Daitaro

No content yet

Daitaro

"Wall Street never changes, the pockets change, the suckers change, the stocks change, but Wall Street never changes because human nature never changes."

• Jesse Lauriston Livermore

• Jesse Lauriston Livermore

- Reward

- like

- Comment

- Repost

- Share

[Market Update]

This is the most likely scenario imo.

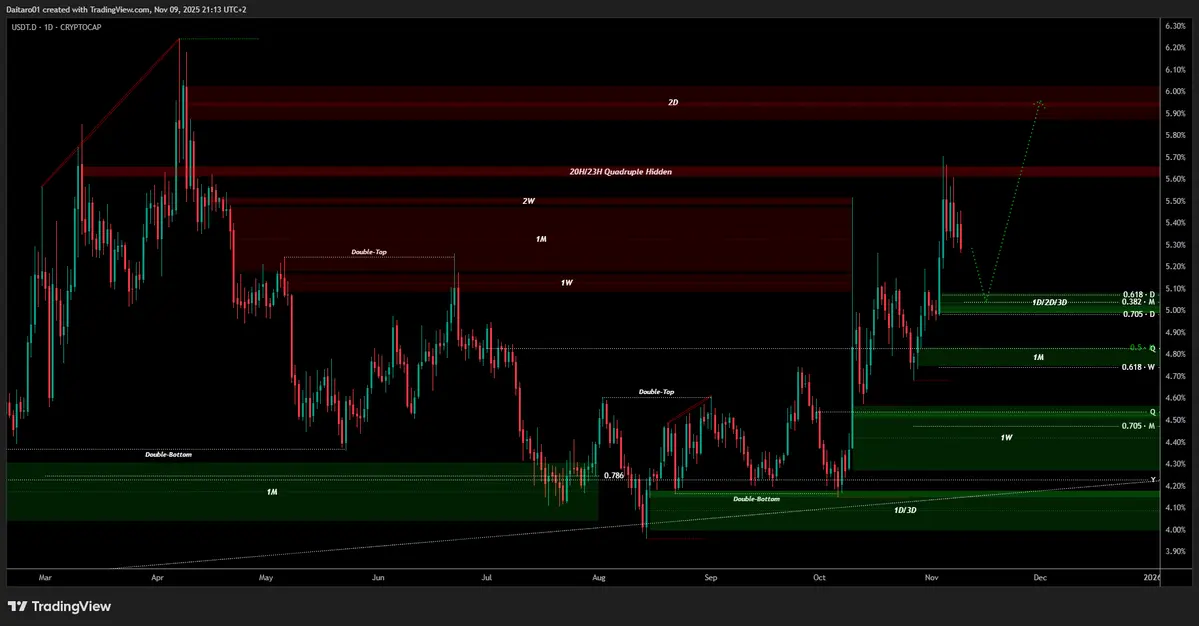

- Tether & Circle Dominance

A relief for crypto market until USDT.D hits HTF demand at 5.5% and a nasty rejection that will take us all the way up until 7.5% (a wick to 8% is possible) and a reversal to occur from there early next year.

