Today's strategy: Short around 3160, add positions at 3200, stop loss at 3230, take profit at 3100, pattern at 3000

Post content & earn content mining yield

placeholder

GateUser-16562a86

Gate has now launched the BREV trading carnival. Everyone can participate in the challenge, with individuals able to receive up to 710 USDT airdrops. The rewards are limited and available on a first-come, first-served basis. While supplies last. https://www.gate.com/campaigns/3746?ref_type=132

View Original

- Reward

- like

- Comment

- Repost

- Share

SOL's early trading momentum is strong, with a nearly 5% increase for the day, successfully breaking through the 140 resistance level. It is recommended to buy on dips at 140-138, with targets of 143-148#GateFun马勒戈币暴涨1251.09%

SOL5,61%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

一直涨

一直涨

Created By@0x08d6...cd3E

Listing Progress

0.00%

MC:

$3.56K

Create My Token

$TAI very undervalued here 🤫

Breakout and retest on the weekly chart are done ✅

Time to be sent 🏌🏼♂️⛳️

Breakout and retest on the weekly chart are done ✅

Time to be sent 🏌🏼♂️⛳️

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 UPDATE: Fed Chair Powell says the threat of criminal charges is a consequence of the Fed setting interest rates to serve the public rather than presidential preferences. #crypto

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Don't be fooled by $ETH 's seemingly impressive breakout

What is 3300–3400?

That's the zone where many people want to sell and cash out

Only when it surpasses 3300 is it truly strong

If it falls below 3000, sell without mercy

This article is sponsored by #Gate Gateway Exchange | @Gate_zh

What is 3300–3400?

That's the zone where many people want to sell and cash out

Only when it surpasses 3300 is it truly strong

If it falls below 3000, sell without mercy

This article is sponsored by #Gate Gateway Exchange | @Gate_zh

ETH2,31%

- Reward

- 1

- Comment

- Repost

- Share

Morning suggestion for the 12th

The姨太 is also empty, recommend rebounding to around 3180-3210 to short, with targets down to 3120-3060, if broken, continue to look lower at 3000.

#Gate广场创作者新春激励 #非农就业数据

View OriginalThe姨太 is also empty, recommend rebounding to around 3180-3210 to short, with targets down to 3120-3060, if broken, continue to look lower at 3000.

#Gate广场创作者新春激励 #非农就业数据

- Reward

- 1

- 1

- Repost

- Share

AZhouWanying :

:

2026 Go Go Go 👊#Trading Bot #我正在 Gate uses BTC/USDT spot Martingale bot, with a total return since creation of +1.20%

It's a long-term approach that keeps increasing in price, so no need to watch the market constantly. Checking once a month is enough. No comparison means no harm, unless it goes to zero and runs away. Staying non-zero guarantees profit.

It's a long-term approach that keeps increasing in price, so no need to watch the market constantly. Checking once a month is enough. No comparison means no harm, unless it goes to zero and runs away. Staying non-zero guarantees profit.

BTC1,96%

- Reward

- like

- Comment

- Repost

- Share

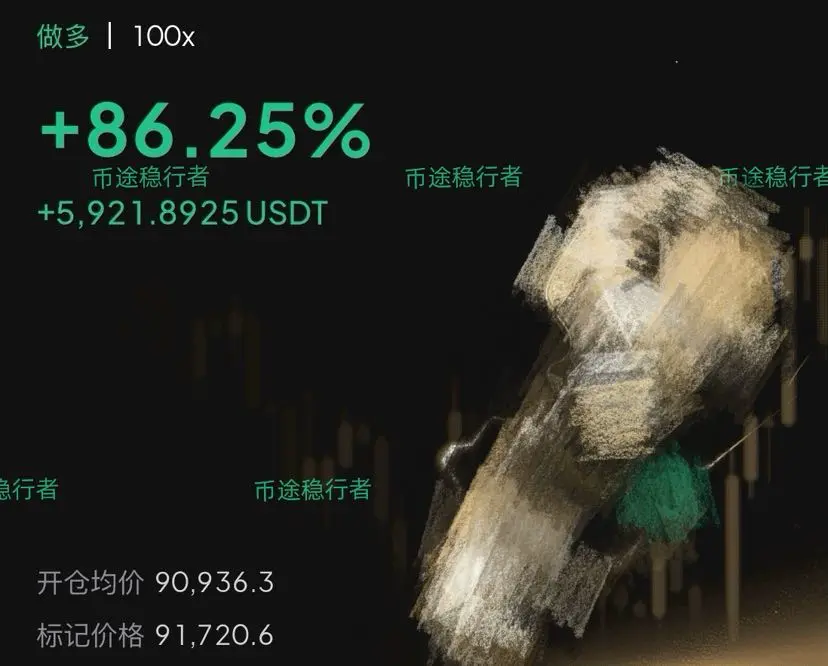

this is what locking in actually looks like

- Reward

- like

- Comment

- Repost

- Share

#FedRateCutComing One of the most influential forces shaping the crypto market heading into 2026 is the growing expectation that the Federal Reserve will begin cutting interest rates. This anticipated policy shift is not just a headline event—it represents a potential change in the financial environment that directly affects liquidity, capital flows, volatility, and investor behavior across digital assets. For crypto markets, where liquidity sensitivity is high, even early signals of easing can meaningfully alter market dynamics.

