2025 AKT Fiyat Tahmini: Olgunlaşan Web3 Ekosisteminde Akash Network Token’ının Gelecekteki Gelişim Yollarının Değerlendirilmesi

Giriş: AKT'nin Piyasa Konumu ve Yatırım Değeri

Akash Network (AKT), merkeziyetsiz bulut bilişim pazarında piyasaya çıktığı günden bu yana önemli bir ilerleme gösterdi. 2025 yılı itibarıyla Akash Network’ün piyasa değeri 289.003.879 dolar seviyesine ulaşırken, dolaşımdaki arz yaklaşık 278.236.140 token ve fiyatı da 1,0387 dolar civarında seyrediyor. “DeFi için DeCloud” olarak anılan bu varlık, merkeziyetsiz bulut bilişim sektöründe kritik bir oyuncu haline gelmekte.

Bu makalede, Akash Network’ün 2025-2030 yılları arasındaki fiyat eğilimleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler çerçevesinde ele alınacak; yatırımcılar için profesyonel fiyat tahminleri ve uygulamaya yönelik yatırım stratejileri sunulacaktır.

I. AKT Fiyat Geçmişi ve Güncel Piyasa Durumu

AKT Fiyat Gelişim Seyri

- 2021: Tüm zamanların zirvesi, fiyat 7 Nisan’da 8,07 dolar ile rekor kırdı

- 2022: Piyasa gerilemesi, 22 Kasım’da 0,164994 dolar ile taban yaptı

- 2025: Kademeli toparlanma, fiyat 1,0387 dolar seviyesinde

AKT Güncel Piyasa Durumu

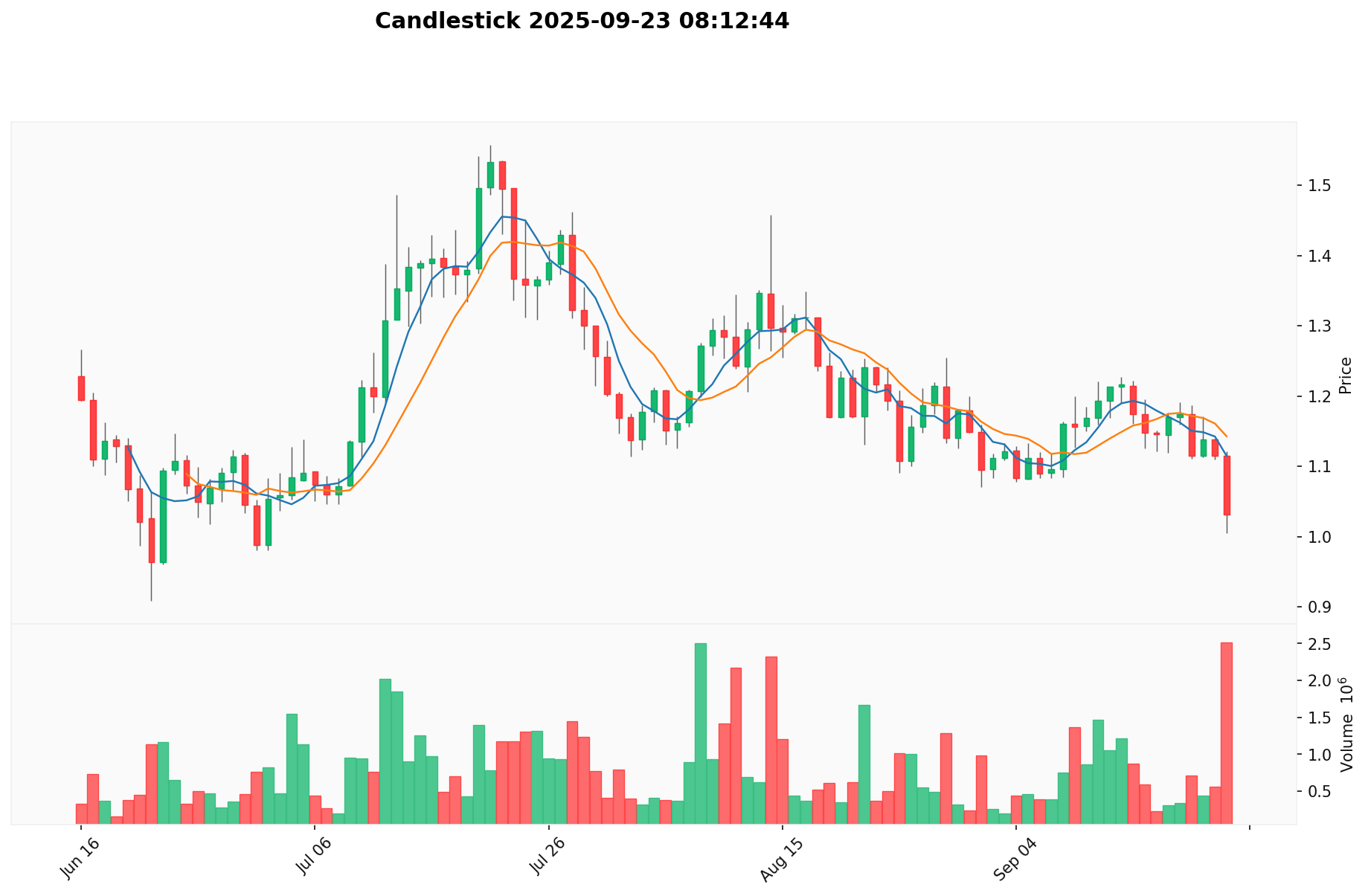

23 Eylül 2025 itibarıyla, AKT 1,0387 dolardan işlem görüyor. 24 saatlik işlem hacmi 1.946.122,58 dolar, piyasa değeri ise 289.003.879,35 dolar seviyesinde. AKT son 24 saatte %0,77’lik hafif bir gerileme yaşadı. Bu fiyat, bir yıl öncesine göre %63,24’lük ciddi bir düşüşü ifade ediyor. Kısa vadede AKT, bir saatlik periyotta %0,13, son bir haftada %9,11, son bir ayda ise %13,17 oranında düşüşte. Dolaşımdaki AKT miktarı 278.236.140,71 token olup, bu da maksimum 388.539.008 AKT arzının %71,61’ine denk geliyor.

Güncel AKT piyasa fiyatını incelemek için tıklayın

AKT Piyasa Duyarlılık Göstergesi

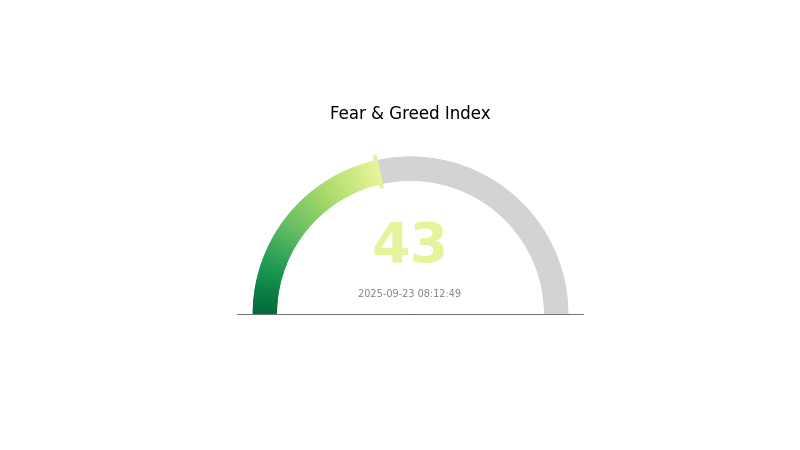

23 Eylül 2025 Korku ve Açgözlülük Endeksi: 43 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında şu an korku hakim; Korku ve Açgözlülük Endeksi 43 seviyesinde. Bu, yatırımcıların temkinli davrandığı bir ortamı gösteriyor ve hesaplı risk almak isteyenler için potansiyel alım fırsatları sunabiliyor. Ancak piyasa duyarlılığı hızla değişebilir. Yatırımcıların gelişmeleri yakından izlemesi, kapsamlı analiz yapması ve bu kararsız ortamda riskleri azaltmak için portföylerinde çeşitlendirmeyi önceliklendirmesi gerekir. Her zaman sadece kaybetmeyi göze alabileceğiniz meblağlarla yatırım yapmanız önerilir.

AKT Varlık Dağılımı

AKT’nin adres bazlı varlık dağılımı verileri, token sahipliğinin yapısında önemli bir dağılım olduğunu gösteriyor. Bu çeşitlilik, merkeziyetsizlik ve potansiyel piyasa dinamikleri hakkında fikir verir.

