2025 PROM Fiyat Tahmini: Merkeziyetsiz borsa tokeni için piyasa trendlerinin ve gelecekteki değerleme faktörlerinin kapsamlı analizi

Giriş: PROM’un Piyasadaki Konumu ve Yatırım Potansiyeli

Prometeus (PROM), NFT oyunları ve metaverse sektörü için merkezi bir giriş noktası olarak, 2019’dan bu yana kayda değer ilerleme gösterdi. 2025 itibarıyla PROM’un piyasa değeri $176.806.000’a ulaşırken, dolaşımdaki yaklaşık 18.250.000 token ile fiyatı $9,688 düzeyindedir. “NFT ve GameFi toplayıcısı” olarak anılan PROM, NFT pazar yerleri, merkeziyetsiz finans ve metaverse geliştirme alanlarında giderek daha stratejik bir pozisyona sahip.

Makale, PROM’un 2025-2030 arası fiyat trendlerini tarihsel hareketler, piyasa dengesi, ekosistem gelişimi ve makroekonomik etkenlerle birlikte değerlendirerek profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejiler ortaya koymaktadır.

I. PROM Fiyat Geçmişi ve Mevcut Piyasa Durumu

PROM’un Fiyatında Dönüşüm

- 2019: İlk çıkış, 8 Kasım’da en düşük seviyede $0,088747

- 2021: Boğa dönemi zirvesi, 30 Nisan’da en yüksek seviye olan $105,94

- 2022-2023: Kripto kışı, fiyatlar zirveden ciddi düşüş yaşadı

PROM Güncel Piyasa Görünümü

24 Eylül 2025’te PROM $9,688 seviyesinden işlem görüyor. Token kısa vadede karmaşık bir performans gösterdi. Son 24 saatte %2,35 yükselerek pozitif ivme yakaladı; fakat son 7 günde %15,1 düşüşle satış baskısı öne çıktı.

Orta ve uzun vadede ise PROM güçlü performans sergiledi. 30 günlük getiri %7,24 pozitif ve yıllık bazda %69,19 artış söz konusu. Bu büyüme, Prometeus ağına olan ilgide ve benimsemede sürekliliğe işaret ediyor.

Piyasa değeri $176.806.000 olan PROM, tüm kripto paralar arasında 317. sırada yer alıyor. Şu anki fiyatı, tüm zamanların en yüksek seviyesinin epey altında; piyasa koşulları iyileşirse değerlenme potansiyeli bulunuyor.

Dolaşımdaki arz 18.250.000 PROM olup, toplam arzın %94,81’ini oluşturuyor. Bu yüksek oran, tokenlerin büyük bölümünün piyasada olduğunu ve gelecekteki enflasyon baskısının sınırlı kalabileceğini gösteriyor.

Güncel PROM piyasa fiyatını görmek için tıklayın

PROM Piyasa Duyarlılığı

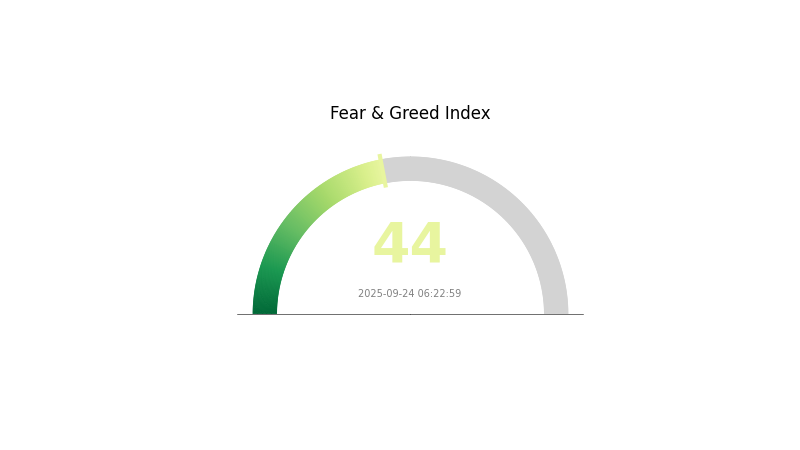

24 Eylül 2025 Korku ve Açgözlülük Endeksi: 44 (Korku)

Güncel Korku ve Açgözlülük Endeksi buradan görüntülenebilir

Kripto piyasasında baskın duygu temkinlilik. Endeksin 44 olması korku ortamı anlamına geliyor ve yatırımcılar çekingen davranıyor, olası alım fırsatlarını kolluyor. Bu tür düşük duyarlılık yatırım için avantaj sunabilir; ancak kapsamlı analiz ve iyi risk yönetimi gerektirir. Trendleri izleyin ve belirsizlikte düzenli alım (maliyet ortalaması) stratejisini değerlendirin.

