#NFPBeatsExpectations

NFP Beats Expectations — Full Market, Historical & Crypto Analysis (January 2026)

The U.S. Non-Farm Payrolls (NFP) report for January 2026 significantly beat expectations, with 130,000 jobs added versus a forecast of 70,000, and the unemployment rate falling to 4.3%. Wages continued modestly upward, signaling a resilient labor market. This stronger-than-expected print immediately affected global markets, risk sentiment, and cryptocurrencies, highlighting why NFP remains one of the most closely watched economic indicators.

What the NFP Report Measures

The NFP is part of the Bureau of Labor Statistics’ Employment Situation summary and tracks the change in paid workers in the U.S. economy, excluding:

Farm workers (highly seasonal)

Private household employees

Nonprofit organization employees

Self-employed, volunteers, and active military

It covers roughly 80% of U.S. employment, focusing on industries like manufacturing, construction, services, healthcare, retail, finance, and government (non-military).

Two main surveys form the report:

Establishment Survey (Payroll Survey) – ~149,000 businesses & government agencies; provides headline NFP change, hours worked, and earnings by industry.

Household Survey – ~60,000 households; provides unemployment rate, labor force participation, and demographic breakdowns.

Key components include Headline Nonfarm Payroll Change, Unemployment Rate, Average Hourly Earnings, Average Weekly Hours, Labor Force Participation, Industry Breakdowns, Private Payrolls, and Revisions to prior months.

January 2026 NFP Highlights

Jobs Added: +130,000 (well above the consensus 66,000–70,000; December revised down to +48,000)

Unemployment Rate: 4.3% (slightly lower than December’s 4.4%; expected ~4.4%)

Private Sector Jobs: +172,000 (stronger than headline due to government losses)

Top Gainers: Health care (+82,000), Social Assistance (+41,600), Construction (+33,000), Business/Professional Services (+34,000)

Notable Declines: Federal Government (-42,000), some financial sub-sectors

Wages: Annual growth ~3.7%, indicating modest inflation pressures

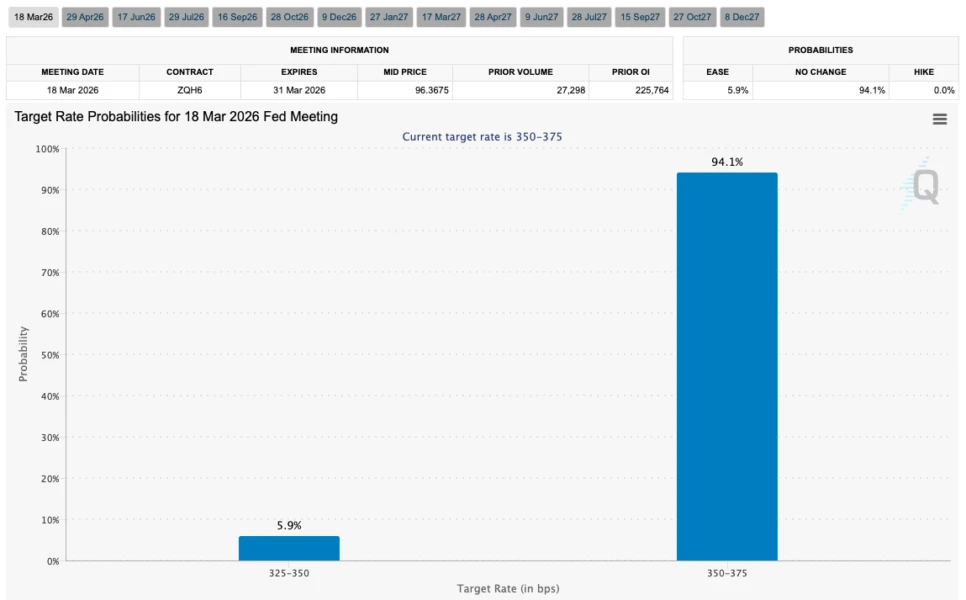

This strong labor report reinforced economic strength, reduced near-term Fed rate-cut expectations, strengthened the USD, pushed Treasury yields higher, and triggered volatility in risk assets, particularly crypto.

