JuliusElum

No content yet

JuliusElum

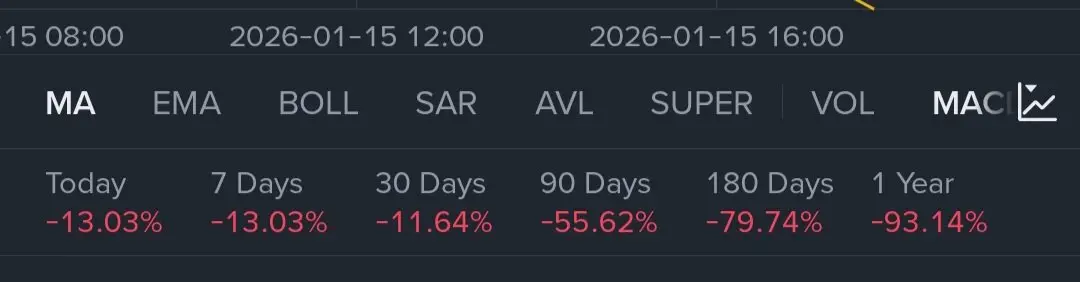

If Satoshi Nakamoto sells his $105 billion Bitcoin supply, what price would Bitcoin dump to?💔

BTC-1,84%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Eyes on Privacy, you already know my best pick🔥💰

- Reward

- like

- Comment

- Repost

- Share

InfoFi tokens are dead. Pivot now or die with KAITO, TRAC, COOKIE, BMT, BARA, OM. It's not bad news. Death happens to bring life. Determine the next step to take.

InfoFi is Data monetization is dead with X APi revoke. Other infoFi features: AI integration, Web3 infrastructure, and real-world assets tokenization are still very key in the crypto and blockchain industry.

InfoFi is Data monetization is dead with X APi revoke. Other infoFi features: AI integration, Web3 infrastructure, and real-world assets tokenization are still very key in the crypto and blockchain industry.

- Reward

- like

- Comment

- Repost

- Share

I bought 2 Solana mobile back in 2024, each costing $535. Unfortunately, Nigeria customs, NDLEA, and DSS held my package in Lagos Nigeria when I was there to pick the package requesting I pay $1000 to clear one package while NDLEA is asking to provide documents that have no bearing with mobile phone purchase, DSS is asking me to fill a form that's long from Lagos Nigeria to California. I got angry and left the phone for them. I'll place an order while on trip to my destination. Right now, sadly, I can't claim my Seeker SRK airdrop because I don't have the phone😭

If you've got your Solana mobi

If you've got your Solana mobi

- Reward

- like

- Comment

- Repost

- Share

You're financially, morally, socially, physique-wise, and spiritually bankrupt. You know it, yet you're still worried about which woman ignored you or doesn't love you nor allow you sex access. That's a misplaced priority bro, forget about woman & sex for now, you'll have lots of that in the future if you decide to be a brostitute. Right now, focus on those areas listed above, build it. The early you start the easier it becomes.

If you ignore it now, in 5 years when you see people who are supposedly your mate by age, you will hide your face in shame.

Not putting you on competitive pressure

But

If you ignore it now, in 5 years when you see people who are supposedly your mate by age, you will hide your face in shame.

Not putting you on competitive pressure

But

- Reward

- like

- Comment

- Repost

- Share

It's time to live a holy life. It's time to seek the face of God. It's time to embrace Jesus Christ. It's time to develop and nurture a relationship with the Holy Spirit. It's time to become a positive influence in your generation.

God is real.

He's with you

Ask him for help.

God is real.

He's with you

Ask him for help.

- Reward

- like

- Comment

- Repost

- Share

I'm big long-term Holder of XVG & ASTER, no pressure, no FOMO, no bag fumbling. Just a pure believer who wants to play long term.

