توقعات سعر TRACAI لعام 2025: تحليل القيمة المستقبلية وإمكانات السوق لتقنية البلوكشين الناشئة

مقدمة: مكانة TRACAI في السوق وقيمتها الاستثمارية

تبرز OriginTrail (TRACAI) كمنافس رئيسي في تطوير إنترنت موثوق للذكاء الاصطناعي منذ انطلاقتها عام 2017، وحققت إنجازات فعلية في التصدي للمعلومات المضللة وتعزيز مصداقية البيانات. في عام 2025، بلغ رأس مال TRACAI السوقي 168,547,142 دولاراً، مع عرض متداول يقارب 499,546,955 رمزاً، وسعر مستقر عند 0.3374 دولاراً. وتُعرف هذه العملة غالباً باسم "مُمكّن الثقة للذكاء الاصطناعي" وتؤدي دوراً أساسياً ومتنامياً في قطاعات مثل ترميز الأصول الواقعية، إدارة سلاسل الإمداد، ونظم المعرفة للذكاء الاصطناعي.

يستعرض هذا المقال تحليلاً احترافياً لتوجهات أسعار TRACAI خلال الفترة 2025 - 2030، ويركز على الأنماط التاريخية، وآليات العرض والطلب في السوق، وتطور النظام البيئي، والعوامل الاقتصادية الكلية، بهدف تقديم توقعات سعرية دقيقة واستراتيجيات عملية للمستثمرين.

أولاً: مراجعة تاريخ سعر TRACAI والوضع الحالي للسوق

تطور سعر TRACAI عبر السنوات

- 2018: الإطلاق الأول، السعر بدأ عند 0.1 دولار

- 2024: سجل أعلى سعر تاريخي عند 1.2354 دولار في 9 ديسمبر

- 2025: هبوط حاد بالسوق، بلغ أدنى سعر 0.2834 دولار في 22 يونيو

الوضع الحالي لسوق TRACAI

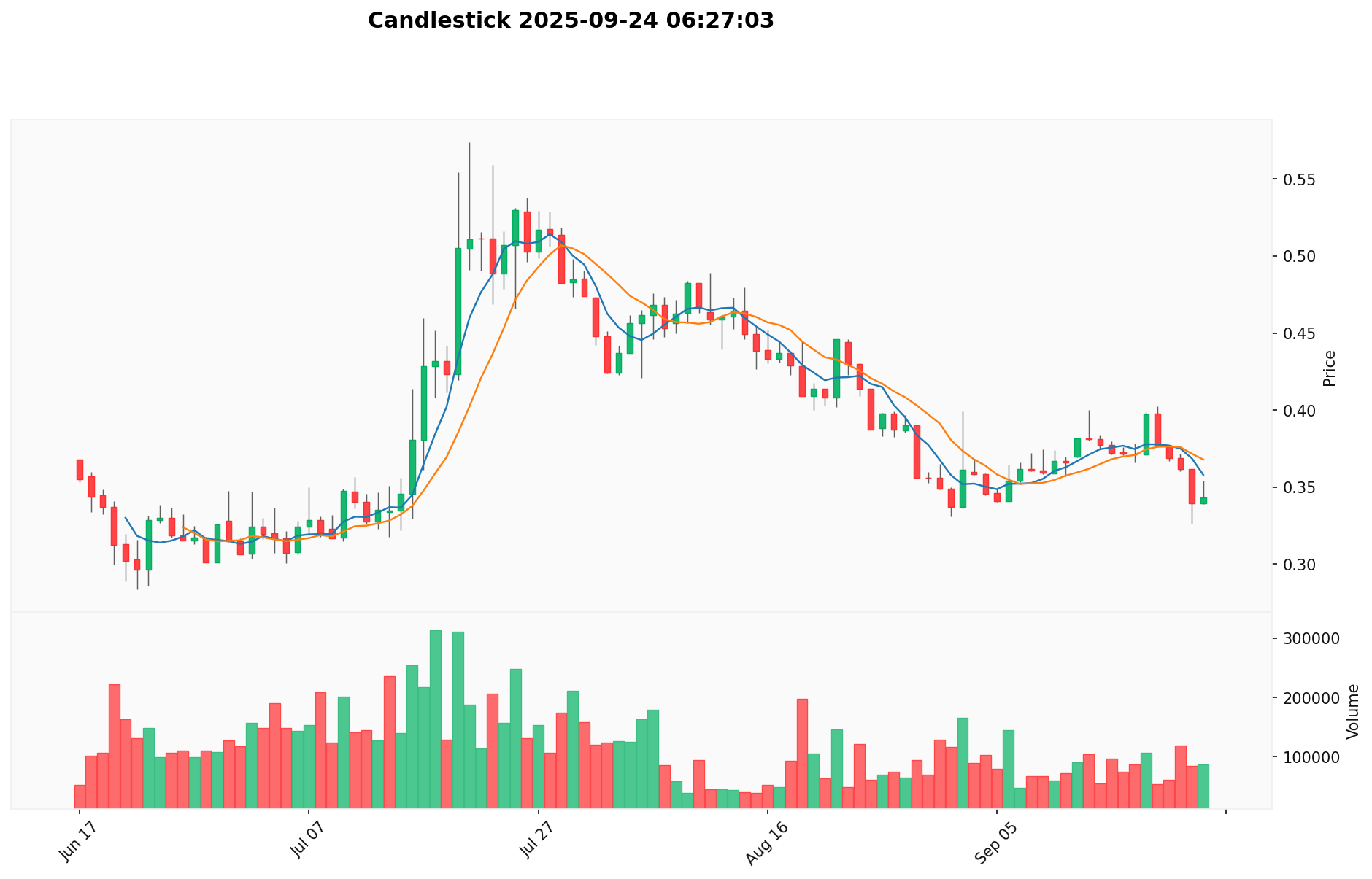

في 24 سبتمبر 2025، يتداول TRACAI عند 0.3374 دولاراً مع تراجع نسبته 2.51% خلال آخر 24 ساعة. شهد الرمز انخفاضات مؤثرة عبر الفترات الزمنية المختلفة: هبط بنسبة 9.9% خلال أسبوع، و17.4% خلال 30 يوماً، أما الأداء السنوي فبلغ انخفاضاً بنسبة 42.98%.

بلغ رأس المال السوقي الحالي لـ TRACAI مبلغ 168,547,142 دولاراً، ليحتل المرتبة 330 في سوق العملات الرقمية. وسجل حجم التداول خلال 24 ساعة 28,965 دولاراً، في إشارة إلى نشاط متوسط. ويبلغ العرض المتداول 499,546,955 رمزاً من أصل 500,000,000، لتبلغ نسبة التداول 99.91%.

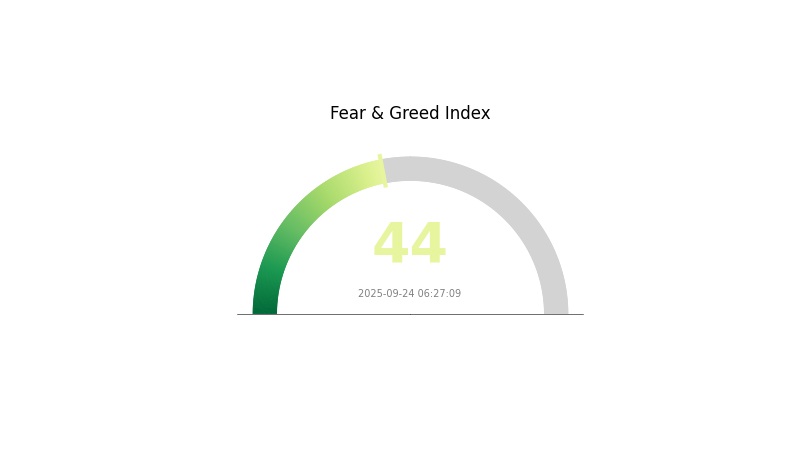

يشير السعر الحالي إلى تراجع واضح عن القمة التاريخية، ما يعكس اتجاهاً هبوطياً على المدى القصير والمتوسط. ويعكس مؤشر VIX البالغ 44 حالة من الخوف تسود بين المستثمرين.