Macro & Traditional Market Reactions

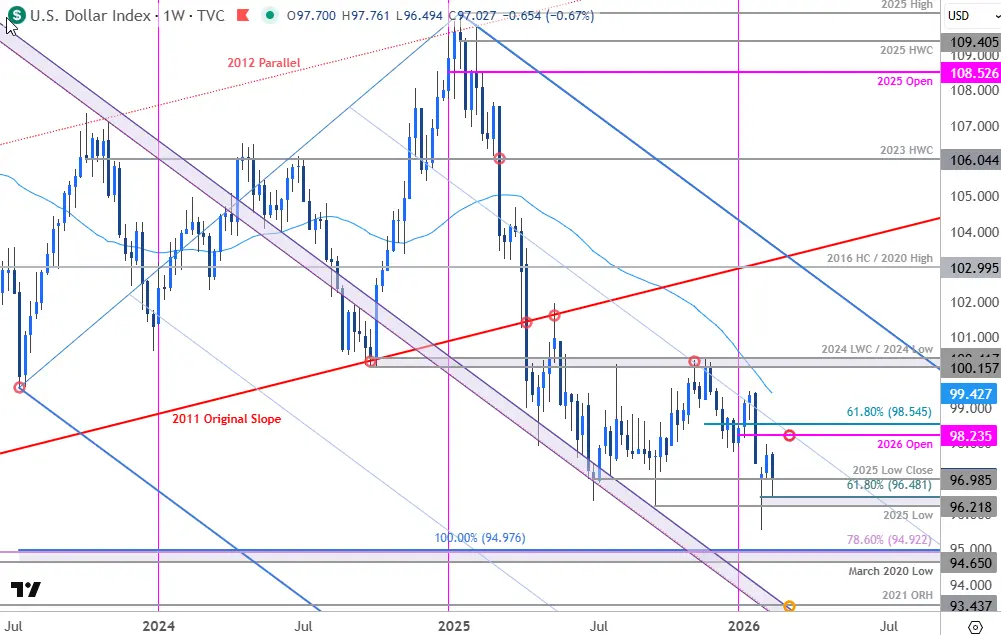

1️⃣ U.S. Dollar (USD)

Strengthened as markets priced in higher-for-longer rates.

Traders reduced expectations for near-term cuts.

2️⃣ Treasury Yields

2-year & 10-year yields spiked, reflecting expectations the Fed will hold rates steady.

Higher yields increased the opportunity cost of holding risk assets.

3️⃣ Equities

Mixed performance: growth and tech sectors pressured by higher rate expectations.

Broader indices steadied, but intraday volatility rose.

4️⃣ Commodities & Safe Havens

Gold dipped, losing safe-haven demand.

Energy & industrial metals gained slightly, reflecting optimism for economic growth.