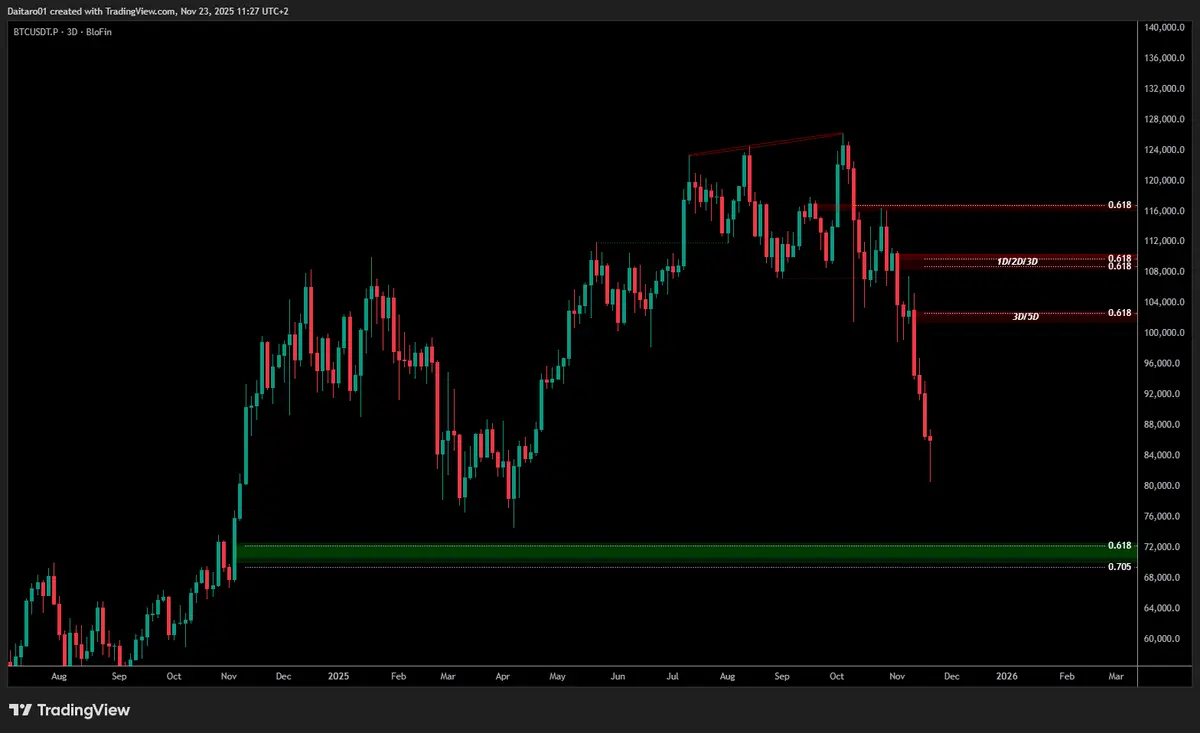

- Bitcoin

The most important bearish levels are the weekly opposite pole with multiple fib confluences from external and internal swings @$98k and the HTF supply @$102k.

The most important bullish levels are the 2D/3D @$72k which was front-run in April (possibility of another front-run with double bottom or

This is the most likely scenario imo.

- Tether & Circle Dominance

A relief for crypto market until USDT.D hits HTF demand at 5.5% and a nasty rejection that will take us all the way up until 7.5% (a wick to 8% is possible) and a reversal to occur from there early next year.

- Bitcoin

The most important bearish levels are the weekly opposite pole with multiple fib confluences from external and internal swings @$98k and the HTF supply @$102k.

The most important bullish levels are the 2D/3D @$72k which was front-run in April (possibility of another front-run with double bottom or

- Reward

- like

- Comment

- Repost

- Share

Where do you imagine yourself five years from now ?

What would you like to have achieved by that time, and what do you think would make you genuinely happy ?

What would you like to have achieved by that time, and what do you think would make you genuinely happy ?

- Reward

- like

- Comment

- Repost

- Share

[Makret Update]

