Into the Bittensor Ecosystem

Crypto has always been exciting for me. There’s always new things somewhere that I can learn from. I’m naturally a curious person, I like to ask a lot of dumb questions especially to technical persons to just get a glimpse into their insights & learn from their valuable experiences.

AI is no exception, in fact things are moving at break neck speed with Web2 tech giants constantly improving their models, major applications capitalizing on AI, releasing AI-driven use cases

- @canva launched AI tools to allow non-technical artists & creators to easily build interactive experiences & augment their creations with AI

- @YouTube introduced a new AI tool that allows creators to generate background music for videos

- Ride-hailing players like Grab deploying agentic AI to support merchants & driver partners

- E-commerce players like Lazada helping to introduce GenAI tools to help sellers with sales, marketing, and customer service

And the list goes on and on. Practical real-world use cases that utilize generative AI & agentic AI to improve workflows have continued to gain adoption from enterprises & retail users alike.

Good thing about these tech is that they’re easily accessible—you can find free or low cost solutions everywhere. The benefits highly outweigh the financial costs.

But what people often overlook are the hidden tradeoffs when using these AI products, such as:

- Who owns your data?

- Can someone else take your idea and create a competing product?

- Is the platform secure? Could your data get leaked?

- If the platform goes down (like AWS did), could that halt your business? Could customer funds be at risk?

- Can you always access your platform? Are you required to verify your ID? If the platform shuts down, do you still own your product or business?

Many more questions (I’ve talked about this more extensively in my previous article if you haven’t read it yet).

Centralized players have the centralized power to make decisions that can (inadvertently) drastically impact your life.

You could argue that it doesn’t matter—maybe you won’t use these tools much, or you trust these companies to act in the users’ best interest. That’s fine. You might even want to invest in these AI startups since they’re tapping into massive addressable markets. But the thing is—you can’t. Unless you’re at @ycombinator or a top VC firm, you don’t get access to these deals.

On the other hand, in Web3 AI, there are many investable AI ecosystems with teams that are working to bring decentralized AI products & services to the users. One of the top investable DeAI ecosystems is @opentensor (Bittensor)

Bittensor: Darwinian AI

Bittensor falls under the category of “Darwinian AI”—the evolution of AI through natural selection. Think of this as Hunger Games but for AI where each subnet has their own hunger game with “miners” as the tribute (or participants). They compete against each other with their own models & their own data on a performance in a specific task. Only the fittest models (the ones that perform best) are rewarded. Weaker models are replaced or evolve (via training, tweaking, or learning from others). Over time, this leads to a more robust, diverse, and high-performing AI ecosystem.

What’s exciting about Bittensor in particular is the competition & incentive mechanism that’s design to align incentives between different stakeholders. I’ve outlined the challenges that Web3 AI agent teams are facing in the tweet below…

tl;dr the current agent tokens are good for speculators & good for teams to utilize as a tool to build hype but it’s bad for using the tokens to acquire & retain users, and also bad because it can’t be use as incentives to retain talents (devs, founders, etc) especially when price goes down

Bittensor addresses this by using market-driven mechanism that allocates $TAO emissions to the subnets, thereby incentivizing & supporting teams runway. Market determine which subnets receive more emissions by staking $TAO within those subnets. Once staked, the $TAO convert into Alpha subnet tokens. The more people stake, the more alpha token price go up, the more emissions you’ll receive (in the form of alpha tokens)

$TAO follows very similar emission schedule to $BTC with fixed 21 million tokens supply & halving cycle every 4 years (everyday 7,200 $TAO is emitted to subnets). The first $TAO halving is projected to occur around Jan 5, 2026 with circulating supply reaching 10.5 million tokens.

Why This Matters for Investors

Not going too deep into the tech here—just want to share why I think Bittensor is one of the most exciting ecosystems from a trading/investing perspective

Beyond the dynamic shared above, when you’re trading alpha subnet tokens, it feels like you’re both trading & farming at the same time.

This is because every time there’s a price appreciation for alpha tokens, you experience the price appreciation, and at the same time, you experience $TAO emissions (in the form of alpha tokens).

If the subnet performs really well and climb up the rank, your initial $TAO stack will experience drastic price appreciation & large boost in emissions. The earlier you are to staking your $TAO in subnets, the higher your APY becomes (because the market hasn’t caught on yet so there’s less amount of people / $TAO staked within subnets)

dTAO vs Solidly

(h/t @DeSpreadTeam)

Solidly ve(3,3) requires long-term lock & continual participation. Loss from unreasonable emissions (voting for wrong LP pools) are born by all holders (emissions get dumped, price of all token holders go down).

dTAO doesn’t require long-term lock so anyone can get in and get out any time but getting in (staking on a subnet) requires lots of due diligence / DYOR. Investing in a wrong subnet could lead to large loss (since people can just get out pretty easily, there’s no lock up or anything)

But Jeff, FDV is so high! How can we invest in subnets with >$500m+ FDV?

FDV may not the right metric to look at here since the subnets are still in their early innings so MC might be a better fit here (if you’re trading over short to medium term).

