2025 ASTR Fiyat Tahmini: Astar Network’ün Token’ına Yönelik Büyüme Trendleri ve Piyasa Potansiyelinin Analizi

Giriş: ASTR’nin Piyasadaki Konumu ve Yatırım Değeri

Japonya’dan doğan, topluluk güdümlü bir Web3 adaptasyon hareketi olan Astar Token (ASTR), kurulduğu günden bu yana Astar Network ile Soneium ekosistemleri arasında sorunsuz bir köprü işlevi görmüştür. 2025 yılı itibarıyla ASTR’nin piyasa değeri 188.045.119 $’a ulaşmış; yaklaşık 8.179.431.044 token dolaşımda olup, token fiyatı 0,02299 $ civarındadır. “Japon Web3 Öncüsü” olarak bilinen bu varlık, kullanıcı dostu uygulamalar, ödeme sistemleri ve merkeziyetsiz finans çözümlerinde giderek daha kritik bir misyon üstlenmektedir.

Bu makalede, ASTR’nin 2025–2030 dönemine ait fiyat trendleri; geçmiş fiyat verileri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkiler ışığında kapsamlı olarak incelenecek, yatırımcılara yönelik profesyonel fiyat tahminleri ve pratik yatırım stratejileri aktarılacaktır.

I. ASTR Fiyat Geçmişi ve Güncel Durum

ASTR Tarihsel Fiyat Gelişimi

- 2022: 17 Ocak’ta ASTR, 0,421574 $ ile tarihi zirvesini gördü ve önemli bir başarı kaydetti.

- 2025: Ciddi değer kaybı sonrası 23 Haziran’da 0,0208857 $ ile en düşük seviyeye indi.

- 2025: Güncel döngüde, fiyat dipten hafif toparlanarak 0,02299 $ seviyesine yükseldi.

