currencies outperformed strongly — global capital is broadly lea

- Reward

- like

- Comment

- Repost

- Share

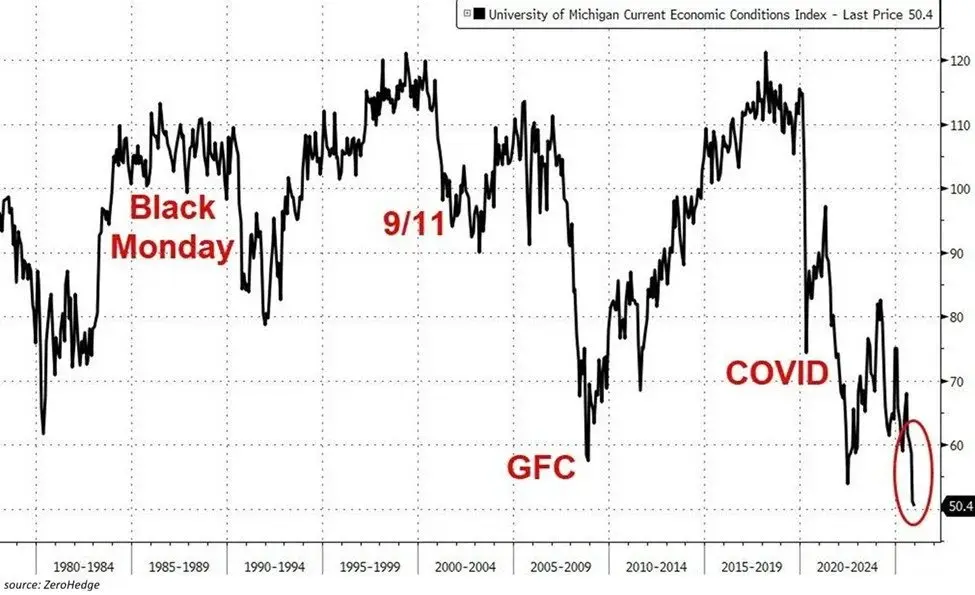

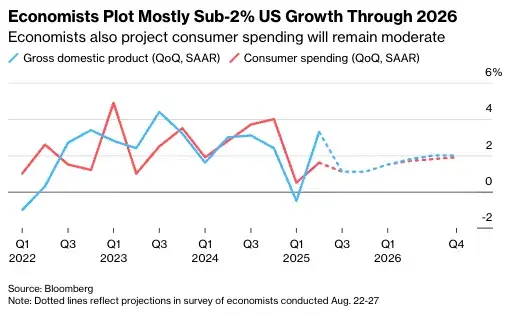

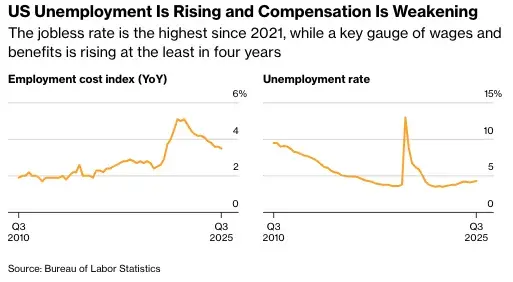

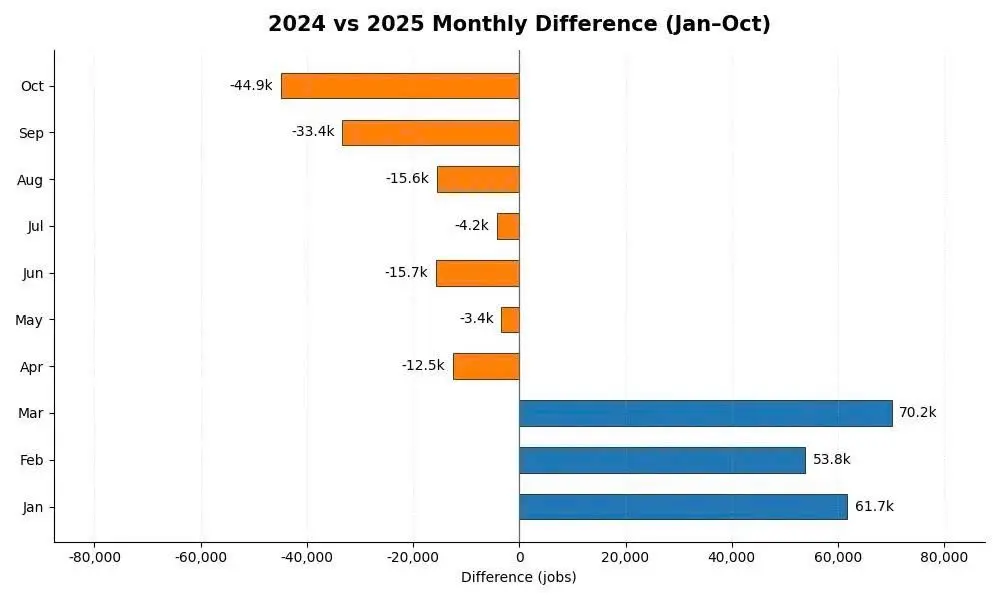

📍The US economy in 2026 will fall into a "lite stagflation" — a milder version of the stagflation era, with sluggish growth and sticky inflation.

📌US economic growth is likely to hover around 1.5-2%. The cycle where fiscal stimulus and asset price increases are the main drivers of the market, while the rest of the economy follows at a slow pace.

📌Inflation remains subdued due to OER reflecting housing market lags. Non-housing services will decline very slowly as they follow wage trends; tariffs have not yet fully reflected the impact, leaving room for price increases throughout 2026. The Fe

View Original📌US economic growth is likely to hover around 1.5-2%. The cycle where fiscal stimulus and asset price increases are the main drivers of the market, while the rest of the economy follows at a slow pace.

📌Inflation remains subdued due to OER reflecting housing market lags. Non-housing services will decline very slowly as they follow wage trends; tariffs have not yet fully reflected the impact, leaving room for price increases throughout 2026. The Fe

