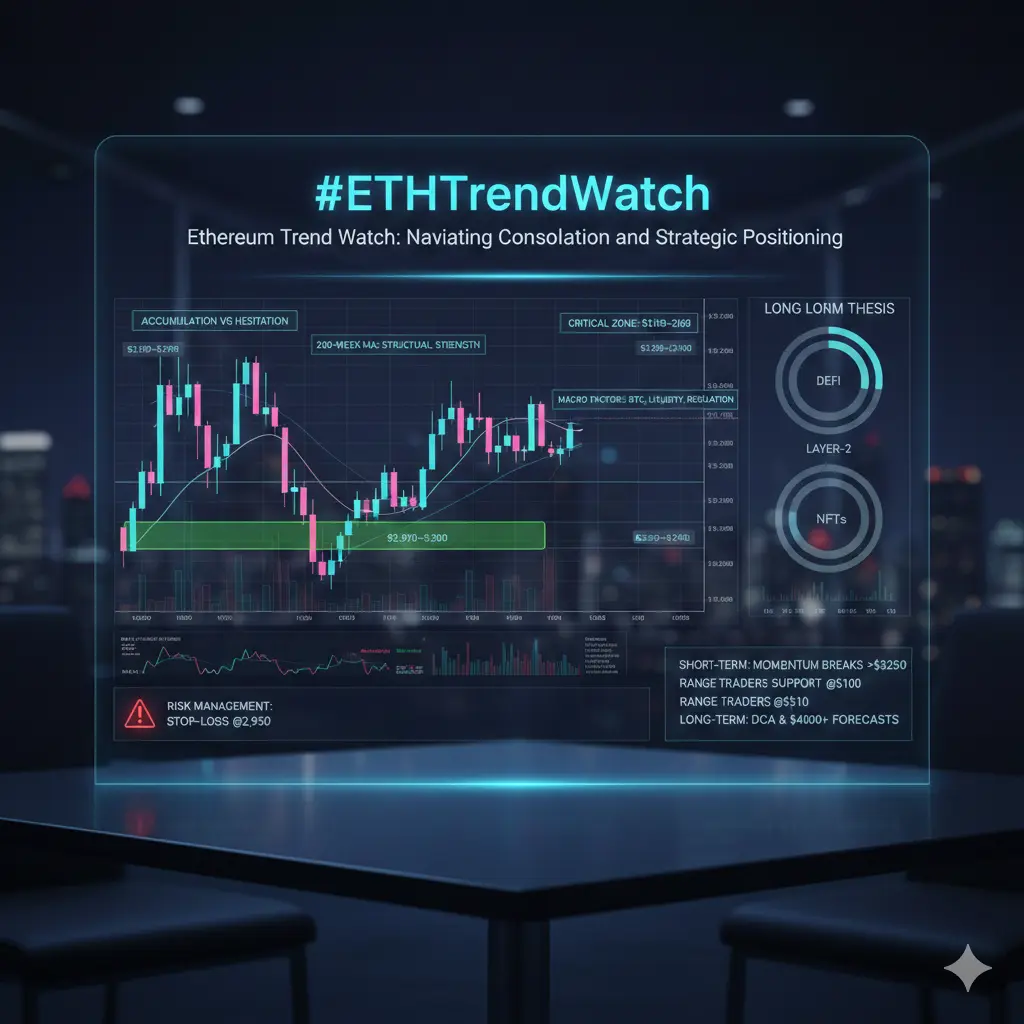

#ETHTrendWatch

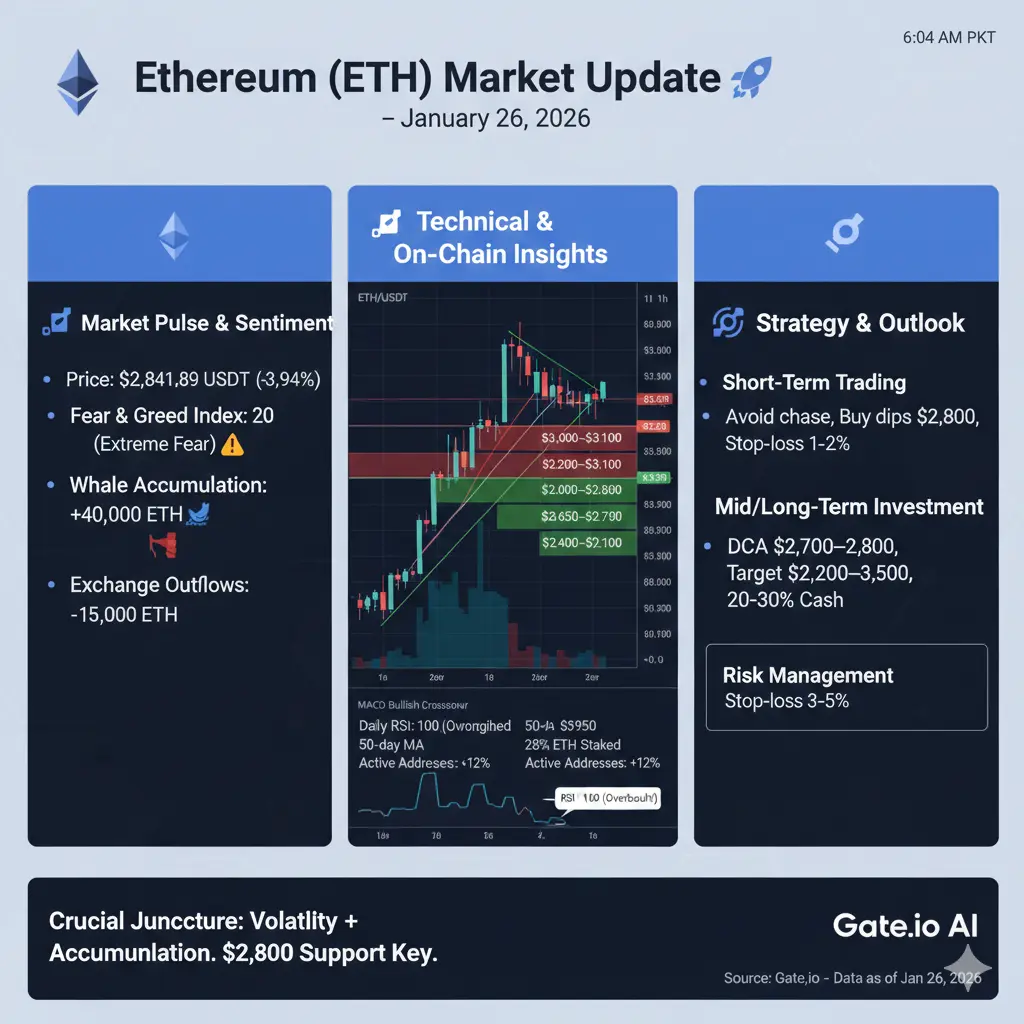

Ethereum (ETH) Market Update – January 26, 2026 🚀

Current Price: $2,841.89 USDT

24h Range: $2,787.25 – $2,960.46

24h Change: -3.94% (up 1.2% in last hour)

24h Volume: 197,278 ETH (~$568M)

📊 Market Pulse & Sentiment

Ethereum is navigating high volatility amid a broader crypto correction. Extreme fear dominates the market (Fear & Greed Index: 20), historically a potential bounce zone—but also a warning for short-term pullbacks. Short-term charts (15min–1h) show buying strength with volume surging 56%, signaling potential accumulation. Daily RSI hits 100—rare overbought levels that often precede 5–10% corrections.

Whale activity is heating up: $115M (~40,000 ETH) recently shifted to cold storage, hinting at institutional accumulation. Net exchange outflows (-15,000 ETH) reinforce HODLing sentiment.

