AxelAdlerJr

No content yet

AxelAdlerJr

Satoshi Nakamoto is a single individual, not a group.

At the time of Bitcoin's creation, he was likely in his 30s or older. His references to Hashcash, b-money, and DigiCash were not random citations, they represented his actual working context. He possessed deep expertise in applied cryptography and financial systems.

He was a person for whom solving the problem was more important than owning the solution. It is highly probable that he still holds the keys, which makes him a potential target for criminal activity.

The world does not need to know his identity, as a Patoshi coin dump could tri

At the time of Bitcoin's creation, he was likely in his 30s or older. His references to Hashcash, b-money, and DigiCash were not random citations, they represented his actual working context. He possessed deep expertise in applied cryptography and financial systems.

He was a person for whom solving the problem was more important than owning the solution. It is highly probable that he still holds the keys, which makes him a potential target for criminal activity.

The world does not need to know his identity, as a Patoshi coin dump could tri

BTC5,36%

- Reward

- like

- Comment

- Repost

- Share

Realized Price Under Threat: Market Approaching Critical Support Zone

The market is falling, but long-term support remains intact: LTH Cost Basis is rising (~$38.2K), Realized Price is declining (~$55.0K), and at current rates they will form a critical corridor of $43K-$51K within a quarter.

☕️ Adler AM 👇

The market is falling, but long-term support remains intact: LTH Cost Basis is rising (~$38.2K), Realized Price is declining (~$55.0K), and at current rates they will form a critical corridor of $43K-$51K within a quarter.