- Reward

- like

- Comment

- Repost

- Share

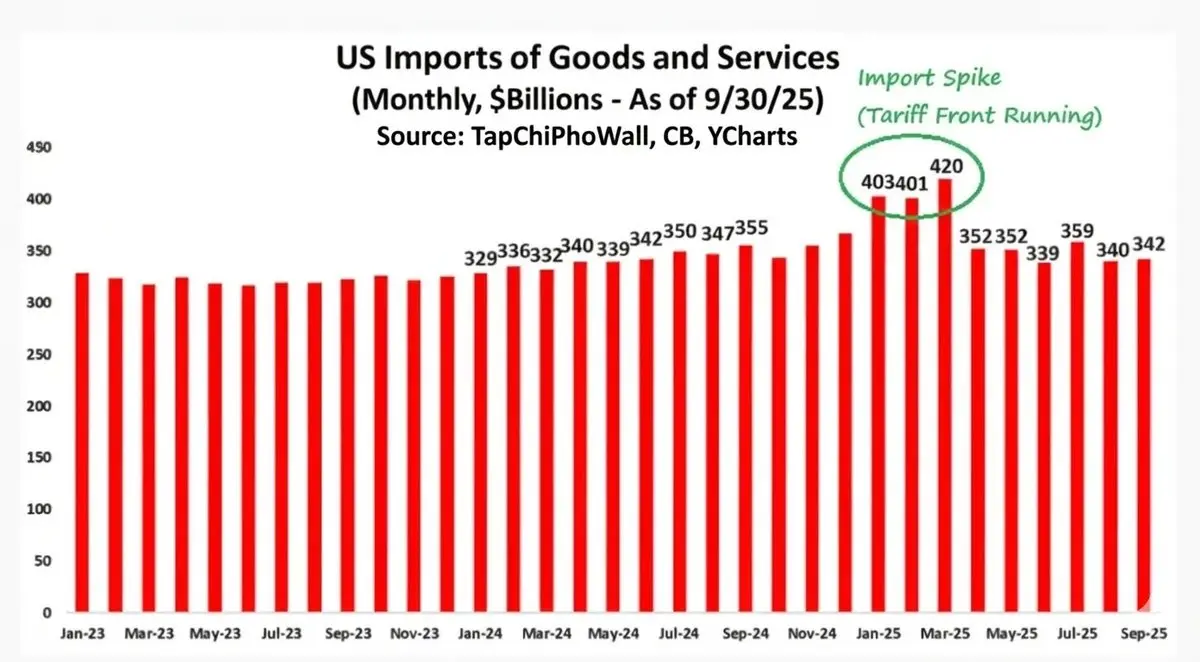

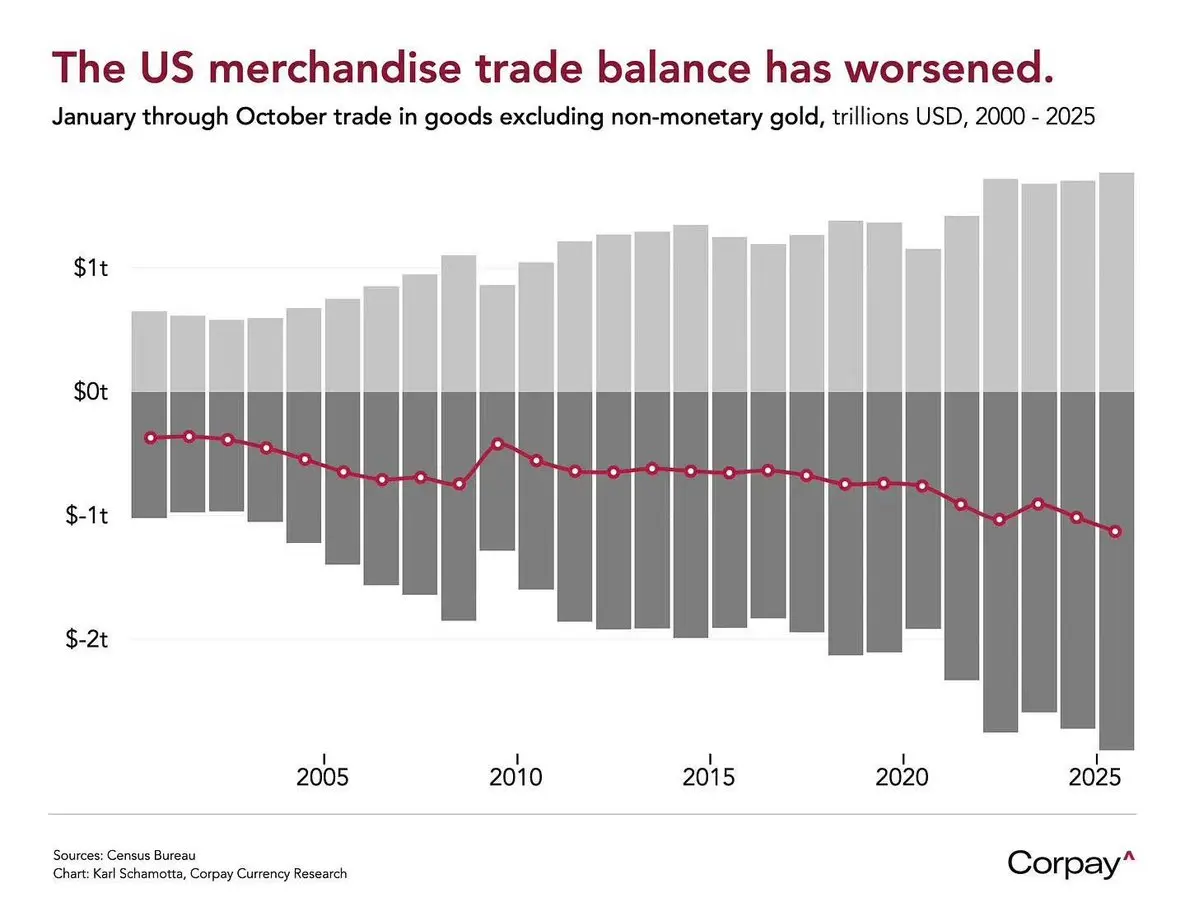

🟠 The US trade deficit in October fell to -$29.4B, the lowest since 2009

The figure is surprising because it is much better than the forecasted -$58.1B. September was also revised from -$52.8B to -$48.1B, paving the way for an upward adjustment of Q3 GDP.

- Exports increased +2.6% MoM to $302B

- Imports decreased -3.2% MoM to $342.1B.

-> Compared to 2024, the deficit continues to improve. The US is balancing its trade deficit by increasing exports of gold, jewelry, and pharmaceuticals — surprising as these asset groups saw strong gains in 2025.