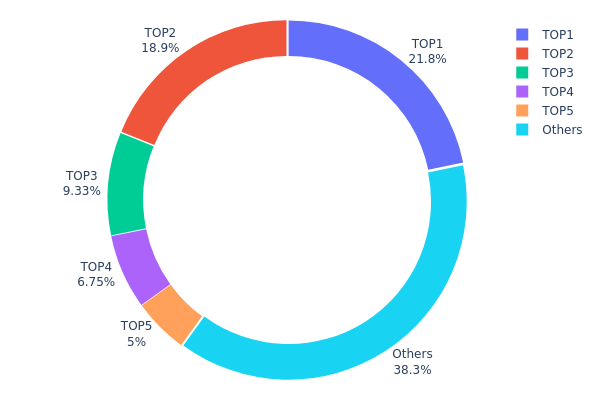

PROM Varlık Dağılımı

PROM’un adres dağılımı, tokenlerin büyük bölümünün birkaç büyük yatırımcıda toplandığını gösteriyor. İlk 5 adres toplam arzın %61,69’una sahip ve en büyük adres %21,75 ile önde. Bu merkezi yoğunlaşma, piyasa yapısında önemli riskler ve volatilite yaratabilir.

Bu yapı, büyük yatırımcıların hareketlerinin fiyatlar üzerinde ciddi etkiler yaratabileceğini gösteriyor. Beş adresin %60’tan fazla tokenı elinde bulundurması, olası büyük işlemlerde ani fiyat dalgalanmalarını tetikleyebilir. Ayrıca, bu yoğunlaşma, piyasa manipülasyonu olasılığı ve likidite risklerini arttırıyor.

%38,31 PROM tokenı diğer adreslerde dağılmış durumda; merkeziyet düzeyi görece düşük. Bu güç yoğunlaşması, zincir üstü yapının istikrarı ve uzun vadeli yatırımcılar için yönetişim riskleri açısından dikkatle değerlendirilmelidir.

Güncel PROM Varlık Dağılımı buradan incelenebilir

| Üst | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0xe906...97112b | 4.350.00K | 21,75% |

| 2 | 0xf977...41acec | 3.775.48K | 18,87% |

| 3 | 0x856f...09841a | 1.865.43K | 9,32% |

| 4 | 0x7996...63c31e | 1.350.00K | 6,75% |

| 5 | 0x3cdf...cc6d1c | 1.000.00K | 5,00% |

| - | Diğerleri | 7.659.08K | 38,31% |

II. PROM’un Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Piyasa Duyarlılığı

- Sosyal Medya Etkisi: Projenin 30 Haziran’daki yükseliş odaklı tweet’i, PROM fiyatında 24 saatte %12 artış sağladı.

- Teknik Analiz: PROM, üst üste altı gün yeşil mum ile teknik olarak güçlü bir görünüm sergiledi.

- Destek Seviyeleri: $5,4 - $5,5 aralığında güçlü destek mevcut.

Teknolojik Gelişmeler ve Ekosistem

- Temel İşlev: PROM, Web3 oyun ekosisteminde NFT alım-satım ve değişimi için bir pazar yeri olarak faaliyet gösterir.

- Ana Hizmetler: Merkeziyetsiz NFT kiralama ve teminatlı kredi, NFT pazarı ve toplayıcı, eğitim portalı, analiz araçları, GameFi varlıkları için borsa ve varlık yönetimi araçları sunar.

- Hedef Kitle: NFT oyun tutkunlarının blokzincire etkin şekilde girişini kolaylaştırır.

Makroekonomik Çerçeve

- Kripto Piyasa Eğilimleri: Korku ve Açgözlülük Endeksi (şu anda 63) nötrden hafif iyimserlik aralığında ve bu, PROM fiyatına etki edebilir.

- Küresel Göstergeler: Hisse senedi endeksleri (S&P 500, Dow Jones, NASDAQ) ve altın fiyatları, kripto piyasasına ve PROM’a dolaylı yönden etki edebilir.

III. PROM İçin 2025-2030 Fiyat Tahminleri

2025 Görünümü

- Temkinli: $7,257 - $9,676

- Nötr: $9,676 - $12,00

- İyimser: $12,00 - $14,417 (güçlü piyasa toparlanması ve benimseme ile)

2027-2028 Görünümü

- Piyasa aşaması: Volatilitenin yükseldiği olası büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2027: $11,228 - $20,585

- 2028: $12,943 - $21,688

- Temel tetikleyiciler: Teknolojik ilerlemeler, blokzincir entegrasyonu ve olası düzenleyici açıklık

2030 Uzun Vadeli Görünüm

- Temel senaryo: $15,00 - $20,569 (istikrarlı büyüme ile)

- İyimser senaryo: $20,569 - $23,860 (benimsemenin hızlanması ve olumlu piyasa ortamı ile)

- Dönüştürücü senaryo: $23,860+ (aşırı pozitif koşullar ve yenilikçi kullanım alanları ile)

- 31 Aralık 2030: PROM $20,569 (uzun vadeli büyüme sonrası istikrar)