ASTR Güncel Piyasa Görünümü

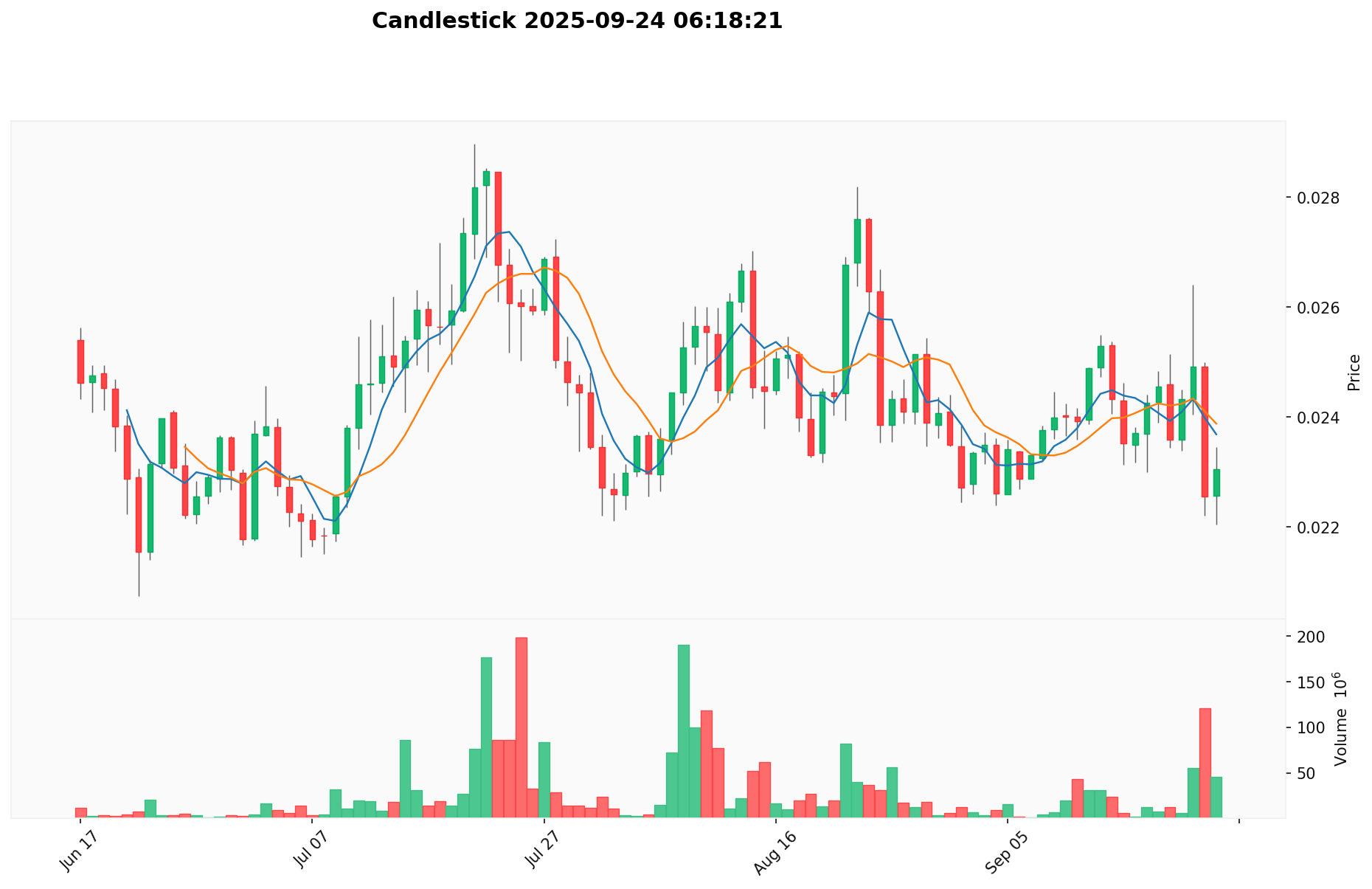

24 Eylül 2025 itibarıyla ASTR 0,02299 $ seviyesinden işlem görmektedir; son 24 saatlik artış oranı %1,95’tir. Piyasa değeri 188.045.119 $’a ulaşan token, küresel kripto sıralamasında 306. sıradadır. ASTR farklı zaman periyotlarında değişken performans sergilemiştir: Son 1 saatte %1,099, son 1 günde %1,95 artış; son 1 haftada %2,59, son 1 ayda %11,35, son bir yılda ise %65,63 oranında düşüş gerçekleşmiştir. Güncel fiyat, tarihi zirvenin %94,55 altındayken, dip seviyesinin %10,07 üzerindedir. Dolaşımdaki arz 8.179.431.044 ASTR, toplam arz ise 8.519.579.873 ASTR olup, dolaşım oranı yüksek (%116,85) seviyededir.