The deficit with China is only -$175.4B, the lo

View OriginalThe figure is surprising because it is much better than the forecasted -$58.1B. September was also revised from -$52.8B to -$48.1B, paving the way for an upward adjustment of Q3 GDP.

- Exports increased +2.6% MoM to $302B

- Imports decreased -3.2% MoM to $342.1B.

-> Compared to 2024, the deficit continues to improve. The US is balancing its trade deficit by increasing exports of gold, jewelry, and pharmaceuticals — surprising as these asset groups saw strong gains in 2025.

The deficit with China is only -$175.4B, the lo

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

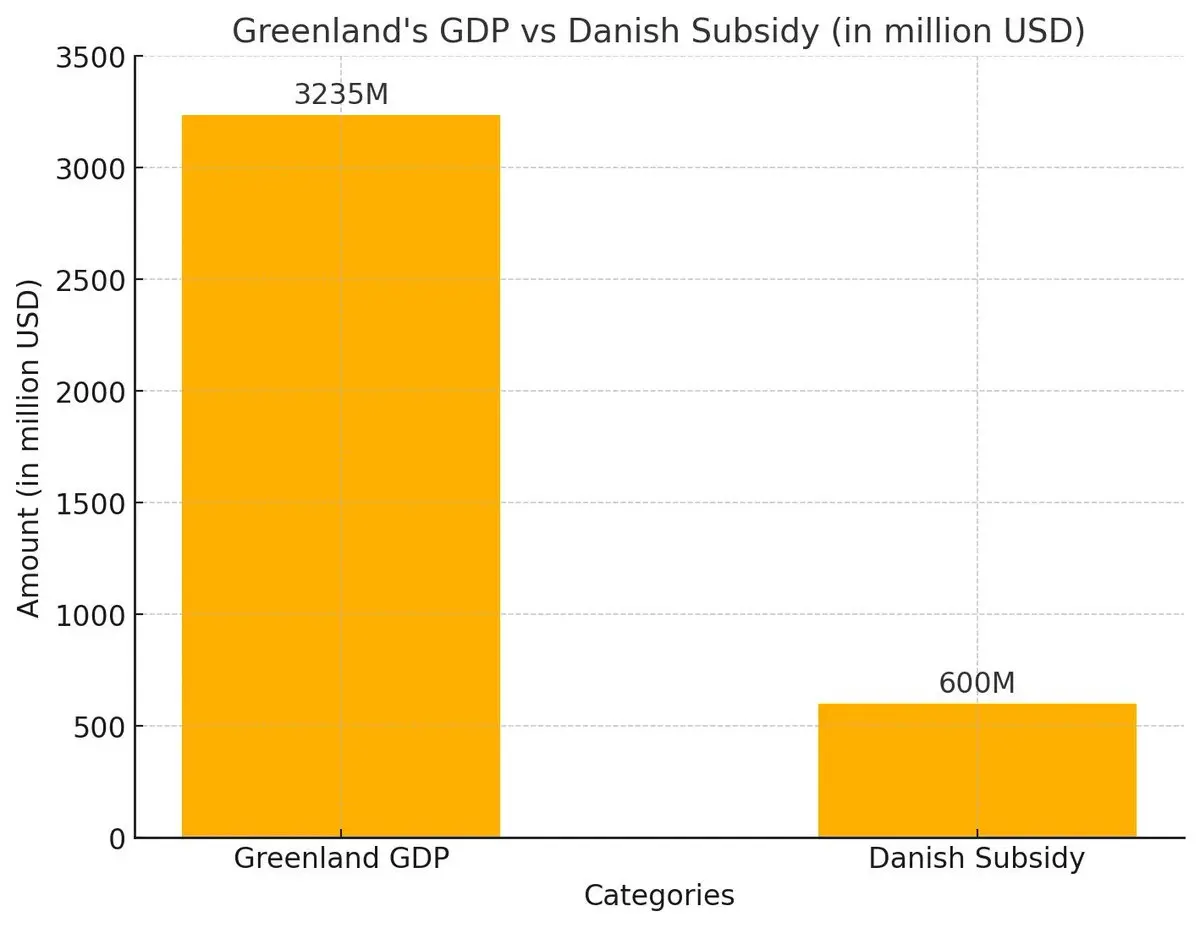

🟠 The United States accelerates the purchase of Greenland

Greenland openly states it can negotiate separately with the US. Denmark confirms it will go to Washington with Greenland next week. Signs indicate that this 57,000-population island has implicitly agreed to the deal from Trump.

