CICC: U.S. Liquidity Shock, Restarting QE, and Sovereign Wealth Funds

What is Basis Trading?

Basis trading spans across the U.S. Treasury spot, futures, and repurchase markets, using the price differences between the spot and futures markets for arbitrage. Since Treasury futures typically carry a premium over the spot market, and the premium diminishes as the futures contract expiration date approaches, investors can go long on Treasury spot (which is priced lower) and short Treasury futures (which are priced higher), waiting for futures delivery. The funds for the long spot position can be refinanced in the repo market (effectively cashing out Treasury securities in the repo market), continuously rolling over the repo until futures delivery. Without considering transaction fees, the cost of basis trading for investors is mainly the borrowing cost in the repo market (e.g., SOFR rates), while the return is the premium part of the futures relative to the spot (the basis). If the basis exceeds the cost of purchasing Treasury spot and refinancing in the repo market, the trade becomes profitable. Since the basis itself is not large, and futures trading involves leverage, Treasury spot trading also requires leverage, which is impacted by the haircut on repo collateral. Investors need to provide liquidity funds mainly for margin payments and repo interest.

Chart 1: U.S. Treasury Futures Premium Over Spot.

Source: OFR, CICC Research Department. Data based on the average of all five-year contracts from 2016-2020.

Chart 2: Hedge Fund Repo Net Borrowing and U.S. Treasury Spot Holdings in Sync

Source: Haver, CICC Research Department.

Chart 3: Illustration of Hedge Fund Basis Trading

Source: OFR, CICC Research Department.

The main risks of basis trading stem from repo rollovers, futures margin requirements, and high leverage:

First, repo rollover risk. Basis trading typically aims to minimize borrowing costs by choosing overnight repos for financing. This requires continuous repo rollovers, which cannot lock in interest rates. If repo market liquidity is insufficient and rollover costs surge, the cost of basis trading will increase, potentially leading to losses.

Second, margin risk. Basis trading requires maintaining a certain level of futures margin. Normally, U.S. Treasury futures and spot move in the same direction, so going long on spot effectively hedges the short futures position. However, if Treasury market volatility increases and prices diverge (i.e., futures and spot prices move differently), the futures losses may exceed the spot market gains, forcing the investor into margin calls or even forced liquidations, which may involve selling the spot.

Third, leverage risk. Since basis trading often involves high leverage, the two risks mentioned earlier may be amplified by leverage.

How Big Is the Risk of Unwinding Basis Trades?

The unwinding of hedge fund basis trades may have been a significant catalyst in the March 2020 U.S. Treasury market crisis. As shown in Chart 4, during this crisis, the U.S. Treasury market faced an oversupply. On the supply side, in August 2019, the U.S. Congress suspended the debt ceiling for two years, and the U.S. Treasury debt stock increased from $22 trillion in Q2 2019 to $23.2 trillion in Q1 2020. On the demand side, the Federal Reserve stopped shrinking its balance sheet in August 2019 but had not yet significantly expanded it. Under the shock of the pandemic, Treasury market volatility intensified, hedge fund basis trades incurred losses, and U.S. Treasury spot sales were triggered. These factors quickly drained liquidity, overstretching market makers’ ability to function, which led to risks across multiple markets, including Treasuries, corporate bonds, and foreign exchange, until the Federal Reserve implemented multiple measures to stabilize the market by providing unlimited liquidity to primary dealers. This intervention was crucial in calming the crisis (Chart 5).

Chart 4: The Reversal of Hedge Fund Basis Trades Was a Key Factor in the March 2020 U.S. Treasury Crisis.

Source: BIS, CICC Research Department

Chart 5: After the March 2020 Crisis, the Federal Reserve Introduced Multiple Financing Policies to Stabilize the Market

Source: Brookings Institution, CICC Research Department

How Large Is the Current Basis Trading Volume?