انقر لرؤية السعر الحالي لـ TRACAI

مؤشر شعور السوق لـ TRACAI

مؤشر الخوف والطمع 2025-09-24: 44 (خوف)

انقر لرؤية مؤشر الخوف والطمع الحالي

يظل المزاج العام لسوق العملات الرقمية حذراً، إذ يظهر مؤشر الخوف والطمع عند 44، وهو ما يعكس حالة من القلق بين المستثمرين. يشير ذلك إلى تردد وتوقعات ببحث البعض عن فرص شراء، مع ضرورة إجراء البحث الوافي وإدارة المخاطر بحذر. تذكر أن المزاج السوقي قابل للتغيير السريع، لذا تابع مستجدات السوق ولا تتردد في تنويع استثماراتك. يوفر لك Gate.com أدوات متنوعة تساعدك على التعامل مع هذه الظروف بكفاءة.

توزيع ملكية رموز TRACAI

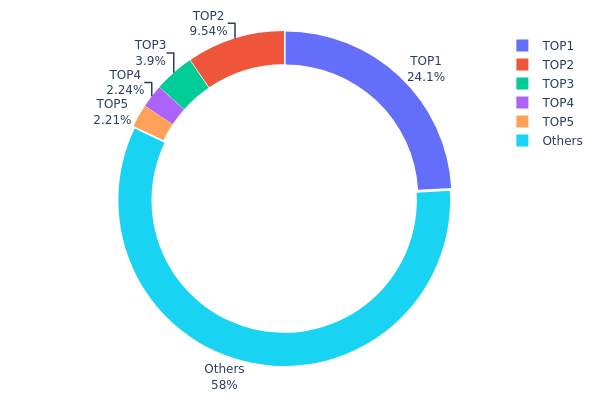

توضح بيانات توزيع الحيازات وجود تركّز كبير في ملكية TRACAI، إذ يحتفظ أكبر عنوان بنسبة 24.10% من إجمالي الرموز، وتسيطر أكبر خمسة عناوين معاً على 41.97%. هذا التركّز يثير القلق بشأن إمكانية التلاعب وتقلب الأسعار.

تشير هذه الأنماط إلى مركزية نسبية، حيث يمتلك عدد قليل من الكيانات حصة مؤثرة في النظام البيئي للرمز. وعلى الرغم من أن "الآخرين" يملكون 58.03% من الرموز، إلا أن سيطرة كبار الحائزين قد تؤثر على ديناميكيات السوق، إلى جانب تأثيرها على استقرار السعر وسيولة الرمز.

يمثل هذا الوضع مرحلة مبكرة لنمو النظام البيئي لـ TRACAI، ما يستدعي مراقبة نشاط كبار الحائزين، وضرورة تعزيز التوزيع لتحقيق مزيد من اللامركزية وتخفيف المخاطر النظامية المرتبطة بتركيز الملكية.

انقر لرؤية توزيع ملكية TRACAI

| الترتيب | العنوان | كمية الحيازة | نسبة الحيازة (%) |

|---|---|---|---|

| 1 | 0x248f...b8d65d | 120500.61K | 24.10% |

| 2 | 0x88ad...655671 | 47701.83K | 9.54% |

| 3 | 0x5624...509283 | 19500.00K | 3.90% |

| 4 | 0x3154...0f2c35 | 11186.89K | 2.23% |

| 5 | 0xf630...0aa91c | 11043.16K | 2.20% |

| - | الآخرون | 290067.51K | 58.03% |

ثانياً: أبرز العوامل المؤثرة في سعر TRACAI المستقبلي

ديناميكيات السوق

- حجم التداول: نشاط التداول يؤثر مباشرةً في حركة سعر TRACAI.

- اتجاهات السوق: توجّهات سوق العملات الرقمية العامة تحدد مسار السعر.

- رأس المال السوقي: رأس المال الحالي لـ TRACAI يحدد مدى الاستقرار والإمكانات المستقبلية.

تطور المشروع

- تحديثات الفريق: مستجدات وأخبار فريق OriginTrail تؤثر بوضوح في القيمة السوقية.

- الشراكات الجوهرية: التعاونات الرئيسية تدعم صعود السعر.

التحليل الفني

- توزيع أزواج التداول: التوزيع بين أزواج العملات يؤثر على السيولة والسعر.

- مخططات الأسعار: تحليل المخططات الفنية يكشف عن تحركات مستقبلية محتملة.

تفاعل المجتمع

- تحليلات الخبراء: آراء المتخصصين عبر Gate Post تلعب دوراً حاسماً في توجهات السوق.

- نقاشات المجتمع: النقاش النشط ضمن مجتمع Gate.com يوجّه سلوك المستثمرين ويؤثر في سعر TRACAI.

ثالثاً: توقعات سعر TRACAI للفترة 2025 - 2030

توقعات عام 2025

- توقع متحفظ: بين 0.31706 و0.33730 دولار

- توقع حيادي: بين 0.33730 و0.37609 دولار

- توقع متفائل: بين 0.37609 و0.41488 دولار (رهناً بتحسن المزاج السوقي وتطورات المشروع)

توقعات 2027 - 2028

- مرحلة السوق: نمو محتمل مع ازدياد التبني

- نطاق أسعار متوقع:

- 2027: من 0.30407 حتى 0.60353 دولار

- 2028: من 0.42570 حتى 0.57469 دولار

- عوامل الدفع الرئيسة: التطوير التقني، توسيع النظام البيئي، انتعاش السوق

توقعات المدى الطويل 2029 - 2030

- السيناريو الأساسي: من 0.55340 إلى 0.62258 دولار (مع نمو مستقر)

- السيناريو المتفائل: من 0.62258 إلى 0.69176 دولار (مع ظروف سوق قوية وتبني واسع)

- سيناريو التحول النوعي: من 0.69176 حتى 0.70000 دولار (مع ابتكارات رائدة)

- 31/12/2030: TRACAI عند 0.69106 دولار (ذروة متوقعة)

| العام | أعلى توقع | متوسط التوقع | أدنى توقع | نسبة التغير |

|---|---|---|---|---|

| 2025 | 0.41488 | 0.3373 | 0.31706 | 0 |

| 2026 | 0.54533 | 0.37609 | 0.28207 | 11 |

| 2027 | 0.60353 | 0.46071 | 0.30407 | 36 |

| 2028 | 0.57469 | 0.53212 | 0.4257 | 57 |

| 2029 | 0.69176 | 0.5534 | 0.53127 | 64 |

| 2030 | 0.69106 | 0.62258 | 0.59768 | 84 |

رابعاً: استراتيجيات الاستثمار وإدارة المخاطر المهنية لـ TRACAI

منهجية الاستثمار في TRACAI

(1) استراتيجية الاحتفاظ طويل الأمد

- مناسبة للمستثمرين المهتمين بالتقنيات الحديثة والذكاء الاصطناعي

- نصائح تشغيلية:

- تجميع الرموز أثناء الهبوط

- الاحتفاظ لمدة لا تقل عن 2-3 سنوات لمواجهة التقلبات

- تخزين الرموز في محافظ آمنة للأجهزة

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- المتوسطات المتحركة 50 و200 يوم لرصد الاتجاهات

- RSI لمراقبة حالات التشبع الشرائي أو البيعي

- نقاط تداول المدى القصير:

- استخدام أوامر وقف الخسارة لتقليل الخسائر

- تحديد جني الأرباح عند مستويات مقاومة معروفة

إطار إدارة المخاطر في TRACAI

(1) مبادئ توزيع الأصول

- المستثمر المحافظ: 1 - 3% من محفظة العملات الرقمية

- المستثمر الجريء: 5 - 10% من المحفظة

- المستثمر المحترف: حتى 15% من المحفظة

(2) حلول التحوط من المخاطر

- تنويع الاستثمارات في عدة مشاريع تقنية وذكاء اصطناعي

- استراتيجيات الخيارات (Options): استخدام خيارات البيع للحماية من تقلبات الهبوط

(3) حلول التخزين الآمن

- محفظة ساخنة موصى بها: Gate محفظة web3

- تخزين بارد: استخدام محافظ الأجهزة لتخزين طويل الأجل

- إجراءات الأمن: تفعيل المصادقة الثنائية واستخدام كلمات مرور قوية

خامساً: أبرز المخاطر والتحديات لـ TRACAI

مخاطر السوق لـ TRACAI

- تقلبات عالية في السعر

- المنافسة من مشاريع تقنية ناشئة في الذكاء الاصطناعي والبلوك تشين

- تأثر المزاج السوقي بالأخبار السلبية في القطاع

مخاطر التنظيم لـ TRACAI

- تطورات تنظيمية غير واضحة في مجال العملات الرقمية عالمياً

- احتمال تصنيف العملة كأوراق مالية

- الفروق التنظيمية الدولية قد تقلل فرص الاستخدام

مخاطر تقنية لـ TRACAI

- ثغرات في العقود الذكية قد تسمح باستغلال الكود

- تحديات توسعية عند ارتفاع الطلب على الشبكة

- مشكلات توافق مع أنظمة الذكاء الاصطناعي القائمة

سادساً: الخلاصة وتوصيات عملية

تقييم استثماري لـ TRACAI

تمثل TRACAI فرصة طويلة الأجل عند تقاطع الذكاء الاصطناعي والبلوك تشين، لكنها تواجه تقلبات آنية وصعوبات في التبني الواسع. وتعتبر ميزة مكافحة التضليل وتعزيز الثقة في الذكاء الاصطناعي أساساً لاستثمار مدروس بحذر.

توصيات استثمارية في TRACAI

✅ للمبتدئين: ابدأ باستثمار تدريجي ومنتظم لفهم السوق ✅ للمستثمرين الخبراء: اتبع استراتيجية متوازنة تجمع بين الاحتفاظ والتداول النشط ✅ للمؤسسات: استكشاف شراكات استراتيجية وتطبيقات واسعة لتقنية OriginTrail

طرق التداول والمشاركة في TRACAI

- تداول مباشر عبر Gate.com

- الاشتراك في برامج staking المتاحة

- دمج الرمز مع بروتوكولات التمويل اللامركزي حسب الإمكانية

الاستثمار في العملات الرقمية يحمل مخاطر مرتفعة للغاية. هذا المقال ليس نصيحة استثمارية. اتخذ قرارك وفق قدرة تحملك للمخاطر وراجع مستشارين ماليين محترفين. لا تستثمر أكثر من قدرتك على تحمل الخسارة.

الأسئلة الشائعة

ما هو توقع سعر Trac لعام 2030؟

وفق التحليل الحالي للسوق، من المتوقع أن يصل سعر Trac إلى 0.499319 دولاراً في عام 2030.

هل يُنصح بشراء Trac؟

استناداً للمؤشرات الفنية لسنة 2025، لا يمثل TRAC صفقة شراء جيدة حالياً، والاتجاه السعري هابط.

أي ذكاء اصطناعي يتوقع أسعار العملات الرقمية؟

يُعد Incite AI أداة متقدمة لتوقع أسعار العملات الرقمية، إذ يعتمد خوارزميات تحليل سوق دقيقة ويوفر واجهة استخدام عملية.

هل سيبلغ ICP سعر 100 دولار؟

احتمالية وصول ICP إلى 100 دولار تقدّر بين 25% و35%. يعتمد ذلك على تطورات السوق ونجاح المشروع، وتشير البيانات إلى أن هذا السيناريو ما يزال غير مؤكد.

توقعات سعر FET لعام 2025: دراسة اتجاهات السوق وفرص النمو المستقبلية لرمز Fetch.ai الأصلي

توقعات سعر CAMP لعام 2025: دراسة اتجاهات السوق وفرص النمو لأصول ألعاب البلوكشين

توقع سعر NC في عام 2025: تحليل اتجاهات السوق وآفاق النمو المستقبلي

توقعات سعر AITECH لعام 2025: اتجاهات السوق، العوامل الاقتصادية وفرص الاستثمار في قطاع الذكاء الاصطناعي

توقع سعر REX لعام 2025: توقعات إيجابية مدفوعة بتوسع الاعتماد وتعزيز فائدة الاستخدام

توقع سعر MIRA في عام 2025: تحليل الاتجاهات المستقبلية وعوامل النمو المحتملة

إجابة اختبار Xenea اليومي بتاريخ ١٤ ديسمبر ٢٠٢٥

الدليل الشامل للمبتدئين لفهم مصطلحات العملات الرقمية

فهم Soulbound Tokens: آفاق جديدة في عالم الرموز غير القابلة للاستبدال (NFTs)

فهم آلية الإجماع لـ Tendermint في تقنية البلوكشين

كيفية شراء وإدارة نطاقات Ethereum Name Service