2025 TRACAI Fiyat Tahmini: Yükselen Blockchain Teknolojisi için Gelecek Değerleme Analizi ve Piyasa Potansiyeli

Giriş: TRACAI'nin Piyasadaki Konumu ve Yatırım Potansiyeli

OriginTrail (TRACAI), 2017'de faaliyete geçtiğinden bu yana Yapay Zeka için Doğrulanabilir İnternet altyapısının önde gelen isimlerinden biri olarak konumlanmış; yanlış bilgilerle mücadele ve veri güvenilirliği alanında büyük ilerlemeler kaydetmiştir. 2025 yılı itibarıyla TRACAI'nin piyasa değeri 168.547.142 dolara ulaşırken, dolaşımdaki arz yaklaşık 499.546.955 token düzeyinde; fiyat ise 0,3374 dolar civarında istikrarını korumaktadır. "AI için Güven Sağlayıcı" olarak nitelenen bu varlık, gerçek varlıkların tokenleştirilmesi, tedarik zinciri yönetimi ve yapay zeka bilgi ekosistemleri gibi pek çok alanda giderek daha stratejik bir konuma gelmektedir.

Makale kapsamında, 2025-2030 döneminde TRACAI'nin fiyat trendi; geçmiş hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurlar ışığında derinlemesine analiz edilecek; profesyonel fiyat öngörüleri ve yatırımcılara yönelik stratejik yol haritaları sunulacaktır.

