I have been telling everyone to buy gold (PAXG)

only crypto asset that gave ne good solid returns in $PAXG

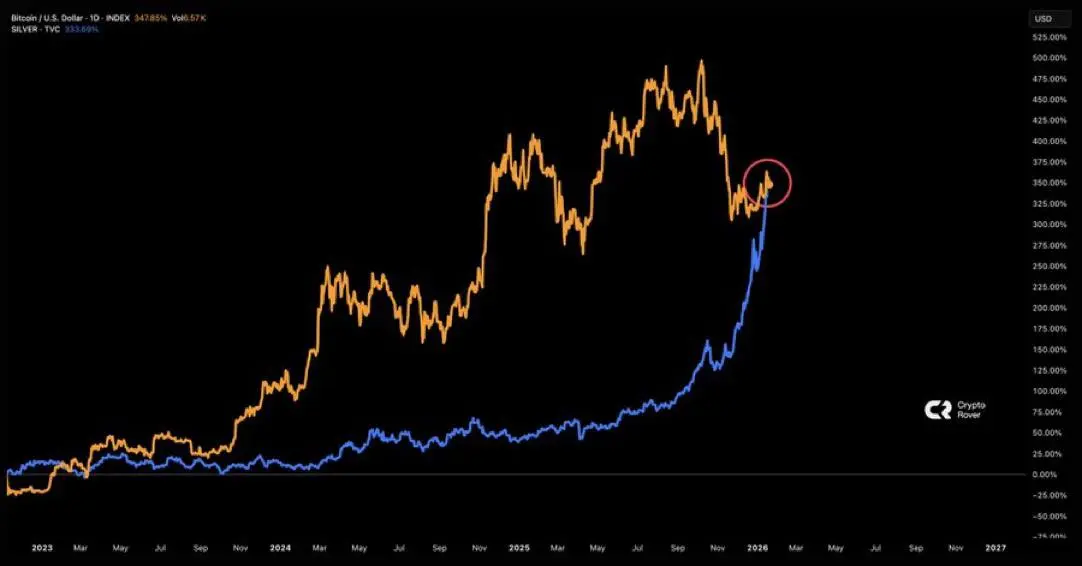

NOW i checked, even SILVER is doing great

is there any stable coin for silver?? please let me know, I want to buy

if you bought Silver yesterday, you got MORE returns in 1 day than if you held ETH for 4 years!! let that sink in

#silver

only crypto asset that gave ne good solid returns in $PAXG

NOW i checked, even SILVER is doing great

is there any stable coin for silver?? please let me know, I want to buy

if you bought Silver yesterday, you got MORE returns in 1 day than if you held ETH for 4 years!! let that sink in

#silver