Gate日報:ทรัมป์ขู่ว่าจะเพิ่มภาษีจีน;Qubic จะโจมตี DOGE ด้วยการโจมตีทางไซเบอร์;ญี่ปุ่นอนุมัติสเตเบิลคอยน์เยนในฤดูใบไม้ร่วงปีนี้

บิทคอยน์ (BTC) วอลลุ่มเทรดช่วงสุดสัปดาห์ซบเซา โดยเมื่อวันที่ 18 สิงหาคม ในช่วงเอเชียรายงานประมาณ 117,230 ดอลลาร์สหรัฐฯ ประธานาธิบดีสหรัฐฯ โดนัลด์ ทรัมป์ กล่าวว่า เขาจะชะลอการเพิ่มภาษีต่อสินค้าจีน เนื่องจากจีนซื้อขายน้ำมันจากรัสเซีย Qubic ได้โจมตีเหรียญมอนโร (XMR) และขั้นตอนถัดไปจะมุ่งเป้าไปที่เหรียญขยะ (DOGE) ญี่ปุ่นระบุว่าจะอนุมัติสเตเบิลคอยน์ที่สนับสนุนโดยเยนญี่ปุ่นเป็นครั้งแรกในฤดูใบไม้ร่วงปีนี้.

การพยากรณ์วันนี้

1、บัญชีการค้าที่ปรับฤดูกาลของยูโรโซนในเดือนมิถุนายน (พันล้านยูโร) ค่าก่อนหน้าอยู่ที่ 16.2

2, ดัชนีราคาบ้าน NAHB เดือนสิงหาคมของสหรัฐอเมริกา ค่าเดิมอยู่ที่ 33

เหตุการณ์มหภาค & จุดเด่นในเหรียญ

1、《彭博社》8 สิงหาคม 16 รายงานว่า ประธานาธิบดีสหรัฐฯ โดนัลด์ ทรัมป์ กล่าวว่า เขาจะเลื่อนการเพิ่มภาษีสินค้าจากจีน เนื่องจากจีนซื้อปิโตรเลียมจากรัสเซีย และทรัมป์ยังกล่าวว่า เขาและประธานาธิบดีรัสเซีย วลาดิเมียร์ ปูติน ได้มีความก้าวหน้าในการยุติสงครามยูเครน ทรัมป์กล่าวในการสัมภาษณ์กับ ฟ็อกซ์นิวส์ หลังจากการพูดคุยกับปูตินเมื่อวันที่ 15 สิงหาคมว่า: “เพราะสถานการณ์ในวันนี้ ฉันรู้สึกว่าฉันไม่จำเป็นต้องพิจารณาประเด็นนี้ในตอนนี้… ตอนนี้ ฉันอาจจะต้องพิจารณาประเด็นนี้อีกครั้งในสองหรือสามสัปดาห์ แต่เราไม่จำเป็นต้องพิจารณาประเด็นนี้ในตอนนี้” ทรัมป์ไม่สามารถบรรลุข้อตกลงในการหยุดยิงกับปูตินในระหว่างการประชุมที่อลาสก้า แต่เขากล่าวว่า ทั้งสองฝ่ายได้บรรลุฉันทามติในหลายประเด็น และได้กระตุ้นประธานาธิบดียูเครน โวโลดิเมียร์ เซเลนสกี ให้ทำข้อตกลงกับปูติน.

-

Qubic เป็นบล็อกเชนที่มุ่งเน้นด้านปัญญาประดิษฐ์ ซึ่งเมื่อสัปดาห์ที่แล้วได้ทำการโจมตี 51% ต่อเครือข่ายความเป็นส่วนตัวของเหรียญ XMR โดยการตัดสินใจของการลงคะแนนเสียงจากชุมชนที่อยู่เบื้องหลังในการโจมตีครั้งต่อไปคือเหรียญขยะ (DOGE) Sergey Ivancheglo ผู้ก่อตั้ง Qubic (ใช้ชื่อเล่นในโลกออนไลน์ว่า Come-from-Beyond) ได้ให้ตัวเลือกหลายอย่างสำหรับเป้าหมายถัดไปแก่ชุมชน รวมถึง DOGE, Kaspa, Zcash และบล็อกเชนอื่น ๆ ที่สมาชิกกำหนดไว้ ในตอนท้ายของการลงคะแนน DOGE ได้รับคะแนนจากชุมชน Qubic มากกว่า 300 คะแนน ซึ่งมากกว่าจำนวนคะแนนรวมของตัวเลือกอื่น ๆ ทั้งหมด Qubic ประสบความสำเร็จในการโจมตี 51% ต่อเหรียญ XMR และตอนนี้ชุมชนกำลังมองหาที่จะโจมตีบล็อกเชนที่ใช้หลักการทำงานของการพิสูจน์การทำงาน ซึ่งอาจสร้างปัญหาให้กับเครือข่ายเงินดิจิทัลที่อิงจากบล็อกเชนเหล่านี้.