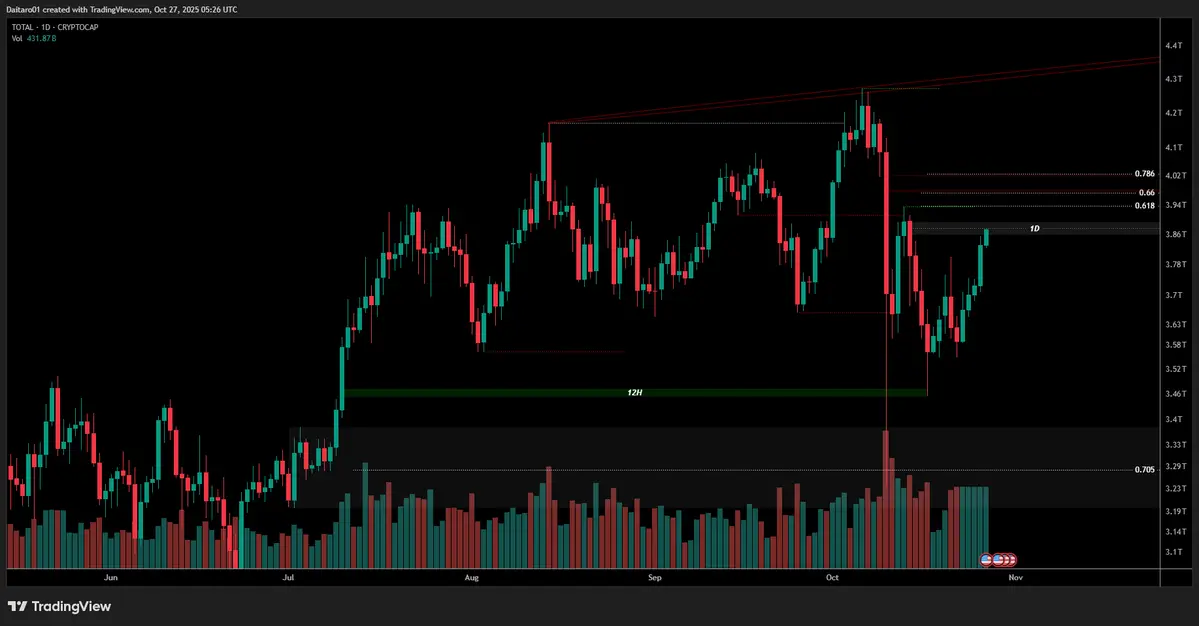

We're not far away from the most optimal reversal levels across the market, with fear induced everywhere and S&P bouncing off its key SL.