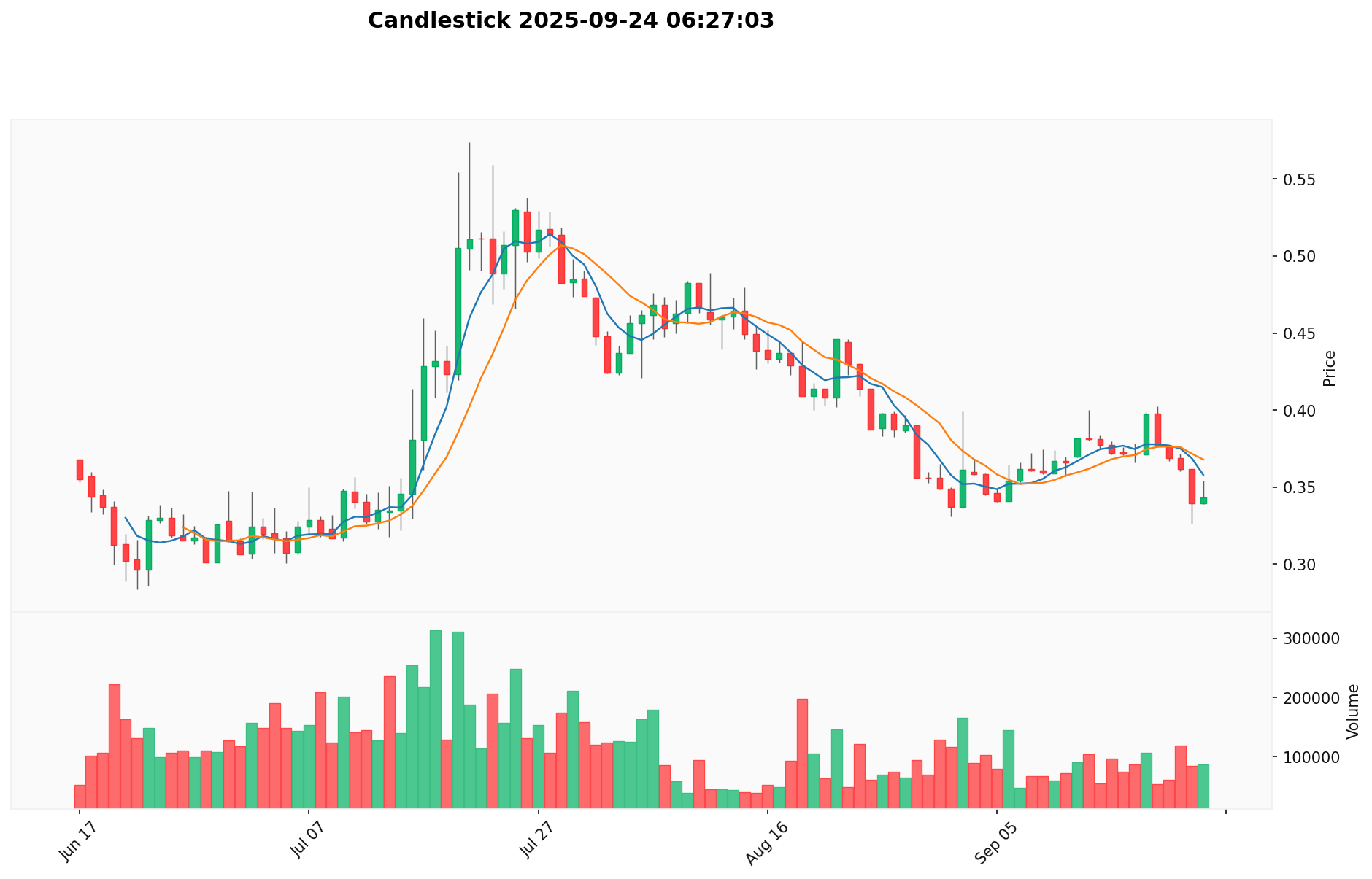

I. TRACAI Fiyat Geçmişi ve Güncel Piyasa Durumu

TRACAI'nin Tarihsel Fiyat Gelişimi

- 2018: İlk lansman, fiyat 0,10 dolar seviyesinden işlem görmeye başladı

- 2024: 9 Aralık'ta tüm zamanların zirvesi olan 1,2354 dolara ulaşıldı

- 2025: Piyasa gerilemesiyle, 22 Haziran'da tüm zamanların dip seviyesi olan 0,2834 dolara indi

TRACAI Güncel Piyasa Görünümü

24 Eylül 2025 itibarıyla TRACAI, 0,3374 dolardan işlem görürken, son 24 saatlik hareket %2,51 düşüş ile negatifti. Token haftalık bazda %9,9, son 30 gün içinde ise %17,4 oranında kayıp yaşadı. Yıl başından bu yana performansı ise %42,98'lik ciddi bir düşüş gösteriyor.

TRACAI'nin anlık piyasa değeri 168.547.142 dolar olup, genel kripto piyasasında 330’uncu sırada konumlanıyor. Son 24 saatteki işlem hacmi 28.965 dolar ile ortalama seviyede. Dolaşımda 499.546.955 TRACAI token bulunurken toplam arz 500.000.000; bu da %99,91'lik bir dolaşım oranı anlamına geliyor.

Mevcut fiyat, tarihi zirveye göre ciddi bir gerilemeyi temsil ediyor; kısa ve orta vadede negatif trendin baskın olduğu net biçimde görülüyor. VIX endeksi 44 seviyesinde olup, piyasa oyuncuları arasında güçlü bir korku algısı hâkim.

Güncel TRACAI piyasa fiyatını görmek için tıklayın

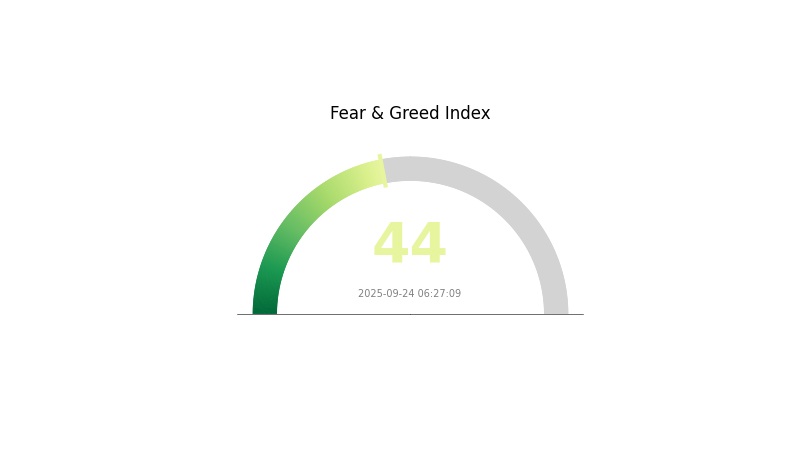

TRACAI Piyasa Duyarlılığı Göstergesi

24 Eylül 2025 Korku ve Açgözlülük Endeksi: 44 (Korku)

Güncel Korku ve Açgözlülük Endeksini incelemek için tıklayın

Kripto piyasasında temkinli bir hava hâkim ve Korku ve Açgözlülük Endeksi'nin 44 düzeyi, yatırımcıların endişeli olduğunu gösteriyor. Bu dönemler, alım fırsatı sunabilir; ancak piyasa koşullarını iyi araştırmak ve riskleri titizlikle yönetmek gerekir. Unutmayın, piyasa duyarlılığı hızla değişebilir; güncel kalmayı, portföyünüzü çeşitlendirmeyi ihmal etmeyin. Gate.com, bu zorlu koşullarda yatırımlarınızı yönetmeniz için geniş bir araç yelpazesi sunar.

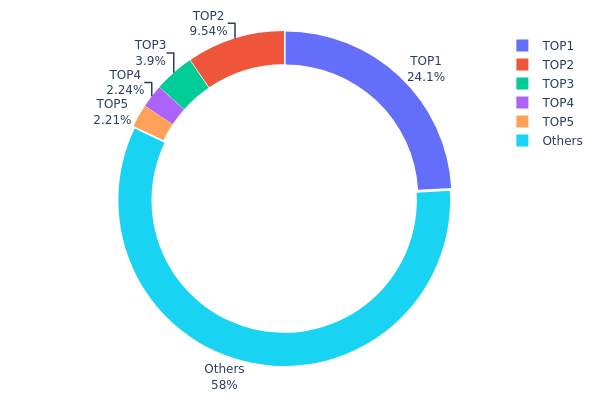

TRACAI Varlık Dağılımı

Adres tabanlı varlık dağılımı verileri, TRACAI token sahipliğinde ciddi bir yoğunlaşma olduğunu gösteriyor. En büyük adres toplam arzın %24,10'unu, ilk 5 adres ise tüm tokenlerin %41,97'sini elinde bulunduruyor. Bu seviyedeki yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı riskini gündeme getiriyor.

Bu dağılım, ekosistemin görece merkezi bir yapıda olduğunu ve az sayıda büyük yatırımcının ekosisteme yön verdiğini gösteriyor. Tokenlerin %58,03'ü "Diğerleri" segmentinde olsa da, üst adreslerin baskın etkisi fiyatı ve likiditeyi etkileyecek düzeyde. Büyük yatırımcıların hareketleri, fiyat üzerinde hassasiyet yaratırken tokenin genel istikrarı tehlikeye girebilir.

Piyasa açısından bu kompozisyon, TRACAI ekosisteminin erken gelişim sürecinde olduğunu işaret ediyor. Büyük sahiplerin hareketlerini izlemek ve dağılımı artırmak, merkeziyetsizliği teşvik ederek sistemik riskleri azaltmanın anahtarıdır.

Güncel TRACAI Varlık Dağılımını görmek için tıklayın

| Sıra | Adres | Varlık (Adet) | Pay (%) |

|---|---|---|---|

| 1 | 0x248f...b8d65d | 120.500,61K | 24,10% |

| 2 | 0x88ad...655671 | 47.701,83K | 9,54% |

| 3 | 0x5624...509283 | 19.500,00K | 3,90% |

| 4 | 0x3154...0f2c35 | 11.186,89K | 2,23% |

| 5 | 0xf630...0aa91c | 11.043,16K | 2,20% |

| - | Diğerleri | 290.067,51K | 58,03% |

II. TRACAI'nin Gelecek Fiyatını Belirleyen Ana Faktörler

Piyasa Dinamikleri

- İşlem Hacmi: TRACAI'nin fiyat hareketleri, işlem hacmindeki dalgalanmalara doğrudan bağlıdır.

- Piyasa Trendleri: Kripto para sektöründeki genel eğilimler fiyatı şekillendirir.

- Piyasa Değeri: Anlık piyasa değeri, tokenin istikrarı ve büyüme potansiyeli için önem taşır.

Proje Gelişimi

- Takım Güncellemeleri: OriginTrail geliştiricilerinin resmi açıklamaları fiyat üzerinde ciddi etki yaratabilir.

- Önemli Ortaklıklar: Stratejik iş birlikleri, TRACAI'nin değerinde pozitif sıçramalara neden olabilir.