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Artış Oranı |

|---|---|---|---|---|

| 2025 | 14,41724 | 9,676 | 7,257 | 0 |

| 2026 | 16,7448 | 12,04662 | 6,38471 | 24 |

| 2027 | 20,58587 | 14,39571 | 11,22865 | 48 |

| 2028 | 21,68858 | 17,49079 | 12,94318 | 80 |

| 2029 | 21,54865 | 19,58968 | 15,47585 | 102 |

| 2030 | 23,86023 | 20,56917 | 11,10735 | 112 |

IV. PROM İçin Yatırım Stratejileri ve Risk Yönetimi

PROM Yatırım Stratejisi

(1) Uzun Vadeli Tutma

- Uygun profil: Yüksek risk toleranslı uzun vadeli yatırımcılar

- Öneriler:

- Piyasa düşüşlerinde PROM alımı yapın

- Fiyat hedefleri belirleyip plana sadık kalın

- Tokenlarınızı donanım cüzdanında saklayın

(2) Aktif Alım-Satım

- Teknik analiz araçları:

- Hareketli Ortalama: Trend ve dönüş noktalarını tespit edin

- RSI: Aşırı alım/aşırı satım durumlarını takip edin

- Swing trade ipuçları:

- Stop-loss ile zararları sınırlayın

- Kârı belirlenen seviyelerde alın

PROM Risk Yönetimi

(1) Varlık Dağıtımı

- Temkinli yatırımcı: %1 - %3

- Agresif yatırımcı: %5 - %10

- Profesyonel yatırımcı: %10 - %15

(2) Riskten Korunma

- Çeşitlendirme: Birden fazla kripto para ile riski bölün

- Stop-loss uygulayın

(3) Güvenlik

- Donanım cüzdanı: Gate Web3 Cüzdan önerilir

- Yazılım cüzdanı: PROM’un resmi cüzdanı (varsa)

- Güvenlik önlemleri: İki faktörlü doğrulama ve anahtarları çevrimdışı tutma

V. PROM İçin Riskler ve Zorluklar

PROM Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarda ani dalgalanmalar

- Rekabet: NFT ve metaverse alanında rakip projeler

- Likidite riski: Düşük hacimler, yüksek kayma riski

PROM Düzenleyici Riskleri

- Belirsiz düzenleyici ortam

- Hükümet kaynaklı potansiyel kısıtlamalar

- Uyum zorlukları, değişen kurallara adaptasyon gereksinimi

PROM Teknik Riskleri

- Akıllı kontrat açıkları ve kötüye kullanım riski

- Ethereum ağ tıkanıklığı, maliyet artışı

- Ölçeklenebilirlik: Artan kullanıcı yüküne karşı adaptasyon

VI. Sonuç ve Eylem Önerileri

PROM Yatırım Potansiyeli Değerlendirmesi

PROM, NFT ve metaverse alanında büyüme potansiyeli barındırıyor; ancak yatırımcıların piyasadaki volatilite ve düzenleyici riskleri dikkate alması gerekir.

PROM Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük yatırımlar ve eğitim odaklı yaklaşım ✅ Deneyimli yatırımcılar: Dengeli portföy ve düzenli kâr alımı ✅ Kurumsal yatırımcılar: Detaylı analiz ve güçlü risk yönetimi şart

PROM Alım-Satım Yöntemleri

- Spot işlem: Gate.com üzerinden alış-satış

- Staking: Uygunsa staking programlarına katılım

- DeFi entegrasyonu: PROM ile merkeziyetsiz finans fırsatları

Kripto para yatırımları yüksek risk içerir. Bu metin yatırım tavsiyesi değildir; yatırımcılar kendi risk profillerine göre karar vermeli ve profesyonel danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Pepe’nin 2025 fiyat tahmini nedir?

2025 yılı için Pepe’nin ortalama fiyatı $0,00001431 olarak öngörülüyor; beklenen aralık $0,00000708 – $0,00002405 arasındadır.

PROM Coin nedir?

PROM, Layer 2 blokzincir çözümüdür; sıfır-bilgi kanıtlarıyla ölçeklenebilirlik ve birlikte çalışabilirlik sağlar. İşlemleri zincir dışı işleyip Ethereum güvenliğini korur, blokzincirler arası iletişimi tek noktadan yönetmeyi hedefler.

PERP’in 2030 fiyat tahmini nedir?

Geçmiş veri analizleriyle, PERP’in 2030 fiyat tahmini $18,87 olup, mevcut seviyeye göre ciddi bir yükseliş anlamına gelir.

PROM Coin’in fiyatı nedir?

24 Eylül 2025’te PROM Coin $9,32 seviyesindedir ve son 24 saatte %4,44 artış göstermiştir.

2025 VOXEL Fiyat Tahmini: Gelecekteki Piyasa Analizi ve Metaverse Ekonomisinde Yatırım Fırsatları

2025 HIGH Fiyat Tahmini: Düzenleme Sonrası Kripto Ekosisteminde HIGH Token’ın Piyasa Trendleri ve Gelecekteki Değerlemesinin Analizi

2025 RACA Fiyat Tahmini: Gelişen NFT Oyun Ekosisteminde Büyüme Dinamikleri ve Piyasa Potansiyelinin Değerlendirilmesi

2025 TLM Fiyat Tahmini: Alien Worlds Token’ının Piyasa Trendleri ve Gelecek Değer Potansiyelinin Analizi

2025 ARTY Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi