Sykodelicc

No content yet

Sykodelicc

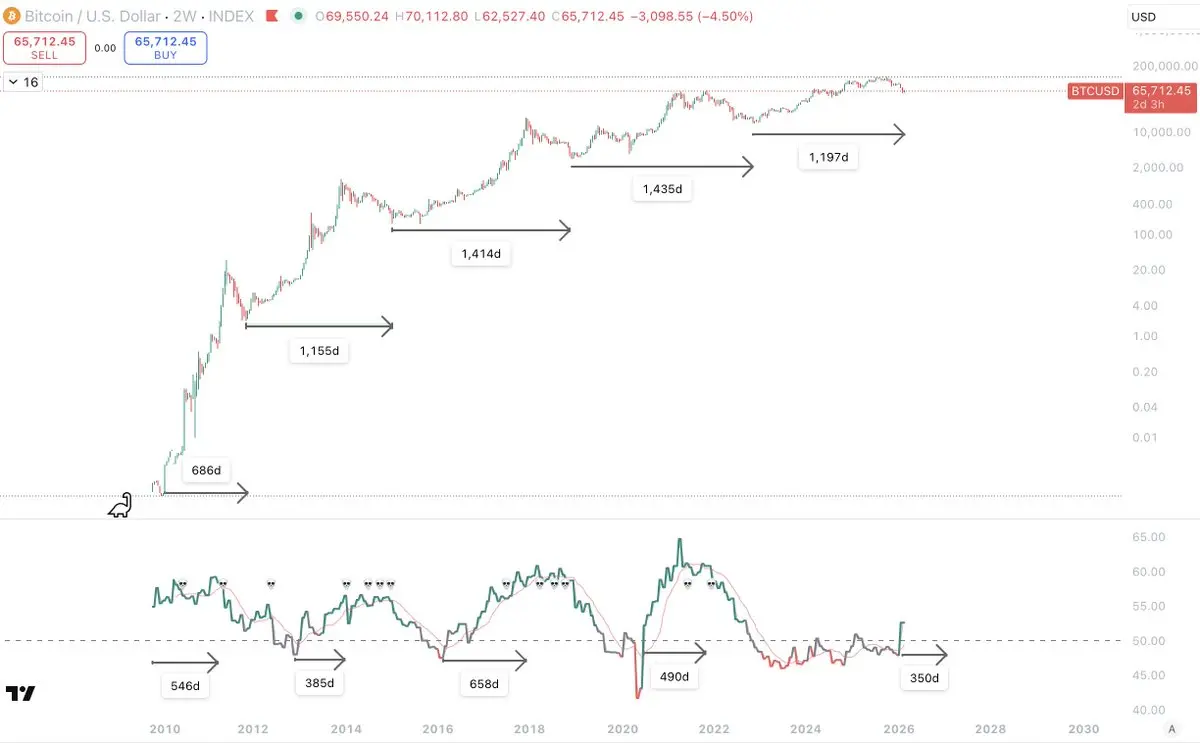

It becomes very clearly when you look at it like this.

We have actually only had two cycles that can be put down as "4 year cycles".

They are: 2014 - 2018 & 2018 - 2022.

2009 - 2014 do not fall into it.

This cycle it is yet to be decided.

So out of 8 years of Bitcoins 16 year life, as of now, only 50% of it can be linked to the "4 year cycle" theory.

However, what is 100% consistent is that every time ISM enters expansion from contraction, it has begun a bull cycle for at least 385 days.

And yet, everyone holds onto the 4 year cycle and discounts the ISM/Business cycle?

Right now, we are clear

We have actually only had two cycles that can be put down as "4 year cycles".

They are: 2014 - 2018 & 2018 - 2022.

2009 - 2014 do not fall into it.

This cycle it is yet to be decided.

So out of 8 years of Bitcoins 16 year life, as of now, only 50% of it can be linked to the "4 year cycle" theory.

