- Trending TopicsView More

13.9K Popularity

4.7M Popularity

123.7K Popularity

78.1K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Mastering Short Trading Strategies for Cryptocurrency Success

Ethereum Market Dynamics: Walking the Tightrope

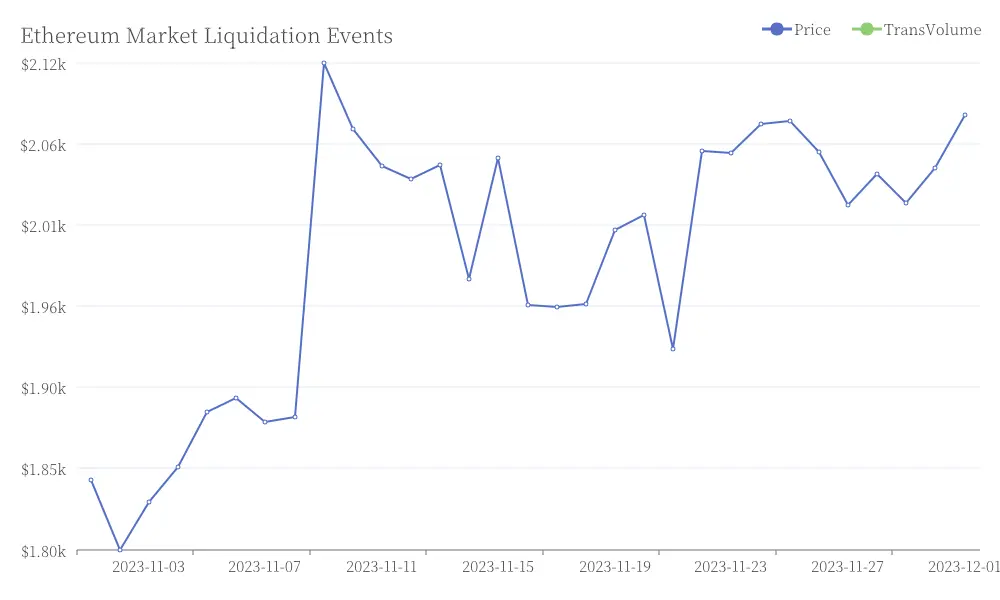

A seismic event just rattled the Ethereum market as a substantial short position was liquidated at $4,482.52, sending shockwaves through the trading community. This $12.5K liquidation may be just the opening salvo in what could become a larger market movement. Ethereum Market Liquidation Events

Ethereum Market Liquidation Events

Potential Market Scenarios

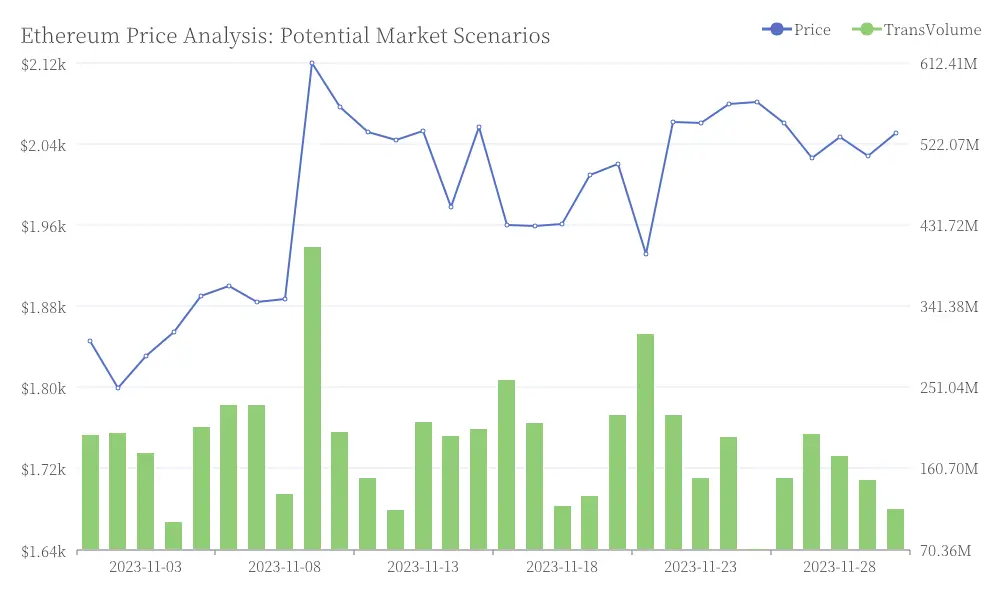

The current market structure presents two distinct possibilities that traders should be acutely aware of. First, an upside squeeze could occur if prices move above $4,800, potentially triggering a $7.2B short-covering wave. Alternatively, a downside cascade might unfold if prices drop below $4,200, which could result in $1.1B of long liquidations. Ethereum Price Analysis: Potential Market Scenarios

Ethereum Price Analysis: Potential Market Scenarios

Macro Factors Amplifying Volatility

The influx of institutional capital and the accumulation of Ethereum through various investment vehicles are injecting significant liquidity into the market. This increased participation has the potential to magnify price movements in either direction, adding an extra layer of complexity to trading decisions.

Market Implications

The recent liquidation event at $4,482.52 serves as a stark reminder of the market's razor-edge conditions. Traders operating in this environment must remain vigilant, as the potential for explosive moves looms large.

A breach of the $4,800 level could trigger a massive short squeeze, potentially propelling prices to new heights as short sellers scramble to cover their positions. Conversely, a drop below $4,200 could unleash a wave of long liquidations, potentially accelerating a downward spiral.

Institutional Influence

The increasing presence of institutional investors in the Ethereum market is a double-edged sword. While it brings increased liquidity and potential price stability in the long term, it also introduces the possibility of larger, more impactful trades that could swiftly alter market dynamics.

Trading in Volatile Conditions

In light of these market conditions, Ethereum traders are advised to approach their strategies with extreme caution. The current state of affairs demands meticulous risk management, clear entry and exit points, and a readiness to adapt to rapidly changing market conditions.

As the Ethereum market teeters on this knife-edge, the coming days and weeks may prove crucial in determining the next significant move. Traders and investors alike should brace themselves for potential high-impact events and remain prepared for swift market reactions.