☕️ Adler AM 👇

- Reward

- like

- Comment

- 1

- Share

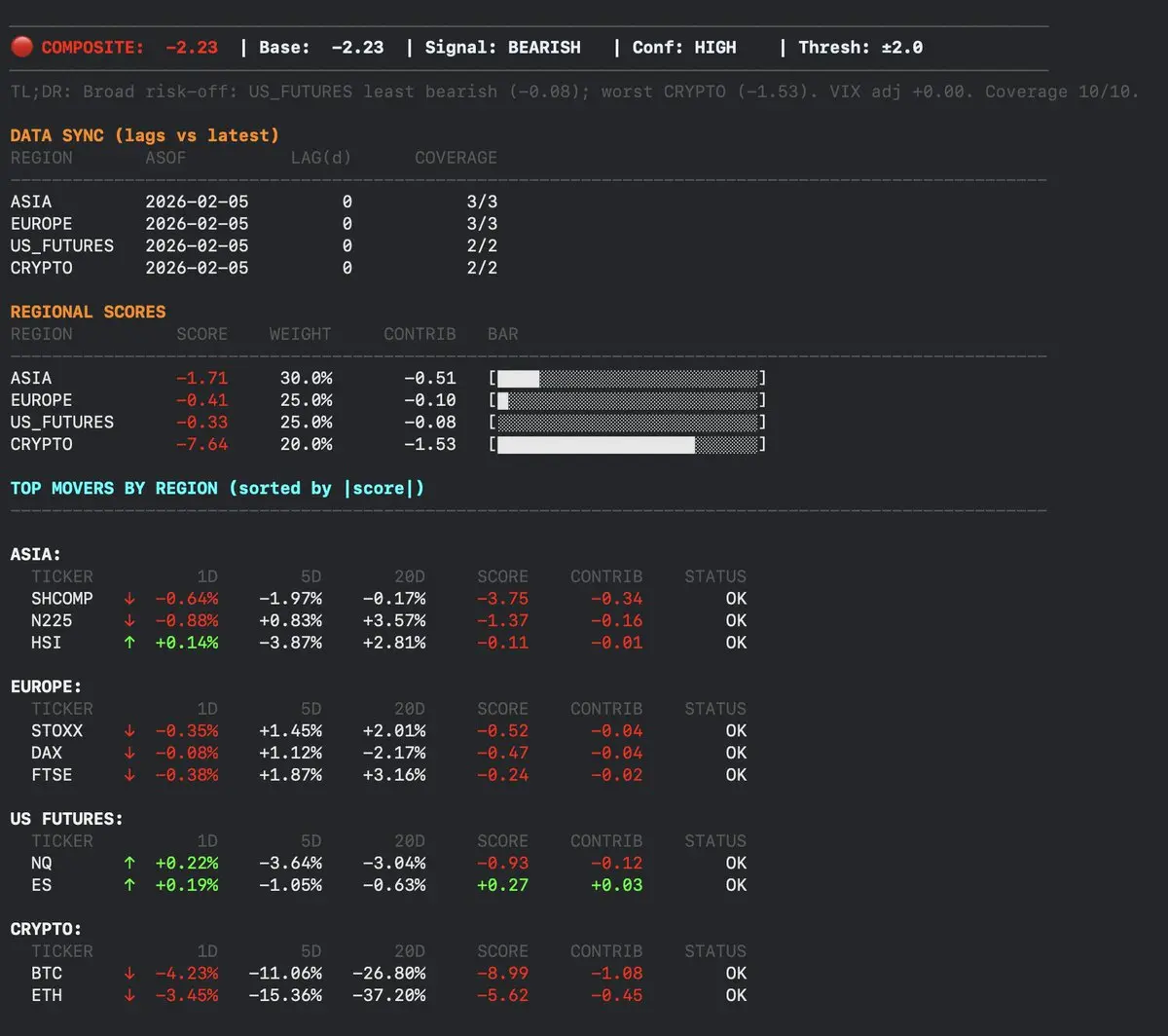

Market Back to Risk-Off: Stablecoins Confirm BTC Weakness

new ☕️Adler AM 👇

new ☕️Adler AM 👇

BTC5,36%

- Reward

- like

- Comment

- Repost

- Share

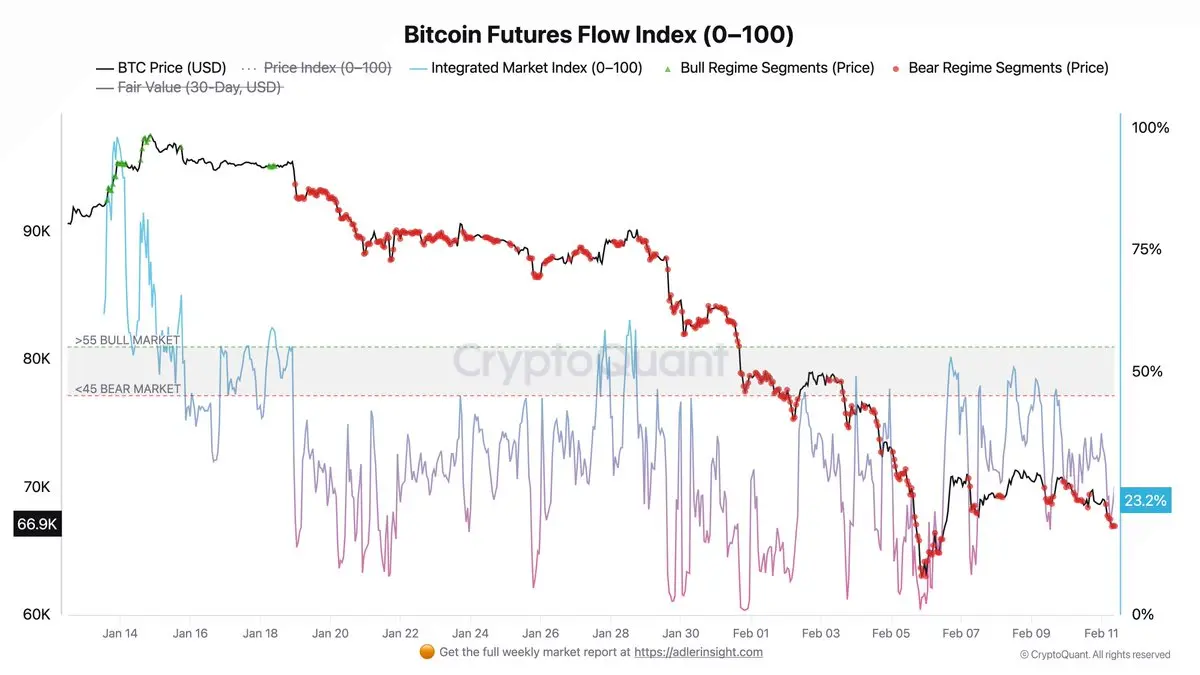

I’m checking the LTF futures charts every other day, hoping for some signs of improvement, but I don't see any yet.

- Reward

- like

- Comment

- Repost

- Share

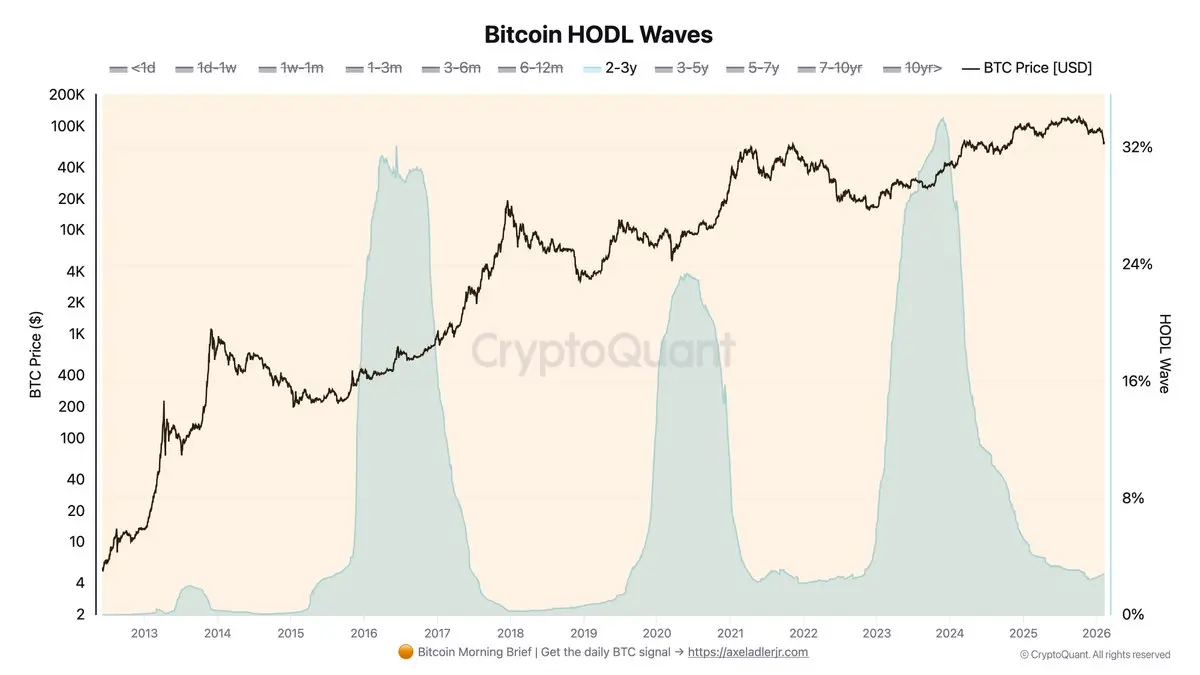

Who actually holds the supply? This lesson shows how STH/LTH Supply and HODL Waves reveal whether a rally has strong support - or is just weak hands chasing price.

- Reward

- like

- Comment

- Repost

- Share

True Diamond Hands Spectrum💎🙌

- Reward

- like

- Comment

- Repost

- Share

These three lessons will give you a basic understanding of one of the key pillars of on-chain analysis - unrealized profit/loss and the psychology of market cycles.

Save them to your bookmarks and set aside 2-3 hours over the weekend to calmly go through them and understand how it works.

Save them to your bookmarks and set aside 2-3 hours over the weekend to calmly go through them and understand how it works.

- Reward

- like

- Comment

- Repost

- Share

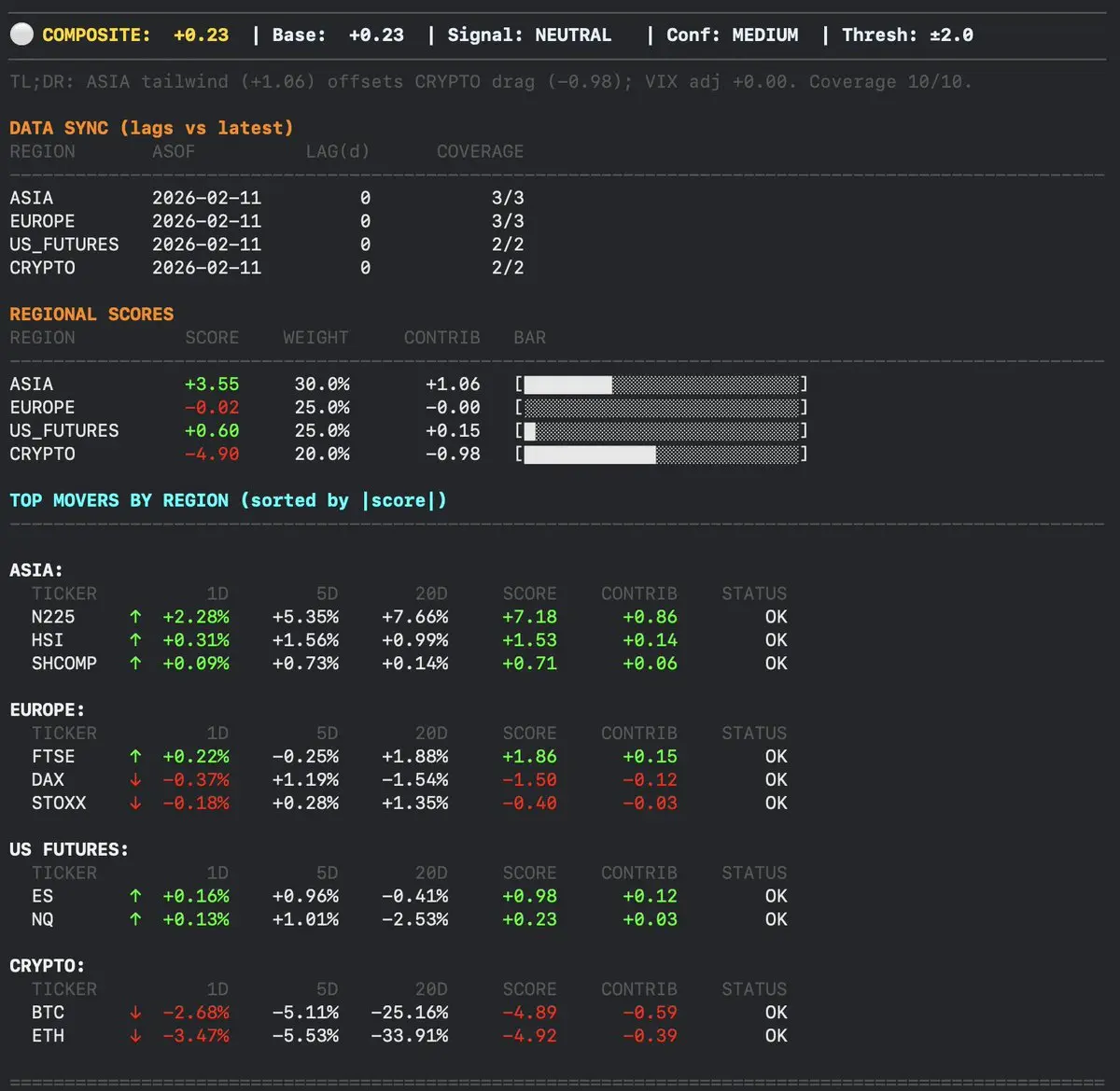

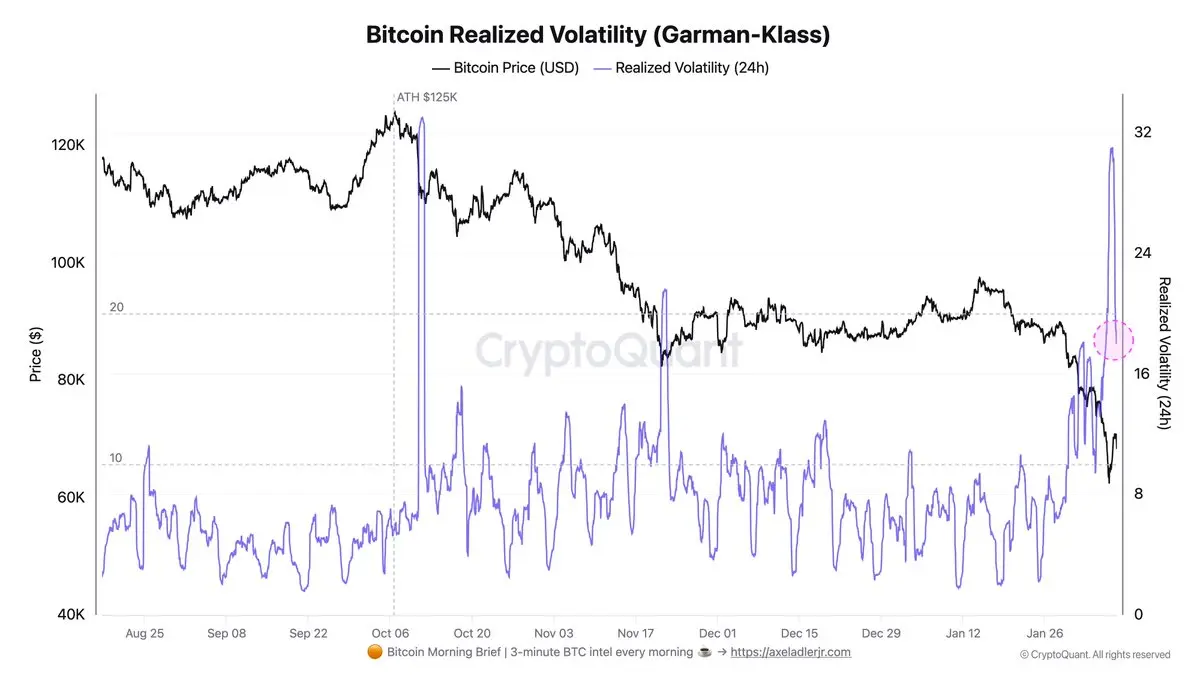

Overall morning sentiment is neutral, but rising VIX and MOVE are strengthening a defensive bias and increasing the likelihood of a risk-off shift.

- Reward

- like

- Comment

- Repost

- Share

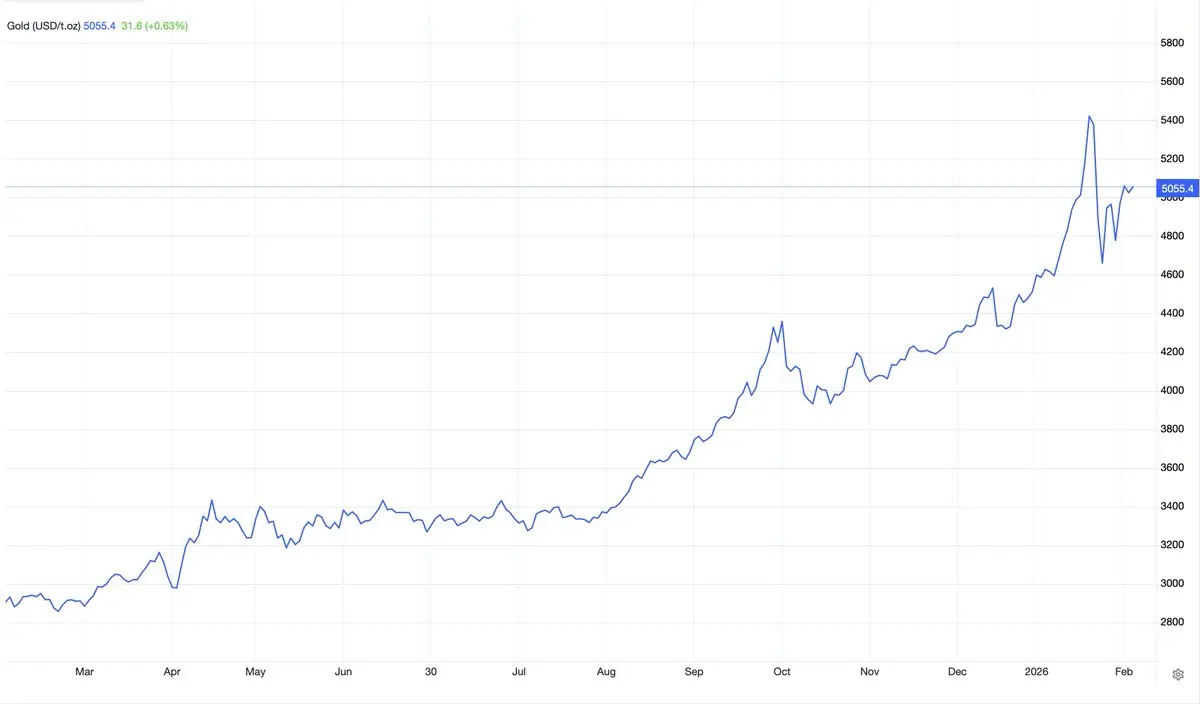

Gold recovered above $5,055 per ounce on Wednesday, approaching a nearly two-week high. The move followed weak U.S. data, as December retail sales fell short of expectations, signaling a slowdown in consumer spending and heightening concerns about moderating economic growth.

- Reward

- like

- Comment

- Repost

- Share

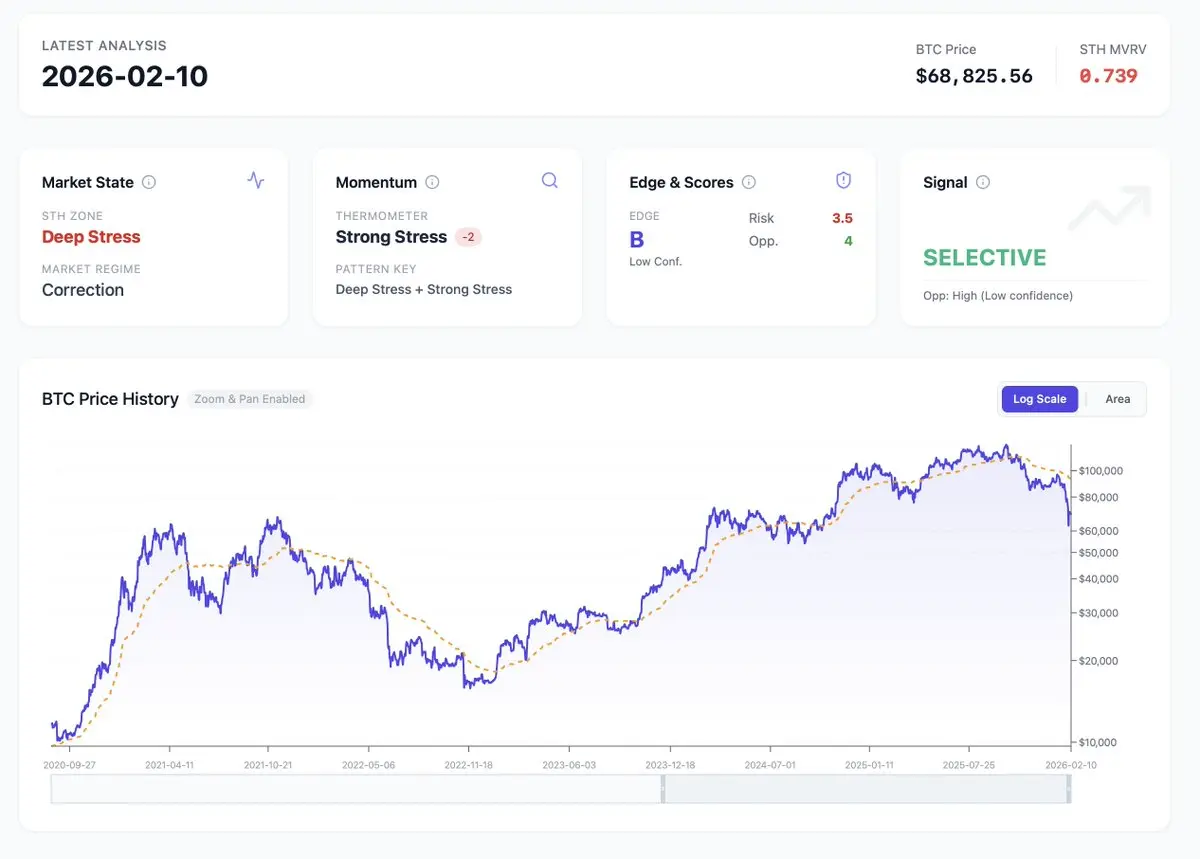

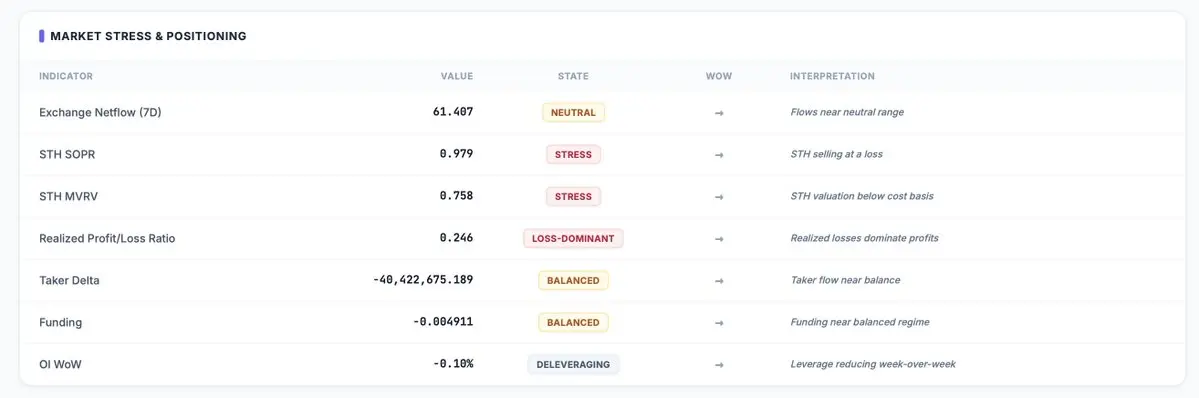

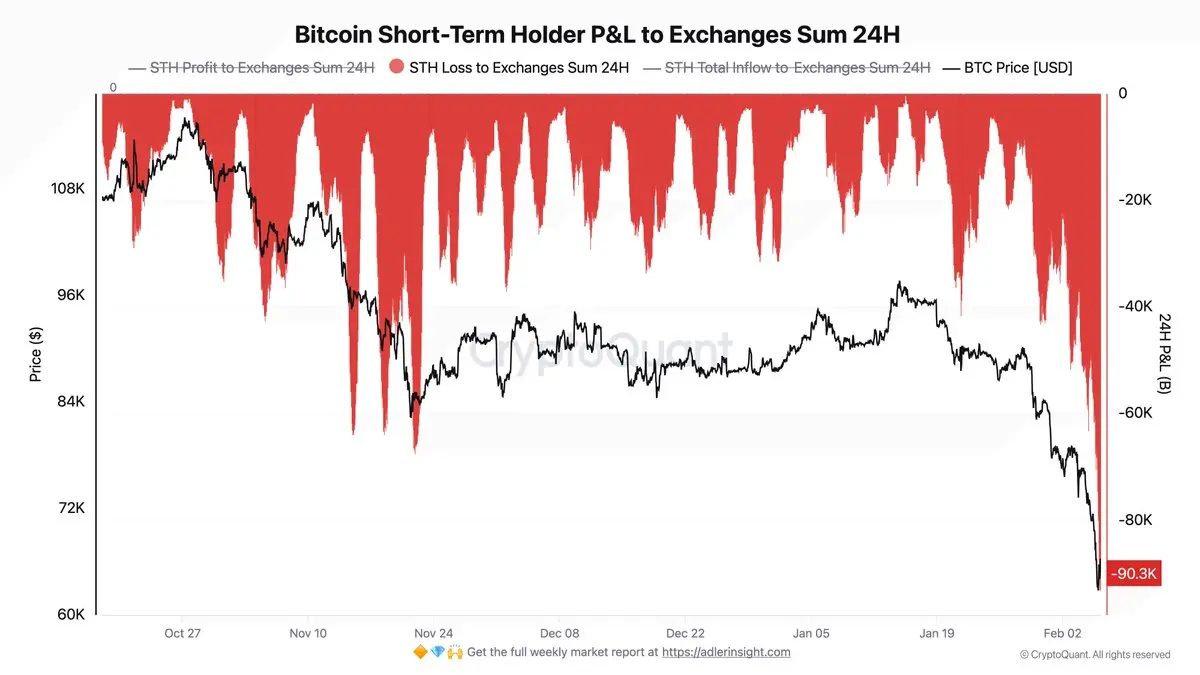

You can say all you want that BTC is fine, but the data tells a different story: the model classifies the current regime for STH as Deep Stress.

A detailed breakdown of the framework is here:

A detailed breakdown of the framework is here:

BTC5,36%

- Reward

- like

- Comment

- Repost

- Share

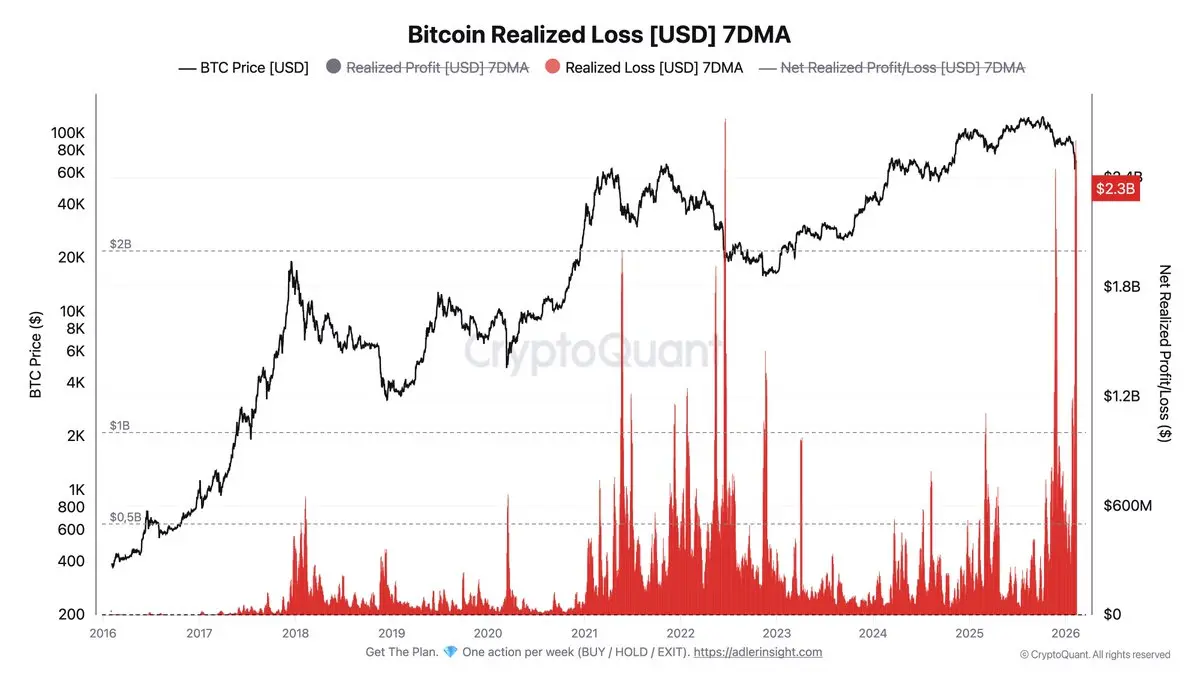

Bitcoin Realized Loss (7DMA) hit $2.3B - a level exceeded only once: during the Luna crash in June 2022.

But here's the key difference: back then it was $19K and a systemic collapse. Now it's $67K and a correction from ATH. Same scale of pain, completely different context.

new ☕️ Adler AM 👇

But here's the key difference: back then it was $19K and a systemic collapse. Now it's $67K and a correction from ATH. Same scale of pain, completely different context.

new ☕️ Adler AM 👇

- Reward

- like

- Comment

- Repost

- Share

Most traders don’t lose because of bad TA. They lose because they misread the regime.

This Sunday: Trader’s Evidence 1-page companion to the Weekly Engine.

On-chain + derivatives snapshot.

LLM-ready (prompt included): instant interpretation of stress, positioning, bias, and invalidation.

Get access:

This Sunday: Trader’s Evidence 1-page companion to the Weekly Engine.

On-chain + derivatives snapshot.

LLM-ready (prompt included): instant interpretation of stress, positioning, bias, and invalidation.

Get access:

- Reward

- like

- Comment

- Repost

- Share

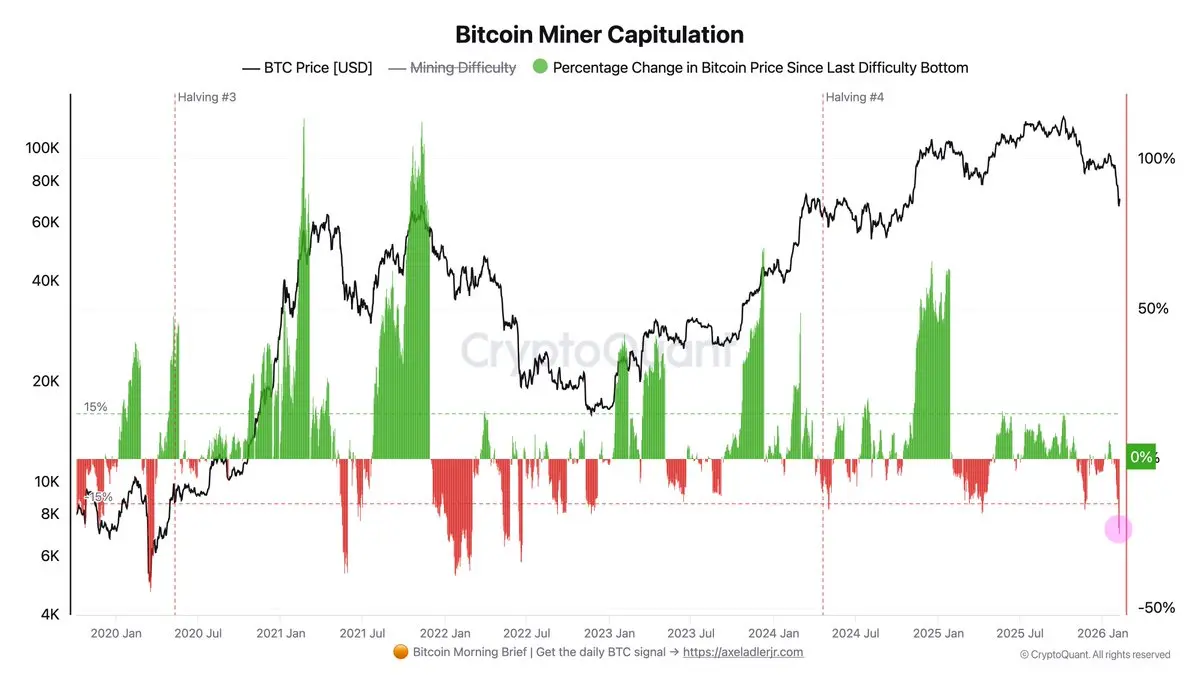

Cango sold 4,451 BTC for $305M - panic or deleveraging?

Difficulty is down 14%, Puell <0.8, but miner exchange flows remain stable.

Full breakdown in ☕️Adler AM #102 👇

Difficulty is down 14%, Puell <0.8, but miner exchange flows remain stable.

Full breakdown in ☕️Adler AM #102 👇

- Reward

- like

- Comment

- Repost

- Share

Weekly Engine starts tomorrow. Stop guessing and get one clear BTC action per week: BUY / HOLD / EXIT.

BTC5,36%

- Reward

- like

- Comment

- Repost

- Share

Market volatility will remain elevated for some time.

- Reward

- like

- Comment

- Repost

- Share

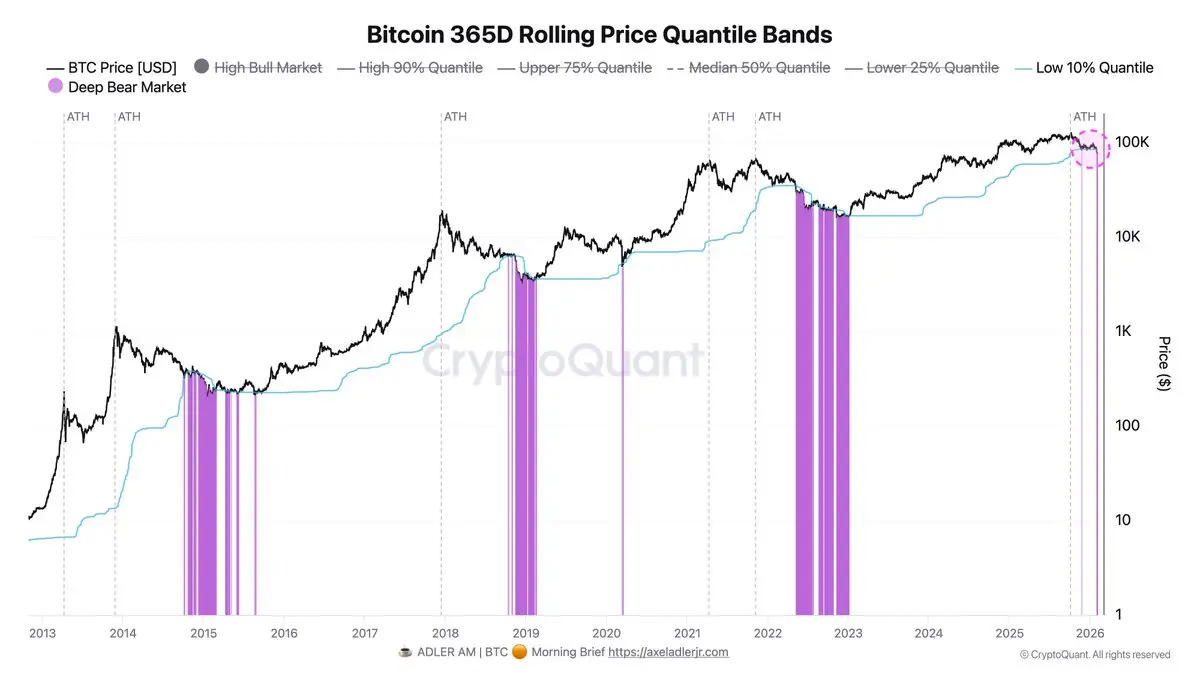

Welcome to the deep bear market.

- Reward

- like

- Comment

- Repost

- Share

The drop from $72K to $59K triggered the largest cascade of long liquidations since the start of the year. Short-term holders sent a record volume of losses to exchanges this year.new☕️Adler AM 👇

- Reward

- like

- Comment

- Repost

- Share

Tough year for institutional players holding risk assets. How’s it going, portfolio managers?

- Reward

- like

- Comment

- Repost

- Share

I’m really worried about what’s going to happen at the US market open!

- Reward

- 1

- Comment

- Repost

- Share

The market is falling - which means it’s time to look for capitulation. We’re learning how to identify the bottom zone using a ready-made aNUPL model.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More55.41K Popularity

48.13K Popularity

19.29K Popularity

45.22K Popularity

254.81K Popularity

Pin