# CryptoMarket

74.37K

GateUser-9a01c836

The crypto market rewards patience and preparation. 📊

Volatility creates opportunity, but only for traders who respect risk management and follow market structure. #GateioSquare #CryptoMarket #Trading

Volatility creates opportunity, but only for traders who respect risk management and follow market structure. #GateioSquare #CryptoMarket #Trading

- Reward

- 2

- 12

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

📊 #XRPSpotETFFundInflows

Recently, XRP spot ETFs have seen significant net inflows, pushing total assets under management past $1 billion. Interestingly, during the same period, Bitcoin and Ethereum ETFs experienced outflows, highlighting strong investor interest in XRP.

🔹 Key Points:

1️⃣ Long-Term HODL Signals

Continuous ETF inflows indicate that investors are holding XRP for the long term.

This reduces immediate selling pressure, as more coins are moving off exchanges into ETFs.

2️⃣ Impact on Liquidity and Supply

ETF purchases reduce the available supply on exchanges, potentially supporti

Recently, XRP spot ETFs have seen significant net inflows, pushing total assets under management past $1 billion. Interestingly, during the same period, Bitcoin and Ethereum ETFs experienced outflows, highlighting strong investor interest in XRP.

🔹 Key Points:

1️⃣ Long-Term HODL Signals

Continuous ETF inflows indicate that investors are holding XRP for the long term.

This reduces immediate selling pressure, as more coins are moving off exchanges into ETFs.

2️⃣ Impact on Liquidity and Supply

ETF purchases reduce the available supply on exchanges, potentially supporti

XRP-1,29%

- Reward

- 9

- 12

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

The crypto market rewards patience and preparation. 📊

Volatility creates opportunity, but only for traders who respect risk management and follow market structure. #GateioSquare #CryptoMarket #Trading

$BTC $ETH $SOL

Volatility creates opportunity, but only for traders who respect risk management and follow market structure. #GateioSquare #CryptoMarket #Trading

$BTC $ETH $SOL

- Reward

- 1

- 1

- Repost

- Share

GateUser-9a01c836 :

:

Happy New Year! 🤑📉 #ExchangeBTCNetOutflowsExpand

Bitcoin exchanges are seeing a notable increase in net outflows, signaling that more BTC is moving off centralized platforms than coming in. This trend often indicates stronger long-term holding behavior among investors, as coins are being transferred to private wallets rather than remaining on exchanges for trading or selling.

Key Points:

🏦 Exchange Outflows Rising: The net outflows have expanded over the past week, showing growing investor confidence and potential accumulation.

🔒 HODL Signals: Higher outflows often correlate with longer-term holding, reduci

Bitcoin exchanges are seeing a notable increase in net outflows, signaling that more BTC is moving off centralized platforms than coming in. This trend often indicates stronger long-term holding behavior among investors, as coins are being transferred to private wallets rather than remaining on exchanges for trading or selling.

Key Points:

🏦 Exchange Outflows Rising: The net outflows have expanded over the past week, showing growing investor confidence and potential accumulation.

