晓月ur

Eight-year experienced trader

晓月ur

11.7 Noon Market Analysis and Strategy

The four-hour chart shows a clear sign of stabilization after three consecutive bearish candles. The length of the bearish bodies is gradually decreasing, indicating that the bearish momentum is weakening. Additionally, the lower band of the Bollinger Bands is forming an effective support level, and the bottom structure is gradually solidifying, providing a technical foundation for a price rebound.

On the hourly chart, more bullish signals are emerging—after a brief dip, the price has consecutively risen with four bullish candles, forming an initial doub

View OriginalThe four-hour chart shows a clear sign of stabilization after three consecutive bearish candles. The length of the bearish bodies is gradually decreasing, indicating that the bearish momentum is weakening. Additionally, the lower band of the Bollinger Bands is forming an effective support level, and the bottom structure is gradually solidifying, providing a technical foundation for a price rebound.

On the hourly chart, more bullish signals are emerging—after a brief dip, the price has consecutively risen with four bullish candles, forming an initial doub

- Reward

- like

- Comment

- Repost

- Share

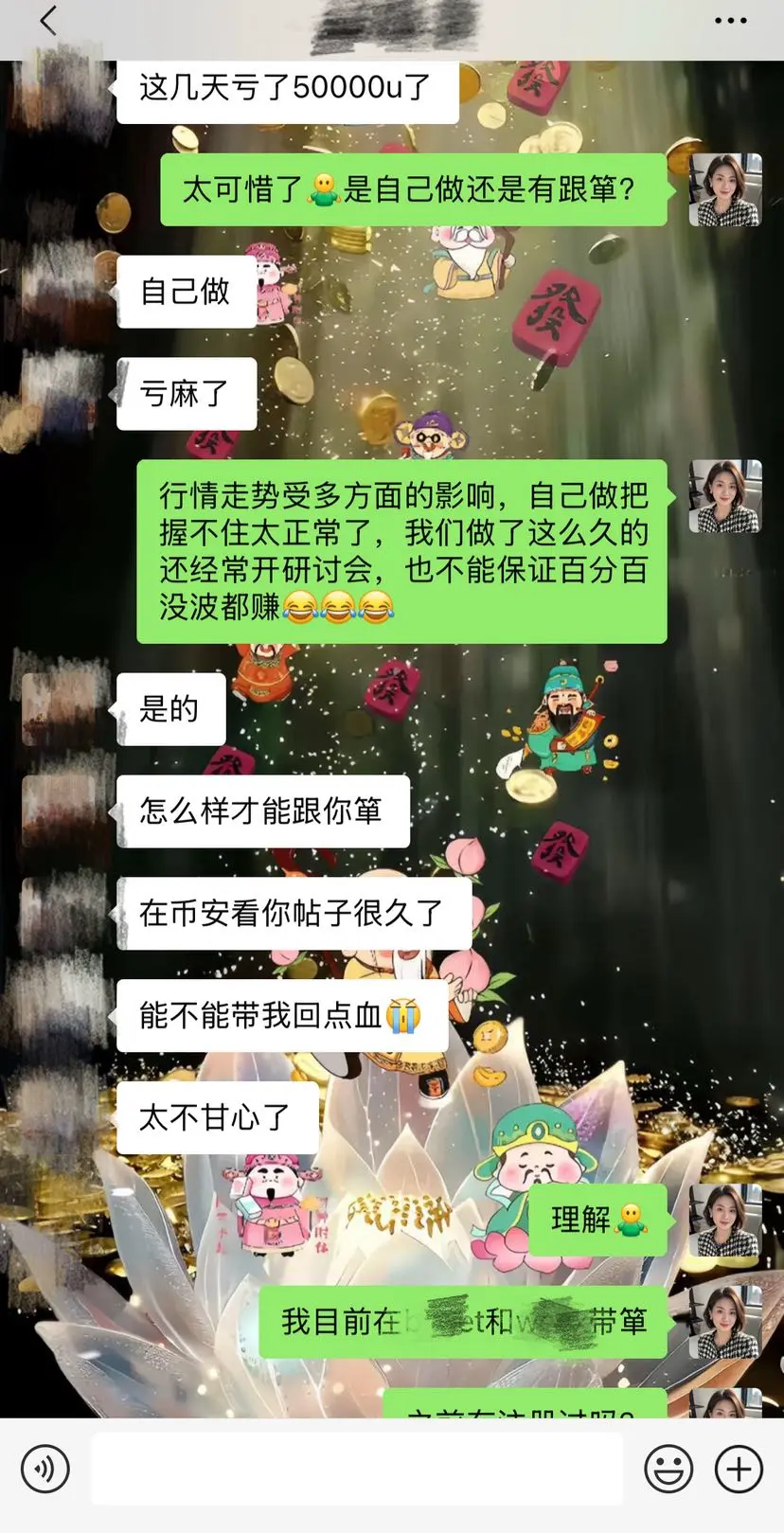

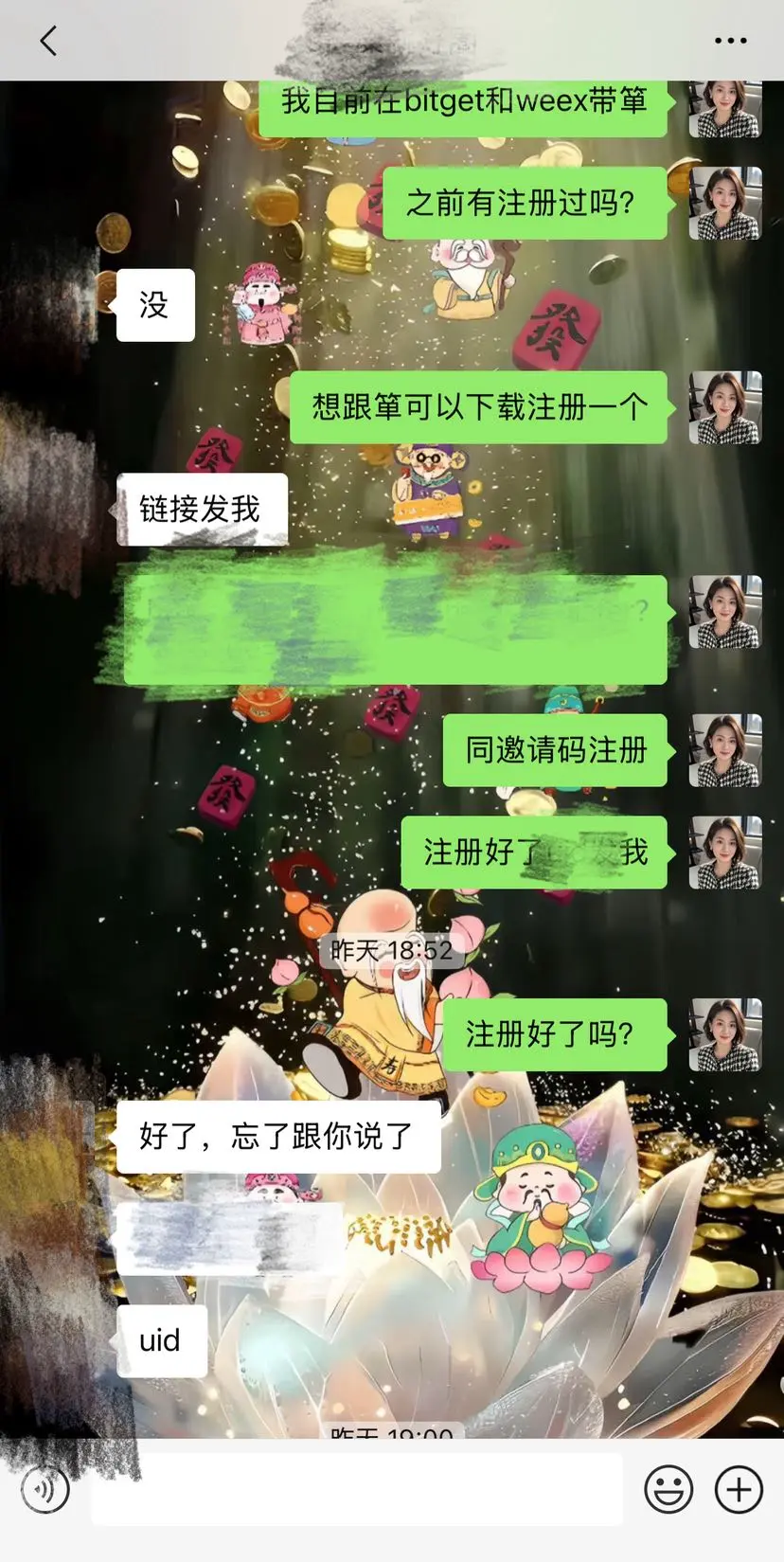

Only a few thousand yuan left in your hands, still hoping to turn things around in the crypto world? Don’t think it’s just a pipe dream!