The deal Trump wants: the US will pay $600M/year to Denmark for 100 years to acquire Greenland.

$60,000,000,000 / 2,166,000,000,000 m² ≈ $0.028/m²

-> Cheap as dirt. The US may have to offer a higher price.

Greenland possesses 25 out of 34 strategic resources according to EU standards, including rare earth elem

View OriginalGreenland openly states it can negotiate separately with the US. Denmark confirms it will go to Washington with Greenland next week. Signs indicate that this 57,000-population island has implicitly agreed to the deal from Trump.

The deal Trump wants: the US will pay $600M/year to Denmark for 100 years to acquire Greenland.

$60,000,000,000 / 2,166,000,000,000 m² ≈ $0.028/m²

-> Cheap as dirt. The US may have to offer a higher price.

Greenland possesses 25 out of 34 strategic resources according to EU standards, including rare earth elem

- Reward

- like

- Comment

- Repost

- Share

🟠 Scott Bessent: “Americans receiving benefits are not allowed to send money out of the US”

According to Bessent, starting today, banks will have to ask customers whether they receive benefits when conducting international transactions, including transferring money abroad.

Even if the benefit recipients keep the money in their US accounts, making payments abroad with Visa/Mastercard cards is also considered a flow of funds leaving the United States and may be subject to control or restrictions under the new regulations.

-> The main purpose is to keep liquidity within the United States.

View OriginalAccording to Bessent, starting today, banks will have to ask customers whether they receive benefits when conducting international transactions, including transferring money abroad.

Even if the benefit recipients keep the money in their US accounts, making payments abroad with Visa/Mastercard cards is also considered a flow of funds leaving the United States and may be subject to control or restrictions under the new regulations.

-> The main purpose is to keep liquidity within the United States.

- Reward

- like

- Comment

- Repost

- Share

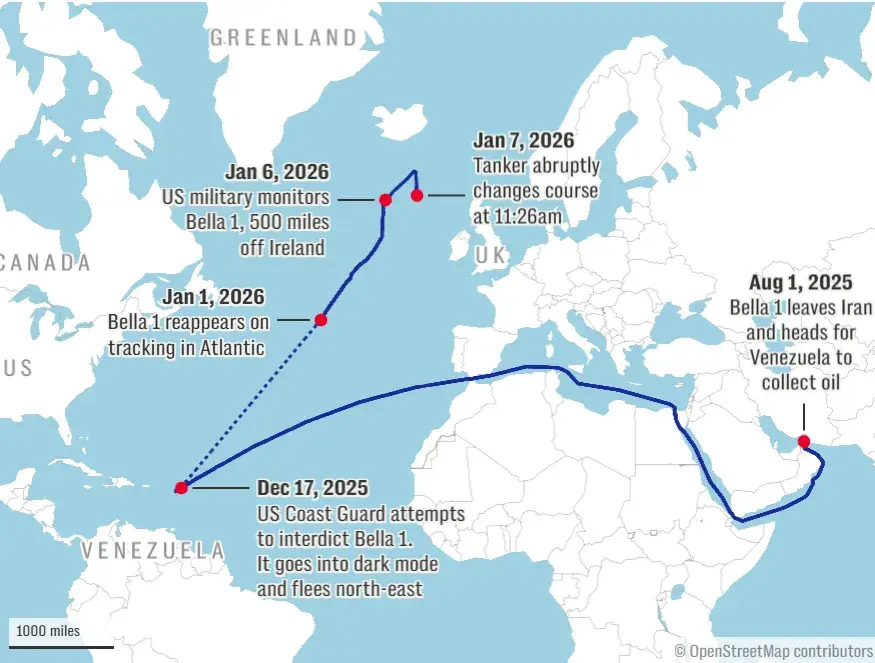

🟢 US - Russia confrontation at sea: Russia is at a disadvantage as Bella-1 falls into US hands

🟠 Bella-1 with its zig-zag journey from Iran to Venezuela and then looping up the North Atlantic has triggered a chase between the US and Russian navies:

📌 12/19: Bella-1 is detected leaving Iran to go to Venezuela to take oil.

📌 12/21: The US attempts to intercept. The ship immediately turns off signals and flees northeast.

📌 01/01: Bella-1 reappears on radar in the Atlantic Ocean.

📌 01/06: Russia deploys submarines and escort warships.

📌 01/07: The ship changes name, flies the Russian flag,

View Original🟠 Bella-1 with its zig-zag journey from Iran to Venezuela and then looping up the North Atlantic has triggered a chase between the US and Russian navies:

📌 12/19: Bella-1 is detected leaving Iran to go to Venezuela to take oil.

📌 12/21: The US attempts to intercept. The ship immediately turns off signals and flees northeast.

📌 01/01: Bella-1 reappears on radar in the Atlantic Ocean.

📌 01/06: Russia deploys submarines and escort warships.

📌 01/07: The ship changes name, flies the Russian flag,

- Reward

- like

- Comment

- Repost

- Share

🟠Rumors that Venezuela holds 600,000 $BTC - nearly 3% of the supply - are causing market panic.

Since 2018, Venezuela has sold over 70 tons of gold, exchanging it at BTC prices of $5k–10k. By 2025, 80% of crude oil revenue will be paid in USDT and gradually transitioned to $BTC. All to evade US sanctions. Most BTC and USDT are stored in cold wallets, dispersed, with no on-chain trace.

Assets worth nearly $60B are at risk of change of ownership after Maduro's arrest on 1/3/2026. The key question is where the private key is stored.

After Maduro's arrest and Venezuela potentially being governe

Since 2018, Venezuela has sold over 70 tons of gold, exchanging it at BTC prices of $5k–10k. By 2025, 80% of crude oil revenue will be paid in USDT and gradually transitioned to $BTC. All to evade US sanctions. Most BTC and USDT are stored in cold wallets, dispersed, with no on-chain trace.

Assets worth nearly $60B are at risk of change of ownership after Maduro's arrest on 1/3/2026. The key question is where the private key is stored.

After Maduro's arrest and Venezuela potentially being governe

BTC-0,04%

- Reward

- like

- Comment

- Repost

- Share

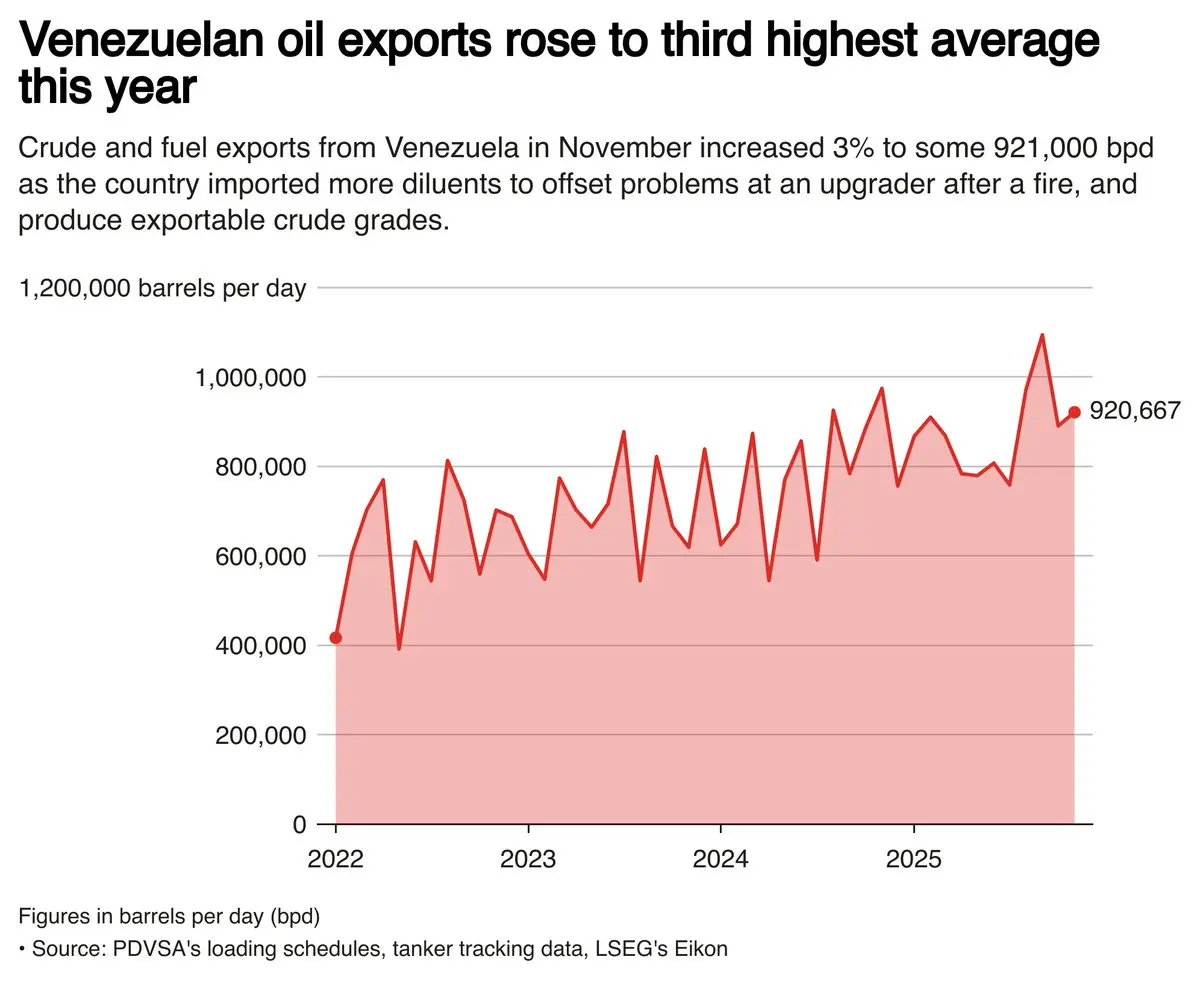

🟠 Trump exerts pressure to force US companies back to Venezuela

Most of the oil in the Orinoco belt is extra-heavy sour crude. High viscosity, high sulfur content, requiring diluent blending or upgrading before sale. The selling price is even 10-20% lower than the global oil price, sometimes about ~$20/bbl below Brent.

Poor infrastructure + higher operating costs than industry standards -> Venezuela, despite having one of the world's largest reserves, has seen production drop from >3.5mbd at the end of the 20th century to around ~1.1mbd currently.

It is estimated that increasing production by

View OriginalMost of the oil in the Orinoco belt is extra-heavy sour crude. High viscosity, high sulfur content, requiring diluent blending or upgrading before sale. The selling price is even 10-20% lower than the global oil price, sometimes about ~$20/bbl below Brent.

Poor infrastructure + higher operating costs than industry standards -> Venezuela, despite having one of the world's largest reserves, has seen production drop from >3.5mbd at the end of the 20th century to around ~1.1mbd currently.

It is estimated that increasing production by

- Reward

- like

- Comment

- Repost

- Share

🟠 BlackRock Bitcoin ETF records the largest inflow in nearly 3 months

🟢According to updated data, #ETF Bitcoin của BlackRock (iShares Bitcoin Trust – #IBIT) recorded an inflow of $287.4M on 02/01/2026, the highest in nearly 3 months. As a result, the total inflow of the Bitcoin spot #ETF group in the US reached $471.3M for the session, the highest since mid-November 2025.

🟢The capital mainly focused on:

- $IBIT (BlackRock): +$287.4M

- $FBTC (Fidelity): +$88.1M

- $BITB (Bitwise): +$41.5M

🟢The remaining ETFs recorded smaller inflows, while no funds experienced significant outflows during thi

🟢According to updated data, #ETF Bitcoin của BlackRock (iShares Bitcoin Trust – #IBIT) recorded an inflow of $287.4M on 02/01/2026, the highest in nearly 3 months. As a result, the total inflow of the Bitcoin spot #ETF group in the US reached $471.3M for the session, the highest since mid-November 2025.

🟢The capital mainly focused on:

- $IBIT (BlackRock): +$287.4M

- $FBTC (Fidelity): +$88.1M

- $BITB (Bitwise): +$41.5M

🟢The remaining ETFs recorded smaller inflows, while no funds experienced significant outflows during thi

BTC-0,04%

- Reward

- like

- Comment

- Repost

- Share

Meme wave ( if there is ) will @MustStopMurad come ashore?

View Original

- Reward

- like

- Comment

- Repost

- Share