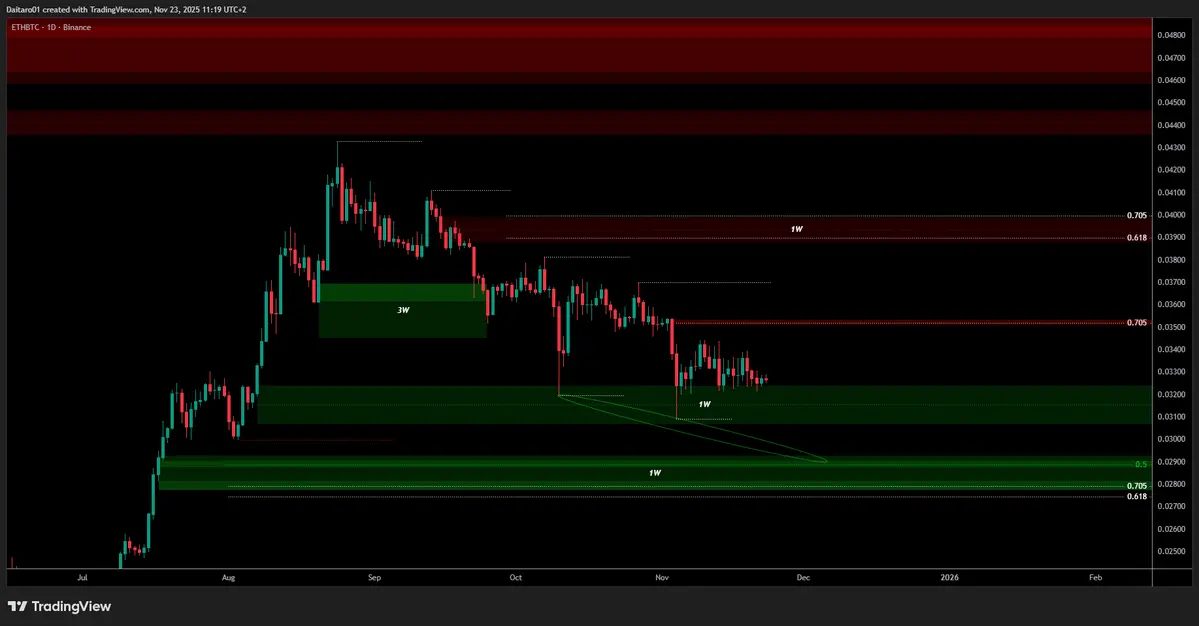

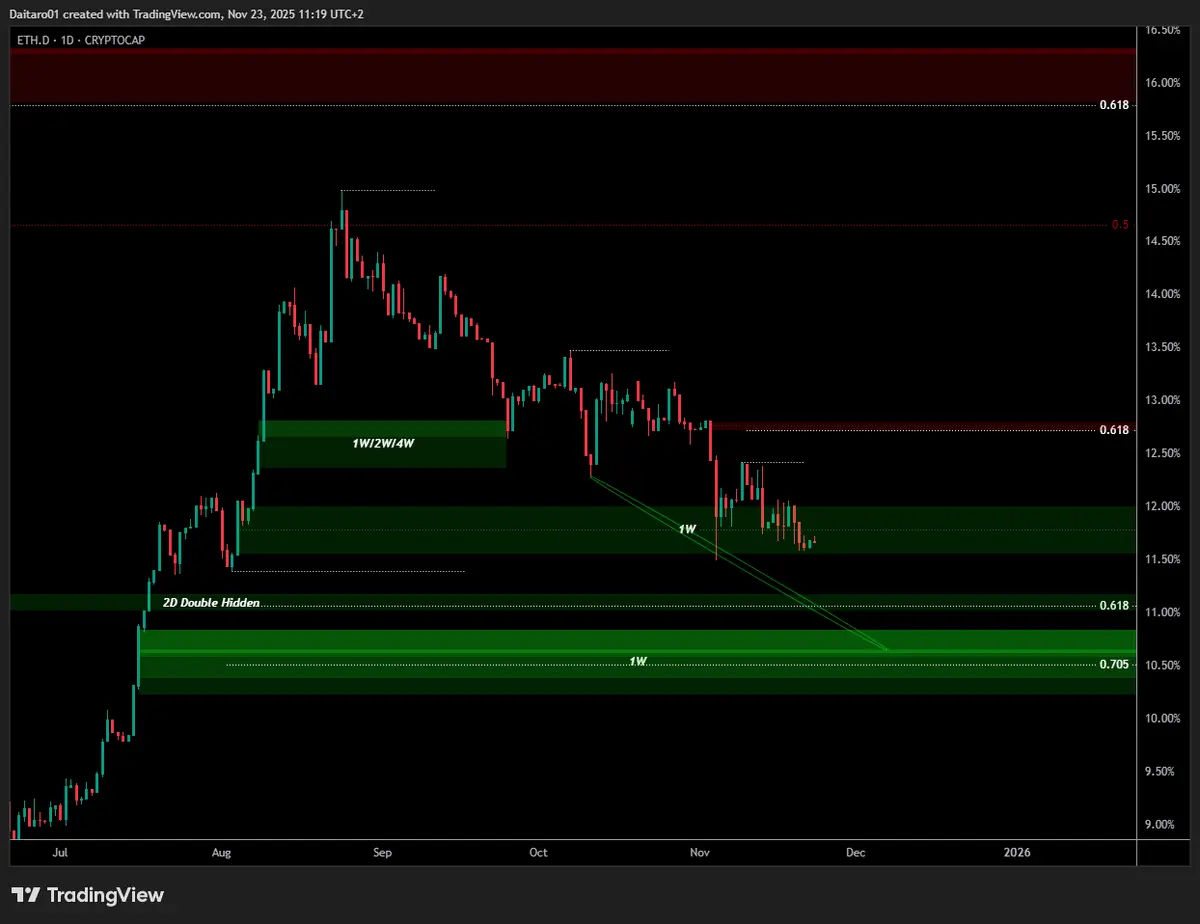

Ethereum target is $2k-$2.1k as the most optimal reversal, which could be hit simultaneously with Bitcoin $72k and USDT.D 7.4%.

If they all hit together, in confluence with ETH/BTC hitting 0.028-0.029 and ETH.D hitting 10.8%, ideally with exchanges ❄️and a ⚡️wick, then that's a picture-perfect bottom hit across the market that could lead to a strong bounce across the board.

We're not far away from the most optimal reversal levels across the market, with fear induced everywhere and S&P bouncing off its key SL.

Ethereum target is $2k-$2.1k as the most optimal reversal, which could be hit simultaneously with Bitcoin $72k and USDT.D 7.4%.