Every time you see stories of “turning a few thousand into millions” in the crypto circle, do you feel excited but also hesitant? Want to try, but worried that your small capital won’t make a splash? Dare to enter but afraid of being swept away by the market as a “newbie” who gets caught? In the end, losing everything? You’re not alone. Many people are stuck in the internal struggle of “wanting to make money but afraid of losses.” But the secret to wealth in

View OriginalEvery time you see stories of “turning a few thousand into millions” in the crypto circle, do you feel excited but also hesitant? Want to try, but worried that your small capital won’t make a splash? Dare to enter but afraid of being swept away by the market as a “newbie” who gets caught? In the end, losing everything? You’re not alone. Many people are stuck in the internal struggle of “wanting to make money but afraid of losses.” But the secret to wealth in

- Reward

- like

- Comment

- Repost

- Share

If you've also experienced ups and downs in the crypto world, perhaps these four survival rules, which I’ve developed over eight years, can light the way for you.

In the winter of 2016, I was curled up on a moldy bed in a Shenzhen village, the glow of my phone screen reflecting a balance of only 198.73 yuan in my bank account — not even enough to buy a 15-yuan rice bowl. I endured such days for seventeen months.

Eight years later, I stand at Shenzhen Bay One, watching my account balance jump to 23.76 million. This isn’t luck; it’s the result of four ironclad rules I’ve learned through blood, t

View OriginalIn the winter of 2016, I was curled up on a moldy bed in a Shenzhen village, the glow of my phone screen reflecting a balance of only 198.73 yuan in my bank account — not even enough to buy a 15-yuan rice bowl. I endured such days for seventeen months.

Eight years later, I stand at Shenzhen Bay One, watching my account balance jump to 23.76 million. This isn’t luck; it’s the result of four ironclad rules I’ve learned through blood, t

