Ethereum (ETH) News Today

Latest crypto news and price forecasts for ETH: Gate News brings together the latest updates, market analysis, and in-depth insights.

Ethereum Shifts Focus to P2P Networking With PeerDAS in Fusaka Upgrade

Ethereum&39;s Fusaka upgrade introduces PeerDAS, focusing on improving P2P networking and data propagation for better scalability.

PeerDAS enhances Ethereum’s support for rollups by improving data distribution, reducing reliance on centralized systems.

Vitalik Buterin emphasizes the importance

ETH6.41%

CryptoNewsLand·4m ago

Beyond Cryptocurrency: How Are Tokenized Assets Quietly Reshaping the Market Landscape?

Written by Paula Albu

Compiled by: AididioJP, Foresight News

In a recent interview, Fabienne van Kleef, Senior Analyst at Global Digital Finance, delved into the current state of tokenized assets, their application scenarios, and their potential reshaping of financial markets. She pointed out that tokenization is quickly becoming a core driver of financial infrastructure evolution, and its impact may extend beyond short-term fluctuations to touch the deep logic of market structure, liquidity, and global capital flows.

Tokenization is skyrocketing, and some (like the BlackRock CEO) claim that its importance may surpass AI in the future, what do you think of this trend?

Paula Albu: Yes, tokenization, as a transformative force, is rapidly rising in the financial sector. According to 21.c

DeepFlowTech·54m ago

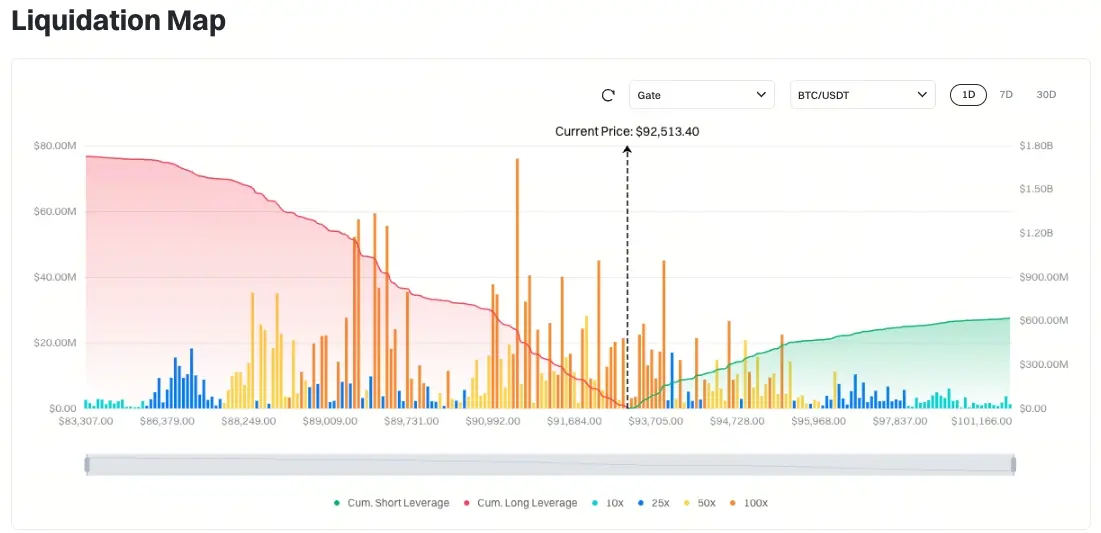

Trading moment: The FOMC decision is imminent, Bitcoin is at $91,500 as a key support, and Ethereum is aiming for the $3,500 mark

Daily market key data review and trend analysis, produced by PANews.

1. Market observation

In a complex macroeconomic environment, the Fed's policy decision this week has become the focus of the market. The market generally expects the Fed to cut interest rates by 25 basis points, with a probability of 88.6% to 95%, but Bank of America and other institutions believe that given the structural cooling of the labor market with "low hiring, low turnover, and rising layoffs", the Fed may send a "hawkish rate cut" signal, that is, cut interest rates but hint at the possibility of future policy tightening. This uncertainty has led to fluctuations in U.S. Treasury yields, while Goldman Sachs has warned of early signs of a recession through indicators such as Las Vegas consumption data.