If you’re concerned about inflation, it’s worth understanding the 18%/41%/41% — these are the emission distributed to subnet owners, validators, miners respectively (in the form of alpha tokens). As stakers / alpha token owners, you’re earning from the 41% from validators part since you’re delegating your $TAO to them when you stake.

Many subnet owners continue to hold their alpha tokens received from emissions to show confidence, many have active dialogue with validators & miners to get them bullish and not dump large amount of their tokens (these are available for you to explore on taostats btw)

Zooming out, one of the best charts that’s great at showing the trends within Bittensor ecosystem is the the charts below

Source: taoapp

% TAO in Roots (OG subnet that manages Bittensor incentives system) continue to go down since February which is the month that dTAO goes live WHILE % TAO in Subnets continue to go up. This means that stakers / investors are getting more risk on (staking on Root network will yield conservative APY of something like 20-25% and there’s no price appreciation of alpha subnet token on Root).

This trend align with the pace at which subnets teams are shipping their product. Ever since the dTAO launch, teams need to build publicly, build products that users would want, iterate & find PMF fast, get users & generate real-world utility with tangible revenue quickly. Ever since I got into the ecosystem, I could feel that the pace at which teams are shipping are a lot faster than other ecosystem (due to the competition & the incentives distribution)

This brings us to the subnets and their unique investable DeAI use cases

Leading Subnets & Use Cases

The team that’s considered #1 at shipping products with PMF, catered to everyday people, teams that execute professionally & continuously show that they build in public is@rayon_labs""> @rayon_labs — SN64 (Chutes), SN56 (Gradients), SN19 (Nineteen)

Chutes — offers infrastructure to easily deploy your AI in a serverless manner. Best case study to why we need this is the recent AWS outage, if you’re relying on centralized providers, with outage your AI apps can go down (leading to potential loss of funds / exploits) due to single point of failure.

Gradients — Anyone (w/o coding knowledge) can train their own AI models (for specialized use cases, image gen, custom LLMs) on Gradients. Recently launched v3 which is cheaper than peers

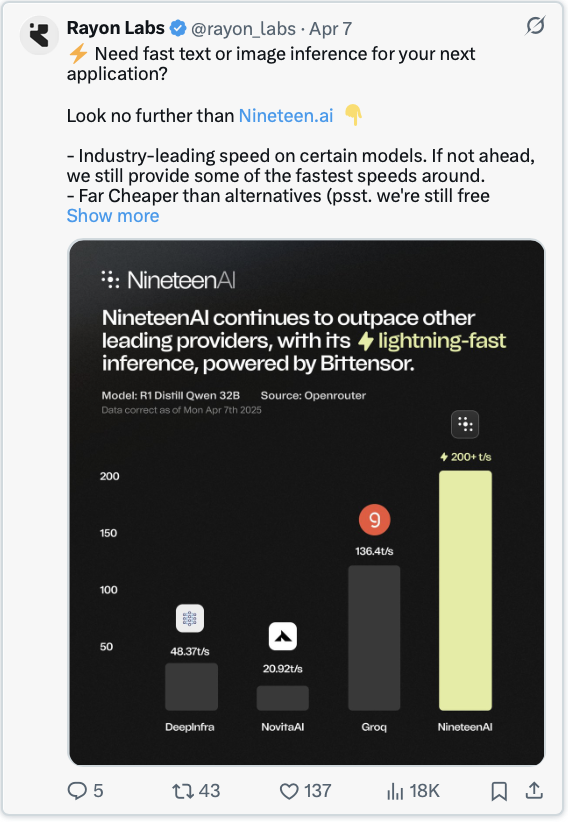

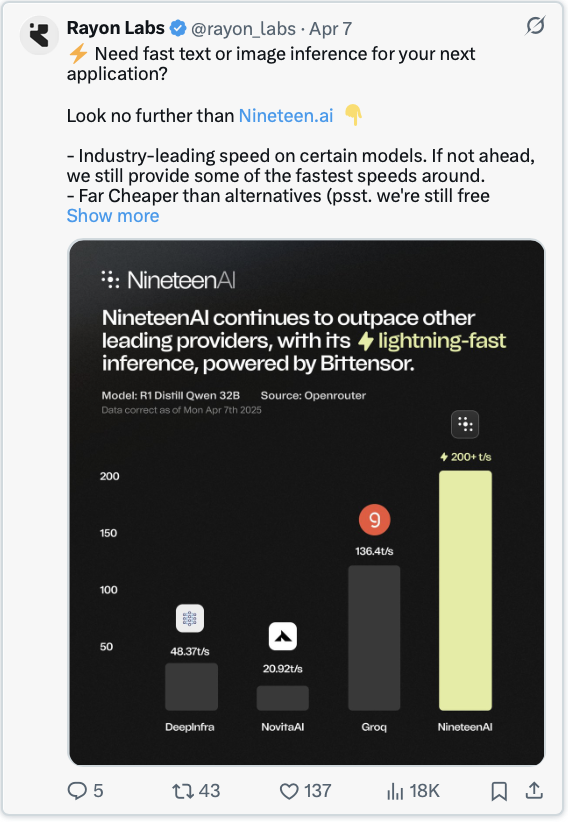

Nineteen — provides a platform for fast, scalable, and decentralized AI inference (anyone can use this for text & image generation use cases as this is a lot faster than peers)

On top of this, Rayon is rolling out Squad AI agent platform which is an easy-to-use drag-and-drop node-style AI agent builder platform which has garnered interests in the community

All 3 subnets combined own >1/3rd of the entire emissions of $TAO—This is a testament to team’s ability to publicly build & deliver good products that people would want (Rayon is hailed as the number one team by many subnet owners lol)

Gradients did 13x in a month (currently $32m MC)

Chutes 2.3x ($63m MC)

Nineteen 3x ($18m MC)

The trend doesn’t seem to stop any time soon especially with the rate of adoption with Chutes (currently the #1 subnet)

Besides Rayon Labs subnets there are many interesting teams—protein folding, deepfake / AI content detection, 3D models, trading strategies, role-play LLM. I’ve not gone deep into the rabbit hole to look at everything yet, the ones that I think are the most relatable are subnets under “Predictive Systems” (taopill) primarily with

SN41 @sportstensor

Many of you might know them from @AskBillyBets, Sportstensor is an intelligence that help powers Billy’s decisions (the main team that leads Billy is @ContangoDigital which is a VC investing in DeAI as well as validator/miner for Bittensor subnets)

What’s interesting about SN41 is their product — Sportstensor Model. It’s a competition between miners that has the best models + datasets for predicting the outcomes of sport matches.

Example: In the latest NBA league, if you’re betting with the crowd (betting in crowd favorites), you’ll experience about 68% accuracy / win rate. Does this mean everyone betting on crowd favorites make a lot of money? Nope, in fact they lose money. If you’re betting $100 across every crowd favorites, in the end you ended up with negative ROI, losing about $1.7k.

While crowd favorites tend to have better win rate, they come with better odds which means you win less money if you’re right. People often pile onto their favorites leading to underdogs having pretty low odds of winning which means there’s a lot of money to be captured if you’re betting on the right underdogs.

This is where Sportstensor model come in. Miners run their own machine learning models (Monte Carlo, Random Forest, Linear Regression, etc) with their own data (free or proprietary) to get the best results. Sportstensor then take the average / median of this and use that as an intelligence to identify edge within the market.

An actual odds in the market is 25:75. The model might show that there’s 45:55 odds. This 15 gap is the edge. If models find many of this kind of edge, you don’t have to hit large win rate to start accruing positive ROI over the long run.

Check their full trading report here (if you wanna dig deeper):

This is the result of their model shared in their latest report. Pretty impressive numbers. The team has also been running a betting fund every month starting off with $10k as buffer, using the profits to continue betting with their intelligence. At the end of the month, they’ll use the profit to buyback their alpha token. Team made around $18k profit in March

Depending on how you’re using the intelligence, you can get widely different results as well e.g. intelligence yields 35:65 and actual odds in the market could be 40:60. A person might bet on this, you might not because the gap is small and there’s not enough edge. What Billy does with the intelligence differs to what Sportstensor does with their intelligence. (No one knows what’s the best way to consistently get positive ROI yet at this point cuz it’s very early)

Sportstensor plan to further monetize their intelligence by creating a dashboard where users can easily comprehend the insights and make betting decisions based on them.

I personally like this team because there are lots of ways to go with their product. We’ve already seen the impact of this based on how Billy was able to garner mindshare and get sports crowd excited betting alongside Billy. Since the team covers many sports, there can be a lot of ways in which agents can change the ways in which people vibe, interact, and bet.

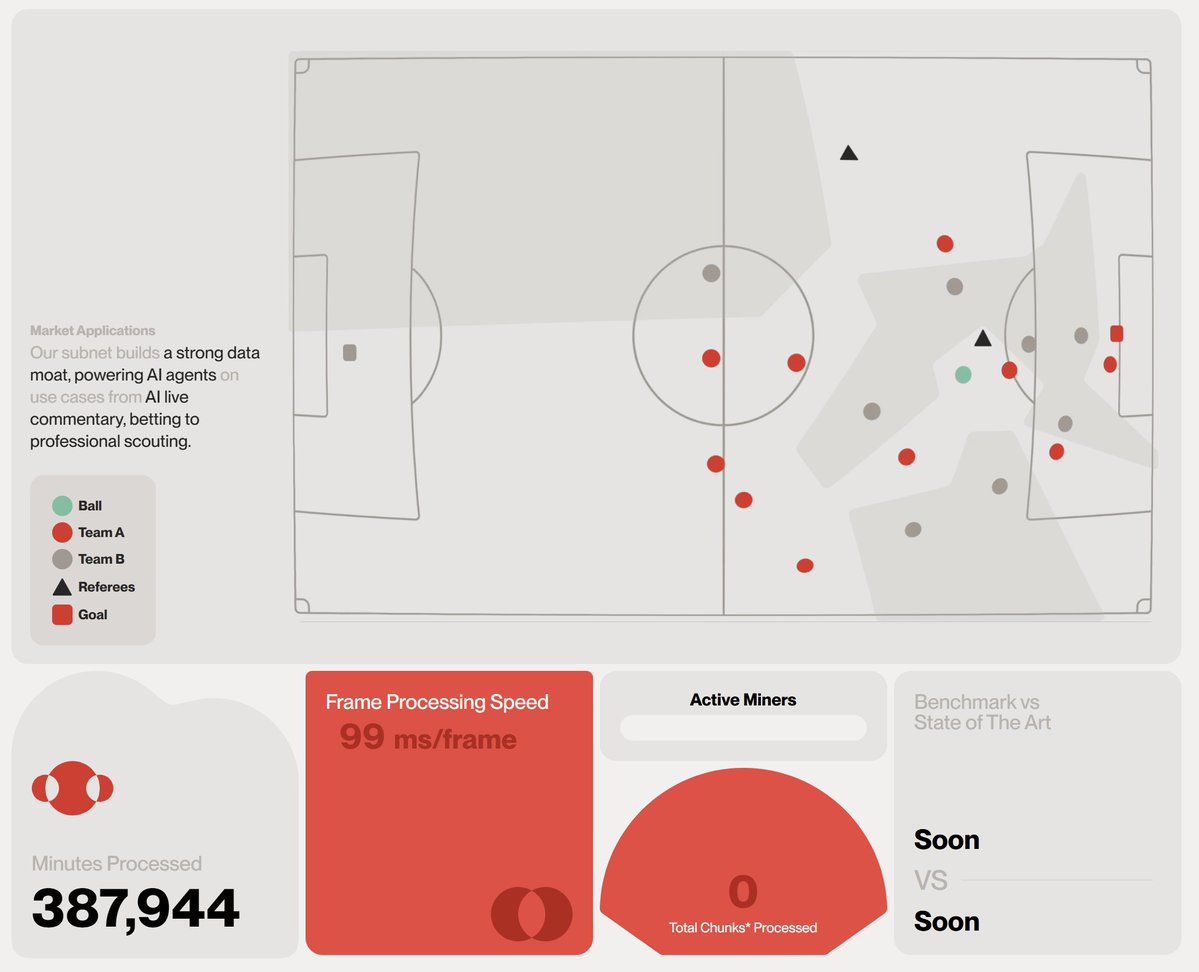

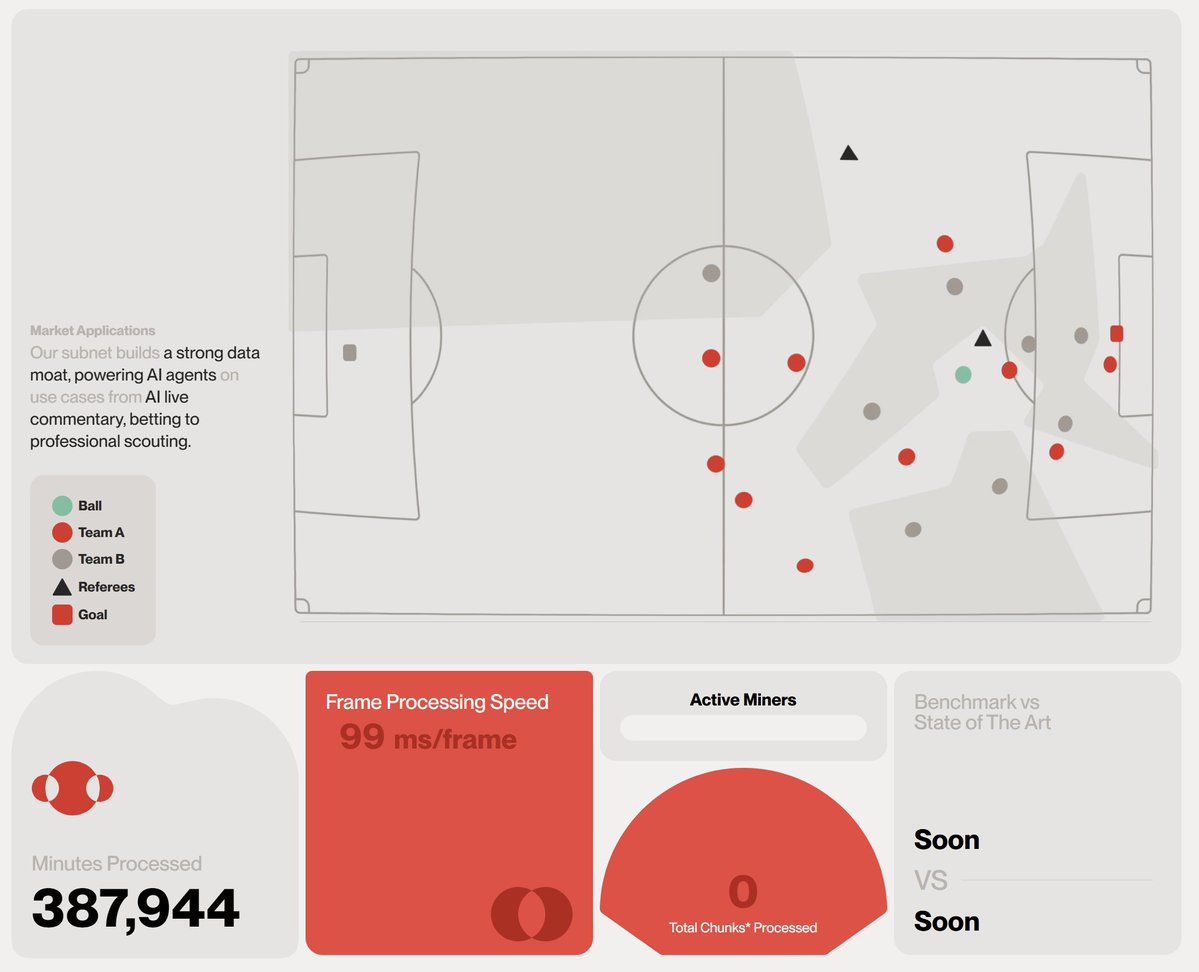

SN44 @webuildscore

Score used to build something similar to Sportstensor but pivoted to Computer Vision after realizing that there’s a lot more value that comes with the ability to predict what’s coming next.

In order to understand this you need computer vision to analyze what’s happening on the screen, for the AI to understand the objects on the screen, locate them and annotate the data, then draw conclusions on the data w/ different algo (conclusions like probability of a player making a certain move), and turning all of this into a universal score that can be used to improve players performance (as well as scout for talents early)

Miners compete to annotate the objects (this is the first main objective for miners). Score utilizes their in-house algo to draw conclusions (for now).

When you score player (akin to setting an Elo on chess or in LoL but more granular & dynamic.. dynamically changes in every game based on player decisions & their impact), you can do many things as club owners, you can find talents at a very young age. If you have footage from a kids game, it’ll be same approach to a professional game. It’s quantifying the entire football world w/ the same approach.

From the proprietary data, Score can monetize the score & the insights to data brokers, club owners, sports data companies, and betting companies.

For consumer applications, Score is doing different things

@thedkingdao, a sports hedge fund DAO, a customer of Score with betting models that ingest Score data & turn them to actionable betting execution. v2 terminal with launch tomorrow (users will get access to full model with different subscription models from match analysis, ask advanced qestions on bankroll management, i.e. the best betting companion, use agent to get your own strategy together). Vault product where users can put in TVL and the agent will auto-bet offering yields from betting will likely come next month (or before summer).

Soon people would be able to upload videos on a Score’s self-service platform for the videos to be annotated by the miners. Usually soccer games footage tend to take hours, the miners take 10-12 mins to annotate 90 mins game which is significantly faster than anywhere else. Users can then take the annotated data and use it on their models for their own use cases.

Personally like Score because this can be applied to everything else outside of sports e.g. self-driving cars, robotics, etc. In the world where garbage data is everywhere, high quality proprietary data is highly sought after.

SN18 @zeussubnet

This is a new subnet that recently gained a lot of traction. I’ve had not had a chance to talk with the team yet but the product is pretty interesting.

Zeus is a ML-based climate / weather forecasting subnet that’s designed to outperform traditional models by giving faster & accurate predictions.

This kind of intelligence is highly sought after by hedge funds since accurately predicting weather can lead to better forecast of commodity prices (Hedgefund would pay millions to access the intelligence since they can make hundreds of millions if they nail the commodity trades)

Zeus subnet is fairly new since they recently acquired subnet 18. The alpha token recently rose by 210% over the last 7d

Other Subnets that I’m interested in but have yet to dive deeper

- @404gen_ SN17 — infrastructure for AI-generated 3D assets. Create 3D models for games, AI characters, vtuber, etc. Recent integration w/ @unity could enables seamless 3D model generation, changing creative workflow for Unity’s 1.2M MAU

- @metanova_labs SN68 — DeSci drug discovery subnet which transforms drug discovery into a collaborative, high-speed competition, addressing traditional challenges like cost and time (traditional process take over a decade & could cost billions)

And many more which I’ll share more later once I get a chance to dig deeper. I’m starting with the ones that’s easiest for me to understand (since I’m not a technical person)

Wrapping Things Up

Tried my best to not go full technical here. There are bunch of good resources on technical explanation of the whole dTAO, emissions, incentive distribution, all the stakeholders, yadayadaya.

Based on what I learn during the agent szn (Oct 24 – Now) is to stay quite nimble. I’ve been a bag holder for too many projects and I think dTAO offers quite a good mechanics to stay nimble and rotate out of different investable DeAI startups.

There still aren’t many participants right now so users can experience 80%–150%+ APY on top of the price appreciation from the subnets. This dynamic will likely change over the next 6 months when more people hop on board and TAO eco has better bridges, wallets, trading infrastructure.

For now, I suggest you to enjoy the PvE season on TAO and learn more about cool DeAI tech with me :D

Thanks for checking out my first piece. See you guys again soon on the next one!

0xJeff

Personal Note: Thanks a lot for reading! If you’re in Crypto AI and want to connect, shoot a DM!

Also, thanks @mxmsbt, @luciancxyz, @gylestensora, @contangojosh, @mikecontango, @JosephJacks_, @Old_Samster, @bloomberg_seth for helping me get up to speed to everything Bittensor.

I’ll be reaching out & connecting with more subnet owners next week & learn what everyone is working on.

Disclaimer:

This article is reprinted from [X]. All copyrights belong to the original author [@Defi0xJeff]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Into the Bittensor Ecosystem

Bittensor: Darwinian AI

Why This Matters for Investors

dTAO vs Solidly

Leading Subnets & Use Cases

SN41 @sportstensor

SN44 @webuildscore

SN18 @zeussubnet

Wrapping Things Up

Crypto has always been exciting for me. There’s always new things somewhere that I can learn from. I’m naturally a curious person, I like to ask a lot of dumb questions especially to technical persons to just get a glimpse into their insights & learn from their valuable experiences.

AI is no exception, in fact things are moving at break neck speed with Web2 tech giants constantly improving their models, major applications capitalizing on AI, releasing AI-driven use cases

- @canva launched AI tools to allow non-technical artists & creators to easily build interactive experiences & augment their creations with AI

- @YouTube introduced a new AI tool that allows creators to generate background music for videos

- Ride-hailing players like Grab deploying agentic AI to support merchants & driver partners

- E-commerce players like Lazada helping to introduce GenAI tools to help sellers with sales, marketing, and customer service

And the list goes on and on. Practical real-world use cases that utilize generative AI & agentic AI to improve workflows have continued to gain adoption from enterprises & retail users alike.

Good thing about these tech is that they’re easily accessible—you can find free or low cost solutions everywhere. The benefits highly outweigh the financial costs.

But what people often overlook are the hidden tradeoffs when using these AI products, such as:

- Who owns your data?

- Can someone else take your idea and create a competing product?

- Is the platform secure? Could your data get leaked?

- If the platform goes down (like AWS did), could that halt your business? Could customer funds be at risk?

- Can you always access your platform? Are you required to verify your ID? If the platform shuts down, do you still own your product or business?

Many more questions (I’ve talked about this more extensively in my previous article if you haven’t read it yet).

Centralized players have the centralized power to make decisions that can (inadvertently) drastically impact your life.

You could argue that it doesn’t matter—maybe you won’t use these tools much, or you trust these companies to act in the users’ best interest. That’s fine. You might even want to invest in these AI startups since they’re tapping into massive addressable markets. But the thing is—you can’t. Unless you’re at @ycombinator or a top VC firm, you don’t get access to these deals.

On the other hand, in Web3 AI, there are many investable AI ecosystems with teams that are working to bring decentralized AI products & services to the users. One of the top investable DeAI ecosystems is @opentensor (Bittensor)

Bittensor: Darwinian AI

Bittensor falls under the category of “Darwinian AI”—the evolution of AI through natural selection. Think of this as Hunger Games but for AI where each subnet has their own hunger game with “miners” as the tribute (or participants). They compete against each other with their own models & their own data on a performance in a specific task. Only the fittest models (the ones that perform best) are rewarded. Weaker models are replaced or evolve (via training, tweaking, or learning from others). Over time, this leads to a more robust, diverse, and high-performing AI ecosystem.

What’s exciting about Bittensor in particular is the competition & incentive mechanism that’s design to align incentives between different stakeholders. I’ve outlined the challenges that Web3 AI agent teams are facing in the tweet below…

tl;dr the current agent tokens are good for speculators & good for teams to utilize as a tool to build hype but it’s bad for using the tokens to acquire & retain users, and also bad because it can’t be use as incentives to retain talents (devs, founders, etc) especially when price goes down

Bittensor addresses this by using market-driven mechanism that allocates $TAO emissions to the subnets, thereby incentivizing & supporting teams runway. Market determine which subnets receive more emissions by staking $TAO within those subnets. Once staked, the $TAO convert into Alpha subnet tokens. The more people stake, the more alpha token price go up, the more emissions you’ll receive (in the form of alpha tokens)

$TAO follows very similar emission schedule to $BTC with fixed 21 million tokens supply & halving cycle every 4 years (everyday 7,200 $TAO is emitted to subnets). The first $TAO halving is projected to occur around Jan 5, 2026 with circulating supply reaching 10.5 million tokens.

Why This Matters for Investors

Not going too deep into the tech here—just want to share why I think Bittensor is one of the most exciting ecosystems from a trading/investing perspective

Beyond the dynamic shared above, when you’re trading alpha subnet tokens, it feels like you’re both trading & farming at the same time.

This is because every time there’s a price appreciation for alpha tokens, you experience the price appreciation, and at the same time, you experience $TAO emissions (in the form of alpha tokens).

If the subnet performs really well and climb up the rank, your initial $TAO stack will experience drastic price appreciation & large boost in emissions. The earlier you are to staking your $TAO in subnets, the higher your APY becomes (because the market hasn’t caught on yet so there’s less amount of people / $TAO staked within subnets)

dTAO vs Solidly

(h/t @DeSpreadTeam)

Solidly ve(3,3) requires long-term lock & continual participation. Loss from unreasonable emissions (voting for wrong LP pools) are born by all holders (emissions get dumped, price of all token holders go down).

dTAO doesn’t require long-term lock so anyone can get in and get out any time but getting in (staking on a subnet) requires lots of due diligence / DYOR. Investing in a wrong subnet could lead to large loss (since people can just get out pretty easily, there’s no lock up or anything)

But Jeff, FDV is so high! How can we invest in subnets with >$500m+ FDV?

FDV may not the right metric to look at here since the subnets are still in their early innings so MC might be a better fit here (if you’re trading over short to medium term).

If you’re concerned about inflation, it’s worth understanding the 18%/41%/41% — these are the emission distributed to subnet owners, validators, miners respectively (in the form of alpha tokens). As stakers / alpha token owners, you’re earning from the 41% from validators part since you’re delegating your $TAO to them when you stake.

Many subnet owners continue to hold their alpha tokens received from emissions to show confidence, many have active dialogue with validators & miners to get them bullish and not dump large amount of their tokens (these are available for you to explore on taostats btw)

Zooming out, one of the best charts that’s great at showing the trends within Bittensor ecosystem is the the charts below

Source: taoapp

% TAO in Roots (OG subnet that manages Bittensor incentives system) continue to go down since February which is the month that dTAO goes live WHILE % TAO in Subnets continue to go up. This means that stakers / investors are getting more risk on (staking on Root network will yield conservative APY of something like 20-25% and there’s no price appreciation of alpha subnet token on Root).

This trend align with the pace at which subnets teams are shipping their product. Ever since the dTAO launch, teams need to build publicly, build products that users would want, iterate & find PMF fast, get users & generate real-world utility with tangible revenue quickly. Ever since I got into the ecosystem, I could feel that the pace at which teams are shipping are a lot faster than other ecosystem (due to the competition & the incentives distribution)

This brings us to the subnets and their unique investable DeAI use cases

Leading Subnets & Use Cases

The team that’s considered #1 at shipping products with PMF, catered to everyday people, teams that execute professionally & continuously show that they build in public is@rayon_labs""> @rayon_labs — SN64 (Chutes), SN56 (Gradients), SN19 (Nineteen)

Chutes — offers infrastructure to easily deploy your AI in a serverless manner. Best case study to why we need this is the recent AWS outage, if you’re relying on centralized providers, with outage your AI apps can go down (leading to potential loss of funds / exploits) due to single point of failure.

Gradients — Anyone (w/o coding knowledge) can train their own AI models (for specialized use cases, image gen, custom LLMs) on Gradients. Recently launched v3 which is cheaper than peers

Nineteen — provides a platform for fast, scalable, and decentralized AI inference (anyone can use this for text & image generation use cases as this is a lot faster than peers)

On top of this, Rayon is rolling out Squad AI agent platform which is an easy-to-use drag-and-drop node-style AI agent builder platform which has garnered interests in the community

All 3 subnets combined own >1/3rd of the entire emissions of $TAO—This is a testament to team’s ability to publicly build & deliver good products that people would want (Rayon is hailed as the number one team by many subnet owners lol)

Gradients did 13x in a month (currently $32m MC)

Chutes 2.3x ($63m MC)

Nineteen 3x ($18m MC)

The trend doesn’t seem to stop any time soon especially with the rate of adoption with Chutes (currently the #1 subnet)

Besides Rayon Labs subnets there are many interesting teams—protein folding, deepfake / AI content detection, 3D models, trading strategies, role-play LLM. I’ve not gone deep into the rabbit hole to look at everything yet, the ones that I think are the most relatable are subnets under “Predictive Systems” (taopill) primarily with

SN41 @sportstensor

Many of you might know them from @AskBillyBets, Sportstensor is an intelligence that help powers Billy’s decisions (the main team that leads Billy is @ContangoDigital which is a VC investing in DeAI as well as validator/miner for Bittensor subnets)

What’s interesting about SN41 is their product — Sportstensor Model. It’s a competition between miners that has the best models + datasets for predicting the outcomes of sport matches.

Example: In the latest NBA league, if you’re betting with the crowd (betting in crowd favorites), you’ll experience about 68% accuracy / win rate. Does this mean everyone betting on crowd favorites make a lot of money? Nope, in fact they lose money. If you’re betting $100 across every crowd favorites, in the end you ended up with negative ROI, losing about $1.7k.

While crowd favorites tend to have better win rate, they come with better odds which means you win less money if you’re right. People often pile onto their favorites leading to underdogs having pretty low odds of winning which means there’s a lot of money to be captured if you’re betting on the right underdogs.

This is where Sportstensor model come in. Miners run their own machine learning models (Monte Carlo, Random Forest, Linear Regression, etc) with their own data (free or proprietary) to get the best results. Sportstensor then take the average / median of this and use that as an intelligence to identify edge within the market.

An actual odds in the market is 25:75. The model might show that there’s 45:55 odds. This 15 gap is the edge. If models find many of this kind of edge, you don’t have to hit large win rate to start accruing positive ROI over the long run.

Check their full trading report here (if you wanna dig deeper):

This is the result of their model shared in their latest report. Pretty impressive numbers. The team has also been running a betting fund every month starting off with $10k as buffer, using the profits to continue betting with their intelligence. At the end of the month, they’ll use the profit to buyback their alpha token. Team made around $18k profit in March

Depending on how you’re using the intelligence, you can get widely different results as well e.g. intelligence yields 35:65 and actual odds in the market could be 40:60. A person might bet on this, you might not because the gap is small and there’s not enough edge. What Billy does with the intelligence differs to what Sportstensor does with their intelligence. (No one knows what’s the best way to consistently get positive ROI yet at this point cuz it’s very early)

Sportstensor plan to further monetize their intelligence by creating a dashboard where users can easily comprehend the insights and make betting decisions based on them.

I personally like this team because there are lots of ways to go with their product. We’ve already seen the impact of this based on how Billy was able to garner mindshare and get sports crowd excited betting alongside Billy. Since the team covers many sports, there can be a lot of ways in which agents can change the ways in which people vibe, interact, and bet.

SN44 @webuildscore

Score used to build something similar to Sportstensor but pivoted to Computer Vision after realizing that there’s a lot more value that comes with the ability to predict what’s coming next.

In order to understand this you need computer vision to analyze what’s happening on the screen, for the AI to understand the objects on the screen, locate them and annotate the data, then draw conclusions on the data w/ different algo (conclusions like probability of a player making a certain move), and turning all of this into a universal score that can be used to improve players performance (as well as scout for talents early)

Miners compete to annotate the objects (this is the first main objective for miners). Score utilizes their in-house algo to draw conclusions (for now).

When you score player (akin to setting an Elo on chess or in LoL but more granular & dynamic.. dynamically changes in every game based on player decisions & their impact), you can do many things as club owners, you can find talents at a very young age. If you have footage from a kids game, it’ll be same approach to a professional game. It’s quantifying the entire football world w/ the same approach.

From the proprietary data, Score can monetize the score & the insights to data brokers, club owners, sports data companies, and betting companies.

For consumer applications, Score is doing different things

@thedkingdao, a sports hedge fund DAO, a customer of Score with betting models that ingest Score data & turn them to actionable betting execution. v2 terminal with launch tomorrow (users will get access to full model with different subscription models from match analysis, ask advanced qestions on bankroll management, i.e. the best betting companion, use agent to get your own strategy together). Vault product where users can put in TVL and the agent will auto-bet offering yields from betting will likely come next month (or before summer).

Soon people would be able to upload videos on a Score’s self-service platform for the videos to be annotated by the miners. Usually soccer games footage tend to take hours, the miners take 10-12 mins to annotate 90 mins game which is significantly faster than anywhere else. Users can then take the annotated data and use it on their models for their own use cases.

Personally like Score because this can be applied to everything else outside of sports e.g. self-driving cars, robotics, etc. In the world where garbage data is everywhere, high quality proprietary data is highly sought after.

SN18 @zeussubnet

This is a new subnet that recently gained a lot of traction. I’ve had not had a chance to talk with the team yet but the product is pretty interesting.

Zeus is a ML-based climate / weather forecasting subnet that’s designed to outperform traditional models by giving faster & accurate predictions.

This kind of intelligence is highly sought after by hedge funds since accurately predicting weather can lead to better forecast of commodity prices (Hedgefund would pay millions to access the intelligence since they can make hundreds of millions if they nail the commodity trades)

Zeus subnet is fairly new since they recently acquired subnet 18. The alpha token recently rose by 210% over the last 7d

Other Subnets that I’m interested in but have yet to dive deeper

- @404gen_ SN17 — infrastructure for AI-generated 3D assets. Create 3D models for games, AI characters, vtuber, etc. Recent integration w/ @unity could enables seamless 3D model generation, changing creative workflow for Unity’s 1.2M MAU

- @metanova_labs SN68 — DeSci drug discovery subnet which transforms drug discovery into a collaborative, high-speed competition, addressing traditional challenges like cost and time (traditional process take over a decade & could cost billions)

And many more which I’ll share more later once I get a chance to dig deeper. I’m starting with the ones that’s easiest for me to understand (since I’m not a technical person)

Wrapping Things Up

Tried my best to not go full technical here. There are bunch of good resources on technical explanation of the whole dTAO, emissions, incentive distribution, all the stakeholders, yadayadaya.

Based on what I learn during the agent szn (Oct 24 – Now) is to stay quite nimble. I’ve been a bag holder for too many projects and I think dTAO offers quite a good mechanics to stay nimble and rotate out of different investable DeAI startups.

There still aren’t many participants right now so users can experience 80%–150%+ APY on top of the price appreciation from the subnets. This dynamic will likely change over the next 6 months when more people hop on board and TAO eco has better bridges, wallets, trading infrastructure.

For now, I suggest you to enjoy the PvE season on TAO and learn more about cool DeAI tech with me :D

Thanks for checking out my first piece. See you guys again soon on the next one!

0xJeff

Personal Note: Thanks a lot for reading! If you’re in Crypto AI and want to connect, shoot a DM!

Also, thanks @mxmsbt, @luciancxyz, @gylestensora, @contangojosh, @mikecontango, @JosephJacks_, @Old_Samster, @bloomberg_seth for helping me get up to speed to everything Bittensor.

I’ll be reaching out & connecting with more subnet owners next week & learn what everyone is working on.

Disclaimer:

This article is reprinted from [X]. All copyrights belong to the original author [@Defi0xJeff]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.