However, what is 100% consistent is that every time ISM enters expansion from contraction, it has begun a bull cycle for at least 385 days.

And yet, everyone holds onto the 4 year cycle and discounts the ISM/Business cycle?

Right now, we are clear

- Reward

- 1

- Comment

- Repost

- Share

March is lining up to be very volatile.

And I think it will be for the bulls.

Upcoming early March we have:

- Clarity Act deadline

- Iran conflict resolution one way or another

- Higher ISM print

- New lunar cycle

I am currently in a long trade from these levels $65,500 with very tight stops.

I think there is a high chance we will be leaving this range early March, and the below levels on the chart are key to watch for.

I could totally see an escalation in Iran conflict that dumps us to $61,000, or even sweep the lows, that then marks the bottom as ISM prints.

The last time Iran escalated it m

And I think it will be for the bulls.

Upcoming early March we have:

- Clarity Act deadline

- Iran conflict resolution one way or another

- Higher ISM print

- New lunar cycle

I am currently in a long trade from these levels $65,500 with very tight stops.

I think there is a high chance we will be leaving this range early March, and the below levels on the chart are key to watch for.

I could totally see an escalation in Iran conflict that dumps us to $61,000, or even sweep the lows, that then marks the bottom as ISM prints.

The last time Iran escalated it m

BTC-3.15%

- Reward

- like

- Comment

- Repost

- Share

There we go.

Thank you, New York Times.

The perfect top and bottom signal.

Send it.

Thank you, New York Times.

The perfect top and bottom signal.

Send it.

- Reward

- 1

- Comment

- Repost

- Share

Everybody needs to see this chart.

If you are struggling to understand my thesis...

This is another simple and effective chart that tells a very broad macro picture, all in one.

its probably one of the best overall macro charts you could see.

What we are looking at here is:

- COPPER

- BITCOIN

- GOLD

- ISM

Now, these 4 charts all tell a very distinct story, but when you put them together, they tell almost everything.

Copper is an asset that signals overall expansion as it is the most used metal in construction and development of all forms, and now, with the added tailwind of AI.

Copper has brok

If you are struggling to understand my thesis...

This is another simple and effective chart that tells a very broad macro picture, all in one.

its probably one of the best overall macro charts you could see.

What we are looking at here is:

- COPPER

- BITCOIN

- GOLD

- ISM

Now, these 4 charts all tell a very distinct story, but when you put them together, they tell almost everything.

Copper is an asset that signals overall expansion as it is the most used metal in construction and development of all forms, and now, with the added tailwind of AI.

Copper has brok

BTC-3.15%

- Reward

- 2

- Comment

- Repost

- Share

This is all one massive psyop.

The market makers have laid the perfect trap out there and everyone is falling for it.

And the crazy thing, what is happening is what always happens...

Its just happening in a different way this cycle that most cant see.

What they have done is use the 4 year cycle to lay the perfect trap, just as the macro cycle is expanding.

They have followed the 4 year cycle for now, and it has convinced everyone it is truly over, right before it gets reversed.

This is the first time in Bitcoins life that the 4 year cycle and the business cycle are diverging, and right now, is

The market makers have laid the perfect trap out there and everyone is falling for it.

And the crazy thing, what is happening is what always happens...

Its just happening in a different way this cycle that most cant see.

What they have done is use the 4 year cycle to lay the perfect trap, just as the macro cycle is expanding.

They have followed the 4 year cycle for now, and it has convinced everyone it is truly over, right before it gets reversed.

This is the first time in Bitcoins life that the 4 year cycle and the business cycle are diverging, and right now, is

BTC-3.15%

- Reward

- 2

- Comment

- Repost

- Share

That is exactly what you want to see from a bottom.

Perfect, really.

We had aggressive shorts load in as price dropped to $62.5k, and they got hunted which started our move.

As that happened OI got slammed as they all got liquidated - decent bear trap.