If they all hit together, in confluence with ETH/BTC hitting 0.028-0.029 and ETH.D hitting 10.8%, ideally with exchanges ❄️and a ⚡️wick, then that's a picture-perfect bottom hit across the market that could lead to a strong bounce across the board.

- Reward

- like

- Comment

- Repost

- Share

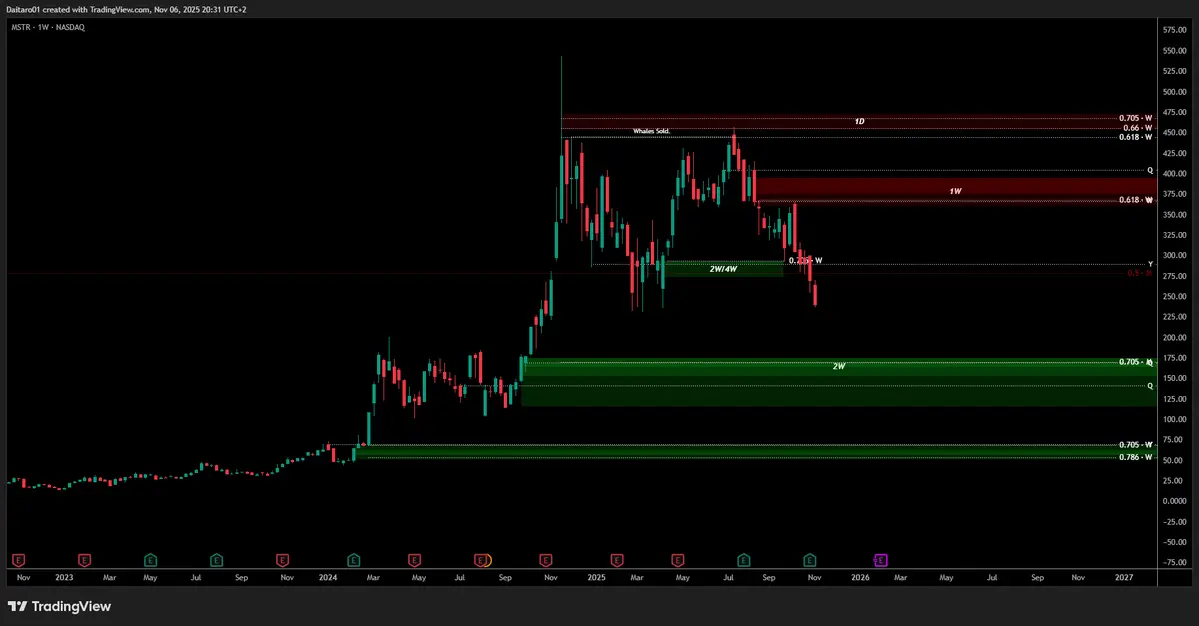

When in a sell program, bearish levels work wonders., and this has been happening since the beginning of Q4 so far.

We've a HTF supply level with a 1D BB inside right at the EQ of the daily FVG with fibs adding more pressure for another swing short opportunity all the way till $89k level.

All charts are identical with HTF BOS and cluster of supply/BBs created and paired with significant fibs.

$BTC $89,000 and $MSTR $170 could provide a nice long opportunity, that should be treated as scalp, until proven otherwise.

We've a HTF supply level with a 1D BB inside right at the EQ of the daily FVG with fibs adding more pressure for another swing short opportunity all the way till $89k level.

All charts are identical with HTF BOS and cluster of supply/BBs created and paired with significant fibs.

$BTC $89,000 and $MSTR $170 could provide a nice long opportunity, that should be treated as scalp, until proven otherwise.

