Post content & earn content mining yield

placeholder

- Reward

- 2

- Comment

- Repost

- Share

【$VVV Signal】Long - 1H Breakout and Pullback Confirmation, Negative Funding Rate Short Squeeze Expectation

$VVV The 1H timeframe is consolidating strongly above EMA20 (5.19), just completing a test of the previous high at 5.38. The 4H timeframe has closed bullish for several consecutive periods, breaking through the previous consolidation platform, indicating an upward trend. The current negative funding rate (-0.0596%) combined with firm price action suggests short squeeze potential, typical of a short-term momentum continuation structure.

🎯Direction: Long (Long)

⚡Entry/Order: 5.38 - 5.42 (n

View Original$VVV The 1H timeframe is consolidating strongly above EMA20 (5.19), just completing a test of the previous high at 5.38. The 4H timeframe has closed bullish for several consecutive periods, breaking through the previous consolidation platform, indicating an upward trend. The current negative funding rate (-0.0596%) combined with firm price action suggests short squeeze potential, typical of a short-term momentum continuation structure.

🎯Direction: Long (Long)

⚡Entry/Order: 5.38 - 5.42 (n

- Reward

- 1

- Comment

- Repost

- Share

汗血宝马

汗血宝马

Created By@gatefunuser_22b1

Listing Progress

100.00%

MC:

$8.03K

More Tokens

U.S stocks closed lower with the crypto market broadly declining

- Reward

- 1

- 3

- Repost

- Share

AylaShinex :

:

LFG 🔥View More

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinBouncesBack

Bitcoin Bounces Back Deep Technical, Liquidity, and Structural Market Analysis

Bitcoin (BTC) is currently trading near $61,800 after successfully reclaiming short-term support following a corrective move that tested the $58,000 liquidity zone. This rebound is not merely a relief bounce but represents a technically significant reaction from a high-probability institutional demand region. The recovery reinforces the broader bullish market structure and confirms that the recent decline was primarily a corrective liquidity sweep rather than a macro trend reversal.

From a marke

Bitcoin Bounces Back Deep Technical, Liquidity, and Structural Market Analysis

Bitcoin (BTC) is currently trading near $61,800 after successfully reclaiming short-term support following a corrective move that tested the $58,000 liquidity zone. This rebound is not merely a relief bounce but represents a technically significant reaction from a high-probability institutional demand region. The recovery reinforces the broader bullish market structure and confirms that the recent decline was primarily a corrective liquidity sweep rather than a macro trend reversal.

From a marke

BTC1,23%

- Reward

- 3

- 4

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#BitcoinBouncesBack

1️⃣ Current Market Snapshot

Bitcoin (BTC) Current Price: $66,934

Market Capitalization: ~$1.3 Trillion

24-Hour Trading Volume: ~$40 Billion

Dominance in Crypto Market: ~46%

Bitcoin has recently shown a significant technical rebound from lows around $64,500–$65,000. This recovery demonstrates that buyers are actively defending support levels, signaling potential continuation of upward momentum. The market is currently characterized by strong liquidity, institutional interest, and improving sentiment, creating favorable conditions for short-term and potentially medium-term g

1️⃣ Current Market Snapshot

Bitcoin (BTC) Current Price: $66,934

Market Capitalization: ~$1.3 Trillion

24-Hour Trading Volume: ~$40 Billion

Dominance in Crypto Market: ~46%

Bitcoin has recently shown a significant technical rebound from lows around $64,500–$65,000. This recovery demonstrates that buyers are actively defending support levels, signaling potential continuation of upward momentum. The market is currently characterized by strong liquidity, institutional interest, and improving sentiment, creating favorable conditions for short-term and potentially medium-term g

- Reward

- 8

- 7

- Repost

- Share

MoonGirl :

:

Ape In 🚀View More

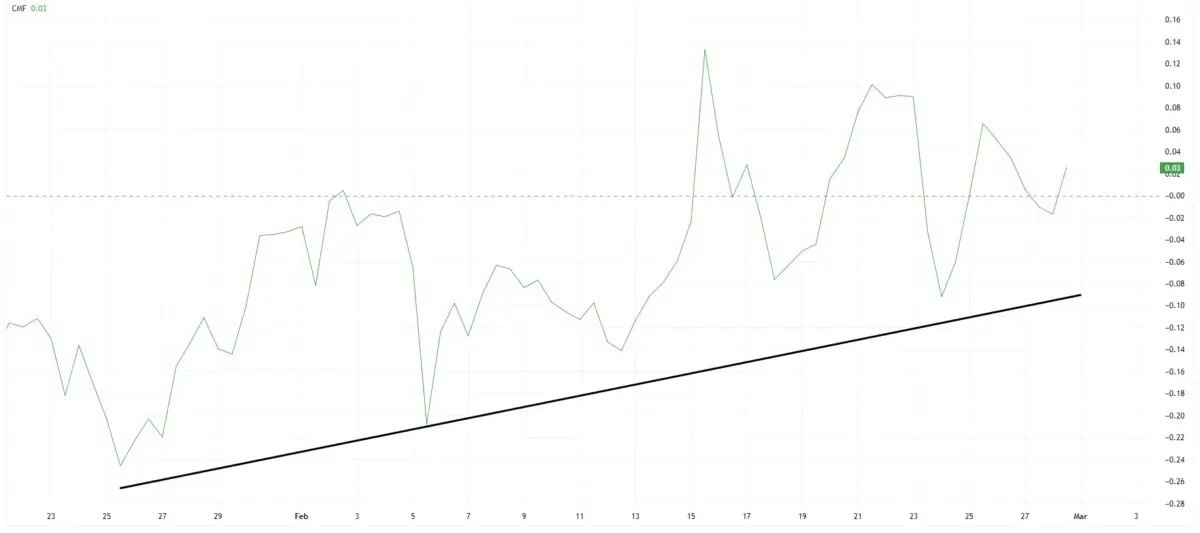

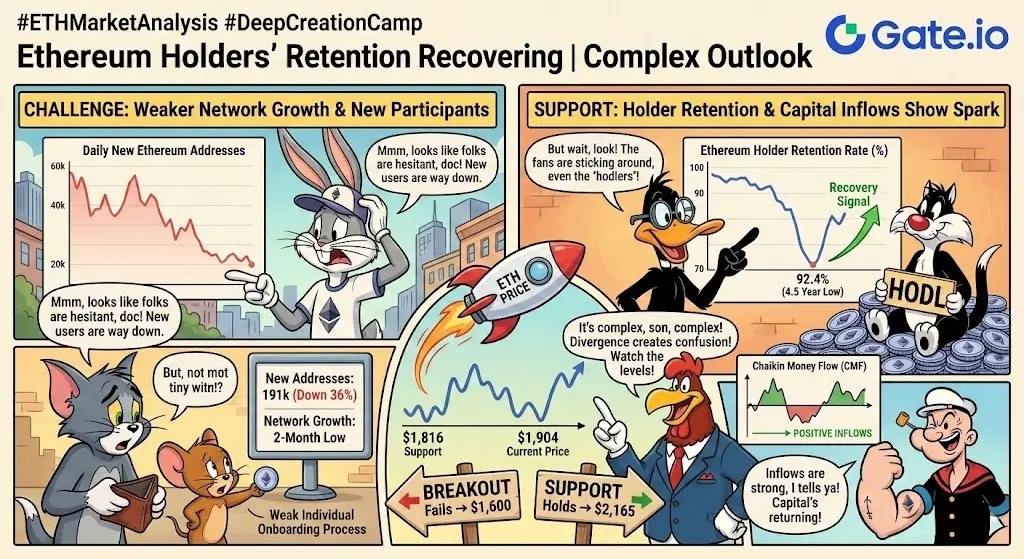

#ETHMarketAnalysis

#DeepCreationCamp

Ethereum Holders' Retention Rate Recovers from 4-Year Low

The Ethereum price has recently been exhibiting a sideways trend, resembling a slow decline rather than stability. ETH is struggling to gain sustained upward momentum. The withdrawal of new participants from the market is negatively impacting investor sentiment. Despite this, some long-term on-chain metrics have begun to show signs of recovery.

This divergence creates a complex picture for Ethereum. While network growth is weak, the improvement in the number of investors holding Ethereum is somew

#DeepCreationCamp

Ethereum Holders' Retention Rate Recovers from 4-Year Low

The Ethereum price has recently been exhibiting a sideways trend, resembling a slow decline rather than stability. ETH is struggling to gain sustained upward momentum. The withdrawal of new participants from the market is negatively impacting investor sentiment. Despite this, some long-term on-chain metrics have begun to show signs of recovery.

This divergence creates a complex picture for Ethereum. While network growth is weak, the improvement in the number of investors holding Ethereum is somew

ETH1,53%

- Reward

- 2

- Comment

- Repost

- Share

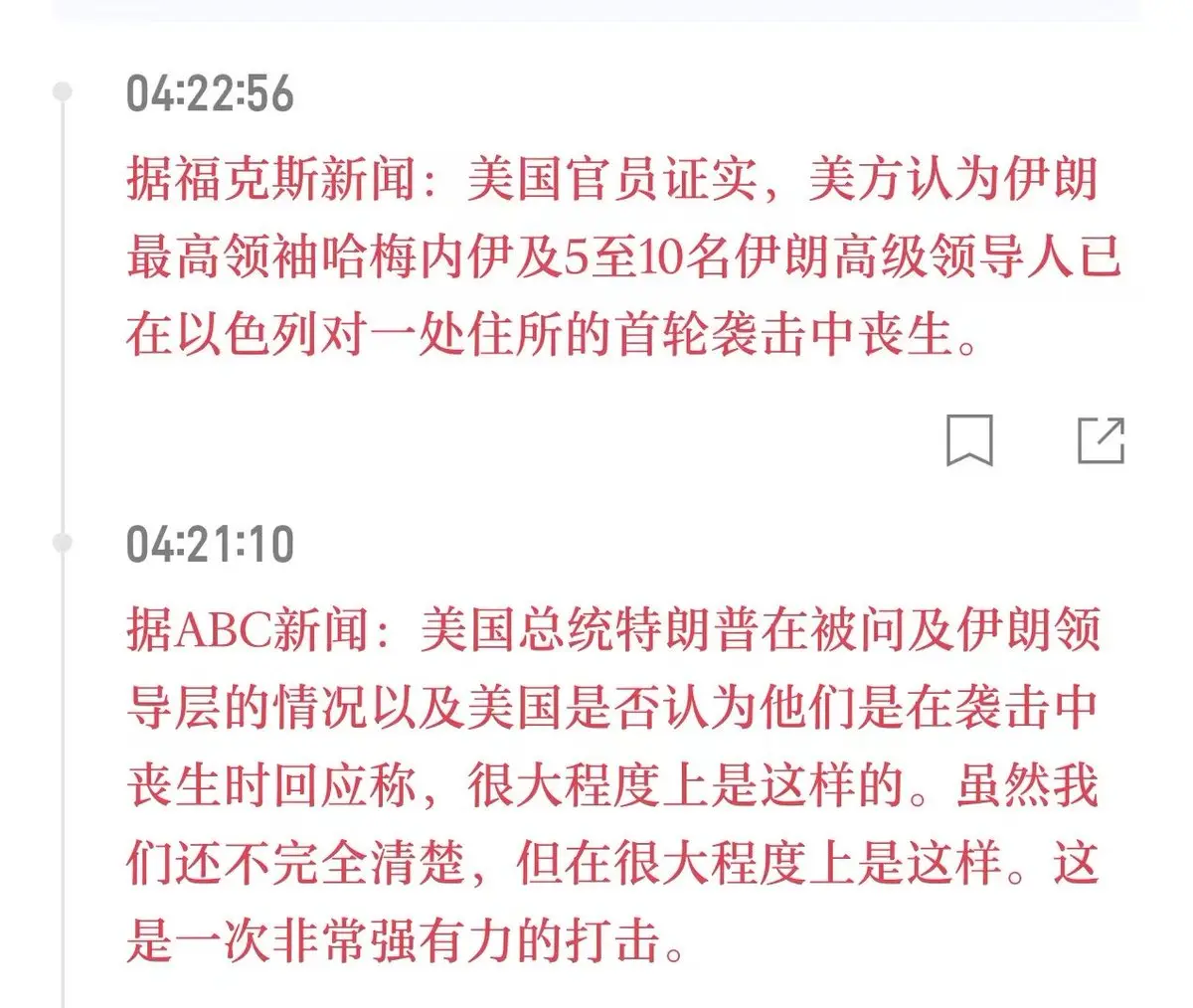

Congratulations to all of you #IsraelStrikesIranBTCPlunges #IsraelStrikesIranBTCPlunges #GateSquare$50KRedPacketGiveaway #DeepCreationCamp #NvidiaQ4RevenueSurges73%

View Original

- Reward

- 1

- Comment

- Repost

- Share

The early session market once again experienced a correction. Bitcoin recovered to around 65,000 in the early hours and continued to fluctuate, still maintaining a strong support at the bottom. The market saw a bullish rebound and adjustment. Currently, Bitcoin's highest recovery is around 67,800, but the price has remained around 67,000. Ethereum's movement is synchronized with Bitcoin; after recovering to around 1900, it stabilized somewhat. In the evening, following Bitcoin's correction pattern, Ethereum once surged to around 1980, and the overall market has stabilized within a range of flu

View Original

- Reward

- 1

- Comment

- Repost

- Share

The microphone applauds me, listening to me sing aloud.

View Original

- Reward

- like

- Comment

- Repost

- Share

It's already 2026. To verify the authenticity of the news, just check PM🤣. As long as there is any insider trading, the price change will reveal the truth in advance.

View Original

- Reward

- 1

- Comment

- Repost

- Share

pi

pi

Created By@LINA1

Listing Progress

0.00%

MC:

$2.38K

More Tokens

In the Pursuit of a Vision

Some platforms are built.

Others are born.

Gate Square belongs to the second kind. Because behind it, there is not only code and infrastructure — there is a belief: Financial freedom is not the privilege of the chosen few, but the right of everyone.

Leadership Speaks Quietly

True visionary leaders do not speak by shouting, but by building.

The fact that Gate Square has reached over 20 million users today is not a coincidence. It is the accumulated result of every right decision made over the years, every genuine respect shown to the community.

Large platforms often f

Some platforms are built.

Others are born.

Gate Square belongs to the second kind. Because behind it, there is not only code and infrastructure — there is a belief: Financial freedom is not the privilege of the chosen few, but the right of everyone.

Leadership Speaks Quietly

True visionary leaders do not speak by shouting, but by building.

The fact that Gate Square has reached over 20 million users today is not a coincidence. It is the accumulated result of every right decision made over the years, every genuine respect shown to the community.

Large platforms often f

- Reward

- 11

- 16

- Repost

- Share

repanzal :

:

To The Moon 🌕View More

Former Mt. Gox CEO Pushes Controversial Bitcoin Fork to Recover Lost Coins - - #dao #former #usa

BTC1,23%

- Reward

- 1

- Comment

- Repost

- Share

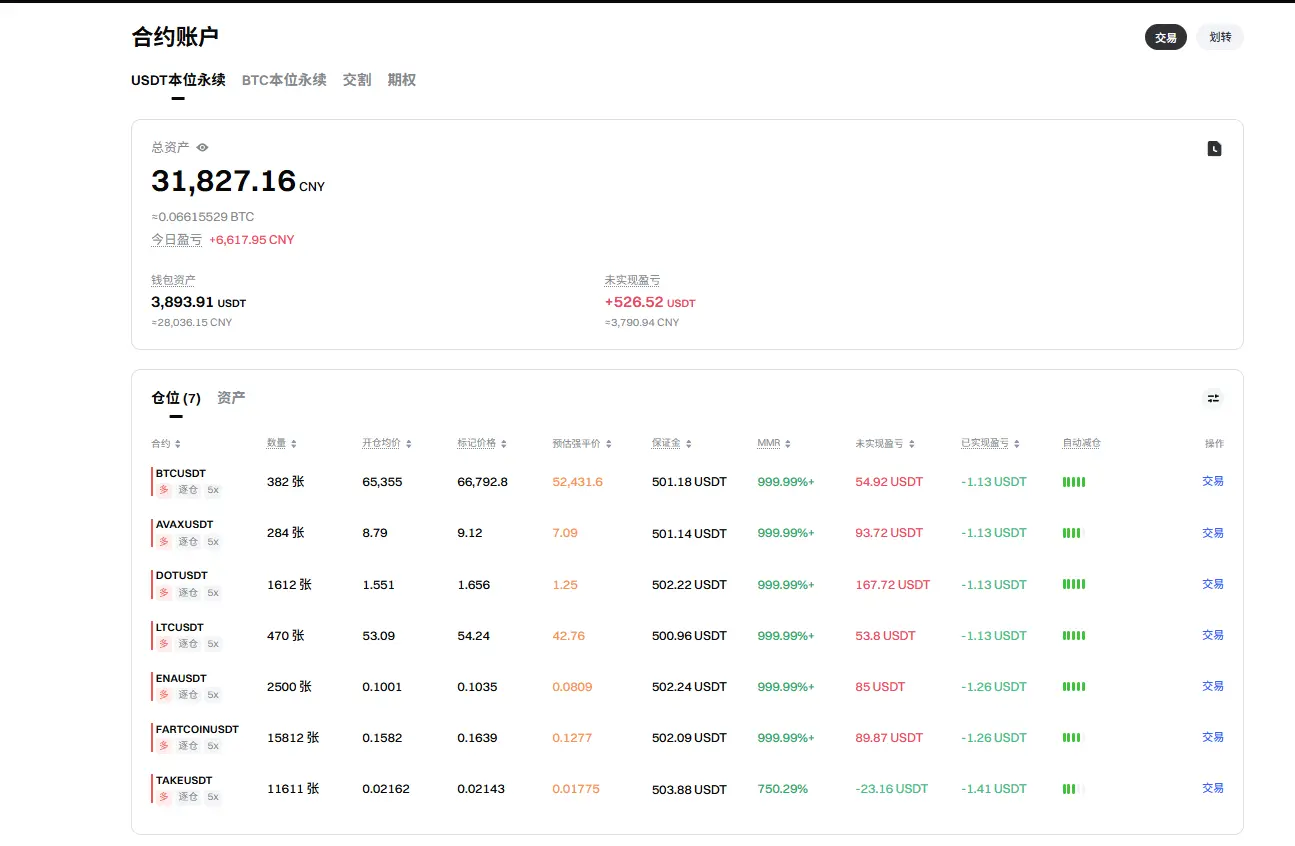

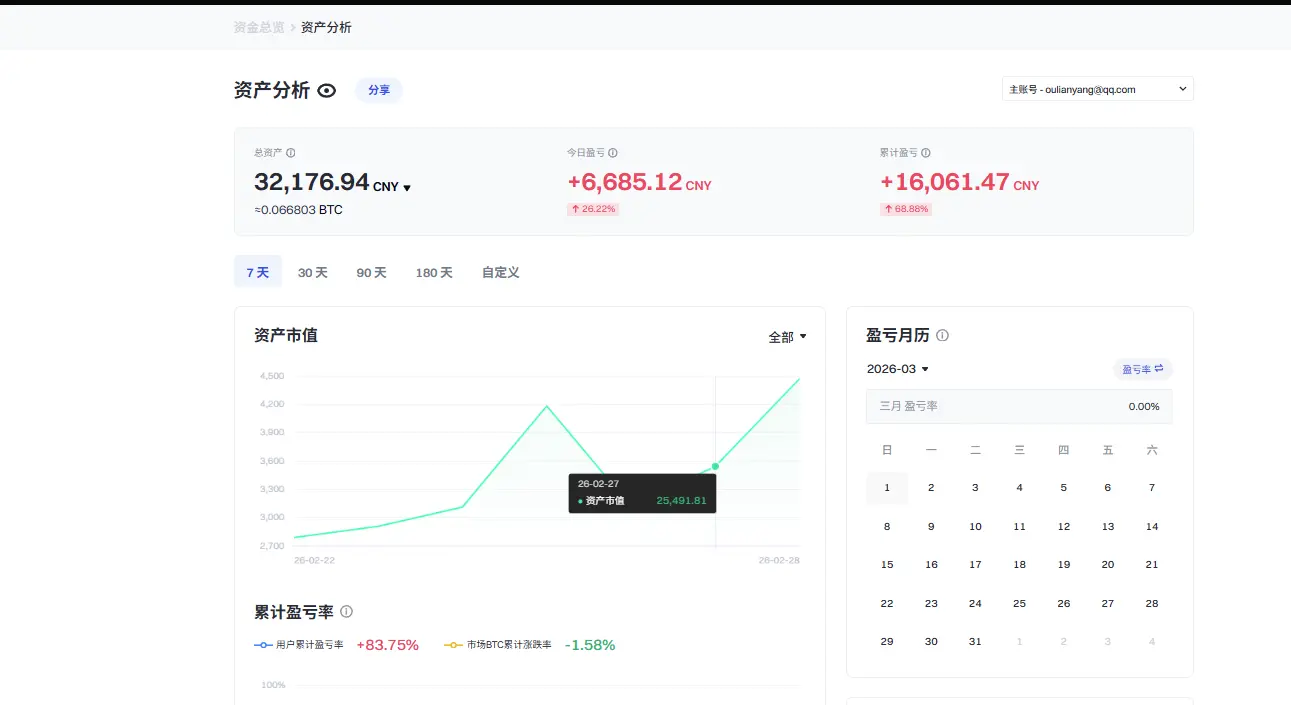

Challenge to earn 2,000 U to make 1 million U - Day 3

View Original

- Reward

- 2

- Comment

- Repost

- Share

#TrumpordersfederalbanonAnthropicAI knkjbvvbnnbbbvfffffffgnlmnjbbbbhbbbvccvvvhvbnnbbbbbbvvcfggjjhggnlllmmnvgfkşllllkbccccgfffffghbbbbbvbbb

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Yo funka play march madness 🫨

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

Buy The Dip or Wait Now?

(Real-Time Karachi Update: March 1, 2026 – Early Morning Asia Session

BTC Crashes Into Extreme Fear: $65K–$67K Range Holds – Is This the Ultimate Accumulation Zone or a Trap Before $50K?

Bitcoin Faces Make-or-Break Week: $60,000 Line in the Sand Decides Bull Continuation or Bear Acceleration

Extreme Fear Index at 11–14: Historical Bottom Signal or Prolonged Pain Ahead?

Spot BTC ETFs Flip Script: $1.1B+ Inflows in Late February – Institutions Quietly Loading the Dip?

Leverage Flush Mostly Done? Negative Funding + Declining Sell Volume Signal Pote

Buy The Dip or Wait Now?

(Real-Time Karachi Update: March 1, 2026 – Early Morning Asia Session

BTC Crashes Into Extreme Fear: $65K–$67K Range Holds – Is This the Ultimate Accumulation Zone or a Trap Before $50K?

Bitcoin Faces Make-or-Break Week: $60,000 Line in the Sand Decides Bull Continuation or Bear Acceleration

Extreme Fear Index at 11–14: Historical Bottom Signal or Prolonged Pain Ahead?