Then from there we’ve had a very strong rally from spot buying, with a relatively flat OI, meaning leverage is minimal…

But still negative funding so most are trying to short this move.

The kinda setup you want to see for a low to form, and for it to continue higher.

We will get more signals about what is next at the range highs.

Perfect, really.

We had aggressive shorts load in as price dropped to $62.5k, and they got hunted which started our move.

As that happened OI got slammed as they all got liquidated - decent bear trap.

Then from there we’ve had a very strong rally from spot buying, with a relatively flat OI, meaning leverage is minimal…

But still negative funding so most are trying to short this move.

The kinda setup you want to see for a low to form, and for it to continue higher.

We will get more signals about what is next at the range highs.

- Reward

- like

- Comment

- Repost

- Share

Absolutely perfect short squeeze.

Driven by spot buyers.

Price up big, OI nuked... Spot CVD up.

Re-longed at the right time.

Higher.

Driven by spot buyers.

Price up big, OI nuked... Spot CVD up.

Re-longed at the right time.

Higher.

- Reward

- like

- Comment

- Repost

- Share

Alts are not dead.

I don't care what your feelings tell you...

This chart is tells you the truth of it.

This is TOTAL3ES/BTC.

It is essentially all altcoins minus stables, divided by BTC.

What we can see is that this is currently at cycle lows for this chart.

It is nothing like previous cycle highs.

What we have here is a very tight accumulation and bottoming zone for alts against Bitcoin.

And we can see from 2020, once it decides to move... it moves fast.

I cant tell you when it will happen...

But I can tell you that we are within the total bottom zone for alts against Bitcoin.

And what comes

I don't care what your feelings tell you...

This chart is tells you the truth of it.

This is TOTAL3ES/BTC.

It is essentially all altcoins minus stables, divided by BTC.

What we can see is that this is currently at cycle lows for this chart.

It is nothing like previous cycle highs.

What we have here is a very tight accumulation and bottoming zone for alts against Bitcoin.

And we can see from 2020, once it decides to move... it moves fast.

I cant tell you when it will happen...

But I can tell you that we are within the total bottom zone for alts against Bitcoin.

And what comes

BTC-3.15%

- Reward

- like

- Comment

- Repost

- Share

This happens in every cycle.

And its always around mid cycle peak.

This adds an interesting weight on the overall market position.

You can see that each time Global Liquidity breaks out, Bitcoin moves slightly higher, then has a multi month correction...

Just like now.

Then, as global liquidity continues to increase, Bitcoin resumes higher again.

Last two cycles Global liquidity broke out for 671 days and 731 days.

Very similar.

So far, this cycle, we are only at 306 days.

What is also very striking to observe is that the contraction of global liquidity this cycle was much larger than 2016 and

And its always around mid cycle peak.

This adds an interesting weight on the overall market position.

You can see that each time Global Liquidity breaks out, Bitcoin moves slightly higher, then has a multi month correction...

Just like now.

Then, as global liquidity continues to increase, Bitcoin resumes higher again.

Last two cycles Global liquidity broke out for 671 days and 731 days.

Very similar.

So far, this cycle, we are only at 306 days.

What is also very striking to observe is that the contraction of global liquidity this cycle was much larger than 2016 and

BTC-3.15%

- Reward

- 3

- 1

- Repost

- Share

Mrworldwide :

:

true 💯 it's always around mid cycle peak when ever global liquidity breaks outIt happens every single time