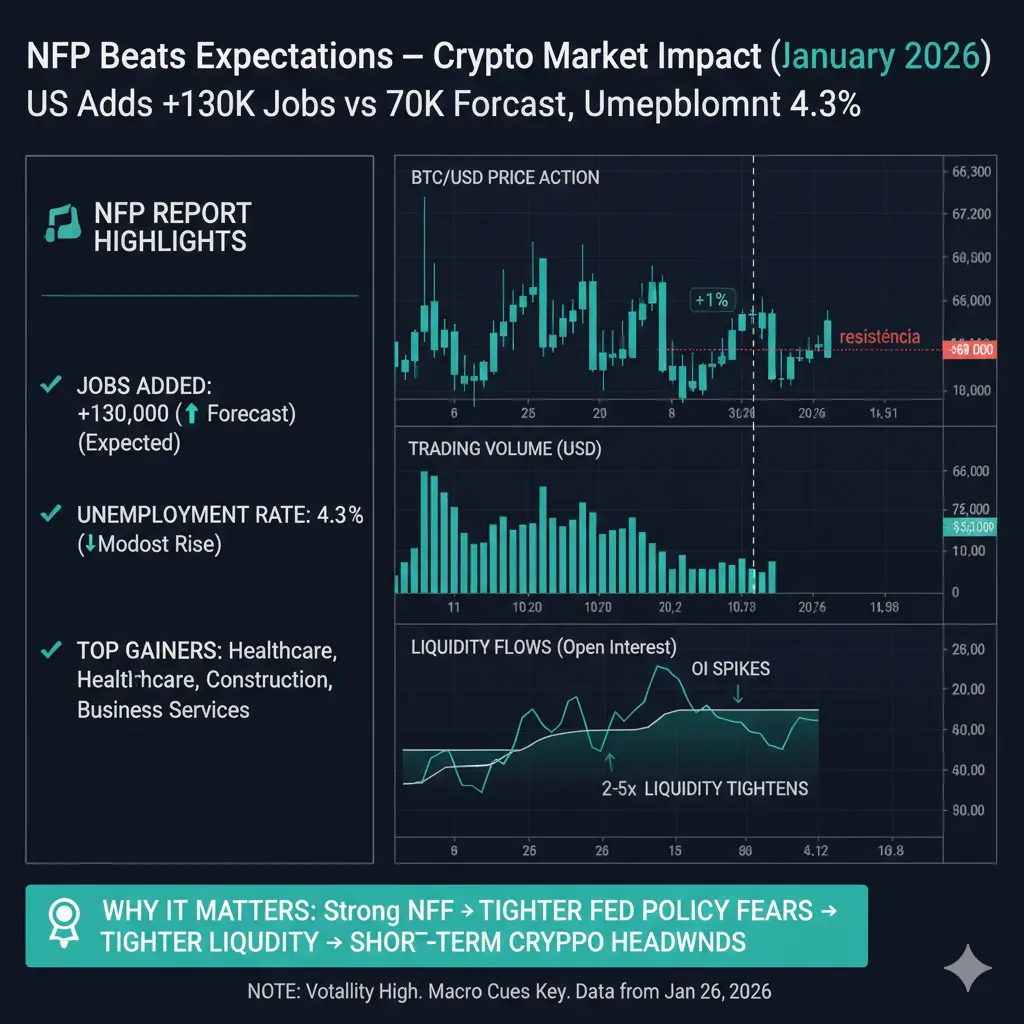

Crypto Market Reaction

Crypto is highly sensitive to macroeconomic surprises:

Bitcoin (BTC)

Pre-NFP: ~$66,000–$67,000, with traders cautious.

Post-NFP: Briefly rebounded above $67,000, but failed to hold, trending sideways near $66,000–$67,000.

Attempts to break $69,000 resistance failed amid cautious Fed outlook.

Ethereum & Altcoins

Volatility ranged ±5–12%, moving in sync with BTC.

Total crypto market cap experienced temporary pullbacks after initial spikes.

Liquidity & Volume

Trading volumes surged 2–5x around the release.

Open interest in futures increased, highlighting leveraged positioning.

Overall crypto liquidity temporarily tightened due to recalibration of risk sentiment.

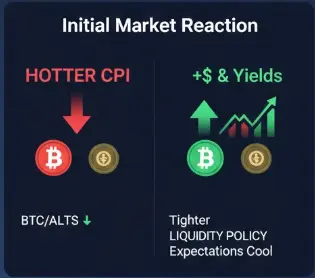

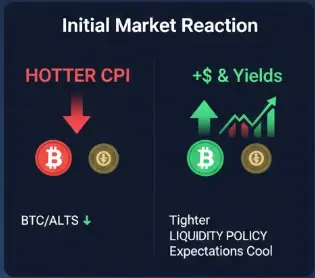

Why Crypto Reacts This Way:

Strong Jobs Data → Fed may delay cuts → Tighter liquidity → Short-term downward pressure on non-yielding assets

Higher Yields → Opportunity cost rises → BTC & altcoins face pressure

Market Psychology → Traders adjust quickly, creating volatility

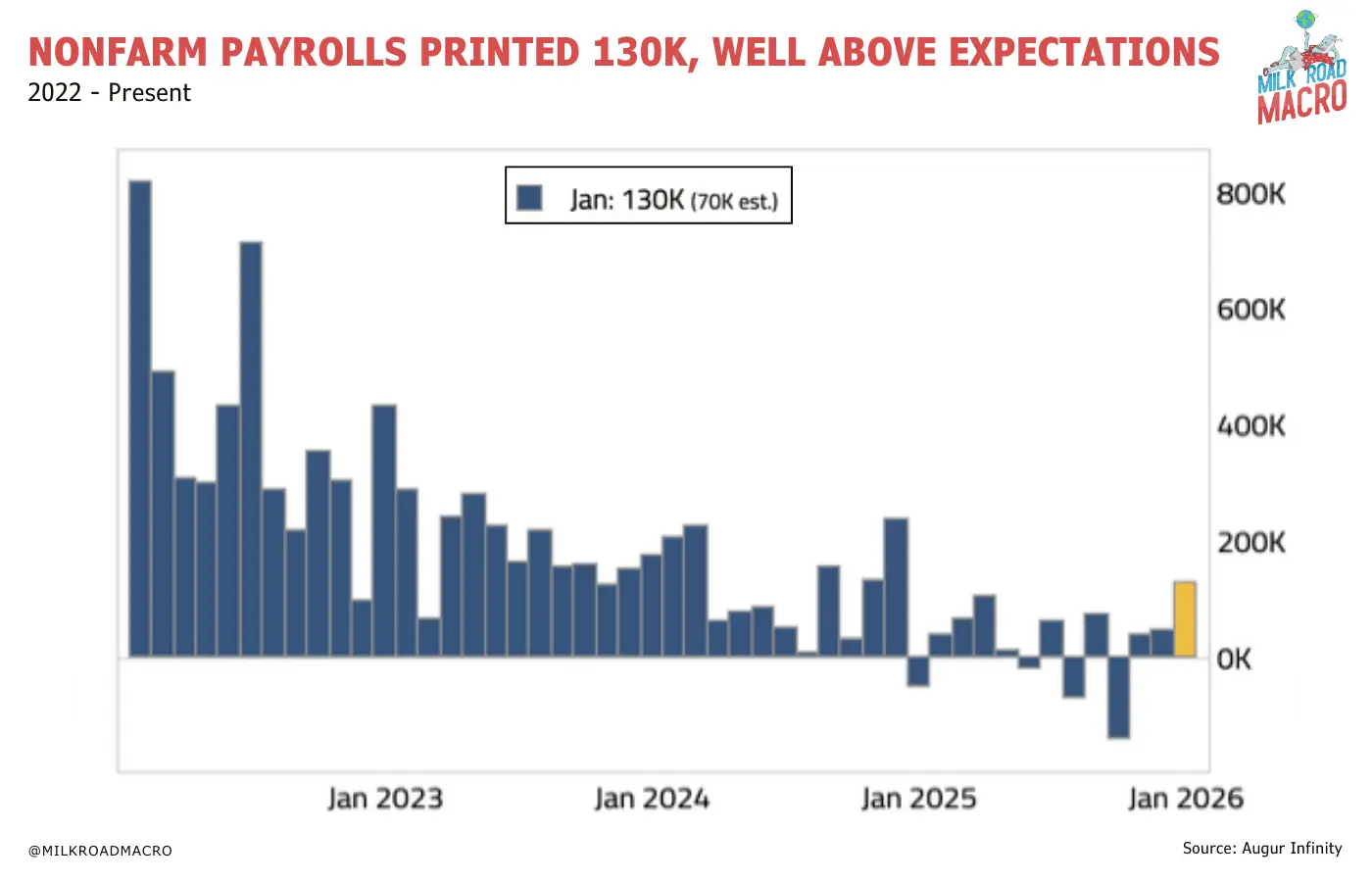

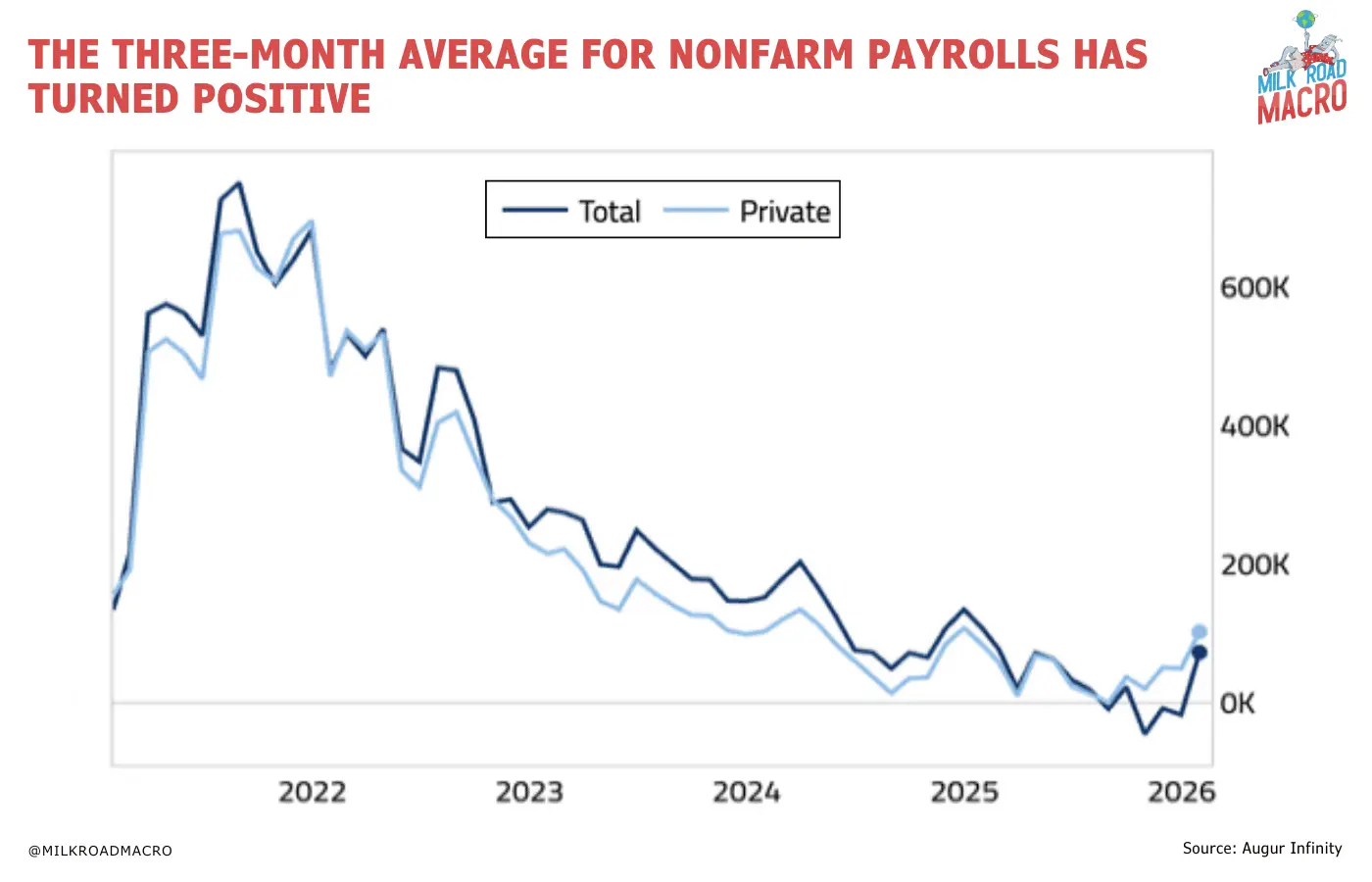

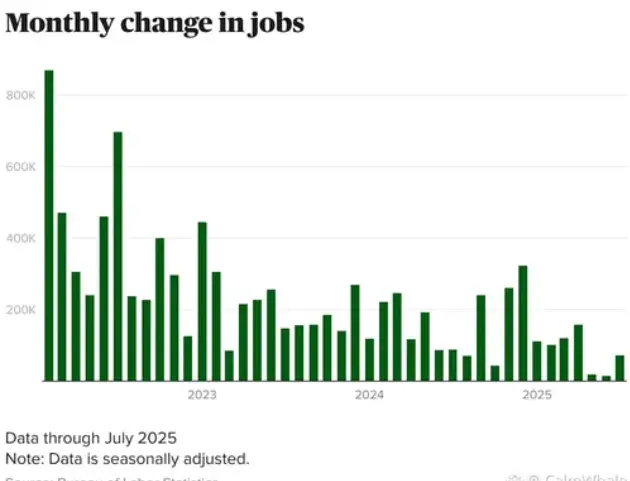

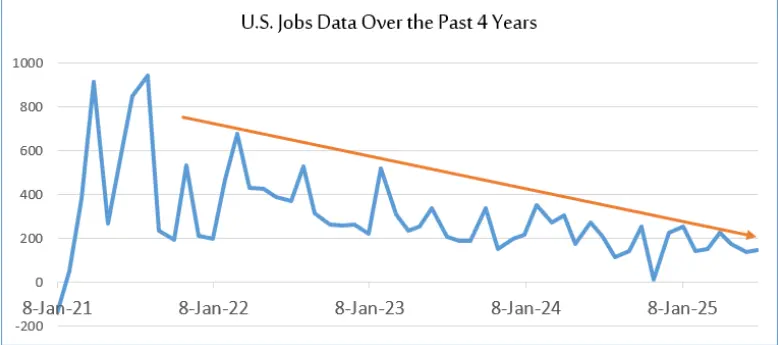

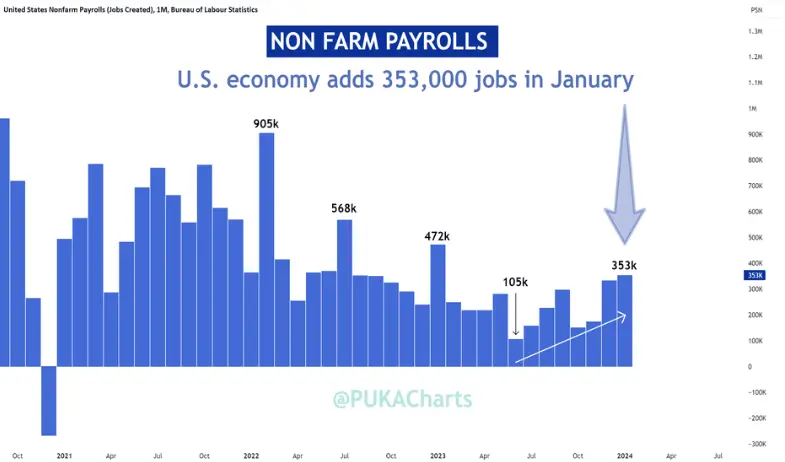

Historical Context

Long-term NFP trends provide insight into the U.S. labor market’s health:

Long-run average (1939–2026): ~123,000 jobs/month

Record highs: Post-COVID rebounds (June 2020 +4.63M, May 2020 +2.61M)

Record lows: Pandemic lockdowns (April 2020 -20.47M), 2008–09 recession significant drops

Recent Decade Trends:

2015–2019: 150–250k/month; low unemployment (~3.5–4%)

2020–2022: Extreme volatility, followed by robust recovery (300k–800k+ monthly gains)

2023–2024: Moderate positive growth (~150–250k/month)

2025: Significant slowdown; final revisions cut annual gains from +584k to +181k (avg. ~15k/month)

Insights:

NFP surges in expansions, plunges in recessions

Revisions can dramatically alter market perception (2025 downward adjustment notable)