In the commodity market, spot silver performed well, breaking through $60 per ounce for the first time to hit a record high, with an increase of more than 100% during the year, significantly outperforming gold, and the gold-silver ratio fell to its lowest level since 2021. However, ARK In

PANews·2h ago

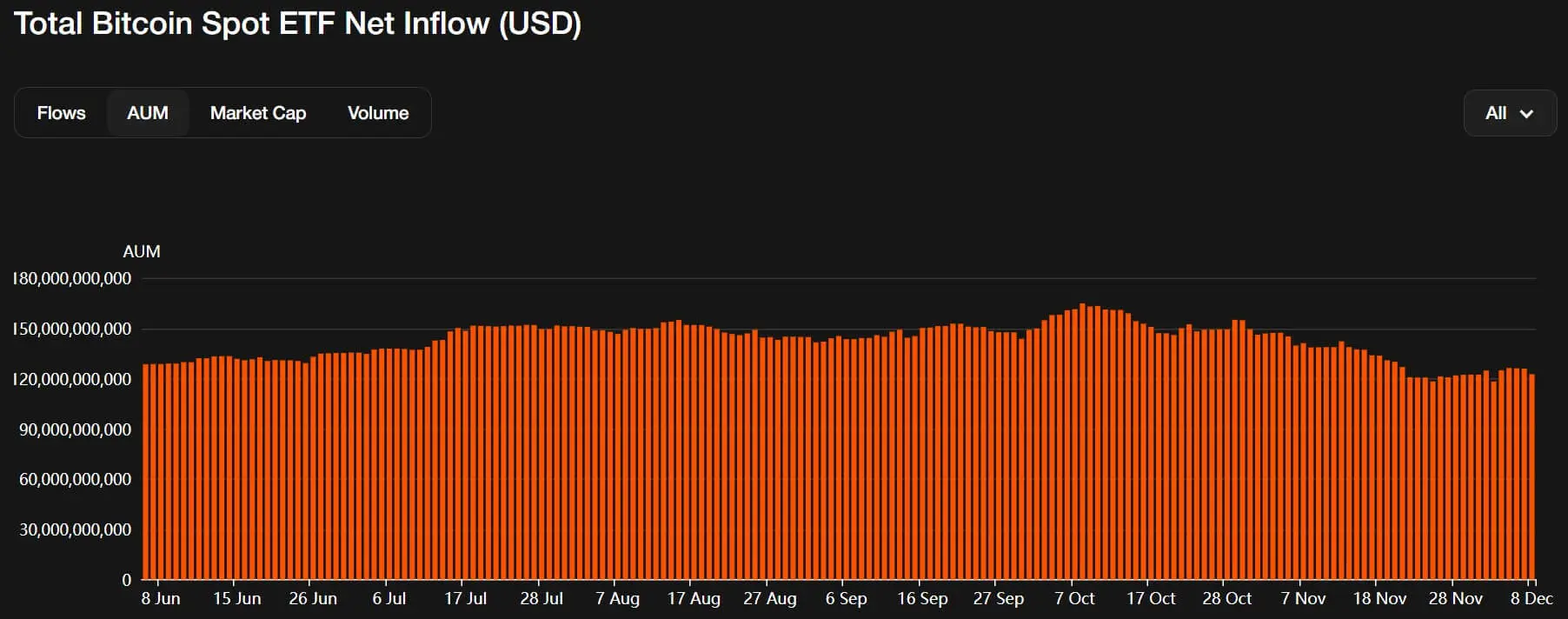

Gate Research: BTC and ETH lead the rise in mainstream assets|Exchange BTC supply has dropped sharply

CN:

Panorama of crypto assets

BTC(+2.07% 丨 Current Price 92,005 USDT)

BTC briefly fell back to the $92,000 range and saw buying intake, and although the price pulled back from the high of $94,500, it remained in the short-term bullish structure as a whole. In terms of moving averages, MA5 and MA10 have slightly retraced, but they are still above MA30, indicating that the trend has not yet weakened and has only entered a short-term consolidation. The MACD red bars converged from the highs, the momentum slowed down but was still above the zero axis, and the market was in a cooling phase after strength. If BTC can stabilize the $91,800–92,200 zone, it can continue the repair trend; A break below the MA30 could further backtest the $90,500 support.

GateResearch·2h ago

MicroStrategy and BitMine Arbitrage Crash! 600 billion "unlimited capital loopholes" are in a structural crisis

The disappearance of the "unlimited money loophole" that underpins microstrategies and BitMine has forced the crypto asset bank (DAT) to transform. On December 8, MicroStrategy revealed that it spent $9.627 billion to purchase 10,624 Bitcoins last week, the largest weekly expenditure since July, but the stock price fell 51% year-on-year to $178.99. BitMine similarly added 138,452 ETH to its balance sheet.