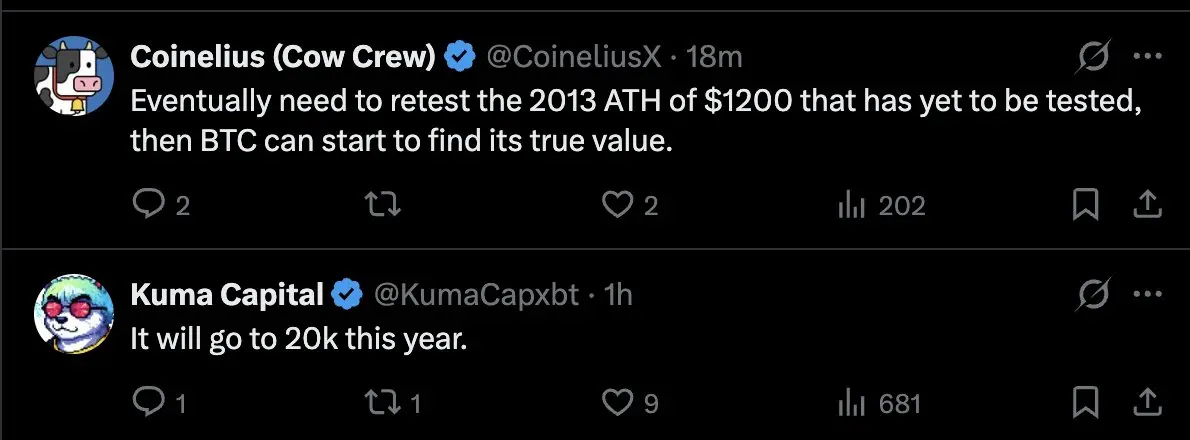

Every single time Bitcoin has been at these record levels of oversold on the weekly timeframe, people declare it dead.

And it just so happens that every time, there is a new narrative for it.

- Bitcoin is useless

- Bitcoin has lost the digital gold race

- Quantum will kill it

- Saylor will be liquidated

- 20k coming

Right now, we are the most oversold on the weekly ever…

So is it a surprise that the FUD is worse than ever?

The funniest thing about this phenomenon is everyone is capable of looking back and seeing this…

But this is the power of emotion.

The fear of t

Every single time Bitcoin has been at these record levels of oversold on the weekly timeframe, people declare it dead.

And it just so happens that every time, there is a new narrative for it.

- Bitcoin is useless

- Bitcoin has lost the digital gold race

- Quantum will kill it

- Saylor will be liquidated

- 20k coming

Right now, we are the most oversold on the weekly ever…

So is it a surprise that the FUD is worse than ever?

The funniest thing about this phenomenon is everyone is capable of looking back and seeing this…

But this is the power of emotion.

The fear of t

BTC-3.15%

- Reward

- like

- Comment

- Repost

- Share

Is a 100% move coming for $ETH?

Nice hidden bullish divergence printed on the Weekly chart here.

Last time this happened, $ETH rallied 100%.

For those that don't know, a hidden bullish divergence is when the RSI makes a lower lower, but price makes a higher low.

It means that momentum was actually stronger, but price absorbed it better.

Its a Bullish continuation signal and on HTF it matters more.

Nice hidden bullish divergence printed on the Weekly chart here.

Last time this happened, $ETH rallied 100%.

For those that don't know, a hidden bullish divergence is when the RSI makes a lower lower, but price makes a higher low.

It means that momentum was actually stronger, but price absorbed it better.

Its a Bullish continuation signal and on HTF it matters more.

ETH-5.98%

- Reward

- 2

- 1

- Repost

- Share

Yunna :

:

Wishing you great wealth in the Year of the Horse 🐴What the hell is this timeline...

Its become so utterly bear jaded that Its genuinely baffling.

This is the state of comments over and over, on every post i see.

Crazy times.

Its become so utterly bear jaded that Its genuinely baffling.

This is the state of comments over and over, on every post i see.

Crazy times.

- Reward

- 2

- Comment

- Repost

- Share

Same thing happens every cycle.

And its always around mid cycle peak.

This further hits home where we are and my overall thesis.

You can see that each time Global Liquidity breaks out, Bitcoin moves slightly higher, then has a multi month correction...

Just like now.

Then, as global liquidity continues to increase, Bitcoin resumes higher again.