🔒 HODL Signals: Higher outflows often correlate with longer-term holding, reduci

BTC-1,09%

- Reward

- 10

- 11

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

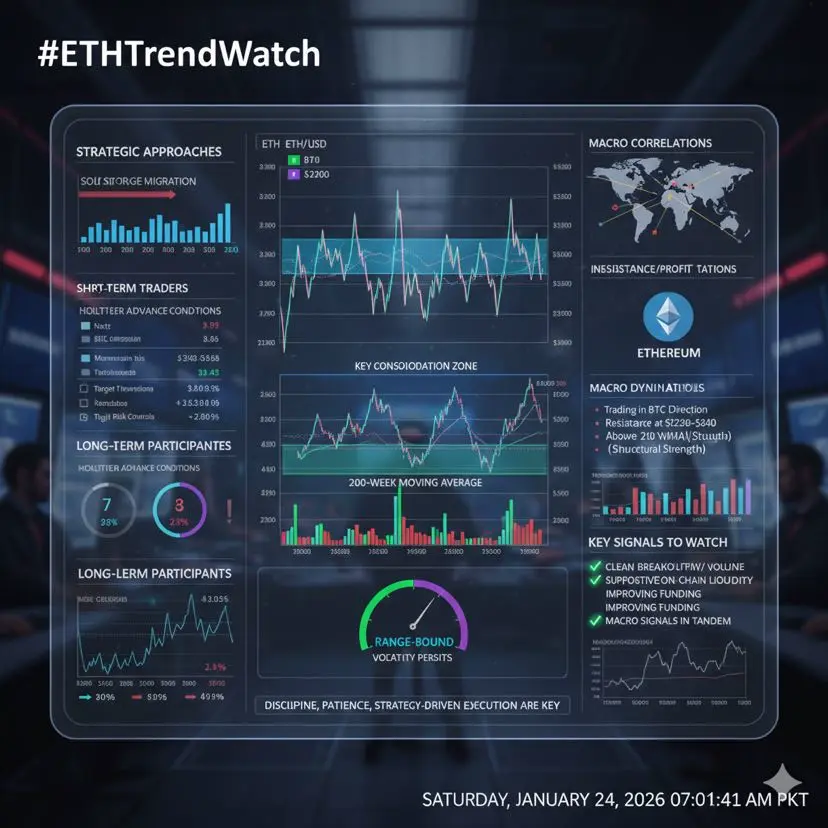

🔥 #ETHTrendWatch | Ethereum in Consolidation Mode

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

- Reward

- 1

- Comment

- Repost

- Share

🚀 RIVER Surges 50x in Just One Month — A Market Phenomenon 🚀

RIVER has delivered an extraordinary 50x price surge within a single month, placing it firmly in the spotlight of the crypto market. This explosive performance reflects a powerful combination of strong fundamentals, expanding adoption, and strategic ecosystem partnerships.

📈 What’s Driving RIVER’s Momentum?

RIVER’s rapid appreciation is fueled by growing real-world utility across sectors such as DeFi, staking, and emerging blockchain use cases. Increased demand, coupled with rising on-chain activity, has strengthened investor conf

RIVER has delivered an extraordinary 50x price surge within a single month, placing it firmly in the spotlight of the crypto market. This explosive performance reflects a powerful combination of strong fundamentals, expanding adoption, and strategic ecosystem partnerships.

📈 What’s Driving RIVER’s Momentum?

RIVER’s rapid appreciation is fueled by growing real-world utility across sectors such as DeFi, staking, and emerging blockchain use cases. Increased demand, coupled with rising on-chain activity, has strengthened investor conf

- Reward

- 5

- 9

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

📉 #ExchangeBTCNetOutflowsExpand

Bitcoin exchanges are seeing a notable increase in net outflows, signaling that more BTC is moving off centralized platforms than coming in. This trend often indicates stronger long-term holding behavior among investors, as coins are being transferred to private wallets rather than remaining on exchanges for trading or selling.

Key Points:

🏦 Exchange Outflows Rising: The net outflows have expanded over the past week, showing growing investor confidence and potential accumulation.

🔒 HODL Signals: Higher outflows often correlate with longer-term holding, reduci

Bitcoin exchanges are seeing a notable increase in net outflows, signaling that more BTC is moving off centralized platforms than coming in. This trend often indicates stronger long-term holding behavior among investors, as coins are being transferred to private wallets rather than remaining on exchanges for trading or selling.

Key Points:

🏦 Exchange Outflows Rising: The net outflows have expanded over the past week, showing growing investor confidence and potential accumulation.

