Post content & earn content mining yield

placeholder

Korean_Girl

Latest point share! #Trump cancels threat of tariffs on Europe💪💪💪💪

- Reward

- 2

- 2

- Repost

- Share

GateUser-dc0fbea6 :

:

hey dearView More

- Reward

- like

- 5

- Repost

- Share

rotten :

:

New Year Wealth Explosion 🤑View More

AI Agent Total Amnesia? Vanar Directly Embeds "Memory + Brain" into the Chain

The most critical problem with AI agents today is not insufficient computing power, but their memory is worse than a fish! The intelligent agents you deploy with great effort are confused and clueless every time you interact with them, as if meeting for the first time. The core reason is that they run on stateless architectures. Traditional blockchains, in pursuit of execution speed, have sacrificed context continuity, making it impossible for agents to form long-term memories, let alone continuous learning and adapt

The most critical problem with AI agents today is not insufficient computing power, but their memory is worse than a fish! The intelligent agents you deploy with great effort are confused and clueless every time you interact with them, as if meeting for the first time. The core reason is that they run on stateless architectures. Traditional blockchains, in pursuit of execution speed, have sacrificed context continuity, making it impossible for agents to form long-term memories, let alone continuous learning and adapt

VANRY-6,51%

- Reward

- like

- Comment

- Repost

- Share

米奇妙妙屋

米奇妙妙屋

Created By@Bought300UgqHundredfoldCoin

Listing Progress

0.00%

MC:

$3.41K

Create My Token

🎯 #ETH Positive📈(

The market is witnessing institutional accumulation of ETH: Ethereum remains a key asset in the tokenization sector of )RWA(; increased investor interest is confirmed by activity from major wallets and the participation of BlackRock and Bitmine funds. Amid overall fear in the )25–34( index, ETH shows potential for recovery supported by institutional demand and Bitcoin market correction.

News and Institutional Factors )📈(:

Major Purchases and Institutional Drivers: The address “0xfb7” via FalconX bought 20,013 ETH )≈ $59 million(, reinforcing accumulation signals.

Applicati

View OriginalThe market is witnessing institutional accumulation of ETH: Ethereum remains a key asset in the tokenization sector of )RWA(; increased investor interest is confirmed by activity from major wallets and the participation of BlackRock and Bitmine funds. Amid overall fear in the )25–34( index, ETH shows potential for recovery supported by institutional demand and Bitcoin market correction.

News and Institutional Factors )📈(:

Major Purchases and Institutional Drivers: The address “0xfb7” via FalconX bought 20,013 ETH )≈ $59 million(, reinforcing accumulation signals.

Applicati

- Reward

- 2

- 2

- Repost

- Share

NextGame :

:

Follow 🔍 closelyView More

#TrumpWithdrawsEUTariffThreats BREAKING Trump Files $5B Lawsuit Against JPMorgan Markets Take Notice

Donald Trump has filed a $5 billion lawsuit against JPMorgan Chase & Co. and its CEO Jamie Dimon, alleging that the bank engaged in politically motivated debanking. JPMorgan has publicly denied the claims, stating that its actions were based on internal risk and compliance policies, not political bias.

Why this is important: debanking accusations go beyond one lawsuit. They raise broader questions about financial access, regulatory power, and political neutrality within the banking system. If

Donald Trump has filed a $5 billion lawsuit against JPMorgan Chase & Co. and its CEO Jamie Dimon, alleging that the bank engaged in politically motivated debanking. JPMorgan has publicly denied the claims, stating that its actions were based on internal risk and compliance policies, not political bias.

Why this is important: debanking accusations go beyond one lawsuit. They raise broader questions about financial access, regulatory power, and political neutrality within the banking system. If

- Reward

- 2

- Comment

- Repost

- Share

1 Added a little more to the position\nCurrently already in alpha,\nBut the general consensus among BSC trenches,\nAlmost everyone sells once they buy.\n\nHopefully one day,\nThis situation can be changed.