Spot BTC ETFs Flip Script: $1.1B+ Inflows in Late February – Institutions Quietly Loading the Dip?

Leverage Flush Mostly Done? Negative Funding + Declining Sell Volume Signal Pote

BTC1,23%

- Reward

- 2

- 5

- Repost

- Share

AYATTAC :

:

1000x VIbes 🤑View More

$LOOKS Over 7 million tokens burned.

Looks has a fixed supply — no more minting.

Every token burned is gone forever.

Supply decreases, never increases.

It’s a slow path toward scarcity.

If you believe in its future,

the small portion you burn

could be part of a bigger shift.

Time + deflation + liquidity return

Looks has a fixed supply — no more minting.

Every token burned is gone forever.

Supply decreases, never increases.

It’s a slow path toward scarcity.

If you believe in its future,

the small portion you burn

could be part of a bigger shift.

Time + deflation + liquidity return

LOOKS0,84%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More42.47M Popularity

155.59K Popularity

113.42K Popularity

1.67M Popularity

511.73K Popularity

News

View MoreMichael Saylor: STRC's March 2026 deferred dividend yield increased to 11.50%

13 m

Aave Will Win Proposal Temp Check Passed

27 m

Four of Hamaney's relatives are reportedly killed in the attack.

39 m

Iran's crypto "shadow economy" size reaches $7.78 billion, with the public turning to Bitcoin for risk hedging

43 m

Data: If BTC drops below $63,467, the total long liquidation strength on mainstream CEXs will reach $971 million.

43 m

Pin