# BreakoutTrading

79

TheAboveOne

Why Most Traders Lose Money During Breakouts

Breakouts look exciting, but they are where most traders make their worst decisions. The problem isn’t the breakout itself it’s when and how people enter. By the time price explodes and social media turns bullish, early positioning has already happened, and risk to reward is often poor.

Strong breakouts are usually prepared by long periods of consolidation. During those quiet phases, liquidity builds and weak hands exit. When price finally moves, it often pulls back first, testing patience before continuation. Traders who chase green candles freque

Breakouts look exciting, but they are where most traders make their worst decisions. The problem isn’t the breakout itself it’s when and how people enter. By the time price explodes and social media turns bullish, early positioning has already happened, and risk to reward is often poor.

Strong breakouts are usually prepared by long periods of consolidation. During those quiet phases, liquidity builds and weak hands exit. When price finally moves, it often pulls back first, testing patience before continuation. Traders who chase green candles freque

- Reward

- 1

- Comment

- Repost

- Share

$MON USDT exploded from 0.0218 into 0.0296 with relentless follow through, no pullbacks, no mercy. That was pure trend ignition. Price is now consolidating above the breakout zone, not giving back gains. This is strength, not exhaustion. As long as 0.0278 holds, momentum stays in control. A clean push through 0.0300 opens the next expansion leg.

#AltcoinMomentum #BreakoutTrading #PerpMarkets

#AltcoinMomentum #BreakoutTrading #PerpMarkets

MON-3,38%

- Reward

- 3

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

295.45K Popularity

25.37K Popularity

45.49K Popularity

12.09K Popularity

458.67K Popularity

346.85K Popularity

4.57K Popularity

65.01K Popularity

12.87K Popularity

94.68K Popularity

15.92K Popularity

11.9K Popularity

7.08K Popularity

6.88K Popularity

40.17K Popularity

News

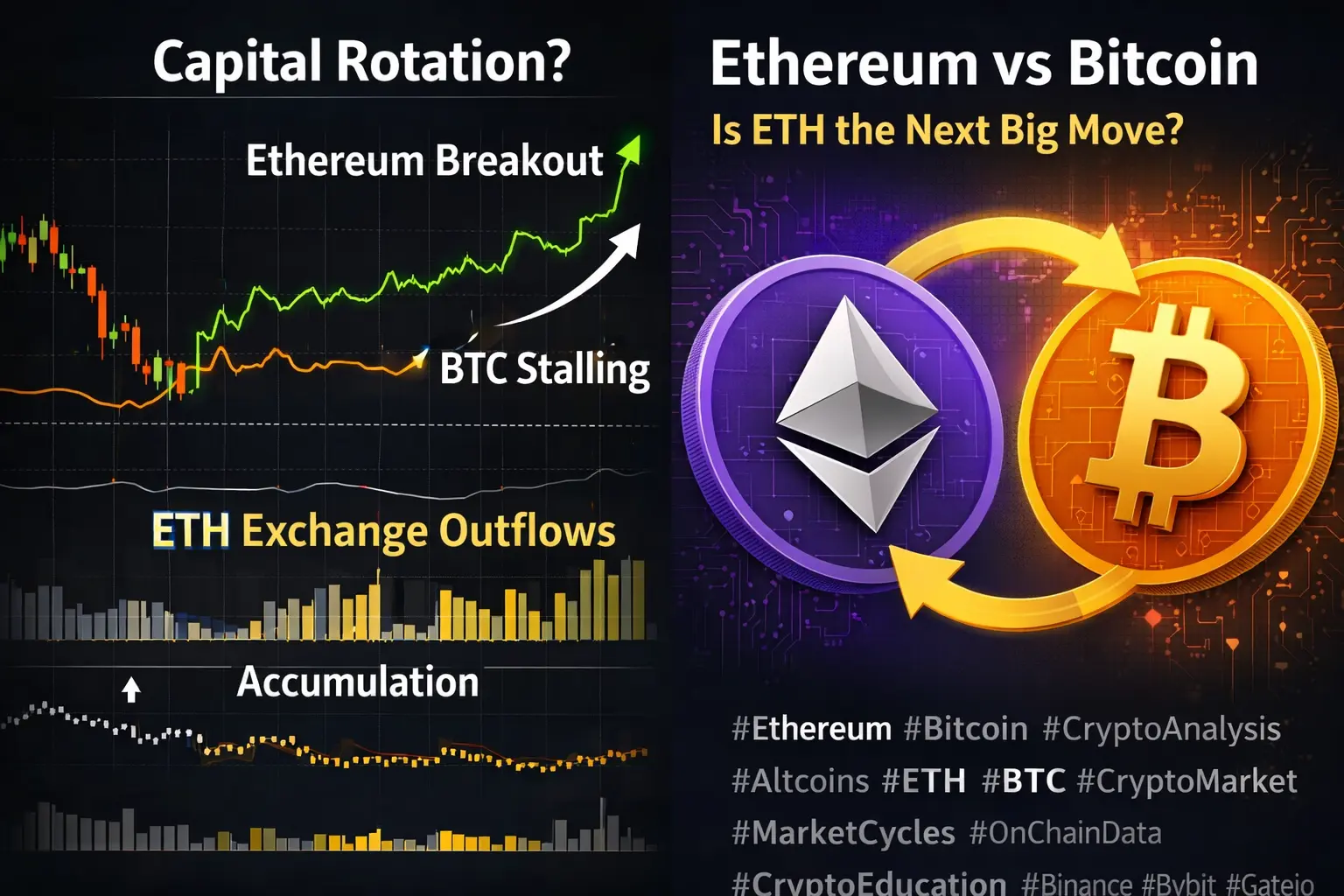

View MoreEthereum spot ETF had a net inflow of $6,574,200 yesterday, marking three consecutive days of net inflows.

5 m

Base Ecosystem Flow Protocol completes exclusive agent auction, raising over $100,000 in 9 minutes

5 m

City Protocol Virality Leaderboard is now live, with an initial prize pool of $20,000 already open

14 m

Strategy CEO: Bitcoin is a self-repairing virtuous cycle, while AI is a self-reinforcing destructive cycle

18 m

Behind Major Block Layoffs: Stablecoin Low Fees Disrupt Credit Card Model, AI Payment Era Approaching

19 m

Pin