View Original

- Reward

- like

- Comment

- Repost

- Share

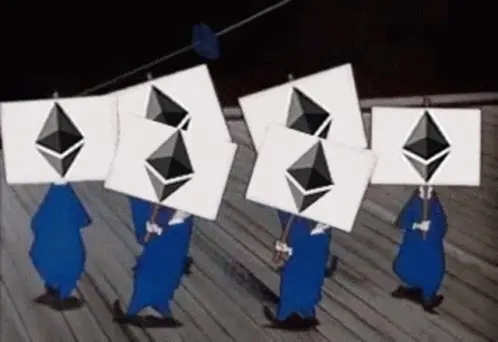

I sent private messages to a few friends, and none of them bought at the time. After it rose to over 4000, they came back to ask if they could buy. 😂

View Original

- Reward

- like

- Comment

- Repost

- Share

Whenever Bitcoin pulls back now, some people reflexively shout, “Is it back to 2022 again?” but this is more like looking at the chart without considering the times.

That year was characterized by high inflation and aggressive rate hikes, squeezing the market layer by layer; whereas the current environment features cooling inflation, rising expectations of rate cuts, and money gradually flowing back. The trend may look similar, but the script has long changed. Using the old bear market to frame the current situation is inherently unreliable.

From a macro perspective, 2022 was a phase of rapid

That year was characterized by high inflation and aggressive rate hikes, squeezing the market layer by layer; whereas the current environment features cooling inflation, rising expectations of rate cuts, and money gradually flowing back. The trend may look similar, but the script has long changed. Using the old bear market to frame the current situation is inherently unreliable.

From a macro perspective, 2022 was a phase of rapid

BTC-0,32%

- Reward

- like

- Comment

- Repost

- Share

Supreme Treasure needs no words!

The most powerful comparison of the pool reflow destruction!

View OriginalThe most powerful comparison of the pool reflow destruction!