BTC-4,61%

- Reward

- like

- Comment

- Repost

- Share

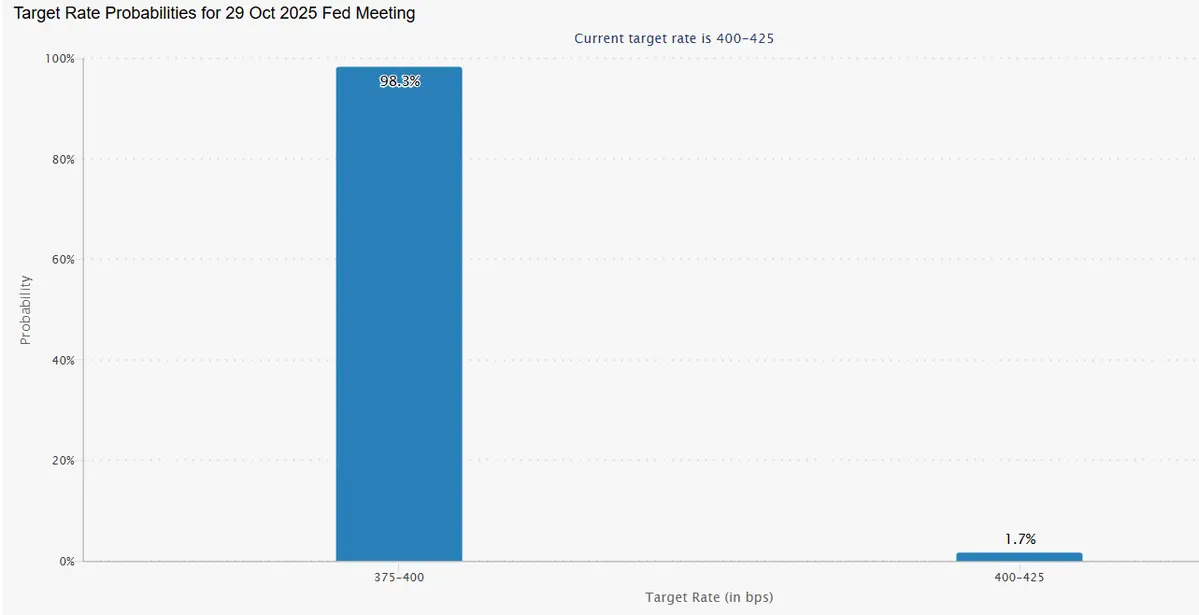

FOMC is in 4 days from now and we'll most likely get the cuts.

I expect a pump to validate the bullish narrative of rate cuts, Q4 etc.

My plan is to short the key levels on Bitcoin and Ethereum at $116k and $4.3k if given.

* These are my HTF pre-plans for next week and not a blind-follow.

I expect a pump to validate the bullish narrative of rate cuts, Q4 etc.

My plan is to short the key levels on Bitcoin and Ethereum at $116k and $4.3k if given.

* These are my HTF pre-plans for next week and not a blind-follow.

- Reward

- like

- Comment

- Repost

- Share

I've been flat the past few days in crypto market since we've been very choppy and I missed a few plays being away from charts.

There are 3 POI I'm interested in trading on HTF.

1. Short @ $116k-$117k

2. Long @ $102k

3. Long @ $89k

There are 3 POI I'm interested in trading on HTF.

1. Short @ $116k-$117k

2. Long @ $102k

3. Long @ $89k

- Reward

- like

- Comment

- Repost

- Share

Imagine $BTC at $93k , $ETH at $3.2k, and $SPX at $6.1k all in sync for the next pivot in November, while Gold & Silver top right after retail jumps straight into the local top.

By the time retail jumps back to crypto and stocks, a major crash happens, and retail gets wrecked again.

Then capitulates at CNY bottom, only to watch crypto & stocks pumping. But failing to sustain the pump and enter a bear market until Q3-Q4 2026.

In the meanwhile, gold & silver have already started their next bull market with a top at the end of the decade.

Peak euphoria 2029 in all markets before the Roaring 20s

By the time retail jumps back to crypto and stocks, a major crash happens, and retail gets wrecked again.

Then capitulates at CNY bottom, only to watch crypto & stocks pumping. But failing to sustain the pump and enter a bear market until Q3-Q4 2026.

In the meanwhile, gold & silver have already started their next bull market with a top at the end of the decade.

Peak euphoria 2029 in all markets before the Roaring 20s

- Reward

- like

- 1

- Repost

- Share

CalmlyRecoveringFunds :

:

It's empty.Bitcoin Macro Projection

364d of bear market followed by 1064d of bull market.

A pattern that is repeating over and over again.