Teknik Analiz

- İşlem Çifti Dağılımı: Farklı kripto çiftlerinde gerçekleşen işlemler, likidite ve fiyat dengesini etkiler.

- Fiyat Grafikleri: TRACAI K-line trend grafikleri, olası fiyat yönelimleri hakkında veri sunar.

Topluluk Katılımı

- Uzman Analizleri: Gate.com/Gate Post platformundaki profesyonel değerlendirmeler piyasa algısını şekillendirir.

- Topluluk Etkileşimi: Gate.com ve benzeri platformlardaki aktif tartışmalar, yatırımcı davranışlarını ve fiyatlamaları doğrudan etkileyebilir.

III. TRACAI Fiyat Tahmini (2025-2030)

2025 Beklentisi

- Temkinli tahmin: 0,31706 - 0,33730 dolar

- Nötr tahmin: 0,33730 - 0,37609 dolar

- İyimser tahmin: 0,37609 - 0,41488 dolar (olumlu piyasa algısı ve proje gelişimiyle mümkün)

2027-2028 Beklentisi

- Piyasa fazı: Benimsenmenin arttığı olası büyüme dönemi

- Fiyat aralığı:

- 2027: 0,30407 - 0,60353 dolar

- 2028: 0,42570 - 0,57469 dolar

- Başlıca tetikleyiciler: Teknolojik gelişmeler, ekosistem büyümesi ve toparlanma

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,55340 - 0,62258 dolar (istikrarlı büyüme ve sürekli proje ilerlemesi varsayımıyla)

- İyimser senaryo: 0,62258 - 0,69176 dolar (piyasa gücü ve yaygın kullanım olması durumunda)

- Dönüştürücü senaryo: 0,69176 - 0,70000 dolar (çığır açan yenilikler ve liderlik varsayımıyla)

- 2030-31 Aralık: TRACAI 0,69106 dolar (mevcut tahminlere göre muhtemel zirve)

| Yıl | Tahmini Zirve Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,41488 | 0,3373 | 0,31706 | 0 |

| 2026 | 0,54533 | 0,37609 | 0,28207 | 11 |

| 2027 | 0,60353 | 0,46071 | 0,30407 | 36 |

| 2028 | 0,57469 | 0,53212 | 0,4257 | 57 |

| 2029 | 0,69176 | 0,5534 | 0,53127 | 64 |

| 2030 | 0,69106 | 0,62258 | 0,59768 | 84 |

IV. TRACAI Yatırım Stratejileri ve Risk Kontrolü

TRACAI Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Profil: AI ve blockchain teknolojisi odaklı uzun vadeli yatırımcılar

- İpuçları:

- Piyasa düşüşlerinde TRACAI biriktirin

- Dalgalanmanın etkilerine karşı minimum 2-3 yıl süreyle tutun

- Token'ları donanım cüzdanında güvenle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz yöntemleri:

- Hareketli ortalamalar: 50 ve 200 günlük ortalamalar trend tespiti için kullanılır

- RSI göstergesi: Aşırı alım/satım noktalarını izleyin

- Swing işlemler için ana kriterler:

- Zararı durdur emirleriyle kayıpları sınırlayın

- Belirlediğiniz direnç noktalarında kârınızı alın

TRACAI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli: Kripto portföyünün %1-3'ü

- Agresif: %5-10

- Profesyonel: Maksimum %15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: AI ve blockchain projelerine dağıtım yapın

- Opsiyon stratejileri: Düşüşe karşı satım opsiyonu kullanın

(3) Güvenli Saklama Alternatifleri

- Sıcak cüzdan: Gate web3 cüzdanı

- Soğuk saklama: Donanım cüzdanları uzun vadeli tutum için ideal

- Güvenlik: İki faktörlü doğrulama açın, güçlü şifre tercih edin

V. TRACAI’ye Yönelik Riskler ve Zorluklar

TRACAI Piyasa Riskleri

- Yüksek fiyat oynaklığı: TRACAI sert dalgalanmalara açık

- Rekabet: Yeni AI blockchain projeleri pazar payını azaltabilir

- Piyasa algısı: AI ve kripto alanındaki negatif haberler fiyat üzerinde hızlı baskı oluşturabilir

TRACAI Düzenleyici Riskler

- Belirsiz regülasyonlar: Uluslararası mevzuatın değişkenliği benimsemeyi engelleyebilir