🔒 HODL Signals: Higher outflows often correlate with longer-term holding, reduci

BTC-1,09%

- Reward

- 1

- Comment

- Repost

- Share

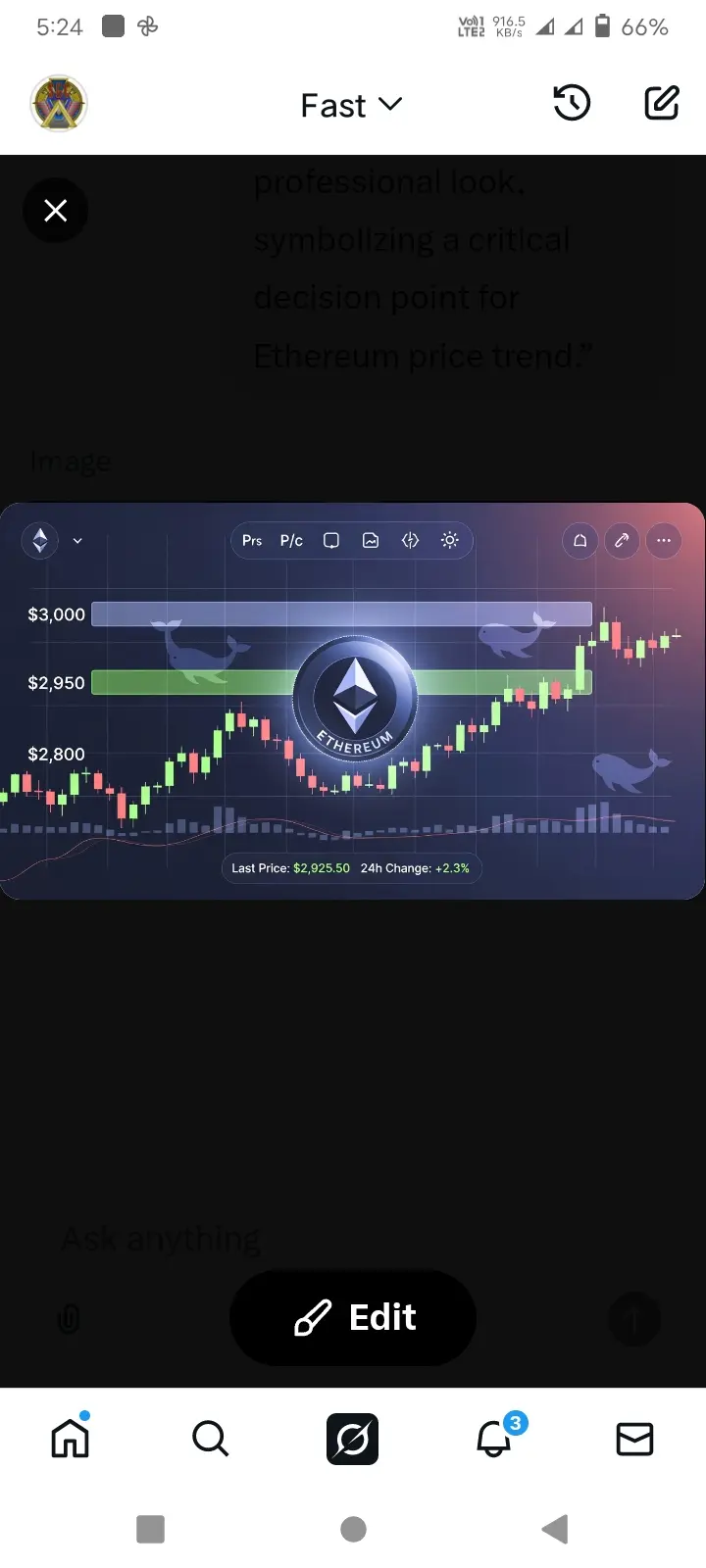

#ETHTrendWatch

Ethereum (ETH) is currently trading around $2,950, with the market showing clear indecision.

The $3,000 level has once again turned into a strong resistance, while buyers remain active in the $2,800–$2,900 support zone.