When $BTC hit its ATH back in 2021 at $69k, no one expected it to move down under 20s.

Same thing will happen in 2026.

No one will expect Bitcoin to move under 50s.

There are 2 big POI zones for 2026 macro bottom.

The first being at $44k-$47k and the second being at $26k-$30k.

364d of bear market followed by 1064d of bull market.

A pattern that is repeating over and over again.

When $BTC hit its ATH back in 2021 at $69k, no one expected it to move down under 20s.

Same thing will happen in 2026.

No one will expect Bitcoin to move under 50s.

There are 2 big POI zones for 2026 macro bottom.

The first being at $44k-$47k and the second being at $26k-$30k.

- Reward

- like

- Comment

- Repost

- Share

You can't cheat your way to mastery.

Monk mode 2.0 starting next week.

Time to level up.

Monk mode 2.0 starting next week.

Time to level up.

- Reward

- like

- Comment

- Repost

- Share

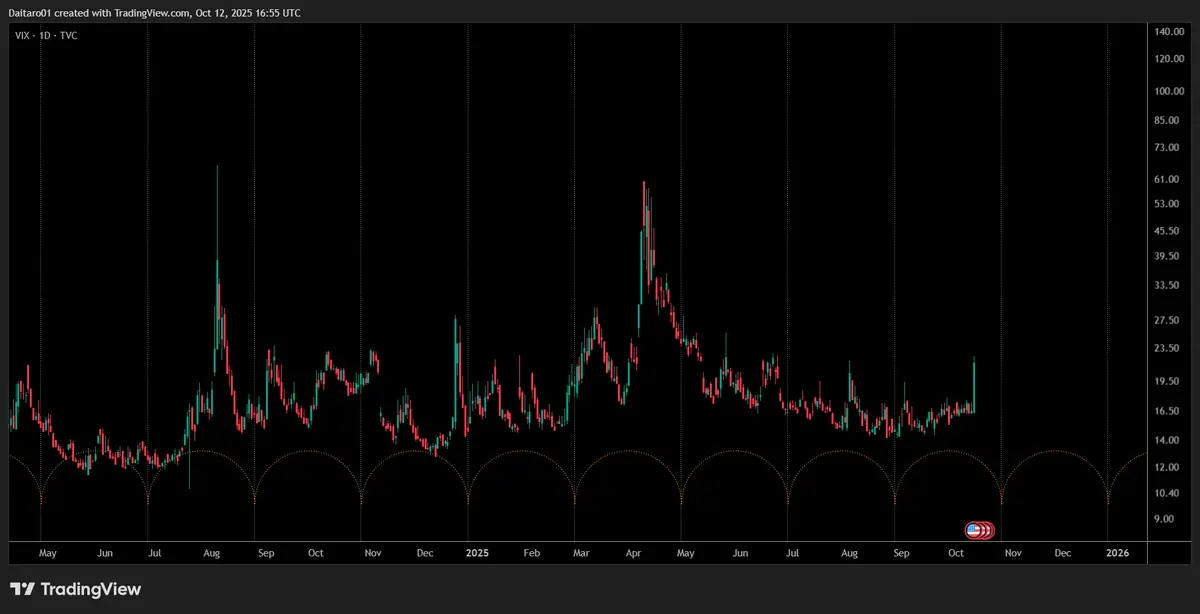

$SPX

$VIX

Stock market correction is just starting imo with a clean 4D BB on S&P, VIX pumping above 20s and a pivot due to late October - early November.

Meanwhile, crypto is pumping on a Sunday right into key levels before weekly closure and Monday US market open.

Trump is playing around with Xi manipulating the markets like usual and White House Official Greer says financial markets will calm in the coming week.

Interesting week ahead of us.

$VIX

Stock market correction is just starting imo with a clean 4D BB on S&P, VIX pumping above 20s and a pivot due to late October - early November.

Meanwhile, crypto is pumping on a Sunday right into key levels before weekly closure and Monday US market open.

Trump is playing around with Xi manipulating the markets like usual and White House Official Greer says financial markets will calm in the coming week.

Interesting week ahead of us.

- Reward

- like

- Comment

- Repost

- Share