Perpetuals DEX Showdown: Aster Sparks Trading Surge, Can the Veterans Hold Their Ground?

What Sparked the Perpetual Contract DEX Craze?

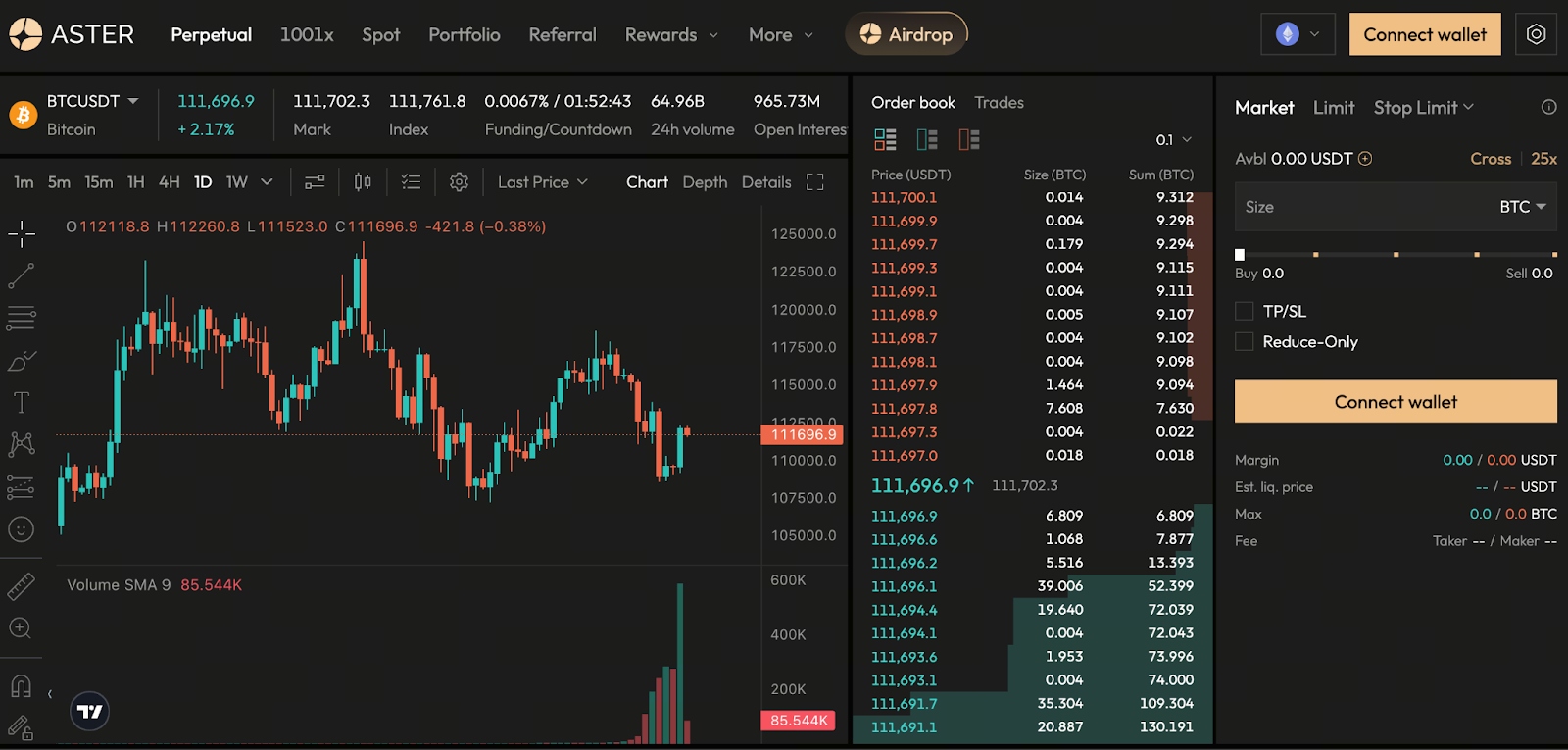

Image: https://www.asterdex.com/en/futures/v1/BTCUSDT

The rise of perpetual contract DEX competition is the product of years of technological progress and incentive mechanisms—not a sudden phenomenon. Established platforms like Hyperliquid and dYdX have built lasting advantages with mature technology and sizable user bases. Recently, however, new entrants have quickly captured market attention through airdrops, outsized rewards, and innovative on-chain features, initiating strong competition for user engagement.

Aster’s Breakout and Data Trends

Aster’s breakout is among the most notable recent developments. Aster has sharply increased daily perpetual DEX trading volumes, sometimes exceeding tens of billions of dollars in a single day. This prompts questions about whether this growth can last. Short-term incentives attract users and boost trading activity, but they also lead to wash trading and increased slippage, especially when genuine user retention is weak and traffic quickly declines.

Legacy Platform Strengths and Token Unlock Challenges

Established platforms benefit from proven market-making strategies, deep liquidity, and strong user loyalty. However, they face challenges from large-scale token unlocks, inflationary pressures, and capital chasing airdrop opportunities in the short term. When significant token unlocks occur, they amplify price and sentiment swings and impact funding rates and derivatives arbitrage opportunities in the market.

Choosing the Right Platform: Tips for Traders and Market Makers

For everyday traders and market makers, what’s the best way to choose in this DEX showdown? Focus on three core metrics: First, the quality of real trading volume (not just volume driven by incentives); second, funding rates and slippage; third, the platform’s risk controls and liquidation mechanisms. Short-term arbitrage opportunities abound. If you’re focused on long-term value or strategic trading, reliable technology and stable liquidity are key factors for long-term success.

Risks and Outlook

New platforms expose users to elevated funding rates, liquidation risk, and governance or contract security vulnerabilities. If you’re chasing airdrops or short-term rewards, manage your position size carefully, avoid excessive leverage, and stay alert to incentive schemes and token unlock schedules. Overall, perpetual contract DEXs are entering a phase of intense competition. Short-term incentive battles will continue. Long-term winners will be defined by superior product experience, deep liquidity, and sustained ecosystem growth.

Trade Aster now: https://www.gate.com/trade/ASTER_USDT

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data