Post content & earn content mining yield

placeholder

AciewWelcomeToOurWebsite!Here,

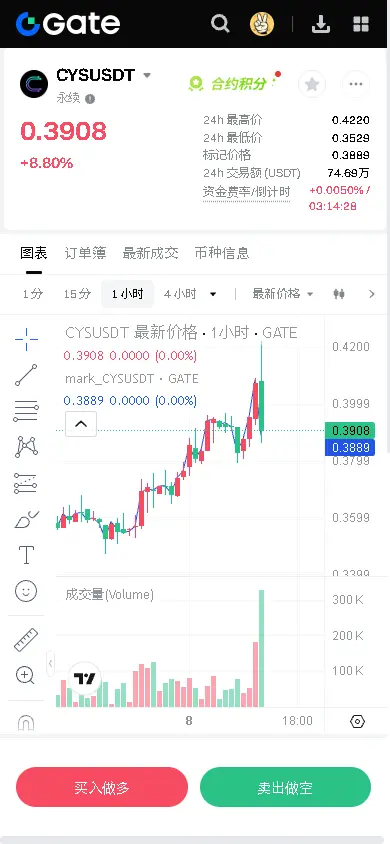

#BuyTheDipOrWaitNow? Crypto Trading Risks

Trading crypto is not as easy as it looks.

Risks You Should Know

- Prices change fast – gains can turn into losses quickly.

- Scams exist – many coins are unsafe or fake.

- Stressful decisions – emotions often lead to mistakes.

- Security problems – hacks and exchange failures can cost you money.

Stay Careful

Always learn first, set clear limits, and only invest what you can afford to lose.

---

👉 For more simple tips and honest crypto education, follow our account and stay safe in the market!

Trading crypto is not as easy as it looks.

Risks You Should Know

- Prices change fast – gains can turn into losses quickly.

- Scams exist – many coins are unsafe or fake.

- Stressful decisions – emotions often lead to mistakes.

- Security problems – hacks and exchange failures can cost you money.

Stay Careful

Always learn first, set clear limits, and only invest what you can afford to lose.

---

👉 For more simple tips and honest crypto education, follow our account and stay safe in the market!

- Reward

- 1

- Comment

- Repost

- Share

[$OP Signal] Short position + Weak consolidation awaiting a breakout

$OP is consolidating weakly below a key resistance level, with no effective rebound on the 4H timeframe, and buying pressure continues to be absorbed.

🎯 Direction: Short position

After being blocked at 0.2027, the price failed to break above 0.1970 for four consecutive 4H candles, indicating that the bulls are losing strength. Taker Volume shows that active selling dominates, and although the funding rate is negative, its absolute value is small, unable to generate a short squeeze. The order book is heavily stacked with se

View Original$OP is consolidating weakly below a key resistance level, with no effective rebound on the 4H timeframe, and buying pressure continues to be absorbed.

🎯 Direction: Short position

After being blocked at 0.2027, the price failed to break above 0.1970 for four consecutive 4H candles, indicating that the bulls are losing strength. Taker Volume shows that active selling dominates, and although the funding rate is negative, its absolute value is small, unable to generate a short squeeze. The order book is heavily stacked with se

- Reward

- like

- Comment

- Repost

- Share

#币圈生存指南 The Most Simple Survival Guide for Ordinary People in the Cryptocurrency World

In the crypto space, the most important thing to remember is:

Anything is possible.

You might hear stories of overnight riches, or you might hear about losing everything and going broke, so anything can happen.

For ordinary people in the crypto world, here are some rational and practical suggestions.

1. If you don’t understand it and don’t believe it, stay far away from the crypto space.

Most ordinary people actually don’t understand the crypto world; admitting your ignorance is a form of wisdom. Don’t try t

In the crypto space, the most important thing to remember is:

Anything is possible.

You might hear stories of overnight riches, or you might hear about losing everything and going broke, so anything can happen.

For ordinary people in the crypto world, here are some rational and practical suggestions.