- Reward

- like

- Comment

- Repost

- Share

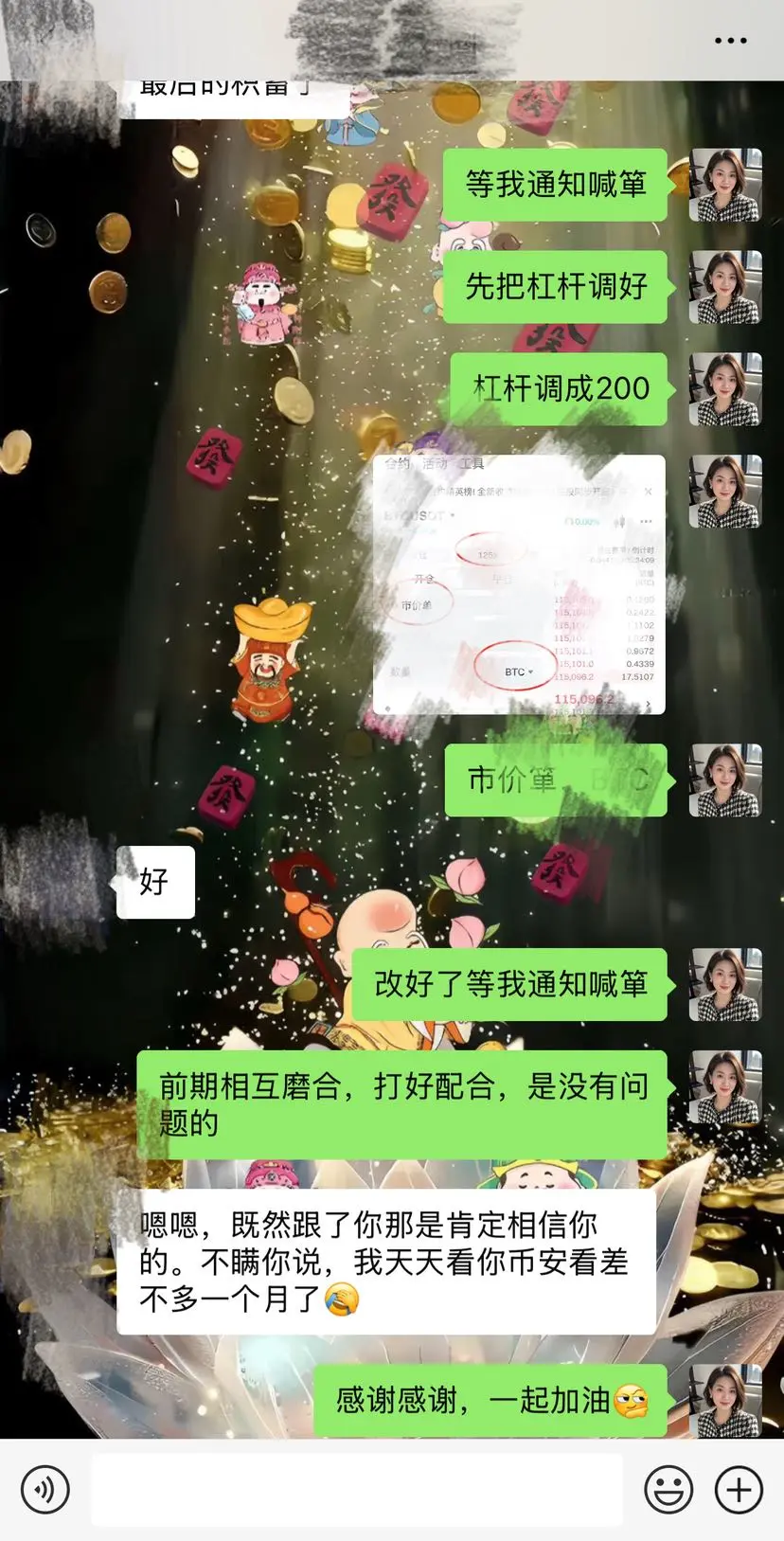

From $3,000 to $75,000 in just 7 weeks.

This isn't some get-rich-quick myth; it's a real story happening right around me — the sharer lives next door.

He didn't blow up his account, nor did he bet his entire life savings. As he puts it, “After being in the crypto world for a while, I realized that relying on luck won’t get you far.”

Back then, he only had $3,000 in his account, and even opening his trading app took courage. “It felt like my heart was being emptied out,” he recalls, “but I refused to give up.”

He had also chased after quick gains, trying to catch the market’s ups and downs in

View OriginalThis isn't some get-rich-quick myth; it's a real story happening right around me — the sharer lives next door.

He didn't blow up his account, nor did he bet his entire life savings. As he puts it, “After being in the crypto world for a while, I realized that relying on luck won’t get you far.”

Back then, he only had $3,000 in his account, and even opening his trading app took courage. “It felt like my heart was being emptied out,” he recalls, “but I refused to give up.”

He had also chased after quick gains, trying to catch the market’s ups and downs in

- Reward

- like

- Comment

- Repost

- Share

Stock Market Turmoil + Government Shutdown: Short-Term Pain, Long-Term Crypto Opportunities

Currently, the U.S. stock market has experienced a significant decline, internal Federal Reserve policy disagreements have intensified, and the U.S. government shutdown continues—these three major events are intertwined, plunging global financial markets into a vortex of "high risk, high volatility." For cryptocurrencies, this short-term shock brings downward pressure, but from a medium- to long-term perspective, it may actually serve as an important opportunity for core assets like Bitcoin to stand out

View OriginalCurrently, the U.S. stock market has experienced a significant decline, internal Federal Reserve policy disagreements have intensified, and the U.S. government shutdown continues—these three major events are intertwined, plunging global financial markets into a vortex of "high risk, high volatility." For cryptocurrencies, this short-term shock brings downward pressure, but from a medium- to long-term perspective, it may actually serve as an important opportunity for core assets like Bitcoin to stand out

- Reward

- 1

- 1

- Repost

- Share

SilentlyHoldingTheBottomEdge :

:

Charge! 😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀Recently, the crypto market has been swinging wildly, and many newcomers are feeling uneasy. Some keep asking me, “Has this bull run already ended?”

