Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More4.32K Popularity

5.13K Popularity

50.08K Popularity

7.35K Popularity

86.4K Popularity

Pin

January 04 | BTC Trend Analysis

Core Viewpoints

Current Price: $91,037 (as of 09:51 AM on January 4)

Short-term Outlook: Slightly bullish in the short term. Technical indicators show BTC exhibiting clear bullish momentum on lower timeframes (1-hour/4-hour), testing the upper Bollinger Band, MACD displaying positive histogram, and multiple indicators forming a bullish alignment. Short positions were liquidated to the tune of $52.3M within 24 hours, significantly exceeding long liquidations of $5.9M, squeezing out bears and providing upward momentum. Derivatives open interest increased to $57.8B (+1.66% over 24h), funding rates remain positive (Binance 0.01%, Bybit 0.009%), indicating prevailing bullish sentiment.

Key Support Levels:

Key Resistance Levels:

Technical Analysis

Multi-timeframe Indicators

Price Action

BTC rebounded from approximately $89,800 on the 50-period 1-hour SMA, then steadily pushed up toward $91,000 for consolidation. Price remains above key moving averages on 1-hour and 4-hour charts, testing the upper Bollinger Band, indicating strong short-term momentum. On daily, EMA12 ($89,056) is below EMA26 ($89,180), but current price is well above both, confirming a healthy medium-term uptrend.

Derivatives and On-chain Data

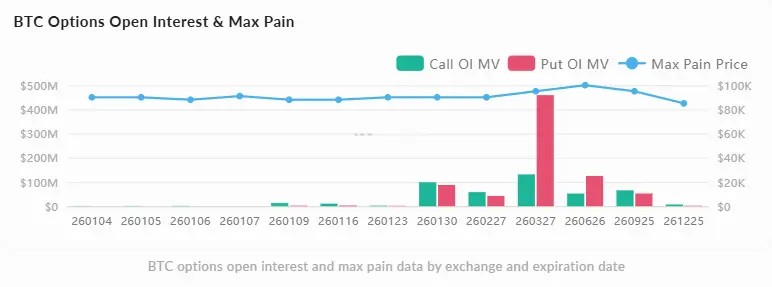

Futures and Options Market

Liquidation Risk Distribution

High density of long liquidations below, with about $71M clustered near 91,027, and $1B+ in open interest around 88k, forming potential support on a pullback. Short liquidations are concentrated around $91,125 (about $18M); breaking above could trigger chain reactions of liquidations, pushing prices higher.

Exchange Flows

Net outflows on Jan 2-3:

Persistent net outflows and declining reserves suggest investors are transferring BTC off exchanges for long-term holding, reducing available supply for selling, which is a medium-term bullish signal.

Market Sentiment and Narrative

Community Views

Market sentiment remains cautiously optimistic. BTC regained above $90,000 on Jan 3, with technical analysts viewing this as a low-risk rebound zone. Mainstream opinions include:

Institutional and Policy Movements

Key recent events in 48 hours:

$779M Mainstream Narrative

The 17th anniversary of BTC (Jan 3) prompts reevaluation of the Genesis Block’s anti-fiat rescue concept. The fiat devaluation narrative heats up (USD has depreciated 97% in purchasing power since 1913), with institutional allocations and national reserves positioning BTC as a hedge. Despite some crypto fatigue, BTC’s fundamental value and regulatory progress make it a preferred long-term store of value amid a cooling of altcoin speculation.

Trading Strategy Recommendations

$123M Bullish Entry

$2T Risk Warning

Despite short-term technical bullish signals, caution is advised:

Summary

BTC is currently in a short-term bullish phase, with multi-timeframe technicals aligning upward, derivatives data favoring longs, and on-chain net outflows providing medium-term support. The immediate upside target is $91,800-$92,200, but watch for RSI overbought signals and potential technical corrections. Maintaining support above $90,000 and clearing short liquidation zones could extend the rebound to higher resistance levels; failure to hold $89,000 warrants reassessment of bullish structure and waiting for lower support confirmation. Overall, under risk management, the bias is to buy on dips in the short term, with strict stop-losses to handle sudden volatility.