ETH6.41%

MarketWhisper·3h ago

$440,000 hack exposes threat from "permit" scams on Ethereum

A hacker has stolen more than $440,000 in USDC after a wallet owner accidentally signed a malicious "permit" signature, according to a warning published Monday by anti-phishing platform Scam Sniffer.

The incident comes amid a sharp increase in damage from phishing attacks. In November alone, about 7.77 million

TapChiBitcoin·4h ago

People who made $69 million from NFTs four years ago are still making money

Written by: Cookies, Rhythm

beeple, the man who sold 1 NFT for a sky-high $69 million, has long been regarded as a symbol of the beginning of the golden age of NFTs.

Although the NFT glory is gone, beeple and his team have remained active in the NFT circle. At this year's Art Basel, he once again brought a "golden dog" to the currently deserted NFT market - Regular Animals.

Yesterday, several Regular Animas sold on OpenSea for more than 10 ETH (about $35,000), and this work was given away for free at Art Basel, with a total of 256 pieces. At this price, beeple gave away nearly 10 million dollars worth at Art Basel

ETH6.41%

DeepFlowTech·5h ago

Gate Daily (December 10): US Congress to review the "Responsible Financial Innovation Act" next week; SEC Chairman hints at accelerated crypto regulation in 2026

After surging, Bitcoin (BTC) saw a slight pullback and was temporarily quoted at around $92,190 on December 10. The U.S. Senate version of the crypto market structure bill (the "Responsible Financial Innovation Act") is expected to be released this week, with a hearing and vote scheduled for next week. U.S. SEC Chairman hinted that key crypto regulatory initiatives will be rapidly advanced at the beginning of the 2026 New Year, stating that "the best is yet to come."

MarketWhisper·8h ago

The US is rushing to buy while Japan bans it! Crypto ETF spread contract trading faces a crackdown

The Financial Services Agency (FSA) of Japan has released a revised regulatory Q&A, confirming that contracts for difference (CFDs) linked to overseas crypto ETFs are "not acceptable." The ban takes immediate effect, with companies such as IG Securities ceasing to offer CFD products tracking US Bitcoin ETFs. Japan states that, under the Financial Instruments and Exchange Act, these products are considered high-risk crypto derivatives. Since Japan has not approved spot crypto ETFs, the investor protection framework remains incomplete.

MarketWhisper·8h ago

CFTC Launches Crypto Pilot With BTC, ETH, USDC Driving Margin Heat

A new CFTC pilot program opens the door for regulated tokenized collateral in U.S. derivatives markets, signaling broader acceptance of bitcoin, ether and stablecoins while removing barriers that once constrained digital asset innovation.

