Bitcoin Price Prediction: BTC Could Face 70% Crash, Dropping to $75,000 After Cycle Peak

Preface

If you missed this year’s Bitcoin rally, there may still be another chance to position yourself in the market. Crypto analyst Ben Cowen recently noted that with the next bear market looming, Bitcoin (BTC) could be at risk for a correction of up to 70%.

A 70% Correction Has Historical Precedent

During a conversation with Kyle Chasse, Cowen highlighted that previous bear markets in Bitcoin saw corrections of 94%, 87%, and 77%. He stressed that while history doesn’t guarantee a repeat, investors should remain vigilant—similar declines have occurred frequently in past Bitcoin cycles. If Bitcoin reaches a $250,000 peak this year, as some bulls expect, a 70% retracement could push the price down to roughly $75,000.

Potential Market Movements

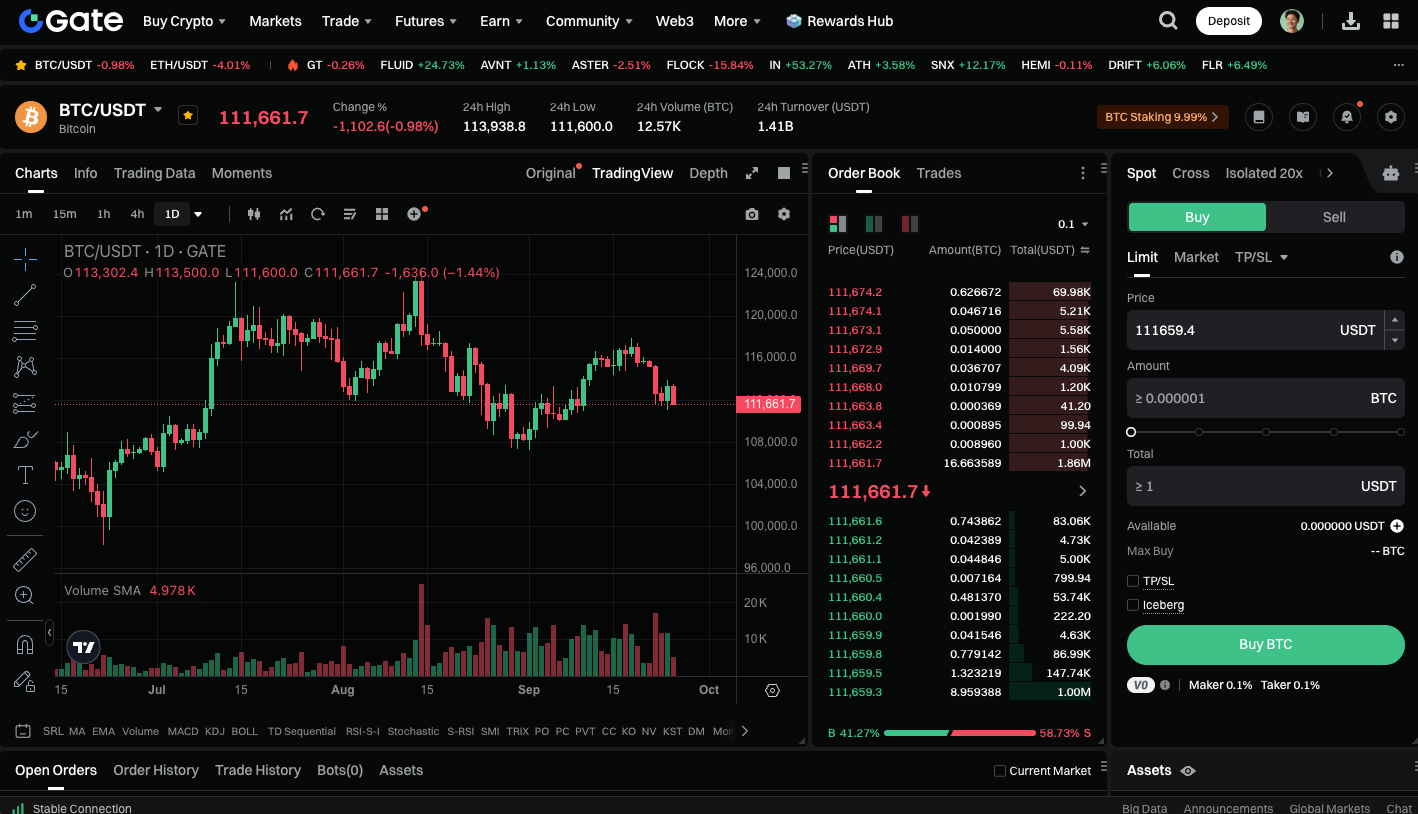

As of the time of writing, Bitcoin traded around $111,600. Cowen suggests the fourth quarter could see a significant rally, but market tops tend to form during periods of peak optimism. He cautions investors not to ignore correction risks. If Q4 brings a significant surge, Cowen says he would take profits and might wait until mid-2026 before re-entering the market.

Ethereum Could Outperform Bitcoin as the Cycle Ends

Beyond Bitcoin, Cowen also weighed in on Ethereum (ETH). He expects ETH to remain relatively weak over the coming weeks, but anticipates that as the market cycle draws to a close, ETH could outperform Bitcoin.

How Much Longer Will the Bull Market Last?

The outlook for Bitcoin’s future remains split:

- Bitwise CIO Matt Hougan predicts Bitcoin’s uptrend will extend into 2026.

- Canary Capital CEO Steven McClurg believes Bitcoin could reach $140,000–$150,000 this year before entering a bear market.

- MicroStrategy Executive Chairman Michael Saylor is even more bullish. In June, he commented, “Winter will not return.”

You can trade spot BTC at: https://www.gate.com/trade/BTC_USDT

Conclusion

Bitcoin’s price is likely to fluctuate between dramatic rallies and sharp corrections. If the price truly hits $250,000 this year, investors should beware the risk of a bear market declining by 70% to $75,000. Ethereum’s end-of-cycle performance could emerge as the next big focus.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article