-

สำนักงานการเงินของญี่ปุ่น (FSA) เตรียมที่จะอนุมัติการออกสเตเบิลคอยน์ที่มีการกำหนดราคาเป็นเงินเยนในฤดูใบไม้ร่วงนี้ ซึ่งเป็นการอนุญาตให้มีการออกสกุลเงินดิจิทัลในประเทศที่ผูกติดกับสกุลเงิน fiat เป็นครั้งแรก ตามรายงานของสื่อญี่ปุ่น “ญี่ปุ่นเศรษฐกิจข่าว” เมื่อวันอาทิตย์ที่ผ่านมา บริษัทฟินเทค JPYC ที่ตั้งอยู่ในโตเกียวจะจดทะเบียนเป็นบริษัทโอนเงินภายในเดือนนี้และจะเป็นผู้นำในการเปิดตัวบริการนี้ เป้าหมายการออกแบบของ JPYC คือการรักษามูลค่าคงที่ที่ 1 เยน = 1 เยน โดยใช้สินทรัพย์ที่มีสภาพคล่องสูง เช่น เงินฝากธนาคารและพันธบัตรญี่ปุ่นเป็นหลักประกัน หลังจากได้รับคำขอซื้อจากบุคคลหรือธุรกิจ โทเค็นจะถูกออกโดยการโอนผ่านธนาคารไปยังกระเป๋าเงินดิจิทัล การอนุมัติในครั้งนี้เกิดขึ้นในขณะที่ขนาดตลาดสเตเบิลคอยน์ทั่วโลกเกิน 286,000 ล้านดอลลาร์ โดยตลาดนี้ถูกนำโดยสินทรัพย์ที่ผูกติดกับดอลลาร์ เช่น USDt และ USDC ของ Circle แม้ว่าสเตเบิลคอยน์ดอลลาร์จะมีฐานที่มั่นในญี่ปุ่น แต่การออกสเตเบิลคอยน์ที่อิงตามเยนนี้จะเป็นครั้งแรกในประเทศ.

แนวโน้มตลาด

- $BTC ปริมาณการซื้อขายซบเซารายงานอย่างไม่แน่นอนที่ประมาณ 117,230 ดอลลาร์และตําแหน่งถูกระเบิดขึ้น 23.94 ล้านดอลลาร์ในช่วง 24 ชั่วโมงที่ผ่านมาและการระเบิดหลักนั้นยาวนาน

2, ตลาดหุ้นสหรัฐฯ ปิดตลาดในวันที่ 15 สิงหาคมส่วนใหญ่ลดลง โดยทรัมป์ได้กล่าวเมื่อเร็ว ๆ นี้ว่าจะมีการกำหนดภาษีชิปภายในสองสัปดาห์ข้างหน้า โดยอัตราภาษีอาจเพิ่มขึ้นเป็น 200% หรือแม้กระทั่ง 300% ซึ่งแสดงให้เห็นว่าเขากำลังเพิ่มความพยายามในการผลักดันอุตสาหกรรมการผลิตเซมิคอนดักเตอร์ให้กลับมาที่สหรัฐฯ ดัชนีฟิลาเดลเฟียเซมิคอนดักเตอร์ลดลงมากกว่า 2% ดัชนีดาวโจนส์เพิ่มขึ้น 34.86 จุด หรือ 0.08% ปิดที่ 44,946.12 จุด ดัชนี S&P 500 ลดลง 18.74 จุด หรือ 0.29% ปิดที่ 6,449.80 จุด ดัชนีแนสแด็กซึ่งเน้นหุ้นเทคโนโลยีลดลง 87.69 จุด หรือ 0.40% ปิดที่ 21,622.98 จุด ดัชนีฟิลาเดลเฟียเซมิคอนดักเตอร์ลดลง 132.754 จุด หรือ 2.26% ปิดที่ 5,752.736 จุด;

3、ในแผนที่การชำระบัญชี Gate BTC/USDT โดยใช้ 117,254.10 USDT เป็นเกณฑ์ หากลดลงใกล้ 116,846 ดอลลาร์ จำนวนเงินชำระบัญชีของตำแหน่ง Long จะเกิน 3.36 แสนดอลลาร์; หากเพิ่มขึ้นใกล้ 119,320 ดอลลาร์ จำนวนเงินชำระบัญชีของตำแหน่ง Short จะเกิน 6.02 แสนดอลลาร์ จำนวนเงินชำระบัญชีของฝ่าย Short สูงกว่าฝ่าย Long อย่างมีนัยสำคัญ แนะนำให้ควบคุมสัดส่วนเลเวอเรจอย่างเหมาะสม เพื่อหลีกเลี่ยงการกระตุ้นการชำระบัญชีขนาดใหญ่ในระหว่างที่มีการเปลี่ยนแปลงของตลาด;

4、ในช่วง 24 ชั่วโมงที่ผ่านมา BTC มีการไหลเข้าจำนวน 7.10 ล้านดอลลาร์สหรัฐฯ และไหลออกจำนวน 8.27 ล้านดอลลาร์สหรัฐฯ ส่งผลให้มีการไหลออกสุทธิ 1.17 ล้านดอลลาร์สหรัฐฯ;

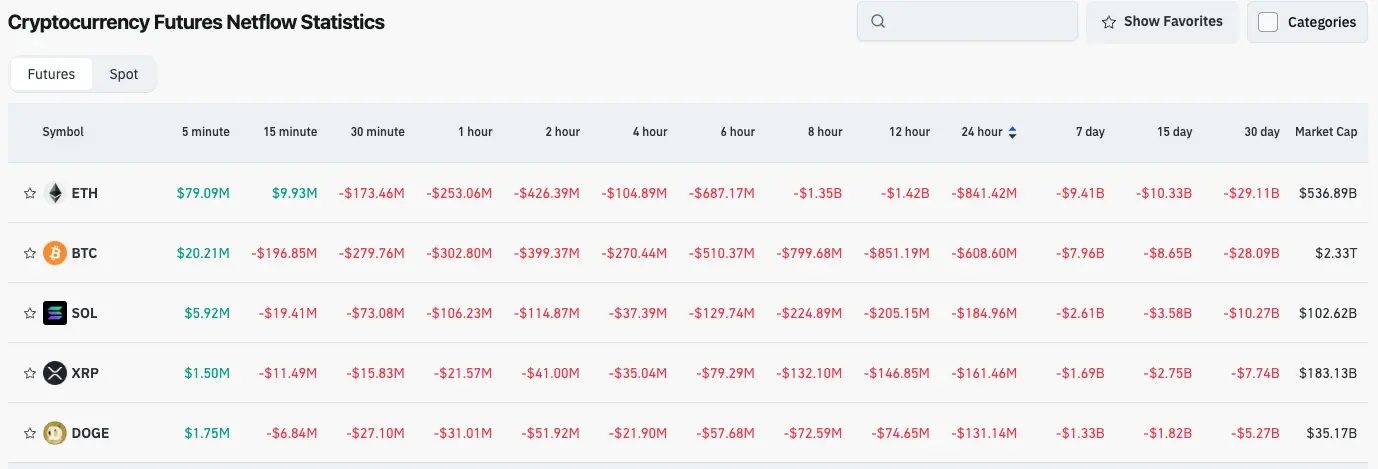

5、ในช่วง 24 ชั่วโมงที่ผ่านมา สัญญาซื้อขายสุทธิของ $ETH, $BTC, $SOL, $XRP, $DOGE เป็นต้น มีการไหลออกนำหน้า ซึ่งมีโอกาสในการซื้อขาย.

ข่าวสาร

1、ข้อมูล: 2.5 พันล้านเหรียญ PUMP ส่งจากที่อยู่การแจกจ่ายโทเค็น PumpFun ไปยัง CEX

2、ที่อยู่กระเป๋าเงินใหม่สองที่ที่สงสัยว่าเป็นของเอนทิตีเดียวกัน ได้รับการโอน ETH มูลค่าเกิน 1.15 ล้านดอลลาร์สหรัฐจาก FalconX

3、某巨鯨/機机构最近 6 วัน以循环กู้方式ผ่าน CEX สะสมมูลค่า 1.36 ล้านดอลลาร์ WBTC และ ETH

4、สี่ตัววาฬถอนเหรียญ LINK รวมกว่า 400,000 เหรียญจาก CEX ในช่วง 24 ชั่วโมงที่ผ่านมา มีมูลค่าประมาณ 9.82 ล้านดอลลาร์สหรัฐ

5、ที่อยู่ที่น่าสงสัยเกี่ยวข้องกับนักลงทุนคริปโต Rudy Kadoch ได้โอนประมาณ 1.976 ล้าน CRV ไปยัง CEX

6、Arbitrum DAO ของ Ethereum มีการเพิ่มเดือนละประมาณ 36% ขณะนี้แตะ 22,500 เหรียญ ETH

7、นักลงทุนส่วนใหญ่ที่เข้าร่วมการสำรวจผู้จัดการกองทุนทั่วโลกของธนาคารสหรัฐมีความเสี่ยงจากสกุลเงินดิจิทัลยังคงเป็นศูนย์

8、นักเทรดคนหนึ่งทำกำไร 29,600,000 ดอลลาร์จากการซื้อ ETH ด้วยเงิน 125,000 ดอลลาร์ ได้รับผลตอบแทน 236 เท่า

9、กระเป๋าเงินใหม่บางใบถอน 450 เหรียญ BTC จาก Binance มูลค่า 53,220,000 ดอลลาร์สหรัฐ

10、ข้อมูล: โทเค็น FTN, ZRO, KAITO จะมีการปลดล็อกจำนวนมากในสัปดาห์หน้า โดยที่ FTN มีมูลค่าการปลดล็อกประมาณ 9,140 ล้านดอลลาร์สหรัฐ

11、Sky 联创 Rune ใช้ 177 ล้านเหรียญ ENA ซื้อคืน 16,380,000 เหรียญ SKY

12、CEO Metaplanet: เป้าหมายในการเพิ่มการถือครองบิทคอยน์เป็น 30,000 เหรียญในปีนี้ยังคงไม่เปลี่ยนแปลง

13、Michael Saylor ได้เผยแพร่ข้อมูลการติดตามบิทคอยน์อีกครั้ง ข่าวนี้อาจเปิดเผยข้อมูลการถือครองในสัปดาห์นี้

X KOL คัดสรรความคิดเห็น

Phyrex Ni(@Phyrex_Ni):“งานวันนี้ก็ไม่ค่อยมีความยากลำบากอะไร สองวันหยุดสุดสัปดาห์ก็เป็นแบบนี้ ความผันผวนของ BTC ในสถานการณ์ที่มีสภาพคล่องต่ำก็ถือว่าดีอยู่แล้ว แสดงให้เห็นว่าความรู้สึกของนักลงทุนยังคงมั่นคง ขณะที่สถานการณ์ทางการเมืองยังคงวนเวียนอยู่รอบความขัดแย้งระหว่างรัสเซียและยูเครน วันจันทร์ทรัมป์จะพบกับเซเลนสกี แม้ว่าเขาจะบอกว่ามีความก้าวหน้าครั้งสำคัญกับปูติน แต่ก็เหมือนที่พูดเมื่อวานนี้ โอกาสสูงที่จะต้องให้ดินแดนในยูเครนเป็นเงื่อนไข วันนี้ Bitcoin สูงสุดประมาณ 118,500 ดอลลาร์ แต่เมื่อพิจารณาว่าสัปดาห์หน้าไม่มีเหตุการณ์ใหญ่เกิดขึ้นนอกจากการประชุมประจำปีที่แจ็คสันโฮลในวันศุกร์ ตลาดยังคงอยู่ที่การต่อสู้ระหว่างทรัมป์และพาวล์ ดังนั้นคำสั่งซื้อของฉันจึงยังไม่ปิด ทำการถือครองไว้ก่อน ดูไปก่อน จริงๆ แล้วการปิดเป็นสิ่งที่ปลอดภัยกว่า แต่ก็มีความโลภอยู่บ้าง กลับมาที่ข้อมูลของ Bitcoin ดูแล้ว อัตราการเปลี่ยนมือที่ต่ำทำให้ตกใจ ช่วงตลาดหมีเป็นแบบนี้เอง แสดงให้เห็นว่านักลงทุน BTC กลับเข้าสู่สถานการณ์ที่เราเคยพูดถึงเกี่ยวกับการลดการขาย ซึ่งมีส่วนช่วยให้ราคาของ BTC มีเสถียรภาพ ก่อนการประชุมประจำปีที่แจ็คสันโฮลยังไม่พบสถานการณ์ที่มองโลกในแง่ร้ายมากนัก นอกจากนี้ก็ไม่มีอะไรอื่น รองรับความมั่นคงมาก สั้นๆ ก็คือไม่ต้องกังวลอะไร และตำแหน่งที่ 117,000 ดอลลาร์มีการถือครองมากกว่า 750,000 เหรียญ ดูแล้วก็ยังโอเค ฉันยังรู้สึกว่าตลาด แม้จะถูกบังคับให้เลือกทิศทางก็จะเป็นหลังวันศุกร์แล้ว.”