Post content & earn content mining yield

placeholder

CryptoPulseElite

What Is Bittensor (TAO)? The Decentralized AI Network Facing Its First Halving

Bittensor (TAO) is an open-source, blockchain-based protocol that creates a peer-to-peer marketplace for machine intelligence.

- Reward

- like

- Comment

- Repost

- Share

📊 Latest market updates on major coins. This is a review from a crypto enthusiast, based purely on my own observations.

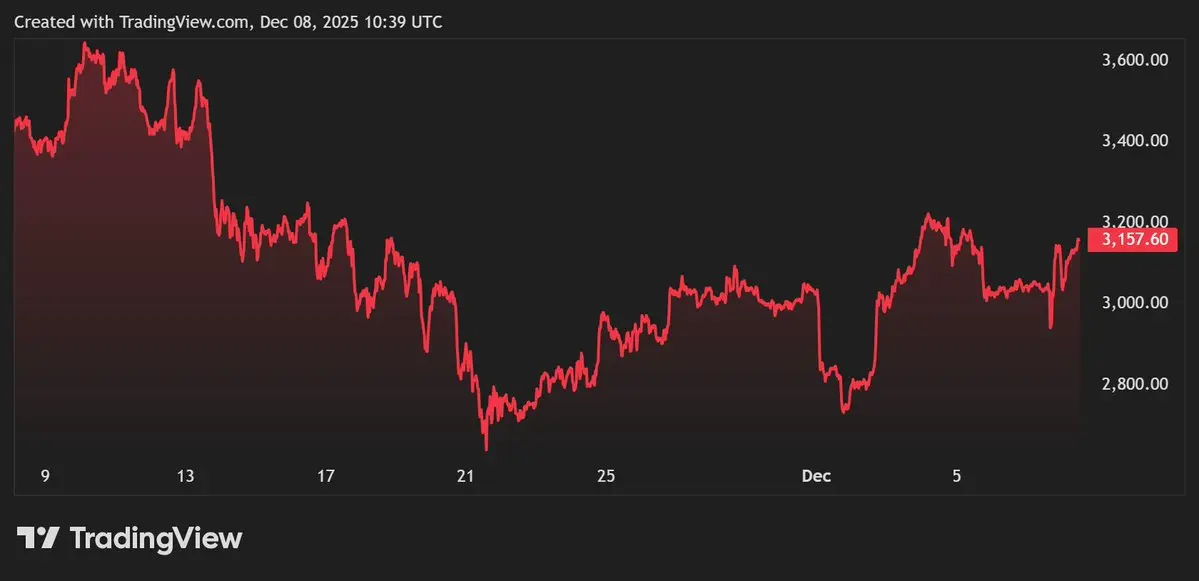

Crypto Market Overview: November 29 - December 6, 2025.

The market spent the week with mixed sentiment: sharp moves, quick rebounds, and a lot of caution among traders. I see this even in myself, as I’m not rushing and just observing for now. BTC is driving the market’s overall dynamics, while altcoins are looking for support points after declines.

🟧 BTC. Bitcoin experienced strong price swings this week—from a deep drop to a partial recovery. Demand is returning gradually,

Crypto Market Overview: November 29 - December 6, 2025.

The market spent the week with mixed sentiment: sharp moves, quick rebounds, and a lot of caution among traders. I see this even in myself, as I’m not rushing and just observing for now. BTC is driving the market’s overall dynamics, while altcoins are looking for support points after declines.

🟧 BTC. Bitcoin experienced strong price swings this week—from a deep drop to a partial recovery. Demand is returning gradually,

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Ethereum whales are making a major bet on a rebound.

On-chain data shows they have opened $426M in new leveraged long positions, with several well-known wallets taking large exposure as ETH holds above the $3,000 level.

These positions include:

- 1011short: $169M long

- Anti-CZ: $194M long

- pension-usdt.eth: $62.5M long

On-chain data shows they have opened $426M in new leveraged long positions, with several well-known wallets taking large exposure as ETH holds above the $3,000 level.

These positions include:

- 1011short: $169M long

- Anti-CZ: $194M long

- pension-usdt.eth: $62.5M long

ETH6.81%

- Reward

- like

- Comment

- Repost

- Share

Guys, take a close look at this $ETH As I've been saying all along.....

Ethereum whales just scooped up nearly 400,000 ETH between Sunday and Monday one of the biggest accumulation spikes in recent months.

This surge in whale activity comes right as the Federal Reserve is expected to cut interest rates by 25 bps on Wednesday, adding fuel to the bullish narrative.