- Reward

- like

- Comment

- Repost

- Share

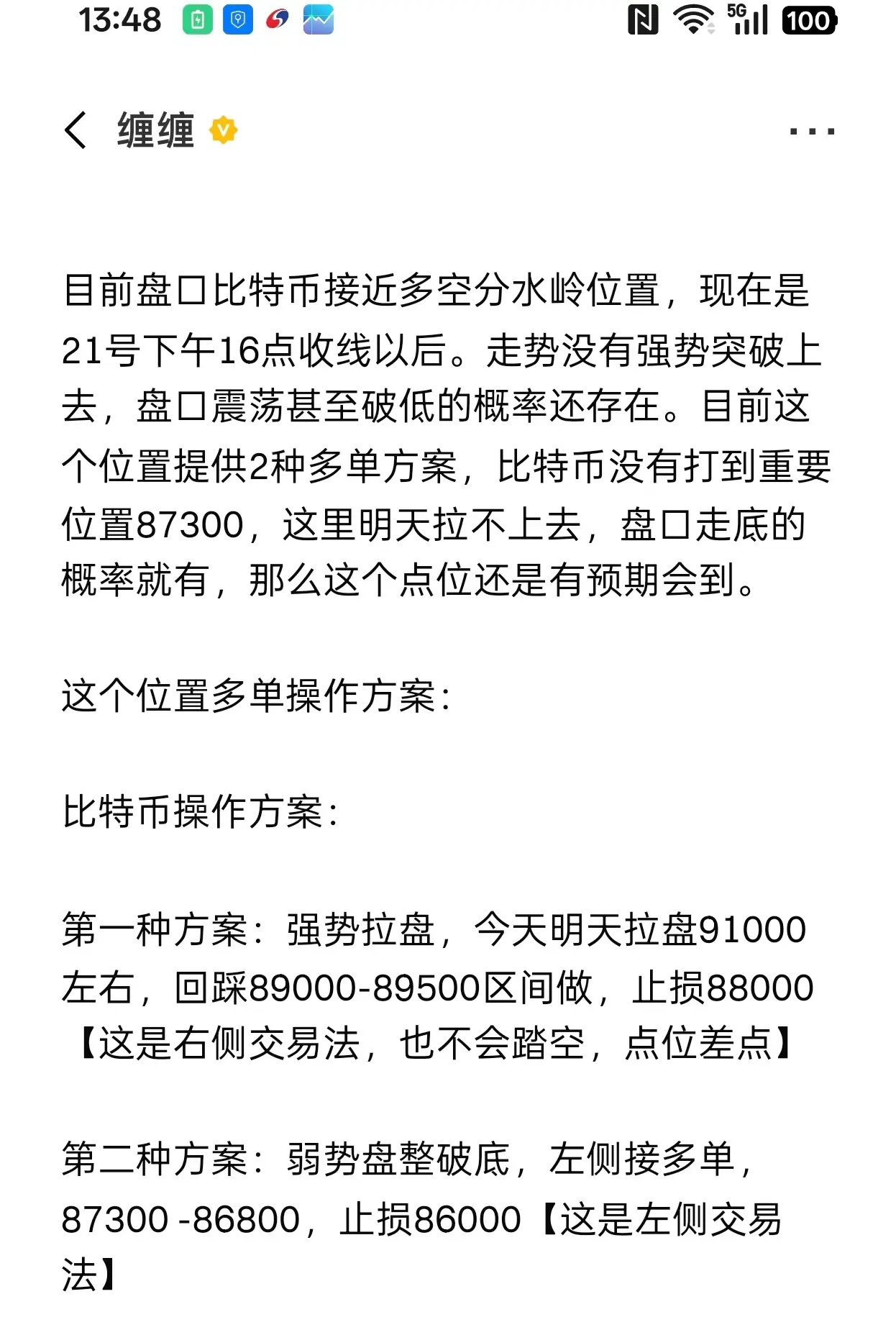

Subscription updates have given over 87,300, Ethereum over 2,982, ready to take a chance. Are your long positions still open? Welcome everyone to like and follow. During the 2.2GT subscription event.....

View Original

- Reward

- like

- Comment

- Repost

- Share

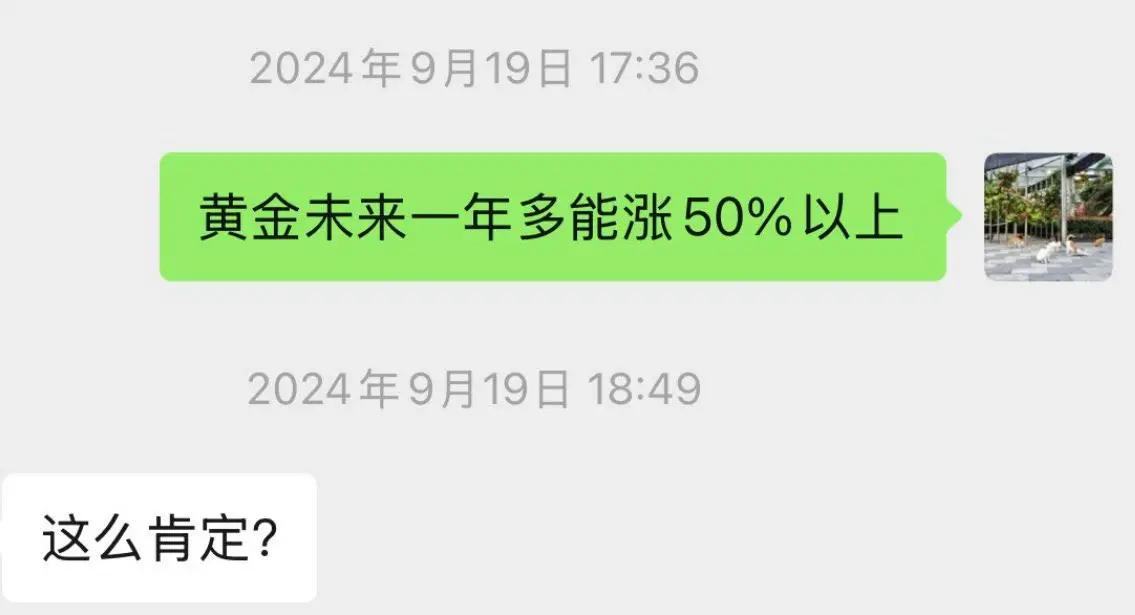

#GoldandSilverHitNewHighs

The Rally Continues: Gold and Silver Smash All-Time Highs 🌟

Precious metals enthusiasts, buckle up! As we dive into 2026, gold and silver are not just shining – they're shattering records and captivating investors worldwide. Gold has surged to an astonishing all-time high of over $4,800 per ounce, marking a year-to-date increase of more than 12% and a staggering 76% rise over the past 12 months. Meanwhile, silver has outpaced its golden counterpart, rocketing to new peaks above $95 per ounce, with intraday highs reaching $97.44 – that's a whopping 34% YTD gain and o

