Can Trump's $2,000 Tariff Dividend Trigger a Crypto Bull Market?

Tariff Dividend: Origin and Rationale

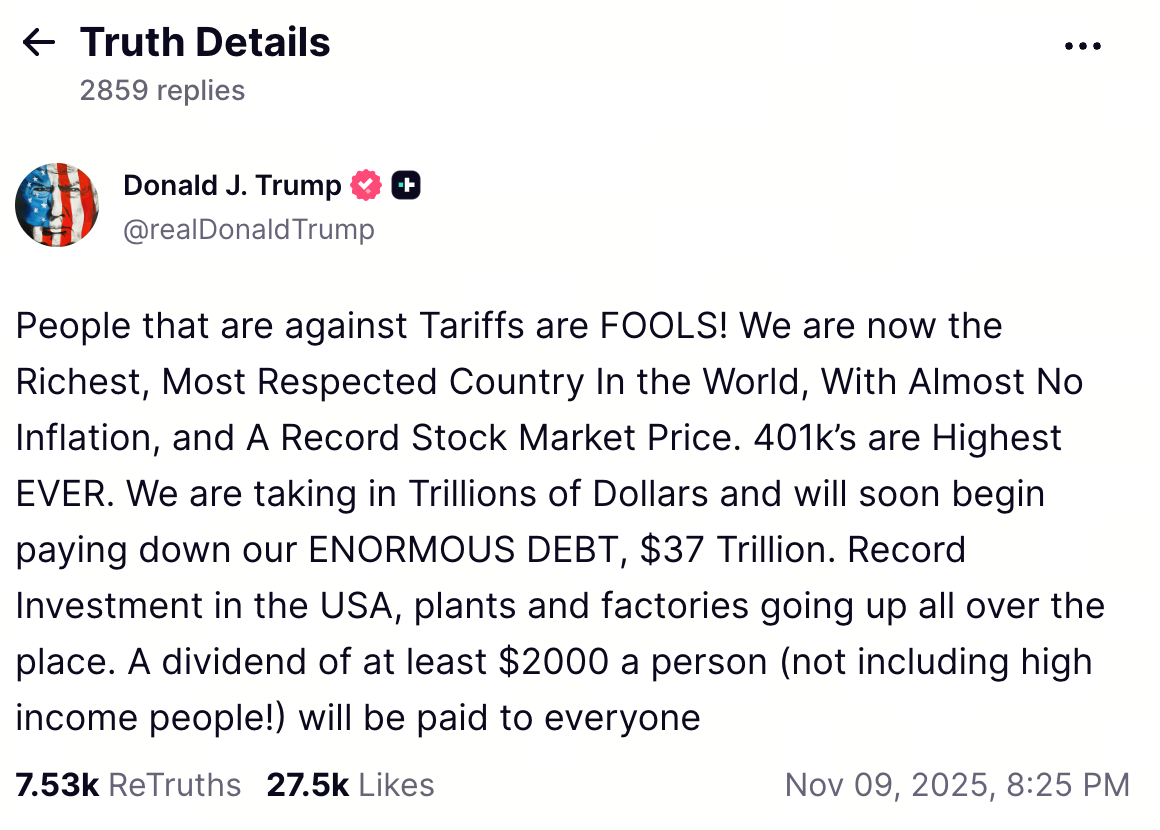

Image: @realDonaldTrump/posts/115519726463094783””>@realDonaldTrump/posts/115519726463094783"">https://truthsocial.com/@realDonaldTrump/posts/115519726463094783

On November 9, 2025, President Trump announced via Truth Social his plan to distribute a $2,000 “tariff dividend” to every low- and middle-income American, funded by substantial import tariffs. In 2025, U.S. tariff revenues reached $195 billion. Trump contends that allocating a portion of these funds to dividends could also help alleviate the national debt.

Advocates claimed this policy ensures “foreign countries pay for America,” but economists emphasized that the burden ultimately falls on U.S. consumers. While short-term stimulus may drive demand, sustained inflationary pressures are likely in the long run.

Short-Term Market Response: Crypto Asset Rally

Image: https://www.gate.com/trade/BTC_USDT

After the announcement, Bitcoin climbed 1.75%, Ethereum gained 3.32%, and privacy-focused coins such as Zcash and Monero recorded double-digit surges, with trading volumes spiking. The immediate market reaction was driven primarily by sentiment, not by actual capital inflows. Investors recall the 2020 stimulus checks, which propelled Bitcoin from $4,000 to nearly $70,000, which is fueling current bullish expectations.

Uncertainty in Policy Execution

No timeline, eligibility requirements, or congressional approval have been established for the dividend. The Supreme Court is reviewing cases concerning tariff legality, and prediction markets estimate only a 22%-23% chance of passage. Treasury Secretary Bessent suggested the dividend might be provided through tax cuts rather than direct payments. Accordingly, the rally appears driven more by anticipation than by an actual influx of liquidity.

Potential Risks: Inflation, Monetary Policy, Trade Tensions

- Large-scale cash distributions or tax cuts could spur short-term demand but intensify inflationary pressures.

- The Federal Reserve may tighten monetary policy, making risky assets like Bitcoin and Altcoins vulnerable.

- Tariffs could trigger trade tensions, disrupt global supply chains, and impact mining and the broader crypto ecosystem.

Investor Strategies: Navigating Sentiment Swings and Mitigating Risk

- Focus on sentiment: Short-term rallies are largely news-driven, suitable for tactical trading.

- Diversify: Allocate assets across Bitcoin, leading Altcoins, and a modest allocation to growth equities.

- Risk management: Set stop-losses and monitor policy developments and Federal Reserve actions.

- Exercise patience: Until actual liquidity materializes, expect pronounced volatility in the market driven by shifts in sentiment.

Conclusion: Sentiment vs. Real Liquidity

Trump’s tariff dividend proposal has ignited a short-lived market rally. Yet the funds are far from guaranteed, and execution remains uncertain. The current bull run is fueled by sentiment; however, long-term risks persist, including inflation, fiscal deficits, and trade tensions. Investors should carefully assess the gap between market expectations and actual liquidity.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article