JPMorgan Chase says: Bitcoin is still too cheap!

“Bitcoin‘s volatility has reached record lows, making it more attractive to institutional investors than gold,” JPMorgan stated in its latest research report. The Wall Street giant indicated: Bitcoin is significantly undervalued compared to gold.

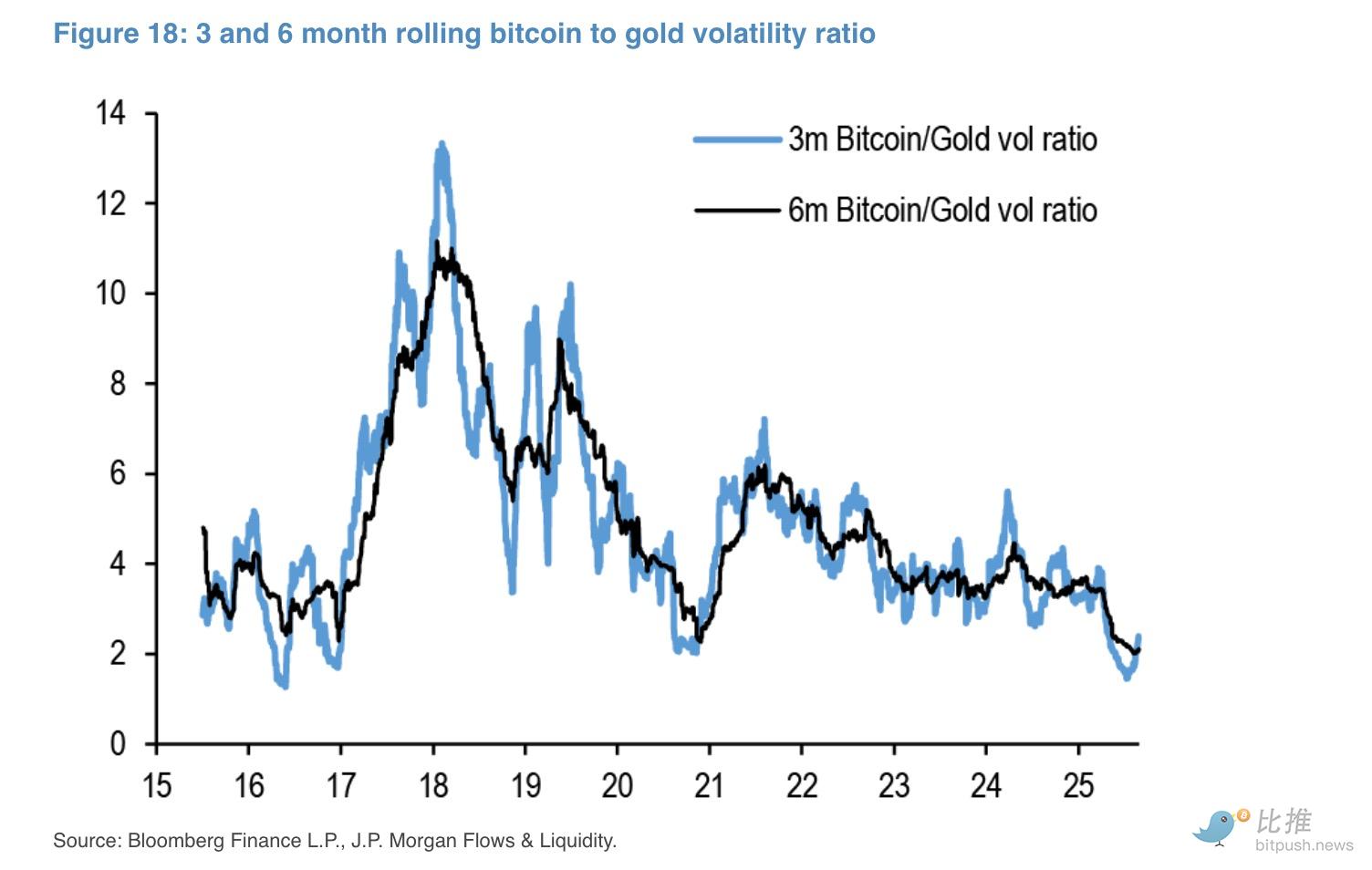

JPMorgan’s analysis shows that Bitcoin’s six-month rolling volatility plummeted from nearly 60% at the start of the year to about 30%, setting a historic low. At the same time, the ratio of Bitcoin to gold volatility also fell to its lowest ever, with Bitcoin now only twice as volatile as gold.

