# GoldandSilverHitNewHighs

11.28K

Gold and silver both reached record highs as safe-haven demand increased. Are you adding precious metals here? What’s your strategy?

Yusfirah

#GoldandSilverHitNewHighs

Gold and Silver Hit Record Highs Analyzing Safe-Haven Demand, Market Drivers, and Strategic Opportunities for Precious Metals Investors

Gold and silver have recently reached record highs, driven by surging demand for safe-haven assets amid increasing market volatility and macroeconomic uncertainty. As investors seek protection from inflation, geopolitical risks, and fluctuating equities and crypto markets, precious metals have once again demonstrated their role as reliable stores of value. This trend highlights the enduring appeal of gold and silver as both hedges ag

Gold and Silver Hit Record Highs Analyzing Safe-Haven Demand, Market Drivers, and Strategic Opportunities for Precious Metals Investors

Gold and silver have recently reached record highs, driven by surging demand for safe-haven assets amid increasing market volatility and macroeconomic uncertainty. As investors seek protection from inflation, geopolitical risks, and fluctuating equities and crypto markets, precious metals have once again demonstrated their role as reliable stores of value. This trend highlights the enduring appeal of gold and silver as both hedges ag

- Reward

- 8

- 14

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

As of January 20, 2026, the global financial system is experiencing one of the most significant "tectonic shifts" in modern economic history, witnessing a dramatic "collapse of trust" and the subsequent magnificent surge of precious metals. The developments gathering under the hashtag #GoldandSilverHitNewHighs are more than just green numbers on price tickers; they represent the story of the paper currency empire—built since the 1944 Bretton Woods system—crashing into the hard wall of physical reality.

Here is an in-depth analysis of the "perfect storm" that has prop

As of January 20, 2026, the global financial system is experiencing one of the most significant "tectonic shifts" in modern economic history, witnessing a dramatic "collapse of trust" and the subsequent magnificent surge of precious metals. The developments gathering under the hashtag #GoldandSilverHitNewHighs are more than just green numbers on price tickers; they represent the story of the paper currency empire—built since the 1944 Bretton Woods system—crashing into the hard wall of physical reality.

Here is an in-depth analysis of the "perfect storm" that has prop

SXP5.07%

- Reward

- 34

- 27

- Repost

- Share

xiaoXiao :

:

2026 Go Go Go 👊View More

#GoldandSilverHitNewHighs

On January 19, 2026, gold and silver surged to all-time or near-record highs, reflecting major shifts in global financial markets. Investors are rushing into precious metals as traditional markets face volatility and uncertainty, while Bitcoin has reacted differently.

📊 Current Prices (Approx) — Gold & Silver

🌍 International Spot Prices

Gold: ~$4,663 per ounce — all-time highs.

Silver: ~$92.93 per ounce — also near record levels.

🇵🇰 Pakistan Market (Approximate Local Prices)

Gold per tola: ~Rs 481,000+

Gold per 10 g: ~Rs 413,000+

Silver per tola: ~Rs 9,400+

💡 Ob

On January 19, 2026, gold and silver surged to all-time or near-record highs, reflecting major shifts in global financial markets. Investors are rushing into precious metals as traditional markets face volatility and uncertainty, while Bitcoin has reacted differently.

📊 Current Prices (Approx) — Gold & Silver

🌍 International Spot Prices

Gold: ~$4,663 per ounce — all-time highs.

Silver: ~$92.93 per ounce — also near record levels.

🇵🇰 Pakistan Market (Approximate Local Prices)

Gold per tola: ~Rs 481,000+

Gold per 10 g: ~Rs 413,000+

Silver per tola: ~Rs 9,400+

💡 Ob

- Reward

- 21

- 28

- Repost

- Share

CryptoVortex :

:

2026 GOGOGO 👊View More

Gold remains "steady," while silver moves "aggressively," with capital preferences already diverging

Although gold and silver are reaching new highs together, the underlying capital attributes of the two are quietly diverging. The rise of gold is more dominated by "conservative capital," while silver clearly attracts more trading and aggressive capital.

Gold's advantages are:

* Continual accumulation by global central banks

* Relatively controllable volatility

* Clear macro risk hedging properties

In contrast, silver's characteristics are:

* Combination of financial and industrial attributes

*

View OriginalAlthough gold and silver are reaching new highs together, the underlying capital attributes of the two are quietly diverging. The rise of gold is more dominated by "conservative capital," while silver clearly attracts more trading and aggressive capital.

Gold's advantages are:

* Continual accumulation by global central banks

* Relatively controllable volatility

* Clear macro risk hedging properties

In contrast, silver's characteristics are:

* Combination of financial and industrial attributes

*

- Reward

- 7

- 8

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

#GoldandSilverHitNewHighs 🏆💰

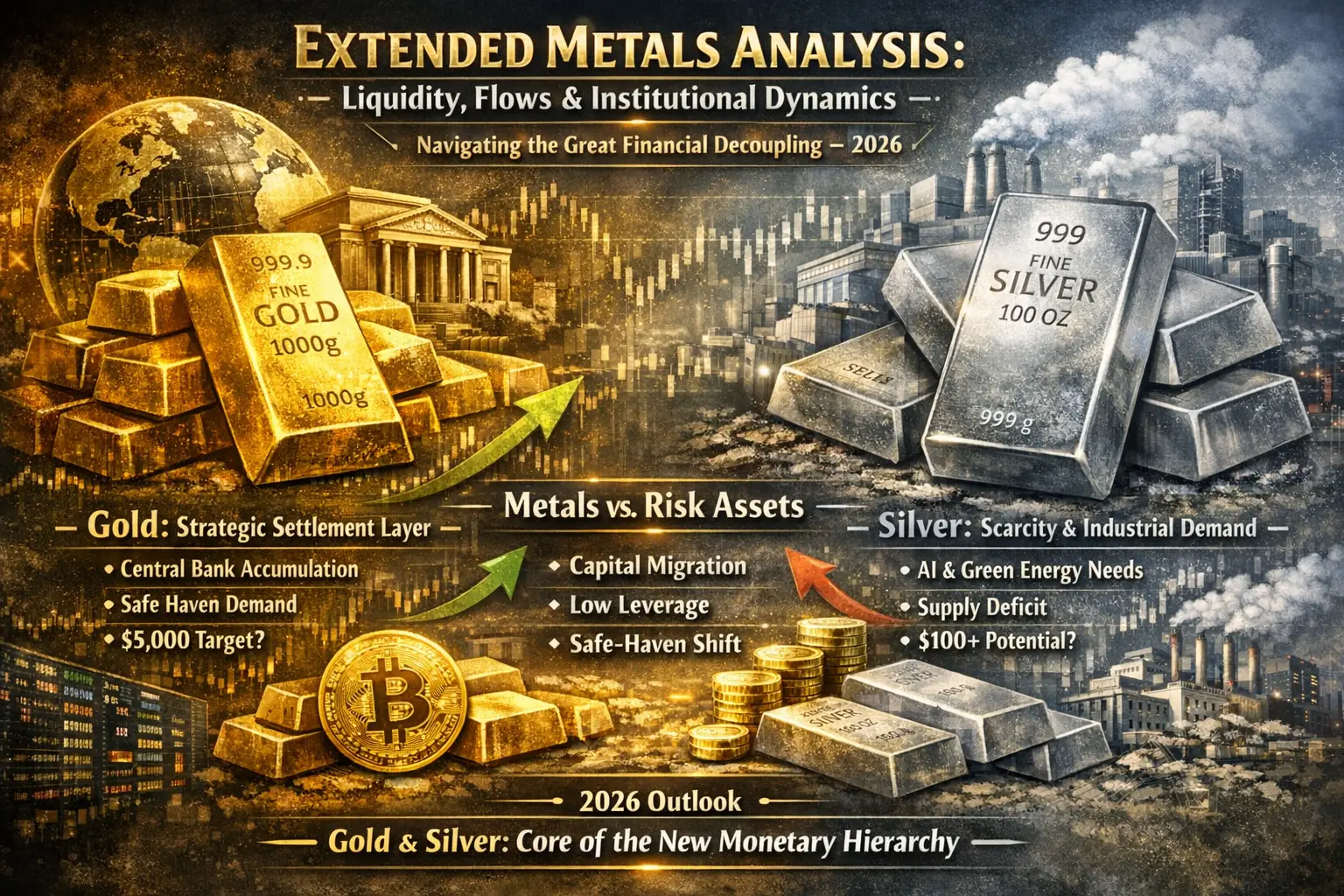

In 2026, the financial landscape is undergoing a major structural shift. Gold and Silver are breaking records, not as a fleeting spike, but as part of a long-term capital reallocation, while Bitcoin and other risk assets behave in fundamentally different ways. This is the era of the Great Financial Decoupling, where tangible, strategic assets dominate, and highly leveraged, speculative instruments fluctuate violently.

Gold: The Strategic Safe Haven (~$4,663/oz)

Gold’s rally is more than a price movement — it reflects deep institutional

#GoldandSilverHitNewHighs 🏆💰

In 2026, the financial landscape is undergoing a major structural shift. Gold and Silver are breaking records, not as a fleeting spike, but as part of a long-term capital reallocation, while Bitcoin and other risk assets behave in fundamentally different ways. This is the era of the Great Financial Decoupling, where tangible, strategic assets dominate, and highly leveraged, speculative instruments fluctuate violently.

Gold: The Strategic Safe Haven (~$4,663/oz)

Gold’s rally is more than a price movement — it reflects deep institutional

- Reward

- 14

- 18

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs ⚡ #GoldandSilverHitNewHighs – 19 Jan 2026

Precious metals are back in the spotlight! Gold has surged past $2,050/oz, while silver hits $27.50/oz, marking new multi-year highs. This surge reflects global market uncertainty, inflation concerns, and the flight to safety amid ongoing macroeconomic turbulence.

📌 Market Overview:

Gold: Strong upward momentum driven by rising inflation expectations and geopolitical tensions.

Silver: Benefiting from both industrial demand and investor hedge demand, showing higher volatility than gold.

Correlation with Crypto: BTC and other d

Precious metals are back in the spotlight! Gold has surged past $2,050/oz, while silver hits $27.50/oz, marking new multi-year highs. This surge reflects global market uncertainty, inflation concerns, and the flight to safety amid ongoing macroeconomic turbulence.

📌 Market Overview:

Gold: Strong upward momentum driven by rising inflation expectations and geopolitical tensions.

Silver: Benefiting from both industrial demand and investor hedge demand, showing higher volatility than gold.

Correlation with Crypto: BTC and other d

BTC-2.92%

- Reward

- 8

- 17

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

Gold and silver hit new highs simultaneously, and the risk pricing logic is reshaping

Spot gold and spot silver both reached new cycle highs. This is not just an ordinary price rally but more like a signal that the global risk pricing logic is changing. Historically, gold and silver rising together often occurred in three stages: runaway inflation expectations, shaky monetary credit, or rising systemic uncertainties. Currently, the market is experiencing all three simultaneously.

From a macro perspective, although interest rate expectations have fluctuated, the logic that “high interest rates

View OriginalSpot gold and spot silver both reached new cycle highs. This is not just an ordinary price rally but more like a signal that the global risk pricing logic is changing. Historically, gold and silver rising together often occurred in three stages: runaway inflation expectations, shaky monetary credit, or rising systemic uncertainties. Currently, the market is experiencing all three simultaneously.

From a macro perspective, although interest rate expectations have fluctuated, the logic that “high interest rates

- Reward

- 5

- 5

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

💎 Gold & Silver Hit Record Highs — What’s Really Happening? 💎

The safe-haven rush is real. Both gold and silver have surged to all-time highs, driven by investors looking for stability in uncertain times. But why now?

1️⃣ Global Uncertainty: Trade tensions, inflation worries, and market volatility are pushing money into assets that hold intrinsic value.

2️⃣ Currency Pressure: Weakening fiat currencies make precious metals more attractive as a store of value.

3️⃣ Portfolio Defense: Investors are reallocating from riskier assets like stocks and crypto to hedge agains

💎 Gold & Silver Hit Record Highs — What’s Really Happening? 💎

The safe-haven rush is real. Both gold and silver have surged to all-time highs, driven by investors looking for stability in uncertain times. But why now?

1️⃣ Global Uncertainty: Trade tensions, inflation worries, and market volatility are pushing money into assets that hold intrinsic value.

2️⃣ Currency Pressure: Weakening fiat currencies make precious metals more attractive as a store of value.

3️⃣ Portfolio Defense: Investors are reallocating from riskier assets like stocks and crypto to hedge agains

- Reward

- 11

- 8

- Repost

- Share

QueenOfTheDay :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

Gold and silver prices are making headlines around the world today as both precious metals hit new all-time highs, reflecting a powerful shift in investor behavior amid global uncertainty. Across major financial markets, gold has surged to historic price levels, breaking previous ceilings and drawing attention from traders, analysts, and everyday investors alike. Silver has also gained strong momentum, reaching price levels not seen in years. This rally is not driven by hype alone; it is the result of several economic and geopolitical forces coming together at the sa

Gold and silver prices are making headlines around the world today as both precious metals hit new all-time highs, reflecting a powerful shift in investor behavior amid global uncertainty. Across major financial markets, gold has surged to historic price levels, breaking previous ceilings and drawing attention from traders, analysts, and everyday investors alike. Silver has also gained strong momentum, reaching price levels not seen in years. This rally is not driven by hype alone; it is the result of several economic and geopolitical forces coming together at the sa

- Reward

- 3

- 8

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#GoldandSilverHitNewHighs

Recently, gold and silver prices have reached new record or near-record highs across global markets. This surge reflects a combination of geopolitical tensions, market uncertainty, and increased investor demand for safe-haven assets. Here is a clear, detailed analysis:

1. Precious Metals Reaching Record Levels

Gold has climbed above $4,650 per ounce, reaching unprecedented levels.

Silver has surged toward $90 per ounce, marking a historic high.

These levels show strong demand and investor confidence in metals as stores of value.

2. Safe-Haven Demand

Investors are mov

Recently, gold and silver prices have reached new record or near-record highs across global markets. This surge reflects a combination of geopolitical tensions, market uncertainty, and increased investor demand for safe-haven assets. Here is a clear, detailed analysis:

1. Precious Metals Reaching Record Levels

Gold has climbed above $4,650 per ounce, reaching unprecedented levels.

Silver has surged toward $90 per ounce, marking a historic high.

These levels show strong demand and investor confidence in metals as stores of value.

2. Safe-Haven Demand

Investors are mov

- Reward

- 4

- 7

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

4.72K Popularity

34.39K Popularity

49.18K Popularity

11.28K Popularity

8.53K Popularity

338.09K Popularity

5.6K Popularity

7.46K Popularity

106.16K Popularity

14.89K Popularity

185.32K Popularity

13.52K Popularity

6.55K Popularity

8K Popularity

150.14K Popularity

News

View MoreCitigroup CEO: Federal Reserve independence is crucial

1 m

Over the past hour, the entire network has liquidated $186 million, with $103 million in ETH liquidations.

8 m

The U.S. Supreme Court has not ruled on the legality challenge of Trump's global tariffs.

8 m

The U.S. Supreme Court has not ruled on the legality challenge of Trump's global tariffs.

9 m

Data: ETH drops below $3000

9 m

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889