#USSECPushesCryptoReform The regulatory evolution unfolding under #USSECPushesCryptoReform reflects a structural recalibration of how digital assets integrate into U.S. financial law. The U.S. Securities and Exchange Commission is not redesigning securities law from scratch; rather, it is refining how long-standing statutory principles apply to blockchain-based assets, token issuance models, and crypto market infrastructure. This signals movement away from enforcement-led ambiguity toward codified compliance pathways.

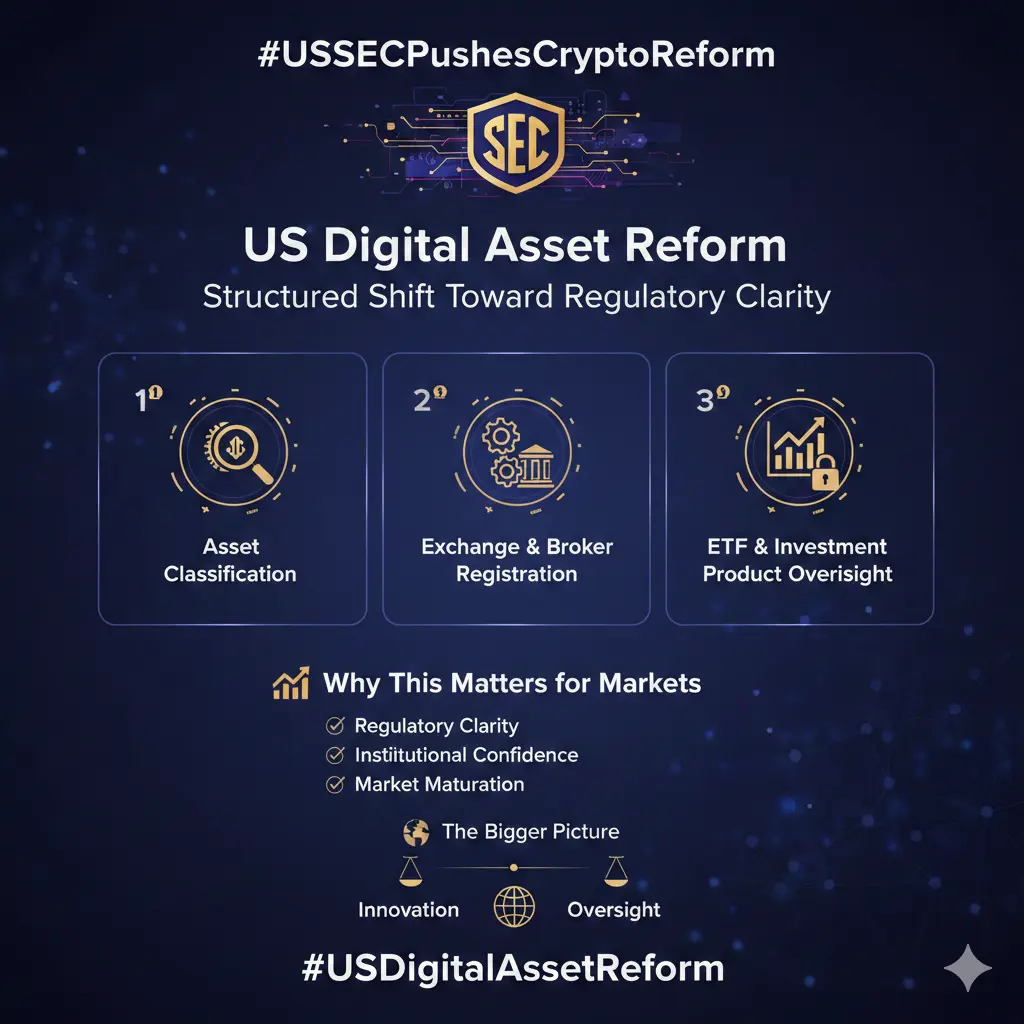

At the center of reform discussions is asset classification clarity. Determining when a token constitutes a security under existing legal tests directly affects disclosure obligations, issuer liability, and trading venue requirements. Clearer classification standards could reduce prolonged litigation cycles and provide builders with defined regulatory blueprints before launching products. For institutional capital allocators, predictability is often more important than permissiveness.