Volatility Declines Sharply, Initiating Value Reassessment

Volatility has traditionally been a key obstacle to full-scale Bitcoin adoption by institutional investors. That barrier is now quickly disappearing. JPMorgan’s analyst team details this transformation in their recent report.

This steep drop in Bitcoin volatility isn’t just a technical market metric—it signals a compelling advancement in market maturity. The report notes that the lower volatility directly reflects a shift in Bitcoin’s investor base—from retail dominance toward institutional leadership.

This transition is comparable to how central bank quantitative easing stabilizes bond volatility. Corporate treasuries are now acting as stabilizing agents in the Bitcoin market—steadily buying and holding BTC, reducing the available market supply, and curbing price swings.

JPMorgan used a volatility-adjusted model to thoroughly compare Bitcoin and gold. Their analysis shows Bitcoin’s market cap needs to jump 13% to match the $5 trillion value of gold held by private investors. Based on this, Bitcoin’s fair value would be about $126,000—leaving significant room for upside at current levels.

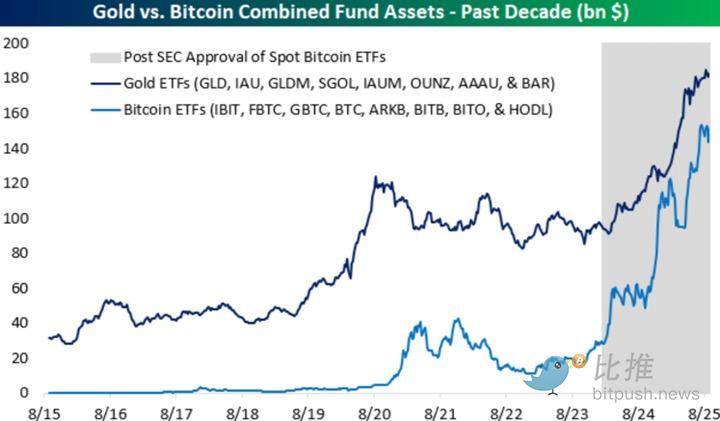

ETF Competition: An Unprecedented Shift of Capital

If falling volatility proves Bitcoin’s internal maturity, then the approval and launch of spot Bitcoin ETFs serves as the external catalyst accelerating institutional adoption. This milestone event has unlocked a new investment channel for both retail and institutional players—directly initiating a competition between Bitcoin and gold for assets under management (AUM).

The latest data from Bespoke Investment Group shows Bitcoin funds now manage around $150 billion in assets under management (AUM), compared to $180 billion for gold funds. The gap is down to just $30 billion, revealing Bitcoin’s rapid growth.

Looking at specific funds, the world’s largest gold ETF—SPDR Gold Shares (GLD)—holds about $104.16 billion in assets. Leading Bitcoin ETFs, like BlackRock’s IBIT, have amassed roughly $82.68 billion in just a year. This demonstrates a notable change in investor allocation, confirming Bitcoin’s growing prominence in global asset allocations.

JPMorgan analysts believe: “Bitcoin is becoming more appealing, especially for institutional portfolios. Lower volatility and clearer regulation are creating the ideal conditions for widespread adoption.”

Technical Outlook

After JPMorgan released its report, Bitcoin’s price experienced a brief rally followed by a retracement. According to TradingView, as of publishing, Bitcoin rose as much as 2.3% intraday to around $113,479, then retreated roughly 1% to the $112,272 level.

Veteran trader Peter Brandt notes that while Bitcoin has rebounded recently, the price must break through the key resistance at $117,570 to decisively overcome medium-term bearish sentiment.

Looking out over the longer term, multiple technical signals indicate bullish momentum. Bitcoin’s resilience above $110,000 shows institutions are steadily accumulating positions on every dip, supporting a sustained upward trend in the coming months.

JPMorgan’s $126,000 price target may represent only the initial phase. If Bitcoin continues to attract institutional capital at its current pace, the concept of “digital gold” surpassing traditional gold could soon be realized.

Disclaimer:

- This article is reprinted from [BitpushNews]. Copyright belongs to the original author [BitpushNews]. For any republication concerns, please contact the Gate Learn team. We will address your concerns promptly per our procedures.

- Disclaimer: The views and opinions expressed in this article are the author’s own and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team. Without reference to Gate, copying, distributing, or plagiarism of these translations is strictly prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.