CFTC Launches Tokenized Collateral Pilot and Pulls Back

Coinpedia·8h ago

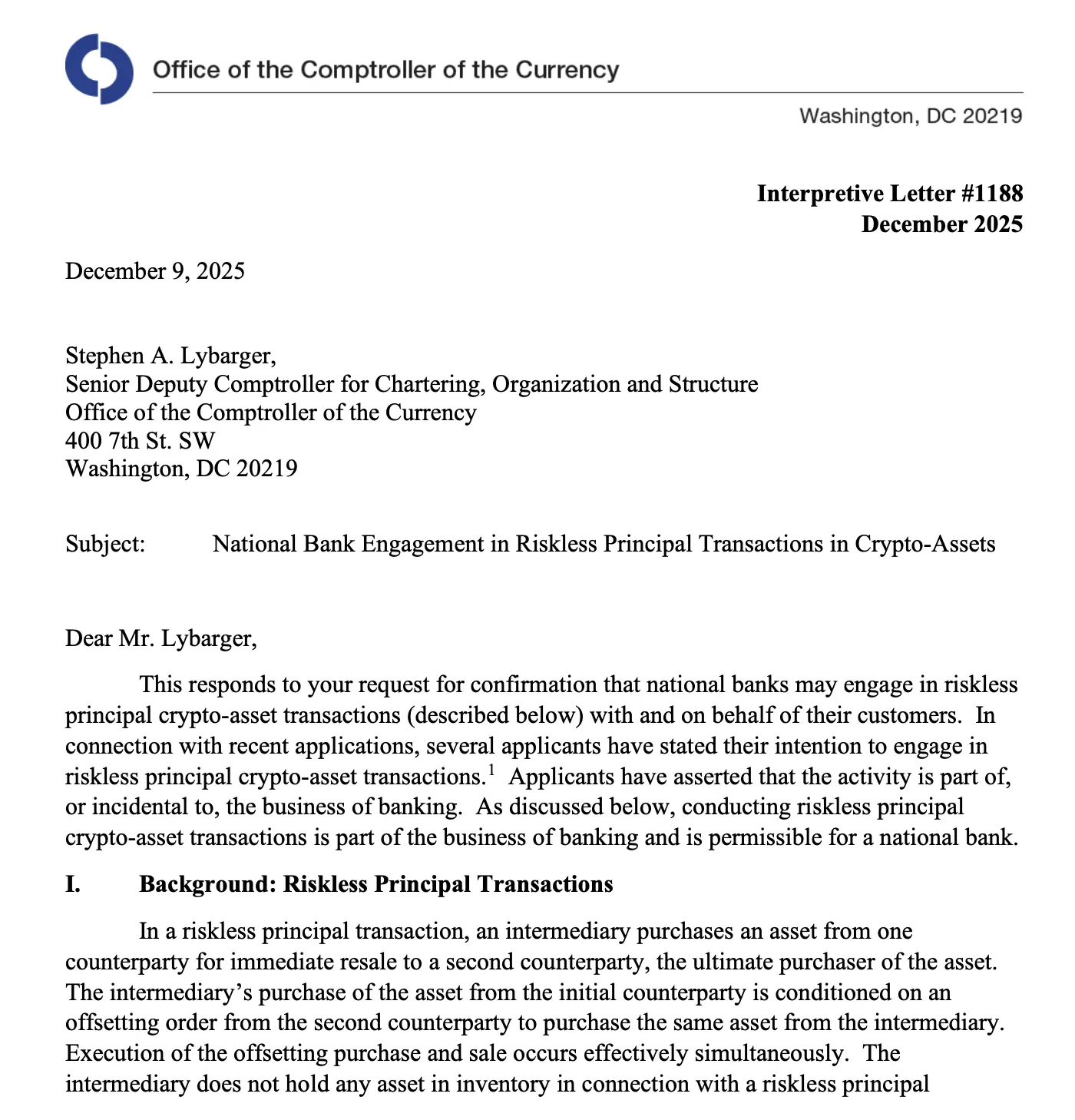

U.S. national banks approved for cryptocurrency trading! Will $30 trillion in funds flow in?

The Office of the Comptroller of the Currency (OCC) issued an interpretive letter confirming that national banks can act as riskless principals in facilitating crypto transactions without having to include the assets on their balance sheets. The guidance confirms that facilitating crypto transactions for clients falls within the scope of "banking activities," citing 12 U.S. Code § 24 as the legal basis. Banks can act as principals in transactions with clients while simultaneously hedging with another client, a structure similar to riskless principal transactions in traditional markets.

ETH6.41%

MarketWhisper·8h ago

Ethereum Faces Structural Test as Multi-Year Support Weakens

Ethereum nears a multi-year support that has defined the 2022–2025 market structure.

Exchange supply continues falling, suggesting long-term holders retain confidence.

Past cycles show similar breaks led to steep declines after trendline failure.

Ethereum trades near a major structural zone as lo

ETH6.41%

CryptoFrontNews·8h ago

Ethereum Layer 2s: Powering Institutional Blockchain Adoption

Ethereum Layer 2 networks enhance transaction speed and reduce costs, making them ideal for enterprises. With Optimistic and ZK Rollups providing security, institutions can customize workflows efficiently. L2 AppChains enable dedicated chains while maintaining Ethereum's security, supporting large-scale blockchain adoption.

ETH6.41%

CryptoFrontNews·10h ago

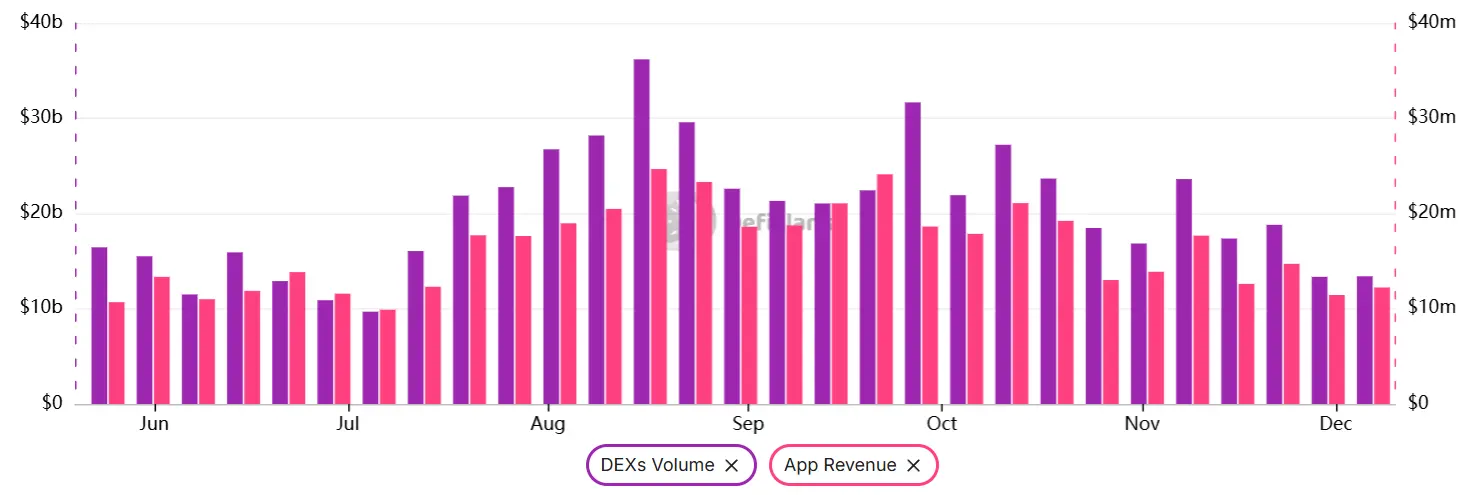

Ethereum network sees 62% drop in fees: Is ETH price at risk?

Key takeaways:

Ethereum’s base layer activity has cooled, with fees and TVL dropping, showing slower demand despite the recent price recovery.

Layer-2 networks are growing rapidly, helping to support Ethereum even as base layer usage weakens and traders remain cautious.

Ether (ETH) rallied to a

Cointelegraph·11h ago

Crypto Markets Consolidate as BTC and ETH Lead Activity: Wintermute

BTC and ETH dominate trading as investors avoid smaller altcoins, signaling cautious consolidation in crypto markets.

Last week’s $4K BTC drop tested markets but recovery showed resilience without widespread selling.

Delta-neutral and yield-focused strategies grow, reflecting low appetite for

CryptoFrontNews·13h ago

What a $440,000 Hack Shows About the Rising Threat of Ethereum 'Permit Scams'

In brief

A USDC holder lost more than $440,000 after signing a malicious "permit" transaction.

"Permit" phishing attacks accounted for some of November's largest individual crypto losses.

Experts warn that scammers rely on human error and that recovery is highly unlikely.

Decrypt's Art,

Decrypt·15h ago

Bitmine Purchases 138,452 ETH as Holdings Rise to 3.86 Million ETH

Bitmine has disclosed $13.2 billion in combined crypto, cash, and strategic “moonshot” holdings, reaffirming its status as the world’s largest ethereum treasury. The update highlights the company’s long-term accumulation strategy as ETH continues to strengthen in market prominence.

Massive $13.2 B

Coinpedia·15h ago

CFTC Launches Pilot Allowing BTC, ETH, USDC as Collateral

The CFTC launched a pilot allowing Bitcoin, Ethereum, and USDC as tokenized collateral for U.S. derivatives under strict regulations, enhancing safety and oversight amid evolving digital asset markets.

CryptoFrontNews·17h ago

Daylight, backed by a16z, launches the DayFi protocol to turn electricity into crypto yield assets.

Blockchain startup Daylight launched the DayFi protocol on Ethereum on December 9, aiming to convert electricity into yield-generating crypto assets. Through the GRID stablecoin and sGRID token, the project funds solar installations to meet the growing demand for electricity and plans to expand into more markets.

DeepFlowTech·19h ago

Ethereum Market Structure Compresses as Price Coils Within Bullish Pattern

Ethereum is currently in a narrowing formation, trading around $3,117, supported by a bullish pennant pattern. Recent ETF inflows have softened selling pressure, while lower trading volumes reflect cautious conditions. Key resistance exists near $3,140–$3,160, where a breakout may signal further upward momentum.

CryptoFrontNews·19h ago

Ethereum Whales Load Up on $426M in Long Positions as ETH Surges

Ethereum whales open $426M in long positions as ETH surges above $3,000, eyeing a potential move towards $4,000.

Ethereum has gained significant momentum recently, holding steady above $3,000. As the price moves closer to $4,000, whales are loading up on long positions. These positions, worth a

ETH6.41%

LiveBTCNews·19h ago

Cardano Price Prediction: BlackRock’s Staked Ether ETF Filing Boosts Ethereum Momentum As DeepSni...

BlackRock submitted a Form S-1 registration to the U.S. SEC for its new iShares Staked Ethereum Trust. The fund gives investors indirect access to staked Ether without managing validator operations

The trust, intended to trade under the ticker ETHB on Nasdaq, could become one of the first

CaptainAltcoin·22h ago

Ethereum Gas Futures Plan by Vitalik Buterin Gains Attention

Vitalik Buterin proposes a trustless on-chain gas futures market for Ethereum, allowing users to lock in transaction fees and reduce unpredictability. This system aims to enhance user confidence, especially for DeFi users, while supporting Ethereum's decentralized philosophy. Challenges include market complexity and user education.

ETH6.41%

Coinfomania·22h ago

Why Kaspa (KAS) Could Be a Superior Tokenization Platform Compared to Ethereum

Ethereum is widely regarded as the strongest foundation for tokenization in crypto today. The network commands more than half of the entire on-chain real-world asset sector, supported by established standards, deep liquidity, and institutional activity that continues to pull builders into its

CaptainAltcoin·22h ago

Vitalik Flags Ethereum P2P Gaps, Backs PeerDAS Fix

PeerDAS brings faster propagation, stronger resilience and better privacy after years of limited P2P focus in Ethereum.

Developers see major latency gains as networking, client behavior and protocol design converge in Ethereum’s roadmap.

Vitalik proposes trustless gas futures as fee volatility per

ETH6.41%

CryptoFrontNews·23h ago

Huobi Tech Livio: Why is the market underestimating the value of the Ethereum Fusaka upgrade?

In the late autumn of 2025, the global crypto asset market experienced a sharp correction, with price panic and liquidity concerns reaching their most “extreme” levels since 2022. However, while widespread pessimism shrouded the market, most people collectively overlooked another event of greater strategic significance—the Fusaka upgrade completed by Ethereum on December 3.

In previous years, Ethereum upgrades always began to warm up at least six months in advance; this year, due to the prevailing bearish sentiment, the upgrade barely entered the public’s view. However, upon our analysis, we found that Fusaka is not a simple technical patch—it is an adjustment to Ethereum’s economic model and ecosystem performance, systematically addressing two core bottlenecks that have plagued it for years: “value capture” and “user experience.”

So, what exactly was upgraded?—Widening and making the “road” for L2 cheaper, along with adding “speed limit signs” and “guardrails.”

The strategic significance of Fusaka...