Exchange and broker registration frameworks are another focal point. Digital trading platforms may increasingly align with regulatory structures similar to alternative trading systems and national securities exchanges. This includes strengthened custody segregation, enhanced market surveillance, capital adequacy requirements, and transparent order-handling practices. Rather than isolating crypto markets, the likely direction is integration into traditional supervisory architecture.

Investment product oversight remains a key bridge between crypto-native markets and Wall Street. The approval and supervision of spot crypto exchange-traded products have demonstrated how blockchain-based assets can be packaged within regulated vehicles. Expanded ETF clarity could encourage pension funds, asset managers, and registered investment advisors to allocate through familiar structures while maintaining compliance discipline.

Enforcement priorities are also evolving from reactive case-by-case actions toward broader rulemaking guidance. While fraud prevention and unregistered offering scrutiny remain central, the tone of reform suggests a desire to replace uncertainty with procedural pathways. Regulatory clarity can reduce the adversarial dynamic that previously characterized parts of the crypto-policy relationship.

From a market perspective, regulatory structure typically introduces short-term adjustment volatility but long-term stability. Clear frameworks can reduce headline-driven speculation and redirect capital toward compliant innovation. Institutional participants often require legal certainty before deploying significant balance sheet exposure, making reform a prerequisite for deeper integration.

On the macro level, the United States is competing globally to define digital asset governance standards. Jurisdictional clarity influences where companies domicile, where capital flows, and where financial infrastructure develops. If reform successfully balances innovation with investor protection, the U.S. could reinforce its position as a leading hub for regulated blockchain finance.

Ultimately, #USDigitalAssetReform represents maturation rather than restriction. Markets transition from experimentation to institutionalization through rule formation. The long-term signal is not contraction, but normalization — where digital assets become a recognized component of regulated financial architecture rather than an external alternative.

At the center of reform discussions is asset classification clarity. Determining when a token constitutes a security under existing legal tests directly affects disclosure obligations, issuer liability, and trading venue requirements. Clearer classification standards could reduce prolonged litigation cycles and provide builders with defined regulatory blueprints before launching products. For institutional capital allocators, predictability is often more important than permissiveness.

Exchange and broker registration frameworks are another focal point. Digital trading platforms may increasingly align with regulatory structures similar to alternative trading systems and national securities exchanges. This includes strengthened custody segregation, enhanced market surveillance, capital adequacy requirements, and transparent order-handling practices. Rather than isolating crypto markets, the likely direction is integration into traditional supervisory architecture.

Investment product oversight remains a key bridge between crypto-native markets and Wall Street. The approval and supervision of spot crypto exchange-traded products have demonstrated how blockchain-based assets can be packaged within regulated vehicles. Expanded ETF clarity could encourage pension funds, asset managers, and registered investment advisors to allocate through familiar structures while maintaining compliance discipline.

Enforcement priorities are also evolving from reactive case-by-case actions toward broader rulemaking guidance. While fraud prevention and unregistered offering scrutiny remain central, the tone of reform suggests a desire to replace uncertainty with procedural pathways. Regulatory clarity can reduce the adversarial dynamic that previously characterized parts of the crypto-policy relationship.

From a market perspective, regulatory structure typically introduces short-term adjustment volatility but long-term stability. Clear frameworks can reduce headline-driven speculation and redirect capital toward compliant innovation. Institutional participants often require legal certainty before deploying significant balance sheet exposure, making reform a prerequisite for deeper integration.

On the macro level, the United States is competing globally to define digital asset governance standards. Jurisdictional clarity influences where companies domicile, where capital flows, and where financial infrastructure develops. If reform successfully balances innovation with investor protection, the U.S. could reinforce its position as a leading hub for regulated blockchain finance.

Ultimately, #USDigitalAssetReform represents maturation rather than restriction. Markets transition from experimentation to institutionalization through rule formation. The long-term signal is not contraction, but normalization — where digital assets become a recognized component of regulated financial architecture rather than an external alternative.