- Trending TopicsView More

52K Popularity

89.2K Popularity

8.9K Popularity

165K Popularity

322 Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

BlackRock dumped almost $250 million of this crypto in a week

As the cryptocurrency market corrected this week, BlackRock, the world’s largest asset manager, also recorded significant outflows from its top exchange-traded funds

Specifically, the fund manager unloaded $250million worth of Ethereum in just five trading days.

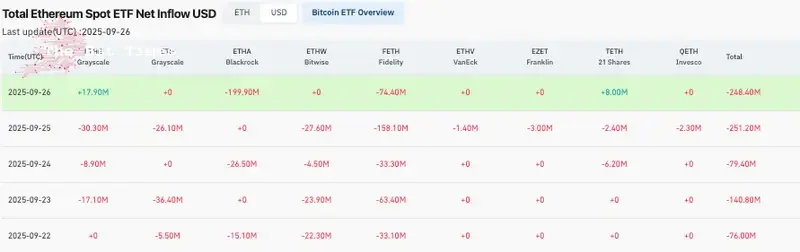

Data on spot Ethereum ETF flows by Coinglass shows that BlackRock’s ETHA ETF experienced heavy outflows during the week ending September 26, 2025

Coinglass Ethereum net ETF inflows. Source: Coinglass**Ethereum net ETF inflows. Source: CoinglassThe heaviest selling occurred on September 26, when the fund shed almost $200 million in a single day, the sharpest daily redemption of the period

Ethereum net ETF inflows. Source: Coinglass**Ethereum net ETF inflows. Source: CoinglassThe heaviest selling occurred on September 26, when the fund shed almost $200 million in a single day, the sharpest daily redemption of the period

Additional withdrawals on September 24 and September 22, worth $26.5 million and $15.1 million respectively, brought BlackRock’s total to $241.5 million in net sales for the week.

Ethereum ETFs massive outflows

Overall, the broader Ethereum ETF market also saw substantial withdrawals. Fidelity’s FETH product was hit especially hard, losing $158.1 million on September 25 and another $74.4 million the next day

Grayscale’s ETHE had a more mixed week, posting an inflow of $17.9 million on September 26 but facing steep losses earlier, including $30.3 million on September 25 and $17.1 million on September 23

Bitwise’s ETHW ETF added pressure with redemptions of $27.6 million on September 25 and $22.3 million on September 22, while VanEck, Franklin, 21Shares, and Invesco all posted smaller but steady outflows over the same stretch.

Altogether, Ethereum ETFs shed more than $766 million in just five days, pointing to the fragile state of institutional sentiment toward the asset

ETH price analysis

The timing of these withdrawals coincides with Ethereum’s struggle to hold key technical levels and the growing dominance of Bitcoin ETFs, which continue to attract the bulk of investor inflows.

By press time, Ethereum was trading at $4,023, up about 0.2% in the last 24 hours but down over 10% on the weekly chart.

If indecision persists, the asset is likely to hold the $4,000 support. However, prolonged bearish pressure could see Ethereum lose this crucial anchor point.

Featured image via Shutterstock

Featured image via ShutterstockFeatured image via Shutterstock