The Rally Continues: Gold and Silver Smash All-Time Highs 🌟

Precious metals enthusiasts, buckle up! As we dive into 2026, gold and silver are not just shining – they're shattering records and captivating investors worldwide. Gold has surged to an astonishing all-time high of over $4,800 per ounce, marking a year-to-date increase of more than 12% and a staggering 76% rise over the past 12 months. Meanwhile, silver has outpaced its golden counterpart, rocketing to new peaks above $95 per ounce, with intraday highs reaching $97.44 – that's a whopping 34% YTD gain and o

- Reward

- 3

- 3

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

On a black gold background, golden rays cascade like a waterfall forming an upward arrowhead. Piles of coins and dollar symbols stand firmly in the center, seemingly indicating that wealth is breaking through chaos amidst the tide of the era, depicting a magnificent scene of continuous ascent.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$3.42KHolders:7

0.00%

- Reward

- like

- 1

- Repost

- Share

TeXiaoPu :

:

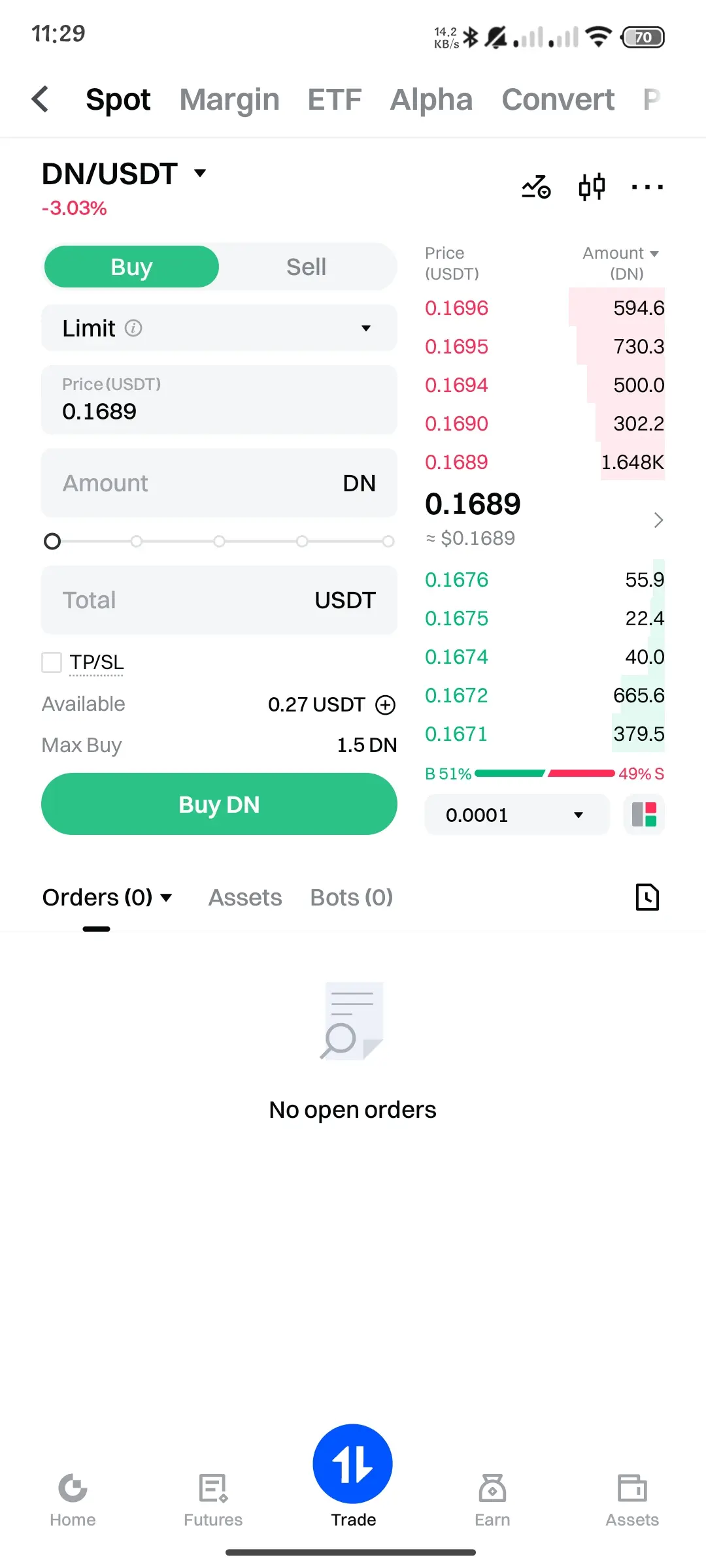

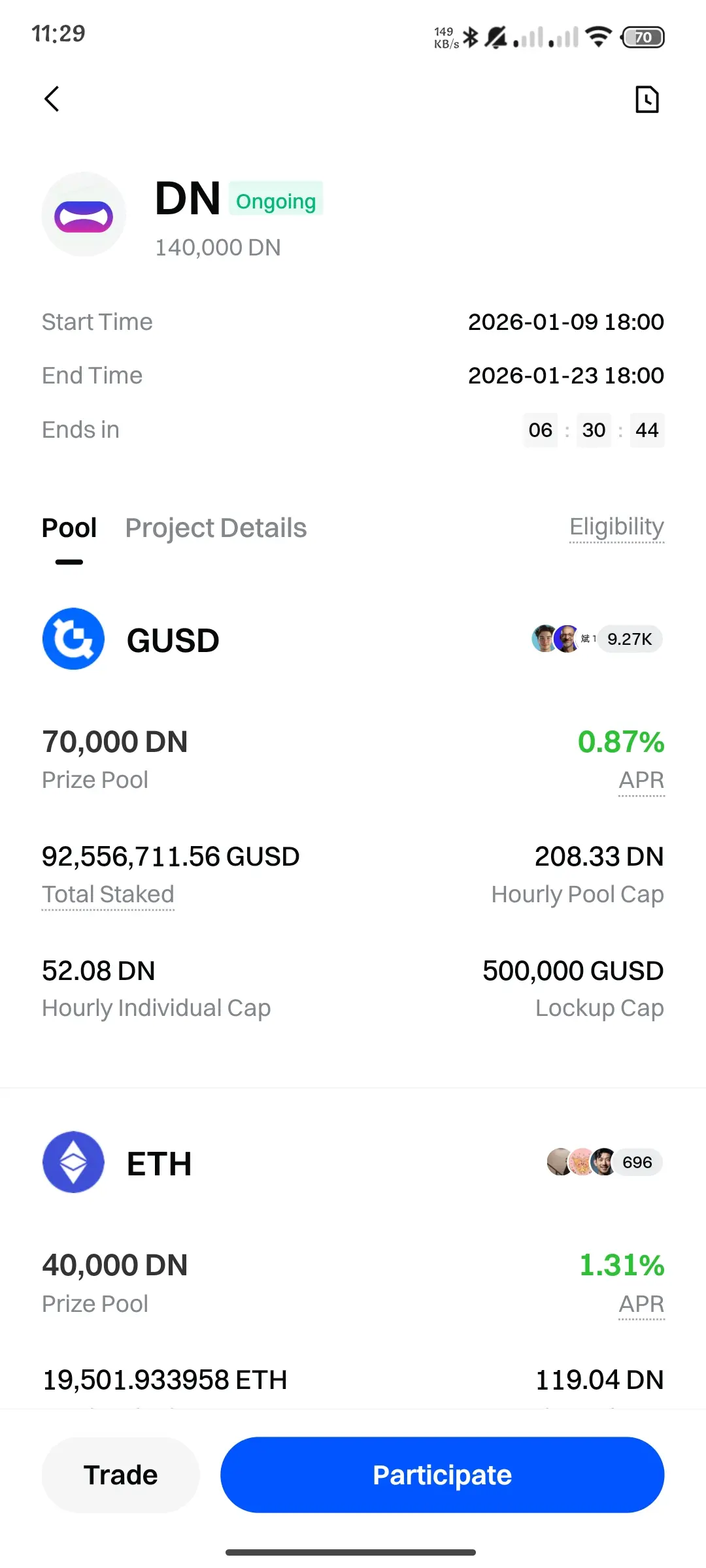

Brothers, change the battlefield!DN Launchpool Now Live on Gate.io

Gate.io has officially launched Launchpool offering users the opportunity to earn DN tokens through a structured and low-risk staking mechanism.

With a total reward pool of 140,000 DN, participants can earn rewards simply by staking eligible assets such as GUSD, without engaging in active trading.

🔹 Key Highlights

• Total Rewards: 140,000 DN

• Status: Ongoing

• End Date: 23 January 2026 (UTC+8)

• Participation Method: Stake & Earn (No Trading Required)

• Pool Available: GUSD Pool

🔹 Why Participate?

✔ Low-risk earning model

✔ Suitable for beginners and long-t

Gate.io has officially launched Launchpool offering users the opportunity to earn DN tokens through a structured and low-risk staking mechanism.

With a total reward pool of 140,000 DN, participants can earn rewards simply by staking eligible assets such as GUSD, without engaging in active trading.

🔹 Key Highlights

• Total Rewards: 140,000 DN

• Status: Ongoing

• End Date: 23 January 2026 (UTC+8)

• Participation Method: Stake & Earn (No Trading Required)

• Pool Available: GUSD Pool

🔹 Why Participate?

✔ Low-risk earning model

✔ Suitable for beginners and long-t

DN-3,88%

- Reward

- 1

- 6

- Repost

- Share

CryptoMafia :

:

Watching Closely 🔍️View More

p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$2.82K

Create My Token

[2026 Market] Warning: If Bitcoin loses $88,000, it could trigger $638 million in cascading long liquidations

- Reward

- like

- Comment

- Repost

- Share

The short position has already been entered in the morning. The plan remains unchanged; if it reaches the add position level, consider reducing the position to recover the cost.

View Original

- Reward

- 1

- 2

- Repost

- Share

huangjinshizi :

:

Brother Gou, trading altcoins carries high risks. Stick to mainstream coins🤣View More

#TrumpWithdrawsEUTariffThreats

#TrumpWithdrawsEUTariffThreats shifts the tone in global markets from tension to temporary relief.

After recent risk-off reactions, this move could calm trade fears and improve short-term sentiment across equities and crypto.

Markets often react strongly to tariff headlines, and removing the threat may reduce pressure on risk assets.

But the real question is whether this relief is lasting or just a pause in a larger trade narrative.

If uncertainty fades, we might see confidence return and volatility cool down.

I’m watching how BTC and major assets respond to th

#TrumpWithdrawsEUTariffThreats shifts the tone in global markets from tension to temporary relief.

After recent risk-off reactions, this move could calm trade fears and improve short-term sentiment across equities and crypto.

Markets often react strongly to tariff headlines, and removing the threat may reduce pressure on risk assets.

But the real question is whether this relief is lasting or just a pause in a larger trade narrative.

If uncertainty fades, we might see confidence return and volatility cool down.

I’m watching how BTC and major assets respond to th

BTC-0,32%

- Reward

- 2

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

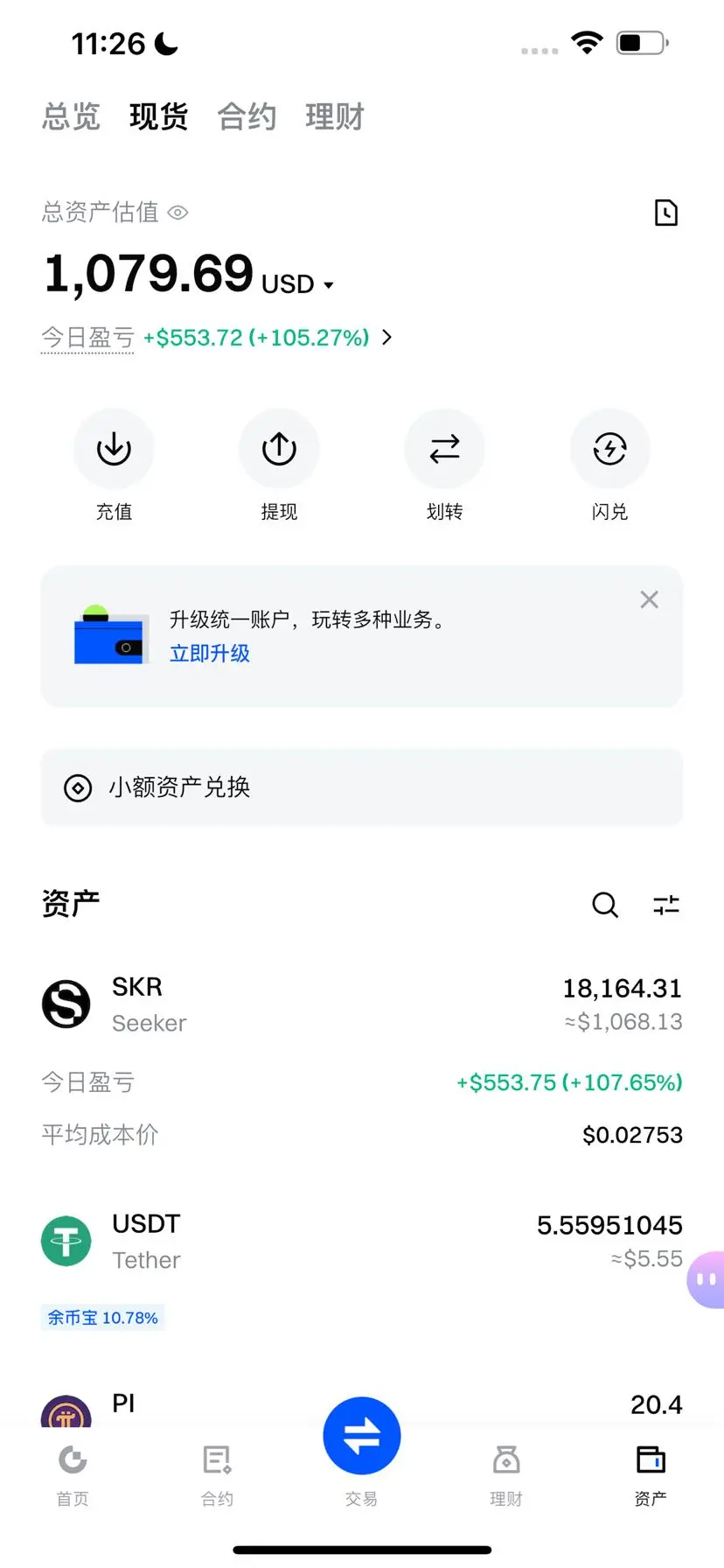

From loss to stability, it's not luck.

A Sharpe ratio of 6.25, honestly, even I am a bit surprised.

Last month, I entered the market with 1000U, and in one day, it was rubbed down to 250 😂, leading to a few days of self-isolation.

Later, I realized: the problem isn't the market, but the method.

The biggest progress during this period isn't how much I made, but finally finding a trading approach that suits me.

No grand ambitions, no stubborn holding, only taking action where there is liquidity and structural confirmation, and exiting immediately if wrong.

Accept small gains and small losses, u

View OriginalA Sharpe ratio of 6.25, honestly, even I am a bit surprised.

Last month, I entered the market with 1000U, and in one day, it was rubbed down to 250 😂, leading to a few days of self-isolation.

Later, I realized: the problem isn't the market, but the method.

The biggest progress during this period isn't how much I made, but finally finding a trading approach that suits me.

No grand ambitions, no stubborn holding, only taking action where there is liquidity and structural confirmation, and exiting immediately if wrong.

Accept small gains and small losses, u

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

1.23 Midday Outlook

From the current chart, the four-hour timeframe shows that the overall market remains in a narrow range of fluctuation, with clearly defined support and resistance zones. The current price has already moved to the upper resistance area of the range, limiting upward potential. For midday trading, it is recommended to focus on rebound trades.

Market stance: Range-bound between 3000-3050, with a downside near 2850.

Aggressive traders can enter in batches, with proper defensive positioning #社区成长值抽奖十六期 $ETH

From the current chart, the four-hour timeframe shows that the overall market remains in a narrow range of fluctuation, with clearly defined support and resistance zones. The current price has already moved to the upper resistance area of the range, limiting upward potential. For midday trading, it is recommended to focus on rebound trades.

Market stance: Range-bound between 3000-3050, with a downside near 2850.

Aggressive traders can enter in batches, with proper defensive positioning #社区成长值抽奖十六期 $ETH

ETH-1,43%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More19.06K Popularity

1.81K Popularity

29.7K Popularity

658 Popularity

434 Popularity

Hot Gate Fun

View More- MC:$3.41KHolders:10.00%

- MC:$0.1Holders:20.00%

- MC:$3.41KHolders:00.00%

- MC:$3.41KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreSevere snow and ice weather in the southern United States may significantly impact Bitcoin mining companies' operations

5 m

Gate Web3 rebrands to Gate DEX, advancing the upgrade of decentralized trading experience

10 m

BitMart将上线Spacecoin($SPACE)

10 m

Matrixport: This round of decline may be more of a tactical correction

16 m

Citadel CEO: Surge in Japanese bond yields rings alarm for the United States

21 m

Pin