Historically, periods of monetary easing encourage investors to

Historically, periods of monetary easing encourage investors to

- Reward

- 2

- Comment

- Repost

- Share

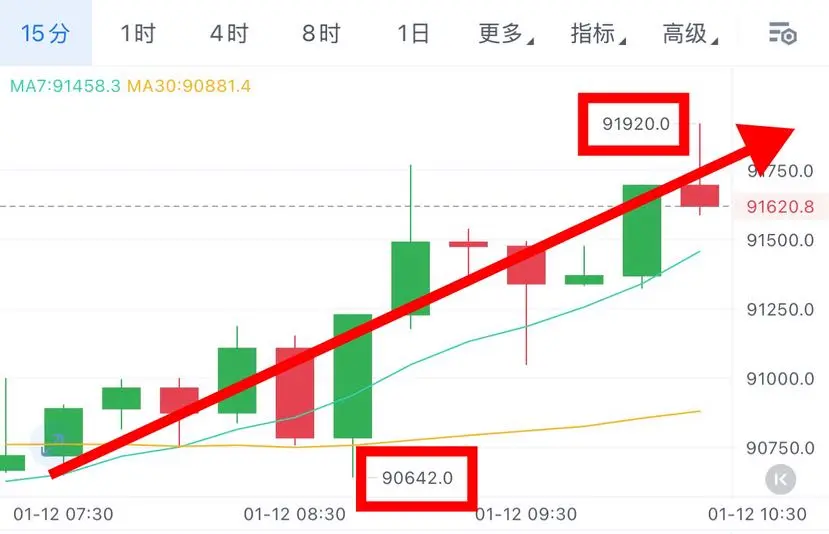

The early bird catches the worm

Morning bullish outlook

From 90642 to 91920

A 1278-point range has been traversed

A good start has been made, and this week will undoubtedly be an extraordinary one

$BTC #GateFun马勒戈币暴涨1251.09% $GT #Gate广场创作者新春激励 $ETH #非农就业数据

View OriginalMorning bullish outlook

From 90642 to 91920

A 1278-point range has been traversed

A good start has been made, and this week will undoubtedly be an extraordinary one

$BTC #GateFun马勒戈币暴涨1251.09% $GT #Gate广场创作者新春激励 $ETH #非农就业数据

- Reward

- like

- Comment

- Repost

- Share

Charge up 123669847855666996632254885633699863669822288085744122366885221447889633225589988774122255800966332551488

View Original

- Reward

- like

- Comment

- Repost

- Share

嫦娥奔月

嫦娥奔月

Created By@gatefunuser_9b1e

Listing Progress

0.00%

MC:

$3.56K

Create My Token

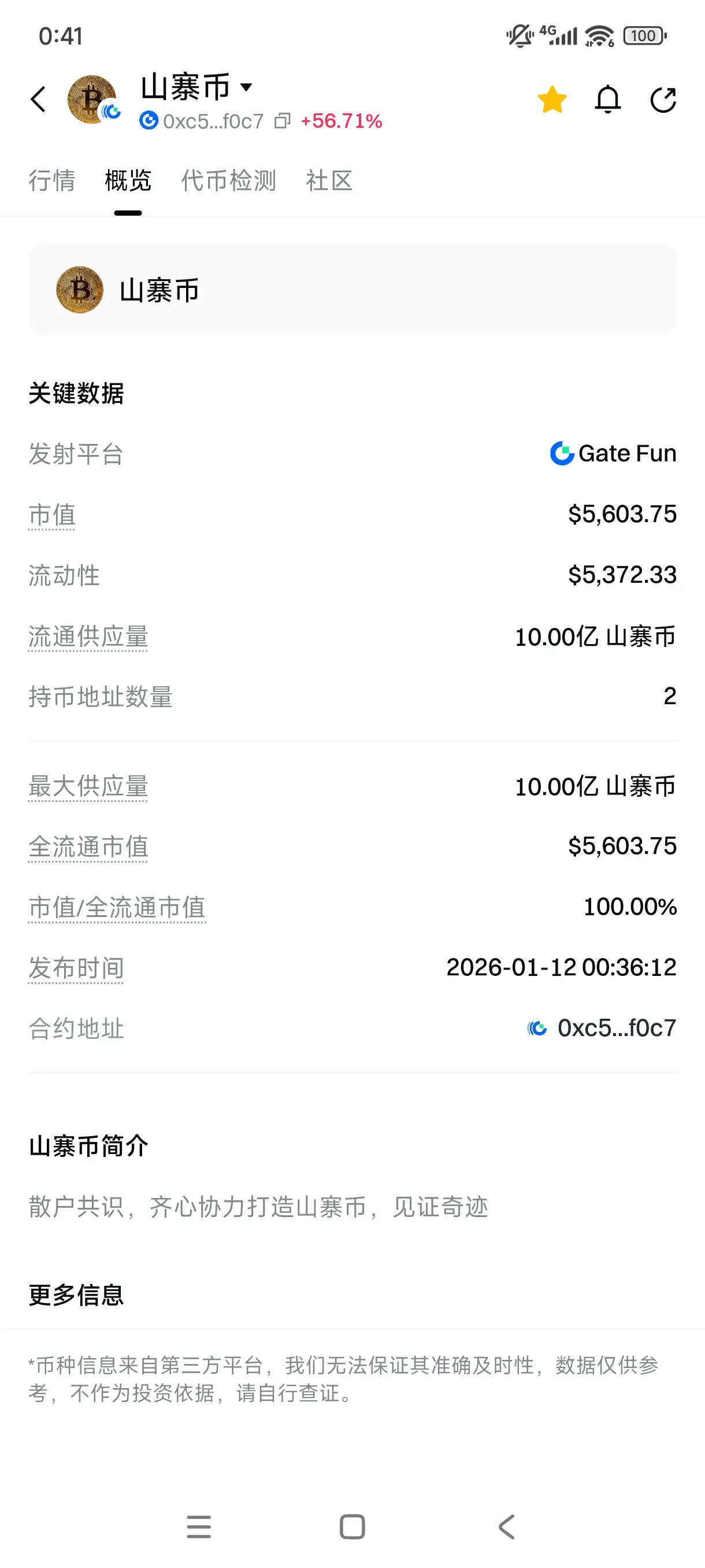

Altcoins, just released, brothers, go all out. By 2026, there will be no more altcoin seasons in the crypto world. Why not retail investors work together to create a hundredfold or thousandfold altcoin? Everyone buys 10USDT or 20USDT and holds it there, with a common goal. Usually, holding 10USDT doesn't make you rich, so why not build consensus together on this altcoin, and make money together, reaching the peak of life.

Share and repost, brothers, so more people can come to a consensus.

View OriginalShare and repost, brothers, so more people can come to a consensus.

MC:$5.67KHolders:2

9.51%

- Reward

- 3

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

No fake stuff, 3156 has been opened.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

HundredUChallengesThousandU

- Reward

- like

- 1

- Repost

- Share

HundredUChallengesThousandU :

:

Someone said during the live broadcast that I only talk big. From now on, I will show everyone my positions live, with real profits and losses, and my track record can be verified.2026

End of an Era

The year the world of CT came to an annihilation.

Not even joking, if this is a permanent thing, no more using “TL updates by the crypto accounts you follow or engage with” as a strategy anymore.

Streets are about to go dark.

Looking forward to the new Era 👏🏽

End of an Era

The year the world of CT came to an annihilation.

Not even joking, if this is a permanent thing, no more using “TL updates by the crypto accounts you follow or engage with” as a strategy anymore.

Streets are about to go dark.

Looking forward to the new Era 👏🏽

- Reward

- like

- Comment

- Repost

- Share

#Today #MarketNews #News #TopMarket Don't panic, still push Buy $SAROS , The best Project 2026. whales prepare to UltraPump $SAROS $LOVE . we hope today market SAROS and LOVE ultrapump

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More45.96K Popularity

82.02K Popularity

243.66K Popularity

19.53K Popularity

102.46K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.59KHolders:20.00%

- MC:$3.57KHolders:10.00%

- MC:$0.1Holders:20.09%

- MC:$3.56KHolders:10.00%

News

View More"Die-hard Bull" takes profit and reduces FARTCOIN long positions, with an unrealized profit of $42,000.

10 m

South Korea ends nine-year corporate crypto ban, allowing 5% equity investment in the top 20 cryptocurrencies

13 m

Trove public sale total subscriptions exceed $11 million, now reporting $11.93 million

14 m

Gate's latest total reserve ratio reaches 125%, BTC reserve ratio is 140.69%

14 m

"Lightning Reverse" whale takes profit and reduces BTC long positions, with a total unrealized loss of $930,000 in the account

21 m

Pin