Güncel ASTR piyasa fiyatını görmek için tıklayın

ASTR Piyasa Duyarlılığı Göstergesi

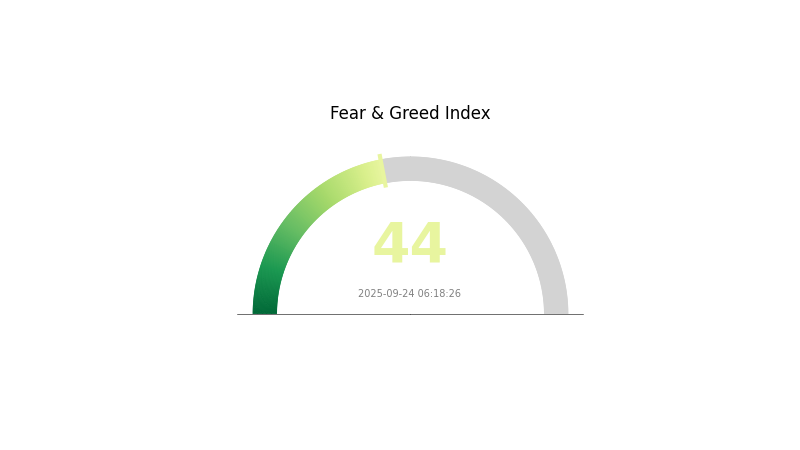

24 Eylül 2025 Korku ve Açgözlülük Endeksi: 44 (Korku)

Güncel Korku & Açgözlülük Endeksi’ni görmek için tıklayın

Kripto piyasasında duyarlılık hâlâ temkinli seyrediyor. Korku ve Açgözlülük Endeksi 44 ile “korku” seviyesinde; bu, yatırımcıların çekingen kaldığını ve güvenli liman arayışında olabileceğini gösteriyor. Ancak deneyimli yatırımcılar için, bu tür korku dönemleri alım fırsatı anlamına gelebilir. Yine de kapsamlı araştırma yapmak ve etkin risk yönetimi uygulamak çok önemlidir. Gate.com mevcut piyasa koşullarında kullanıcılara kapsamlı analiz ve araçlar sunar. Piyasa duyarlılığının hızla değişebileceği unutulmamalı; bilgili kalın ve işlemlerde dikkatli davranın.

ASTR Varlık Dağılımı

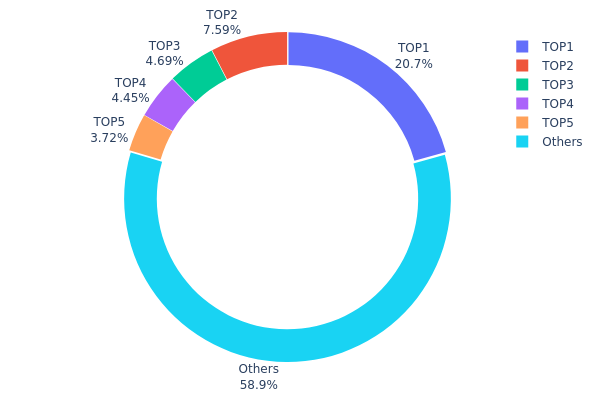

Adres bazlı dağılım verileri, ASTR tokenlarının sahiplikteki yoğunlaşmasını açıkça ortaya koyuyor. Mevcut verilere göre, en büyük adres toplam arzın %20,67’sini elinde bulunduruyor; en büyük ilk 5 adres ise toplamda %41,11 oranında paya sahip.

Bu seviyedeki yoğunlaşma, ASTR arzında görece merkeziyetçi bir yapı olduğunu gösteriyor. Büyük sahiplerin fiyat üzerinde etkili olabileceği bu yapı, önemli işlemlerde fiyat oynaklığını artırabilir. Ancak %58,89’luk token dilimi de diğer adreslere dağılmış durumda; bu durum ekosistemde daha geniş katılımı yansıtıyor.

Bu dağılım profili, ağdaki birkaç büyük oyuncunun fiyat ve piyasa istikrarında önemli rol üstlendiğini, merkeziyetsizliğin ve dirençliliğin değerlendirilmesinde bu unsurun dikkate alınması gerektiğini gösteriyor. Yoğunluk oranı açısından yatırımcı ve analistlerin piyasa manipülasyonu ve dayanıklılık risklerine karşı uyanık olması gerekiyor.

Güncel ASTR Dağılımını görmek için tıklayın

| Sıra | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | YDFuxC...pzHGgA | 1.761.657,39K | 20,67% |

| 2 | aRXcHQ...pPX5ve | 646.619,84K | 7,59% |

| 3 | Yc66s2...sZxSVM | 399.444,59K | 4,68% |

| 4 | agF2sH...jDVgae | 379.272,95K | 4,45% |

| 5 | ZEyDXf...ma57Tg | 317.286,89K | 3,72% |

| - | Diğerleri | 5.015.079,74K | 58,89% |

II. ASTR’nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- ASTR Yerel Token: ASTR, Astar platformunun yerel tokenidir; işlem ücretlerinde kullanılır ve sahipleri, ağ yönetimine katılarak ödül kazanabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Astar, merkeziyetsiz uygulamalar (dApp) ve kurumsal kullanım senaryoları için yüksek performanslı bir blokzincir altyapısı sunmayı amaçlar.

Makroekonomik Çevre

- Parasal Politikaların Etkisi: Makro ekonomik dalgalanmalar, zayıf tüketici güveni ve güçlü dolar kuru, ASTR’nin büyüme ve sürdürülebilirliğini etkileyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Cosmos SDK tabanlı: Astar, Cosmos SDK üzerinde geliştirilmiştir; bu açık kaynak framework, özel blokzincir uygulamaları için kapsamlı modüller ve araçlar sağlar.