AKT özelinde belirgin veri eksikliği, sahipliğin yaygın bir tabana yayıldığını gösteriyor. Önde gelen adresler arasında yoğunlaşma olmaması, ekosistemin daha dağıtık olduğu anlamına geliyor. Bu yapı, büyük yatırımcıların piyasa manipülasyonu riskini azaltarak fiyatlarda daha istikrarlı ve sağlıklı hareketler sağlayabilir.

Böylesi dağınık bir sahiplik, daha geniş bir benimseme kitlesi veya merkeziyetsiz yönetişim yapısı anlamına gelebilir. Böylece fiyat hareketleri, birkaç büyük cüzdandan ziyade daha geniş bir katılımcı kitlesi tarafından belirlenir.

Güncel AKT Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|

II. AKT’nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Enflasyonist Model: AKT, doğrulayıcılar ve delegatörler için yeni tokenların üretildiği enflasyonist bir modele sahip.

- Tarihsel Trend: Arzdaki kademeli artış, tarihsel olarak fiyat üzerinde aşağı yönlü baskı oluşturdu.

- Güncel Etki: Süregelen enflasyonun, AKT fiyatı üzerinde hafif satış baskısı oluşturmaya devam etmesi bekleniyor.

Teknolojik Gelişme ve Ekosistem Oluşumu

- Ağ Güncellemeleri: Akash Network, ölçeklenebilirlik ve işlevsellik için güncellemeler yapmaya devam ediyor.

- Ekosistem Uygulamaları: Platform, bulut altyapısını kullanan çeşitli merkeziyetsiz uygulama ve hizmetlere ev sahipliği yapıyor.

III. 2025-2030 Arası AKT Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,6964 - 0,9000 dolar

- Nötr tahmin: 0,9000 - 1,0394 dolar

- İyimser tahmin: 1,0394 - 1,14334 dolar (elverişli piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Artan volatiliteyle birlikte olası büyüme evresi

- Fiyat aralığı tahmini:

- 2027: 0,74388 - 1,46451 dolar

- 2028: 0,81431 - 1,35281 dolar

- Başlıca katalizörler: Teknolojik ilerlemeler ve Akash Network’ün yaygınlaşması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,23526 - 1,50641 dolar (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 1,50641 - 2,03366 dolar (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 2,03366 dolar üzeri (son derece olumlu koşullarda)

- 31 Aralık 2030: AKT 2,03366 dolar (yıl içindeki muhtemel en yüksek fiyat)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 1,14334 | 1,0394 | 0,6964 | 0 |

| 2026 | 1,23325 | 1,09137 | 0,56751 | 5 |

| 2027 | 1,46451 | 1,16231 | 0,74388 | 11 |

| 2028 | 1,35281 | 1,31341 | 0,81431 | 26 |

| 2029 | 1,67972 | 1,33311 | 0,99983 | 28 |

| 2030 | 2,03366 | 1,50641 | 1,23526 | 45 |

IV. AKT İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

AKT Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Merkeziyetsiz bulut bilişime inanan uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde AKT biriktirin

- Akash Network’teki gelişmeleri ve adaptasyonu yakından takip edin

- AKT’leri özel anahtar kontrolünde güvenli bir cüzdanda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri izleyin

- RSI: Aşırı alım veya aşırı satım sinyallerini tespit edin

- Dalgalı işlem için başlıca noktalar:

- Teknik göstergelere göre net giriş-çıkış seviyeleri belirleyin

- Piyasa duyarlılığını ve Akash Network haber akışını izleyin

AKT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Orta düzey yatırımcı: Kripto portföyünün %3-7’si

- Agresif yatırımcı: Kripto portföyünün %7-10’u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto varlıkları ve geleneksel yatırımlar arasında dağıtım

- Zarar durdur emirleri: Belirlenmiş seviyelerde çıkış yaparak potansiyel kayıpları sınırlandırın

(3) Güvenli Saklama Çözümleri

- Yazılım cüzdanı önerisi: Gate Web3 Cüzdan

- Donanım cüzdanı: Yüklü tutarları soğuk depolamada saklayın

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve düzenli yazılım güncellemeleri

V. AKT’nin Potansiyel Riskleri ve Zorlukları

AKT Piyasa Riskleri

- Volatilite: Kripto para piyasaları aşırı dalgalanma gösterebilir

- Rekabet: Merkeziyetsiz bulut bilişimde artan rekabet

- Benimseme hızı: Yavaş benimsenme AKT’nin değerini olumsuz etkileyebilir

AKT Regülasyon Riskleri

- Mevzuat belirsizliği: Kripto para mevzuatındaki değişiklikler AKT’nin operasyonunu etkileyebilir