As a veteran who has experienced two cycles of bull and bear markets, I want to say: Pullbacks and fluctuations are part of a bull market. Today, I’d like to share five signals that still give me confidence in the future market. Beginners don’t need to panic over short-term volatility.

1. Liquidity Turning Point Is Near

Next week, the quantitative tightening (QT) is expected to officially end, which means more “water” will flow back into the mar

View OriginalAs a veteran who has experienced two cycles of bull and bear markets, I want to say: Pullbacks and fluctuations are part of a bull market. Today, I’d like to share five signals that still give me confidence in the future market. Beginners don’t need to panic over short-term volatility.

1. Liquidity Turning Point Is Near

Next week, the quantitative tightening (QT) is expected to officially end, which means more “water” will flow back into the mar

- Reward

- 1

- Comment

- Repost

- Share

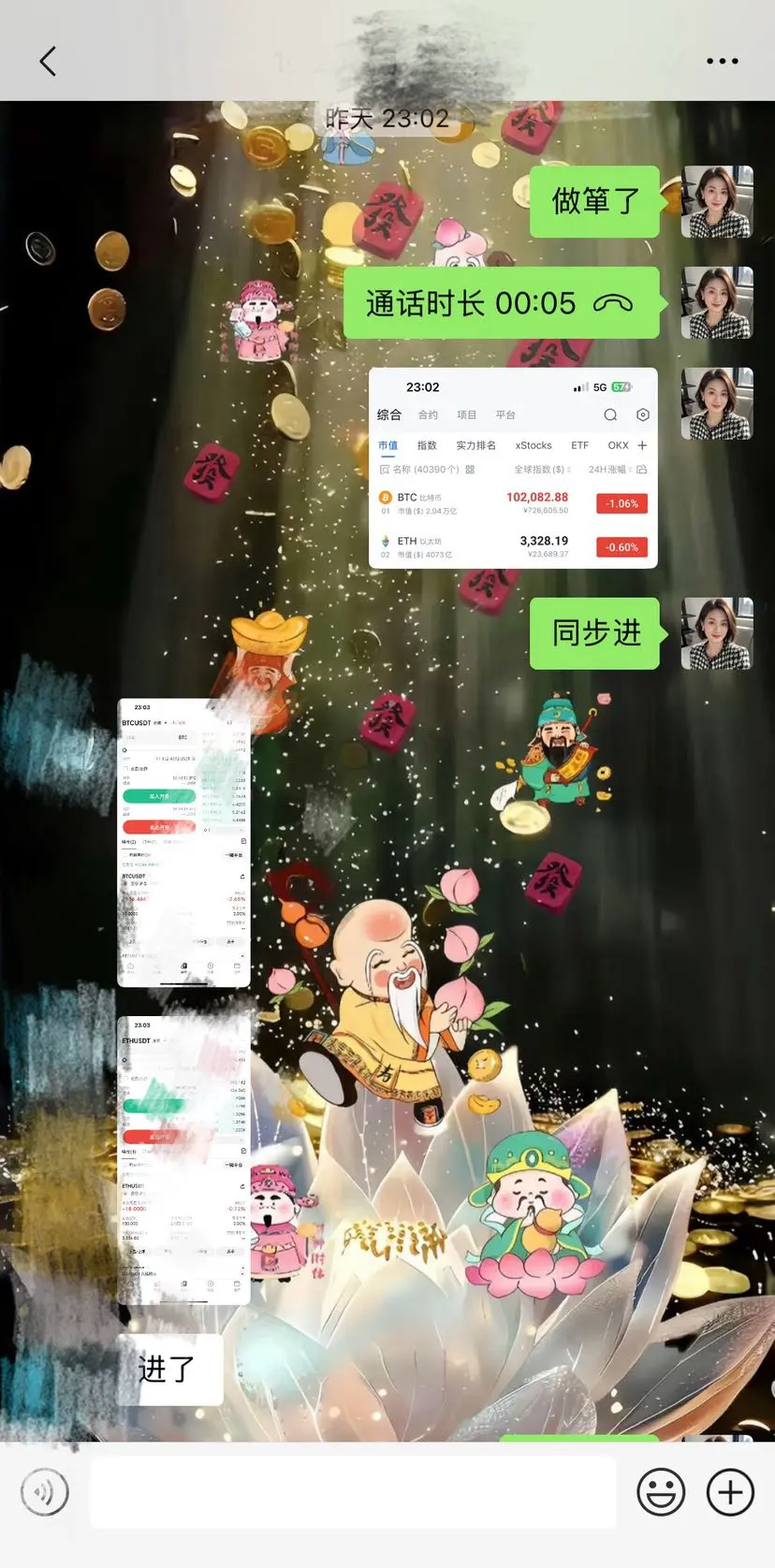

November 7 Morning Moonlight Market Analysis and Strategy

From the four-hour chart perspective, the market has consecutively formed several bearish candles, indicating a overall sideways downward trend. Currently, the price is moving within a descending channel, with the Bollinger Bands' three lines all trending downward, suggesting that the bearish momentum remains dominant. The bullish rebound strength is relatively weak, and the overall trend remains bearish.

Bitcoin (BTC): Consider short positions around the 10,150-10,200 range, with a target near 9,920.

Ethereum (ETH): Enter short positio

View OriginalFrom the four-hour chart perspective, the market has consecutively formed several bearish candles, indicating a overall sideways downward trend. Currently, the price is moving within a descending channel, with the Bollinger Bands' three lines all trending downward, suggesting that the bearish momentum remains dominant. The bullish rebound strength is relatively weak, and the overall trend remains bearish.

Bitcoin (BTC): Consider short positions around the 10,150-10,200 range, with a target near 9,920.

Ethereum (ETH): Enter short positio

- Reward

- like

- 1

- Repost

- Share

ThreeStonesNotes :

:

Mutual exchange, creating the future together🤝🤝🤝🤝🤝🤝🤝🤝🤝🤝11.6 Today's Student Summary

Market sentiment is shifting, so decisive portfolio adjustments are necessary. During increased volatility, strict stop-losses are the top priority to protect your principal. Take profits when gains are evident; steady and cautious progress is the long-term approach. The essence of trading lies in precise judgment and unwavering action.