As of Q3 2024, hedge fund long positions in U.S. Treasury spot totaled $2.06 trillion. As of Q2 2024, net borrowing in the repo market amounted to approximately $1 trillion (see Chart 2), and as of March 18 this year, short positions in U.S. Treasury futures reached $1.1 trillion (see Chart 6). Combining these figures, we estimate the total size of basis trading to be between $1 trillion and $1.5 trillion.

Chart 6: As of March 18, This Year, Hedge Fund Short Positions in U.S. Treasury Futures Were Approximately $1.1 Trillion

Source: OFR, CICC Research Department

Several Characteristics of the Current Market Increase the Likelihood That the Unwinding of Basis Trades Could Trigger Risks in U.S. Treasuries

First, market volatility has rapidly increased, with both the VIX index for stocks and the MOVE index for bonds reaching recent highs (see Chart 7, Chart 8). This may lead to increased futures margin requirements, potentially triggering hedge fund basis trade unwinding.

Chart 7: MOVE Index Spikes Close to 140

Source: OFR, CICC Research Department

Chart 8: VIX Index Reaches Historic Highs Post-Pandemic

Source: Haver, CICC Research Department

Second, U.S. Treasuries are still in an oversupply situation. As we pointed out in the “U.S. Treasury Quarterly Report: The Second Liquidity Inflection Point,” although the debt ceiling limits net issuance, demand remains weak, especially overseas demand, which has started to decrease since the end of last year (see Chart 9). At the same time, the potential supply of U.S. Treasuries is increasing. On April 5, the U.S. Senate passed a new version of the debt ceiling plan, which adds $5.8 trillion to the basic deficit over the next decade, more aggressive than the House version from late February (see Chart 10). We expect that the final version of the budget adjustment bill could pass in May or June, at which point U.S. Treasury supply may increase significantly, causing considerable liquidity pressure, and the real liquidity shock may still be ahead (see Chart 11).

Chart 9: Overseas Demand for Treasuries Has Weakened Since the End of Last Year

Source: Haver, CICC Research Department

Chart 10: Senate’s New Version Further Increases U.S. Treasury/GDP Ratio

Source: CRFB, CBO, CICC Research Department

Chart 11: After the Debt Ceiling Issue Is Resolved, TGA Will Rise Again to Absorb Liquidity

Source: FRED, CICC Research Department

Third, escalating trade conflicts and resulting geopolitical risks could cause continued outflows of overseas capital from the U.S., leading to a “triple kill” in stocks, bonds, and the exchange rate. Over the past two years, despite the U.S. fiscal and trade deficits, the U.S. dollar has continued to rise, primarily supported by the “AI narrative” in U.S. equities, which has attracted continuous overseas investment (see Chart 12). However, since the beginning of this year, the DeepSeek incident has cracked the “AI narrative” (refer to “Macro Market Insights February Report: DeepSeek Triggers Revaluation of U.S.-China Assets“), followed by trade conflicts that have caused a retreat in U.S. financial market risk appetite. Funds flowing into U.S. equities may shift to the bond market or flow out amid risk aversion. If the relatively safe U.S. Treasury market also faces risks, overseas capital outflows will accelerate, leading to a decline in the U.S. dollar and a “triple kill” in stocks, bonds, and the exchange rate (see “Trump’s ‘Great Reset’: Debt Resolution, Transition from Virtual to Real, and Dollar Depreciation“).

Chart 12: Overseas Funds Continued to Flow into U.S. Stocks After the Birth of ChatGPT

