Bitcoin Price Outlook: Bitcoin Set to Reach $200,000 by June 2026

Preface

Despite a nearly 6% pullback in Bitcoin's price this past week, market specialist Timothy Peterson remains bullish. As an economist and Bitcoin-focused author, Peterson recently shared his perspective on X (formerly Twitter), stating there’s at least a 50% chance Bitcoin will set a new record and reach $200,000 by June 2026.

Bitcoin’s Bullish Outlook

Peterson’s forecast is based on his analysis of the Median Bitcoin Yearly Price Path. He notes October typically marks the start of Bitcoin’s next upward trend, which often extends through the following June. To reach $200,000, Bitcoin needs to maintain an average monthly rise of about 7%, which equals an annual growth rate of nearly 120%. Peterson also notes the chance of Bitcoin setting a new high before November this year is above 50%.

His model presents two main scenarios for Bitcoin’s future:

Optimistic: Price rallies to $240,000.

Conservative: Gains are moderate, with Bitcoin reaching $160,000.

Peterson’s data shows Bitcoin has significant upside potential through the rest of this year and into 2026.

Macroeconomic Factors

While the long-term outlook is positive, short-term market moves are influenced by macroeconomic factors. Recently, Bitcoin and other cryptocurrencies—including Ethereum (ETH), XRP, and Solana (SOL)—have declined as investor attention shifts to the upcoming release of U.S. Personal Consumption Expenditures (PCE) data. This is the Federal Reserve’s key inflation measure, and it will directly affect the next interest rate decision. Lower rates reduce yields on traditional assets like bonds and stocks. As a result, investors often look to higher-risk markets such as crypto for returns.

Recovery After Excess Leverage Liquidations

Maja Vujinovic, CEO of FG Nexus Digital Assets, says the recent market volatility comes not from weak fundamentals but from excessive leverage being unwound. She explains, “Rate cuts by the Fed drive excess capital into the system. When Bitcoin corrects, leveraged positions are forced to liquidate. This further affects ETH and other tokens.” Vujinovic adds that leverage purges often build a healthier market by reducing the risks of speculation. Over the long term, this is more beneficial than harmful.

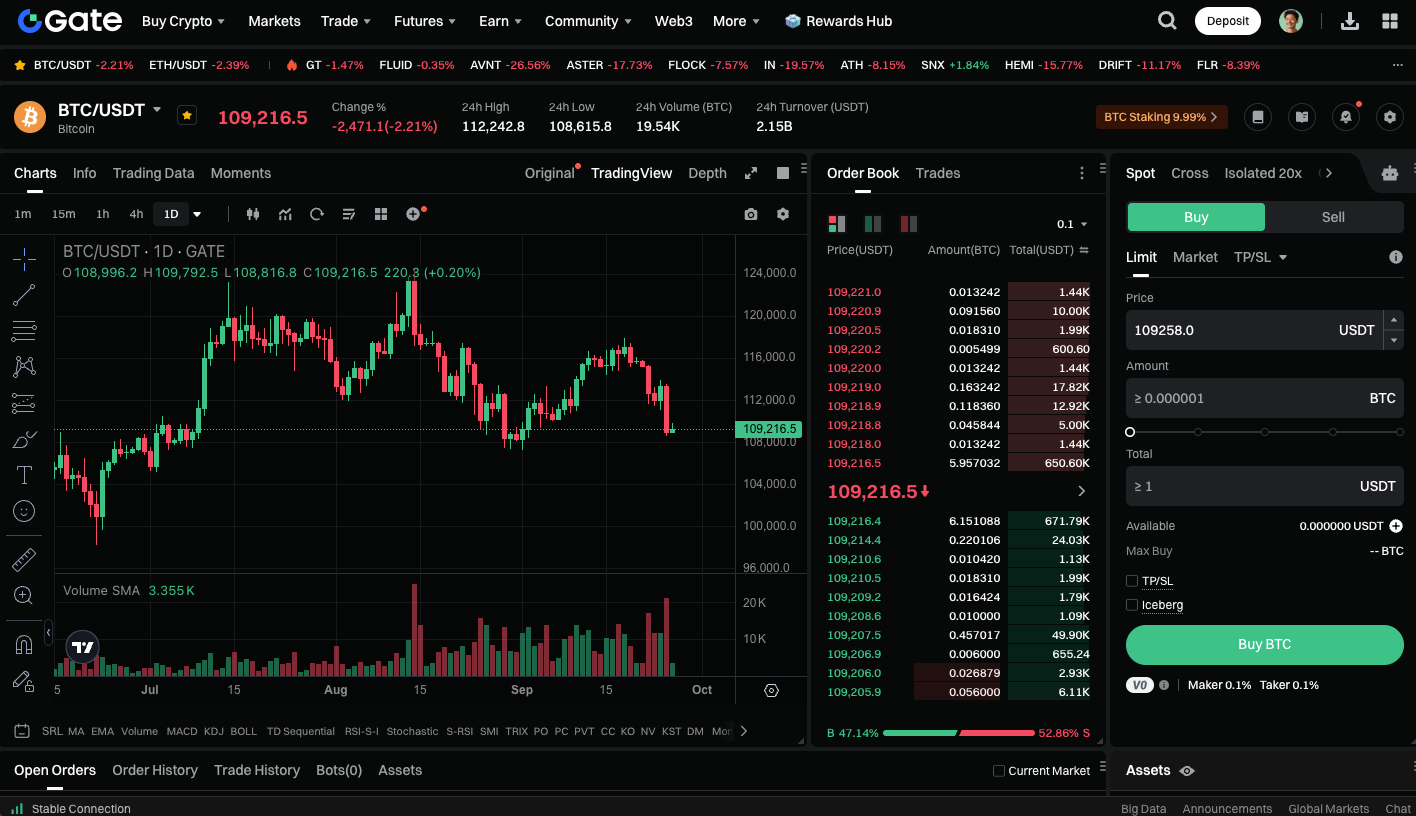

For those interested, you can start trading Bitcoin spot now: https://www.gate.com/trade/BTC_USDT

Conclusion

Despite short-term pressures from economic reports and leverage liquidations, Bitcoin shows strong medium- and long-term potential. Timothy Peterson’s model estimates at least a 50% chance Bitcoin will reach $200,000 by June 2026. Achieving this would mean gains of up to 120%, which could ignite a new bull market cycle.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article