ETH6.41%

PANews·23h ago

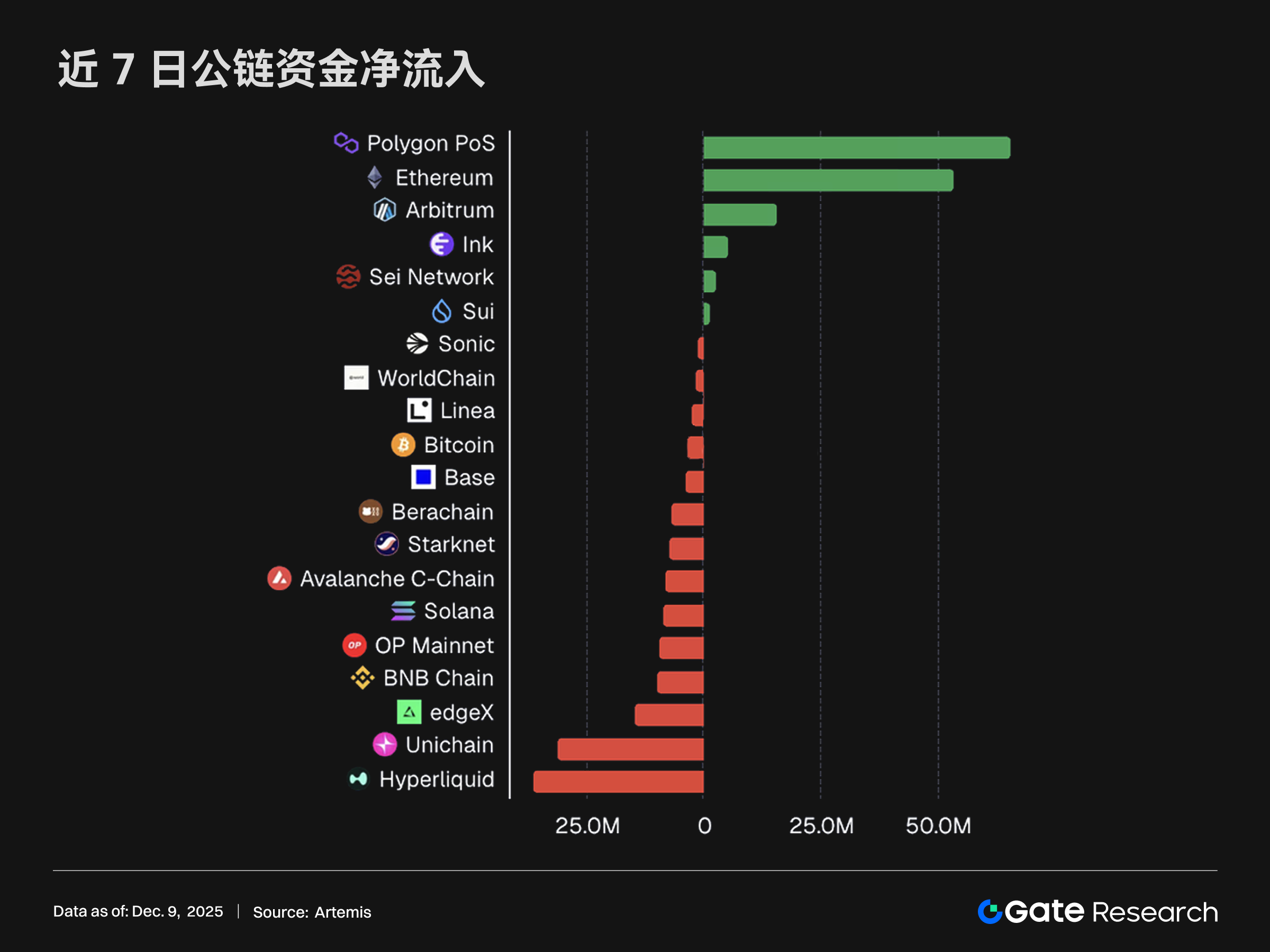

Gate Research: 2Z Weekly Increase Exceeds 31%, Polygon Leads Public Chain Capital Inflows | Gate VIP Weekly Report

BTC remains fluctuating in the $89,000–$93,000 range, and is still in a short-term weak recovery phase. ETH is relatively more resilient, but technical indicators show that selling pressure above has not been fully released. 2Z surged over 31.63% last week, becoming the standout token; Polygon PoS led the way, with Polygon’s strong performance driven by both stablecoin payments and the Polymarket prediction market, with scale and trading volume both hitting new highs. In contrast, after Monad’s mainnet launch, its popularity quickly faded, with trading volume and user activity dropping significantly. The ecosystem still lacks native applications with sustained depth, making it difficult to attract incremental capital in the short term.

GateResearch·23h ago

What is Sidra Chain? The world's first interest-free blockchain revolutionizing Islamic finance

Sidra Chain is the world's first blockchain platform specifically designed for Shariah compliance. Forked from Ethereum, it adopts a Proof-of-Work (PoW) mechanism and provides interest-free financial transactions that meet Halal standards. The project was founded by Qatari entrepreneur Dr. Mohammed Al Jefairi (MJ), and its target market covers the global population of 1.8 billion Muslims.

MarketWhisper·12-09 09:07

What Is the Corporate Giant That Just Added 138,452 ETH and Now Holds Over 3.86 Million ETH in 2025

A major U.S.-listed corporation has aggressively expanded its Ethereum treasury, acquiring 138,452 ETH last week alone at an average price of \$3,139 — a \$435 million purchase that pushed its total holdings to 3,864,951 ETH, equivalent to roughly 3.2% of Ethereum’s entire circulating supply.