🔍 Current Market Snapshot

Short-term trend: Sideways to Bearish

ETH has failed to deliver a clear breakout so far

Trading volume remains cautious as traders wait for confirmation

🐳 On-Chain Signals

Whales are gradually accumulating ETH

Staking activity and network fundamentals re

Ethereum (ETH) is currently trading around $2,950, with the market showing clear indecision.

The $3,000 level has once again turned into a strong resistance, while buyers remain active in the $2,800–$2,900 support zone.

🔍 Current Market Snapshot

Short-term trend: Sideways to Bearish

ETH has failed to deliver a clear breakout so far

Trading volume remains cautious as traders wait for confirmation

🐳 On-Chain Signals

Whales are gradually accumulating ETH

Staking activity and network fundamentals re

ETH-0,89%

- Reward

- 6

- 5

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

📊ETF FLOWS & MARKET OVERVIEW 👀

🇺🇸 WEEKLY ETF NET INFLOWS:

💰$BTC: $458.77M

🔹$ETH: $160.58M

🪙$SOL: $10.43M

🪙$XRP: $43.16M

⭐️Net inflows across all major ETFs — institutional interest remains strong.

📈LIVE MARKET SNAPSHOT:

💰$BTC: $92,468.41

🔹 $ETH: $3,156.07

🪙 $SOL: $135.35

🪙 $XRP: $2.13

🪙 CMC METRICS 🪙

🪙 #CMC20: $196

😱 Fear & Greed Index: 42 (Fear)

🌊 Altcoin Season Index: 22 / 100

🌍 Total Market Cap: $3.15T

Indices show mild "fear" and "altcoin season not active" signals.

⚡️ KEY TAKEAWAYS:

✅ BTC & ETH ETFs continue to show institutional confidence

✅ XRP ETF seeing stronger

🇺🇸 WEEKLY ETF NET INFLOWS:

💰$BTC: $458.77M

🔹$ETH: $160.58M

🪙$SOL: $10.43M

🪙$XRP: $43.16M

⭐️Net inflows across all major ETFs — institutional interest remains strong.

📈LIVE MARKET SNAPSHOT:

💰$BTC: $92,468.41

🔹 $ETH: $3,156.07

🪙 $SOL: $135.35

🪙 $XRP: $2.13

🪙 CMC METRICS 🪙

🪙 #CMC20: $196

😱 Fear & Greed Index: 42 (Fear)

🌊 Altcoin Season Index: 22 / 100

🌍 Total Market Cap: $3.15T

Indices show mild "fear" and "altcoin season not active" signals.

⚡️ KEY TAKEAWAYS:

✅ BTC & ETH ETFs continue to show institutional confidence

✅ XRP ETF seeing stronger

- Reward

- like

- Comment

- Repost

- Share

The crypto market rewards patience and preparation. 📊

Volatility creates opportunity, but only for traders who respect risk management and follow market structure. #GateioSquare #CryptoMarket #Trading

Volatility creates opportunity, but only for traders who respect risk management and follow market structure. #GateioSquare #CryptoMarket #Trading

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

58.66K Popularity

34.61K Popularity

28.57K Popularity

10.3K Popularity

21.76K Popularity

15.92K Popularity

13.93K Popularity

81.88K Popularity

42.79K Popularity

24.79K Popularity

13.81K Popularity

2.51K Popularity

259.38K Popularity

24.22K Popularity

182.88K Popularity

News

View MoreRussia designates Ukrainian cryptocurrency exchange WhiteBit and its parent company as unfriendly organizations

3 m

Data: 403.9 BTC transferred out from an anonymous address, then routed through a relay and sent to another anonymous address

8 m

Whale Converts 120 BTC Worth $10.68M into 3,623 ETH Over Two Days

10 m

This week, the US Ethereum spot ETF experienced a net outflow of $600 million.

10 m

Ethereum spot ETF net outflow of $611 million this week, with BlackRock's ETHA experiencing the largest net outflow of $432 million

18 m

Pin