Source: Haver, CICC Research Department

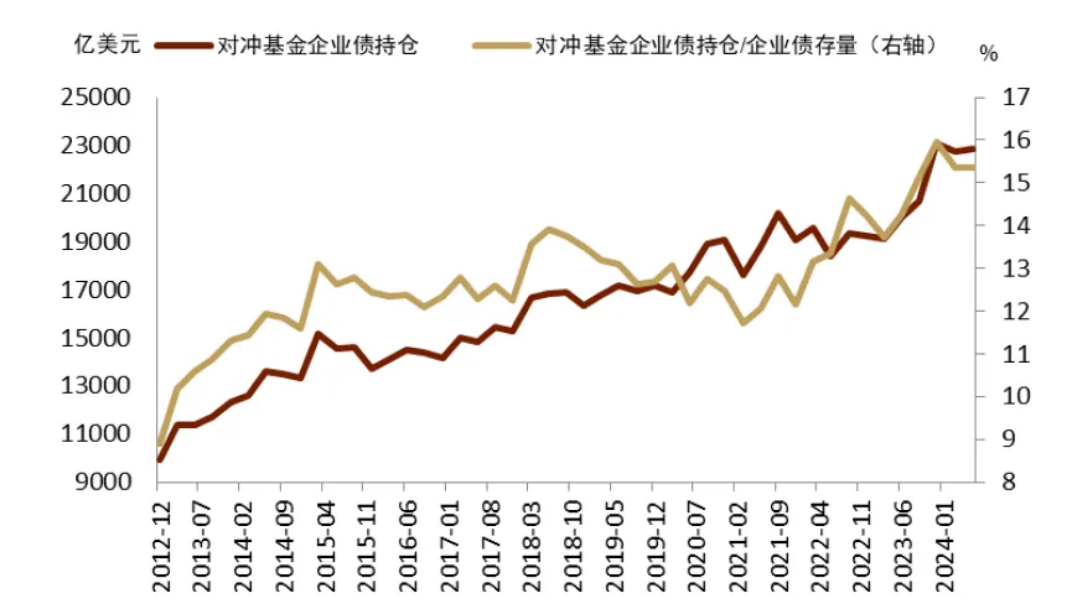

Fourth, hedge funds, which are at the core of the risk, have been significant net buyers of U.S. Treasuries since the start of the Fed’s balance sheet reduction (see Chart 13) and have large net exposures to other assets, giving them the ability to spread risks across multiple markets. For example, by the end of last year, hedge funds held $9.1 trillion in interest rate swaps, $5.9 trillion in equities, and $4.6 trillion in foreign exchange (see Chart 14), and they held 15% of U.S. corporate bonds (see Chart 15).

Chart 13: Hedge Funds Have Been Major Net Buyers of U.S. Treasuries Since Balance Sheet Reduction

Source: Haver, CICC Research Department

Chart 14: Hedge Funds Have Large Exposures Across Multiple Markets

Source: OFR, CICC Research Department

Chart 15: Hedge Funds Hold 15% of U.S. Corporate Bonds

Source: Haver, CICC Research Department

The 10Y SOFR Spread, Which Measures Basis Arbitrage Risk, Has Recently Widened Significantly, Indicating Increased Liquidity Shock Risk (Chart 16).

We suggest that, under the continued high volatility caused by trade conflicts, the likelihood of systemic risks in U.S. financial markets is increasing. The liquidity shock after the resolution of the U.S. debt ceiling in May-June deserves caution. The risks of a “triple kill” in stocks, bonds, and the exchange rate could further intensify, potentially forcing the Federal Reserve to restart QE to stabilize market volatility, with the U.S. dollar likely to decline further.

Chart 16: SOFR Spread Has Widened Significantly, Raising Liquidity Risk Probability

Source: Bloomberg, CICC Research Department

It is also worth noting that the use of QE to boost financial assets as a market-saving measure may further widen the wealth gap, which does not align with the Trump administration’s current policy direction of “transitioning from virtual to real and strengthening the middle class.” We believe the Trump administration may bypass the Federal Reserve to purchase U.S. assets (such as through the newly established U.S. Sovereign Wealth Fund) and use the subsequent returns for re-industrialization projects, such as investments in U.S. manufacturing and infrastructure.

Disclaimer:

This article is reproduced from [CICC], the copyright belongs to the original author [CICC], if you have any objection to the reprint, please contact the Gate Learn team, and the team will handle it as soon as possible according to the relevant procedures.

Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

Other language versions of the article are translated by the Gate Learn team. The translated article may not be copied, distributed or plagiarized without mentioning Gate.io.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem

What Is a Cold Wallet?

Blockchain Profitability & Issuance - Does It Matter?

Notcoin & UXLINK: On-chain Data Comparison