2025 SN Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of SN

SpaceN (SN) is an NFT one-stop investment management tool that automatically calculates investment income information for users buying and selling NFTs, enabling them to understand changes in their NFT assets in real time. As of December 2025, SpaceN's market capitalization has reached $587.9 million, with a circulating supply of approximately 40.01 million tokens, maintaining a price around $0.5879. This innovative platform, recognized for its comprehensive NFT portfolio management capabilities, is playing an increasingly critical role in the NFT investment ecosystem.

The present analysis will comprehensively examine SpaceN's price trends through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

SpaceN (SN) Market Analysis Report

I. SN Price History Review and Current Market Status

SN Historical Price Evolution

SpaceN (SN) has experienced significant volatility since its inception. The token reached its all-time high (ATH) of $6.15 on January 29, 2025, followed by a substantial correction. The all-time low (ATL) was recorded at $0.04957282 on October 3, 2022, representing the trough of the market cycle during that period.

SN Current Market Performance

As of December 20, 2025, SpaceN is trading at $0.5879, reflecting considerable pressure in recent trading periods. The token has experienced notable declines across multiple timeframes:

- 1-hour change: -0.22%

- 24-hour change: -4.18%

- 7-day change: -42.51%

- 30-day change: -54.52%

- 1-year change: +9.70%

The 24-hour trading range shows the token fluctuating between $0.5609 (low) and $0.7132 (high). The 24-hour trading volume stands at approximately $12,913.84, indicating moderate liquidity in the market.

Market Capitalization Metrics:

- Circulating market cap: $23,521,879

- Fully diluted valuation (FDV): $587,900,000

- Circulating supply: 40,010,000 SN

- Total supply: 1,000,000,000 SN

- Market dominance: 0.018%

The project maintains 599 token holders and is available on the BSC (Binance Smart Chain) blockchain. Current market sentiment indicates extreme fear, reflecting broader market conditions affecting the cryptocurrency sector.

Click to view current SN market price

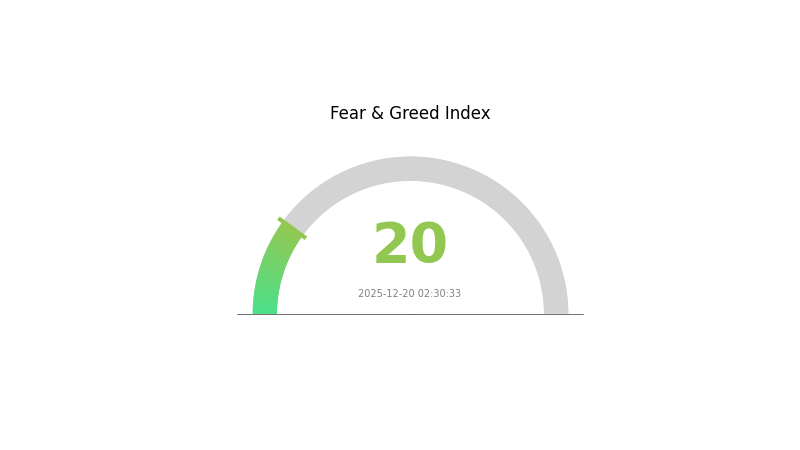

SN Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates investors are highly pessimistic about market conditions, with widespread uncertainty driving risk-averse behavior. Such extreme fear levels often create contrarian buying opportunities for long-term investors, as panic selling typically leads to oversold conditions. However, traders should exercise caution and conduct thorough analysis before making investment decisions. Monitor market developments closely on Gate.com to stay informed about emerging opportunities and risks during this volatile period.

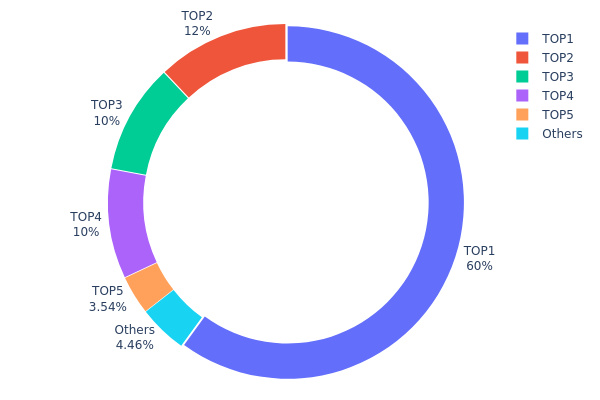

SN Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the network by tracking the top token holders and their respective share of total supply. This metric serves as a critical indicator for assessing the decentralization level, market structure stability, and potential vulnerability to price manipulation within the SN ecosystem.

The current holdings data reveals a highly concentrated distribution pattern, with significant centralization risk. The top address alone commands 60.00% of total supply (600,000.00K tokens), while the top four addresses collectively control 92.00% of all tokens in circulation. This extreme concentration is further underscored by address 0x63bc...d63c7e holding 12.00% and addresses 0xd88a...c3f34c and 0x9c86...a589cb each maintaining 10.00% stakes. Only 4.46% of tokens remain distributed among other addresses, indicating a fragmented long-tail distribution.

Such pronounced centralization presents notable implications for market dynamics. The dominant holders possess substantial leverage over price movements and could theoretically execute coordinated actions that significantly impact token valuation or market sentiment. The concentration in a handful of addresses elevates the risk profile for market manipulation and reduces the network's resilience to sudden liquidation events. The current structure suggests limited decentralization, with decision-making power and market influence concentrated among a small cohort of stakeholders. This distribution pattern warrants continued monitoring, as shifts in these top holdings could trigger substantial volatility and reshape market structure considerably.

Click to view current SN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7544...45004f | 600000.00K | 60.00% |

| 2 | 0x63bc...d63c7e | 120000.00K | 12.00% |

| 3 | 0xd88a...c3f34c | 100000.00K | 10.00% |

| 4 | 0x9c86...a589cb | 100000.00K | 10.00% |

| 5 | 0x2c28...611db2 | 35408.88K | 3.54% |

| - | Others | 44591.12K | 4.46% |

II. Core Factors Affecting SN's Future Price

Supply Mechanism

-

Supply Dynamics and Market Sentiment: SN's price is influenced by supply-demand balance and investor sentiment. Short-term price movements are driven by market capitalization changes and trading volume fluctuations.

-

On-chain Data Indicators: Active address changes, trading volume peaks, and whale behavior patterns serve as key metrics for understanding price trends. Investor activity intensifies during price volatility periods, reflecting strong market participation.

Institutional and Whale Activity

-

Whale Behavior: On-chain analysis reveals that large holders demonstrate heightened activity during market volatility. These participants' trading patterns significantly influence short-term price movements and market direction.

-

Strategic Investment: Canton Network's receipt of strategic investment has catalyzed notable price appreciation, with SN surging over 90% against market trends, indicating institutional confidence in the ecosystem's development prospects.

-

Market Funding Flows: Sustained inflows of market capital into SN demonstrate continued investor interest, with price consolidation at elevated levels suggesting sustained bullish sentiment after initial profit-taking phases.

Market Technicals

-

Price Action Patterns: Following initial breakout phases, SN exhibits healthy pullback and consolidation patterns, maintaining price levels significantly above pre-surge levels. This consolidation after volatility indicates genuine demand rather than speculative rallies.

-

Market Sentiment: Post-breakout price stability with multi-directional upward movements signals dominant bullish sentiment among market participants and sustained buying pressure from institutional entities.

Three、2025-2030 SN Price Prediction

2025 Outlook

- Conservative Prediction: $0.4586 - $0.5879

- Neutral Prediction: $0.5879

- Bullish Prediction: $0.8407 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery potential, featuring moderate volatility and incremental value accumulation as the project matures.

- Price Range Predictions:

- 2026: $0.3643 - $0.8000

- 2027: $0.4013 - $0.9843

- Key Catalysts: Enhanced protocol adoption, strategic partnerships, ecosystem expansion, and overall cryptocurrency market sentiment improvement.

2028-2030 Long-term Outlook

- Base Case: $0.8446 - $0.9839 (assuming stable market conditions and moderate adoption growth)

- Bullish Case: $1.1684 - $1.3413 (assuming accelerated ecosystem development and increased institutional interest)

- Transformative Case: $1.3413+ (contingent on breakthrough technological innovations, mainstream adoption, and favorable regulatory environment)

- 2030-12-20: SN trading near $1.34 (representing substantial long-term appreciation relative to current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.8407 | 0.5879 | 0.45856 | 0 |

| 2026 | 0.80001 | 0.7143 | 0.36429 | 21 |

| 2027 | 0.9843 | 0.75716 | 0.40129 | 28 |

| 2028 | 0.98392 | 0.87073 | 0.84461 | 48 |

| 2029 | 1.16843 | 0.92733 | 0.85314 | 57 |

| 2030 | 1.34129 | 1.04788 | 0.81735 | 78 |

SpaceN (SN) Professional Investment Strategy and Risk Management Report

IV. SN Professional Investment Strategy and Risk Management

SN Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: NFT enthusiasts and long-term believers in decentralized asset management platforms

- Operational Recommendations:

- Accumulate SN tokens during market downturns to build a diversified crypto portfolio

- Set long-term price targets based on platform adoption metrics and NFT market recovery cycles

- Reinvest any staking rewards or platform incentives to compound returns over time

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price floors at $0.5609 (24H low) and resistance at $0.7132 (24H high) for entry and exit signals

- Moving Averages: Use 50-day and 200-day moving averages to identify trend direction and momentum shifts

- Wave Trading Key Points:

- Capitalize on the 7-day decline of -42.51% by identifying potential reversal patterns

- Monitor trading volume fluctuations, with current 24H volume at $12,913.84, to confirm breakout signals

SN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio

- Active Investors: 3-8% of total crypto portfolio

- Professional Investors: 8-15% of total crypto portfolio, with hedging strategies

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Spread purchases over multiple months to reduce timing risk and average entry price

- Profit-Taking Strategy: Establish predetermined exit points at 30%, 50%, and 80% gains to lock in profits during rallies

(3) Secure Storage Solutions

- Hardware wallet Methods: Store SN tokens in secure hardware wallets with multi-signature authentication for long-term holdings

- Self-Custody Best Practices: Maintain private key security with encrypted backups stored in geographically diverse locations

- Security Considerations: Enable two-factor authentication on all exchange accounts, regularly audit wallet addresses, and avoid sharing seed phrases with third parties

V. SN Potential Risks and Challenges

SN Market Risks

- Price Volatility: SN has experienced significant drawdowns, including a -42.51% decline over 7 days and -54.52% over 30 days, exposing investors to substantial liquidation risks

- Low Trading Liquidity: With only $12,913.84 in 24H volume and 1 exchange listing, the token faces limited liquidity, potentially resulting in slippage during large trades

- Market Sentiment Deterioration: Negative price momentum across multiple timeframes (1H: -0.22%, 24H: -4.18%, 7D: -42.51%) signals weakening investor confidence

SN Regulatory Risks

- NFT Market Uncertainty: The NFT sector faces evolving regulatory frameworks globally, with potential restrictions impacting SpaceN's platform viability

- Classification Ambiguity: Regulatory agencies may reclassify NFT investment tools, creating compliance challenges for the platform

- Jurisdictional Restrictions: Different countries may impose varying restrictions on NFT trading and DAO formation activities

SN Technology Risks

- Smart Contract Vulnerabilities: As a BSC-based token, SpaceN is exposed to potential smart contract security breaches or exploitation

- Platform Scalability Issues: Increased user adoption could strain infrastructure, leading to network congestion and transaction failures

- Integration Dependencies: SpaceN's functionality relies on third-party NFT platforms and oracles, creating single points of failure

VI. Conclusion and Action Recommendations

SN Investment Value Assessment

SpaceN presents a niche opportunity within the NFT infrastructure space, offering portfolio management and DAO formation capabilities. However, the token faces significant headwinds: severe recent price depreciation (-54.52% in 30 days), minimal trading liquidity ($12,913.84 daily volume), and concentration on a single blockchain (BSC). With a market cap of $23.5 million and only 599 holders, SN remains a speculative, high-risk asset dependent on NFT market recovery and platform adoption acceleration. Long-term viability hinges on the team's ability to increase user engagement and expand exchange listings.

SN Investment Recommendations

✅ Beginners: Start with a micro-allocation (0.5-1% of crypto portfolio) through Gate.com, using only disposable capital. Dollar-cost average over 3-6 months to mitigate timing risks.

✅ Experienced Investors: Implement a 2-5% allocation with technical analysis-driven entry points during confirmed reversal patterns. Set strict stop-losses at -25% to -30% below entry.

✅ Institutional Investors: Conduct deep due diligence on SpaceN's development roadmap and tokenomics. If entering, negotiate over-the-counter transactions to minimize market impact and ensure liquidity management protocols.

SN Trading Participation Methods

- Spot Trading on Gate.com: Execute buy/sell orders directly using BNB or stablecoins on Gate.com's spot trading platform with competitive fee structures

- Limit Orders for Risk Control: Place limit buy orders near support levels ($0.56) and limit sell orders near resistance ($0.71) to automate entry/exit execution

- Dollar-Cost Averaging Program: Use Gate.com's automated purchase feature to accumulate SN tokens at fixed intervals, reducing emotional trading decisions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their risk tolerance and consult professional financial advisors. Never invest funds you cannot afford to lose.

FAQ

Is SN a good stock to buy?

SN shows strong growth potential based on current market analysis and forecasts. The token demonstrates solid fundamentals with increasing trading volume and positive market sentiment. Investors should review latest performance data before making decisions.

What is SN's price target?

SN's price target is $133.50, with a forecast range of $110.00-$175.00 based on Wall Street analyst predictions and comprehensive market analysis.

How high will ServiceNow stock go?

Based on 29 Wall Street analysts, ServiceNow's 12-month average price target is $1,154.04, representing 35.08% upside potential. The consensus rating is Strong Buy, with some analysts targeting $1,250.

2025 DOOD Price Prediction: Analyzing Market Trends and Growth Factors for the Coming Bull Run

2025 SKEB Price Prediction: Will This NFT Platform Token Reach New Heights?

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

ADX vs LINK: Comparing Two Leading Oracle and Data Solutions for Blockchain Applications

Guide to Participating in Digital Asset Airdrop and Earning Rewards

Comprehensive Guide to the Solana NFT Platform for Beginners

Unlocking Solana's DeFi Potential: KMNO's Future in Yield Farming and Price Trends to 2025

Understanding EVM Wallet Addresses: A Comprehensive Guide