- Uyum zorlukları: Farklı ülkelerdeki düzenleyici gerekliliklere uyumda zorluklar

- Vergisel etkiler: Değişen vergi düzenlemeleri AKT sahiplerini etkileyebilir

AKT Teknik Riskleri

- Akıllı sözleşme açıkları: Temel akıllı kontratlarda güvenlik zafiyeti riski

- Ağ ölçeklenebilirliği: Akash Network’ün talepleri karşılamada zorlanması

- Birlikte çalışabilirlik: Diğer blockchainlerle entegrasyon güçlüğü

VI. Sonuç ve Eylem Önerileri

AKT Yatırım Değeri Değerlendirmesi

AKT, merkeziyetsiz bulut bilişimde uzun vadeli büyüme potansiyeline sahip benzersiz bir varlık sunmaktadır. Ancak, yatırımcıların hem kısa vadeli volatiliteyi hem de teknolojinin yeni oluşumunu göz önünde bulundurması gerekir.

AKT Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, önce teknolojiyi öğrenin

✅ Deneyimli yatırımcılar: Dengeli portföy oluşturun, düzenli yeniden dengelemeler yapın

✅ Kurumsal yatırımcılar: Kapsamlı inceleme ile AKT’yi çeşitlendirilmiş portföye dahil edin

AKT İşlem Yöntemleri

- Spot işlem: Gate.com’da AKT alın/satın

- Staking: Ağ güvenliğine katkı sağlamak ve ödül kazanmak için AKT staking’ine katılın

- DeFi entegrasyonu: AKT tabanlı DeFi fırsatlarını değerlendirin

Kripto para yatırımları yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar risk toleranslarını dikkate alarak hareket etmeli ve profesyonel finans danışmanlarına başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

2030’da AKT için fiyat tahmini nedir?

Piyasa trendleri ve büyüme potansiyeline bağlı olarak, AKT 2030’da, merkeziyetsiz bulut bilişimde artan benimseme ve teknolojik gelişmeler sayesinde 50-75 dolar aralığına ulaşabilir.

Akash en fazla ne kadar yükselebilir?

Akash, merkeziyetsiz bulut bilişim benimsenmesindeki artış ve genel kripto piyasası büyümesiyle 2026’da 10-15 dolar seviyelerini görebilir.

2025 için Akash’ın fiyat tahmini nedir?

Piyasa analizleri ve büyüme trendlerine göre, Akash (AKT) 2025’te yaklaşık 5 ila 7 dolar civarında bir değere ulaşarak uzun vadeli yatırımcılar için güçlü bir potansiyel sunabilir.

Act 1 AI için fiyat tahmini nedir?

Act 1 AI’nın fiyatının 2025 sonunda 0,15 dolara çıkması, 2026’da ise benimsenme ve talebin artışıyla daha fazla yükselmesi bekleniyor.

2025 OMNIA Fiyat Tahmini: Güçlü Bir Yükseliş mi, Yoksa Piyasada Bir Düzeltme mi Bekleniyor?

2025 FLUX Fiyat Tahmini: Merkeziyetsiz Bulut Platformu Yeni Zirvelere Ulaşabilir mi?

2025 MOBILE Fiyat Tahmini: Akıllı Telefon Sektöründe Gelecek Trendler ve Piyasa Dinamiklerinin Analizi

2025 FIL Fiyat Tahmini: Filecoin’in Piyasa Trendleri, Ağ Benimsenme Süreci ve Potansiyel Büyüme Faktörlerine Yönelik Profesyonel Analiz

Yatırım Yapmak için En Çok Hangi Sebep Sizinle Yankı Buluyor ve Neden?

Metin Argo'da TP Nedir? Kullanımına Dair Tam Kılavuz

Ponzi Şeması Nedir? Ponzi Dolandırıcılıkları Nasıl Çalışır ve Nasıl Tanınır?

DRK: Tartışmalı Kripto Parayı ve Pazar Üzerindeki Etkisini Anlamak

Infrared Finance LSD: IR Token'un DeFi getiri çiftçiliği ve likit staking süreçlerinde işleyişi

Solana’da Ondo Finance ETF’leri ile Tokenize ABD Hisselerine Yatırım Yapma Rehberi

Theoriq (THQ): Web3’e Yönelik Yapay Zeka Tabanlı DeFi Altyapısı