📈 Technical Highlights

Short-Term (15min–1h):

Strong uptrend testing $2,842.70 resistance

MACD bullish crossover, Stochastic near overbought (85+)

Bollinger Bands squeezing—watch for breakout

Daily & Weekly:

RSI at 100 (overbought)

50-day MA resistance at $2,950

Bearish engulfing weekly, but ETH still correlated with BTC (0.92)

Order Book & Liquidity:

Tight bid-ask spread (0.05%)

Exchange liquidity ~$1.2B within 2% range

Thin support below $2,700—risk of amplified drops

🌐 On-Chain Insights

Active addresses up 12% to 450,000+

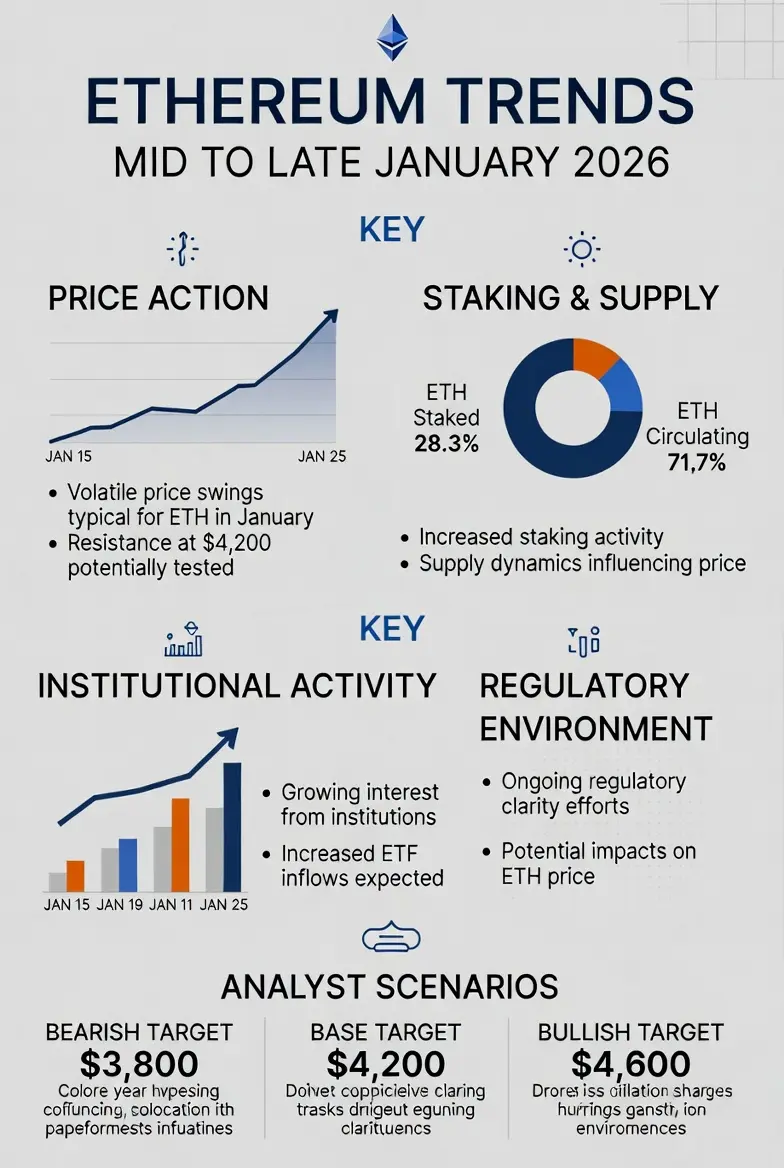

28% of ETH staked (~4.5% APY)

Exchange outflows suggest accumulation, not selling pressure

⚡ Market Drivers & Catalysts

Bullish:

Ethereum upgrades (Dencun hard fork, cheaper L2 fees)

ETF inflows (~$500M weekly potential)

Macro easing (Fed rate cuts in Q1 2026)

Historical bounces from Extreme Fear: 15–25% within 2 weeks (60% probability)

Bearish:

ETF outflows ($200M+ weekly)

BTC drop below $85K could drag ETH to $2,500

Whale dumps, low-liquidity flash crashes

Comparative Outlook:

ETH underperforming BTC (ETH/BTC ratio 0.0327, down 2% weekly)

Defensive layer-2 tokens holding better; high-beta altcoins tanking

DeFi TVL at $90B (+5% WoW), NFT volumes rebounding 15%

🎯 Investment & Trading Strategy

Short-Term Trading:

Avoid chasing 15min uptrend near $2,842 resistance

Buy dips: $2,800 (target $2,900), tight stop 1–2%

Monitor Asian session (6–8 AM PKT) for volume spikes

Mid/Long-Term Investment:

DCA into $2,800–$2,700 support (20–30% allocation)

Target recovery $3,200–$3,500 by Q2 2026 (60% probability)

Stake for 4–5% yield or diversify into ETH ecosystem projects

Keep 20–30% cash for deeper dips

Local Tip (Karachi / PKT):

Hedge against PKR volatility using stablecoins

Focus on 1h/4h charts for trading; quarterly on-chain reports for long-term

🔹 Precise Entry & Exit Zones

Buy Zones:

Strong Buy: $2,800–$2,850 (high-volume node)

Value Buy: $2,650–$2,750 (Fib 0.618 retracement)

Deep Value: $2,400–$2,500 (cycle low, high risk/reward)

Sell Zones:

Initial: $3,000–$3,100 (50-day MA resistance)

Target: $3,200–$3,300 (Fib 1.618 extension)

Overextended: $3,500+ (psychological level, trail stops recommended)

Risk Management:

Stop-loss 3–5% below buy zones

Never risk >2% per trade

Monitor whale moves, macro news, and ETF flows

Bottom Line:

ETH is at a crucial juncture: short-term volatility offers scalp opportunities, while institutional accumulation and staking mechanics provide a strong mid/long-term floor. Market support at $2,800–$2,700 is key—breaking it could test $2,500. Watch BTC and macro trends for directional cues.

If you want, I can also create a high-impact infographic/image for this ETH analysis with key buy/sell zones, charts, and whale activity,

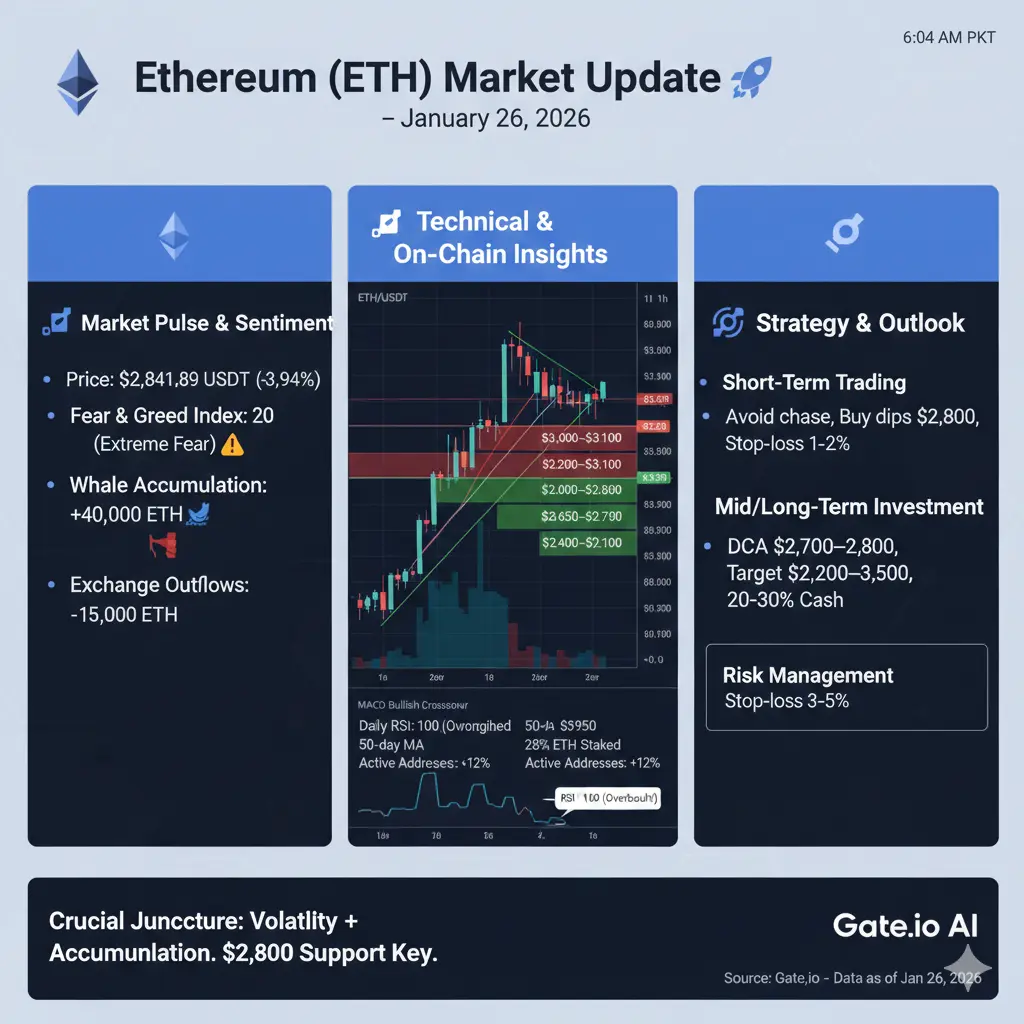

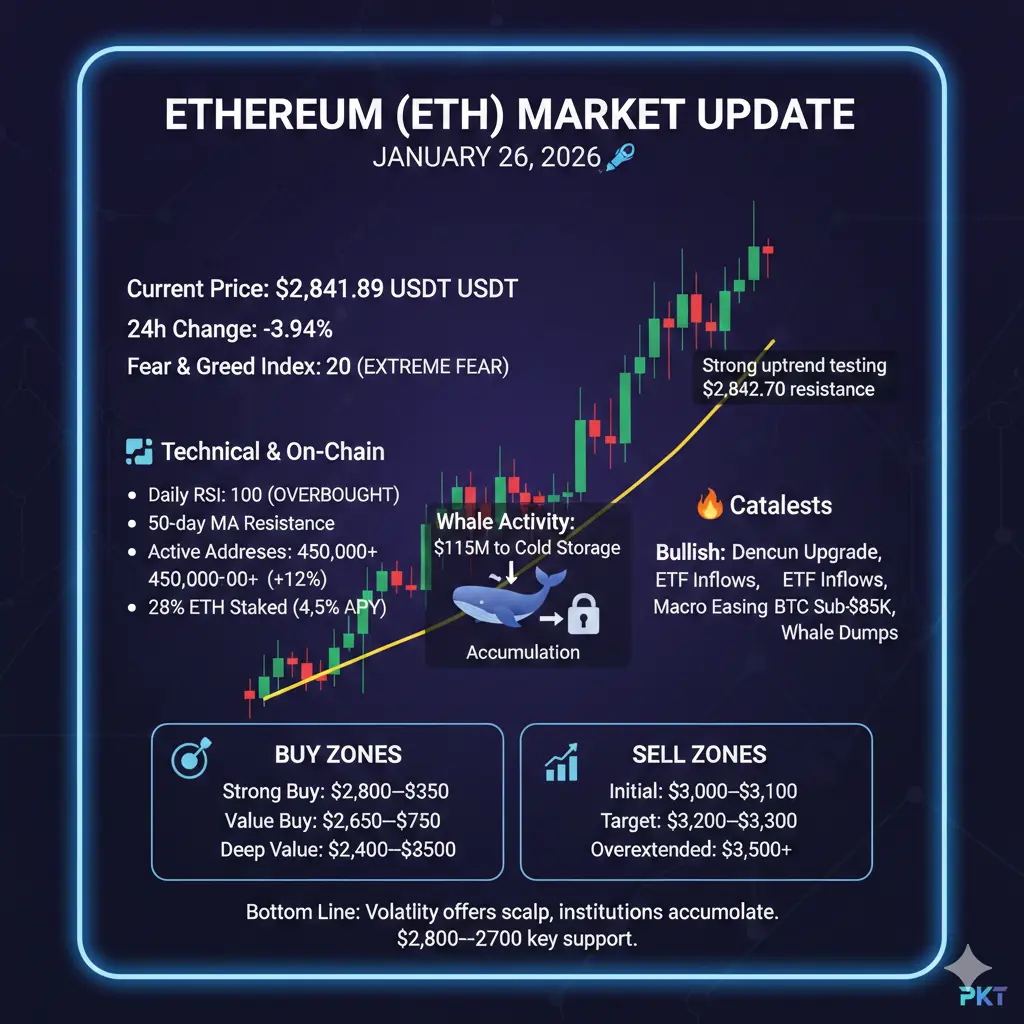

Ethereum (ETH) Market Update – January 26, 2026 🚀

Current Price: $2,841.89 USDT

24h Range: $2,787.25 – $2,960.46

24h Change: -3.94% (up 1.2% in last hour)