1. If you don’t understand it and don’t believe it, stay far away from the crypto space.

Most ordinary people actually don’t understand the crypto world; admitting your ignorance is a form of wisdom. Don’t try t

BTC-2,06%

- Reward

- 7

- 11

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

芝麻财富

芝麻财富

Created By@AYyA

Listing Progress

0.00%

MC:

$0.1

Create My Token

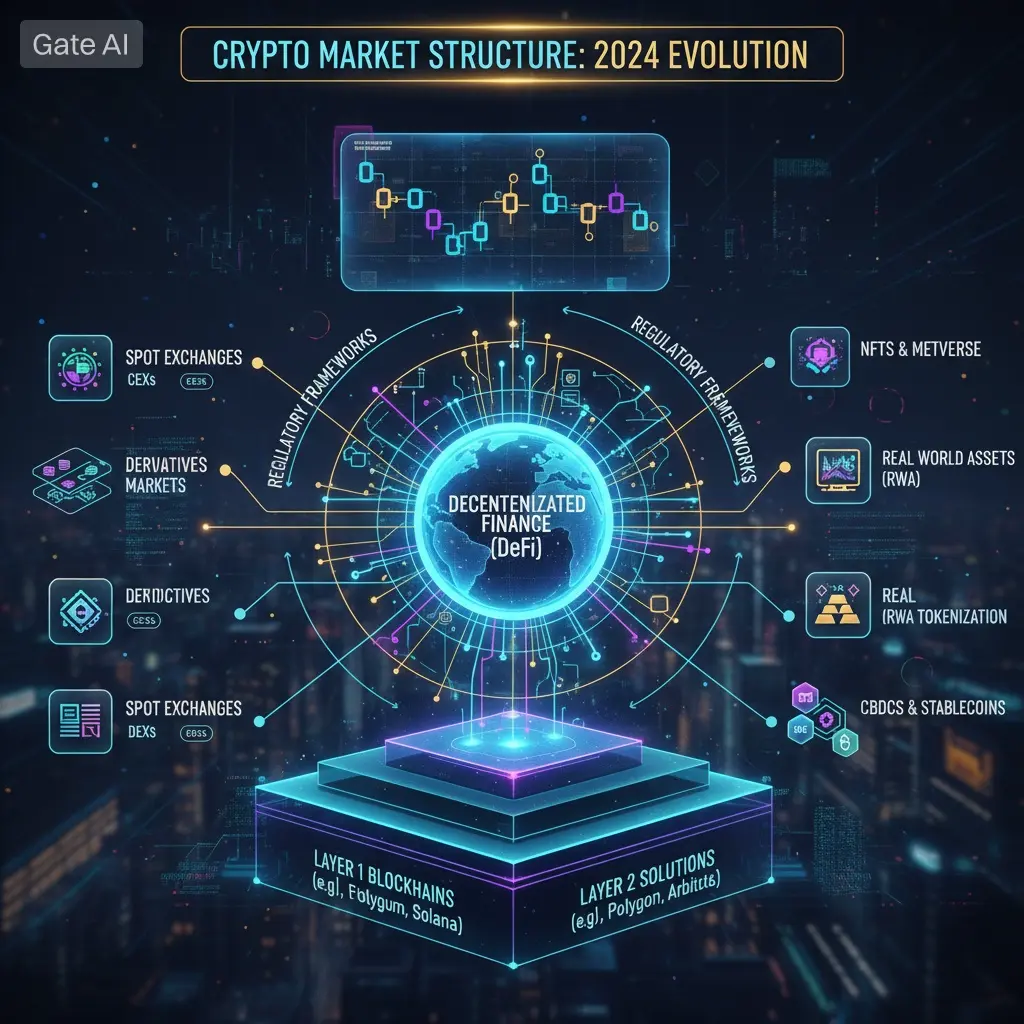

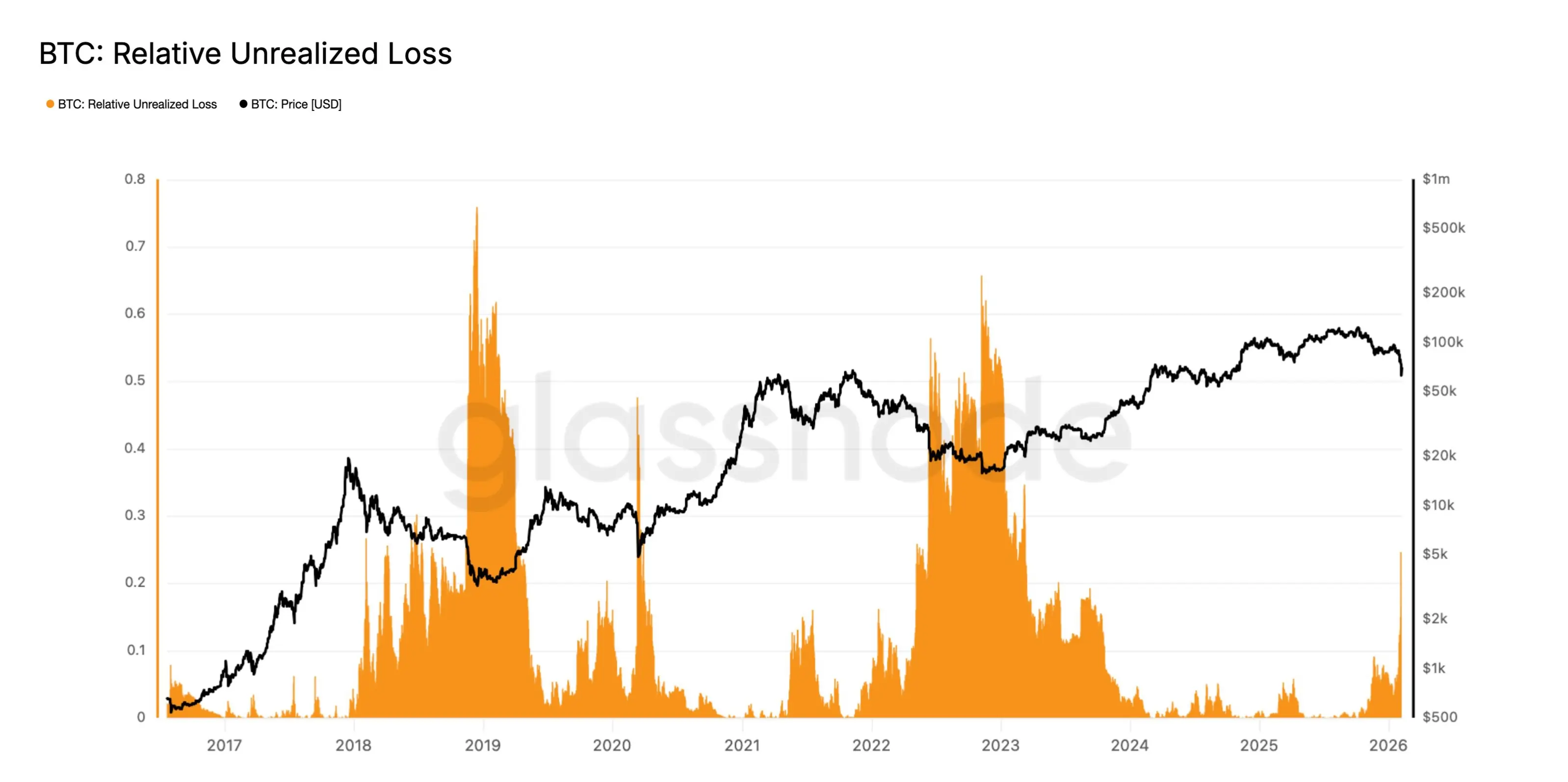

#CryptoMarketStructureUpdate 🔥 Crypto Market Structure Update – February 2026: Capitulation, Rebound, and Fragile Recovery 🔥

The crypto market has just experienced one of its sharpest shake-outs since late 2022. Bitcoin led the move, briefly breaching the $61,000 support level before rebounding powerfully into the $70,000–$71,000 zone. This pattern reflects a classic “flush-and-bounce” scenario, where panic selling triggers forced liquidations, stops cascade, and opportunistic buyers step in to absorb the excess supply. While this short-term rebound has restored some confidence, the broader

The crypto market has just experienced one of its sharpest shake-outs since late 2022. Bitcoin led the move, briefly breaching the $61,000 support level before rebounding powerfully into the $70,000–$71,000 zone. This pattern reflects a classic “flush-and-bounce” scenario, where panic selling triggers forced liquidations, stops cascade, and opportunistic buyers step in to absorb the excess supply. While this short-term rebound has restored some confidence, the broader

- Reward

- 1

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

"Arrogant dragons will regret, excess cannot last long."#CryptoMarketPullback: A Healthy Reset or a Warning Sign?

The crypto market has entered another pullback phase, triggering mixed reactions among investors. While some see the recent decline as a natural and healthy correction, others fear it could signal deeper weakness ahead. Understanding the nature of a crypto market pullback is essential for making informed decisions rather than reacting emotionally to short-term price movements.