ASTER-2,15%

- Reward

- like

- Comment

- Repost

- Share

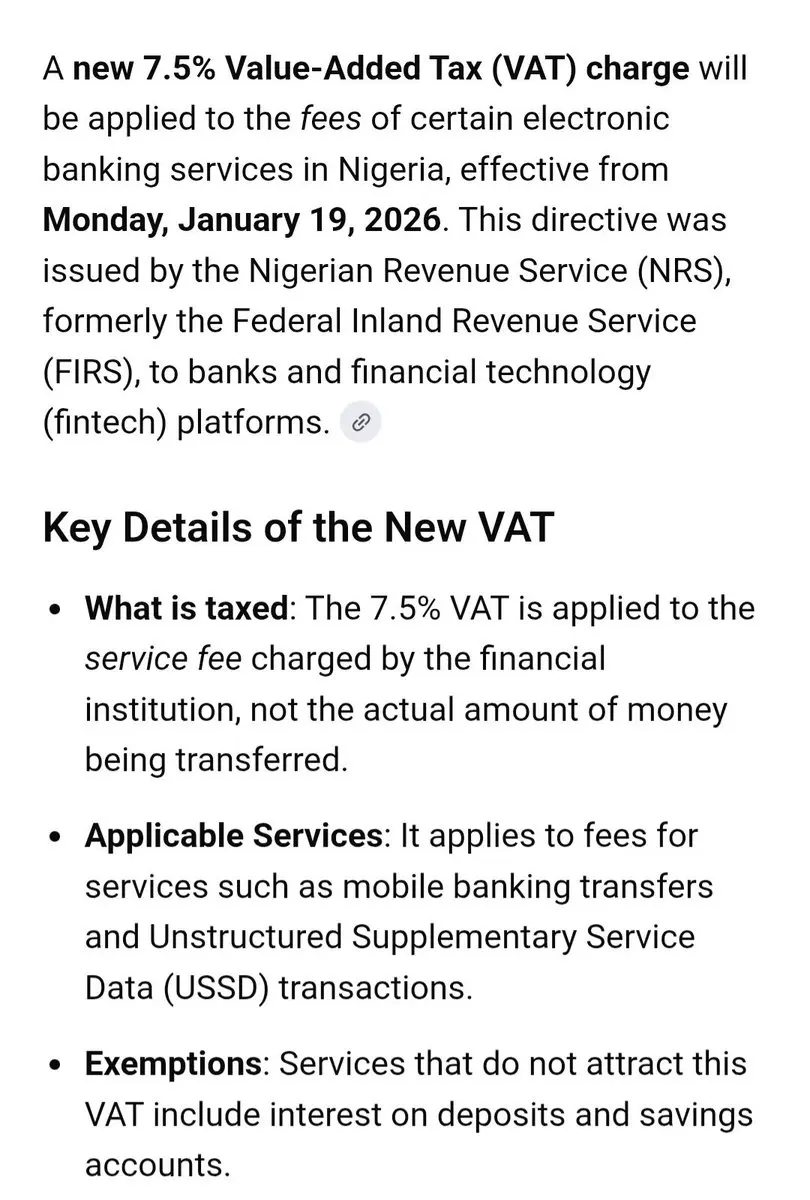

Here is what it looks like to transfer money through banks starting from 19th January.

For each Mobile, Card, and USSD transfer you make, you would pay:

-7.5% VAT for the government

-N50 electronic levy

-Bank transfer charges

To be a Nigerian, you pay daily with your hard-earned money through a transfer.

To do business or earn in Nigeria, you pay monthly or annually with:

-Corporate tax up to 25%

-Income tax up to 25%

-7.5% VAT on goods and services

At this point, cash and crypto payment is the only solution to this madness.

Get a DEX crypto wallet. Let customers pay you through crypto. Then

For each Mobile, Card, and USSD transfer you make, you would pay:

-7.5% VAT for the government

-N50 electronic levy

-Bank transfer charges

To be a Nigerian, you pay daily with your hard-earned money through a transfer.

To do business or earn in Nigeria, you pay monthly or annually with:

-Corporate tax up to 25%

-Income tax up to 25%

-7.5% VAT on goods and services

At this point, cash and crypto payment is the only solution to this madness.

Get a DEX crypto wallet. Let customers pay you through crypto. Then

- Reward

- like

- Comment

- Repost

- Share

I'm sure those who believed with me, bought $XVG and held are now the winners

- Reward

- 1

- 1

- Repost

- Share

ISTANBULL :

:

Happy New Year! 🤑The Tax law is a mass extraction. Profits are taxable, losses are privatized. That’s not partnership, that’s extraction. If I can own my losses but share my profit with the government it's not a fair society. It's Broad day robbery.

- Reward

- like

- Comment

- Repost

- Share

You're sleeping?

- Reward

- like

- 1

- Repost

- Share

Salahu12 :

:

no sirA young man struggling, manages to raise $1k to bet on crypto, a risky venture. Painstakingly grow that $1k to $10k. Then you mandate him to pay tax to you. But if he lost that $1k on meme betting or futures, he can't turn to the bank for loans neither you the government for government assistance. You will collect tax when people profit but won't provide jobs, loans, or government aid when they make losses. Isn't that systemic extraction and exploitation?

MEME-1%

- Reward

- like

- Comment

- Repost

- Share

If you earn 800k and above annually as personal income, here is how to abate Tax: open an LLC business, do all transactions with the accounts of the business. If your income does not exceed N100 million annually, you won't be taxed. Since the government wants your hard-earned money as GPD growth. Turn your personal income into business income. Don't be fooled by this government. There are always loopholes to exploit.

- Reward

- like

- Comment

- Repost

- Share

Wow, my dream of relocating while doing business in Nigeria is crushed, my tax lawyer just informed me that I will pay more tax if I live in a different country and do business in Nigeria. For instance, living in Nigeria, I would pay 25% max tax, in Ghana, pay 35%, in South Africa, pay 45% it's even more up to 50% in a developed country. Except I'm willing to go 100% offshore.

- Reward

- like

- 1

- Repost

- Share

Lookcoolman :

:

wow To abate VAT, buy everything with cash

- Reward

- like

- Comment

- Repost

- Share

You've got no business with sleep till you hit that milestone😭

- Reward

- like

- Comment

- Repost

- Share

I'm dangerously optimistic. It's why results are loyal to me.

- Reward

- like

- Comment

- Repost

- Share