- Token sınıflandırması: Menkul kıymet olarak değerlendirilme riski

- Ülke sınırları: Küresel düzenleme farkları kullanım alanını daraltabilir

TRACAI Teknik Riskler

- Akıllı kontrat açıkları: Temel yapıda istismar olasılığı mevcut

- Ölçeklenebilirlik: Yoğun talepte ağda tıkanıklık oluşabilir

- Entegrasyon: Mevcut AI sistemleriyle uyumsuzluk riski

VI. Sonuç ve Eylem Önerileri

TRACAI Yatırım Değeri Analizi

TRACAI, AI ve blockchain kesişiminde uzun vadeli potansiyel sunarken, kısa vadede volatilite ve benimseme engelleri ile karşı karşıya. Yanlış bilgiyle mücadele ve AI güvenilirliğinin artırılması konusundaki özgün değer önerisi, temkinli yatırımcılar açısından cazip bir fırsat sunuyor.

TRACAI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini anlamak için küçük ve düzenli yatırımlar yapın

✅ Deneyimli yatırımcılar: Uzun vadeli tutum ve aktif al-satı bir arada değerlendirin

✅ Kurumsal yatırımcılar: OriginTrail teknolojisinin stratejik iş birlikleri ve büyük ölçekli uygulamalarını keşfedin

TRACAI Alım-Satım Katılımı Yöntemleri

- Spot işlemler: Gate.com üzerinden TRACAI alıp satabilirsiniz

- Staking: Uygun program varsa, staking ile ek getiri elde edin

- DeFi entegrasyonu: Merkeziyetsiz finans protokollerinde TRACAI kullanımını değerlendirin

Kripto para yatırımları çok yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Risk toleransınızı dikkate alarak, profesyonel finansal danışmanlardan destek alınız. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

2030 için Trac fiyat tahmini nedir?

Mevcut piyasa analizine göre, Trac'ın 2030 fiyatı 0,499319 dolar seviyesine ulaşacak şekilde tahmin ediliyor.

Trac yatırım için uygun mu?

Güncel teknik göstergeler, TRAC'ın 2025'te alım için uygun olmadığını ve düşüş beklendiğini gösteriyor.

Hangi yapay zeka kripto fiyat tahmininde kullanılabilir?

Incite AI, kripto para fiyatlarını tahmin etmek için önde gelen bir araçtır. Gelişmiş algoritmalarla piyasa trendini analiz ederek, kullanıcı dostu arayüzüyle hassas öngörüler sunar.

ICP 100 dolara ulaşır mı?

ICP'nin 100 dolara çıkma ihtimali %25-35 aralığında öngörülmektedir. Bu tahmin, piyasanın gidişatına ve projenin başarı durumuna bağlı. Mevcut veriler bu sonucun halen belirsiz olduğunu göstermektedir.

2025 FET Fiyat Tahmini: Fetch.ai’nin Yerel Token’ı FET İçin Piyasa Eğilimleri ve Gelecek Potansiyeli Analizi

2025 CAMP Fiyat Tahmini: Blockchain oyun varlıklarının piyasa trendleri ve büyüme potansiyeli üzerine analiz

2025 NC Fiyat Tahmini: Piyasa Trendleri ve Gelecekteki Büyüme Potansiyelinin Analizi

2025 AITECH Fiyat Tahmini: Piyasa Trendleri, Ekonomik Gelişmeler ve Yapay Zeka Sektöründe Yatırım Olanakları

2025 REX Fiyat Tahmini: Benimsenme ve kullanımın büyümeyi tetiklemesiyle yükseliş yönlü görünüm

2025 MIRA Fiyat Tahmini: Gelecek Trendler ve Potansiyel Büyüme Faktörlerinin Analizi

Kripto para cüzdanınızda ENS Domainlerini kullanmanın yolları: Uzmanlara özel rehber

Blockchain Katman 0 Mimarisi: Ana Ağlar ve Yan Zincirlerdeki İlerlemeler

Bored Ape NFT Yatırımı İçin Kapsamlı Rehber

Kripto piyasasında panik havasının nasıl tespit edileceği ve yönetileceğine dair pratik bir rehber

Zincirler Arası Token Transferi: Solana ve Ethereum Köprü Rehberi