Last two cycles Global liquidity broke out for 671 days and 731 days.

Very similar.

So far, this cycle, we are only at 306 days.

What is also very striking to observe is that the contraction of global liquidity this cycle was much larger than 2016 and 2

And its always around mid cycle peak.

This further hits home where we are and my overall thesis.

You can see that each time Global Liquidity breaks out, Bitcoin moves slightly higher, then has a multi month correction...

Just like now.

Then, as global liquidity continues to increase, Bitcoin resumes higher again.

Last two cycles Global liquidity broke out for 671 days and 731 days.

Very similar.

So far, this cycle, we are only at 306 days.

What is also very striking to observe is that the contraction of global liquidity this cycle was much larger than 2016 and 2

BTC-3.15%

- Reward

- 2

- Comment

- Repost

- Share

Here is my thesis.

Broken down and put forward with key charts that I think show the greatest signal of it.

A lot of people don't understand why I think what I do... why I am targeting a continued cycle and new highs this year...

When surely a prolonged bear market seems obvious?

Overall, this chart highlights almost all the key differences we have seen within this cycle that have to be accounted for, and explained.

But most notably, in my view, it shows us exactly where we are in the cycle right now...

Even if it looks a little different to what most of us expected.

It looks a little complex

Broken down and put forward with key charts that I think show the greatest signal of it.

A lot of people don't understand why I think what I do... why I am targeting a continued cycle and new highs this year...

When surely a prolonged bear market seems obvious?

Overall, this chart highlights almost all the key differences we have seen within this cycle that have to be accounted for, and explained.

But most notably, in my view, it shows us exactly where we are in the cycle right now...

Even if it looks a little different to what most of us expected.

It looks a little complex

- Reward

- 2

- Comment

- Repost

- Share

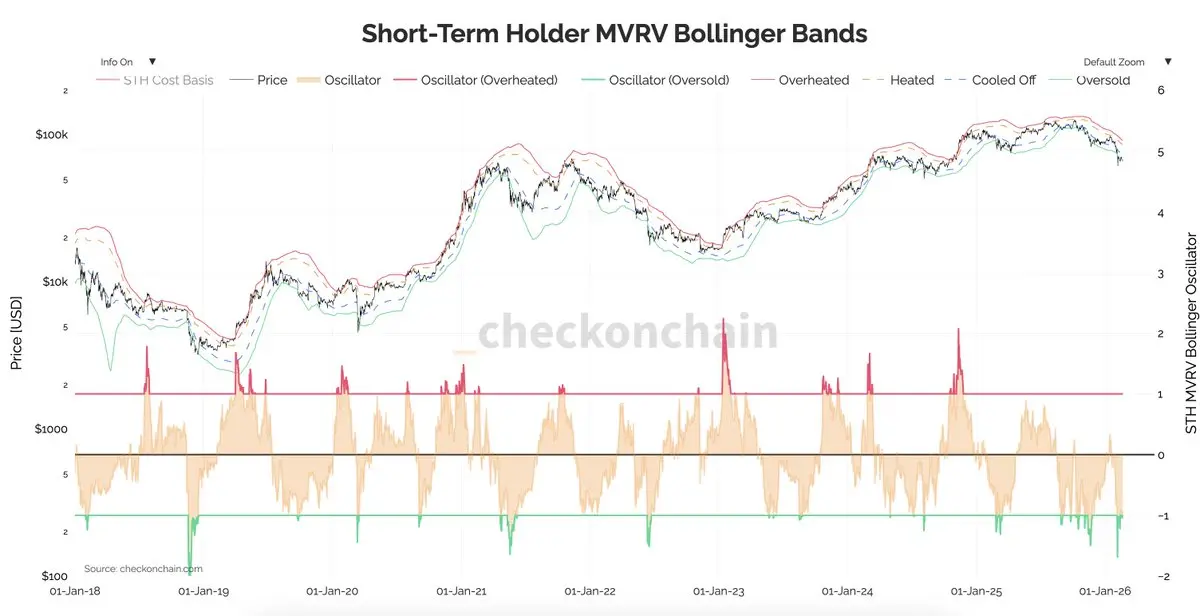

Max pain is now officially, up.

People say this all the time and usually it is not the case.

But the market bottoming here and pushing on to new highs in aggressive fashion, this year, is the most unexpected scenario right now.

It would quite literally leave the space utterly stunned.

Almost everyone is expecting 4 year cycle lows, $35k in October, then new highs 2029 etc.

Suggesting anything different is simply attacked right now.

But right here, Short term holders reached the most overextended Bollinger bands, and most STH losses since 2018.

What that means is short term holders have capitul

People say this all the time and usually it is not the case.

But the market bottoming here and pushing on to new highs in aggressive fashion, this year, is the most unexpected scenario right now.

It would quite literally leave the space utterly stunned.

Almost everyone is expecting 4 year cycle lows, $35k in October, then new highs 2029 etc.

Suggesting anything different is simply attacked right now.

But right here, Short term holders reached the most overextended Bollinger bands, and most STH losses since 2018.

What that means is short term holders have capitul

- Reward

- 3

- Comment

- Repost

- Share

I'm calling it now...

The ISM is going to come in even higher than 52.6 for Feb.

The US economy is now fully within expansion mode, and the process of it entering expansion like this has always sparked large bull runs... 100% of the time.

To signal this, the top chart is "Deere & Co" a large industrial machinery company, and there stock is god candling like it never has before.

That is not for no reason. This is expansion.

Next is IWM, which is small cap stocks, which mirror closely to Deere & Co as small caps only perform well in economic and liquidity expansion.

Then below, ETH, which moves

The ISM is going to come in even higher than 52.6 for Feb.

The US economy is now fully within expansion mode, and the process of it entering expansion like this has always sparked large bull runs... 100% of the time.

To signal this, the top chart is "Deere & Co" a large industrial machinery company, and there stock is god candling like it never has before.

That is not for no reason. This is expansion.

Next is IWM, which is small cap stocks, which mirror closely to Deere & Co as small caps only perform well in economic and liquidity expansion.

Then below, ETH, which moves

ETH-5.98%

- Reward

- 2

- Comment

- Repost

- Share

Its all happening at the same time.

The Clarity Act has been given a deadline of March 1st.

With now an 84% chance on Polymarket.

This is one of those things were they will be positive, then negative, then positive... then it will seem like it'll never happen... and then all of a sudden it does.

So lining up for the beginning of March is:

- Clarity Act

- Next ISM print

- New Lunar cycle

- All bears are gay

The Clarity Act has been given a deadline of March 1st.

With now an 84% chance on Polymarket.

This is one of those things were they will be positive, then negative, then positive... then it will seem like it'll never happen... and then all of a sudden it does.

So lining up for the beginning of March is:

- Clarity Act

- Next ISM print

- New Lunar cycle

- All bears are gay

- Reward

- 1

- Comment

- Repost

- Share

This is very clean.

When you take emotions out of it and just observe Bitcoin on the 1M with simple metrics...

You can see its just in one massive uptrend, with a breakout and retest of previous ATH...

Every cycle.

Whats interesting is that every cycle:

- BTC at least tags the 1M 50EMA

- At least tags its old ATH

- Never closes a candle below its old ATH

- RSI resets to a very similar level

The main difference this cycle is that the RSI never entered overexpnasion.

From a TA perspective, this is very clean.

If we were to close a monthly candle below $61,400 it would be the first time it has ev

When you take emotions out of it and just observe Bitcoin on the 1M with simple metrics...

You can see its just in one massive uptrend, with a breakout and retest of previous ATH...

Every cycle.

Whats interesting is that every cycle:

- BTC at least tags the 1M 50EMA

- At least tags its old ATH

- Never closes a candle below its old ATH

- RSI resets to a very similar level

The main difference this cycle is that the RSI never entered overexpnasion.

From a TA perspective, this is very clean.

If we were to close a monthly candle below $61,400 it would be the first time it has ev

BTC-3.15%

- Reward

- 1

- Comment

- Repost

- Share

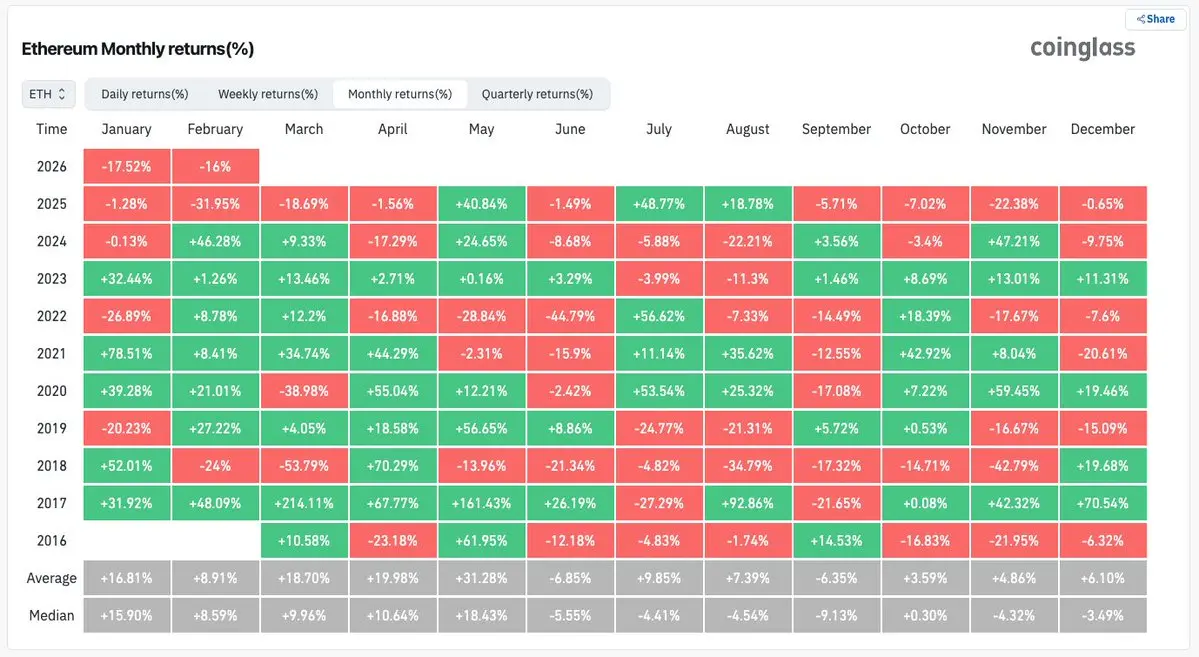

More records have been broken.

2025 was Ethereums worst year on record.

11 out of the last 14 months have been red.

And 2025 tied 2018 with 9 out of 12 red months.

Simply put, this last 14 months has been Ethereums worst ever performance over that period of time.

So if you have been here this whole time, you have endured the worst market conditions ever.

If you've made money, you're truly skilled.

The silver lining?

The last time ETH performed like this it had 5 green months in a row.

Soon.

2025 was Ethereums worst year on record.

11 out of the last 14 months have been red.

And 2025 tied 2018 with 9 out of 12 red months.

Simply put, this last 14 months has been Ethereums worst ever performance over that period of time.

So if you have been here this whole time, you have endured the worst market conditions ever.

If you've made money, you're truly skilled.

The silver lining?

The last time ETH performed like this it had 5 green months in a row.

Soon.

ETH-5.98%

- Reward

- 3

- Comment

- Repost

- Share