A pullback refers to a temporary decline in asset prices after a period of upward movement. In crypto, pullbacks are common due to the market’s high volatility an

The crypto market has entered another pullback phase, triggering mixed reactions among investors. While some see the recent decline as a natural and healthy correction, others fear it could signal deeper weakness ahead. Understanding the nature of a crypto market pullback is essential for making informed decisions rather than reacting emotionally to short-term price movements.

A pullback refers to a temporary decline in asset prices after a period of upward movement. In crypto, pullbacks are common due to the market’s high volatility an

- Reward

- 1

- 2

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

- Reward

- 1

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? #TARA Stay Alert in Crypto Trading

Crypto trading may look simple, but the risks are real. Prices can jump or crash in seconds, scams are everywhere, and emotional decisions often cause losses. Security issues like hacks or exchange failures add more danger. The smart way is to learn first, set clear limits, and only invest what you can afford to lose.

👉 For more honest tips and simple crypto education, don’t forget to follow our account.

Crypto trading may look simple, but the risks are real. Prices can jump or crash in seconds, scams are everywhere, and emotional decisions often cause losses. Security issues like hacks or exchange failures add more danger. The smart way is to learn first, set clear limits, and only invest what you can afford to lose.

👉 For more honest tips and simple crypto education, don’t forget to follow our account.

TARA7,08%

- Reward

- 1

- Comment

- Repost

- Share

Yesterday early morning, $ETH 's market maker had an issue

It provided a risk-free profit opportunity for a few minutes

It was incredibly satisfying to profit from it

However, not many people managed to take advantage of it, as the window was very short

And many people didn't realize they could make money🤷

It provided a risk-free profit opportunity for a few minutes

It was incredibly satisfying to profit from it

However, not many people managed to take advantage of it, as the window was very short

And many people didn't realize they could make money🤷

ETH-0,15%

- Reward

- 1

- 1

- Repost

- Share

XiaoKalami'sGoldRushJourney :

:

Someone made millions in just 1 minute.BTC Market Structure: Support, Resistance & Liquidity Zones (Educational Analysis)”

- Reward

- like

- Comment

- Repost

- Share

#TopCoinsRisingAgainsttheTrend 🚀 Top Coins Rising Against the Trend: Resilience in a Pullback Market — February 2026

As the crypto market endures a sharp pullback in early February 2026 — with Bitcoin slipping below $65,000, Ethereum under pressure, and total market capitalization contracting — a small but notable group of altcoins is defying the broader trend. While fear dominates headlines and leverage is being unwound across the board, these projects are holding key levels, posting gains, or drawing consistent capital inflows, highlighting selective rotation and investor conviction.

📈 Sta

As the crypto market endures a sharp pullback in early February 2026 — with Bitcoin slipping below $65,000, Ethereum under pressure, and total market capitalization contracting — a small but notable group of altcoins is defying the broader trend. While fear dominates headlines and leverage is being unwound across the board, these projects are holding key levels, posting gains, or drawing consistent capital inflows, highlighting selective rotation and investor conviction.

📈 Sta

- Reward

- 5

- 11

- Repost

- Share

MoonGirl :

:

2026 GOGOGO 👊View More

Bitcoin/Ethereum Market Analysis and Trading Strategies

Yesterday's Trading Review

Yesterday morning, we entered short positions at high levels around 70,800 for Bitcoin and 2,080 for Ethereum, then precisely reversed to long positions at low levels around 68,000 and 2,000. Overall, this approach yielded a good profit margin.

Technical Deep Dive

- Candlestick Patterns: Recently, the market has experienced intense volatility. On February 6, after a price dip, there was a rapid rally, leaving a long lower shadow. This pattern confirms strong support below. Currently, prices are in a phase of alt

View OriginalYesterday's Trading Review

Yesterday morning, we entered short positions at high levels around 70,800 for Bitcoin and 2,080 for Ethereum, then precisely reversed to long positions at low levels around 68,000 and 2,000. Overall, this approach yielded a good profit margin.

Technical Deep Dive

- Candlestick Patterns: Recently, the market has experienced intense volatility. On February 6, after a price dip, there was a rapid rally, leaving a long lower shadow. This pattern confirms strong support below. Currently, prices are in a phase of alt

- Reward

- like

- Comment

- Repost

- Share

孔子

孔子

Created By@PiggyFromTheOcean

Listing Progress

100.00%

MC:

$56.46K

Create My Token

New cross-chain breakthrough: SushiSwap officially integrates Solana, enabling seamless swaps between SOL and EVM assets

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

- Reward

- like

- Comment

- Repost

- Share

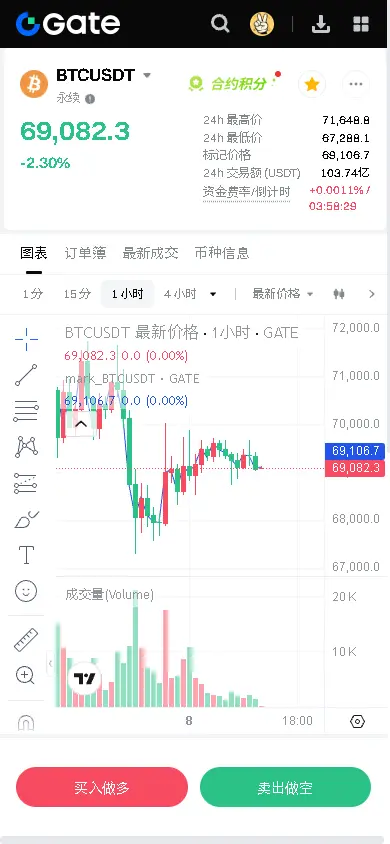

【$BTC Signal】Short Position + Downtrend Consolidation

$BTC After declining on the 4H timeframe, the price entered a narrow range of consolidation, indicating a downtrend continuation. Key data: Open interest remains stable but Taker sell volume dominates, funding rate turns negative, suggesting the decline is driven by genuine sell orders rather than just long liquidations. The 69000-69600 zone is a recent supply area with significant sell walls (order book shows a 2.332 BTC sell wall at 69064.8). The 4H candlestick rebound highs are gradually decreasing (69887→69688→69666), showing buying p

View Original$BTC After declining on the 4H timeframe, the price entered a narrow range of consolidation, indicating a downtrend continuation. Key data: Open interest remains stable but Taker sell volume dominates, funding rate turns negative, suggesting the decline is driven by genuine sell orders rather than just long liquidations. The 69000-69600 zone is a recent supply area with significant sell walls (order book shows a 2.332 BTC sell wall at 69064.8). The 4H candlestick rebound highs are gradually decreasing (69887→69688→69666), showing buying p

- Reward

- like

- Comment

- Repost

- Share

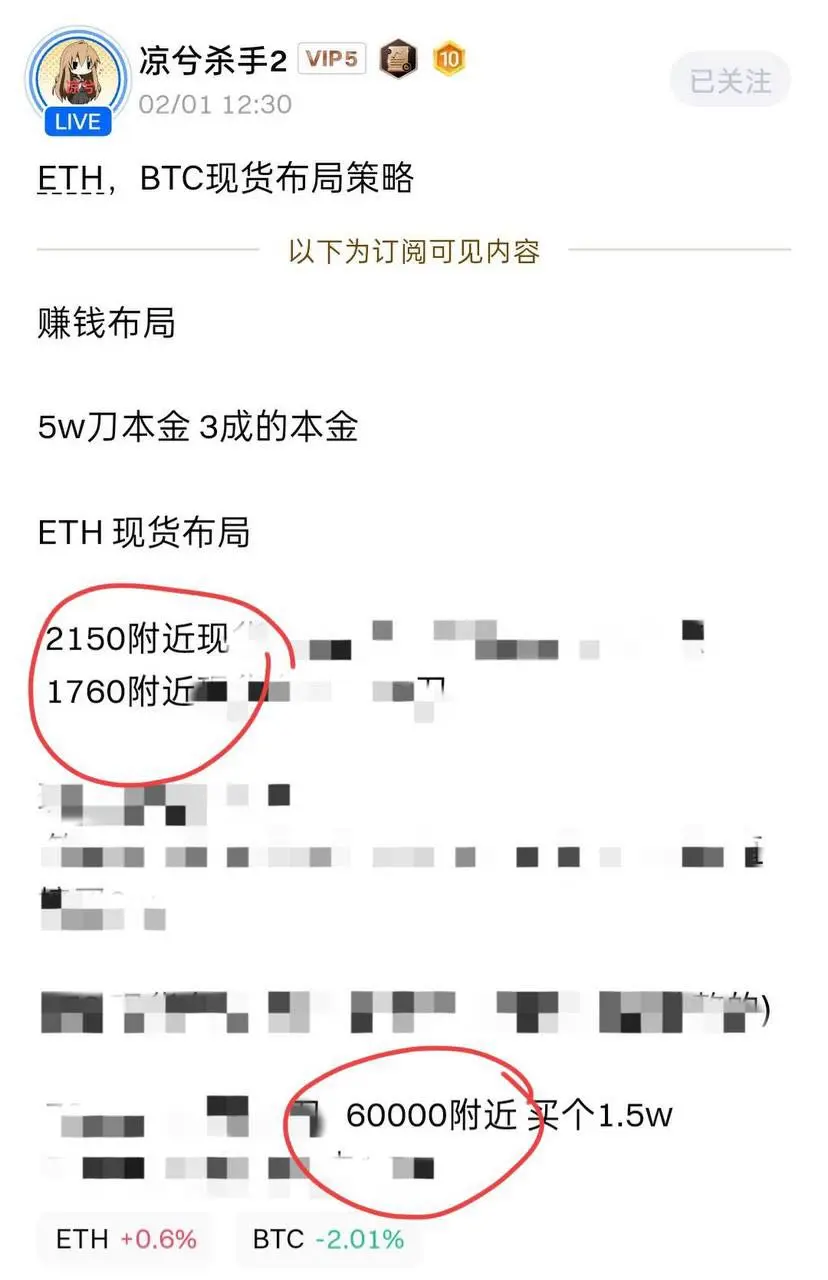

On February 1st, I set up spot positions from 2150 to 2395 for take profit and then reversed to open a short position. Currently holding 60,000 BTC and 1760 in spot positions. At the moment, all positions are reduced to half.

BTC-2,06%

- Reward

- 1

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets Crypto in the Crossfire

The recent global tech sell-off isn’t just Nasdaq pain. Its shockwaves are hitting all risk assets, including crypto. Understanding the dynamics is critical for strategic positioning.

Drivers of the Sell-Off

1. Rising Interest Rate Pressure

Growth-oriented, leveraged tech stocks are highly sensitive to rates.

Higher bond yields → future cash flows discounted → valuations decline.

2. Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens: USD, bonds, gold.

Crypto, as a high-beta asset, experiences immediate pressure.

3

The recent global tech sell-off isn’t just Nasdaq pain. Its shockwaves are hitting all risk assets, including crypto. Understanding the dynamics is critical for strategic positioning.

Drivers of the Sell-Off

1. Rising Interest Rate Pressure

Growth-oriented, leveraged tech stocks are highly sensitive to rates.

Higher bond yields → future cash flows discounted → valuations decline.

2. Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens: USD, bonds, gold.

Crypto, as a high-beta asset, experiences immediate pressure.

3

- Reward

- 1

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

"Hidden Dragon, Do Not Act," it is advisable to remain patient and wait for the right opportunity at this time, and not to act rashly.Follow me: Get more real-time analysis and insights on the crypto market!

View Original

- Reward

- like

- Comment

- Repost

- Share

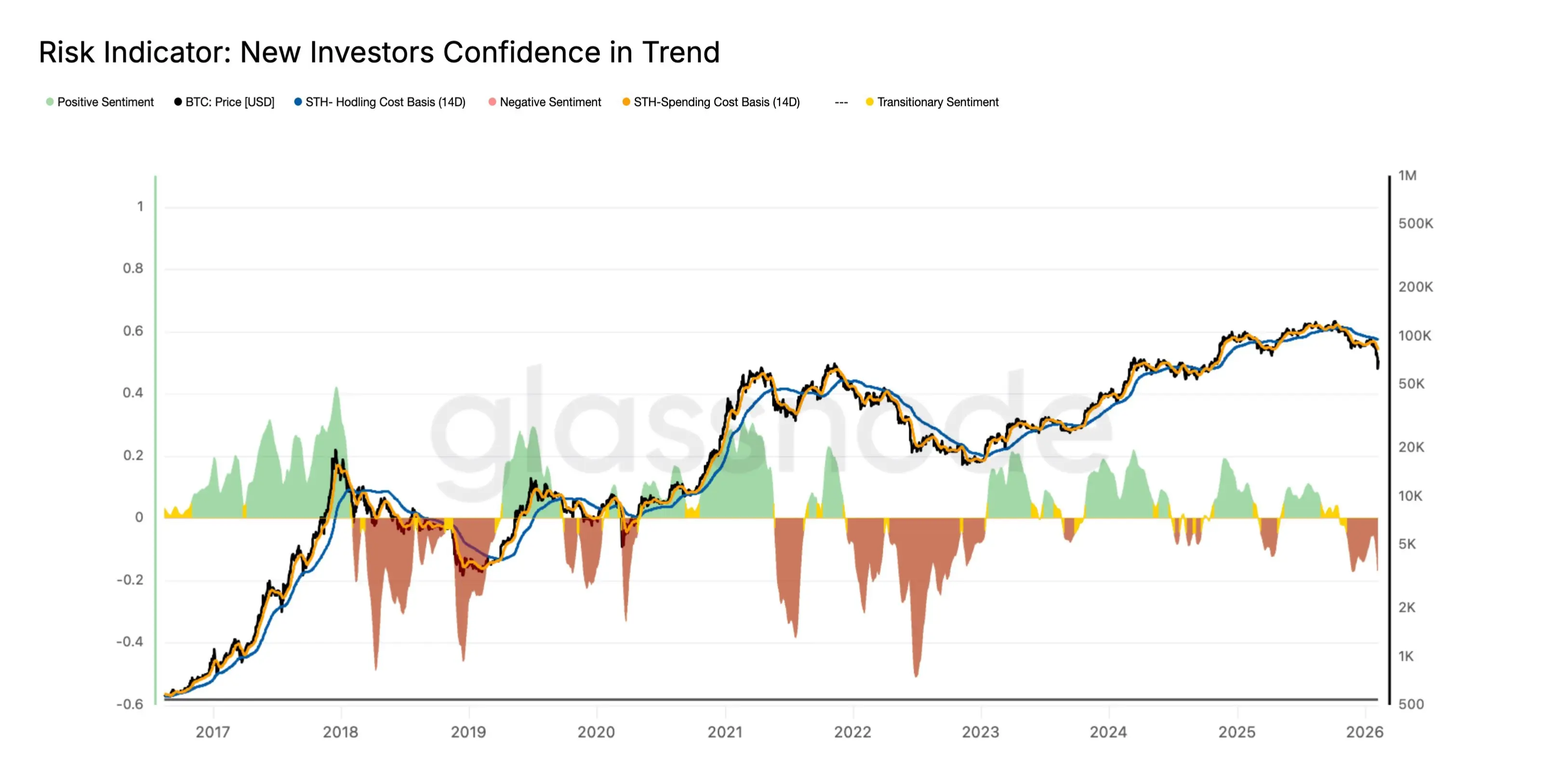

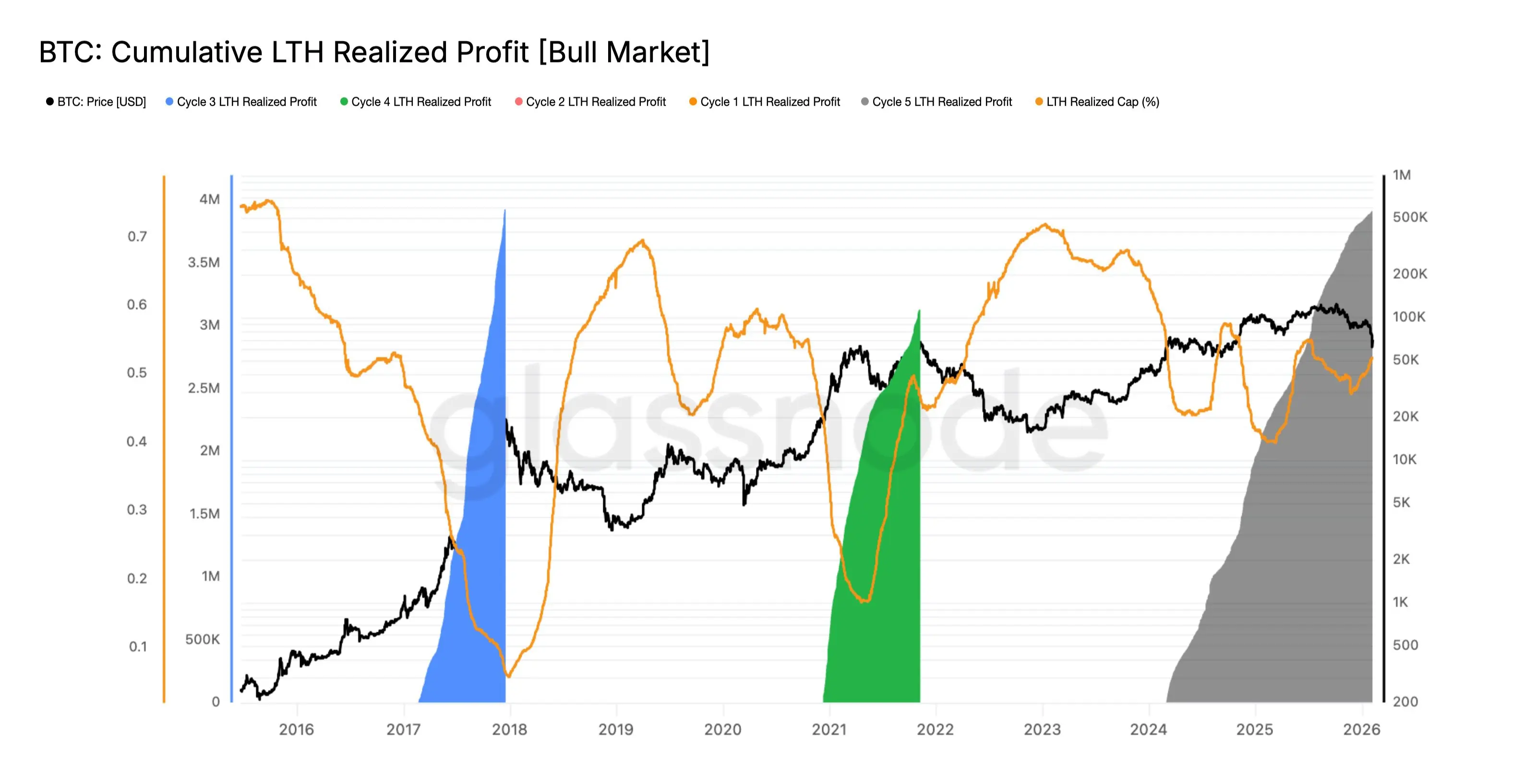

Has Bitcoin’s Explosive Momentum Ended or Is This the Calm Before the Next Big Move?

Bitcoin is not crashing.

It is not exploding either.

What we are seeing now is something more interesting a shift in behavior.

Recent on-chain data shows that Bitcoin is moving into a transition stage. This is the phase where strong upward momentum begins to slow, and long-term holders quietly start locking in profits. The market structure itself is changing, not breaking.

Bitcoin’s price is currently trading close to levels where late-cycle buyers usually enter. Historically, this is the zone where many new

Bitcoin is not crashing.

It is not exploding either.

What we are seeing now is something more interesting a shift in behavior.

Recent on-chain data shows that Bitcoin is moving into a transition stage. This is the phase where strong upward momentum begins to slow, and long-term holders quietly start locking in profits. The market structure itself is changing, not breaking.

Bitcoin’s price is currently trading close to levels where late-cycle buyers usually enter. Historically, this is the zone where many new

BTC-2,06%

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN | ARENAR INTEL:🇺🇸 Trump administration uncovers $8.6 billion in COVID-related small business fraud in California.#Trump #COVIDFraud #California #SmallBusiness #Breaking

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More148.34K Popularity

9.83K Popularity

393.58K Popularity

192 Popularity

14.36K Popularity

Hot Gate Fun

View More- MC:$2.36KHolders:00.00%

- MC:$2.37KHolders:10.00%

- MC:$2.38KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreBessent: The U.S. government has no authority to "rescue" Bitcoin, and taxpayers' money will not be invested in crypto assets.

21 m

Du Jun: Li Lin will not sell Bitcoin to exchange for Ethereum. His family office is the largest holder of IBIT in Asia.

55 m

Scam Sniffer: In January, there were a total of 4,741 victims of signature-based phishing, with total losses of $6.27 million.

1 h

The Pentagon "Pizza Index" surges, currently at alert level 4

1 h

Project Hunt: Fair Launch and Trading Platform Flap for the past 7 days' top projects with the most new followers

1 h

Pin