Strong beats, like January 2026, boost USD, raise yields, and temporarily pressure risk assets including crypto

Key Takeaways

Macro Strength: Strong NFP confirms labor market resilience → supports USD & yields

Crypto Impact: BTC briefly rallied but faced sideways pressure; liquidity tightened

Volatility: Trading volume surged, and short-term swings were pronounced

Risk Sentiment: Strong macro data reduces appetite for speculative assets temporarily

Historical Significance: January 2026 shows resilience amid broader cooling trends from 2025

Bottom Line:

The January 2026 NFP report beat expectations, demonstrating U.S. labor market strength. While this reinforces economic stability and strengthens the USD, it also creates temporary headwinds for crypto due to tighter liquidity and lower Fed easing expectations. Traders and investors should monitor macro indicators, liquidity, and market positioning to navigate the short-term volatility effectively.

NFP Beats Expectations — Full Market, Historical & Crypto Analysis (January 2026)

The U.S. Non-Farm Payrolls (NFP) report for January 2026 significantly beat expectations, with 130,000 jobs added versus a forecast of 70,000, and the unemployment rate falling to 4.3%. Wages continued modestly upward, signaling a resilient labor market. This stronger-than-expected print immediately affected global markets, risk sentiment, and cryptocurrencies, highlighting why NFP remains one of the most closely watched economic indicators.

What the NFP Report Measures

The NFP is part of the Bureau of Labor Statistics’ Employment Situation summary and tracks the change in paid workers in the U.S. economy, excluding:

Farm workers (highly seasonal)

Private household employees

Nonprofit organization employees

Self-employed, volunteers, and active military

It covers roughly 80% of U.S. employment, focusing on industries like manufacturing, construction, services, healthcare, retail, finance, and government (non-military).

Two main surveys form the report:

Establishment Survey (Payroll Survey) – ~149,000 businesses & government agencies; provides headline NFP change, hours worked, and earnings by industry.

Household Survey – ~60,000 households; provides unemployment rate, labor force participation, and demographic breakdowns.