24h Volume: 197,278 ETH (~$568M)

📊 Market Pulse & Sentiment

Ethereum is navigating high volatility amid a broader crypto correction. Extreme fear dominates the market (Fear & Greed Index: 20), historically a potential bounce zone—but also a warning for short-term pullbacks. Short-term charts (15min–1h) show buying strength with volume surging 56%, signaling potential accumulation. Daily RSI hits 100—rare overbought levels that often precede 5–10% corrections.

Whale activity is heating up: $115M (~40,000 ETH) recently shifted to cold storage, hinting at institutional accumulation. Net exchange outflows (-15,000 ETH) reinforce HODLing sentiment.

📈 Technical Highlights

Short-Term (15min–1h):

Strong uptrend testing $2,842.70 resistance

MACD bullish crossover, Stochastic near overbought (85+)

Bollinger Bands squeezing—watch for breakout

Daily & Weekly:

RSI at 100 (overbought)

50-day MA resistance at $2,950

Bearish engulfing weekly, but ETH still correlated with BTC (0.92)

Order Book & Liquidity:

Tight bid-ask spread (0.05%)

Exchange liquidity ~$1.2B within 2% range

Thin support below $2,700—risk of amplified drops

🌐 On-Chain Insights

Active addresses up 12% to 450,000+

28% of ETH staked (~4.5% APY)

Exchange outflows suggest accumulation, not selling pressure

⚡ Market Drivers & Catalysts

Bullish:

Ethereum upgrades (Dencun hard fork, cheaper L2 fees)

ETF inflows (~$500M weekly potential)

Macro easing (Fed rate cuts in Q1 2026)

Historical bounces from Extreme Fear: 15–25% within 2 weeks (60% probability)

Bearish:

ETF outflows ($200M+ weekly)

BTC drop below $85K could drag ETH to $2,500

Whale dumps, low-liquidity flash crashes

Comparative Outlook:

ETH underperforming BTC (ETH/BTC ratio 0.0327, down 2% weekly)

Defensive layer-2 tokens holding better; high-beta altcoins tanking

DeFi TVL at $90B (+5% WoW), NFT volumes rebounding 15%

🎯 Investment & Trading Strategy

Short-Term Trading:

Avoid chasing 15min uptrend near $2,842 resistance

Buy dips: $2,800 (target $2,900), tight stop 1–2%

Monitor Asian session (6–8 AM PKT) for volume spikes

Mid/Long-Term Investment:

DCA into $2,800–$2,700 support (20–30% allocation)

Target recovery $3,200–$3,500 by Q2 2026 (60% probability)

Stake for 4–5% yield or diversify into ETH ecosystem projects

Keep 20–30% cash for deeper dips

Local Tip (Karachi / PKT):

Hedge against PKR volatility using stablecoins

Focus on 1h/4h charts for trading; quarterly on-chain reports for long-term

🔹 Precise Entry & Exit Zones

Buy Zones:

Strong Buy: $2,800–$2,850 (high-volume node)

Value Buy: $2,650–$2,750 (Fib 0.618 retracement)

Deep Value: $2,400–$2,500 (cycle low, high risk/reward)

Sell Zones:

Initial: $3,000–$3,100 (50-day MA resistance)

Target: $3,200–$3,300 (Fib 1.618 extension)

Overextended: $3,500+ (psychological level, trail stops recommended)

Risk Management:

Stop-loss 3–5% below buy zones

Never risk >2% per trade

Monitor whale moves, macro news, and ETF flows

Bottom Line:

ETH is at a crucial juncture: short-term volatility offers scalp opportunities, while institutional accumulation and staking mechanics provide a strong mid/long-term floor. Market support at $2,800–$2,700 is key—breaking it could test $2,500. Watch BTC and macro trends for directional cues.

If you want, I can also create a high-impact infographic/image for this ETH analysis with key buy/sell zones, charts, and whale activity,