- Ekosistem Uygulamaları: Proje, dApp ve kurumsal çözümler için ölçeklenebilirlik, güvenlik ve geliştirici dostu altyapı sunmaya odaklanır.

III. 2025–2030 ASTR Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı tahmin: 0,01541 $ – 0,02 $

- Tarafsız tahmin: 0,02 $ – 0,025 $

- İyimser tahmin: 0,025 $ – 0,03128 $ (güçlü piyasa toparlanması ve proje gelişimi gerektirir)

2027–2028 Beklentisi

- Beklenen Piyasa Aşaması: Benimsenmede artışla büyüme fazı

- Fiyat tahmini aralığı:

- 2027: 0,01559 $ – 0,04139 $

- 2028: 0,02034 $ – 0,04604 $

- Kilit katalizörler: Ekosistem genişlemesi, teknolojik yenilikler ve genel kripto piyasası trendleri

2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,04 $ – 0,05 $ (istikrarlı büyüme ve piyasa dengesini varsayar)

- İyimser senaryo: 0,05 $ – 0,07 $ (projenin güçlü performans ve elverişli piyasa koşullarını varsayar)

- Dönüştürücü senaryo: 0,07 $ – 0,07428 $ (çığır açıcı yenilikler ve kitlesel benimseme varsayıldığında)

- 2030-12-31: ASTR için öngörülen ortalama fiyat 0,04985 $

| Yıl | Tahmini Zirve Fiyat | Tahmini Ortalama | Tahmini Dip Fiyat | Artış (%) |

|---|---|---|---|---|

| 2025 | 0,03128 | 0,023 | 0,01541 | 0 |

| 2026 | 0,03284 | 0,02714 | 0,02307 | 18 |

| 2027 | 0,04139 | 0,02999 | 0,01559 | 30 |

| 2028 | 0,04604 | 0,03569 | 0,02034 | 55 |

| 2029 | 0,05884 | 0,04086 | 0,02901 | 77 |

| 2030 | 0,07428 | 0,04985 | 0,02941 | 116 |

IV. ASTR İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ASTR Yatırım Stratejisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Riski tolere edebilen, uzun vadeli perspektife sahip yatırımcılar

- Öneriler:

- Piyasa düşüşlerinde ASTR biriktirin

- Staking’e katılarak ek ödüller elde edin

- Tokenları güvenli, kişisel (saklamasız) bir cüzdanda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını tespit etmek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım ya da satım bölgelerini izlemek için kullanılır

- Swing trade için ipuçları:

- Stop-loss ve kar-al seviyelerini net şekilde belirleyin

- Proje gelişmelerini ve piyasa duyarlılığını düzenli takip edin

ASTR Risk Yönetimi Yapısı

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcılar: Kripto portföyünün %1–3’ü

- Agresif yatırımcılar: %5–10’u

- Profesyonel yatırımcılar: Maksimum %15’i

(2) Koruyucu Risk Çözümleri

- Çeşitlendirme: Farklı kripto varlıklarına yatırım dağıtımı

- Stop-loss emirleri: Potansiyel kayıpları sınırlandırmak için kullanılır

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk depolama: Donanım cüzdanı ile uzun vadeli güvenli muhafaza

- Güvenlik: İki faktörlü kimlik doğrulama etkinleştirilmeli, güçlü parola seçilmeli

V. ASTR İçin Olası Riskler ve Zorluklar

ASTR Piyasa Riskleri

- Yüksek volatilite: Fiyat, ciddi dalgalanmalara maruz kalabilir

- Rekabet: Diğer Layer 1 ve Layer 2 projeleri pazar payına etki edebilir

- Likitide riski: Düşük işlem hacmi, pozisyona giriş-çıkışları zorlaştırabilir

ASTR Düzenleyici Riskler

- Belirsiz regülasyonlar: Kripto düzenlemelerinin evrimi benimsemeyi sınırlayabilir

- Uluslararası uyum: Farklı ülkelerdeki regülasyonlar küresel büyümeyi etkileyebilir

- Güvenlik tokenı sınıflandırılması: Ek düzenleyici denetimlere neden olabilir

ASTR Teknik Riskler

- Akıllı sözleşme açıkları: Ağ kodundaki potansiyel zaaflar

- Ölçeklenebilirlik sorunları: Yüksek talepli dönemde ağ tıkanıklığı

- Birlikte çalışabilirlik engelleri: Diğer blokzincirlerle entegrasyon zorlukları

VI. Sonuç ve Eylem Önerileri

ASTR Yatırım Değeri Değerlendirmesi

ASTR, Japonya merkezli yaklaşımı ve Sony ile olan ortaklığı sayesinde özgün bir değer vadeder. Ancak yüksek piyasa oynaklığı ve regülasyon belirsizliği nedeniyle yatırımcıların temkinli hareket etmesi gerekir.

ASTR Yatırım Tavsiyeleri

✅ Yeni başlayanlara: Küçük tutarlarla giriş yapın ve projeyi öğrenmeye öncelik verin ✅ Deneyimli yatırımcılara: Düzenli maliyet ortalaması ve staking ile dengeli strateji uygulayın ✅ Kurumsal yatırımcılara: Detaylı ön inceleme yapın, büyük pozisyonlar için OTC olanaklarını değerlendirin

ASTR Alım-Satım ve Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden ASTR alım-satımı yapın

- Staking: Doğrulayıcı olarak katılım sağlayıp ek ödüller elde edin

- DeFi entegrasyonu: Astar ekosistemi içinde merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları yüksek risk içerir; bu makale yatırım tavsiyesi sunmaz. Yatırım kararlarınızı kendi risk iştahınıza göre verin ve gerekirse profesyonel finansal danışmanlara başvurun. Kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

Sıkça Sorulan Sorular

Astar’ın en yüksek tarihi fiyatı nedir?

Astar'ın en yüksek fiyatı, 10 Nisan 2022’de ulaşılan 0,3353 $’dır.

2040 için Astar fiyat tahmini nedir?

Tahmini %5 yıllık büyüme ile, 2040’ta Astar (ASTR) fiyatının 0,05643 $ olması beklenmektedir.

2025 için en yüksek fiyat tahmini hangi kripto paraya ait?

2025 yılında en yüksek fiyat tahmini Bitcoin (BTC) için yapılmaktadır; hemen ardından Ethereum (ETH) gelmektedir. Bu tahminler güncel piyasa eğilimleri ve uzman analizlerine dayanmaktadır.

Astra Labs için fiyat tahmini nedir?

Astra Labs fiyatında kısa vadede yükseliş beklenmektedir. Şu anki fiyat 245,20 $ olup, analistlere göre olumlu piyasaya işaret eden sinyaller sebebiyle potansiyel bir alım fırsatı söz konusudur.

Sei Network 2025 Gelişim Durumu ve Yatırım Fırsatı Analizi

2025'te SEI Ekosisteminin Gelişim Durumu ve Yatırım Fırsatlarının Analizi

Altseason 2025: Web3 Altcoin Patırtısı ve DeFi Fırsatları

Bulla Token 2025 Yatırım Rehberi: Fiyat, Satın Alma ve Web3 Ekosistemindeki Rol Analizi

2025'te Alınacak En İyi Kuruş Kripto: Büyük Potansiyele Sahip Düşük Maliyetli Coinler

2025 WCT Fiyat Tahmini: World Computer Token için Piyasa Analizi ve Gelecek Perspektifi

RENDER nedir: Kripto Para Dünyasının Dağıtık GPU Hesaplama Ağına Kapsamlı Bir Rehber

USDD Nedir: Tron’un Merkeziyetsiz Stablecoin’ine Kapsamlı Rehber

SEI nedir: Sürdürülebilir Kalkınma Çerçevesi ve Küresel Etkisi Üzerine Kapsamlı Bir Rehber

NEXO Nedir: Lider Kripto Para Kredi Platformuna Kapsamlı Bir Rehber

FIL nedir: Filecoin ve Merkeziyetsiz Depolama Alanındaki Rolüne Kapsamlı Bir Rehber