Texas Takes First Step Toward State-Level Bitcoin Allocation

Texas Reportedly Makes Its First Bitcoin Reserve Allocation

Texas is emerging as a frontrunner in state-level Bitcoin adoption in the United States. According to the Texas Blockchain Council, the state government has reportedly made its initial Bitcoin-related investment of about $5 million by purchasing BlackRock’s IBIT Bitcoin ETF. While official documentation has yet to be released, this transaction is already considered a key milestone. It signals Texas’s initiative to establish a state-level Bitcoin reserve.

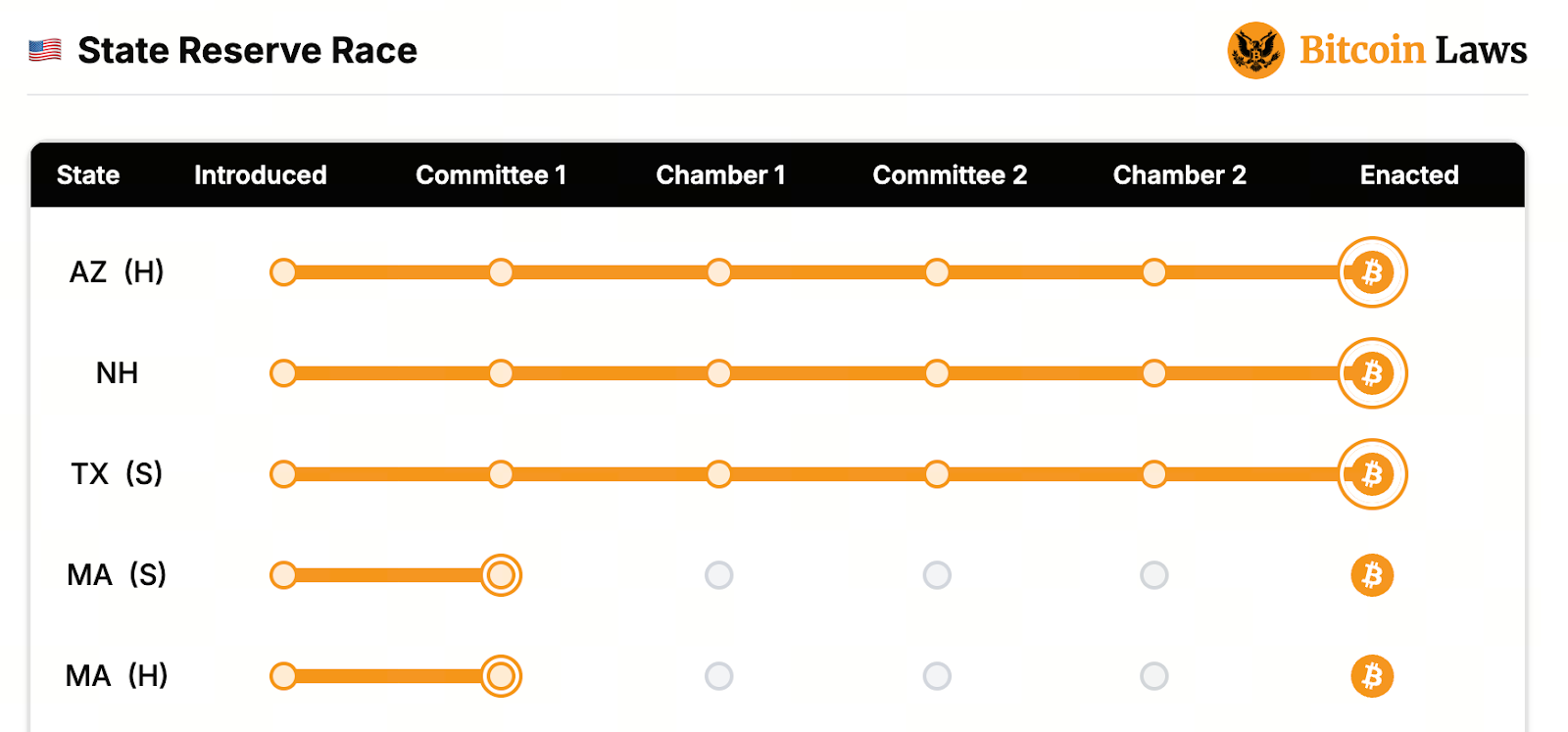

(Source: Bitcoin Laws)

SB 21 Bill: Formal Launch of Texas’s State Bitcoin Reserve Mechanism

This allocation is believed to have been executed under SB 21, a bill signed into law by Governor Greg Abbott in June. The core provisions of SB 21 are:

- Establishing a Bitcoin reserve managed by the Texas Treasury Safekeeping Trust Company

- Allowing the state government to treat Bitcoin as a long-term asset in its portfolio

- Creating an institutional framework for Texas in the digital asset sector

This represents a shift in perspective: Bitcoin is no longer regarded only as a speculative asset. It is now recognized as a legitimate category for long-term investment consideration.

Rationale for Including Bitcoin

State Senator Charles Schwertner, who introduced the bill, stated that the government should have the option to assess top-performing assets over the past decade. His rationale centers on:

- Bitcoin’s strong track record of long-term returns

- Despite short-term volatility, Bitcoin’s underlying characteristics make it suitable for long-term portfolio allocation

- It enables the state’s asset portfolio to diversify with additional assets

Texas recognizes Bitcoin as a financial asset and has formally included it in its investment strategy.

To learn more about Web3 and related developments, register at: https://www.gate.com/

Summary

If this purchase receives official confirmation, Texas will become the first U.S. state to add Bitcoin to its state balance sheet. This milestone would represent a major policy breakthrough. It could prompt other states to follow, potentially prompting increased government-level Bitcoin adoption. Texas’s initiative could initiate a new phase in digital asset allocation for U.S. state governments.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution