2025 SKEB Price Prediction: Will This NFT Platform Token Reach New Heights?

Introduction: SKEB's Market Position and Investment Value

Skeb Coin (SKEB), as a native token of the Japanese commission platform Skeb, has been connecting global art enthusiasts with local talent since its inception. As of 2025, SKEB's market capitalization has reached $3,024,342.63, with a circulating supply of approximately 9,690,300,000 tokens, and a price hovering around $0.0003121. This asset, known as the "creator economy token," is playing an increasingly crucial role in the digital art and content creation sphere.

This article will provide a comprehensive analysis of SKEB's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SKEB Price History Review and Current Market Status

SKEB Historical Price Evolution

- 2022: SKEB reached its all-time high of $0.01238736 on December 6, marking a significant milestone in its price history.

- 2024: The project faced challenges, with the price dropping to its all-time low of $0.0000653 on August 6.

- 2025: SKEB has shown signs of recovery, with the price currently at $0.0003121, representing a 378% increase from its all-time low.

SKEB Current Market Situation

As of November 24, 2025, SKEB is trading at $0.0003121. The token has experienced a 24-hour decline of 2.49%, with a trading volume of $9,923.55. SKEB's market capitalization stands at $3,024,342.63, ranking it 1914th in the cryptocurrency market. The current price represents a 97.48% decrease from its all-time high and a 378% increase from its all-time low. The token's circulating supply is 9,690,300,000 SKEB, which is 96.9% of its total supply of 9,979,886,009 SKEB. Despite the recent negative short-term performance, SKEB has shown positive growth over the past week with a 3.73% increase.

Click to view the current SKEB market price

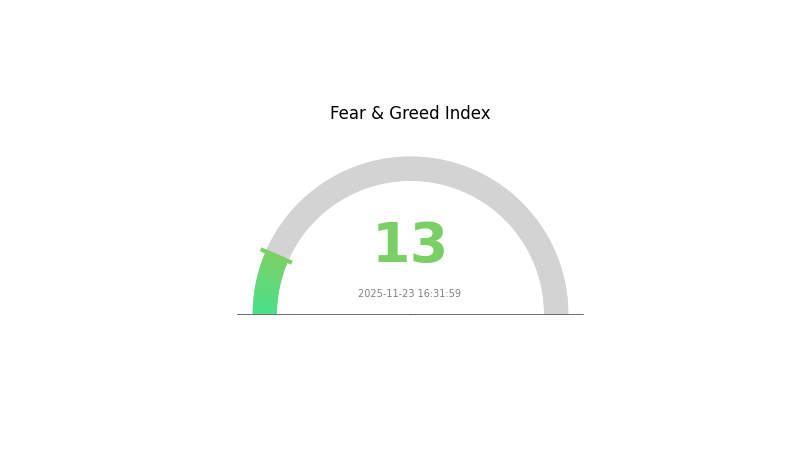

SKEB Market Sentiment Indicator

2025-11-23 Fear and Greed Index: 13 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 13. This level of pessimism often presents potential buying opportunities for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. While fear may indicate oversold conditions, it could also signal underlying market issues. Traders should consider diversifying their portfolios and setting stop-loss orders to manage risk in this volatile environment. As always, stay informed and trade responsibly on Gate.com.

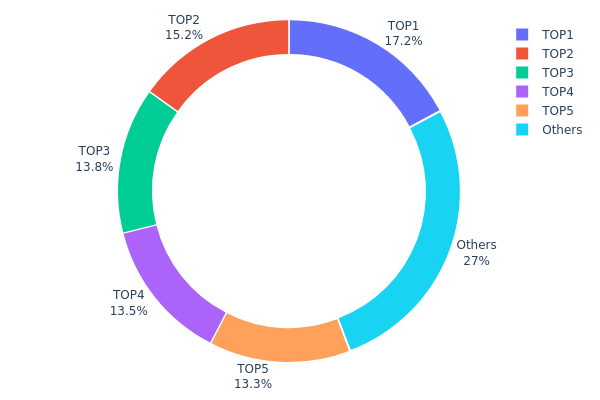

SKEB Holdings Distribution

The address holdings distribution chart provides insight into the concentration of SKEB tokens among different wallet addresses. Analysis of the data reveals a highly concentrated distribution, with the top 5 addresses holding 73.01% of the total supply. The largest holder possesses 17.24% of SKEB tokens, followed closely by four other significant holders with stakes ranging from 13.34% to 15.16%.

This level of concentration raises concerns about potential market manipulation and price volatility. With such a significant portion of tokens held by a small number of addresses, large-scale buying or selling activities by these major holders could lead to substantial price fluctuations. Furthermore, this concentration may impact the token's decentralization ethos, as a small group of entities could potentially exert disproportionate influence over the SKEB ecosystem.

The current distribution structure suggests a relatively low level of on-chain stability and a higher risk of market manipulation. However, it's worth noting that 26.99% of tokens are distributed among other addresses, which could indicate some level of broader market participation. Monitoring changes in this distribution over time will be crucial for assessing the long-term health and decentralization of the SKEB token ecosystem.

Click to view the current SKEB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7ce5...2123df | 1724500.00K | 17.24% |

| 2 | 0x46c5...b9b8ef | 1516000.00K | 15.16% |

| 3 | 0xb743...27c194 | 1381007.24K | 13.81% |

| 4 | 0x09bc...eff74b | 1346689.84K | 13.46% |

| 5 | 0x21eb...d98594 | 1334934.16K | 13.34% |

| - | Others | 2696868.77K | 26.99% |

II. Key Factors Affecting SKEB's Future Price

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, SKEB may exhibit some inflation hedging characteristics in high inflationary environments, similar to other digital assets.

Technical Development and Ecosystem Building

- Ecosystem Applications: SKEB likely has some decentralized applications (DApps) or ecosystem projects built on its network, though specific details are not available.

III. SKEB Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00019 - $0.00025

- Neutral prediction: $0.00025 - $0.00035

- Optimistic prediction: $0.00035 - $0.00039 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00033 - $0.00038

- 2028: $0.00020 - $0.00046

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00038 - $0.00047 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00047 - $0.00057 (assuming strong market performance and increased utility)

- Transformative scenario: $0.00057 - $0.00065 (assuming breakthrough applications and mainstream adoption)

- 2030-12-31: SKEB $0.00057 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00039 | 0.00031 | 0.00019 | 0 |

| 2026 | 0.00038 | 0.00035 | 0.00021 | 12 |

| 2027 | 0.00038 | 0.00037 | 0.00033 | 16 |

| 2028 | 0.00046 | 0.00037 | 0.0002 | 18 |

| 2029 | 0.00047 | 0.00042 | 0.00038 | 32 |

| 2030 | 0.00057 | 0.00045 | 0.00027 | 42 |

IV. SKEB Professional Investment Strategies and Risk Management

SKEB Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate SKEB tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Set clear stop-loss and take-profit levels

SKEB Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term hodlers

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SKEB

SKEB Market Risks

- High volatility: SKEB price may experience significant fluctuations

- Limited liquidity: Low trading volume may lead to slippage

- Market sentiment: Influenced by overall crypto market trends

SKEB Regulatory Risks

- Uncertain regulations: Potential changes in crypto regulations may impact SKEB

- Cross-border restrictions: Different countries may have varying stances on SKEB

- Compliance challenges: Evolving KYC/AML requirements may affect SKEB trading

SKEB Technical Risks

- Smart contract vulnerabilities: Potential bugs in the token contract

- Network congestion: High gas fees on Ethereum network during peak times

- Cybersecurity threats: Risk of hacks or exploits in the SKEB ecosystem

VI. Conclusion and Action Recommendations

SKEB Investment Value Assessment

SKEB presents a unique opportunity in the creator economy space, but faces significant short-term volatility and adoption challenges. Long-term potential exists if the Skeb platform gains traction among creators and users.

SKEB Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the project ✅ Experienced investors: Consider dollar-cost averaging and set clear exit strategies ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large orders

SKEB Trading Participation Methods

- Spot trading: Buy and sell SKEB on Gate.com

- Limit orders: Set desired entry and exit prices to manage risk

- DCA strategy: Regularly invest small amounts to average out price volatility

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will Shiba be worth in 2025?

Based on market trends and expert predictions, Shiba Inu could potentially reach $0.0001 by 2025, representing significant growth from its current price.

How high can Shib go realistically?

Realistically, SHIB could potentially reach $0.001 by 2025, given increased adoption and burn mechanisms. However, reaching $0.01 or $0.1 is highly unlikely due to its massive supply.

How much will Shib price be in 2026?

Based on current trends and market analysis, Shib price could potentially reach $0.0001 by 2026, representing significant growth from its current value.

What is the bone prediction for 2025?

Based on market trends and expert analysis, the bone price prediction for 2025 is around $0.15 to $0.20 per token, potentially reaching a peak of $0.25 in bullish scenarios.

2025 DOOD Price Prediction: Analyzing Market Trends and Growth Factors for the Coming Bull Run

2025 SN Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

CHILLGUY Price Skyrockets 538% in Just Two Days

How Does AIXBT Compare to Arc in the AI Agent Crypto Market?

What Is Driving AIXBT Price Volatility With 44.4% Swings and Historical Highs at $0.6590?

How to Purchase GemPad(GEMS) Tokens Online

Comprehensive Overview of Bitcoin Protocol Standards and Technical Specifications