Key Market Signals

ETH is up 6% today, boosted by fresh whale demand and President Donald Trump’s recent comments about the next Federal Reserve Chair.

Price is now eyeing the $3,470 resistance, a key level that could open the door

Ethereum whales just scooped up nearly 400,000 ETH between Sunday and Monday one of the biggest accumulation spikes in recent months.

This surge in whale activity comes right as the Federal Reserve is expected to cut interest rates by 25 bps on Wednesday, adding fuel to the bullish narrative.

Key Market Signals

ETH is up 6% today, boosted by fresh whale demand and President Donald Trump’s recent comments about the next Federal Reserve Chair.

Price is now eyeing the $3,470 resistance, a key level that could open the door

ETH6.81%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Solana price could rise by 25% if this resistance is broken

The price of Solana (SOL) has continued to remain in a narrow range for almost a month, ranging from $125 to $145 since mid-November. Both buyers and sellers have not been able to dominate significantly, causing the market to fall into a state of tug-of-war.

The price declines are all strongly supported at $125, in the

The price declines are all strongly supported at $125, in the

SOL4.46%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Chainlink price eyes rebound as LINK ETF nears $50m milestone as whales buy

Chainlink's price is stabilizing around $14 after a market rally. A bullish falling wedge pattern and increased ETF inflows signal a potential rise to $20. Supply on exchanges is decreasing, while whale accumulation supports demand for LINK tokens.

- Reward

- like

- Comment

- Repost

- Share

BlackRock officially submits Ethereum staking ETF application—Is Ethereum entering the era of "price + yield" dual engines?

On December 8, 2025, the world’s largest asset management company, BlackRock, officially filed a prospectus for the iShares Staked Ethereum Trust ETF with the U.S. Securities and Exchange Commission. This brand-new product will become BlackRock’s fourth crypto-related ETF, following its spot Bitcoin, spot Ethereum, and “Bitcoin yield” ETFs.

This is not the first time BlackRock has shown interest in Ethereum’s staking capabilities. As early as July this year, the company submitted a rule change request, seeking to add staking functionality to its existing iShares Ethereum Trust (ETHA). Even earlier, in May, the head of BlackRock’s digital assets division stated that current Ethereum ETFs are “not perfect” due to the lack of staking features.

01 Event Focus: From Preparation to Formal Application

According to Bloomberg analysts on social

This is not the first time BlackRock has shown interest in Ethereum’s staking capabilities. As early as July this year, the company submitted a rule change request, seeking to add staking functionality to its existing iShares Ethereum Trust (ETHA). Even earlier, in May, the head of BlackRock’s digital assets division stated that current Ethereum ETFs are “not perfect” due to the lack of staking features.

01 Event Focus: From Preparation to Formal Application

According to Bloomberg analysts on social

- Reward

- like

- Comment

- Repost

- Share

The Battle Between Tokenized Deposits and Stablecoins: The Future of Finance Is Not Replacement but Integration

Author: Simon Taylor

Translation: Block unicorn

Banks create money, stablecoins drive money movement. We need both.

Proponents of tokenized deposits say: “Stablecoins are unregulated shadow banks. Once banks have tokenized deposits, everyone will prefer banks.”

Some banks and central banks really like this narrative.

Stablecoin advocates say: “Banks are dinosaurs. We don’t need them on-chain at all. Stablecoins are the future of money.”

Crypto natives especially like this narrative.

Both sides are missing the point.

Banks provide cheaper credit to their biggest clients

You deposit $100, which turns into $90 in loans (or even more). This is how fractional reserve banking works. For centuries, it has been the engine of economic growth.

Fortune 500 companies

Translation: Block unicorn

Banks create money, stablecoins drive money movement. We need both.

Proponents of tokenized deposits say: “Stablecoins are unregulated shadow banks. Once banks have tokenized deposits, everyone will prefer banks.”

Some banks and central banks really like this narrative.

Stablecoin advocates say: “Banks are dinosaurs. We don’t need them on-chain at all. Stablecoins are the future of money.”

Crypto natives especially like this narrative.

Both sides are missing the point.

Banks provide cheaper credit to their biggest clients

You deposit $100, which turns into $90 in loans (or even more). This is how fractional reserve banking works. For centuries, it has been the engine of economic growth.

Fortune 500 companies

USDC-0.03%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

109.32K Popularity

31.07K Popularity

9.89K Popularity

8.33K Popularity

37.28K Popularity

- Hot Gate FunView More

- MC:$3.63KHolders:10.00%

- MC:$3.64KHolders:10.00%

- MC:$3.69KHolders:30.04%

- MC:$3.63KHolders:10.00%

- MC:$3.63KHolders:10.00%

- Pin