View OriginalMarket sentiment is shifting, so decisive portfolio adjustments are necessary. During increased volatility, strict stop-losses are the top priority to protect your principal. Take profits when gains are evident; steady and cautious progress is the long-term approach. The essence of trading lies in precise judgment and unwavering action.

- Reward

- like

- Comment

- Repost

- Share

Tonight's Data Storm Approaching: My "Stability" Strategy Share

Tonight, the U.S. unemployment claims data will be released—widely known as a "market catalyst." Experienced traders don't fear trends; they fear sudden data shocks. The impact pathway is quite clear:

- If the data is strong (fewer unemployment claims): The market will delay expectations of Fed rate cuts, and risk assets may face pressure.

- If the data is weak (more unemployment claims): Rate cut expectations will rise, potentially giving the market a short-term boost.

In the face of this uncertainty, my core strategy is "Stay ca

View OriginalTonight, the U.S. unemployment claims data will be released—widely known as a "market catalyst." Experienced traders don't fear trends; they fear sudden data shocks. The impact pathway is quite clear:

- If the data is strong (fewer unemployment claims): The market will delay expectations of Fed rate cuts, and risk assets may face pressure.

- If the data is weak (more unemployment claims): Rate cut expectations will rise, potentially giving the market a short-term boost.

In the face of this uncertainty, my core strategy is "Stay ca

- Reward

- like

- Comment

- Repost

- Share

Breaking News! Will the Federal Reserve Pause Rate Cuts in December? Amidst Market Turbulence, Retail Investors’ Opportunity Window Has Opened!

Just caught the latest update: The U.S. government shutdown is distorting economic data, making a December rate cut pause highly likely. This move caught the global markets off guard. Crypto enthusiasts, don’t panic—this isn’t the end. Instead, it could be a key moment to identify real opportunities!

Let’s clarify the logic: The Fed’s pause on rate cuts essentially means short-term liquidity tightening, which could strengthen the U.S. dollar index. For

View OriginalJust caught the latest update: The U.S. government shutdown is distorting economic data, making a December rate cut pause highly likely. This move caught the global markets off guard. Crypto enthusiasts, don’t panic—this isn’t the end. Instead, it could be a key moment to identify real opportunities!

Let’s clarify the logic: The Fed’s pause on rate cuts essentially means short-term liquidity tightening, which could strengthen the U.S. dollar index. For

- Reward

- like

- Comment

- Repost

- Share

When "Digital Gold" Loses Its Shine: What Are We Really Investing in When We Buy Bitcoin?

A friend showed me her Bitcoin holdings, and the chart was so flat it was almost suffocating. “After nearly a year of holding, my returns can’t even beat the 3% annual yield of a money market fund,” she said, her disappointment evident.

Looking at her account, the facts are undeniable: her funds have been locked up for nearly a year, incurring significant opportunity costs. Meanwhile, traditional assets like U.S. stocks, gold, and even A-shares have offered more attractive returns. The once-promising "dig

View OriginalA friend showed me her Bitcoin holdings, and the chart was so flat it was almost suffocating. “After nearly a year of holding, my returns can’t even beat the 3% annual yield of a money market fund,” she said, her disappointment evident.

Looking at her account, the facts are undeniable: her funds have been locked up for nearly a year, incurring significant opportunity costs. Meanwhile, traditional assets like U.S. stocks, gold, and even A-shares have offered more attractive returns. The once-promising "dig

- Reward

- like

- Comment

- Repost

- Share

After 14 consecutive wins totaling $46 million, a trading whale is celebrated as a deity.

On the 15th trade, the account hits zero.

The market demonstrates its fundamental laws in the cruelest way: it doesn't mind how many times you win, as long as one mistake is enough to wipe out everything.

This isn't a matter of luck; it's a cognitive trap.

Those 14 wins were essentially capturing profits from market volatility; but the final failure revealed a complete neglect of systemic risk.

As global liquidity recedes, a brutal “musical chairs” game has already begun. Participants relying on leverage,

View OriginalOn the 15th trade, the account hits zero.

The market demonstrates its fundamental laws in the cruelest way: it doesn't mind how many times you win, as long as one mistake is enough to wipe out everything.

This isn't a matter of luck; it's a cognitive trap.

Those 14 wins were essentially capturing profits from market volatility; but the final failure revealed a complete neglect of systemic risk.

As global liquidity recedes, a brutal “musical chairs” game has already begun. Participants relying on leverage,

- Reward

- 1

- 1

- Repost

- Share

那个戒色男人 :

:

😊😅After losing 80% of my capital, I finally understood: a bull market is never a given gift.

The warning beeps from liquidation sounded shrill at first, then numb. The red and green candles on the chart blurred into faint shadows. When your account balance is down to just a fraction of your initial principal, the most deadly thing isn’t the shrinking numbers—it's the crumbling belief that kept you awake through countless late nights watching the market, which suddenly collapses.

Until one early morning, staring at an empty position, I was jolted awake:

Bull markets never kill the determined; wha

View OriginalThe warning beeps from liquidation sounded shrill at first, then numb. The red and green candles on the chart blurred into faint shadows. When your account balance is down to just a fraction of your initial principal, the most deadly thing isn’t the shrinking numbers—it's the crumbling belief that kept you awake through countless late nights watching the market, which suddenly collapses.

Until one early morning, staring at an empty position, I was jolted awake:

Bull markets never kill the determined; wha

- Reward

- like

- Comment

- Repost

- Share

Market Panic Spreads, But The Truth Is Hidden in the Data

BTC and ETH drop sharply again, with whales continuously reducing their holdings—sounds of “a bear market is coming” are everywhere.

But don’t let emotions lead you astray—behind this decline, there are two key signals.

---

🔍 Signal One: Whales Selling ≠ Faith Collapse

Whale selling isn’t a sign of bearishness about the future; it’s active risk management amid tightening liquidity.

The current issue isn’t trend reversal but a “liquidity crunch”:

· US Treasury yields rising

· ETF net outflows continue

· Leverage liquidations

View OriginalBTC and ETH drop sharply again, with whales continuously reducing their holdings—sounds of “a bear market is coming” are everywhere.

But don’t let emotions lead you astray—behind this decline, there are two key signals.

---

🔍 Signal One: Whales Selling ≠ Faith Collapse

Whale selling isn’t a sign of bearishness about the future; it’s active risk management amid tightening liquidity.

The current issue isn’t trend reversal but a “liquidity crunch”:

· US Treasury yields rising

· ETF net outflows continue

· Leverage liquidations

- Reward

- like

- Comment

- Repost

- Share