CryptoPulseElite·12-09 08:43

ETH/BTC Forms a Multi-Year Reversal Structure as Breakout Pressure Strengthens

ETH/BTC maintains a long-term curved support level that previously triggered strong Ethereum-led rotations during earlier market expansion phases across cycles.

The pair trades beneath an eight-year descending resistance, where price compression and upward structure show growing momentum toward a p

CryptoFrontNews·12-09 08:32

Money printing frenzy pushes Bitcoin past 1 million! Arthur Hayes predicts ultimate boom in 2028

Legendary trader Arthur Hayes warns that the global fiat currency system is fundamentally imbalanced in the long term, with governments relying on money printing to sustain the economy while wages fail to keep up with prices. He believes that Bitcoin, with its transparent rules and fixed supply, has become a key asset to counter fiat currency devaluation. Hayes predicts the market will reach a peak between 2027 and 2028, with Bitcoin prices potentially surpassing one million dollars and Ethereum possibly reaching $10,000 to $20,000.

MarketWhisper·12-09 05:44

Historic Breakthrough for CFTC! Bitcoin, Ethereum, and USDC Approved as Collateral

The U.S. Commodity Futures Trading Commission (CFTC) has launched a digital asset pilot program, allowing Bitcoin, Ethereum, and USDC, among other payment stablecoins, to be used as collateral in the U.S. derivatives market. The program is only applicable to futures commission merchants (FCMs) that meet specific conditions. These firms can accept BTC, ETH, and USDC as margin collateral for futures and swaps trading, but must comply with strict reporting and custody requirements.

MarketWhisper·12-09 03:41

ETH Pattern Targets $7.6K Amid Historic Supply Squeeze

Ethereum is showing signs of recovery with a giant inverted head and shoulders pattern aiming for $7,600. Exchange supply has dropped to a 10-year low, while historic liquidations indicate market reset, creating favorable conditions for a bullish breakout.

LiveBTCNews·12-09 03:36

The "Infinite Money Glitch" is Invalid! The Survival Battle Between Crypto Giants Strategy and BitMine

The crypto asset company arbitrage model, once hailed as the “infinite money glitch,” is now unraveling. This week, even as the premium of stock prices relative to net asset value (NAV) shrank sharply, the two giants, Strategy and BitMine, still made significant purchases against the trend. Strategy spent $962.7 million to acquire 10,624 bitcoins, while BitMine bought 138,000 ether. However, the core engine that fueled their years of expansion— the “perpetual motion” model of financing coin purchases by issuing shares at a high premium— is now on the verge of failure. Facing “channel parity” brought by ETFs, these two companies, which together hold over $72 billion in crypto assets, are being forced into a difficult transformation crucial to their survival.

MarketWhisper·12-09 03:21

Splashing $429 Million! Tom Lee's BitMine Bets on Ethereum "Crypto Supercycle"

The world’s largest Ethereum treasury company, BitMine Immersion Technologies, has made another move, purchasing 138,452 ETH worth approximately $429 million last week. This brings its total Ethereum holdings to an astonishing 3.864 million ETH, valued at about $12 billion, firmly securing its position as the top Ethereum holder in the world. According to the company’s chairman and renowned analyst Tom Lee, this increase is a bet on the arrival of an “encrypted supercycle” for Ethereum, driven by multiple positive factors such as the Fusaka upgrade, a shift in Federal Reserve policy, and the trend of asset tokenization on Wall Street. Despite Ethereum rebounding nearly 11% in a week, market prediction platforms indicate that investors remain cautious about whether it can break through the $4,000 mark.

MarketWhisper·12-09 03:10

DeMark indicator shows ETH has bottomed out, BitMine adds nearly 140,000 ETH

Ethereum reserve enterprise BitMine announced an additional purchase of nearly 140,000 ETH, bringing its total holdings to 3.86 million ETH. In this month’s chairman’s address, Tom Lee specifically mentioned that about five weeks ago, the BitMine team hired Tom DeMark, known for his "market timing" expertise, to analyze cryptocurrency price trends. DeMark indicators show that ETH has bottomed out, and BitMine will step up its efforts to continue buying Ethereum.

BitMine buys more ETH, total holdings reach 3.72 million

Yesterday, BitMine revealed its latest cryptocurrency holdings. As of December 7, BitMine held assets worth $13.2 billion, including:

3,864,951 ETH

192 BTC

$36 million in

ETH6.41%

ChainNewsAbmedia·12-09 03:08

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28