Key components include Headline Nonfarm Payroll Change, Unemployment Rate, Average Hourly Earnings, Average Weekly Hours, Labor Force Participation, Industry Breakdowns, Private Payrolls, and Revisions to prior months.

January 2026 NFP Highlights

Jobs Added: +130,000 (well above the consensus 66,000–70,000; December revised down to +48,000)

Unemployment Rate: 4.3% (slightly lower than December’s 4.4%; expected ~4.4%)

Private Sector Jobs: +172,000 (stronger than headline due to government losses)

Top Gainers: Health care (+82,000), Social Assistance (+41,600), Construction (+33,000), Business/Professional Services (+34,000)

Notable Declines: Federal Government (-42,000), some financial sub-sectors

Wages: Annual growth ~3.7%, indicating modest inflation pressures

This strong labor report reinforced economic strength, reduced near-term Fed rate-cut expectations, strengthened the USD, pushed Treasury yields higher, and triggered volatility in risk assets, particularly crypto.

Macro & Traditional Market Reactions

1️⃣ U.S. Dollar (USD)

Strengthened as markets priced in higher-for-longer rates.

Traders reduced expectations for near-term cuts.

2️⃣ Treasury Yields

2-year & 10-year yields spiked, reflecting expectations the Fed will hold rates steady.

Higher yields increased the opportunity cost of holding risk assets.

3️⃣ Equities

Mixed performance: growth and tech sectors pressured by higher rate expectations.

Broader indices steadied, but intraday volatility rose.

4️⃣ Commodities & Safe Havens

Gold dipped, losing safe-haven demand.

Energy & industrial metals gained slightly, reflecting optimism for economic growth.

Crypto Market Reaction

Crypto is highly sensitive to macroeconomic surprises:

Bitcoin (BTC)

Pre-NFP: ~$66,000–$67,000, with traders cautious.

Post-NFP: Briefly rebounded above $67,000, but failed to hold, trending sideways near $66,000–$67,000.

Attempts to break $69,000 resistance failed amid cautious Fed outlook.

Ethereum & Altcoins

Volatility ranged ±5–12%, moving in sync with BTC.

Total crypto market cap experienced temporary pullbacks after initial spikes.

Liquidity & Volume

Trading volumes surged 2–5x around the release.

Open interest in futures increased, highlighting leveraged positioning.

Overall crypto liquidity temporarily tightened due to recalibration of risk sentiment.

Why Crypto Reacts This Way:

Strong Jobs Data → Fed may delay cuts → Tighter liquidity → Short-term downward pressure on non-yielding assets

Higher Yields → Opportunity cost rises → BTC & altcoins face pressure

Market Psychology → Traders adjust quickly, creating volatility

Historical Context

Long-term NFP trends provide insight into the U.S. labor market’s health:

Long-run average (1939–2026): ~123,000 jobs/month

Record highs: Post-COVID rebounds (June 2020 +4.63M, May 2020 +2.61M)

Record lows: Pandemic lockdowns (April 2020 -20.47M), 2008–09 recession significant drops

Recent Decade Trends:

2015–2019: 150–250k/month; low unemployment (~3.5–4%)

2020–2022: Extreme volatility, followed by robust recovery (300k–800k+ monthly gains)

2023–2024: Moderate positive growth (~150–250k/month)

2025: Significant slowdown; final revisions cut annual gains from +584k to +181k (avg. ~15k/month)

Insights:

NFP surges in expansions, plunges in recessions

Revisions can dramatically alter market perception (2025 downward adjustment notable)

Strong beats, like January 2026, boost USD, raise yields, and temporarily pressure risk assets including crypto

Key Takeaways

Macro Strength: Strong NFP confirms labor market resilience → supports USD & yields

Crypto Impact: BTC briefly rallied but faced sideways pressure; liquidity tightened

Volatility: Trading volume surged, and short-term swings were pronounced

Risk Sentiment: Strong macro data reduces appetite for speculative assets temporarily

Historical Significance: January 2026 shows resilience amid broader cooling trends from 2025

Bottom Line:

The January 2026 NFP report beat expectations, demonstrating U.S. labor market strength. While this reinforces economic stability and strengthens the USD, it also creates temporary headwinds for crypto due to tighter liquidity and lower Fed easing expectations. Traders and investors should monitor macro indicators, liquidity, and market positioning to navigate the short-term volatility effectively.